Market news

-

22:30

Commodities. Daily history for Apr 26’02’2017:

(raw materials / closing price /% change)

Oil 49.21 -0.83%

Gold 1,270.80 +0.52%

-

22:29

Stocks. Daily history for Apr 26’2017:

(index / closing price / change items /% change)

Nikkei +210.10 19289.43 +1.10%

TOPIX +18.20 1537.41 +1.20%

Hang Seng +122.49 24578.43 +0.50%

CSI 300 +4.35 3445.78 +0.13%

Euro Stoxx 50 -4.45 3578.71 -0.12%

FTSE 100 +13.08 7288.72 +0.18%

DAX +5.76 12472.80 +0.05%

CAC 40 +10.00 5287.88 +0.19%

DJIA -21.03 20975.09 -0.10%

S&P 500 -1.16 2387.45 -0.05%

NASDAQ -0.26 6025.23 +0.00%

S&P/TSX -95.65 15649.54 -0.61%

-

22:27

Currencies. Daily history for Apr 26’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0903 -0,22%

GBP/USD $1,2842 +0,07%

USD/CHF Chf0,993 -0,04%

USD/JPY Y111,09 +0,03%

EUR/JPY Y121,13 -0,20%

GBP/JPY Y142,65 +0,08%

AUD/USD $0,7474 -0,78%

NZD/USD $0,6893 -0,75%

USD/CAD C$1,3617 +0,32%

-

21:58

Schedule for today, Thursday, Apr 27’2017 (GMT0)

01:30 Australia Import Price Index, q/q Quarter I 0.2% -0.5%

01:30 Australia Export Price Index, q/q Quarter I 12.4% 8%

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

03:00 Japan BOJ Outlook Report

06:00 Germany Gfk Consumer Confidence Survey May 9.8 9.9

06:00 Switzerland Trade Balance March 3.1 3.01

06:30 Japan BOJ Press Conference

09:00 Eurozone Consumer Confidence (Finally) April -5 -3.6

09:00 Eurozone Business climate indicator April 0.82 0.82

09:00 Eurozone Industrial confidence April 1.2 1.3

09:00 Eurozone Economic sentiment index April 107.9 108.1

09:10 Australia RBA's Governor Philip Lowe Speaks

10:00 United Kingdom CBI retail sales volume balance April 9 6

11:45 Eurozone ECB Interest Rate Decision 0% 0%

11:45 Eurozone Deposit Facilty Rate -0.4% -0.4%

12:00 Germany CPI, m/m (Preliminary) April 0.2% -0.1%

12:00 Germany CPI, y/y (Preliminary) April 1.6% 1.9%

12:30 Eurozone ECB Press Conference

12:30 U.S. Goods Trade Balance, $ bln. March -64.8 -65.5

12:30 U.S. Continuing Jobless Claims 1979 2005

12:30 U.S. Durable Goods Orders March 1.7% 1.2%

12:30 U.S. Durable goods orders ex defense March 2.1%

12:30 U.S. Initial Jobless Claims 244 245

12:30 U.S. Durable Goods Orders ex Transportation March 0.4% 0.4%

14:00 U.S. Pending Home Sales (MoM) March 5.5% -1%

22:45 New Zealand Building Permits, m/m March 14.0%

22:45 New Zealand Trade Balance, mln March -18 370

23:05 United Kingdom Gfk Consumer Confidence April -6 -7

23:30 Japan Unemployment Rate March 2.8% 2.9%

23:30 Japan Household spending Y/Y March -3.8% -0.3%

23:30 Japan Tokyo CPI ex Fresh Food, y/y April -0.4% -0.2%

23:30 Japan Tokyo Consumer Price Index, y/y April -0.4% -0.2%

23:30 Japan National Consumer Price Index, y/y March 0.3% 0.3%

23:30 Japan National CPI Ex-Fresh Food, y/y March 0.2% 0.3%

23:50 Japan Retail sales, y/y March 0.1% 1.5%

23:50 Japan Industrial Production (MoM) (Preliminary) March 3.2% -0.8%

23:50 Japan Industrial Production (YoY) (Preliminary) March 4.7%

-

20:08

The main US stock indices fell on the results of today's session

Major US stock indices fell slightly on Wednesday, responding to details of the tax reform plan of the US President's administration Trump.

According to the plan, the maximum tax rate for individuals will be reduced to 35% from the current 39.6%. In addition, together 7 tax categories for individuals will now be 3 categories - with rates of 10%, 25% and 35%. The plan also implies a reduction in the tax rate for the company to 15% from 35%. The tax rate on income for companies on individual declarations will also be reduced to 15% (now these revenues are subject to separate tax rates). At the same time, it is planned to abolish the targeted tax deductions that were mostly used by the richest, as well as the inheritance tax and the minimum alternative tax. The plan also includes tax breaks for American families, especially middle-income families, and a doubling of the standard tax deduction that Americans can claim for reimbursement from the budget. In addition, it is planned to reduce taxes for families with children and expenses for dependent care.

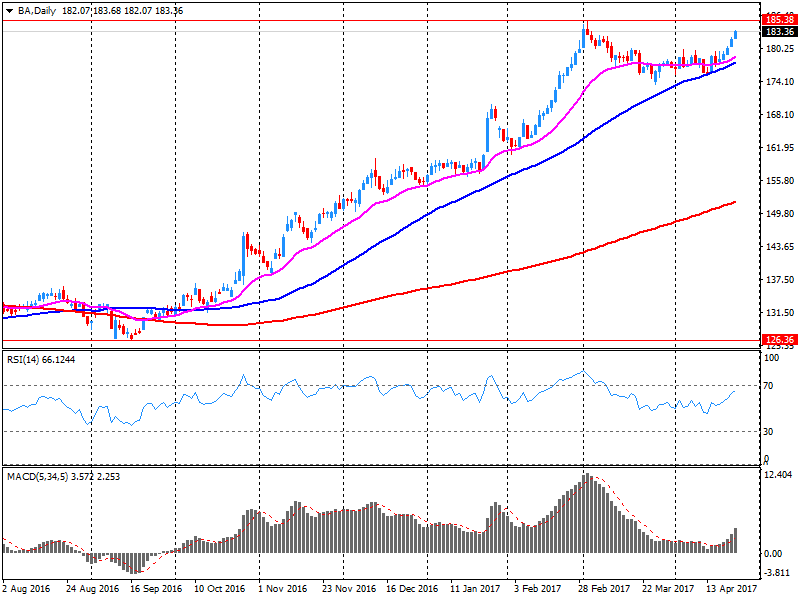

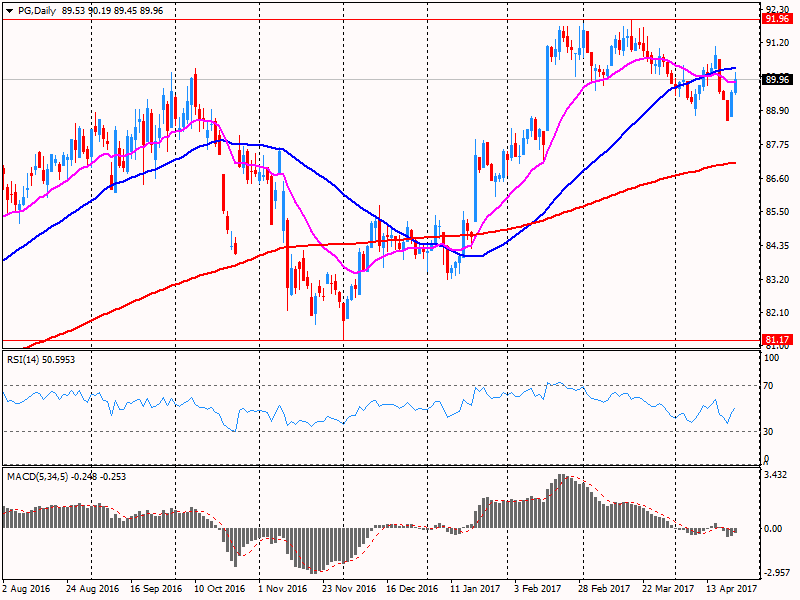

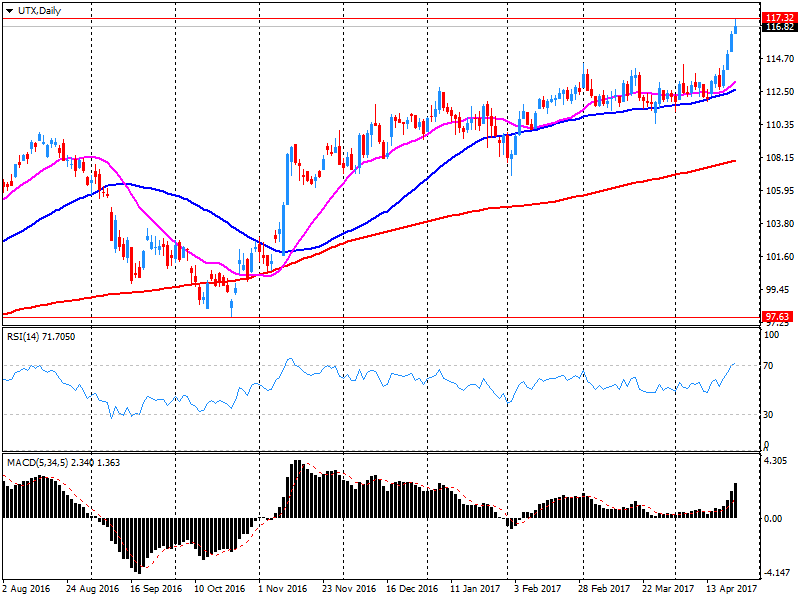

Investors also evaluated the quarterly reports of companies such as Arconic (ARNC), Twitter (TWTR), United Tech (UTX), Procter & Gamble (PG), AT & T (T) and Boeing (BA).

Companies from the S & P 500 index so far reported on profits for the first quarter, which in aggregate exceeded the consensus estimates by 6.8%. If the current growth rate of earnings per share of companies from the S & P 500 will hold, they will become the strongest since the end of 2011, according to FactSet.

Most components of the DOW index finished trading in different directions (15 in negative territory, 15 in positive territory). The leader of growth was shares United Technologies Corporation (UTX, + 1.32%). Most fell shares The Procter & Gamble Company (PG, -2.60%).

The S & P index sector also finished trading mixed. The growth leader was the conglomerate sector (+ 0.5%). Most fell sector of consumer goods (-0.6%).

At closing:

DJIA -0.08% 20.978.93 -17.19

Nasdaq -0.00% 6,025.23 -0.26

S & P -0.04% 2,387.70 -0.91

-

19:00

DJIA +0.15% 21,027.50 +31.38 Nasdaq +0.16% 6,034.83 +9.34 S&P +0.22% 2,393.90 +5.29

-

16:00

European stocks closed: FTSE 100 +13.08 7288.72 +0.18% DAX +5.76 12472.80 +0.05% CAC 40 +10.00 5287.88 +0.19%

-

14:36

U.S. crude oil inventories decreased more than expected. Oil rally 50c

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 3.6 million barrels from the previous week. At 528.7 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 3.4 million barrels last week, and are near the upper limit of the average range. Both finished gasoline inventories and blending components inventories increased last week. Distillate fuel inventories increased by 2.7 million barrels last week and are in the upper half of the average range for this time of year. Propane/propylene inventories were unchanged from last week and are in the lower half of the averag

-

14:30

U.S.: Crude Oil Inventories, April -3.641 (forecast -1.2)

-

14:22

Thaad missile defense system to be operational in South Korea "in the coming days" - U.S. Admiral

-

14:10

Mnuchin says debt ceiling 'absolutely' must be done in the fall

-

Administration does not think border tax will work in its current form

-

There is fundamental agreement with congress on goals of tax reform, details to be worked out

-

Small business will have the benefit of business rate

-

-

13:52

Mnuchin confirms business tax will be 15% @zerohedge

-

13:34

U.S. Stocks open: Dow +0.17%, Nasdaq +0.14%, S&P +0.11%

-

13:27

Before the bell: S&P futures +0.03%, NASDAQ futures +0.05%

U.S. stock-index futures were little changed amid a flood of corporate earnings, while investors awaited President Donald Trump's plan on tax reform.

Stocks:

Nikkei 19,289.43 +210.10 +1.10%

Hang Seng 24,578.43 +122.49 +0.50%

Shanghai 3,140.85 +6.28 +0.20%

FTSE 7,271.97 -3.67 -0.05%

CAC 5,281.02 +3.14 +0.06%

DAX 12,463.57 -3.47 -0.03%

Crude $49.11 (-0.91%)

Gold $1,265.40 (-0.14%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.99

-0.50(-1.37%)

4278

Amazon.com Inc., NASDAQ

AMZN

909.5

1.88(0.21%)

24520

Apple Inc.

AAPL

144.55

0.02(0.01%)

149600

AT&T Inc

T

39.9

-0.04(-0.10%)

86414

Barrick Gold Corporation, NYSE

ABX

17.04

0.15(0.89%)

210095

Boeing Co

BA

181

-2.51(-1.37%)

47346

Caterpillar Inc

CAT

104

-0.42(-0.40%)

38980

Chevron Corp

CVX

106.51

-0.22(-0.21%)

4561

Cisco Systems Inc

CSCO

33.49

0.07(0.21%)

28716

Citigroup Inc., NYSE

C

59.96

-0.25(-0.42%)

17823

E. I. du Pont de Nemours and Co

DD

82.1

-0.11(-0.13%)

4747

Exxon Mobil Corp

XOM

81.42

-0.31(-0.38%)

64017

Facebook, Inc.

FB

146.8

0.31(0.21%)

53658

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.93

-0.17(-1.30%)

35911

General Electric Co

GE

29.49

0.04(0.14%)

147602

General Motors Company, NYSE

GM

34

0.01(0.03%)

2100

Goldman Sachs

GS

226.1

-0.53(-0.23%)

6417

Intel Corp

INTC

36.98

0.11(0.30%)

186897

International Business Machines Co...

IBM

160.58

0.19(0.12%)

7680

JPMorgan Chase and Co

JPM

88.33

0.07(0.08%)

31715

McDonald's Corp

MCD

141.45

-0.25(-0.18%)

20485

Microsoft Corp

MSFT

68.12

0.20(0.29%)

60830

Pfizer Inc

PFE

33.82

0.06(0.18%)

36177

Procter & Gamble Co

PG

89

-1.00(-1.11%)

26584

Starbucks Corporation, NASDAQ

SBUX

61.04

0.08(0.13%)

9842

Tesla Motors, Inc., NASDAQ

TSLA

312.22

-1.57(-0.50%)

37419

The Coca-Cola Co

KO

43

-0.11(-0.26%)

26203

Twitter, Inc., NYSE

TWTR

15.95

1.29(8.80%)

7819500

United Technologies Corp

UTX

117.87

1.00(0.86%)

15659

Visa

V

91.8

-0.31(-0.34%)

52189

Wal-Mart Stores Inc

WMT

75.06

0.01(0.01%)

46302

Yandex N.V., NASDAQ

YNDX

24.03

0.11(0.46%)

12727

-

12:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

McDonald's (MCD) target raised to $150 from $140 at Telsey Advisory Group

3M (MMM) target raised to $202 from $190 at Stifel

-

12:34

Canadian retail sales declined 0.6% to $47.8 billion in February

Retail sales declined 0.6% to $47.8 billion in February, following a 2.3% increase in January. Sales were down in 5 of 11 subsectors, representing 67% of total retail sales.

Lower sales at motor vehicle and parts dealers and gasoline stations were the main contributors to the decline. Excluding these two subsectors, retail sales were up 0.5%.

After removing the effects of price changes, retail sales in volume terms edged down

Sales at motor vehicle and parts dealers (-1.8%) were down for the first time in seven months, largely reflecting weaker sales at new car (-1.7%) and other motor vehicle (-5.5%) dealers. Following gains in January, sales were 1.3% lower at used car dealers.

Gasoline stations (-3.6%) posted their first sales decline in three months, largely reflecting lower prices at the pump.

Following an increase in January, receipts at food and beverage stores decreased 0.4% in February. Lower sales at beer, wine and liquor stores (-1.7%) was the main contributor to the decline. Sales at specialty food stores (-0.6%) also declined, while supermarkets and other grocery stores sales were relatively unchanged from January0.1%.

-

12:30

Canada: Retail Sales, m/m, February -0.6% (forecast -0.1%)

-

12:30

Canada: Retail Sales ex Autos, m/m, February -0.1% (forecast -0.3%)

-

12:30

Canada: Retail Sales YoY, February 4.7%

-

11:55

Company News: Boeing (BA) posts mixed Q1 results

Boeing (BA) reported Q1 FY 2017 earnings of $2.01 per share (versus $1.74 in Q1 FY 2016), beating analysts' consensus estimate of $1.91.

The company's quarterly revenues amounted to $20.976 bln (-7.3% y/y), missing analysts' consensus estimate of $21.266 bln.

BA fell to $182.80 (-0.39%) in pre-market trading.

-

11:47

Canada's foreign minister says has made progress on lumber talks with United States, "but we are not there yet"

-

11:47

Saudi foreign minister, after talks with Russian foreign minister, says wants to end Iran's meddling in middle east

-

Says Russia-brokered Syria peace is going well, sees no need to widen list of participants to Astana talks

-

-

11:41

Company News: Procter & Gamble (PG) quarterly earnings beat analysts’ estimate

Procter & Gamble (PG) reported Q3 FY 2017 earnings of $0.96 per share (versus $0.86 in Q3 FY 2016), beating analysts' consensus estimate of $0.94.

The company's quarterly revenues amounted to $15.605 bln (-1% y/y), slightly below analysts' consensus estimate of $15.705 bln.

PG fell to $89.07 (-1.03%) in pre-market trading.

-

11:30

Company News: United Tech (UTX) Q1 results beat analysts’ forecasts

United Tech (UTX) reported Q1 FY 2017 earnings of $1.48 per share (versus $1.47 in Q1 FY 2016), beating analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $13.815 bln (+3.4% y/y), beating analysts' consensus estimate of $13.501 bln.

UTX rose to $117.90 (+0.88%) in pre-market trading.

-

11:23

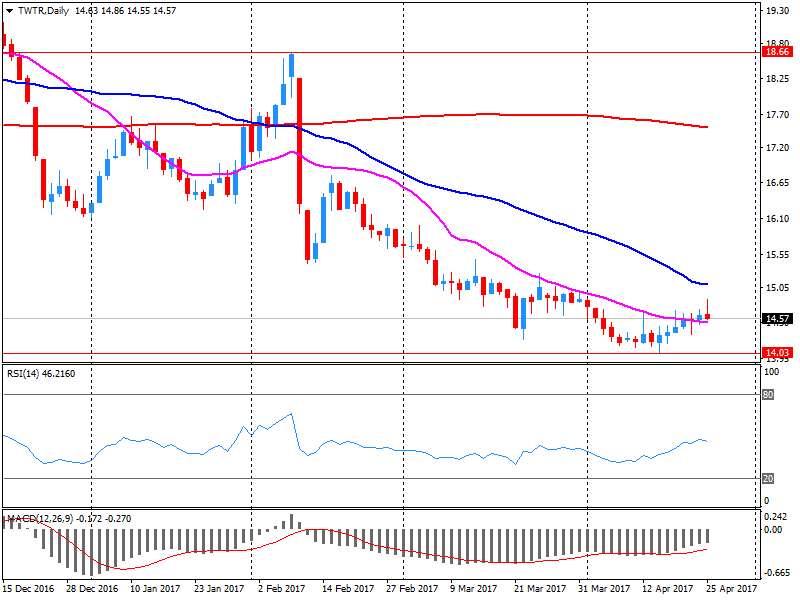

Company News: Twitter (TWTR) Q1 results beat analysts’ estimate

Twitter (TWTR) reported Q1 FY 2017 earnings of $0.11 per share (versus $0.15 in Q1 FY 2016), beating analysts' consensus estimate of $0.01.

The company's quarterly revenues amounted to $0.548 bln (-7.8% y/y), beating analysts' consensus estimate of $0.513 bln.

TWTR rose to $16.03 (+9.35%) in pre-market trading.

-

11:18

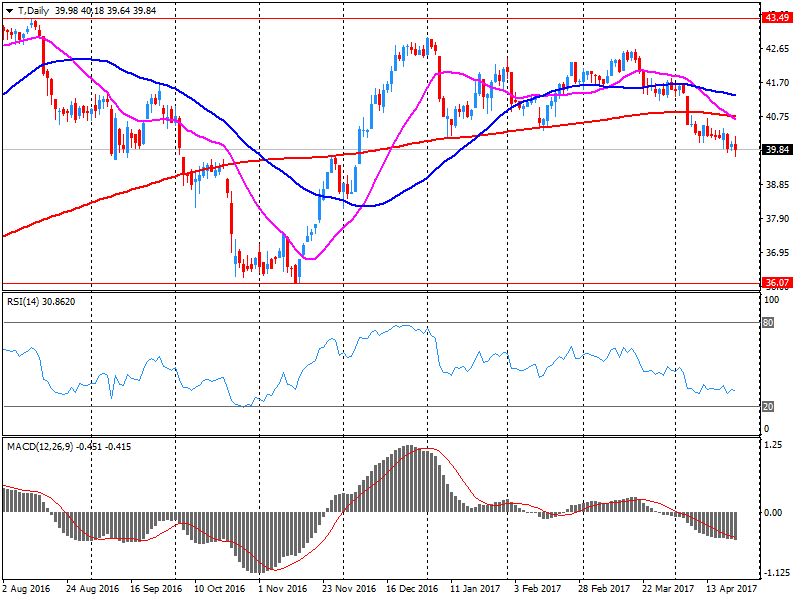

Company News: AT&T (T) posts Q1 EPS in line with analysts' estimates

AT&T (T) reported Q1 FY 2017 earnings of $0.74 per share (versus $0.72 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $39.400 bln (-2.8% y/y), missing analysts' consensus estimate of $40.500 bln.

T rose to $40.01 (+0.18%) in pre-market trading.

-

11:08

Company News: Arconic (ARNC) Q1 results beat analysts’ expectations

Arconic (ARNC) reported Q1 FY 2017 earnings of $0.33 per share, beating analysts' consensus estimate of $0.24.

The company's quarterly revenues amounted to $3.055 bln (-4.3% y/y), beating analysts' consensus estimate of $2.996 bln.

ARNC rose to $28.00 (+3.78%) in pre-market trading.

-

09:53

Macron's french election campaign team says it has been targeted by cyberattackers, says at least five cases seen since january

-

09:03

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0800 (EUR 465m) 1.0850 (500m) 1.0880 (380m) 1.0900 (1.1bln) 1.0930 (385m) 1.0950 (345m) 1.1000 (1.1bln) 1.1050 (415m)

USDJPY: 110.00-10 (2.6bln) 110.45-55 (1.4bln) 112.70-80 (300m) 113.00 (1.4bln)

GBPUSD: 1.2800 (GBP 227m) 1.2830 (180m) 1.2850 (220m)

USDCHF: 1.0000 (USD 175m)

AUDUSD: 0.7500 (AUD 310m) 0.7550 (260m) 0.7600 (265m) 0.7620 ( 450m)

USDCAD: 1.3500 (USD 500m) 1.3600 (240m) 1.3705 (500m)

NZDUSD: 0.7000 (NZD 236m)

EURJPY: 121.00 (EUR 265m)

-

08:58

UK Brexit minister Davis says should favour intelligent approach to regulation in years ahead, avoid unnecessary burdens but ensure new access to markets

-

08:31

UK Brexit minister Davis says UK will not seek to take divide and rule approach to Brexit negotiations

-

Should be under no illusions about scale of the task ahead of us in Brexit negotiations

-

-

08:10

Major stock exchanges in Europe trading mixed: FTSE 7266.65 -8.99 -0.12%, DAX 12461.24 -5.80 -0.05%, CAC 5279.14 +1.26 + 0.02%

-

07:27

Moodys Investors Service is maintaining its stable outlook on the Czech banking system

Moodys Investors Service is maintaining its stable outlook on the Czech banking system, reflecting the rating agencys view that a favourable operating environment will support the countrys banks. The outlook expresses Moodys expectation of how bank creditworthiness will evolve in the Czech Republic over the next 12-18 months.

Moodys report, entitled "Banking System Outlook: Czech Republic: Economic and Employment Growth Will Support Loan Demand," is available on www.moodys.com. Moodys subscribers can access this report via the link provided at the end of this press release.

"Household spending, rising employment and low funding costs in the Czech Republic will support debt servicing and credit demand into 2018, creating favourable conditions for the countrys banks," says Arif Bekiroglu, Assistant Vice President and Analyst at Moodys.

-

06:48

New Zeeland migrant arrivals numbered 129,500 in the March 2017 year, a new annual record

Migrant arrivals numbered 129,500 in the March 2017 year, a new annual record, Stats NZ said today. Migrant departures were 57,600 in the 12 months to March 2017. This led to a record annual net gain in migration of 71,900, which surpasses the previous annual record net gain of 71,300 migrants in the February 2017 year.

Annual net migration has been steadily increasing since 2012. "This was mainly due to the rising number of migrant arrivals to New Zealand," population statistics senior manager Peter Dolan said. "Fewer migrant departures also contributed to the increase in net migration."

-

06:47

Trump plan to tax repatriation of corp. foreign earnings at 10% @zerohedge

-

06:45

France: Consumer confidence , April 100 (forecast 100)

-

06:43

Swiss UBS Consumption Indicator stood at 1.50 in March,

The UBS Consumption Indicator stood at 1.50 in March, and the February figure was revised downwards slightly to 1.45. Following strong growth at the beginning of the year (5.5%), domestic tourism fell by 0.8% in February compared with the same month in the previous year. New car registrations, on the other hand, increased by 4.8% compared with the previous year. A sour mood prevails among retailers, according to a survey conducted by the Swiss Economic Institute (KOF) at ETH Zurich

-

06:42

White house budget director Mulvaney says Trump will not agree to include Obamacare subsidies in spending bill - CNN interview

-

06:37

Options levels on wednesday, April 26, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1036 (4205)

$1.1012 (4151)

$1.0985 (959)

Price at time of writing this review: $1.0935

Support levels (open interest**, contracts):

$1.0852 (842)

$1.0798 (1130)

$1.0732 (1234)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 68591 contracts, with the maximum number of contracts with strike price $1,1100 (5755);

- Overall open interest on the PUT options with the expiration date June, 9 is 69708 contracts, with the maximum number of contracts with strike price $1,0400 (5206);

- The ratio of PUT/CALL was 1.02 versus 0.99 from the previous trading day according to data from April, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.3106 (1935)

$1.3009 (2397)

$1.2913 (1166)

Price at time of writing this review: $1.2824

Support levels (open interest**, contracts):

$1.2787 (676)

$1.2591 (302)

$1.2694 (1310)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 22767 contracts, with the maximum number of contracts with strike price $1,3000 (2397);

- Overall open interest on the PUT options with the expiration date June, 9 is 26569 contracts, with the maximum number of contracts with strike price $1,2500 (4956);

- The ratio of PUT/CALL was 1.17 versus 1.22 from the previous trading day according to data from April, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:12

Australian CPI rose less than expected in Q1

The all groups CPI:

Rose 0.5% this quarter, compared with a rise of 0.5% in the december quarter 2016.

Rose 2.1% over the twelve months to the march quarter 2017, compared with a rise of 1.5% over the twelve months to the december quarter 2016.

Overview of CPI movements:

The most significant price rises this quarter are automotive fuel (+5.7%), new dwelling purchase by owner-occupiers (+1.0%), medical and hospital services (+1.6%) and electricity (+2.5%).

The most significant offsetting price falls this quarter are international holiday travel and accommodation (-3.8%), fruit (-6.7%) and furniture (-3.5%).

-

05:29

Global Stocks

European stocks higher Tuesday, with French stocks closing at a nine-year high as relief over a potentially market-friendly outcome in France's presidential election continued to boost sentiment.

The U.S. stock market extended its rally Tuesday, with the Dow jumping by triple-digits and the Nasdaq closing above 6,000 for the first time ever, as investors welcomed upbeat earnings and the possibility of corporate tax cuts. "Today is one of the busiest days in terms of corporate earnings releases, with 36 companies reporting before and after the market and so far earnings have been strong," said Michael Antonelli, equity sales trader at Robert W. Baird & Co.

Equities in Asia extended gains for a third session early Wednesday as sustained political optimism, currency tailwinds and the growing prospect of a U.S. tax overhaul whetted appetite for risk. Sparked by the success of centrist, market-friendly French presidential candidate Emmanuel Macron in the first round of the election on Sunday, investors have shed prevote caution and piled into risk assets.

-

04:31

Japan: All Industry Activity Index, m/m, February 0.7% (forecast 0.6%)

-

01:30

Australia: CPI, q/q, Quarter I 0.5% (forecast 0.6%)

-

01:30

Australia: CPI, y/y, Quarter I 2.1% (forecast 2.2%)

-

01:30

Australia: Trimmed Mean CPI q/q, March 0.5% (forecast 0.5%)

-

01:30

Australia: Trimmed Mean CPI y/y, March 1.9% (forecast 1.8%)

-