Market news

-

23:29

Stocks. Daily history for Feb 22’2017:

(index / closing price / change items /% change)

Nikkei -1.57 19379.87 -0.01%

TOPIX +1.49 1557.09 +0.10%

Hang Seng +238.33 24201.96 +0.99%

CSI 300 +6.94 3489.76 +0.20%

Euro Stoxx 50 -0.06 3339.27 +0.00%

FTSE 100 +27.42 7302.25 +0.38%

DAX +31.10 11998.59 +0.26%

CAC 40 +7.12 4895.88 +0.15%

DJIA +32.60 20775.60 +0.16%

S&P 500 -2.56 2362.82 -0.11%

NASDAQ -5.32 5860.63 -0.09%

S&P/TSX -92.15 15830.22 -0.58%

-

20:01

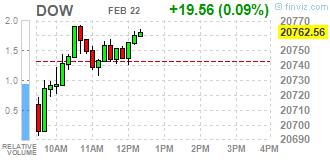

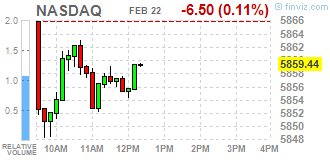

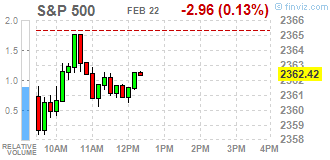

DJIA 20754.16 11.16 0.05%, NASDAQ 5854.09 -11.86 -0.20%, S&P 500 2361.23 -4.15 -0.18%

-

17:27

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes little changed on Wednesday as investors looked ahead to the Federal Reserve's minutes of its most recent meeting for clues on the timing of the next interest rate hike. Policymakers, including Fed Chair Janet Yellen, have been hinting at the possibility of a rate hike at an upcoming meeting. But traders have priced in slim chances of a move until June despite strong economic data.

Most of Dow stocks in negative area (20 of 30). Top loser - Intel Corporation (INTC, -1.59%). Top gainer - E. I. du Pont de Nemours and Company (DD, +4.04%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-1.0%). Top gainer - Conglomerates (+1.0%).

At the moment:

Dow 20735.00 +47.00 +0.23%

S&P 500 2360.50 +0.50 +0.02%

Nasdaq 100 5350.25 +6.50 +0.12%

Oil 53.54 -0.79 -1.45%

Gold 1232.90 -6.00 -0.48%

U.S. 10yr 2.42 -0.00

-

17:00

European stocks closed: FTSE 7302.25 27.42 0.38%, DAX 11998.59 31.10 0.26%, CAC 4895.88 7.12 0.15%

-

14:33

U.S. Stocks open: Dow -0.14%, Nasdaq -0.15%, S&P -0.19%

-

14:28

Before the bell: S&P futures -0.08%, NASDAQ futures 0.00%

U.S. stock-index futures were flat as investors awaited the minutes of the Federal Reserve's most recent policy meeting for clues on the timing of the next interest rate hike.

Global Stocks:

Nikkei 19,379.87 -1.57 -0.01%

Hang Seng 24,201.96 +238.33 +0.99%

Shanghai 3,260.94 +7.61 +0.23%

FTSE 7,284.65 +9.82 +0.13%

CAC 4,886.14 -2.62 -0.05%

DAX 11,979.36 +11.87 +0.10%

Crude $53.97 (-0.66%)

Gold $1,240.30 (+0.11%)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.55

-0.16(-0.4359%)

5226

ALTRIA GROUP INC.

MO

73.52

-0.13(-0.1765%)

625

Amazon.com Inc., NASDAQ

AMZN

856.445

0.005(0.0006%)

20341

American Express Co

AXP

79.73

-0.24(-0.3001%)

1538

Apple Inc.

AAPL

41.61

-0.12(-0.2876%)

1017

AT&T Inc

T

41.61

-0.12(-0.2876%)

1017

Barrick Gold Corporation, NYSE

ABX

20.16

0.05(0.2486%)

37973

Boeing Co

BA

41.61

-0.12(-0.2876%)

1017

Caterpillar Inc

CAT

98.2

0.10(0.1019%)

5970

Cisco Systems Inc

CSCO

34

-0.13(-0.3809%)

3206

Citigroup Inc., NYSE

C

60.26

-0.29(-0.4789%)

96580

Deere & Company, NYSE

DE

108.81

-0.80(-0.7299%)

785

Exxon Mobil Corp

XOM

81.6

-0.29(-0.3541%)

989

Facebook, Inc.

FB

133.56

-0.16(-0.1197%)

16610

Ford Motor Co.

F

12.67

-0.02(-0.1576%)

6348

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.9

-0.23(-1.6277%)

86811

General Electric Co

GE

30.48

-0.04(-0.1311%)

34487

General Motors Company, NYSE

GM

37.73

-0.08(-0.2116%)

2721

Goldman Sachs

GS

250.49

-1.27(-0.5044%)

5297

Google Inc.

GOOG

830.77

-0.89(-0.107%)

1094

Hewlett-Packard Co.

HPQ

16.12

-0.01(-0.062%)

1014

Intel Corp

INTC

36.45

-0.07(-0.1917%)

72027

International Business Machines Co...

IBM

179.97

-0.29(-0.1609%)

470

JPMorgan Chase and Co

JPM

90.6

-0.41(-0.4505%)

8617

McDonald's Corp

MCD

90.6

-0.41(-0.4505%)

8617

Merck & Co Inc

MRK

41.61

-0.12(-0.2876%)

1017

Microsoft Corp

MSFT

64.36

-0.13(-0.2016%)

14948

Pfizer Inc

PFE

41.61

-0.12(-0.2876%)

1017

Starbucks Corporation, NASDAQ

SBUX

57.4

-0.14(-0.2433%)

2445

Tesla Motors, Inc., NASDAQ

TSLA

279.85

2.46(0.8868%)

34882

Twitter, Inc., NYSE

TWTR

16.4

-0.02(-0.1218%)

33484

UnitedHealth Group Inc

UNH

90.6

-0.41(-0.4505%)

8617

Verizon Communications Inc

VZ

49.45

0.02(0.0405%)

511

Visa

V

41.61

-0.12(-0.2876%)

1017

Wal-Mart Stores Inc

WMT

71.8

0.35(0.4899%)

41344

Walt Disney Co

DIS

109.8

-0.21(-0.1909%)

100

Yahoo! Inc., NASDAQ

YHOO

45.27

-0.23(-0.5055%)

713

Yandex N.V., NASDAQ

YNDX

24.02

-0.32(-1.3147%)

1580

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Wal-Mart (WMT) upgraded to Buy from Neutral at BofA/Merrill; target $88

Downgrades:

Other:

Goldman Sachs (GS) initiated with a Neutral at Compass Point

Morgan Stanley (MS) initiated with a Neutral at Compass Point

Intel (INTC) initiated with a Buy at MKM Partners

Intel (INTC) initiated with a Sell at Rosenblat

Home Depot (HD) target raised to $158 from $153 at RBC Capital Mkts

Home Depot (HD) target raised to $154 from $150 at TAG

Wal-Mart (WMT) target raised to $67 from $66 at RBC Capital Mkts

Wal-Mart (WMT) target raised to $72 from $70 at Stifel

-

08:54

Major stock markets in Europe trading in the green zone: FTSE + 0.2%, DAX + 0.2%, CAC40 + 0.2%, FTMIB + 0.4%, IBEX + 0.3%

-

07:22

Slow start of trading expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 + 0.1%, FTSE flat

-

06:26

Global Stocks

European stocks closed at their highest in more than a year Tuesday, finding support from upbeat eurozone data, but HSBC PLC shares suffered the most since 2009 in the wake of financial results from the London-based lender. European equities climbed Tuesday after a better-than-expected preliminary reading on manufacturing activity in the eurozone. IHS Markit's February PMI gauge of eurozone manufacturing activity came in at 56.0, outstripping a 54.3 estimate from FactSet.

U.S. stocks rallied on Tuesday, with major indexes simultaneously closing at records for a second session in a row on the back of gains in defensive sectors and energy, even as concerns remained about the market's valuation. Stocks finished near their highs of the session with the day's gains broad as all 11 of the S&P 500's sectors finished higher.

Asia-Pacific stocks rose broadly following overnight gains overseas, as investors await the release later Wednesday of minutes from this month's U.S. Federal Reserve meeting. But gains are largely muted, as are declines in the few markets whose benchmark indexes are lower.

-