Market news

-

23:29

Stocks. Daily history for Feb 23’2017:

(index / closing price / change items /% change)

Nikkei -8.41 19371.46 -0.04%

TOPIX -0.84 1556.25 -0.05%

Hang Seng -87.10 24114.86 -0.36%

CSI 300 -16.44 3473.32 -0.47%

Euro Stoxx 50 -5.31 3333.96 -0.16%

FTSE 100 -30.88 7271.37 -0.42%

DAX -50.76 11947.83 -0.42%

CAC 40 -4.59 4891.29 -0.09%

DJIA +34.72 20810.32 +0.17%

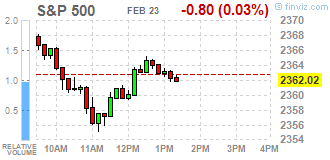

S&P 500 +0.99 2363.81 +0.04%

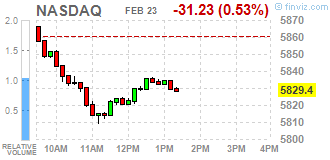

NASDAQ -25.12 5835.51 -0.43%

S&P/TSX -49.02 15781.20 -0.31%

-

20:05

DJIA 20829.93 54.33 0.26%, NASDAQ 5836.26 -24.36 -0.42%, S&P 500 2365.49 2.67 0.11%

-

18:30

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. S&P 500 and the Dow Jones Industrial Average reversed course after hitting record intraday highs late Thursday morning as losses in tech stocks offset the impact of a surge in oil prices. The technology sector, however, dropped, largely due to losses in Nvidia, setting the Nasdaq up for its worst day of this month. Oil rose more than 1% after data showed a surprise decline in U.S. inventories, suggesting a global oversupply may be ending.

Most of Dow stocks in positive area (19 of 30). Top loser - Caterpillar Inc. (CAT, -2.58%). Top gainer - Johnson & Johnson (JNJ, +1.33%).

Most of S&P sectors are also in positive area. Top loser - Conglomerates (-1.1%). Top gainer - Utilities (+1.0%).

At the moment:

Dow 20773.00 +24.00 +0.12%

S&P 500 2360.25 -0.75 -0.03%

Nasdaq 100 5326.25 -24.75 -0.46%

Oil 54.33 +0.74 +1.38%

Gold 1250.50 +17.20 +1.39%

U.S. 10yr 2.38 -0.04

-

17:19

European stocks closed: FTSE 7271.37 -30.88 -0.42%, DAX 11947.83 -50.76 -0.42%, CAC 4891.29 -4.59 -0.09%

-

14:33

U.S. Stocks open: Dow +0.19%, Nasdaq +0.03%, S&P +0.20%

-

14:27

Before the bell: S&P futures +0.17%, NASDAQ futures +0.11%

U.S. stock-index futures rose slightly, as investors weighed the minutes of the Federal Reserve's latest meeting and a fresh batch of corporate earnings.

Global Stocks:

Nikkei 19,371.46 -8.41 -0.04%

Hang Seng 24,114.86 -87.10 -0.36%

Shanghai 3,251.09 -10.13 -0.31%

FTSE 7,304.06 +1.81 +0.02%

CAC 4,911.10 +15.22 +0.31%

DAX 11,992.55 -6.04 -0.05%

Crude $54.72 (+2.11%)

Gold $1,249.30 (+0.82%)

-

13:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

98.62

0.42(0.4277%)

1599

Amazon.com Inc., NASDAQ

AMZN

858.45

2.84(0.3319%)

9984

Apple Inc.

AAPL

137.24

0.13(0.0948%)

61727

Barrick Gold Corporation, NYSE

ABX

20.2

0.33(1.6608%)

62155

Boeing Co

BA

175.1

-0.26(-0.1483%)

298

Caterpillar Inc

CAT

98.62

0.42(0.4277%)

1599

Chevron Corp

CVX

111.13

0.75(0.6795%)

555352

Cisco Systems Inc

CSCO

34.1

0.01(0.0293%)

3255

Deere & Company, NYSE

DE

108.9

-0.75(-0.684%)

2700

Facebook, Inc.

FB

136.35

0.23(0.169%)

78015

Ford Motor Co.

F

98.62

0.42(0.4277%)

1599

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.87

0.14(1.0197%)

103803

General Electric Co

GE

30.12

0.03(0.0997%)

15562

Goldman Sachs

GS

251.2

-0.53(-0.2105%)

1422

Google Inc.

GOOG

832.93

2.17(0.2612%)

945

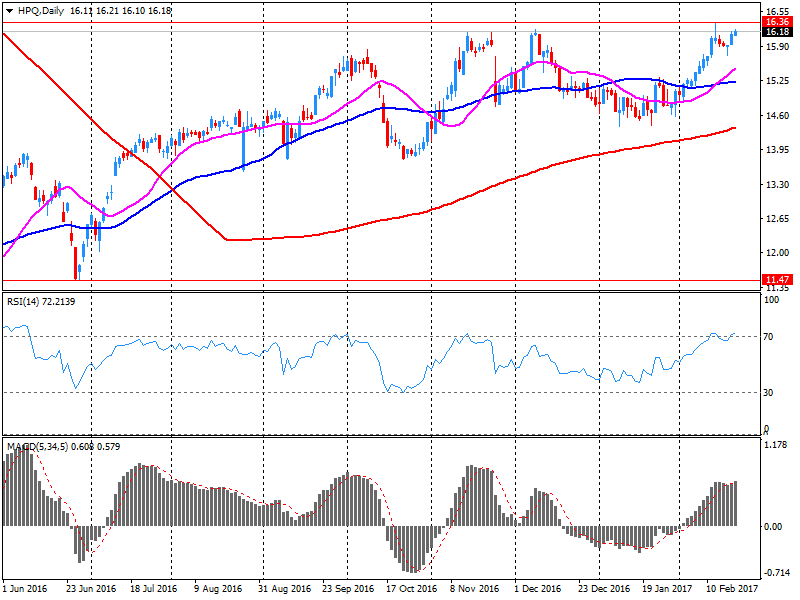

Hewlett-Packard Co.

HPQ

16.6

0.40(2.4691%)

24294

Home Depot Inc

HD

146.42

1.17(0.8055%)

7156

Intel Corp

INTC

36.19

0.12(0.3327%)

1029647

International Business Machines Co...

IBM

98.62

0.42(0.4277%)

1599

Johnson & Johnson

JNJ

98.62

0.42(0.4277%)

1599

McDonald's Corp

MCD

127.63

-0.22(-0.1721%)

1450

Microsoft Corp

MSFT

64.33

-0.03(-0.0466%)

4796

Nike

NKE

98.62

0.42(0.4277%)

1599

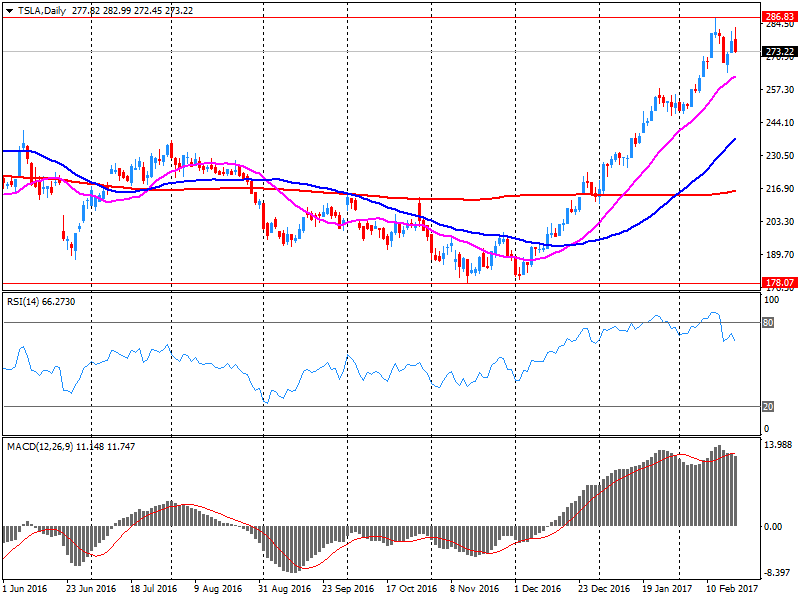

Tesla Motors, Inc., NASDAQ

TSLA

266.53

-6.98(-2.552%)

441805

The Coca-Cola Co

KO

41.67

0.07(0.1683%)

975

UnitedHealth Group Inc

UNH

98.62

0.42(0.4277%)

1599

Wal-Mart Stores Inc

WMT

71.94

0.23(0.3207%)

6230

-

13:48

Upgrades and downgrades before the market open

Upgrades:

Home Depot (HD) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $165 from $150

Downgrades:

Other:

Deere (DE) target raised to $105 from $95 at Jefferies; Hold

Tesla (TSLA) target raised to $314 from $245 at RBC Capital Mkt

HP (HPQ) target raised to $15 from $14 at Mizuho

-

13:41

Company News: Tesla (TSLA) posts mixed quarterly results

Tesla reported Q4 FY 2016 loss of $0.69 per share (versus loss of $0.87 in Q4 FY 2015), missing analysts' consensus estimate of loss of $0.53.

The company's quarterly revenues amounted to $2.285 bln (+88.2% y/y), beating analysts' consensus estimate of $2.204 bln.

The company confirmed that the Model 3 and solar roof launches are on track for the second half of the year. However, it noted, that since even a couple-week shift in timing could have a meaningful impact on total deliveries and installs, it is focusing its guidance on the first half of the year. Tesla expects to deliver 47,000 to 50,000 Model S and Model X vehicles combined in the first half of 2017, representing vehicle delivery growth of 61% to 71% compared with the same period last year.

TSLA fell to $265.89 (-2.79%) in pre-market trading.

-

13:17

Company News: HP (HPQ) quarterly results beat analysts’ expectations

HP reported Q1 FY 2017 earnings of $0.38 per share (versus $0.36 in Q1 FY 2016), beating analysts' consensus estimate of $0.37.

The company's quarterly revenues amounted to $12.684 bln (+3.6% y/y), beating analysts' consensus estimate of $11.826 bln.

The company reaffirmed its FY 2017 non-GAAP diluted net EPS guidance at $1.55-1.65 versus analysts' consensus estimate of $1.59.

HPQ rose to $16.45 (+1.54%) in pre-market trading.

-

11:46

Major stock indices in Europe trading mixed

European stock markets trading near the opening levels, as investors awaited the publication of corporate reports and monitoring the situation around the upcoming presidential elections in France.

It became known yesterday that the candidate Francois Bayrou has proposed an alliance with an independent centrist candidate Emmanuel Macron. Macron has accepted the offer. The news eased worries about the victory of Marine Le Pen, serving for weakening ties with the EU.

In focus were also minutes of the last Fed meeting. Fed officials signaled the possibility of a rate hike in view of the improvement in the economy. Some of them reported a higher probability of a rate hike in the event that inflation will rise sharply and the unemployment rate will go down. However, there was no clear indication of the timing of rate hikes. In addition, Fed officials have provided little new information on the Fed's plans to reduce its asset portfolio. According to the futures market, the likelihood of a Fed hike at the March meeting, is 17.7%, as the previous day.

Certain influence on the dynamics of trade had statistics on Germany. The annualized GDP rose by 1.2%. Experts agree that the German industry continues to gain momentum in the run-up to elections.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.02%. The capitalization of Rio Tinto fell 3.2%, while the value of Glencore rose 2.6% after reports that annual profits increased 18%.

Shares of the French conglomerate Bouygues jumped 5% after allegations of profitability improvement in one of its telecommunications divisions. Operating profit amounted to 1.1 billion euros compared to 941 million in 2015.

The cost of the Spanish telecommunications group Telefonica rose 2.1% as the company reported an increase of 14.3 per cent of the profit for the full year.

At the moment:

FTSE 100 -8.40 -0.12% 7293.85

DAX -4.78 11993.81 -0.04%

CAC 40 +4.65 4900.53 + 0.09%

-

08:34

Major stock markets in Europe trading mixed: FTSE -0.2%, DAX + 0.08%, CAC40 + 0.06%, FTMIB + 0.05%, IBEX +0.5

-

07:29

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.3%, FTSE -0.1%

-

06:32

Global Stocks

European stocks finished flat on Wednesday, backing off their highest levels in more than a year as investors readied for potential signs that borrowing costs are about to rise in the world's largest economy, the U.S. On Wednesday, Germany's closely watched Ifo business climate index came in above expectations, with a reading of 111.0 in February, compared with a 109.5 estimate, according to Dow Jones Newswires.

U.S. stocks finished mostly lower on Wednesday, but that didn't stop the Dow Jones Industrial Average from posting its ninth straight record close -- its longest such streak since Jan. 20, 1987.

Stock markets across Asia were broadly lower early Thursday, following lackluster performance on Wall Street overnight, as investors digested the latest Federal Reserve meeting minutes. Markets have mostly drifted this week, seeing short-term moves ahead of key events before correcting as the muted impact wanes.

-