Market news

-

23:28

Currencies. Daily history for Feb 16’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0673 +0,69%

GBP/USD $1,2488 +0,23%

USD/CHF Chf0,9967 -0,86%

USD/JPY Y113,23 -0,80%

EUR/JPY Y120,85 -0,12%

GBP/JPY Y141,37 -0,59%

AUD/USD $0,7693 -0,19%

NZD/USD $0,7207 -0,21%

USD/CAD C$1,3069 -0,06%

-

22:59

Schedule for today, Friday, Feb 17’2017 (GMT0)

09:00 Eurozone Current account, unadjusted, bln December 40.5

09:30 United Kingdom Retail Sales (MoM) January -1.9% 0.9%

09:30 United Kingdom Retail Sales (YoY) January 4.3% 3.4%

13:30 Canada Foreign Securities Purchases December 7.24

15:00 U.S. Leading Indicators January 0.5% 0.5%

-

21:45

New Zealand: Retail Sales YoY, Quarter IV 4.2%

-

21:45

New Zealand: Retail Sales, q/q, Quarter IV 0.8% (forecast 1%)

-

21:32

New Zealand: Business NZ PMI, January 51.6

-

15:42

Fed's Fisher: We are equally concerned about inflation deviates upward or downward from the target level of 2%

-

We will not make decisions under political pressure

-

We are now in an enabling policy area

-

Interest rates rise will be gradual

-

The election results in the US seems to have played a role in the heating of the economy

-

The Fed expects the economy will grow at a good pace

-

-

15:13

ECB Nowotny: undoing financial regulation would repeat mistakes of the past

-

Could Be 'Chaos' If No Brexit Deal in 2 Years

-

-

14:41

EU official says possible to reach a Greek deal in March - Bloomberg

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

-

13:44

US building permits and housing starts mixed

Privately-owned housing units authorized by building permits in January were at a seasonally adjusted annual rate of 1,285,000. This is 4.6 percent (±2.0 percent) above the revised December rate of 1,228,000 and is 8.2 percent (±1.6 percent) above the January 2016 rate of 1,188,000. Single-family authorizations in January were at a rate of 808,000; this is 2.7 percent (±1.9 percent) below the revised December figure of 830,000. Authorizations of units in buildings with five units or more were at a rate of 446,000 in January.

Privately-owned housing starts in January were at a seasonally adjusted annual rate of 1,246,000. This is 2.6 percent (±11.0 percent)* below the revised December estimate of 1,279,000, but is 10.5 percent (±15.3 percent)* above the January 2016 rate of 1,128,000. Single-family housing starts in January were at a rate of 823,000; this is 1.9 percent (±10.8 percent)* above the revised December figure of 808,000. The January rate for units in buildings with five units or more was 421,000.

-

13:41

Results from the February Philadelphia Manufacturing Business Outlook Survey suggest that growth in regional manufacturing is broadening

The diffusion indexes for general activity, new orders, and shipments were all positive this month and increased notably from their readings last month. The surveyed firms continued to report growth in employment and work hours. Although they moderated from last month, the future indexes for growth over the next six months continued to reflect a high degree of optimism.

The index for current manufacturing activity in the region increased from a reading of 23.6 in January to 43.3 this month and has remained positive for seven consecutive months

-

13:39

US unemployment claims continue to decline

In the week ending February 11, the advance figure for seasonally adjusted initial claims was 239,000, an increase of 5,000 from the previous week's unrevised level of 234,000. The 4-week moving average was 245,250, an increase of 500 from the previous week's revised average. The previous week's average was revised up by 500 from 244,250 to 244,750.

-

13:30

U.S.: Building Permits, January 1285 (forecast 1230)

-

13:30

U.S.: Initial Jobless Claims, 239 (forecast 245)

-

13:30

U.S.: Housing Starts, January 1246 (forecast 1222)

-

13:30

U.S.: Continuing Jobless Claims, 2076 (forecast 2051)

-

13:30

U.S.: Philadelphia Fed Manufacturing Survey, February 43.3 (forecast 18)

-

13:00

Orders

EUR/USD

Offers: 1.0635 1.0650 1.0680 1.0700-05 1.0730 1.0750

Bids: 1.0600 1.0585 1.0550 1.0520 1.0500 1.0480-85 1.0450

GBP/USD

Offers: 1.2500 1.2520 1.2550 1.2580 1.2600

Bids: 1.2465 1.2450 1.2430 1.2400 1.2380 1.2345-50

EUR/GBP

Offers: 0.8520 0.8535 0.8550-60 0.8600

Bids: 0.8480-85 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers: 121.00 121.35 121.50 121.80 122.00 122.50

Bids: 120.80 120.60 102.30 120.00 119.75 119.50

USD/JPY

Offers: 114.00-05 114.20 114.35 114.50 114.75-80 115.00 115.20 115.50

Bids: 113.65 113.50 113.20 113.00 112.80 112.50

AUD/USD

Offers: 0.7730 0.7750 0.7780 0.7800 0.7820 0.7850

Bids: 0.7680 0.7660 0.7620 0.7600 0.7580 0.7550

-

12:33

ECB Officials saw 'no room for complacency' at January policy meeting - Minutes

-

ECB Officials Agreed in Jan That Fundamental Economic Picture Was 'Largely Unaltered'

-

ECB Officials Saw Political Uncertainties at Global Level, Within Eurozone

-

ECB Officials Saw Insufficient Progress Toward Inflation Goal

-

-

11:15

Brazilian economic activity contracted sharply last year, marking the second consecutive year of deep economic recession, according to an index compiled by the central bank

-

09:09

Nomura staying bearish USD and looking to sell rallies

"Today's siren song in currency markets is of upcoming Fed hikes, with many investors being lured into bullish dollar positions.

Admittedly, the dollar has bounced on yesterday's hawkish comments from Fed Chair Yellen and today's strong data, but shortterm bounces do not always translate into long-term trends. Indeed, Ms Yellen's upbeat speech on 18 January saw a similar rally in the dollar only for it to falter some days later

......At the same time, this also implies that other central banks pursuing non-conventional monetary policy, such as the ECB and BOJ, have very negative implied policy rates. But if they were to exit their policies then they should see an equivalent tightening and hence currency appreciation. This will likely be the bigger story for 2017 - US economic strength will help boost global growth and tilt the risks for the ECB and BOJ to exit their ultra-easy policies. Already the BOJ has seemingly ratcheted up its 0% 10yr target to 0.1% and inflation is picking up sharply in the euro area, which should increase the likelihood of the ECB tapering after the French elections.

We therefore favour maintaining a bearish dollar stance and would look to sell any rallies in the currency".

Copyright © 2017 Nomura, eFXnews™

-

07:30

Options levels on thursday, February 16, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0809 (5023)

$1.0726 (3129)

$1.0665 (3056)

Price at time of writing this review: $1.0604

Support levels (open interest**, contracts):

$1.0535 (5206)

$1.0505 (4974)

$1.0470 (5207)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 69879 contracts, with the maximum number of contracts with strike price $1,0800 (5023);

- Overall open interest on the PUT options with the expiration date March, 13 is 83083 contracts, with the maximum number of contracts with strike price $1,0500 (5207);

- The ratio of PUT/CALL was 1.19 versus 1.21 from the previous trading day according to data from February, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (2253)

$1.2603 (2116)

$1.2507 (3513)

Price at time of writing this review: $1.2470

Support levels (open interest**, contracts):

$1.2393 (1904)

$1.2296 (3705)

$1.2198 (1630)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33362 contracts, with the maximum number of contracts with strike price $1,2500 (3513);

- Overall open interest on the PUT options with the expiration date March, 13 is 37218 contracts, with the maximum number of contracts with strike price $1,2300 (3705);

- The ratio of PUT/CALL was 1.12 versus 1.12 from the previous trading day according to data from February, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:09

SNB to increase intervention again - BNPP

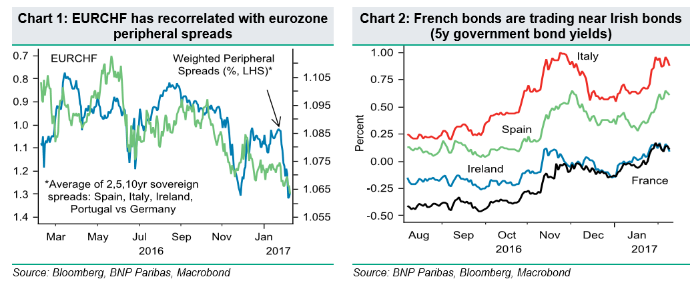

"EURCHF fell to a post-Brexit low below 1.07 at the end of January, likely on the back of reports of a large CHF M&A deal. However, the CHF has continued to rise in February, and we think the most important driver could be the spike in eurozone peripheral spreads. Eurozone peripheral spreads and EURCHF have started to reconverge (Chart 1) and, in our view, the widening of peripheral spreads is leading to safe-haven CHF demand.

However, CHF strength is likely to pressure the Swiss National Bank (SNB) to increase its FX intervention. According to our calculations, the SNB intervened in FX markets in November by approximately CHF 14bn (a record intervention) and CHF 4.9bn in January (in line with recent interventions). This month, the SNB allowed EURCHF to breach 1.07 for the first time, but we think the central bank could start increasing its interventions again, which could counter the safe-haven demand.

This outlook is consistent with our EURCHF target at 1.10 in Q2 17 and 1.12 by the end of the year, although we would not rule out a fall in the pair in the very short term".

Copyright © 2017 BNP Paribas™, eFXnews™

-

07:05

Japan Finance Minister, Taro Aso: the level of 120 on USD/JPY can not be called a weak yen

The Minister stated that the Y120 level can not be considered weak for the Japanese currency. This statement caused a strong resonance wave of discussions in the business press of Japan.

-

07:02

Fed’s Dudley: Expects To Gradually Raise Rates 'A Little Further In The Months Ahead' If Forecast Pans Out @Livesquawk

-

07:01

Australian unemployment rate was 5.7 per cent for the ninth consecutive month

Monthly trend full-time employment increased by 6,500 in Australia in January 2017, according to figures released by the Australian Bureau of Statistics (ABS) today. This was the fourth consecutive month of increasing full-time employment, after eight consecutive decreases earlier in 2016.

Total trend employment increased by 11,700 persons to 11,984,300 persons in January 2017, reflecting an increase in both full-time (6,500) and part-time (5,100) employment. Total employment growth over the year was 0.8 per cent, which was less than half the average growth rate over the past 20 years (1.8%).

"We are still seeing strong growth in part-time employment in January 2017, and in recent months, increasing growth in full-time employment. There are now around 129,800 more people working part-time than there were a year ago, and around 40,100 fewer people working full-time," said the General Manager of ABS' Macroeconomic Statistics Division, Bruce Hockman.

The trend unemployment rate was 5.7 per cent for the ninth consecutive month.

The trend participation rate was unchanged at 64.6 per cent.

-

00:31

Australia: Changing the number of employed, January 13.5 (forecast 10)

-

00:30

Australia: Unemployment rate, January 5.7% (forecast 5.8%)

-

00:00

Australia: Consumer Inflation Expectation, February 4.1%

-