Market news

-

22:01

New Zealand: Retail Sales YoY, Quarter III 5.4%

-

22:01

New Zealand: Retail Sales, q/q, Quarter III 0.2% (forecast 0.4%)

-

21:10

The main US stock indexes finished trading mostly in the red

The main US stock indexes mostly declined, reacting to weak economic data. The minutes of the Fed meeting were also in focus. Meanwhile, trading activity was lowered on the background of the forthcoming Thanksgiving Day on Thursday.

Data showed that orders for durable goods fell by 1.2% in October, which is much worse than forecast (+ 0.3%). With the exception of transport, orders increased by 0.4%. Investment in business fell by 0.5% on the basis of a carefully monitored measure, known as orders for basic capital goods. However, the number of Americans applying for new unemployment benefits fell last week, which is the last signal that the labor market is on a solid foundation at the end of the year. Initial claims for unemployment benefits fell by 13,000 to 239,000, seasonally adjusted in the week to November 18, the Ministry of Labor said. Economists had expected 240,000 new applications.

As for the minutes of the Fed meeting, it was reported that the leaders at the last meeting expected an increase in the rate "in the short term" due to the improvement of the economic situation, while many noted that their decision would depend on whether inflation would accelerate. The document also indicated that the Central Bank executives admitted that the annual inflation rate could remain below the target level of 2% longer than expected. Most of the participants in the meeting still believed that the growth in demand for labor would lead to an acceleration of inflation in the medium term. However, the leaders discussed the likely reasons for the slowdown in prices, which, in their view, include the weakening of the link between the labor market and the rate of price growth, and the likely further growth in employment.

Most components of the DOW index finished trading in the red (21 out of 30). Outsider were shares of 3M Company (MMM, -1.09%). Leader of growth were shares of Verizon Communications Inc. (VZ, + 2.09%).

Most sectors of the S & P index recorded an increase. The conglomerate sector grew most (+ 1.4%). The largest decline was shown in the financial sector (-0.1%).

At closing:

DJIA -0.27% 23,526.18 -64.65

Nasdaq + 0.07% 6,867.36 +4.88

S & P -0.08% 2,597.08 -1.95

-

20:00

DJIA -0.23% 23,536.72 -54.11 Nasdaq +0.14% 6,872.05 +9.57 S&P -0.02% 2,598.41 -0.62

-

18:03

U.S.: Baker Hughes Oil Rig Count, 747

-

17:34

Nikkei 225 - 4h time frame chart

On 4-hour time frame chart we can see that price is now close to the upside trend line.

In this scenario, we can consider long or short entries.

However, it depends of the price how it behaves in this area.

So, we might consider a bullish movement if the price rejects the trend line (wicks touching the trend line)

Besides that, if the price breaks the trend line, then we can expect a depreciation of the Nikkei 225 to the previous relative minimums.

-

15:31

U.S. commercial crude oil inventories decreased by 1.9 million barrels from the previous week

At 457.1 million barrels, U.S. crude oil inventories are in the upper half of the average range for this time of year.

Total motor gasoline inventories remained unchanged last week, and are in the middle of the average range. Finished gasoline inventories increased, while blending components inventories decreased last week. Distillate fuel inventories increased by 0.3 million barrels last week but are in the lower half of the average range for this time of year. Propane/propylene inventories decreased by 1.0 million barrels last week, and are in the lower half of the average range. Total commercial petroleum inventories remained unchanged last week.

-

15:30

U.S.: Crude Oil Inventories, November -1.855 (forecast -1.545)

-

15:06

U.S consumer sentiment narrowed its loss from mid-month says UoM

Consumer sentiment narrowed its loss from mid-month, although it was still slightly below last month's decade peak. Overall, the Sentiment Index has remained largely unchanged since the start of the year at the highest levels since 2004. What has changed recently is the degree of certainty with which consumers hold their economic expectations. In contrast to the media buzz about approaching cyclical peaks and an aging expansion, with the implication of greater uncertainty about future economic trends, consumers have voiced greater certainty about their expectations for income, employment, and inflation. Inflation expectations have shown the smallest dispersion on record, and increased certainty about future income and job prospects has become a key factor that has supported discretionary purchases.

-

15:03

The main event of the day up next (18:00 GMT). Fed meeting minutes expected to shed light on the December rate hike

-

15:00

U.S.: Reuters/Michigan Consumer Sentiment Index, November 98.5 (forecast 98)

-

15:00

Eurozone: Consumer Confidence, November 0.1 (forecast -0.8)

-

14:31

U.S. Stocks open: Dow +0.01%, Nasdaq +0.10%, S&P +0.03%

-

14:28

UK 10-year gilt yield rises after finance minister Hammond outlines heavier borrowing forecast in coming years

-

14:20

Before the bell: S&P futures +0.08%, NASDAQ futures +0.13%

U.S. stock-index futures were slightly higher on Wednesday, as investors assessed a bundle of economic data and earnings reports, while awaiting the release of the minutes from the Federal Reserve's latest policy meeting. Growing oil prices provided support to the market.

Global Stocks:

Nikkei 22,523.15 +106.67 +0.48%

Hang Seng 30,003.49 +185.42 +0.62%

Shanghai 3,430.55 +20.05 +0.59%

S&P/ASX 5,986.41 +22.89 +0.38%

FTSE 7,449.04 +37.70 +0.51%

CAC 5,382.39 +16.24 +0.30%

DAX 13,156.43 -11.11 -0.08%

Crude $57.81 (+1.72%)

Gold $1,285.00 (+0.26%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

233.02

0.11(0.05%)

734

ALCOA INC.

AA

41.7

0.31(0.75%)

1111

Amazon.com Inc., NASDAQ

AMZN

1,143.35

3.86(0.34%)

18073

Apple Inc.

AAPL

173.5

0.36(0.21%)

125141

AT&T Inc

T

34.47

0.14(0.41%)

10107

Barrick Gold Corporation, NYSE

ABX

14

0.08(0.57%)

6475

Caterpillar Inc

CAT

138.55

0.95(0.69%)

8447

Chevron Corp

CVX

115.76

0.59(0.51%)

1069

Cisco Systems Inc

CSCO

36.74

0.09(0.25%)

5632

Citigroup Inc., NYSE

C

72.45

0.07(0.10%)

1019

Deere & Company, NYSE

DE

146.25

7.02(5.04%)

298289

Exxon Mobil Corp

XOM

81.2

0.33(0.41%)

4996

Facebook, Inc.

FB

181.84

-0.02(-0.01%)

55826

Ford Motor Co.

F

12.13

0.01(0.08%)

9004

General Electric Co

GE

17.86

0.03(0.17%)

30491

General Motors Company, NYSE

GM

45.05

0.08(0.18%)

5050

Goldman Sachs

GS

239

0.98(0.41%)

140

Google Inc.

GOOG

1,035.11

0.62(0.06%)

720

Hewlett-Packard Co.

HPQ

21.29

-1.17(-5.21%)

70088

Home Depot Inc

HD

173

0.14(0.08%)

1213

Intel Corp

INTC

44.97

0.03(0.07%)

56961

International Business Machines Co...

IBM

152

0.05(0.03%)

1082

JPMorgan Chase and Co

JPM

98.88

-0.05(-0.05%)

110

McDonald's Corp

MCD

168.7

0.40(0.24%)

4169

Merck & Co Inc

MRK

54.4

0.13(0.24%)

1821

Microsoft Corp

MSFT

83.87

0.15(0.18%)

14975

Tesla Motors, Inc., NASDAQ

TSLA

317.5

-0.31(-0.10%)

23844

Verizon Communications Inc

VZ

46.3

0.12(0.26%)

28675

Visa

V

111.71

0.26(0.23%)

2269

Wal-Mart Stores Inc

WMT

96.78

0.26(0.27%)

2046

-

13:52

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.1500-02 (EUR 1.2bln) 1.1650 (600m) 1.1700 (690m) 1.1750 (975m) 1.1775(360m) 1.1800-05 (1.12bln) 1.1825-30 (1.18bln) 1.1845 (385m) 1.1900-05 (1.57bln)

USDJPY: 112.00 (USD1.4bln) 112.70-80 (585m) 113.00 (680m) 113.15 (310m)

GBPUSD: 1.2900 (GBP 495m) 1.3250 (280m)

EURGBP: 0.8900 (EUR 390m)

AUDUSD: 0.7600 (AUD 555m) 0.7730-40 (1.2bln) 0.8080 (1.53bln)

USDCAD: 1.2545-50 (USD 1.0bln) 1.2780 (980m)

EURJPY: 130.25 (EUR 400m)

AUDNZD: 1.1220-25 (AUD 400m) 1.1300 (865m)

-

13:35

U.S initial claims in line with expectations last week

In the week ending November 18, the advance figure for seasonally adjusted initial claims was 239,000, a decrease of 13,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 249,000 to 252,000. The 4-week moving average was 239,750, an increase of 1,250 from the previous week's revised average. The previous week's average was revised up by 750 from 237,750 to 238,500.

-

13:32

U.S durable goods orders declined 1.2% in October

New orders for manufactured durable goods in October decreased $2.8 billion or 1.2 percent to $236.0 billion, the U.S. Census Bureau announced today. This decrease, down following two consecutive monthly increases, followed a 2.2 percent September increase. Excluding transportation, new orders increased 0.4 percent. Excluding defense, new orders decreased 0.8 percent. Transportation equipment, also down following two consecutive monthly increases, drove the decrease, $3.5 billion or 4.3 percent to $77.1 billion. Shipments of manufactured durable goods in October, up five of the last six months, increased $0.3 billion or 0.1 percent to $241.0 billion. This followed a 1.0 percent September increase. Primary metals, up three of the last four months, led the increase, $0.3 billion or 1.5 percent to $19.9 billion.

-

13:31

U.S.: Durable goods orders ex defense, October -0.8% (forecast 0.9%)

-

13:31

U.S.: Durable Goods Orders ex Transportation , October 0.4% (forecast 0.5%)

-

13:31

U.S.: Durable Goods Orders , October -1.2% (forecast 0.3%)

-

13:30

U.S.: Initial Jobless Claims, 239 (forecast 240)

-

13:30

U.S.: Continuing Jobless Claims, 1.904 (forecast 1.882)

-

13:24

Company News: Hewlett Packard Enterprise (HPE) quarterly earnings beat analysts’ estimate

Hewlett Packard Enterprise (HPE) reported Q4 FY 2017 earnings of $0.29 per share (versus $0.61 in Q4 FY 2016), beating analysts' consensus estimate of $0.28.

The company's quarterly revenues amounted to $7.660 bln (+4.6% y/y), missing analysts' consensus estimate of $7.779 bln.

The company also issued downside guidance for Q1 FY 2018, projecting EPS of $0.20-0.24 versus analysts' consensus estimate of $0.27.

HPE fell to $13.39 (-5.1%) in pre-market trading.

-

13:22

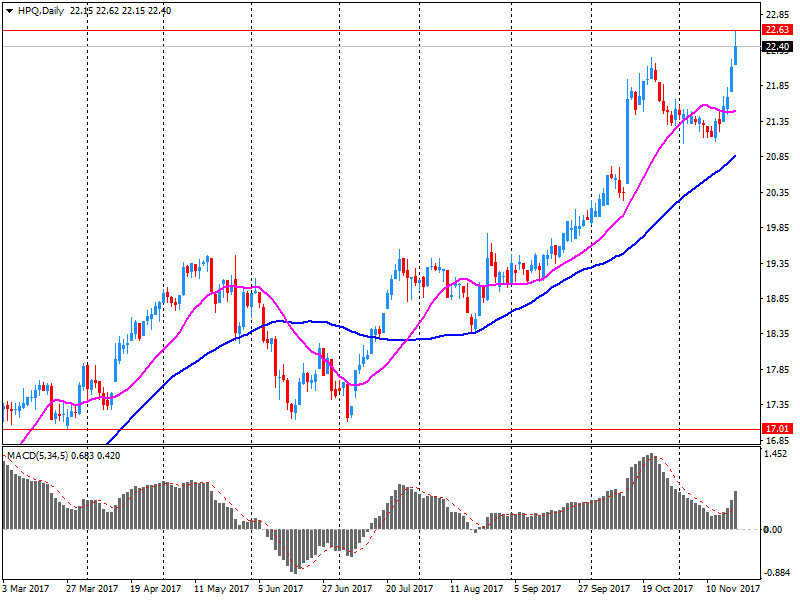

Company News: HP (HPQ) posts quarterly earnings in line with analysts' estimates

HP (HPQ) reported Q4 FY 2017 earnings of $0.44 per share (versus $0.36 in Q4 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $13.927 bln (+11.3% y/y), beating analysts' consensus estimate of $13.365 bln.

HPQ fell to $21.33 (-5.03%) in pre-market trading.

-

13:05

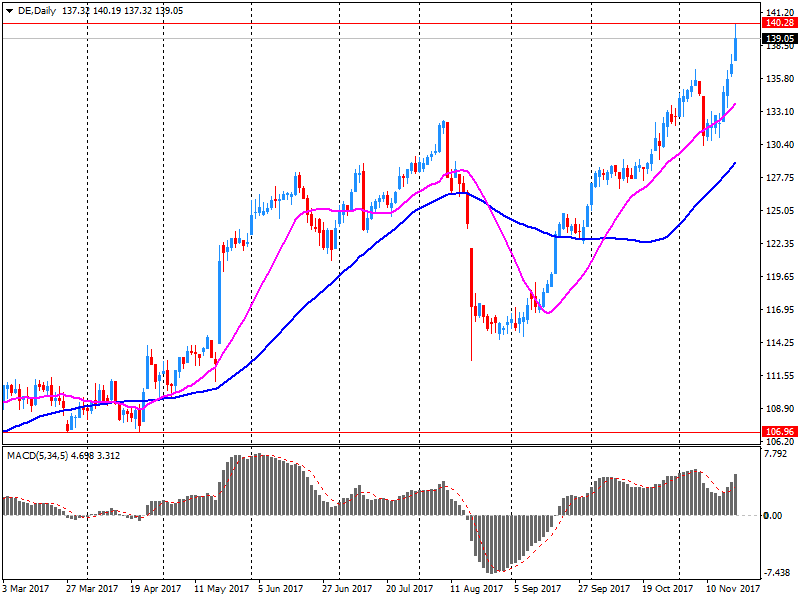

Company News: Deere (DE) quarterly results beat analysts’ expectations

Deere (DE) reported Q4 FY 2017 earnings of $1.57 per share (versus $0.90 in Q4 FY 2016), beating analysts' consensus estimate of $1.44.

The company's quarterly revenues amounted to $7.094 bln (+25.6% y/y), beating analysts' consensus estimate of $6.911 bln.

DE rose to $145.79 (+4.71%) in pre-market trading.

-

11:39

EU Commission recommends broadly neutral fiscal stance for euro zone in 2018

-

11:38

EU Commission says 12 EU countries, same as last year, have macroeconomic imbalances that need in-depth reports

-

Romania did not take effective action reduce its budget deficit, should cut structural gap in 2018 by at least 0.8 pct/gdp

-

Wants to close excessive budget deficit procedure against Britain

-

EU countries must step up efforts to fight aggressive tax planning

-

2018 draft budgets of Estonia, Ireland, Cyprus, Malta, Slovakia are broadly in line with EU rules

-

2018 draft budgets of Belgium, Italy, Austria, Portugal and Slovenia pose a risk of non-compliance with EU budget rules

-

Italy's high government debt is a reason for concern, not falling as EU rules require

-

-

10:52

Russian economy minister Oreshkin sees Russia's GDP growth at 2 pct in 2017

-

Budget deficit at less than 2 pct in 2017

-

-

10:10

Russian C. Bank governor Nabiullina says rouble rate is close to its fundamental levels

-

09:33

Swedish Central Bank stability report - important to implement measures within housing and tax policies to increase the resilience of the household sector and reduce the risks

-

08:59

Forex option contracts rolling off today at 14.00 GMT:

EUR/USD: 1.1500-02(1.2 b), 1.1650(600 m), 1.1700(688 m), 1.1750(971 m), 1.1775(357 m), 1.1800-05(1.12 b), 1.1825-30(1.18 b), 1.1845(382 m), 1.1900(1.57 b)

GBP/USD: 1.2900(492 m), 1.3250(279 m)

USD/JPY: 112.00(1.4 b), 112.70-80(585 m), 113.00(680 m), 113.15(309 m)

AUD/USD: 0.7600(555 m), 0.7730-40(1.2 b), 0.8080(1.53 b)

USD/CAD: 1.2545-50(996 m), 1.2780(980 m)

EUR/GBP: 0.8900(387 m)

EUR/JPY: 130.25(400 m)

-

08:41

EU’s Dombrovskis: we need to support structural reform to strengthen growth - Bloomberg

-

08:39

Russian Central Bank governor Nabiullina says sees potential for key rate cut

-

Inflation is close to target

-

Says we will continue gradual reduction of key rate

-

We do not plan to revise 4-pct inflation target

-

Russia's financial system is stable

-

We have almost finished exit from all anti-crisis measures, will exit special instruments in coming years

-

-

08:38

Major stock markets in Europe trading mixed: FTSE 7411.96 +0.62 + 0.01%, DAX 13171.36 +3.82 + 0.03%, CAC 5360.76 -5.39 -0.10% 0.16%

-

07:50

Options levels on wednesday, November 22, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1843 (5959)

$1.1816 (3073)

$1.1781 (3830)

Price at time of writing this review: $1.1754

Support levels (open interest**, contracts):

$1.1716 (2264)

$1.1693 (3463)

$1.1664 (5982)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date December, 8 is 157608 contracts (according to data from November, 21) with the maximum number of contracts with strike price $1,1500 (8419);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3328 (2791)

$1.3307 (3315)

$1.3277 (1344)

Price at time of writing this review: $1.3249

Support levels (open interest**, contracts):

$1.3190 (1023)

$1.3167 (1105)

$1.3138 (1351)

Comments:

- Overall open interest on the CALL options with the expiration date December, 8 is 41946 contracts, with the maximum number of contracts with strike price $1,3200 (3315);

- Overall open interest on the PUT options with the expiration date December, 8 is 40493 contracts, with the maximum number of contracts with strike price $1,3000 (4011);

- The ratio of PUT/CALL was 0.97 versus 0.98 from the previous trading day according to data from November, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:25

Trump and Putin discussed how to implement a lasting peace in Ukraine, the need to continue pressure on North Korea to halt nuclear weapon program - White House statement

-

07:24

NAFTA negotiators say "progress was made in a number of chapters" during fifth round of talks in Mexico city - Statement

-

Reaffirmed commitment to moving forward in all areas of talks in order to conclude negotiations as soon as possible

-

-

07:22

Yellen: Fed is not certain that low inflation is transitory, keeping open mind that it may be more long-lasting

-

07:22

Yellen: can be quite dangerous to allow inflation to drift down and miss target over time

-

Inflation below target; appropriate to gradually raise rates

-

'reasonably close' to inflation, employment goals; 4.1 pct unemployment at or below goal

-

Raising rates key to dealing with potential future negative shock

-

Inflation expectations have not drifted down too much

-

Wants to avoid 'boom and bust' U.S. economy

-

Raising rates too slowly risks tightening labor market too much

-

-

07:19

10-year U.S. treasury yield at 2.345 percent vs U.S. close of 2.361 percent on Tuesday

-

07:18

Eurostoxx 50 futures up 0.2 pct, DAX futures up 0.2 pct, CAC 40 futures up 0.1 pct, FTSE futures flat

-

06:30

Global Stocks

European stocks closed higher Tuesday, aided by gains for airline easyJet PLC and car maker Volkswagen AG, as investors appeared to set aside concerns about the possibility of a new election in Germany. Equity markets in the region rose as major U.S. stock gauges rallied, with a leap in technology shares pushing the Nasdaq Composite Index COMP, +1.06% to an all-time high.

U.S. stock-market indexes ended at records and near session highs on Tuesday, finding support on another round of strong earnings, with technology shares leading the way. Investors focused on a number of corporate earnings and positive economic data. Trading volumes were expected to thin out this week as investors prepare for the long weekend following Thanksgiving holiday.

Global stocks extended their rally early Wednesday in Asia, with technology shares fueling the gains. The region saw broad advances, with Hong Kong's stock benchmark topping 30,000 for the first time in a decade, as the Hang Seng Index HSI, +0.90% continued its push toward late 2007's intraday record of 31,958.41.

-

00:30

Australia: Construction Work Done, Quarter III 15.7% (forecast -2.3%)

-