Market news

-

22:45

New Zealand: Visitor Arrivals, March -0.2%

-

22:32

Commodities. Daily history for Apr 25’02’2017:

(raw materials / closing price /% change)

Oil 49.36 -0.40%

Gold 1,265.50 -0.13%

-

22:29

Stocks. Daily history for Apr 25’2017:

(index / closing price / change items /% change)

Nikkei +203.45 19079.33 +1.08%

TOPIX +16.02 1519.21 +1.07%

Hang Seng +316.46 24455.94 +1.31%

CSI 300 +10.05 3441.43 +0.29%

Euro Stoxx 50 +5.78 3583.16 +0.16%

FTSE 100 +10.96 7275.64 +0.15%

DAX +12.06 12467.04 +0.10%

CAC 40 +9.03 5277.88 +0.17%

DJIA +232.23 20996.12 +1.12%

S&P 500 +14.46 2388.61 +0.61%

NASDAQ +41.67 6025.49 +0.70%

S&P/TSX +32.73 15745.19 +0.21%

-

22:28

Currencies. Daily history for Apr 25’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0927 +0,58%

GBP/USD $1,2833 +0,35%

USD/CHF Chf0,9934 -0,23%

USD/JPY Y111,06 +1,15%

EUR/JPY Y121,37 +1,74%

GBP/JPY Y142,53 +1,50%

AUD/USD $0,7532 -0,44%

NZD/USD $0,6945 -0,98%

USD/CAD C$1,3573 +0,49%

-

21:59

Schedule for today, Wednesday, Apr 26’2017 (GMT0)

01:30 Australia Trimmed Mean CPI q/q March 0.4% 0.5%

01:30 Australia Trimmed Mean CPI y/y March 1.6% 1.8%

01:30 Australia CPI, q/q Quarter I 0.5% 0.6%

01:30 Australia CPI, y/y Quarter I 1.5% 2.2%

04:30 Japan All Industry Activity Index, m/m February 0.1% 0.6%

06:00 Switzerland UBS Consumption Indicator March 1.5

06:45 France Consumer confidence April 100 100

12:30 Canada Retail Sales, m/m February 2.2% -0.1%

12:30 Canada Retail Sales YoY February 4.5%

12:30 Canada Retail Sales ex Autos, m/m February 1.7% -0.3%

14:30 U.S. Crude Oil Inventories April -1.034

-

20:06

The main US stock indexes rose on the results of today's session

Major US stock indexes finished trading in positive territory, and Nasdaq for the first time in history reached a mark of 6,000 points, which was supported by strong corporate reports and the promise of President Donald Trump about the implementation of a major tax reform plan.

In addition, as it became known, in February, house prices for one family accelerated more rapidly than expected in February, which was caused by low housing stocks. The combined index S & P CoreLogic Case-Shiller for 20 megacities rose in February by 5.9% compared to the previous year, after a 5.7% growth in January. The results of February exceeded the forecast for the increase by 5.7 percent and were the biggest increase in annual terms since July 2014.

In addition, the index of consumer confidence from the Conference Board, which increased in March, declined in April. Now the index is 120.3 (1985 = 100), compared with 124.9 in March. The index of the current situation decreased from 143.9 to 140.6, and the index of expectations fell from 112.3 last month to 106.7.

At the same time, sales of new single-family homes in the US rose to an eight-month high in March, pointing to the strength of the economy, despite the apparent sharp slowdown in growth in the first quarter. The Commerce Department reported that sales of new buildings jumped 5.8% to a seasonally adjusted annual rate of 621,000 units last month, the highest level since July 2016. Sales of new buildings grew by 15.6% compared to March 2016. Economists predicted that sales of new buildings, which account for about 9.8 percent of total housing sales, will drop to 583,000 units.

Most components of the DOW index recorded a rise (26 out of 30). Caterpillar Inc. (CAT, + 8.30%) was the growth leader. More fell shares Verizon Communications Inc. (VZ, -0.58%).

All sectors of the S & P index finished trading in positive territory. The leader of growth was the sector of basic materials (+ 0.9%).

At closing:

DJIA + 1.12% 20,995.78 +231.89

Nasdaq + 0.70% 6,025.49 +41.67

S & P + 0.61% 2,388.56 +14.41

-

19:00

DJIA +1.15% 21,002.83 +238.94 Nasdaq +0.75% 6,028.41 +44.59 S&P +0.64% 2,389.43 +15.28

-

16:00

European stocks closed: FTSE 100 +10.96 7275.64 +0.15% DAX +12.06 12467.04 +0.10% CAC 40 +9.03 5277.88 +0.17%

-

14:39

Spanish prime minister Mariano Rajoy says EU-Mercosur trade agreement is closer than ever

-

14:22

US consumer confidence declined slightly in April

The Conference Board Consumer Confidence Index, which had increased in March, declined in April. The Index now stands at 120.3 (1985=100), down from 124.9 in March. The Present Situation Index decreased from 143.9 to 140.6 and the Expectations Index declined from 112.3 last month to 106.7.

"Consumer confidence declined in April after increasing sharply over the past two months, but still remains at strong levels," said Lynn Franco, Director of Economic Indicators at The Conference Board. "Consumers assessed current business conditions and, to a lesser extent, the labor market less favorably than in March. Looking ahead, consumers were somewhat less optimistic about the short-term outlook for business conditions, employment and income prospects. Despite April's decline, consumers remain confident that the economy will continue to expand in the months ahead."

-

14:02

US new home sales rose more than expected in March

Sales of new single-family houses in March 2017 were at a seasonally adjusted annual rate of 621,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 5.8 percent (±15.5 percent)* above the revised February rate of 587,000 and is 15.6 percent (±15.0 percent) above the March 2016 estimate of 537,000.

The median sales price of new houses sold in March 2017 was $315,100. The average sales price was $388,200.

-

14:00

U.S.: New Home Sales, March 621 (forecast 583)

-

14:00

U.S.: Consumer confidence , April 120.3 (forecast 122.5)

-

13:59

U.S.: Richmond Fed Manufacturing Index, April 20 (forecast 16)

-

13:42

Option expiries for today's 10:00 ET NY cut

EURUSD: 1,0750 (EUR 365) 1.0790-1.0800 (EUR 1,5 млрд) 1.0810-20 (415m) 1,0850 (325m) 1.0990-1.1000 (470m)

USDJPY: 109,50 (USD 221m) 110.00-05 (385) 110,35 (620m) 110.40-50 (260m)

GBPUSD: 1,2600 (GBP 312M) 1,2760 (196m) 1.2800-10 (220м)

AUDUSD: 0,7655 (AUD 376m)

USDCAD: 1,3500 (USD 1.34bln)

EURJPY: 119,00 (EUR 200m) 120.15-20 (220м) 120,50 (200 м)

-

13:34

U.S. Stocks open: Dow +0.76%, Nasdaq +0.35%, S&P +0.33%

-

13:27

Before the bell: S&P futures +0.30%, NASDAQ futures +0.31%

U.S. stock-index rallied as investors continued to cheer the results of Sunday's first-round presidential election in France, assessed quarterly earnings, and prepared for "a big tax reform and tax reduction" announcement by Trump on Wednesday.

Stocks:

Nikkei 19,079.33 +203.45 +1.08%

Hang Seng 24,455.94 +316.46 +1.31%

Shanghai 3,135.40 +5.87 +0.19%

FTSE 7,280.37 +15.69 +0.22%

CAC 5,286.63 +17.78 +0.34%

DAX 12,471.91 +16.93 +0.14%

Crude $49.12 (-0.22%)

Gold $1,269.30 (-0.64%)

-

13:20

U.S. house prices rose in February, up 0.8

U.S. house prices rose in February, up 0.8 percent from the previous month, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI). The previously reported lack of change in January was revised upward to a 0.2 percent increase.

The FHFA monthly HPI is calculated using home sales price information from mortgages sold to, or guaranteed by, Fannie Mae and Freddie Mac. From February 2016 to February 2017, house prices were up 6.4 percent.

-

13:01

U.S.: Housing Price Index, m/m, February 0.8%

-

13:00

Belgium: Business Climate, April -0.8 (forecast -1)

-

13:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, February 5.9% (forecast 5.7%)

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

193.35

-0.88(-0.45%)

61326

ALCOA INC.

AA

34.5

1.19(3.57%)

20537

ALTRIA GROUP INC.

MO

72.65

0.10(0.14%)

350

Amazon.com Inc., NASDAQ

AMZN

905

-2.41(-0.27%)

35751

American Express Co

AXP

80.95

0.50(0.62%)

5007

Apple Inc.

AAPL

144.15

0.51(0.36%)

41403

AT&T Inc

T

40.04

0.02(0.05%)

6407

Barrick Gold Corporation, NYSE

ABX

18.38

-0.66(-3.47%)

65288

Caterpillar Inc

CAT

103.2

6.39(6.60%)

479880

Cisco Systems Inc

CSCO

33.37

0.09(0.27%)

300

Citigroup Inc., NYSE

C

60

0.56(0.94%)

37103

Deere & Company, NYSE

DE

111.85

1.60(1.45%)

1662

E. I. du Pont de Nemours and Co

DD

81.1

1.73(2.18%)

11289

Exxon Mobil Corp

XOM

81.5

0.39(0.48%)

142

Facebook, Inc.

FB

145.9

0.43(0.30%)

85250

Ford Motor Co.

F

11.45

0.02(0.18%)

4850

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.55

0.32(2.62%)

112002

General Electric Co

GE

29.38

-0.17(-0.58%)

166762

General Motors Company, NYSE

GM

34.06

0.15(0.44%)

2352

Goldman Sachs

GS

224.95

1.73(0.78%)

8506

Google Inc.

GOOG

866.5

3.74(0.43%)

4391

Home Depot Inc

HD

152.59

0.70(0.46%)

1415

HONEYWELL INTERNATIONAL INC.

HON

130

0.21(0.16%)

1425

Intel Corp

INTC

36.84

0.09(0.24%)

4350

International Business Machines Co...

IBM

161.25

0.50(0.31%)

690

JPMorgan Chase and Co

JPM

88.25

0.75(0.86%)

34537

McDonald's Corp

MCD

137.88

3.65(2.72%)

119756

Microsoft Corp

MSFT

67.7

0.17(0.25%)

23344

Nike

NKE

55.5

0.03(0.05%)

4827

Pfizer Inc

PFE

33.78

0.04(0.12%)

210

Procter & Gamble Co

PG

89.73

0.18(0.20%)

2032

Starbucks Corporation, NASDAQ

SBUX

60.85

-0.26(-0.43%)

29392

Tesla Motors, Inc., NASDAQ

TSLA

308.68

0.65(0.21%)

11577

The Coca-Cola Co

KO

43.15

-0.13(-0.30%)

44867

Twitter, Inc., NYSE

TWTR

14.75

0.04(0.27%)

31456

United Technologies Corp

UTX

117.1

0.78(0.67%)

2787

UnitedHealth Group Inc

UNH

172.65

0.32(0.19%)

500

Verizon Communications Inc

VZ

47.07

0.02(0.04%)

3148

Visa

V

91.9

0.05(0.05%)

1329

Wal-Mart Stores Inc

WMT

75

0.22(0.29%)

1026

Yahoo! Inc., NASDAQ

YHOO

48.31

0.16(0.33%)

1251

Yandex N.V., NASDAQ

YNDX

23.59

0.21(0.90%)

2206

-

12:45

Upgrades and downgrades before the market open

Upgrades:

American Express (AXP) upgraded to Buy from Neutral at Guggenheim

JPMorgan Chase (JPM) upgraded to Buy from Neutral at Guggenheim

Downgrades:

General Electric (GE) downgraded to Neutral from Buy at BofA/Merrill

Amazon (AMZN) downgraded to Mkt Perform from Outperform at Raymond James

Other:

-

12:42

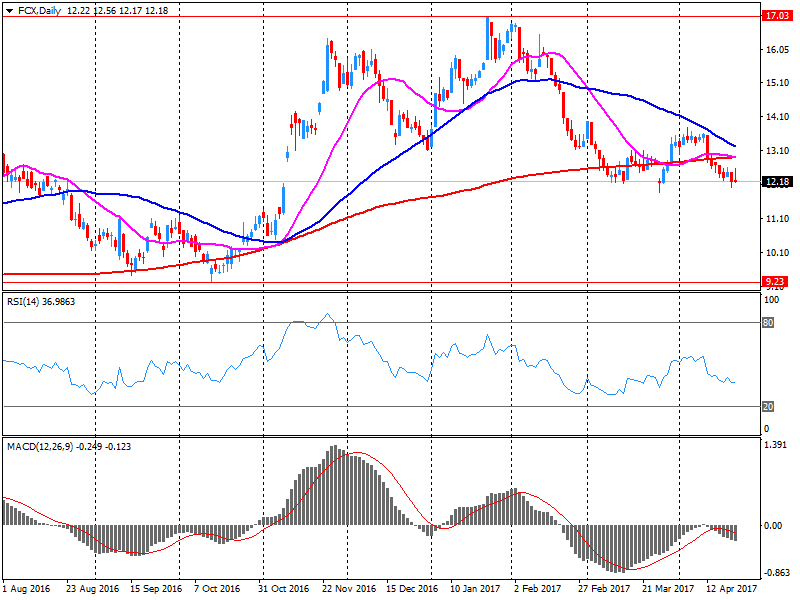

Company News: Freeport-McMoRan (FCX) posts Q1 EPS in line with analysts' estimates

Freeport-McMoRan (FCX) reported Q1 FY 2017 earnings of $0.15 per share (versus -$0.16 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $3.341 bln (-5.3% y/y), missing analysts' consensus estimate of $3.509 bln.

FCX rose to $12.48 (+2.04%) in pre-market trading.

-

12:25

Kremlin spokesman says Ukraine's decision to cut power supplies to Luhansk is another step towards rejection of breakaway territories

-

12:12

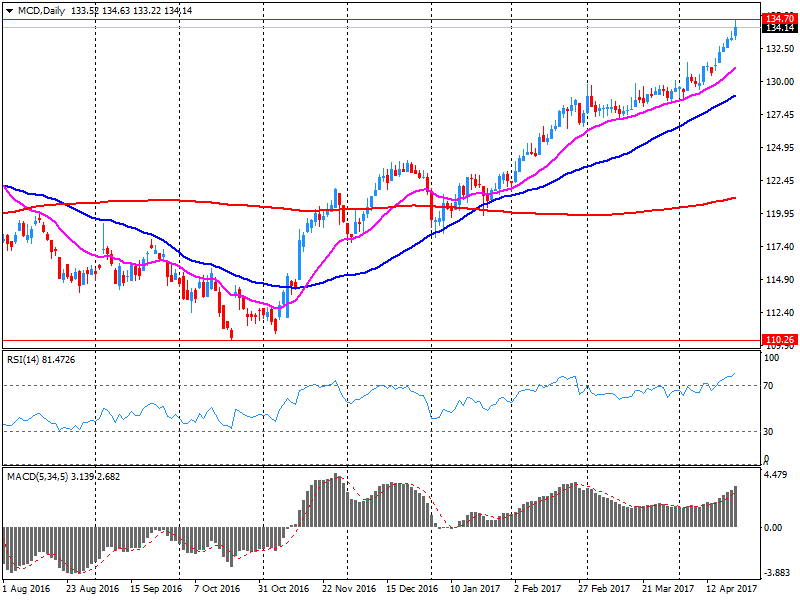

Company News: McDonald's (MCD) Q1 results beat analysts’ estimates

McDonald's (MCD) reported Q1 FY 2017 earnings of $1.47 per share (versus $1.23 in Q1 FY 2016), beating analysts' consensus estimate of $1.33.

The company's quarterly revenues amounted to $5.676 bln (-3.9% y/y), beating analysts' consensus estimate of $5.528 bln.

MCD rose to $137.75 (+2.62%) in pre-market trading.

-

12:00

Orders

EUR/USD

Offers: 1.0900 1.0920 1.0935 1.0950 1.0980 1.1000

Bids: 1.0865 1.0850 1.0820 1.0800 1.0780 1.0760 1.0730 1.0700

GBP/USD

Offers: 1.2820 1.2830-35 1.2850 1.2880 1.2900 1.2920 1.2950-60 1.2975 1.3000

Bids: 1.2775-80 1.2760 1.2750 1.2720 1.2700 1.2680 1.2650

EUR/JPY

Offers: 120.30 120.50 120.85 121.00 121.50

Bids: 119.80 119.50 119.30 119.00 118.80 118.50

EUR/GBP

Offers: 0.8520 0.8535 0.8550 0.8580 0.8600 0.8630 0.8650

Bids: 0.8485 0.8465 0.8450 0.8430 0.8400 0.8380 0.8360 0.8350

USD/JPY

Offers: 110.35 110.50 110.80 111.00 111.20 111.50

Bids: 110.00 109.80 109.60 109.50 109.20 109.00 108.70 108.50

AUD/USD

Offers: 0.7565 0.7585 0.7600 0.7620 0.7650

Bids: 0.7525-30 0.7500 0.7480-85 0.7465 0.7450

-

11:50

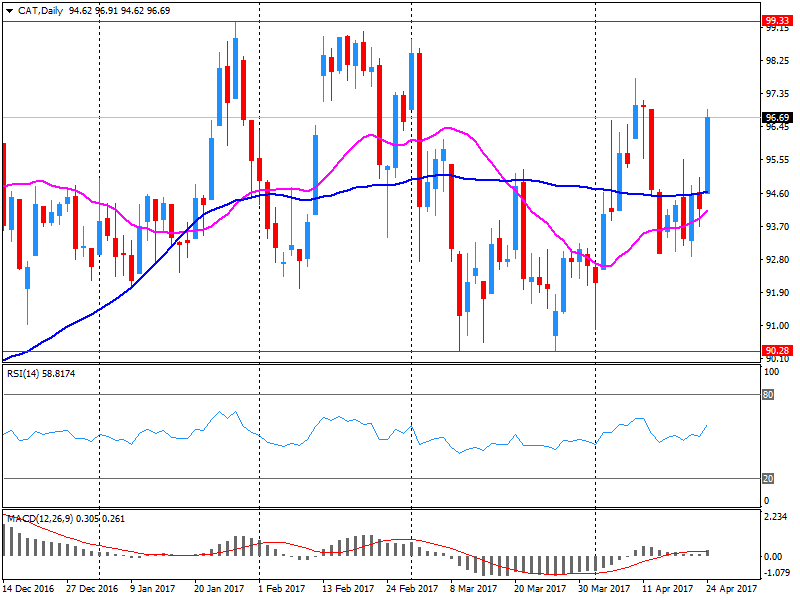

Company News: Caterpillar (CAT) Q1 results beat analysts’ projections

Caterpillar (CAT) reported Q1 FY 2017 earnings of $1.28 per share (versus $0.67 in Q1 FY 2016), beating analysts' consensus estimate of $0.63.

The company's quarterly revenues amounted to $9.822 bln (+3.8% y/y), beating analysts' consensus estimate of $9.271 bln.

CAT rose to $101.70 (+5.05%) in pre-market trading.

-

11:42

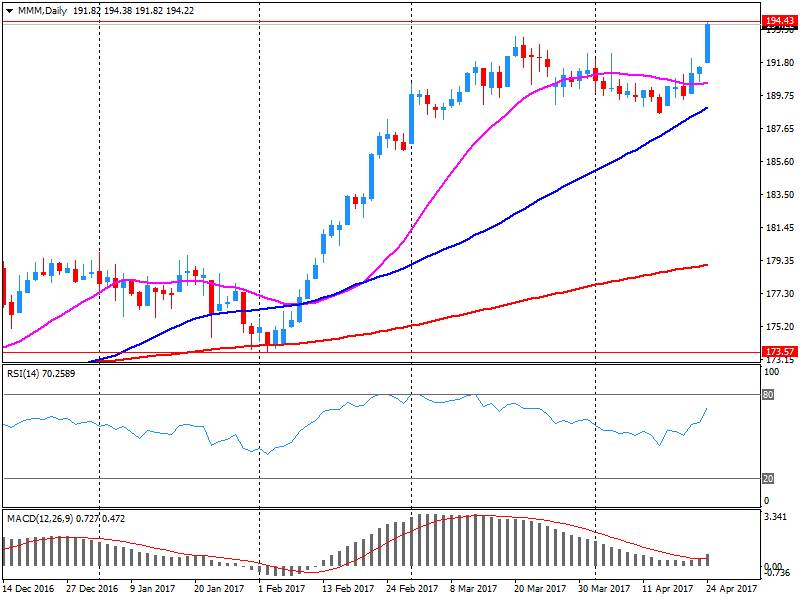

Company News: 3M (MMM) Q1 results beat analysts’ forecasts

3M (MMM) reported Q1 FY 2017 earnings of $2.16 per share (versus $1.95 in Q1 FY 2016), beating analysts' consensus estimate of $2.06.

The company's quarterly revenues amounted to $7.685 bln (+3.7% y/y), beating analysts' consensus estimate of $7.480 bln.

MMM rose to $198.87 (+2.39%) in pre-market trading.

-

11:27

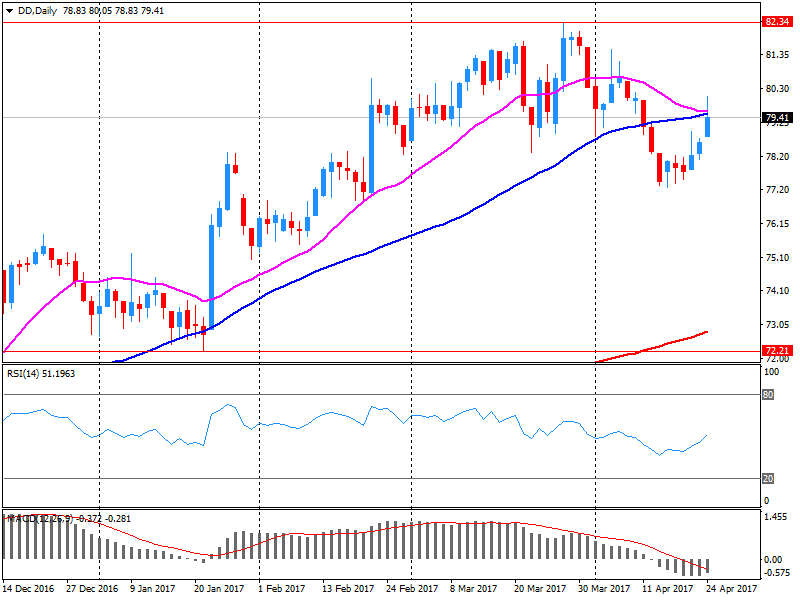

Company News: DuPont (DD) Q1 results beat analysts’ estimates

DuPont (DD) reported Q1 FY 2017 earnings of $1.64 per share (versus $1.26 in Q1 FY 2016), beating analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $7.743 bln (+4.6% y/y), beating analysts' consensus estimate of $7.501 bln.

DD rose to $80.00 (+0.79%) in pre-market trading.

-

11:21

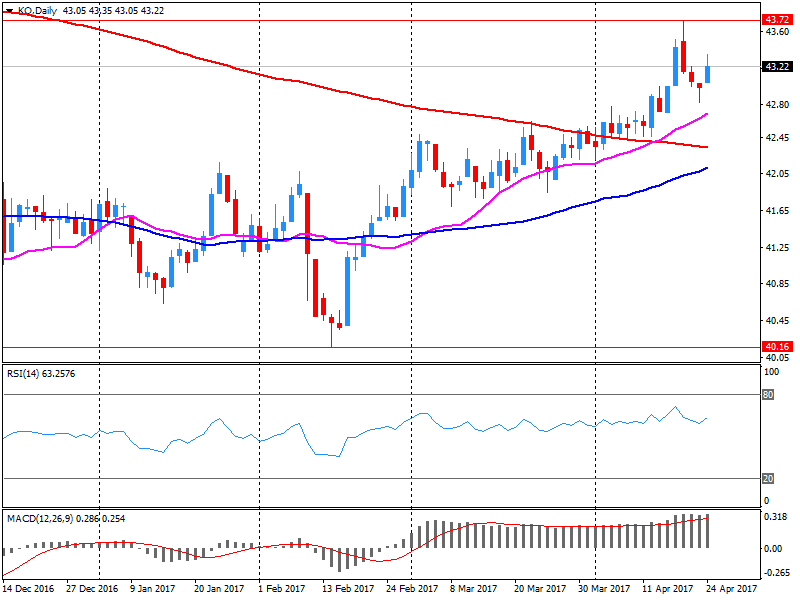

Company News: Coca-Cola (KO) Q1 EPS miss analysts’ estimate

Coca-Cola (KO) reported Q1 FY 2017 earnings of $0.43 per share (versus $0.45 in Q1 FY 2016), missing analysts' consensus estimate of $0.44.

The company's quarterly revenues amounted to $9.118 bln (-11.3% y/y), beating analysts' consensus estimate of $8.851 bln.

KO fell to $43.19 (-0.21%) in pre-market trading.

-

11:15

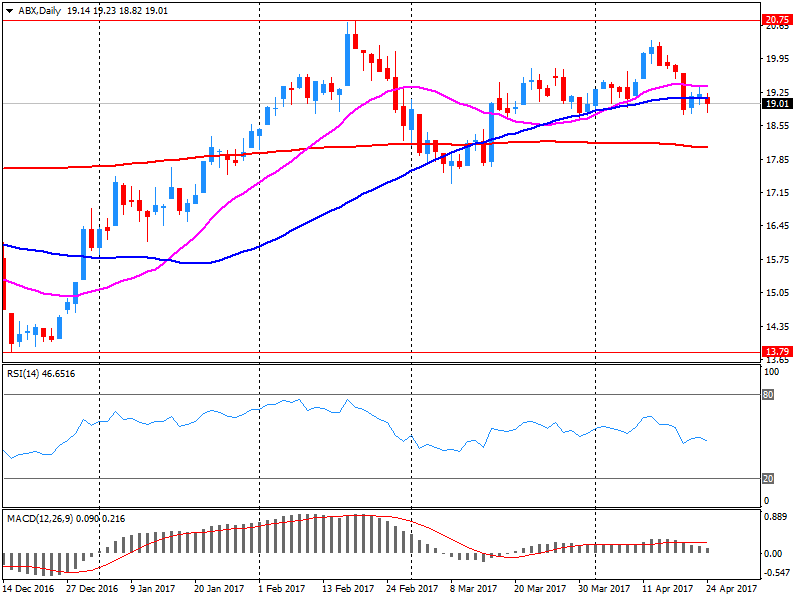

Company News: Barrick Gold (ABX) Q1 results miss analysts’ estimates

Barrick Gold (ABX) reported Q1 FY 2017 earnings of $0.14 per share (versus $0.11 in Q1 FY 2016), missing analysts' consensus estimate of $0.21.

The company's quarterly revenues amounted to $1.993 bln (+3.3% y/y), missing analysts' consensus estimate of $2.221 bln.

ABX fell to $18.44 (-3.15%) in pre-market trading.

-

11:10

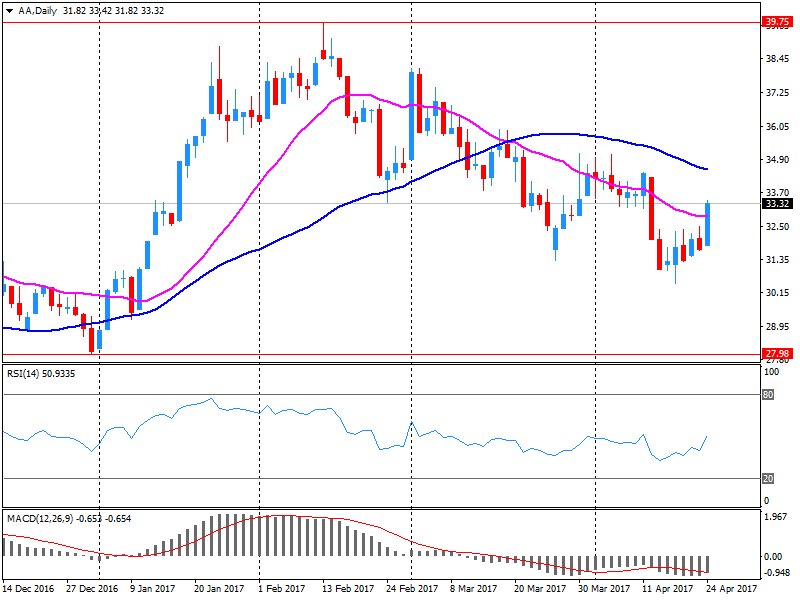

Company News: Alcoa (AA) Q1 EPS beat analysts’ estimate

Alcoa (AA) reported Q1 FY 2017 earnings of $0.63 per share (versus $0.07 in Q1 FY 2016), beating analysts' consensus estimate of $0.48.

The company's quarterly revenues amounted to $2.655 bln (+24.7% y/y), missing analysts' consensus estimate of $2.962 bln.

AA rose to $34.50 (+3.57%) in pre-market trading.

-

10:21

Centrist candidate Macron seen beating far right's Le Pen by 61 pct to 39 pct in French presidential runoff vote - Opinionway poll

-

10:00

Moody's says Poland benefits from favourable governance scores and EU membership, but has suffered from recent political unpredictability

-

Risk of fiscal slippage in Poland in 2017 remains

-

-

09:30

Doha - Qatar energy minister says satisfied with level of compliance in OPEC cut agreement

-

09:03

UK corporation tax revenues in 2016/17 financial year hit record high of 55.7 bln GBP, exceed pre-crisis peak for first time

-

09:03

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1,0750 (EUR 365) 1.0790-1.0800 (EUR 1,5 млрд) 1.0810-20 (415m) 1,0850 (325m) 1.0990-1.1000 (470m)

USDJPY: 109,50 (USD 221m) 110.00-05 (385) 110,35 (620m) 110.40-50 (260m)

GBPUSD: 1,2600 (GBP 312M) 1,2760 (196m) 1.2800-10 (220м)

AUDUSD: 0,7655 (AUD 376m)

USDCAD: 1,3500 (USD 1.34bln)

-

08:39

BoJ Kuroda: No Specific Debate Or Problems About FX At G20/IMF MEETINGS @LiveSquawk

-

08:34

UK public sector net borrowing decreased by £20.0 billion

Public sector net borrowing (excluding public sector banks) decreased by £20.0 billion to £52.0 billion in the financial year ending March 2017 (April 2016 to March 2017), compared with the financial year ending March 2016; this is the lowest net borrowing since the financial year ending March 2008.

The Office for Budget Responsibility (OBR) forecast that public sector net borrowing (excluding public sector banks) would be £51.7 billion during the financial year ending March 2017.

Public sector net borrowing (excluding public sector banks) increased by £0.8 billion to £5.1 billion in March 2017, compared with March 2016; this is the highest March borrowing since 2015.

Public sector net debt (excluding public sector banks) was £1,729.5 billion at the end of March 2017, equivalent to 86.6% of gross domestic product (GDP); an increase of £123.5 billion (or 3.0 percentage points as a ratio of GDP) on March 2016.

-

08:30

United Kingdom: PSNB, bln, March -4.36 (forecast -1.5)

-

07:34

The main European stock exchanges trading in the green zone: FTSE 7268.32 +3.64 + 0.05%, DAX 12465.63 +10.65 + 0.09%, CAC 5271.53 +2.68 + 0.05%

-

07:33

Gap between French and German 10-year govt bond yields lowest since early november at 41 basis points - Reuters

-

06:46

Boj's Iwata: Boj is conducting simulation on exit strategy from stimulus but withholding from publicising it as doing so would cause market confusion

-

06:45

ECB could change its forward guidance on policy rates - ANZ

"Despite the expected dovish communication at the upcoming meeting, we believe the ECB could change its forward guidance on policy rates at the meeting in June. We still believe the ECB will announce an extension of its EUR60 billion monthly QE purchases at the September meeting and hence continue the purchase programme in 2018,"

-

06:44

Ecb's Nowotny says if U.S expands deficit to boost growth, could lead to higher long-term interest rates in Europe - Der Standard

-

About Brexit, EU financial institutions wanting to operate in EU must have seat, supervision in EU

-

Fears Brexit problems have been underestimated, many negative surprises could arise, does not expect extension of negotiation time frame

-

Uncertainties over future U.S measures are worrying, U.S economy could be without orientation for a while

-

-

06:41

China march crude oil imports from Russia +0.94 pct y/y at 1.104 mln bpd - Customs

-

From Saudi Arabia +14.5 pct y/y at 1.072 mln bpd

-

From Iran +5.97 pct y/y at 626,2

-

From U.S 185,167 tonnes

-

-

06:39

Positive start of trading expected on the main European stock markets: DAX + 0.9%, CAC40 + 0.8%, FTSE + 0.3%

-

06:37

Canada Minister Freland & Carr condemn unfair, punitive duties on lumber @LiveSquawk

-

06:36

Trump plans to impose 20% tariff on Canadian soft lumber that is retroactive 90 days; Commerce Sec. informed Canada of plan today - DJ

-

06:35

Options levels on tuesday, April 25, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0950 (4139)

$1.0930 (690)

$1.0900 (466)

Price at time of writing this review: $1.0864

Support levels (open interest**, contracts):

$1.0811 (671)

$1.0766 (719)

$1.0707 (940)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 67634 contracts, with the maximum number of contracts with strike price $1,1000 (5846);

- Overall open interest on the PUT options with the expiration date June, 9 is 66723 contracts, with the maximum number of contracts with strike price $1,0400 (5204);

- The ratio of PUT/CALL was 0.99 versus 1.05 from the previous trading day according to data from April, 24

GBP/USD

Resistance levels (open interest**, contracts)

$1.3105 (1934)

$1.3007 (1319)

$1.2911 (1168)

Price at time of writing this review: $1.2793

Support levels (open interest**, contracts):

$1.2689 (269)

$1.2592 (1221)

$1.2495 (4773)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 21355 contracts, with the maximum number of contracts with strike price $1,2800 (2297);

- Overall open interest on the PUT options with the expiration date June, 9 is 26155 contracts, with the maximum number of contracts with strike price $1,2500 (4773);

- The ratio of PUT/CALL was 1.22 versus 1.23 from the previous trading day according to data from April, 24

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:32

Global Stocks

Bank stocks lighted up across Europe on Monday, collectively closing at a 16-month high as investors cheered the prospect of market-friendly Emmanuel Macron becoming France's next president. Macron-a former investment banker-is expected to win the May 7 runoff election against far-right candidate Marine Le Pen, who's pledged to hold a referendum on France's membership in the European Union if she were elected president.

U.S. stocks rallied to finish higher Monday, with major indexes advancing more than 1% and the tech-heavy Nasdaq scoring a record high close following a strong showing by centrist Emmanuel Macron in the French presidential election, which averted fears of a euroskeptic-only runoff.

Asian stocks were widely higher for a second day after the French presidential election, but gains again trailed those logged overnight in Europe and the U.S. Meanwhile, investors in Asia are on North Korea watch. Tuesday marks the 85th anniversary of the founding of North Korea's army, and North Korea observers have speculated that the county would test a nuclear device or missile.

-