Market news

-

23:50

Japan: Industrial Production (MoM) , March -2.1% (forecast -0.8%)

-

23:50

Japan: Retail sales, y/y, March 2.1% (forecast 1.5%)

-

23:31

Japan: Household spending Y/Y, March -1.3% (forecast -0.3%)

-

23:30

Japan: Unemployment Rate, March 2.8% (forecast 2.9%)

-

23:30

Japan: Tokyo CPI ex Fresh Food, y/y, April -0.1% (forecast -0.2%)

-

23:30

Japan: National Consumer Price Index, y/y, March 0.2% (forecast 0.3%)

-

23:30

Japan: Tokyo Consumer Price Index, y/y, April -0.1% (forecast -0.2%)

-

23:30

Japan: National CPI Ex-Fresh Food, y/y, March 0.2% (forecast 0.3%)

-

23:04

United Kingdom: Gfk Consumer Confidence, April -7 (forecast -7)

-

22:45

New Zealand: Trade Balance, mln, March 322 (forecast 370)

-

22:45

New Zealand: Building Permits, m/m, March -1.8%

-

22:30

Commodities. Daily history for Apr 27’02’2017:

(raw materials / closing price /% change)

Oil 49.24 +0.55%

Gold 1,265.30 -0.05%

-

22:28

Stocks. Daily history for Apr 27’2017:

(index / closing price / change items /% change)

Nikkei -37.56 19251.87 -0.19%

TOPIX -0.74 1536.67 -0.05%

Hang Seng +120.05 24698.48 +0.49%

CSI 300 +0.94 3446.72 +0.03%

Euro Stoxx 50 -15.42 3563.29 -0.43%

FTSE 100 -51.55 7237.17 -0.71%

DAX -29.01 12443.79 -0.23%

CAC 40 -16.18 5271.70 -0.31%

DJIA +6.24 20981.33 +0.03%

S&P 500 +1.32 2388.77 +0.06%

NASDAQ +23.71 6048.94 +0.39%

S&P/TSX -143.07 15506.47 -0.91%

-

22:27

Currencies. Daily history for Apr 27’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0873 -0,28%

GBP/USD $1,2902 +0,47%

USD/CHF Chf0,994 +0,10%

USD/JPY Y111,25 +0,14%

EUR/JPY Y120,96 -0,14%

GBP/JPY Y143,52 +0,61%

AUD/USD $0,7467 -0,09%

NZD/USD $0,6877 -0,23%

USD/CAD C$1,363 +0,10%

-

22:04

Schedule for today, Friday, Apr 28’2017 (GMT0)

01:00 New Zealand ANZ Business Confidence April 11.3

01:30 Australia Private Sector Credit, m/m March 0.3%

01:30 Australia Producer price index, q / q Quarter I 0.5% 0.3%

01:30 Australia Producer price index, y/y Quarter I 0.7%

01:30 Australia Private Sector Credit, y/y March 5.0%

05:00 Japan Construction Orders, y/y March 5.7%

05:00 Japan Housing Starts, y/y March -2.6% -2.4%

05:30 France GDP, Y/Y (Preliminary) Quarter I 1.1%

05:30 France GDP, q/q (Preliminary) Quarter I 0.4% 0.4%

06:00 Germany Retail sales, real adjusted March 1.8% -0.3%

06:00 Germany Retail sales, real unadjusted, y/y March -2.1% 2%

06:45 France CPI, y/y (Preliminary) April 1.1%

06:45 France CPI, m/m (Preliminary) April 0.6% 0.1%

07:00 Switzerland KOF Leading Indicator April 107.6 107.8

08:00 Eurozone Private Loans, Y/Y March 2.3% 2.4%

08:00 Eurozone M3 money supply, adjusted y/y March 4.7% 4.7%

08:00 Switzerland SNB Chairman Jordan Speaks

08:30 United Kingdom BBA Mortgage Approvals March 42.6 42

08:30 United Kingdom GDP, y/y (Preliminary) Quarter I 1.9% 2.2%

08:30 United Kingdom GDP, q/q (Preliminary) Quarter I 0.7% 0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) April 0.7%

09:00 Eurozone Harmonized CPI, Y/Y (Preliminary) April 1.5% 1.8%

12:30 Canada Industrial Product Price Index, y/y March 3.5%

12:30 Canada Industrial Product Price Index, m/m March 0.1%

12:30 Canada GDP (m/m) February 0.6% 0.0%

12:30 U.S. PCE price index ex food, energy, q/q (Preliminary) Quarter I 1.3% 2%

12:30 U.S. PCE price index, q/q (Preliminary) Quarter I 2% 2.3%

12:30 U.S. GDP, q/q (Preliminary) Quarter I 2.1% 1.1%

13:45 U.S. Chicago Purchasing Managers' Index April 57.7 56.4

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Finally) April 96.9 98

17:00 U.S. Baker Hughes Oil Rig Count April 688

17:15 U.S. FOMC Member Brainard Speaks

18:30 U.S. FOMC Member Harker Speaks

-

20:10

Major US stock indexes finished trading above the zero mark

Major US stock indexes rose slightly, as a strong increase in the conglomerate sector leveled the collapse in the core materials segment.

Investors shifted the focus from company reporting, the day after the Trump administration announced a tax reform plan.

As it became known today, the number of Americans who recently lost their jobs and applied for unemployment benefits rose last week to a one-month high, although this growth appears to have mainly concentrated in the state of New York. Initial claims for unemployment benefits rose by 14,000 to 257,000 people, the Ministry of Labor said. Economists had expected that initial applications would amount to 245,000 within seven days from April 16 to April 22.

At the same time, new orders for capital goods produced in the US grew less than expected in March, but the second monthly growth in shipments showed an acceleration of investments in business in the first quarter. The Ministry of Commerce said that non-military orders for goods, with the exception of aircraft that are closely monitored as planned business expenses, increased by 0.2% after rising 0.1% in February. Economists forecast an increase of 0.5%.

It also became known that unfinished transactions for the sale of housing fell in March, as stocks continued to decline. The index of unfinished transactions for the sale of housing from the National Association of Realtors fell by 0.8% to 111.4, NAR reported on Thursday. Economists forecast a decrease of 1.0%.

Most components of the DOW index showed an increase (16 out of 30). The growth leader was the shares of The Home Depot, Inc. (HD, + 1.22%). Caterpillar Inc. shares fell more than others. (CAT, -1.88%).

The S & P sector finished the session mostly in positive territory. The growth leader was the conglomerate sector (+ 1.2%). Most of all fell the sector of basic materials (-1.2%).

At closing:

DJIA + 0.03% 20.981.39 +6.30

Nasdaq + 0.39% 6,048.94 +23.71

S & P + 0.06% 2.388.77 +1.32

-

19:00

DJIA +0.08% 20,991.87 +16.78 Nasdaq +0.37% 6,047.75 +22.52 S&P +0.10% 2,389.87 +2.42

-

16:00

European stocks closed: FTSE 100 -51.55 7237.17 -0.71% DAX -29.01 12443.79 -0.23% CAC 40 -16.18 5271.70 -0.31%

-

14:00

U.S.: Pending Home Sales (MoM) , March -0.8% (forecast -1%)

-

13:49

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0750-55 (795m) 1.0800 (406m) 1.0830 (442m) 1.0850-60 (989m) 1.0880 (467m) 1.0900 (535m) 1.0930 (270m) 1.0975 (305m) 1.1000-05 (783m) 1.1030 (315m)

USDJPY: 110.75 (USD 370m) 111.00 (380m) 111.70 (446m) 112.50 (245m)

USDCAD: 1.3370-80 (882m) 1.3550-60 (1.2bln) 1.3600 (1.16bln)

-

13:48

Euro falls 0.7 percent on day vs sterling to hit 6-day low of 84.30 pence per euro

-

13:33

U.S. Stocks open: Dow +0.08%, Nasdaq +0.18%, S&P +0.06%

-

13:29

Before the bell: S&P futures +0.15%, NASDAQ futures +0.21%

U.S. stock-index futures advanced amid a slew of quarterly earnings reports, while investors assessed President Donald Trump's tax reform plan.

Stocks:

Nikkei 19,251.87 -37.56 -0.19%

Hang Seng 24,698.48 +120.05 +0.49%

Shanghai 3,152.55 +11.70 +0.37%

FTSE 7,255.70 -33.02 -0.45%

CAC 5,275.54 -12.34 -0.23%

DAX 12,467.51 -5.29 -0.04%

Crude $48.73 (-1.79%)

Gold $1,265.10(+0.07%)

-

13:05

Draghi says did not discuss removing easing bias in interest rates in June. EUR/USD revearsal

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

195.5

0.50(0.26%)

578

ALCOA INC.

AA

35.8

-0.65(-1.78%)

284640

ALTRIA GROUP INC.

MO

71.79

0.28(0.39%)

1136

Amazon.com Inc., NASDAQ

AMZN

912.2

2.91(0.32%)

13899

American Express Co

AXP

80.88

0.36(0.45%)

15277

Apple Inc.

AAPL

143.94

0.26(0.18%)

51003

AT&T Inc

T

40.47

0.03(0.07%)

765

Boeing Co

BA

182.7

0.99(0.54%)

584

Caterpillar Inc

CAT

104.32

-0.34(-0.32%)

19969

Cisco Systems Inc

CSCO

34.25

0.85(2.54%)

250967

Citigroup Inc., NYSE

C

60.13

0.19(0.32%)

18042

E. I. du Pont de Nemours and Co

DD

82.32

0.71(0.87%)

150

Exxon Mobil Corp

XOM

81.3

-0.10(-0.12%)

9136

Facebook, Inc.

FB

146.83

0.27(0.18%)

34018

Ford Motor Co.

F

11.7

0.10(0.86%)

387308

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.37

-0.13(-0.96%)

42710

General Electric Co

GE

29.33

0.07(0.24%)

15888

General Motors Company, NYSE

GM

34.65

0.27(0.79%)

15554

Goldman Sachs

GS

226.65

0.45(0.20%)

5220

Google Inc.

GOOG

872

0.27(0.03%)

3257

Intel Corp

INTC

37.02

0.09(0.24%)

14169

International Business Machines Co...

IBM

160.4

0.34(0.21%)

2026

JPMorgan Chase and Co

JPM

88.59

0.16(0.18%)

9756

McDonald's Corp

MCD

141

0.16(0.11%)

4058

Microsoft Corp

MSFT

68.3

0.47(0.69%)

101740

Nike

NKE

55.2

0.04(0.07%)

4747

Procter & Gamble Co

PG

87.87

0.13(0.15%)

6001

Starbucks Corporation, NASDAQ

SBUX

61.68

0.12(0.19%)

2660

Tesla Motors, Inc., NASDAQ

TSLA

312.1

1.93(0.62%)

16043

Twitter, Inc., NYSE

TWTR

15.75

-0.07(-0.44%)

106819

Wal-Mart Stores Inc

WMT

75.25

-0.18(-0.24%)

255

Walt Disney Co

DIS

115.35

-0.23(-0.20%)

2084

Yahoo! Inc., NASDAQ

YHOO

48.05

-0.21(-0.44%)

12177

Yandex N.V., NASDAQ

YNDX

26.18

1.32(5.31%)

85709

-

12:45

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Buy from Hold at Argus

Cisco Systems (CSCO) upgraded to Outperform from Underperform at Credit Suisse

American Express (AXP) upgraded to Neutral from Reduce at Instinet

Downgrades:

Other:

Twitter (TWTR) target raised to $14 from $13 at Wedbush

Microsoft (MSFT) initiated with a Outperform at Credit Suisse; target $80

United Tech (UTX) target raised to $125 from $118 at RBC Capital Mkts

Boeing (BA) target raised to $146 from $138 at RBC Capital Mkts

-

12:41

Draghi: very substantial degree of accommodation still needed

-

Inflation likely to increase in april

-

Risks remain tilted to the downside

-

Underlying inflation to rise only gradually

-

Inflation likely tohover around current level until year-end

-

Foreign demand should add to resilience of exspansion

-

Economic recovery dampened by sluggish reform effort

-

-

12:38

Draghi says idicators suggest recovery becoming increasingly solid. EUR/USD up 50 pips

-

Favorable financing conditions necessary to raise inflation to target

-

Underlying inflation pressures subdued

-

Downside risks have further diminished

-

-

12:36

Draghi: the governing council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases

-

12:35

US unemployment claims rose

In the week ending April 22, the advance figure for seasonally adjusted initial claims was 257,000, an increase of 14,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 244,000 to 243,000. The 4-week moving average was 242,250, a decrease of 500 from the previous week's revised average. The previous week's average was revised down by 250 from 243,000 to 242,750.

-

12:32

US durable goods orders rose less than expected in March

New orders for manufactured durable goods in March increased $1.6 billion or 0.7 percent to $238.7 billion, the U.S. Census Bureau announced today. This increase, up three consecutive months, followed a 2.3 percent February increase. Excluding transportation, new orders decreased 0.2 percent. Excluding defense, new orders increased 0.1 percent. Transportation equipment, also up three consecutive months, drove the increase, $2.0 billion or 2.4 percent to $83.3 billion.

Shipments of manufactured durable goods in March, up four of the last five months, increased $0.6 billion or 0.2 percent to $239.8 billion. This followed a 0.2 percent February increase. Transportation equipment, up following two consecutive monthly decreases, led the increase, $0.4 billion or 0.5 percent to $81.7

billion.

-

12:30

U.S.: Initial Jobless Claims, 257 (forecast 245)

-

12:30

U.S.: Goods Trade Balance, $ bln., March -64.8 (forecast -65.5)

-

12:30

U.S.: Durable Goods Orders , March 0.7% (forecast 1.2%)

-

12:30

U.S.: Durable Goods Orders ex Transportation , March -0.2% (forecast 0.4%)

-

12:30

U.S.: Continuing Jobless Claims, 1988 (forecast 2005)

-

12:30

U.S.: Durable goods orders ex defense, March 0.1%

-

12:09

The inflation rate in Germany is expected to be 2.0% in April

The inflation rate in Germany as measured by the consumer price index is expected to be 2.0% in April 2017. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to remain unchanged from March 2017.

The harmonised index of consumer prices for Germany, which is calculated for European purposes, too, is expected to increase by 2.0% year on year and to remain unchanged from March 2017 in April 2017.

-

12:00

Germany: CPI, y/y , April 2% (forecast 1.9%)

-

12:00

Germany: CPI, m/m, April 0% (forecast -0.1%)

-

11:47

ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged

"At today's meeting the Governing Council of the ECB decided that the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will remain unchanged at 0.00%, 0.25% and -0.40% respectively.

The Governing Council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases".

-

11:45

Eurozone: ECB Interest Rate Decision, 0% (forecast 0%)

-

11:45

Eurozone: Deposit Facilty Rate, -0.4% (forecast -0.4%)

-

11:29

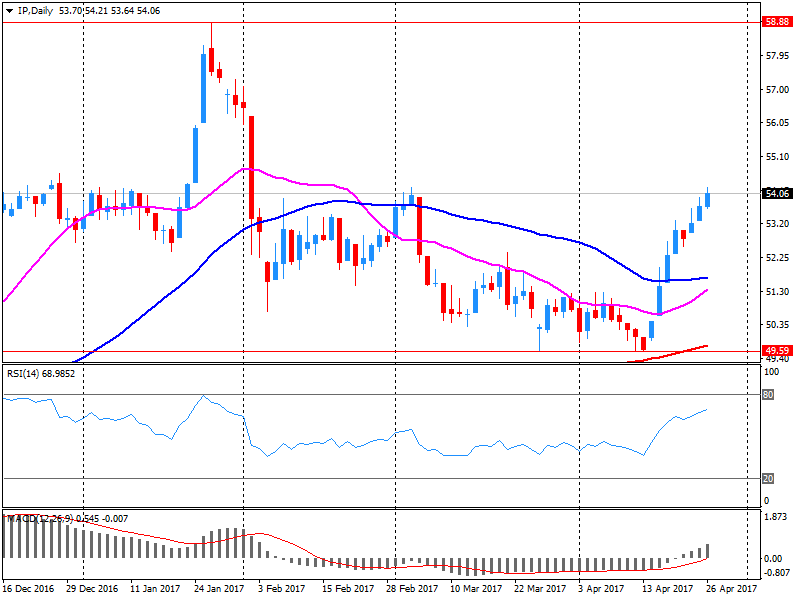

Company News: Ford Motor (F) Q1 results beat analysts’ forecasts

Ford Motor (F) reported Q1 FY 2017 earnings of $0.39 per share (versus $0.68 in Q1 FY 2016), beating analysts' consensus estimate of $0.34.

The company's quarterly revenues amounted to $36.475 bln (+3.5% y/y), beating analysts' consensus estimate of $34.619 bln.

F rose to $11.85 (+2.16%) in pre-market trading.

-

11:22

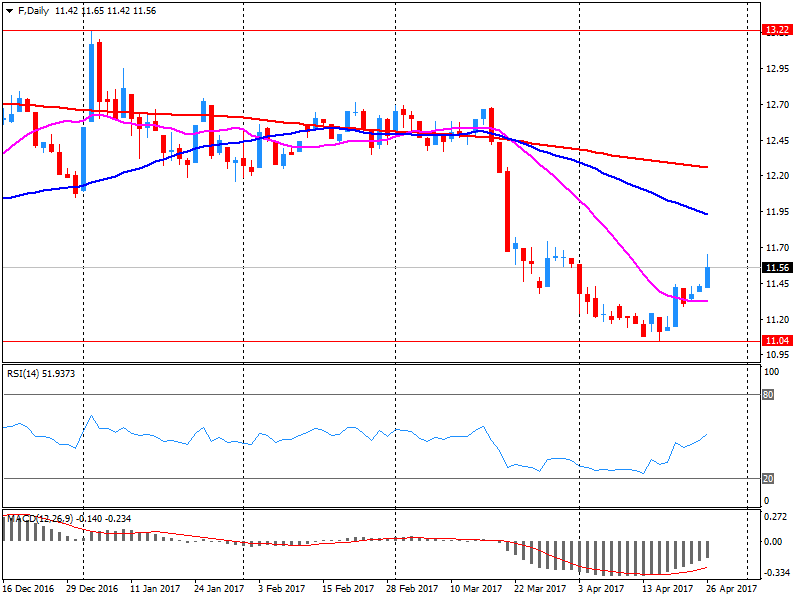

Company News: Intl Paper (IP) Q1 results beat analysts’ estimates

Intl Paper (IP) reported Q1 FY 2017 earnings of $0.60 per share (versus $0.80 in Q1 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $5.511 bln (+7.8% y/y), beating analysts' consensus estimate of $5.443 bln.

IP closed Wednesday's trading session at $54.07 (+0.71%).

-

11:09

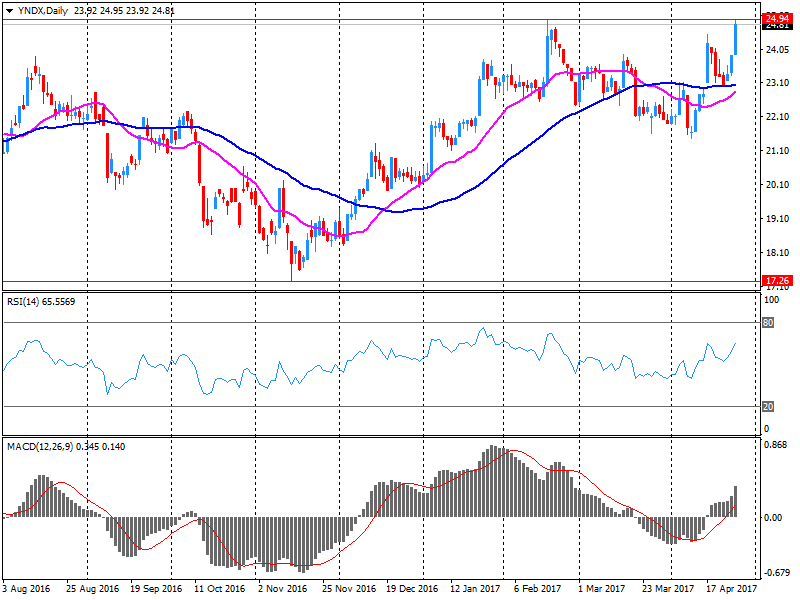

Company News: Yandex N.V. (YNDX) Q1 results beat analysts’ expectations

Yandex N.V. (YNDX) reported Q1 FY 2017 earnings of RUB11.41 per share (versus RUB9.81 in Q1 FY 2016), beating analysts' consensus estimate of RUB9.23.

The company's quarterly revenues amounted to RUB20.652 bln (+25.4% y/y), beating analysts' consensus estimate of RUB20.279 bln.

YNDX rose to $25.65 (+3.18%) in pre-market trading.

-

11:08

OPEC Sec-Gen shows slide to oil conference which says market rebalancing is heading in the right direction

-

The global oil inventory overhang is declining, floating storage volumes are falling too

-

Slide to oil conference which says goal is 100 pct compliance

-

We need to see oil stocks fall closer to 5-year average

-

-

11:02

The volume of UK sales grew at the fastest pace since September 2015 - CBI

The survey of 112 firms, of which 57 were retailers, showed that the volume of sales grew at the fastest pace since September 2015 in the year to April, with orders placed on suppliers rising at the strongest rate for a year-and-a-half. Overall, sales for the time of year were considered to be slightly above seasonal norms.

Looking ahead, however, volumes growth is expected to slow in the year to May and sales are tipped to be broadly average for the time of year, with orders expected to be largely unchanged.

Within the retail sector, the clothing and grocers sectors performed particularly strongly, whilst retailers of furniture & carpets and specialist food & drink stores reported a second consecutive month of falling sales.

-

10:03

United Kingdom: CBI retail sales volume balance, April 38 (forecast 6)

-

09:41

RBA's Lowe says a consideration is signal a tightening of capital controls could send to investors about government's perception of risks facing the economy

-

Broad-based, persistent tightening might also exacerbate domestic vulnerabilities in China

-

Housing prices in some Australian cities affected by inflow of Chinese money

-

Chinese authorities understandably concerned that, left unchecked, turnaround in capital flows could be destabilising

-

Data and reports suggest capital outflow from china has slowed after tightening ability of residents to buy foreign assets

-

-

09:12

The European Central Bank is set to keep the interest rate and QE unchanged setting the stage for a small signal as early as June about an eventual reduction of stimulus

-

09:01

Eurozone: Industrial confidence, April 2.6 (forecast 1.3)

-

09:00

Eurozone: Consumer Confidence, April -3.6 (forecast -3.6)

-

09:00

Eurozone: Economic sentiment index , April 109.6 (forecast 108.1)

-

09:00

Eurozone: Business climate indicator , April 1.09 (forecast 0.82)

-

08:45

Iraq oil minister says OPEC-led cut is gradually leading to long awaited balance in market

-

08:22

Riksbank decided to extend the purchases of government bonds by SEK 15 billion

Economic activity in Sweden is increasingly strong, but the Riksbank now assesses that it will take longer before inflation stabilises around 2 per cent. There is still considerable uncertainty over political and economic developments abroad. The Executive Board decided to extend the purchases of government bonds by SEK 15 billion during the second half of 2017 and to hold the repo rate unchanged at −0.50 per cent. The repo rate is now not expected to be raised until mid-2018, which is slightly later than in the previous forecast.

-

08:17

Spanish CPI tops expectations in April

The estimated annual inflation of the CPI in April 2017 is 2.6%, according to the An advance indicator prepared by INE. This indicator provides an advance of the CPI which, if confirmed, would Increase of three tenths in its annual rate, since in the month of March this variation was 2.3%. In this behavior, the rise in prices of tourist services Easter.

The stability of electricity prices is also influenced by the Fall experienced last year. On the other hand, the annual variation of the leading indicator of the HICP is in April in the 2.6%.

-

08:15

BoJ Kuroda: See No Problem In Purchasing JGBs Of Around (JPY) 80 Tln A Year - Reuters

-

08:01

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0750-55 (795m) 1.0800 (406m) 1.0830 (442m) 1.0850-60 (989m) 1.0880 (467m) 1.0900 (535m) 1.0930 (270m) 1.0975 (305m) 1.1000-05 (783m) 1.1030 (315m)

USDJPY: 110.75 (USD 370m) 111.00 (380m) 111.70 (446m) 112.50 (245m)

USDCAD: 1.3370-80 (882m) 1.3550-60 (1.2bln) 1.3600 (1.16bln)

-

06:41

Negative start of trading on the main European stock markets is expected: DAX -0.4%, CAC40 -0.2%, FTSE -0.1%

-

06:34

Options levels on thursday, April 27, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.1006 (4198)

$1.0979 (4169)

$1.0948 (951)

Price at time of writing this review: $1.0899

Support levels (open interest**, contracts):

$1.0829 (853)

$1.0780 (1093)

$1.0751 (1108)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 69645 contracts, with the maximum number of contracts with strike price $1,1100 (6225);

- Overall open interest on the PUT options with the expiration date June, 9 is 71312 contracts, with the maximum number of contracts with strike price $1,0400 (5207);

- The ratio of PUT/CALL was 1.02 versus 1.02 from the previous trading day according to data from April, 26

GBP/USD

Resistance levels (open interest**, contracts)

$1.3106 (1937)

$1.3009 (2566)

$1.2913 (1275)

Price at time of writing this review: $1.2873

Support levels (open interest**, contracts):

$1.2788 (778)

$1.2591 (302)

$1.2694 (1398)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 23259 contracts, with the maximum number of contracts with strike price $1,3000 (2566);

- Overall open interest on the PUT options with the expiration date June, 9 is 27235 contracts, with the maximum number of contracts with strike price $1,2500 (4976);

- The ratio of PUT/CALL was 1.17 versus 1.17 from the previous trading day according to data from April, 26

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:23

Australian export and import prices rose more than expected

The Import Price Index rose 1.2% in the March quarter 2017. This follows the rise in the December quarter 2016 of 0.2%.

The rise was driven by higher prices received for Mineral fuels, lubricants, and related materials (+9.2%) and Chemical and related products, n.e.s. (+1.9%). Offsetting these price rises were falls in Machinery and transport equipment (-0.9%) and Commodities and transactions, n.e.s. (e.g. non-monetary gold) (-1.0%).

Through the year to the March quarter 2017, the Import Price Index fell 0.6%, driven by Machinery and transport equipment (-4.8%).

The Export Price Index rose 9.4% in the March quarter 2017. This follows the rise in the December quarter 2016 of 12.4%, which was the largest rise since June quarter 2010.

The rise was driven by higher prices received for Crude materials, inedible, except fuels (+17.1%) and Mineral fuels, lubricants, and related materials (+11.0%). Offsetting these price rises was a fall in Food and live animals (-0.4%).

Through the year to the March quarter 2017, the Export Price Index rose 29.1%. The largest annual rise in the index since March quarter 2009.

-

06:22

WH: US won't withdraw from NAFTA at the current time @LiveSquawk

-

06:21

Bank of Japan holds interest rate at -0.10%, as expected

The Bank of Japan kept its monetary stimulus unchanged as widely expected on Thursday, says rttnews.

Governor Haruhiko Kuroda and his board members decided by an 7-2 majority vote to hold its target of raising the amount of outstanding JGB holdings at an annual pace of about JPY 80 trillion.

The bank will purchase government bonds so that the yield of 10-year JGBs will remain at around zero percent.

The board also decided to maintain the -0.1 percent interest rate on current accounts that financial institutions maintain at the bank.

-

06:19

Swiss trade balance surplus at a new record

Between January and March 2017, exports rose by 2.4% (real: - 0.1%), while imports were stagnating (real: - 4.2%). The Chemical-Pharmaceutical Division was responsible for export growth: without this a minus of 2.5% would have resulted. The trade balance closed with a new record surplus of 10.8 billion francs.

-

06:17

Consumer confidence in Germany is clearly enjoying tailwind again in April - GfK

Economic and income expectations have increased significantly and propensity to buy has also risen moderately. Thus, the consumer climate forecast for May stands at 10.2 points and is considerably higher than the April value of 9.8 points.

Consumers in Germany are confident that the national economy is on the right path in the coming months, as shown by the noticeable increase in economic expectation in April. The increasing economic optimism as well as a more moderate increase in prices mean that the income prospects of German citizens, which were already at a high level, have increased even further. The propensity to buy has also increased by around five points. The consumer climate index is predicted to jump to 10.2 points in May.

-

06:02

Germany: Gfk Consumer Confidence Survey, May 10.2 (forecast 9.9)

-

06:01

Switzerland: Trade Balance, March 3.1 (forecast 3.01)

-

05:31

Global Stocks

European stocks ended a choppy session in positive territory on Wednesday, building on the previous days' rally as investors waited for U.S. President Donald Trump's tax-revamp plan.

U.S. stocks closed little-changed on Wednesday, losing altitude in the final minutes of trade, following a highly anticipated announcement of President Donald Trump's ambitious tax proposal that had helped to fuel a breakout for equities in recent days.

Stock markets in Asia were broadly lower early Thursday, tracking overnight weakness on Wall Street with investors cautious early in the day before the Bank of Japan made its policy statement, in which it maintained its easy monetary policy.

-

03:16

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-

01:30

Australia: Export Price Index, q/q, Quarter I 9.4% (forecast 8%)

-

01:30

Australia: Import Price Index, q/q, Quarter I 1.3% (forecast -0.5%)

-