Market news

-

23:29

Commodities. Daily history for Feb 23’02’2017:

(raw materials / closing price /% change)

Oil 54.36 -0.17%

Gold 1,250.70 -0.06%

-

23:29

Stocks. Daily history for Feb 23’2017:

(index / closing price / change items /% change)

Nikkei -8.41 19371.46 -0.04%

TOPIX -0.84 1556.25 -0.05%

Hang Seng -87.10 24114.86 -0.36%

CSI 300 -16.44 3473.32 -0.47%

Euro Stoxx 50 -5.31 3333.96 -0.16%

FTSE 100 -30.88 7271.37 -0.42%

DAX -50.76 11947.83 -0.42%

CAC 40 -4.59 4891.29 -0.09%

DJIA +34.72 20810.32 +0.17%

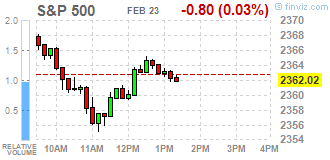

S&P 500 +0.99 2363.81 +0.04%

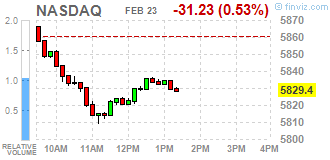

NASDAQ -25.12 5835.51 -0.43%

S&P/TSX -49.02 15781.20 -0.31%

-

23:27

Currencies. Daily history for Feb 23’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0581 +0,22%

GBP/USD $1,2554 +0,85%

USD/CHF Chf1,0059 -0,42%

USD/JPY Y112,60 -0,62%

EUR/JPY Y119,15 -0,39%

GBP/JPY Y141,36 +0,25%

AUD/USD $0,7713 +0,17%

NZD/USD $0,7229 +0,57%

USD/CAD C$1,3103 -0,45%

-

23:00

Schedule for today,Friday, Feb 24’2017 (GMT0)

07:45 France Consumer confidence February 100 100

09:30 United Kingdom BBA Mortgage Approvals January 43.23 41.9

13:30 Canada Consumer Price Index m / m January -0.2% 0.3%

13:30 Canada Consumer price index, y/y January 1.5% 1.6%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y January 1.6%

15:00 U.S. Reuters/Michigan Consumer Sentiment Index January 98.5 96

15:00 U.S. New Home Sales January 536 575

-

20:05

DJIA 20829.93 54.33 0.26%, NASDAQ 5836.26 -24.36 -0.42%, S&P 500 2365.49 2.67 0.11%

-

18:30

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes mixed. S&P 500 and the Dow Jones Industrial Average reversed course after hitting record intraday highs late Thursday morning as losses in tech stocks offset the impact of a surge in oil prices. The technology sector, however, dropped, largely due to losses in Nvidia, setting the Nasdaq up for its worst day of this month. Oil rose more than 1% after data showed a surprise decline in U.S. inventories, suggesting a global oversupply may be ending.

Most of Dow stocks in positive area (19 of 30). Top loser - Caterpillar Inc. (CAT, -2.58%). Top gainer - Johnson & Johnson (JNJ, +1.33%).

Most of S&P sectors are also in positive area. Top loser - Conglomerates (-1.1%). Top gainer - Utilities (+1.0%).

At the moment:

Dow 20773.00 +24.00 +0.12%

S&P 500 2360.25 -0.75 -0.03%

Nasdaq 100 5326.25 -24.75 -0.46%

Oil 54.33 +0.74 +1.38%

Gold 1250.50 +17.20 +1.39%

U.S. 10yr 2.38 -0.04

-

17:19

European stocks closed: FTSE 7271.37 -30.88 -0.42%, DAX 11947.83 -50.76 -0.42%, CAC 4891.29 -4.59 -0.09%

-

16:02

U.S. commercial crude oil inventories increased by 0.6 million barrels from the previous week

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 0.6 million barrels from the previous week. At 518.7 million barrels, U.S. crude oil inventories are above the upper limit of the average range for this time of year.

Total motor gasoline inventories decreased by 2.6 million barrels last week, but are at upper limit of the average range. Both finished gasoline inventories and blending components inventories decreased last week.

Distillate fuel inventories decreased by 4.9 million barrels last week but are above the upper limit of the average range for this time of year. Propane/propylene inventories fell 3.3 million barrels last week but are in the middle of the average range. Total commercial petroleum inventories decreased by 11.0 million barrels last week.

-

16:00

U.S.: Crude Oil Inventories, February 0.564

-

15:31

Bank of England: stock of corporate bond purchases equal 7.401 bln GBP in week ending feb 22 (prior week: 7.055 bln GBP)

-

15:05

Fed's Lockhart says march is "Live" for a rate hike and data are supportive of considering a move then

-

14:48

-

14:33

U.S. Stocks open: Dow +0.19%, Nasdaq +0.03%, S&P +0.20%

-

14:27

Before the bell: S&P futures +0.17%, NASDAQ futures +0.11%

U.S. stock-index futures rose slightly, as investors weighed the minutes of the Federal Reserve's latest meeting and a fresh batch of corporate earnings.

Global Stocks:

Nikkei 19,371.46 -8.41 -0.04%

Hang Seng 24,114.86 -87.10 -0.36%

Shanghai 3,251.09 -10.13 -0.31%

FTSE 7,304.06 +1.81 +0.02%

CAC 4,911.10 +15.22 +0.31%

DAX 11,992.55 -6.04 -0.05%

Crude $54.72 (+2.11%)

Gold $1,249.30 (+0.82%)

-

14:06

U.S. house prices rose 1.5 percent in the fourth quarter of 2016

U.S. house prices rose 1.5 percent in the fourth quarter of 2016 according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). House prices rose 6.2 percent from the fourth quarter of 2015 to the fourth quarter of 2016. FHFA's seasonally adjusted monthly index for December was up 0.4 percent from November.

"Although interest rates rose sharply during the fourth quarter, our data show no signs of a home price slowdown," said FHFA Deputy Chief Economist Andrew Leventis. "Although it will certainly take more time for the full effects of the elevated interest rates to be felt, there is no evidence of a normalization in the unusually low inventories of homes available for sale, which has been the primary force behind the extraordinary price gains."

-

14:01

U.S.: Housing Price Index, m/m, December 0.4% (forecast 0.4%)

-

13:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

98.62

0.42(0.4277%)

1599

Amazon.com Inc., NASDAQ

AMZN

858.45

2.84(0.3319%)

9984

Apple Inc.

AAPL

137.24

0.13(0.0948%)

61727

Barrick Gold Corporation, NYSE

ABX

20.2

0.33(1.6608%)

62155

Boeing Co

BA

175.1

-0.26(-0.1483%)

298

Caterpillar Inc

CAT

98.62

0.42(0.4277%)

1599

Chevron Corp

CVX

111.13

0.75(0.6795%)

555352

Cisco Systems Inc

CSCO

34.1

0.01(0.0293%)

3255

Deere & Company, NYSE

DE

108.9

-0.75(-0.684%)

2700

Facebook, Inc.

FB

136.35

0.23(0.169%)

78015

Ford Motor Co.

F

98.62

0.42(0.4277%)

1599

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.87

0.14(1.0197%)

103803

General Electric Co

GE

30.12

0.03(0.0997%)

15562

Goldman Sachs

GS

251.2

-0.53(-0.2105%)

1422

Google Inc.

GOOG

832.93

2.17(0.2612%)

945

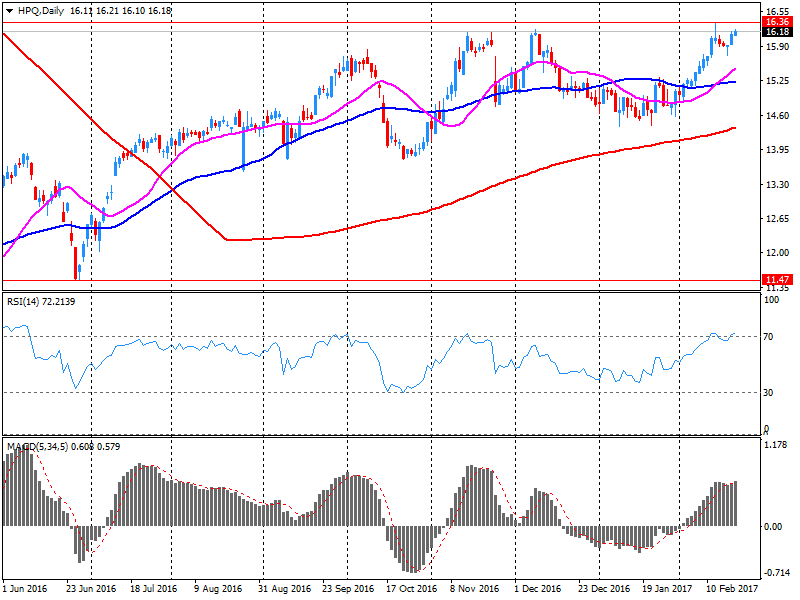

Hewlett-Packard Co.

HPQ

16.6

0.40(2.4691%)

24294

Home Depot Inc

HD

146.42

1.17(0.8055%)

7156

Intel Corp

INTC

36.19

0.12(0.3327%)

1029647

International Business Machines Co...

IBM

98.62

0.42(0.4277%)

1599

Johnson & Johnson

JNJ

98.62

0.42(0.4277%)

1599

McDonald's Corp

MCD

127.63

-0.22(-0.1721%)

1450

Microsoft Corp

MSFT

64.33

-0.03(-0.0466%)

4796

Nike

NKE

98.62

0.42(0.4277%)

1599

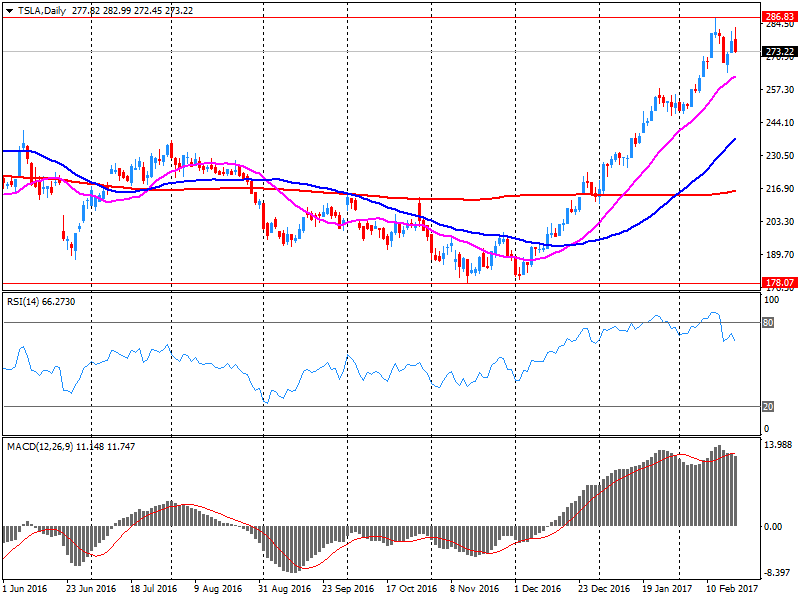

Tesla Motors, Inc., NASDAQ

TSLA

266.53

-6.98(-2.552%)

441805

The Coca-Cola Co

KO

41.67

0.07(0.1683%)

975

UnitedHealth Group Inc

UNH

98.62

0.42(0.4277%)

1599

Wal-Mart Stores Inc

WMT

71.94

0.23(0.3207%)

6230

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0400 (EUR 394 M) 1.0450 (EUR 500 M) 1.0486-1.0500 (EUR 1,116 M) 1.0550 (EUR 741 M) 1.0570-1.0580 (EUR 364 M) 1.0590-1.0600 (EUR 905 M) 1.0615-1.0625 (EUR 251 M) 1.0650-1.0665 (EUR 602 M) 1.0675-1.0685 (EUR 305 M) 1.0700 (EUR 460 M)

GBP/USD 1.2330 (GBP 205 M) 1.2596-1.2600 (GBP 194 M)

EUR/GBP 0.8400 (EUR 450 M)

USD/JPY 112.00 (USD 1,183 M) 112.70-112.75 (USD 587 M) 113.00-113.16 (USD 495 M) 113.20-113.35 (USD 431 M) 113.50-113.55 (USD 1,048 M) 113.90-114.00 (USD 305 M) 114.10-114.25 (USD 271 M) 114.40-114.50 (USD 489 M) 115.00 (USD 724 M)

EUR/JPY 117.75 (EUR 693 M) 119.25 (EUR 743 M)

USD/CHF 0.9990-1.0000 (USD 377 M)

AUD/USD 0.7490-0.7500 (AUD 223 M) 0.7650-0.7660 (AUD 226 M) 0.7675 (AUD 681 M) 0.7695-0.7700 (AUD 263 M)

USD/CAD 1.3105-1.3115 (USD 485 M) 1.3190-1.3200 (USD 420 M)

-

13:48

Upgrades and downgrades before the market open

Upgrades:

Home Depot (HD) upgraded to Overweight from Equal-Weight at Morgan Stanley; target raised to $165 from $150

Downgrades:

Other:

Deere (DE) target raised to $105 from $95 at Jefferies; Hold

Tesla (TSLA) target raised to $314 from $245 at RBC Capital Mkt

HP (HPQ) target raised to $15 from $14 at Mizuho

-

13:41

Company News: Tesla (TSLA) posts mixed quarterly results

Tesla reported Q4 FY 2016 loss of $0.69 per share (versus loss of $0.87 in Q4 FY 2015), missing analysts' consensus estimate of loss of $0.53.

The company's quarterly revenues amounted to $2.285 bln (+88.2% y/y), beating analysts' consensus estimate of $2.204 bln.

The company confirmed that the Model 3 and solar roof launches are on track for the second half of the year. However, it noted, that since even a couple-week shift in timing could have a meaningful impact on total deliveries and installs, it is focusing its guidance on the first half of the year. Tesla expects to deliver 47,000 to 50,000 Model S and Model X vehicles combined in the first half of 2017, representing vehicle delivery growth of 61% to 71% compared with the same period last year.

TSLA fell to $265.89 (-2.79%) in pre-market trading.

-

13:34

Canadian corporations earned $86.8 billion in operating profits in the fourth quarter

Canadian corporations earned $86.8 billion in operating profits in the fourth quarter, up 3.6% from the previous quarter. The operating profits in the non-financial and the financial industries were both up by $1.5 billion.

Overall, operating profits for Canadian corporations rose 13.2% compared with the fourth quarter of 2015.

n the non-financial industries, operating profits increased 2.6% from the third quarter to $58.7 billion in the fourth quarter on a $7.5 billion increase in operating revenues. Overall, profits were up in 14 of 17 non-financial industries.

Operating profits for Canadian non-financial corporations increased 11.9% compared with the fourth quarter of 2015.

-

13:30

U.S.: Initial Jobless Claims, 244 (forecast 241)

-

13:30

U.S.: Continuing Jobless Claims, 2060 (forecast 2068)

-

13:17

Company News: HP (HPQ) quarterly results beat analysts’ expectations

HP reported Q1 FY 2017 earnings of $0.38 per share (versus $0.36 in Q1 FY 2016), beating analysts' consensus estimate of $0.37.

The company's quarterly revenues amounted to $12.684 bln (+3.6% y/y), beating analysts' consensus estimate of $11.826 bln.

The company reaffirmed its FY 2017 non-GAAP diluted net EPS guidance at $1.55-1.65 versus analysts' consensus estimate of $1.59.

HPQ rose to $16.45 (+1.54%) in pre-market trading.

-

13:09

Mnuchin says U.S. National debt is a longer-term issue, not a shorter-term one

-

Both tax plan and regulatory relief will use "Dynamic scoring" to boost revenues

-

Going to have a combined tax plan with congress

-

Sees limited impact from trump administration policies in 2017

-

Does not expect to see growth until 2018

-

-

13:00

Orders

EUR/USD

Offers 1.0580 1.0600 1.0620 1.0635 1.0650

Bids 1.0550 1.0530 1.0500 1.0480-85 1.0450 1.0430 1.0400

GBP/USD

Offers 1.2480-85 1.2500 1.2520 1.2550 1.2575-80 1.2600

Bids 1.2450 1.2425-30 1.2400 1.2380 1.2345-50

EUR/GBP

Offers 0.8485 0.8500 0.8520 0.8535 0.8550

Bids 0.8450 0.8430 0.8400 0.8385 0.8350

EUR/JPY

Offers 119.85 120.00 120.30 120.50 120.80 121.00

Bids 119.30 119.00 118.80 118.50 118.30 118.00

USD/JPY

Offers 113.50 113.80-85 114.00-05114.20114.35 114.50

Bids 113.00 112.80 112.50 112.30 112.00

AUD/USD

Offers 0.7700 0.7720 0.7735 0.7750 0.7780 0.7800

Bids 0.7675-80 0.7665 0.7650 0.7620 0.7600

-

12:10

US Tsy Sec. Mnuchin: 3% GDP Growth Is ‘Very Achievable’ -Could Take Until Late 2018 To Reach 3% Growth @Livesquawk

-

12:10

Macron seen beating Le Pen in run-off vote by 60 pct - Opinionway poll

-

11:46

Major stock indices in Europe trading mixed

European stock markets trading near the opening levels, as investors awaited the publication of corporate reports and monitoring the situation around the upcoming presidential elections in France.

It became known yesterday that the candidate Francois Bayrou has proposed an alliance with an independent centrist candidate Emmanuel Macron. Macron has accepted the offer. The news eased worries about the victory of Marine Le Pen, serving for weakening ties with the EU.

In focus were also minutes of the last Fed meeting. Fed officials signaled the possibility of a rate hike in view of the improvement in the economy. Some of them reported a higher probability of a rate hike in the event that inflation will rise sharply and the unemployment rate will go down. However, there was no clear indication of the timing of rate hikes. In addition, Fed officials have provided little new information on the Fed's plans to reduce its asset portfolio. According to the futures market, the likelihood of a Fed hike at the March meeting, is 17.7%, as the previous day.

Certain influence on the dynamics of trade had statistics on Germany. The annualized GDP rose by 1.2%. Experts agree that the German industry continues to gain momentum in the run-up to elections.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0.02%. The capitalization of Rio Tinto fell 3.2%, while the value of Glencore rose 2.6% after reports that annual profits increased 18%.

Shares of the French conglomerate Bouygues jumped 5% after allegations of profitability improvement in one of its telecommunications divisions. Operating profit amounted to 1.1 billion euros compared to 941 million in 2015.

The cost of the Spanish telecommunications group Telefonica rose 2.1% as the company reported an increase of 14.3 per cent of the profit for the full year.

At the moment:

FTSE 100 -8.40 -0.12% 7293.85

DAX -4.78 11993.81 -0.04%

CAC 40 +4.65 4900.53 + 0.09%

-

11:05

UK retail sales expected to rise again - CBI

The survey of 128 firms, of which 64 were retailers, showed that sales volumes are expected to rise again in the year to March, albeit at a slightly slower pace.

However, the volume of orders placed upon suppliers fell over the year to February, having been stable last month, and a further decline is expected next month. Sales for the time of year remained broadly in line with seasonal norms in February - for a second consecutive month - following above-average sales in the final two months of 2016.

-

11:00

United Kingdom: CBI retail sales volume balance, February 9 (forecast 5)

-

10:45

Fitch on U.S. Government debt: "Congress and administration may want to consider an alternative, more predictable procedure for setting debt limit"

-

10:22

ECB's Praet- we see political accidents can happen in Europe so we have to be vigilant, well prepared

-

On Brexit you cannot only be optimistic, these things can turn very nasty

-

Signals from Trump are worrying because they are simple narratives but with complex stories behind them

-

Global system can go into a very vicious circle if you go into very simplistic narratives

-

-

10:02

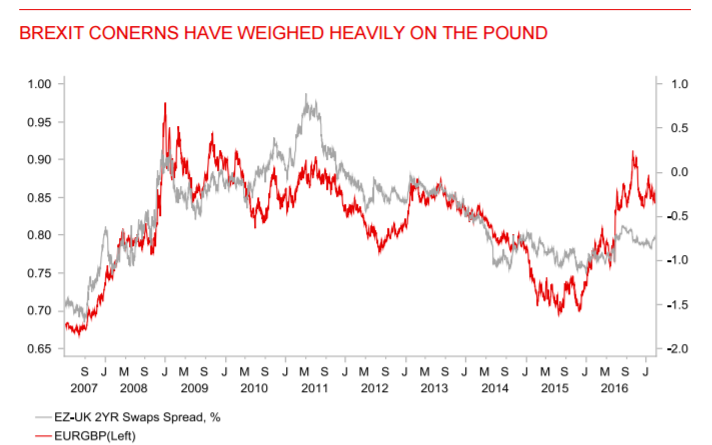

The pound’s upward momentum has been reinforced - BTMU

"The pound has continued to strengthen during the Asian trading session despite further dovish comments yesterday from BoE policymakers.

The pound's upward momentum has been reinforced after EUR/GBP closed below its' 200-day moving average at around 0.8470 for the first time yesterday since late in 2015.

It could provide an important bullish technical signal for the pound in the near-term, and supports our view that the pound will outperform more bearish expectations during the first half of this year and lower EUR/GBP closer to the 0.80000-level.

Building political risks in Europe are providing support for the pound and are beginning to outweigh Brexit concerns at least in the near-term.

We have never bought into the view that the triggering of Article 50 which is still likely next month should justify further pound weakness after it has already lost around a fifth of its value against the currencies of the UK's main trading partners in recent years.

We continue to believe that the bulk of the Brexit adjustment is already behind us with a lot of bad news and uncertainty already priced into the pound at current weak levels".

Copyright © 2017 BTMU, eFXnews™

-

09:57

Oil is trading higher

This morning the New York futures for Brent rose by + 0.7% to 56.23 and WTI rose 0.75% to the level of 53.99. Prices for black gold rose slightly amid optimism associated with themOPEC production cut. Prices rose despite the decline in oil reserves in the United States.

Yesterday, the American Petroleum Institute reported a reduction in reserves of black gold in the United States by -0.9 million barrels, gasoline inventories -0.9 million barrels, while distillates -4.2 million barrels.

-

09:49

Italian retail trade down 0.5% in December

In December 2016 the seasonally adjusted retail trade index decreased by 0.5% with respect to November 2016 (-0.2% for food goods and -0.8% for non-food goods). The average of the last three months increased with respect to the previous three months (+0.1%). The unadjusted index decreased by 0.2% with respect to December 2015.

-

08:34

Major stock markets in Europe trading mixed: FTSE -0.2%, DAX + 0.08%, CAC40 + 0.06%, FTMIB + 0.05%, IBEX +0.5

-

08:16

Switzerland: Industrial Production (YoY), Quarter IV -1.2%

-

08:04

Today’s events

-

At 08:55 GMT the ECB Board Member Peter Praet will make a speech

-

At 10:00 GMT ECB Jens Weidmann will make a speech

-

At 10:30 GMT, Britain will hold an auction of 10-year bonds

-

At 11:00 GMT the ECB Board Member Peter Praet will make a speech

-

At 13:35 GMT FOMC member Dennis Lockhart will give a speech

-

At 18:00 GMT FOMC members Robert Kaplan will deliver a speech

-

At 22:30 GMT RBA Governor Philip Lowe will deliver a speech

-

-

07:29

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.3%, FTSE -0.1%

-

07:27

Options levels on thursday, February 23, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0675 (2818)

$1.0643 (3430)

$1.0604 (1963)

Price at time of writing this review: $1.0546

Support levels (open interest**, contracts):

$1.0509 (5053)

$1.0475 (4956)

$1.0435 (3362)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 73849 contracts, with the maximum number of contracts with strike price $1,0800 (4751);

- Overall open interest on the PUT options with the expiration date March, 13 is 83468 contracts, with the maximum number of contracts with strike price $1,0550 (5462);

- The ratio of PUT/CALL was 1.13 versus 1.15 from the previous trading day according to data from February, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.2701 (2440)

$1.2602 (2246)

$1.2505 (3043)

Price at time of writing this review: $1.2435

Support levels (open interest**, contracts):

$1.2396 (1610)

$1.2298 (3256)

$1.2199 (1489)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33714 contracts, with the maximum number of contracts with strike price $1,2500 (3043);

- Overall open interest on the PUT options with the expiration date March, 13 is 36733 contracts, with the maximum number of contracts with strike price $1,2300 (3256);

- The ratio of PUT/CALL was 1.09 versus 1.05 from the previous trading day according to data from February, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:19

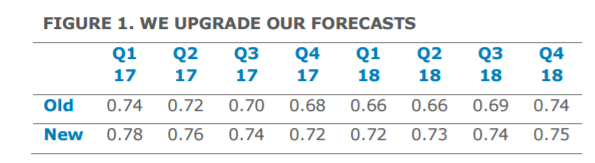

We recommend using AUD weakness to buy rallies - ANZ

"Significant AUD downside has started to look more like a tail risk than a central forecast. Commodity prices have risen more than anticipated, liquidity remains ample and volatility is expected to remain in check.

Valuation has also corrected. There is now a negative risk premium priced into the AUD which suggests that even if a tail risk does manifest, the current level of the AUD provides some protection relative to other cyclical currencies.

Putting this altogether, we continue to think that the current risk premium will be retained in the AUD, that fundamentals will be more stable, and that there is some further downside risk via a USD overshoot on policy.

As such we raise our forecasts, expecting the AUD to remain in its recent range for longer, and shift our bias. We recommend using weakness to buy rallies, rather than aggressively selling into strength".

ANZ maintains a long AUD/USD position from 0.7380 targeting 0.78, with a revised profit-stop at 0.7595.

Copyright © 2017 ANZ, eFXnews™

-

07:16

French election poll by BVA: Le Pen wins in the 1st round of voting with 27.5% (+2.5% higher than the previous survey) but loses in the second round to Macron

-

07:12

Australian new capital expenditure fell 3.1% in the December quarter

The trend volume estimate for total new capital expenditure fell 3.1% in the December quarter 2016 and the seasonally adjusted estimate fell 2.1%.

The trend volume estimate for buildings and structures fell 4.7% in the December quarter 2016 and the seasonally adjusted estimate fell 4.1%.

The trend volume estimate for equipment, plant and machinery fell 0.4% in the December quarter 2016 while the seasonally adjusted estimate rose 0.4%.

-

07:09

Bank Of Korea Leaves Base Rate Unchanged at 1.25%

-

07:08

Consumer confidence in Germany suffers a minor setback in February - GfK

After a splendid start into 2017, consumer confidence in Germany suffers a minor setback in February. Both economic and income expectations, as well as propensity to buy are expected to decline. The consumer climate forecast for March is at 10.0 points following a level of 10.2 in February. The change of administration in the United States and the considerable recent increase in inflation have put a damper on the generally positive consumer mood in February.

As a result, expectations for the economy and income forfeited a major part of their gains from previous months. Pulled down by the lowered income expectations, propensity to buy also dropped moderately. Economic expectation: tangible

-

07:06

German GDP in line with expectations in Q4 2016, lower on year

The German economy continued its moderate growth at the end of 2016. As the Federal Statistical Office (Destatis) already reported in its first release of 14 February 2017, the gross domestic product (GDP) increased 0.4% - upon price, seasonal and calendar adjustment - in the fourth quarter of 2016 compared with the previous quarter. The economic situation in Germany in 2016 thus was characterised by solid and steady growth (+0.7% in the first quarter, +0.5% in the second quarter and +0.1% in the third quarter). For the whole year of 2016, this was an increase of 1.9% (calendar-adjusted: +1.8%). The provisional annual GDP result released in January has thus been confirmed.

The quarter-on-quarter comparison (upon adjustment for price, seasonal and calendar variations) shows that positive contributions came mainly from domestic demand. The final consumption expenditure of general government rose by 0.8% and household final consumption expenditure increased by 0.3% on the third quarter of 2016. A largely positive development was also observed for capital formation. Especially gross fixed capital formation in construction was up (+1.6%) on the previous quarter. Gross fixed capital formation in machinery and equipment fell slightly (-0.1%) on the previous quarter. On the whole, domestic uses rose by 0.9% (upon price, seasonal and calendar adjustment) compared with the third quarter of 2016.

-

07:00

Germany: Gfk Consumer Confidence Survey, March 10.0 (forecast 10.1)

-

07:00

Germany: GDP (YoY), Quarter IV 1.2% (forecast 1.6%)

-

07:00

Germany: GDP (QoQ), Quarter IV 0.4% (forecast 0.4%)

-

06:32

Global Stocks

European stocks finished flat on Wednesday, backing off their highest levels in more than a year as investors readied for potential signs that borrowing costs are about to rise in the world's largest economy, the U.S. On Wednesday, Germany's closely watched Ifo business climate index came in above expectations, with a reading of 111.0 in February, compared with a 109.5 estimate, according to Dow Jones Newswires.

U.S. stocks finished mostly lower on Wednesday, but that didn't stop the Dow Jones Industrial Average from posting its ninth straight record close -- its longest such streak since Jan. 20, 1987.

Stock markets across Asia were broadly lower early Thursday, following lackluster performance on Wall Street overnight, as investors digested the latest Federal Reserve meeting minutes. Markets have mostly drifted this week, seeing short-term moves ahead of key events before correcting as the muted impact wanes.

-

05:16

Japan: Leading Economic Index , December 104.8 (forecast 105.2)

-

05:16

Japan: Coincident Index, December 114.8

-

00:30

Australia: Private Capital Expenditure, Quarter IV -2.1% (forecast -0.5%)

-