Market news

-

21:10

The main US stock indexes finished trading mostly in the red

The main US stock indexes mostly declined, reacting to weak economic data. The minutes of the Fed meeting were also in focus. Meanwhile, trading activity was lowered on the background of the forthcoming Thanksgiving Day on Thursday.

Data showed that orders for durable goods fell by 1.2% in October, which is much worse than forecast (+ 0.3%). With the exception of transport, orders increased by 0.4%. Investment in business fell by 0.5% on the basis of a carefully monitored measure, known as orders for basic capital goods. However, the number of Americans applying for new unemployment benefits fell last week, which is the last signal that the labor market is on a solid foundation at the end of the year. Initial claims for unemployment benefits fell by 13,000 to 239,000, seasonally adjusted in the week to November 18, the Ministry of Labor said. Economists had expected 240,000 new applications.

As for the minutes of the Fed meeting, it was reported that the leaders at the last meeting expected an increase in the rate "in the short term" due to the improvement of the economic situation, while many noted that their decision would depend on whether inflation would accelerate. The document also indicated that the Central Bank executives admitted that the annual inflation rate could remain below the target level of 2% longer than expected. Most of the participants in the meeting still believed that the growth in demand for labor would lead to an acceleration of inflation in the medium term. However, the leaders discussed the likely reasons for the slowdown in prices, which, in their view, include the weakening of the link between the labor market and the rate of price growth, and the likely further growth in employment.

Most components of the DOW index finished trading in the red (21 out of 30). Outsider were shares of 3M Company (MMM, -1.09%). Leader of growth were shares of Verizon Communications Inc. (VZ, + 2.09%).

Most sectors of the S & P index recorded an increase. The conglomerate sector grew most (+ 1.4%). The largest decline was shown in the financial sector (-0.1%).

At closing:

DJIA -0.27% 23,526.18 -64.65

Nasdaq + 0.07% 6,867.36 +4.88

S & P -0.08% 2,597.08 -1.95

-

20:00

DJIA -0.23% 23,536.72 -54.11 Nasdaq +0.14% 6,872.05 +9.57 S&P -0.02% 2,598.41 -0.62

-

17:34

Nikkei 225 - 4h time frame chart

On 4-hour time frame chart we can see that price is now close to the upside trend line.

In this scenario, we can consider long or short entries.

However, it depends of the price how it behaves in this area.

So, we might consider a bullish movement if the price rejects the trend line (wicks touching the trend line)

Besides that, if the price breaks the trend line, then we can expect a depreciation of the Nikkei 225 to the previous relative minimums.

-

14:31

U.S. Stocks open: Dow +0.01%, Nasdaq +0.10%, S&P +0.03%

-

14:20

Before the bell: S&P futures +0.08%, NASDAQ futures +0.13%

U.S. stock-index futures were slightly higher on Wednesday, as investors assessed a bundle of economic data and earnings reports, while awaiting the release of the minutes from the Federal Reserve's latest policy meeting. Growing oil prices provided support to the market.

Global Stocks:

Nikkei 22,523.15 +106.67 +0.48%

Hang Seng 30,003.49 +185.42 +0.62%

Shanghai 3,430.55 +20.05 +0.59%

S&P/ASX 5,986.41 +22.89 +0.38%

FTSE 7,449.04 +37.70 +0.51%

CAC 5,382.39 +16.24 +0.30%

DAX 13,156.43 -11.11 -0.08%

Crude $57.81 (+1.72%)

Gold $1,285.00 (+0.26%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

233.02

0.11(0.05%)

734

ALCOA INC.

AA

41.7

0.31(0.75%)

1111

Amazon.com Inc., NASDAQ

AMZN

1,143.35

3.86(0.34%)

18073

Apple Inc.

AAPL

173.5

0.36(0.21%)

125141

AT&T Inc

T

34.47

0.14(0.41%)

10107

Barrick Gold Corporation, NYSE

ABX

14

0.08(0.57%)

6475

Caterpillar Inc

CAT

138.55

0.95(0.69%)

8447

Chevron Corp

CVX

115.76

0.59(0.51%)

1069

Cisco Systems Inc

CSCO

36.74

0.09(0.25%)

5632

Citigroup Inc., NYSE

C

72.45

0.07(0.10%)

1019

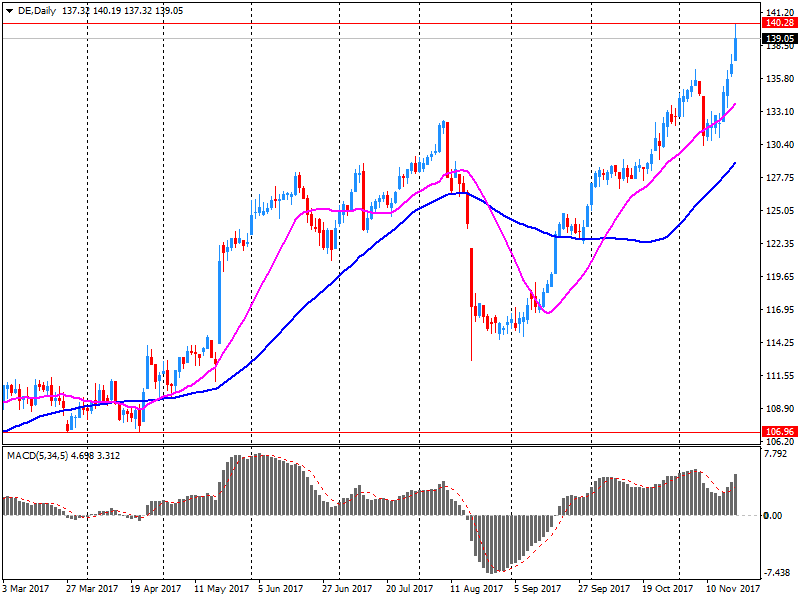

Deere & Company, NYSE

DE

146.25

7.02(5.04%)

298289

Exxon Mobil Corp

XOM

81.2

0.33(0.41%)

4996

Facebook, Inc.

FB

181.84

-0.02(-0.01%)

55826

Ford Motor Co.

F

12.13

0.01(0.08%)

9004

General Electric Co

GE

17.86

0.03(0.17%)

30491

General Motors Company, NYSE

GM

45.05

0.08(0.18%)

5050

Goldman Sachs

GS

239

0.98(0.41%)

140

Google Inc.

GOOG

1,035.11

0.62(0.06%)

720

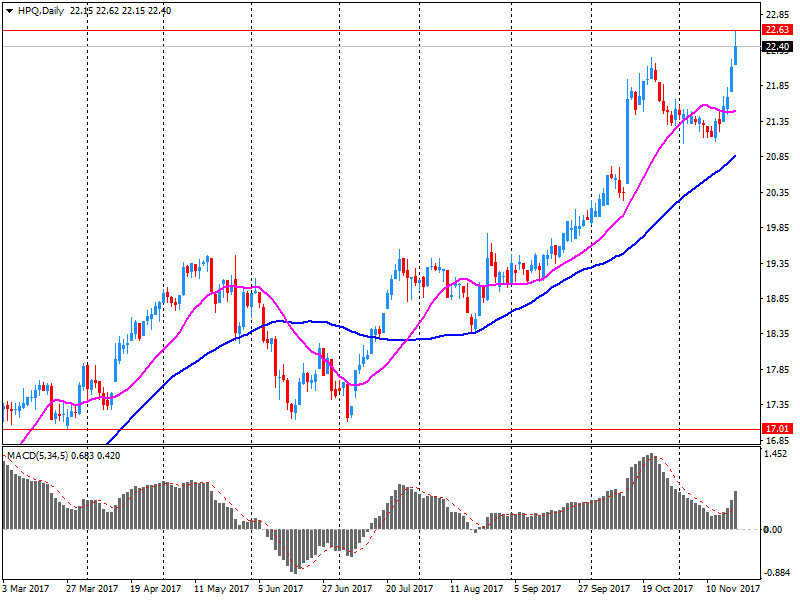

Hewlett-Packard Co.

HPQ

21.29

-1.17(-5.21%)

70088

Home Depot Inc

HD

173

0.14(0.08%)

1213

Intel Corp

INTC

44.97

0.03(0.07%)

56961

International Business Machines Co...

IBM

152

0.05(0.03%)

1082

JPMorgan Chase and Co

JPM

98.88

-0.05(-0.05%)

110

McDonald's Corp

MCD

168.7

0.40(0.24%)

4169

Merck & Co Inc

MRK

54.4

0.13(0.24%)

1821

Microsoft Corp

MSFT

83.87

0.15(0.18%)

14975

Tesla Motors, Inc., NASDAQ

TSLA

317.5

-0.31(-0.10%)

23844

Verizon Communications Inc

VZ

46.3

0.12(0.26%)

28675

Visa

V

111.71

0.26(0.23%)

2269

Wal-Mart Stores Inc

WMT

96.78

0.26(0.27%)

2046

-

13:24

Company News: Hewlett Packard Enterprise (HPE) quarterly earnings beat analysts’ estimate

Hewlett Packard Enterprise (HPE) reported Q4 FY 2017 earnings of $0.29 per share (versus $0.61 in Q4 FY 2016), beating analysts' consensus estimate of $0.28.

The company's quarterly revenues amounted to $7.660 bln (+4.6% y/y), missing analysts' consensus estimate of $7.779 bln.

The company also issued downside guidance for Q1 FY 2018, projecting EPS of $0.20-0.24 versus analysts' consensus estimate of $0.27.

HPE fell to $13.39 (-5.1%) in pre-market trading.

-

13:22

Company News: HP (HPQ) posts quarterly earnings in line with analysts' estimates

HP (HPQ) reported Q4 FY 2017 earnings of $0.44 per share (versus $0.36 in Q4 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $13.927 bln (+11.3% y/y), beating analysts' consensus estimate of $13.365 bln.

HPQ fell to $21.33 (-5.03%) in pre-market trading.

-

13:05

Company News: Deere (DE) quarterly results beat analysts’ expectations

Deere (DE) reported Q4 FY 2017 earnings of $1.57 per share (versus $0.90 in Q4 FY 2016), beating analysts' consensus estimate of $1.44.

The company's quarterly revenues amounted to $7.094 bln (+25.6% y/y), beating analysts' consensus estimate of $6.911 bln.

DE rose to $145.79 (+4.71%) in pre-market trading.

-

08:38

Major stock markets in Europe trading mixed: FTSE 7411.96 +0.62 + 0.01%, DAX 13171.36 +3.82 + 0.03%, CAC 5360.76 -5.39 -0.10% 0.16%

-

06:30

Global Stocks

European stocks closed higher Tuesday, aided by gains for airline easyJet PLC and car maker Volkswagen AG, as investors appeared to set aside concerns about the possibility of a new election in Germany. Equity markets in the region rose as major U.S. stock gauges rallied, with a leap in technology shares pushing the Nasdaq Composite Index COMP, +1.06% to an all-time high.

U.S. stock-market indexes ended at records and near session highs on Tuesday, finding support on another round of strong earnings, with technology shares leading the way. Investors focused on a number of corporate earnings and positive economic data. Trading volumes were expected to thin out this week as investors prepare for the long weekend following Thanksgiving holiday.

Global stocks extended their rally early Wednesday in Asia, with technology shares fueling the gains. The region saw broad advances, with Hong Kong's stock benchmark topping 30,000 for the first time in a decade, as the Hang Seng Index HSI, +0.90% continued its push toward late 2007's intraday record of 31,958.41.

-