Market news

-

23:28

Stocks. Daily history for Feb 21’2017:

(index / closing price / change items /% change)

Nikkei +130.36 19381.44 +0.68%

TOPIX +8.59 1555.60 +0.56%

Hang Seng -182.45 23963.63 -0.76%

CSI 300 +11.43 3482.82 +0.33%

Euro Stoxx 50 +26.94 3339.33 +0.81%

FTSE 100 -25.03 7274.83 -0.34%

DAX +139.87 11967.49 +1.18%

CAC 40 +23.77 4888.76 +0.49%

DJIA +118.95 20743.00 +0.58%

S&P 500 +14.22 2365.38 +0.60%

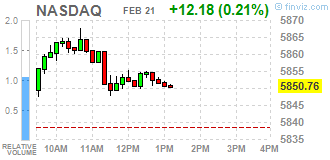

NASDAQ +27.37 5865.95 +0.47%

S&P/TSX +83.74 15922.37 +0.53%

-

20:00

DJIA 20732.98 108.93 0.53%, NASDAQ 5859.52 20.94 0.36%, S&P 500 2363.63 12.47 0.53%

-

18:19

Wall Street. Major U.S. stock-indexes in positive area

Major U.S. stock-indexes hit record intraday highs on Tuesday amid gains across sectors as strong earnings from top retailers underscored the strength of the U.S. economy. One in every six stocks on the S&P 500 hit a new 52-week high as a rally sparked by President Donald Trump's promise of tax reforms shows no sign of fading despite concerns around valuations.

Most of Dow stocks in positive area (23 of 30). Top loser - Caterpillar Inc. (CAT, -0.73%). Top gainer - Wal-Mart Stores, Inc. (WMT, +2.91%).

Most of S&P sectors are also in positive area. Top loser - Services (-1.1%). Top gainer - Basic Materials (+1.1%).

At the moment:

Dow 20691.00 +103.00 +0.50%

S&P 500 2359.00 +11.00 +0.47%

Nasdaq 100 5339.25 +13.50 +0.25%

Oil 54.60 +0.82 +1.52%

Gold 1238.80 -0.30 -0.02%

U.S. 10yr 2.42 -0.00

-

17:00

European stocks closed: FTSE 7274.83 -25.03 -0.34%, DAX 11967.49 139.87 1.18%, CAC 4888.76 23.77 0.49%

-

14:33

U.S. Stocks open: Dow +0.25%, Nasdaq +0.20%, S&P +0.24%

-

14:28

Before the bell: S&P futures +0.23%, NASDAQ futures +0.22%

U.S. stock-index futures advanced as oil prices rose and investors cheered better-than-expected quarterly reports from top U.S. retailers.

Global Stocks:

Nikkei 19,381.44 +130.36 +0.68%

Hang Seng 23,963.63 -182.45 -0.76%

Shanghai 3,253.25 +13.29 +0.41%

FTSE 7,278.95 -20.91 -0.29%

CAC 4,880.08 +15.09 +0.31%

DAX 11,895.12 +67.50 +0.57%

Crude $54.42 (+1.91%)

Gold $1,228.80 (-0.83%)

-

13:54

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.69

0.48(1.3256%)

3662

ALTRIA GROUP INC.

MO

73.02

0.05(0.0685%)

3445

Amazon.com Inc., NASDAQ

AMZN

848.66

3.59(0.4248%)

25978

AMERICAN INTERNATIONAL GROUP

AIG

173.4

0.69(0.3995%)

3543

Apple Inc.

AAPL

136.41

0.69(0.5084%)

184866

AT&T Inc

T

41.49

0.01(0.0241%)

3339

Barrick Gold Corporation, NYSE

ABX

19.93

-0.24(-1.1899%)

80449

Boeing Co

BA

173.4

0.69(0.3995%)

3543

Chevron Corp

CVX

110.8

0.47(0.426%)

1579

Cisco Systems Inc

CSCO

33.79

0.05(0.1482%)

12418

Citigroup Inc., NYSE

C

60.38

0.21(0.349%)

32223

Deere & Company, NYSE

DE

109

-1.27(-1.1517%)

385

E. I. du Pont de Nemours and Co

DD

77.5

0.01(0.0129%)

301

Exxon Mobil Corp

XOM

81.9

0.14(0.1712%)

59398

Facebook, Inc.

FB

133.85

0.32(0.2397%)

41195

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

14.4

-0.51(-3.4205%)

516253

General Electric Co

GE

30.46

0.09(0.2963%)

51565

General Motors Company, NYSE

GM

37.65

0.43(1.1553%)

22091

Goldman Sachs

GS

251.65

1.27(0.5072%)

1770

Google Inc.

GOOG

832.48

4.41(0.5326%)

5451

Home Depot Inc

HD

145.9

2.90(2.028%)

96575

Intel Corp

INTC

36.66

0.18(0.4934%)

29929

Johnson & Johnson

JNJ

118.57

-0.29(-0.244%)

13600

JPMorgan Chase and Co

JPM

90.52

0.29(0.3214%)

8591

McDonald's Corp

MCD

127.5

-0.30(-0.2347%)

1859

Merck & Co Inc

MRK

65.35

-0.04(-0.0612%)

210

Microsoft Corp

MSFT

64.73

0.11(0.1702%)

16048

Nike

NKE

56.23

-0.52(-0.9163%)

21778

Pfizer Inc

PFE

33.6

-0.02(-0.0595%)

13479

Procter & Gamble Co

PG

90.86

-0.23(-0.2525%)

4269

Tesla Motors, Inc., NASDAQ

TSLA

275.69

3.46(1.271%)

56232

The Coca-Cola Co

KO

41.1

-0.13(-0.3153%)

6199

Twitter, Inc., NYSE

TWTR

16.69

0.07(0.4212%)

30743

UnitedHealth Group Inc

UNH

157.39

-0.23(-0.1459%)

2453

Verizon Communications Inc

VZ

49.39

0.20(0.4066%)

44687

Visa

V

87.51

0.05(0.0572%)

5292

Wal-Mart Stores Inc

WMT

71.7

2.33(3.3588%)

672570

Walt Disney Co

DIS

109.91

-0.15(-0.1363%)

1850

Yahoo! Inc., NASDAQ

YHOO

45.43

0.33(0.7317%)

5604

-

13:52

Upgrades and downgrades before the market open

Upgrades:

Verizon (VZ) upgraded to Buy at MoffettNathanson

Downgrades:

Freeport-McMoRan (FCX) downgraded to Sell from Hold at Deutsche Bank

Other:

Apple (AAPL) target raised to $154 from $150 at Morgan Stanley

Deere (DE) target raised to $109 at RBC Capital Mkts

Freeport-McMoRan (FCX) initiated with a Neutral at Citigroup; target $16

-

13:41

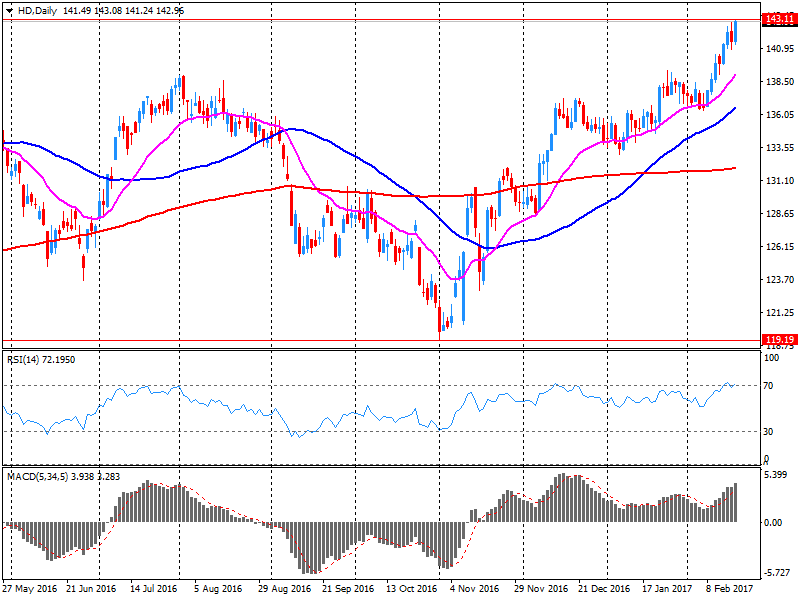

Company News: Home Depot (HD) quarterly results beat analysts’ expectations

Home Depot reported Q4 FY 2017 earnings of $1.44 per share (versus $1.17 in Q4 FY 2016), beating analysts' consensus estimate of $1.34.

The company's quarterly revenues amounted to $22.207 bln (+5.8% y/y), beating analysts' consensus estimate of $21.810 bln.

The company also issued in-line guidance for FY 2018, projecting EPS of $7.13 (versus analysts' consensus estimate of $7.17) and revenues growth of ~4.6% to ~$98.95 bln (analysts' consensus estimate of $98.32 bln).

In addition, the company's board of directors declared a 29 percent increase in the quarterly dividend to $0.89 per share and authorized a $15 bln share repurchase program, replacing its previous authorization.

HD rose to $145.48 (+1.73%) in pre-market trading.

-

13:21

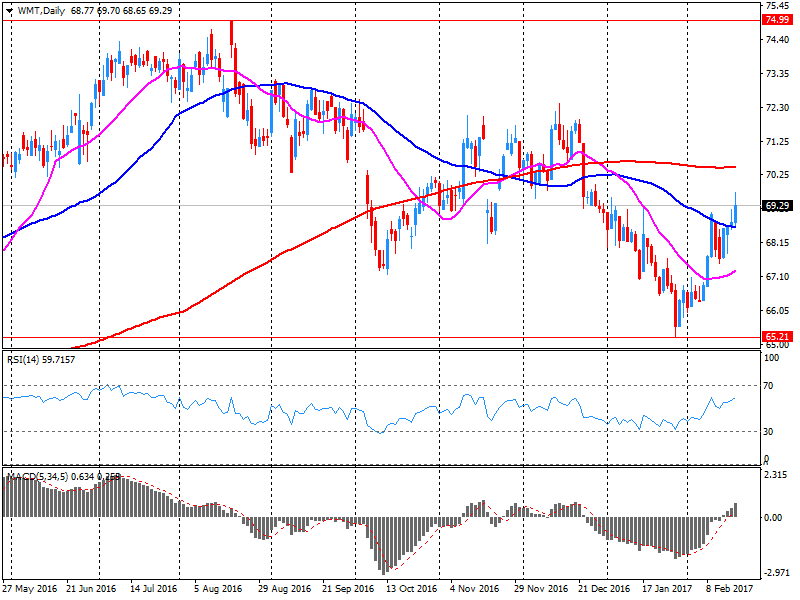

Company News: Wal-Mart (WMT) Q3 EPS slightly beat analysts’ estimate

Wal-Mart reported Q4 of fiscal year (FY) 2017 earnings of $1.30 per share (versus $1.49 in Q4 FY 2016), beating analysts' consensus estimate of $1.29.

The company's quarterly revenues amounted to $129.750 bln (+0.8% y/y), generally in-line with analysts' consensus estimate of $130.217 bln.

The company also issued in-line guidance for Q1 and the full FY 2018. It projected Q1 EPS of $0.90-1.00 versus analysts' consensus estimate of $0.96. For FY 2018 the company guided EPS of $4.20-4.40 (up from $4.15-4.35 in October of last year) analysts' consensus estimate of $4.32.

Walmart approved an annual cash dividend for FY 2018 of $2.04 per share, up 2 percent from the $2.00 per share paid for the last FY.

WMT rose to $71.82 (+3.53%) in pre-market trading.

-

09:10

Major stock markets in Europe trading mixed: FTSE -0.2%, DAX -0.1%, CAC40 flat, FTMIB + 0.1%, IBEX flat

-

07:23

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.1%

-

06:26

Global Stocks

European stocks scored modest gains Monday, helped by jumps for Royal Bank of Scotland, Rolls-Royce and furniture seller Steinhoff International. Investors also tracked a tightening French presidential race, as well as progress made on debt-laden Greece's bailout at a meeting of eurozone finance ministers.

Asian stocks held ground on Tuesday though Chinese equities surged to a fresh two-month high as domestic funds piled into financial counters on expectations the world's second biggest economy may have turned a corner. With U.S. markets closed for the Presidents Holiday on Monday, Asian markets have had few global cues off which to trade.

-