Market news

-

20:01

DJIA 20750.53 -59.79 -0.29%, NASDAQ 5828.02 -7.48 -0.13%, S&P 500 2358.69 -5.12 -0.22%

-

17:59

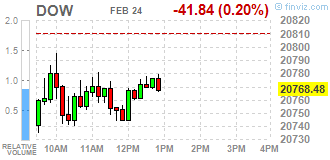

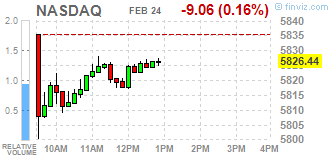

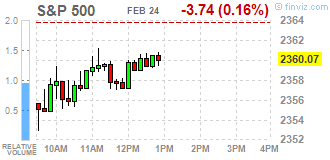

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock indexes slightly fell on Friday, as investors reassessed the "Trump rally" after recent comments suggested that pro-growth policies might take longer to be implemented. U.S. markets are trading at record levels since the U.S. election, spurred by President Donald Trump's promises of tax reforms, reduced regulations and increased infrastructure spending. But, with Trump giving scant detail on his plans - including one on Thursday to bring millions of jobs back to the United States - markets have recently traded in a tight range.

Most of Dow stocks in negative area (18 of 30). Top loser - JPMorgan Chase & Co. (JPM, -1.54%). Top gainer - Wal-Mart Stores, Inc. (WMT, +1.47%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-1.1%). Top gainer - Utilities (+0.6%).

At the moment:

Dow 20755.00 -42.00 -0.20%

S&P 500 2358.75 -4.00 -0.17%

Nasdaq 100 5323.75 -8.25 -0.15%

Oil 54.12 -0.33 -0.61%

Gold 1257.60 +6.20 +0.50%

U.S. 10yr 2.33 -0.06

-

17:00

European stocks closed: FTSE 7243.70 -27.67 -0.38%, DAX 11804.03 -143.80 -1.20%, CAC 4845.24 -46.05 -0.94%

-

15:45

EU's Dombrovskis says hopes greek bailout review can be concluded by March deadline

-

15:17

US consumer confidence remained slightly below the decade peak recorded in January - UoM

While consumer confidence edged upward in late February, it remained slightly below the decade peak recorded in January. Overall, the Sentiment Index has been higher during the past three months than anytime since March 2004. Normally, the implication would be that consumers expected Trump's election to have a positive economic impact.

That is not the case since the gain represents the result of an unprecedented partisan divergence, with Democrats expecting recession and Republicans expecting robust growth. Indeed, the difference between these two parties is nearly identical to the difference between the all-time peak and trough values in the Expectations Index - 64.6 versus 64.4.

While the expectations of Democrats and Republicans largely offset each other, the overall gain in the Expectations Index was due to self-identified Independents, who were much closer to the optimism of the Republicans than the pessimism of the Democrats.

-

15:15

US new home sales rebound in January

Sales of new single-family houses in January 2017 were at a seasonally adjusted annual rate of 555,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.7 percent (±18.5 percent)* above the revised December rate of 535,000 and is 5.5 percent (±25.4 percent)* above the January 2016 estimate of 526,000.

The median sales price of new houses sold in January 2017 was $312,900. The average sales price was $360,900.

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, February 96.3 (forecast 96)

-

15:00

U.S.: New Home Sales, January 555 (forecast 575)

-

14:34

U.S. Stocks open: Dow -0.33%, Nasdaq -0.54%, S&P -0.43%

-

14:29

Before the bell: S&P futures -0.47%, NASDAQ futures -0.56%

U.S. stock-index futures fell as a drop in oil prices weighed and investors assessed if the "Trump rally" had gone too far too soon.

-

14:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

186.56

-0.63(-0.3366%)

2760

ALCOA INC.

AA

33.69

-0.63(-1.8357%)

20315

ALTRIA GROUP INC.

MO

74.02

-0.44(-0.5909%)

6323

Amazon.com Inc., NASDAQ

AMZN

845.18

-7.01(-0.8226%)

21930

American Express Co

AXP

79.57

-0.48(-0.5996%)

2055

Apple Inc.

AAPL

135.33

-1.20(-0.8789%)

205843

AT&T Inc

T

41.75

-0.20(-0.4768%)

1389

Barrick Gold Corporation, NYSE

ABX

20.06

0.40(2.0346%)

91765

Boeing Co

BA

176.11

-0.75(-0.4241%)

1997

Caterpillar Inc

CAT

94.92

-0.63(-0.6593%)

9132

Chevron Corp

CVX

110.5

-0.52(-0.4684%)

5427

Cisco Systems Inc

CSCO

33.87

-0.17(-0.4994%)

9620

Citigroup Inc., NYSE

C

59.79

-0.83(-1.3692%)

115333

Deere & Company, NYSE

DE

106.9

-0.83(-0.7704%)

299

E. I. du Pont de Nemours and Co

DD

79.43

-0.16(-0.201%)

2105

Exxon Mobil Corp

XOM

81.47

-0.31(-0.3791%)

5953

Facebook, Inc.

FB

133.9

-1.46(-1.0786%)

169133

FedEx Corporation, NYSE

FDX

191

-0.18(-0.0942%)

2313

Ford Motor Co.

F

12.48

-0.08(-0.6369%)

33681

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.3

-0.18(-1.3353%)

96942

General Electric Co

GE

29.91

-0.11(-0.3664%)

17955

General Motors Company, NYSE

GM

37

-0.25(-0.6711%)

3320

Goldman Sachs

GS

247.51

-3.68(-1.465%)

54669

Google Inc.

GOOG

35.99

-0.19(-0.5251%)

16808

Hewlett-Packard Co.

HPQ

17.24

-0.36(-2.0455%)

46443

Home Depot Inc

HD

144.12

-0.59(-0.4077%)

4210

Intel Corp

INTC

35.99

-0.19(-0.5251%)

16808

International Business Machines Co...

IBM

180.58

-1.07(-0.589%)

1082

Johnson & Johnson

JNJ

120.66

-0.24(-0.1985%)

3149

JPMorgan Chase and Co

JPM

89.85

-1.28(-1.4046%)

46052

McDonald's Corp

MCD

127.8

-0.47(-0.3664%)

3503

Merck & Co Inc

MRK

65.51

-0.34(-0.5163%)

2840

Microsoft Corp

MSFT

64.26

-0.36(-0.5571%)

46427

Nike

NKE

57.25

-0.14(-0.2439%)

11905

Pfizer Inc

PFE

33.95

-0.11(-0.323%)

2718

Procter & Gamble Co

PG

90.85

-0.28(-0.3073%)

2076

Tesla Motors, Inc., NASDAQ

TSLA

251.46

-4.53(-1.7696%)

102263

The Coca-Cola Co

KO

41.57

-0.09(-0.216%)

7901

Travelers Companies Inc

TRV

122.13

-0.23(-0.188%)

2455

Twitter, Inc., NYSE

TWTR

15.93

-0.10(-0.6238%)

59571

United Technologies Corp

UTX

111.74

-0.35(-0.3123%)

2515

UnitedHealth Group Inc

UNH

162.03

-0.57(-0.3506%)

2222

Verizon Communications Inc

VZ

50.18

-0.13(-0.2584%)

7003

Visa

V

87.61

-0.57(-0.6464%)

2906

Wal-Mart Stores Inc

WMT

71.11

-0.20(-0.2805%)

17987

Walt Disney Co

DIS

109.27

-0.46(-0.4192%)

5154

Yahoo! Inc., NASDAQ

YHOO

44.99

-0.42(-0.9249%)

2850

Yandex N.V., NASDAQ

YNDX

23.66

-0.08(-0.337%)

1609

-

13:52

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Hewlett Packard Enterprise (HPE) downgraded to Hold from Buy at Needham

Hewlett Packard Enterprise (HPE) downgraded to Market Perform from Outperform at BMO Capital

Goldman Sachs (GS) downgraded to Sell from Hold at Berenberg

Other:

-

13:44

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0490-1.0501 (EUR 1,442 M) 1.0520-1.0525 (EUR 710 M) 1.0550 (EUR 1,513 M) 1.0575 (EUR 970 M) 1.0585-1.0600 (EUR 403 M) 1.0650-1.0655 (EUR 419 M) 1.0665-1.0675 (EUR 251 M) 1.0700-1.0715 (EUR 1,449 M)

GBP/USD 1.2450-1.2461 (GBP 352 M) 1.2500 (GBP 473 M) 1.2580-1.2590 (GBP 314 M) 1.2600-1.2615 (GBP 213 M)

EUR/GBP 0.8485-0.8500 (EUR 187 M)

USD/JPY 111.00-111.05 (USD 376 M) 111.45-111.55 (USD 330 M) 111.95-112.00 (USD 643 M) 112.20-112.35 (USD 880 M) 112.50 (USD 550 M) 112.75 (USD 970 M) 113.15-113.25 (USD 361 M) 113.50-113.65 (USD 700 M) 113.70-113.75 (USD 245 M) 114.00-114.10 (USD 1,063 M)

USD/CHF 1.0100-1.0115 (USD 300 M)

AUD/USD 0.7525-0.7540 (AUD 664 M) 0.7600-0.7610 (AUD 396 M) 0.7640-0.7655 (AUD 242 M)

USD/CAD 1.3080-1.3095 (USD 605 M) 1.3100-1.3112 (USD 603 M) 1.3120 (USD 365 M) 1.3150-1.3165 (USD 381 M) 1.3185-1.3200 (USD 330 M) 1.3215-1.3220 (USD 270 M) 1.3285-1.3300 (USD 262 M)

NZD/USD 0.7150-0.7155 (NZD 208 M) 0.7400 (NZD 277 M)

-

13:37

Huge rise for Canadian CPI in January

The Consumer Price Index (CPI) rose 2.1% on a year-over-year basis in January, following a 1.5% gain in December.

Excluding gasoline, the CPI was up 1.5% year over year in January, after posting a 1.4% increase in December.

Prices were up in seven of the eight major components in the 12 months to January, with the transportation and shelter indexes contributing the most to the year-over-year rise in the CPI. The food index declined on a year-over-year basis for the fourth consecutive month.

The transportation index rose on a year-over-year basis, up 6.3% in January after a 3.0% gain in December. The gain in January was led by gasoline prices, which posted their largest increase since September 2011, up 20.6% in the 12 months to January. The increase was partly attributable to higher crude oil prices in January, as well as a monthly decline one year earlier. On a year-over-year basis, the purchase of passenger vehicles index rose more in January (+3.8%) than in December (+2.6%). This acceleration was partly attributable to the greater availability of new 2017-model-year vehicles.

-

13:36

-

13:30

Canada: Bank of Canada Consumer Price Index Core, y/y, January 1.7%

-

13:30

Canada: Consumer price index, y/y, January 2.1% (forecast 1.6%)

-

13:30

Canada: Consumer Price Index m / m, January 0.9% (forecast 0.3%)

-

13:27

Company News: Hewlett Packard Enterprise (HPE) posts mixed results

Hewlett Packard Enterprise reported Q1 FY2017 earnings of $0.45 per share (versus $0.41 in Q1 FY2016), beating analysts' consensus estimate of $0.44.

The company's quarterly revenues amounted to $11.407 bln (-10.4% y/y), missing analysts' consensus estimate of $12.050 bln.

The company issued guidance for Q2 EPS of $0.41-0.45 versus analysts' consensus estimate of $0.45. It also lowered its FY2017 EPS forecast to $1.88-1.98 from $2.00-2.10 versus analysts' consensus estimate of $1.93.

HPE fell to $22.69 (-7.99%) in pre-market trading.

-

13:00

Orders

EUR/USD

Offers 1.0600-05 1.0620 1.0635 1.0650 1.0680 1.0700

Bids 1.0575-80 1.0550 1.0530 1.0500 1.0480-85 1.0450

GBP/USD

Offers 1.2565 1.2575-80 1.2600 1.2630 1.2650

Bids 1.2530 1.2500 1.2480 1.2450 1.2425-30 1.2400

EUR/GBP

Offers 0.8460 0.8485 0.8500 0.8520 0.8535 0.8550

Bids 0.8420 0.8400 0.8385 0.8350 0.8300

EUR/JPY

Offers 119.50 119.85 120.00 120.30 120.50

Bids 119.00 118.80 118.50 118.30 118.00

USD/JPY

Offers 112.85 113.00 113.25-30 113.50 113.80-85 114.00-05

Bids 112.50 112.30 112.00 111.85 111.50 111.00

AUD/USD

Offers 0.7720 0.7735 0.7750 0.7780 0.7800

Bids 0.7680 0.7665 0.7650 0.7620 0.7600

-

11:59

Major European stock indices trading in the red zone

European stock markets show negative dynamics. Market focus is on corporate reporting as well as the continued political instability in Europe and the United States.

Some support provide statistical data from France and Britain. The survey results provided by the Statistical Office Insee showed that consumer sentiment in France remained stable this month. According to the data, in February consumer confidence index remained at the level of 100 points, which corresponds to the long-term average. A reading in line with expectations. "Concerns regarding the Household unemployment were virtually stable in February - said Insee. In addition, fewer households than in January expecting a rise in prices in the next 12 months."

Meanwhile, the British Bankers' Association (BBA) said that in January the British banks approved the largest number of mortgage loans in the last 12 months. According to the data, in January were approved 44,657 applications for mortgage loans compared to 43,581 in December. The last reading was the highest since January last year, when 45,794 applications for mortgage loans have been approved, and exceeded the forecasts of experts who had expected a decline to 41 900.

The composite index of the largest companies in the region Stoxx Europe 600 was down 0.67%, to the level of 370.34. Most of the major stock exchanges and sectors traded in negative territory.

The capitalization of BASF - the world's largest chemical company - fell by 3.6% after the company reported a 6 per cent reduction in profit before tax in 2016.

Shares of Vivendi - French media conglomerate - fell by 4.2%, as financial indicators for 2017 were worse than expectations. The company also reported that in the 4th quarter adjusted net profit fell by 34%, to 130 million euros.

The cost of Royal Bank of Scotland Group fell 3.4% after the lender announced a net loss of $ 8.7 billion. For 2016.

At the moment:

FTSE 100 7226.21 -45.16 -0.62%

DAX -131.74 11816.09 -1.10%

CAC 40 4838.52 -52.77 -1.08%

-

11:17

China overtook the United States and France as the largest trading partner of Germany

As shown by the data, for the first time China has become the most important trading partner of Germany in 2016, overtaking the US, which fell back to third place behind France.

German imports from China and exports to China rose to 170 billion euro in 2016, according to the data of the Federal Bureau of Statistics.

This improvement is likely to be welcomed by the German government, which has set a goal to protect the global free trade after the US president Donald Trump threatened to impose import taxes and his chief adviser blamed Germany to use the weakness of the euro to stimulate exports. German Vice Chancellor Sigmar Gabriel even suggested that the European Union must reorient its economic policies towards Asia, if the Trump administration will stick to the policy of protectionism.

-

10:45

German foreign ministry spokesman says asked about trade with U.S, we don't want to avoid having discussions with anyone

-

10:12

Le Pen will agree to be questioned by police but only after elections this year - Lawyer

-

10:11

UK net mortgage borrowing was 2.4% last month

The BBA's latest high street banking data shows that consumer borrowing through overdrafts, loans and credit cards grew at an annual rate of 6.7%.

Gross mortgage borrowing totalled £13.8 billion in January, 6.3% higher than the same period last year.

Re-mortgaging approvals in January were 15.7% higher than January 2016, driven by historically low interest rates.

Net mortgage borrowing was 2.4% last month, higher than in January 2016.

-

09:30

United Kingdom: BBA Mortgage Approvals, January 44.7 (forecast 41.9)

-

09:28

Oil is trading lower

This morning the New York futures for Brent have fallen in price by 0.57% to a mark of 56.26 and WTI fell 0.57% to 54.14. Oil prices fell slightly after yesterday's energy inventories data. The volume of oil stocks in the United States at the end of last week rose by 564 thousand barrels to 518.683 million barrels. At the same time, gasoline stocks fell by 2,628 thousand barrels and amounted to 256.435 million barrels.

-

09:03

Bundesbank’s Dombret: Brexit Is a Two Way Street For Market Access

-

08:49

Major European stock markets trading in the red zone: FTSE -0.1%, DAX -0.2%, CAC40 -0.1%, FTMIB -0.1%, IBEX + 0.2%

-

08:14

Today’s events

-

At 15:00 GMT US Inflation expectations from the University of Michigan

-

At 18:00 GMT The number of US drilling rigs operating - Baker Hughes data

-

-

07:45

France: Consumer confidence , February 100 (forecast 100)

-

07:39

We are negative on the UK economy going forward although it did well in H2 last year. How to trade GBP/USD - SEB

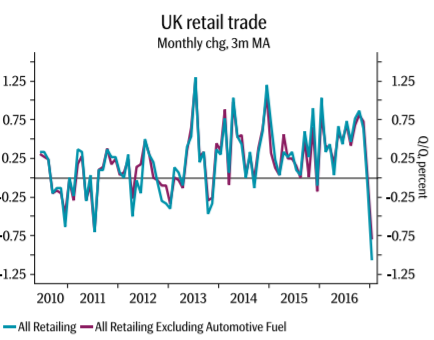

"We are negative on the UK economy going forward although it did well in H2 last year. In particular household and capital spending seem vulnerable from the impact of growing political uncertainty created by the upcoming divorce from the EU. Retail sales have already showed signs of slowing and will likely continue to do so.

However, these reasons for GBP weakness are currently overshadowed by political risks elsewhere, which have caused a small recovery of the GBP. We argue this recovery is just temporary and is unlikely to last.

Nevertheless, the net short exposure to GBP is still much larger than it has been historically. Consequently, sterling may well continue to recover in coming weeks as long as market players focus elsewhere. Not so much because things have improved in any particular way in the UK but more because political uncertainty and risks have increased elsewhere. This might well continue until the second round of the French presidential elections in May.

However, EUR/GBP around 0.83 would represent a compelling buy with a target closer to 0.90. Alternatively we suggest selling GBP/SEK around 11.50-11.70 for the currency pair to reach levels below 10.50 in the second half of this year".

Copyright © 2017 SEB, eFXnews™

-

07:34

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.3%, FTSE -0.2%

-

07:26

Options levels on friday, February 24, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0712 (3286)

$1.0673 (2844)

$1.0642 (3478)

Price at time of writing this review: $1.0588

Support levels (open interest**, contracts):

$1.0537 (5462)

$1.0510 (5437)

$1.0476 (4885)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 73913 contracts, with the maximum number of contracts with strike price $1,0800 (4726);

- Overall open interest on the PUT options with the expiration date March, 13 is 84095 contracts, with the maximum number of contracts with strike price $1,0600 (5462);

- The ratio of PUT/CALL was 1.14 versus 1.13 from the previous trading day according to data from February, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.2800 (3129)

$1.2701 (2385)

$1.2604 (2183)

Price at time of writing this review: $1.2547

Support levels (open interest**, contracts):

$1.2496 (2328)

$1.2398 (1675)

$1.2299 (3260)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 34064 contracts, with the maximum number of contracts with strike price $1,2800 (3129);

- Overall open interest on the PUT options with the expiration date March, 13 is 37423 contracts, with the maximum number of contracts with strike price $1,2300 (3260);

- The ratio of PUT/CALL was 1.10 versus 1.09 from the previous trading day according to data from February, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:25

Joint OPEC/non-OPEC technical committee reports 86 percent compliance with oil cuts for OPEC and non-OPEC for January

-

07:24

Trump says he supports some form of border tax, without offering specifics - Reuters interview

-

07:23

U.S. based technology sector stock funds attract $417 mln over weekly period; 3rd straight week of inflows

-

07:21

Fitch on india banking sector - creation of a 'bad bank' may face significant logistical difficulties

-

A larger-scale bad bank with government backing might have more

-

Believe government will eventually be required to provide more than $10.4 bln that it has earmarked for capital injections by fye19

-

Expect stressed-asset ratio to rise over coming year from 12.3% recorded at end-september 2016

-

-

07:12

Russia raised gold holdings by 29.9 tonnes to 1,645.194 tonnes in 20IMF data

-

06:34

Global Stocks

European stocks ended modestly lower Thursday but stayed on track for a weekly gain, as investors sifted through earnings reports and assessed the mixed tone on the path for monetary policy from the Federal Reserve.

The Dow Jones Industrial Average extended its hot streak on Thursday, closing at a record for a tenth session in a row while the Nasdaq Composite logged its first back-to-back decline of the year, weighed down by big losses in Nvidia Corp.

Shares in Asia lost ground Friday as dovish signals from the U.S. Federal Reserve weakened the dollar, with possible consequences for the competitiveness of Asian exports. The minutes from the U.S. Federal Reserve's latest meeting released earlier this week suggested the next interest-rate increase would come "fairly soon." Some investors interpreted that as a dovish signal that the Fed was backing away from a rate rise in March.

-