Market news

-

23:30

Commodities. Daily history for Feb 22’02’2017:

(raw materials / closing price /% change)

Oil 53.87 +0.52%

Gold 1,238.20 -0.07%

-

23:29

Stocks. Daily history for Feb 22’2017:

(index / closing price / change items /% change)

Nikkei -1.57 19379.87 -0.01%

TOPIX +1.49 1557.09 +0.10%

Hang Seng +238.33 24201.96 +0.99%

CSI 300 +6.94 3489.76 +0.20%

Euro Stoxx 50 -0.06 3339.27 +0.00%

FTSE 100 +27.42 7302.25 +0.38%

DAX +31.10 11998.59 +0.26%

CAC 40 +7.12 4895.88 +0.15%

DJIA +32.60 20775.60 +0.16%

S&P 500 -2.56 2362.82 -0.11%

NASDAQ -5.32 5860.63 -0.09%

S&P/TSX -92.15 15830.22 -0.58%

-

23:27

Currencies. Daily history for Feb 22’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0558 +0,22%

GBP/USD $1,2447 -0,21%

USD/CHF Chf1,0101 +0,07%

USD/JPY Y113,30 -0,32%

EUR/JPY Y119,61 -0,13%

GBP/JPY Y141,01 -0,55%

AUD/USD $0,7700 +0,35%

NZD/USD $0,7188 +0,40%

USD/CAD C$1,3162 +0,17%

-

22:59

Schedule for today, Wednesday, Feb 23’2017 (GMT0)

00:30 Australia Private Capital Expenditure Quarter IV -4.0% -0.5%

05:00 Japan Leading Economic Index (Finally) December 102.6 105.2

05:00 Japan Coincident Index (Finally) December 115

07:00 Germany GDP (QoQ) (Finally) Quarter IV 0.1% 0.4%

07:00 Germany GDP (YoY) (Finally) Quarter IV 1.5% 1.6%

07:00 Germany Gfk Consumer Confidence Survey March 10.2 10.1

08:15 Switzerland Industrial Production (YoY) Quarter IV 0.4%

11:00 United Kingdom CBI retail sales volume balance February -8 5

13:30 U.S. Continuing Jobless Claims 2076 2065

13:30 U.S. Initial Jobless Claims 239 242

14:00 U.S. Housing Price Index, m/m December 0.5% 0.4%

16:00 U.S. Crude Oil Inventories February 9.527

22:30 Australia RBA's Governor Philip Lowe Speaks

-

20:01

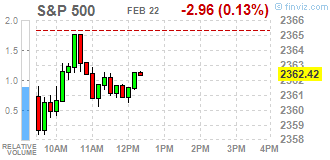

DJIA 20754.16 11.16 0.05%, NASDAQ 5854.09 -11.86 -0.20%, S&P 500 2361.23 -4.15 -0.18%

-

17:27

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes little changed on Wednesday as investors looked ahead to the Federal Reserve's minutes of its most recent meeting for clues on the timing of the next interest rate hike. Policymakers, including Fed Chair Janet Yellen, have been hinting at the possibility of a rate hike at an upcoming meeting. But traders have priced in slim chances of a move until June despite strong economic data.

Most of Dow stocks in negative area (20 of 30). Top loser - Intel Corporation (INTC, -1.59%). Top gainer - E. I. du Pont de Nemours and Company (DD, +4.04%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-1.0%). Top gainer - Conglomerates (+1.0%).

At the moment:

Dow 20735.00 +47.00 +0.23%

S&P 500 2360.50 +0.50 +0.02%

Nasdaq 100 5350.25 +6.50 +0.12%

Oil 53.54 -0.79 -1.45%

Gold 1232.90 -6.00 -0.48%

U.S. 10yr 2.42 -0.00

-

17:00

European stocks closed: FTSE 7302.25 27.42 0.38%, DAX 11998.59 31.10 0.26%, CAC 4895.88 7.12 0.15%

-

15:35

Denmark's central bank says as of 1 march 2017, the 10-year nominal on-the-run issue, 0.5 per cent bullet loan 2027, becomes the new 10-year benchmark bond

-

15:14

US existing home sales rose more than expected in January

Existing-home sales stepped out to a fast start in 2017, surpassing a recent cyclical high and increasing in January to the fastest pace in almost a decade, according to the National Association of Realtors. All major regions except for the Midwest saw sales gains last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, expanded 3.3 percent to a seasonally adjusted annual rate of 5.69 million in January from an upwardly revised 5.51 million in December 2016. January's sales pace is 3.8 percent higher than a year ago (5.48 million) and surpasses November 2016 (5.60 million) as the strongest since February 2007 (5.79 million).

-

15:00

U.S.: Existing Home Sales , January 5.69 (forecast 5.55)

-

14:33

U.S. Stocks open: Dow -0.14%, Nasdaq -0.15%, S&P -0.19%

-

14:28

Before the bell: S&P futures -0.08%, NASDAQ futures 0.00%

U.S. stock-index futures were flat as investors awaited the minutes of the Federal Reserve's most recent policy meeting for clues on the timing of the next interest rate hike.

Global Stocks:

Nikkei 19,379.87 -1.57 -0.01%

Hang Seng 24,201.96 +238.33 +0.99%

Shanghai 3,260.94 +7.61 +0.23%

FTSE 7,284.65 +9.82 +0.13%

CAC 4,886.14 -2.62 -0.05%

DAX 11,979.36 +11.87 +0.10%

Crude $53.97 (-0.66%)

Gold $1,240.30 (+0.11%)

-

14:15

The National Bank of Belgium’s business barometer has dropped in February

This is the first time it has deteriorated since August 2016.

It was only in the manufacturing industry that business confidence weakened. In the trade and building sectors, the business cycle actually picked up a little. And lastly, in business-related services, the economic climate stabilised in February, after having improved for four months in a row.

The downturn in the manufacturing indicator is primarily attributable to an unfavourable assessment of total order books and stock levels.

The slight recovery of confidence in the retail trade sector is due to considerably more optimistic expectations regarding employment.

-

13:59

Belgium: Business Climate, February -1.1 (forecast 0.8)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.55

-0.16(-0.4359%)

5226

ALTRIA GROUP INC.

MO

73.52

-0.13(-0.1765%)

625

Amazon.com Inc., NASDAQ

AMZN

856.445

0.005(0.0006%)

20341

American Express Co

AXP

79.73

-0.24(-0.3001%)

1538

Apple Inc.

AAPL

41.61

-0.12(-0.2876%)

1017

AT&T Inc

T

41.61

-0.12(-0.2876%)

1017

Barrick Gold Corporation, NYSE

ABX

20.16

0.05(0.2486%)

37973

Boeing Co

BA

41.61

-0.12(-0.2876%)

1017

Caterpillar Inc

CAT

98.2

0.10(0.1019%)

5970

Cisco Systems Inc

CSCO

34

-0.13(-0.3809%)

3206

Citigroup Inc., NYSE

C

60.26

-0.29(-0.4789%)

96580

Deere & Company, NYSE

DE

108.81

-0.80(-0.7299%)

785

Exxon Mobil Corp

XOM

81.6

-0.29(-0.3541%)

989

Facebook, Inc.

FB

133.56

-0.16(-0.1197%)

16610

Ford Motor Co.

F

12.67

-0.02(-0.1576%)

6348

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.9

-0.23(-1.6277%)

86811

General Electric Co

GE

30.48

-0.04(-0.1311%)

34487

General Motors Company, NYSE

GM

37.73

-0.08(-0.2116%)

2721

Goldman Sachs

GS

250.49

-1.27(-0.5044%)

5297

Google Inc.

GOOG

830.77

-0.89(-0.107%)

1094

Hewlett-Packard Co.

HPQ

16.12

-0.01(-0.062%)

1014

Intel Corp

INTC

36.45

-0.07(-0.1917%)

72027

International Business Machines Co...

IBM

179.97

-0.29(-0.1609%)

470

JPMorgan Chase and Co

JPM

90.6

-0.41(-0.4505%)

8617

McDonald's Corp

MCD

90.6

-0.41(-0.4505%)

8617

Merck & Co Inc

MRK

41.61

-0.12(-0.2876%)

1017

Microsoft Corp

MSFT

64.36

-0.13(-0.2016%)

14948

Pfizer Inc

PFE

41.61

-0.12(-0.2876%)

1017

Starbucks Corporation, NASDAQ

SBUX

57.4

-0.14(-0.2433%)

2445

Tesla Motors, Inc., NASDAQ

TSLA

279.85

2.46(0.8868%)

34882

Twitter, Inc., NYSE

TWTR

16.4

-0.02(-0.1218%)

33484

UnitedHealth Group Inc

UNH

90.6

-0.41(-0.4505%)

8617

Verizon Communications Inc

VZ

49.45

0.02(0.0405%)

511

Visa

V

41.61

-0.12(-0.2876%)

1017

Wal-Mart Stores Inc

WMT

71.8

0.35(0.4899%)

41344

Walt Disney Co

DIS

109.8

-0.21(-0.1909%)

100

Yahoo! Inc., NASDAQ

YHOO

45.27

-0.23(-0.5055%)

713

Yandex N.V., NASDAQ

YNDX

24.02

-0.32(-1.3147%)

1580

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Wal-Mart (WMT) upgraded to Buy from Neutral at BofA/Merrill; target $88

Downgrades:

Other:

Goldman Sachs (GS) initiated with a Neutral at Compass Point

Morgan Stanley (MS) initiated with a Neutral at Compass Point

Intel (INTC) initiated with a Buy at MKM Partners

Intel (INTC) initiated with a Sell at Rosenblat

Home Depot (HD) target raised to $158 from $153 at RBC Capital Mkts

Home Depot (HD) target raised to $154 from $150 at TAG

Wal-Mart (WMT) target raised to $67 from $66 at RBC Capital Mkts

Wal-Mart (WMT) target raised to $72 from $70 at Stifel

-

13:45

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0500 (EUR 301m) 1.0600 (373m)

USDJPY: 114.00 (USD 259m)

GBPUSD: 1.2300 (GBP 400m)

AUDUSD: 0.7685 (AUD 204m) 0.7750 (356m)

EURNOK: 8.8000 (EUR 822m), 8.8500 (530m)

-

13:42

-

13:32

Following four consecutive monthly increases, Canadian retail sales decreased 0.5% in December

Declines were widespread as lower sales were reported in 9 of 11 subsectors, representing 82% of retail trade.

After removing the effects of price changes, retail sales in volume terms decreased 1.0%.

After three consecutive monthly gains, sales at motor vehicle and parts dealers were down 0.9%. Lower sales at new car dealers accounted for the decline at the subsector level, more than offsetting gains at all other store types. Following an 11.4% decline in November, sales at automotive parts, accessories and tire stores bounced back in December, rising 18.2%. Sales at other motor vehicles dealers (+5.0%), which include snowmobile dealers, were up for the fifth consecutive month. Used car dealers (+1.6%) also reported higher sales in December.

Food and beverage stores registered a 0.4% decrease in December. Lower sales at beer, wine and liquor stores (-3.6%) more than offset gains in October and November. Higher receipts at supermarkets and other grocery stores (+0.4%) and specialty food stores (+0.8%) were mainly due to higher volumes, as food prices were down in December.

-

13:30

Canada: Retail Sales, m/m, December -0.5% (forecast 0.1%)

-

13:30

Canada: Retail Sales ex Autos, m/m, December -0.3% (forecast 0.6%)

-

13:30

Canada: Retail Sales YoY, December 4.3%

-

13:16

Kremlin aide Ushakov says Russia, U.S. not in talks on date for first Putin-Trump meeting

-

13:10

EU says Italy must adopt measures to comply with debt rules

-

13:00

Orders

EUR/USD

Offers 1.0520 1.0550 1.0580 1.0600 1.0620 1.0635 1.0650

Bids 1.0500 1.0480-85 1.0450 1.0430 1.0400

GBP/USD

Offers 1.2500 1.2520 1.2550 1.2575-80 1.2600

Bids 1.2480 1.2465 1.2450 1.2415-20 1.2400 1.2380 1.2345-50

EUR/GBP

Offers 0.8430 0.8450 0.8480 0.8500 0.8520 0.8535

Bids 0.8400 0.8385 0.8350 0.8330 0.8300

EUR/JPY

Offers 119.30 119.50 119.85 120.00 120.30 120.50

Bids 118.80 118.50 118.30 118.00 117.50 117.00

USD/JPY

Offers 113.50 113.80-85 114.00-05 114.20 114.35 114.50

Bids 113.20 113.00 112.80 112.50 112.30 112.00

AUD/USD

Offers 0.7720 0.7735 0.7750 0.7780 0.7800

Bids 0.7680 0.7665 0.7650 0.7620 0.7600

-

12:07

-

11:30

Sweden sells 2025 bonds at average yield 0.37 debt office

-

10:02

Euro area inflation confirms preliminary release

Euro area annual inflation was 1.8% in January 2017, up from 1.1% in December 2016. In January 2016 the rate was 0.3%. European Union annual inflation was 1.7% in January 2017, up from 1.2% in December. A year earlier the rate was 0.3%. These figures come from Eurostat, the statistical office of the European Union.

In January 2017, the lowest annual rates were registered in Ireland (0.2%), Romania (0.3%) and Bulgaria (0.4%). The highest annual rates were recorded in Belgium (3.1%), Latvia and Spain (both 2.9%), and Estonia (2.8%). Compared with December 2016, annual inflation fell in two Member States and rose in twenty-six.

-

10:00

Eurozone: Harmonized CPI, January -0.8% (forecast -0.8%)

-

10:00

Eurozone: Harmonized CPI, Y/Y, January 1.8% (forecast 1.8%)

-

10:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, January 0.9% (forecast 0.9%)

-

09:58

-

09:40

Sentiment among German managers improved this month - Ifo

The Ifo Business Climate Index rose to 111.0 points in February from 109.9 (seasonally adjusted) points last month. Assessments of the current business situation reached their highest level since August 2011. Companies also expressed greater optimism about the months ahead. After making a cautious start to the year, the German economy is back on track.

In the manufacturing sector, the index rose. Manufacturers were far more satisfied with their current business situation. After deteriorating in January, the business outlook also brightened slightly. Current demand and the number of incoming orders picked up markedly. This positive development was mainly driven by food producers, as well as mechanical and electrical engineering firms.

-

09:33

UK business investment down 1.0% in Q4 2016

Gross fixed capital formation (GFCF), in volume terms, was unchanged at £78.0 billion, in Quarter 4 (Oct to Dec) 2016, when compared with Quarter 3 (July to Sept) 2016.

Between Quarter 3 2016 and Quarter 4 2016, business investment, in volume terms, was estimated to have decreased by 1.0%, from £44.0 billion to £43.5 billion.

Between Quarter 4 2015 and Quarter 4 2016, GFCF was estimated to have increased by 0.9%, from £77.3 billion to £78.0 billion.

Business investment was estimated to have decreased by 0.9% between Quarter 4 2015 and Quarter 4 2016, from £43.9 billion to £43.5 billion.

Between 2015 and 2016, GFCF was estimated to have increased by 0.5%, an increase of £1.4 billion.

-

09:31

UK GDP rose more than expected in Q4

UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.7% between Quarter 3 (July to Sept) 2016 and Quarter 4 (Oct to Dec) 2016, revised up 0.1 percentage points from the preliminary estimate of GDP published on 26 January 2017. Upward revisions (due to later data received) within the manufacturing industries is the main reason (these revisions were first published as part of the Index of Production for December 2016 released on 10 February 2017).

UK GDP growth in Quarter 4 2016 saw a continuation of strong consumer spending which is in line with the Retail Sales Index for Quarter 4, which grew by 1.2% (published on 20 January 2017) and strong growth in the output of the services sector with a notable contribution in consumer-focused industries. In Quarter 4 2016, there has been a slowdown within business investment which fell by 1.0%, driven by subdued growth within the "ICT equipment and other machinery and equipment" assets.

-

09:30

United Kingdom: GDP, q/q, Quarter IV 0.7% (forecast 0.6%)

-

09:30

United Kingdom: GDP, y/y, Quarter IV 2% (forecast 2.2%)

-

09:11

Russian average oil production totalled 1.515 mln tonnes per day (11.10 mln bpd) on feb 1-21 - industry sources

-

09:01

Germany: IFO - Expectations , February 104 (forecast 103)

-

09:01

Germany: IFO - Expectations , February 104 (forecast 103)

-

09:00

Germany: IFO - Business Climate, February 111 (forecast 109.6)

-

09:00

Germany: IFO - Current Assessment , February 118.4 (forecast 116.7)

-

08:54

Major stock markets in Europe trading in the green zone: FTSE + 0.2%, DAX + 0.2%, CAC40 + 0.2%, FTMIB + 0.4%, IBEX + 0.3%

-

08:16

ECB says 177 mln euros borrowed using overnight loan facility, 480.225 bln euros deposited

-

08:11

Today’s events

-

At 10:30 GMT Germany will hold an auction of 30-year bonds

-

At 11:00 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

-

At 18:00 GMT FOMC member Jerome Powell will deliver a speech

-

At 19:00 GMT publication of the Fed meeting minutes

-

At 20:00 GMT Deputy Governor of the Bank of England Nemat Shafik will deliver a speech

-

-

07:32

Options levels on wednesday, February 22, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0672 (3000)

$1.0638 (3482)

$1.0592 (1953)

Price at time of writing this review: $1.0520

Support levels (open interest**, contracts):

$1.0464 (4844)

$1.0427 (3320)

$1.0386 (4241)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 72516 contracts, with the maximum number of contracts with strike price $1,0800 (4763);

- Overall open interest on the PUT options with the expiration date March, 13 is 83501 contracts, with the maximum number of contracts with strike price $1,0550 (5594);

- The ratio of PUT/CALL was 1.15 versus 1.22 from the previous trading day according to data from February, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.2800 (3024)

$1.2701 (2445)

$1.2603 (2284)

Price at time of writing this review: $1.2496

Support levels (open interest**, contracts):

$1.2396 (1651)

$1.2298 (3269)

$1.2199 (1514)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33890 contracts, with the maximum number of contracts with strike price $1,2800 (3024);

- Overall open interest on the PUT options with the expiration date March, 13 is 35700 contracts, with the maximum number of contracts with strike price $1,2300 (3269);

- The ratio of PUT/CALL was 1.05 versus 1.07 from the previous trading day according to data from February, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:27

Fitch on Singapore - expects GDP growth to remain close to 2% in 2017

-

Higher spending and smaller budget surplus planned for next year do not pose a risk to Singapore's sovereign credit profile

-

Expansionary Singapore budget targets structural issues

-

-

07:22

Slow start of trading expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 + 0.1%, FTSE flat

-

07:20

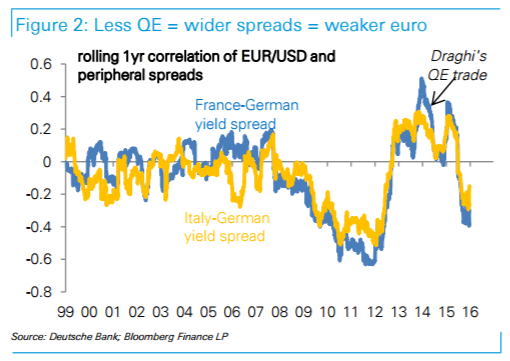

Deutsche Bank says ECB taper is not necessarily bullish for EUR

"One of the pushbacks we get to our weaker euro view is that the ECB will signal tapering this year preventing EUR/USD weakness. We don't agree.

First, tapering is not necessarily bullish for a currency. When the Fed signaled taper in mid-2013 the dollar strengthened a lot against EM but it weakened against both the euro and yen.

Second, ECB tightening is not that simple. Not only would it steepen curves but it risks a return of redenomination risk that has been conveniently compressed by the ECB's fight against deflation.

Finally, EUR/USD is not just about the ECB but also the Fed and the level of US yields...With the dollar having transitioned to a high-yielder and even more Fed hikes to come, the greenback should be doing a good job of attracting inflows and deflecting its use as a funding currency to both the euro and the yen.

The dollar has had a tough start to start the year but we are not giving up on our bullish view for 2017".

Copyright © 2017 DB, eFXnews™

-

07:14

Total construction work done in Australia fell 2.5% in the last quarter of 2016

The trend estimate for total construction work done fell 2.5% in the December quarter 2016.

The seasonally adjusted estimate for total construction work done fell 0.2% to $46,263.5m in the December quarter.

The trend estimate for total building work done fell 0.6% in the December quarter.

The trend estimate for non-residential building work done fell 1.7% and residential building work was flat.

The seasonally adjusted estimate of total building work done rose 1.3% to $26,695.2m in the December quarter.

-

07:13

Australian Wage Price Index rose 1.9 per cent through the year

The seasonally adjusted Wage Price Index (WPI) rose 1.9 per cent through the year to the December quarter 2016, according to figures released today by the Australian Bureau of Statistics (ABS). This result equals the record low wages growth recorded in the September quarter 2016.

Seasonally adjusted, private sector wages rose 0.4 per cent and public sector wages grew 0.6 per cent in the December quarter 2016.

-

07:11

BoJ Gov Kuroda: More Easing Possible If Required To Meet Price Target, Chances Are Small re: Further Rate Cut - Reuters

-

06:26

Global Stocks

European stocks closed at their highest in more than a year Tuesday, finding support from upbeat eurozone data, but HSBC PLC shares suffered the most since 2009 in the wake of financial results from the London-based lender. European equities climbed Tuesday after a better-than-expected preliminary reading on manufacturing activity in the eurozone. IHS Markit's February PMI gauge of eurozone manufacturing activity came in at 56.0, outstripping a 54.3 estimate from FactSet.

U.S. stocks rallied on Tuesday, with major indexes simultaneously closing at records for a second session in a row on the back of gains in defensive sectors and energy, even as concerns remained about the market's valuation. Stocks finished near their highs of the session with the day's gains broad as all 11 of the S&P 500's sectors finished higher.

Asia-Pacific stocks rose broadly following overnight gains overseas, as investors await the release later Wednesday of minutes from this month's U.S. Federal Reserve meeting. But gains are largely muted, as are declines in the few markets whose benchmark indexes are lower.

-

00:30

Australia: Construction Work Done, Quarter IV -0.2% (forecast 0.3%)

-

00:30

Australia: Wage Price Index, q/q, Quarter IV 0.5% (forecast 0.5%)

-

00:30

Australia: Wage Price Index, y/y, Quarter IV 1.9% (forecast 1.9%)

-