Market news

-

22:28

Stocks. Daily history for Apr 27’2017:

(index / closing price / change items /% change)

Nikkei -37.56 19251.87 -0.19%

TOPIX -0.74 1536.67 -0.05%

Hang Seng +120.05 24698.48 +0.49%

CSI 300 +0.94 3446.72 +0.03%

Euro Stoxx 50 -15.42 3563.29 -0.43%

FTSE 100 -51.55 7237.17 -0.71%

DAX -29.01 12443.79 -0.23%

CAC 40 -16.18 5271.70 -0.31%

DJIA +6.24 20981.33 +0.03%

S&P 500 +1.32 2388.77 +0.06%

NASDAQ +23.71 6048.94 +0.39%

S&P/TSX -143.07 15506.47 -0.91%

-

20:10

Major US stock indexes finished trading above the zero mark

Major US stock indexes rose slightly, as a strong increase in the conglomerate sector leveled the collapse in the core materials segment.

Investors shifted the focus from company reporting, the day after the Trump administration announced a tax reform plan.

As it became known today, the number of Americans who recently lost their jobs and applied for unemployment benefits rose last week to a one-month high, although this growth appears to have mainly concentrated in the state of New York. Initial claims for unemployment benefits rose by 14,000 to 257,000 people, the Ministry of Labor said. Economists had expected that initial applications would amount to 245,000 within seven days from April 16 to April 22.

At the same time, new orders for capital goods produced in the US grew less than expected in March, but the second monthly growth in shipments showed an acceleration of investments in business in the first quarter. The Ministry of Commerce said that non-military orders for goods, with the exception of aircraft that are closely monitored as planned business expenses, increased by 0.2% after rising 0.1% in February. Economists forecast an increase of 0.5%.

It also became known that unfinished transactions for the sale of housing fell in March, as stocks continued to decline. The index of unfinished transactions for the sale of housing from the National Association of Realtors fell by 0.8% to 111.4, NAR reported on Thursday. Economists forecast a decrease of 1.0%.

Most components of the DOW index showed an increase (16 out of 30). The growth leader was the shares of The Home Depot, Inc. (HD, + 1.22%). Caterpillar Inc. shares fell more than others. (CAT, -1.88%).

The S & P sector finished the session mostly in positive territory. The growth leader was the conglomerate sector (+ 1.2%). Most of all fell the sector of basic materials (-1.2%).

At closing:

DJIA + 0.03% 20.981.39 +6.30

Nasdaq + 0.39% 6,048.94 +23.71

S & P + 0.06% 2.388.77 +1.32

-

19:00

DJIA +0.08% 20,991.87 +16.78 Nasdaq +0.37% 6,047.75 +22.52 S&P +0.10% 2,389.87 +2.42

-

16:00

European stocks closed: FTSE 100 -51.55 7237.17 -0.71% DAX -29.01 12443.79 -0.23% CAC 40 -16.18 5271.70 -0.31%

-

13:33

U.S. Stocks open: Dow +0.08%, Nasdaq +0.18%, S&P +0.06%

-

13:29

Before the bell: S&P futures +0.15%, NASDAQ futures +0.21%

U.S. stock-index futures advanced amid a slew of quarterly earnings reports, while investors assessed President Donald Trump's tax reform plan.

Stocks:

Nikkei 19,251.87 -37.56 -0.19%

Hang Seng 24,698.48 +120.05 +0.49%

Shanghai 3,152.55 +11.70 +0.37%

FTSE 7,255.70 -33.02 -0.45%

CAC 5,275.54 -12.34 -0.23%

DAX 12,467.51 -5.29 -0.04%

Crude $48.73 (-1.79%)

Gold $1,265.10(+0.07%)

-

12:50

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

195.5

0.50(0.26%)

578

ALCOA INC.

AA

35.8

-0.65(-1.78%)

284640

ALTRIA GROUP INC.

MO

71.79

0.28(0.39%)

1136

Amazon.com Inc., NASDAQ

AMZN

912.2

2.91(0.32%)

13899

American Express Co

AXP

80.88

0.36(0.45%)

15277

Apple Inc.

AAPL

143.94

0.26(0.18%)

51003

AT&T Inc

T

40.47

0.03(0.07%)

765

Boeing Co

BA

182.7

0.99(0.54%)

584

Caterpillar Inc

CAT

104.32

-0.34(-0.32%)

19969

Cisco Systems Inc

CSCO

34.25

0.85(2.54%)

250967

Citigroup Inc., NYSE

C

60.13

0.19(0.32%)

18042

E. I. du Pont de Nemours and Co

DD

82.32

0.71(0.87%)

150

Exxon Mobil Corp

XOM

81.3

-0.10(-0.12%)

9136

Facebook, Inc.

FB

146.83

0.27(0.18%)

34018

Ford Motor Co.

F

11.7

0.10(0.86%)

387308

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.37

-0.13(-0.96%)

42710

General Electric Co

GE

29.33

0.07(0.24%)

15888

General Motors Company, NYSE

GM

34.65

0.27(0.79%)

15554

Goldman Sachs

GS

226.65

0.45(0.20%)

5220

Google Inc.

GOOG

872

0.27(0.03%)

3257

Intel Corp

INTC

37.02

0.09(0.24%)

14169

International Business Machines Co...

IBM

160.4

0.34(0.21%)

2026

JPMorgan Chase and Co

JPM

88.59

0.16(0.18%)

9756

McDonald's Corp

MCD

141

0.16(0.11%)

4058

Microsoft Corp

MSFT

68.3

0.47(0.69%)

101740

Nike

NKE

55.2

0.04(0.07%)

4747

Procter & Gamble Co

PG

87.87

0.13(0.15%)

6001

Starbucks Corporation, NASDAQ

SBUX

61.68

0.12(0.19%)

2660

Tesla Motors, Inc., NASDAQ

TSLA

312.1

1.93(0.62%)

16043

Twitter, Inc., NYSE

TWTR

15.75

-0.07(-0.44%)

106819

Wal-Mart Stores Inc

WMT

75.25

-0.18(-0.24%)

255

Walt Disney Co

DIS

115.35

-0.23(-0.20%)

2084

Yahoo! Inc., NASDAQ

YHOO

48.05

-0.21(-0.44%)

12177

Yandex N.V., NASDAQ

YNDX

26.18

1.32(5.31%)

85709

-

12:45

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Buy from Hold at Argus

Cisco Systems (CSCO) upgraded to Outperform from Underperform at Credit Suisse

American Express (AXP) upgraded to Neutral from Reduce at Instinet

Downgrades:

Other:

Twitter (TWTR) target raised to $14 from $13 at Wedbush

Microsoft (MSFT) initiated with a Outperform at Credit Suisse; target $80

United Tech (UTX) target raised to $125 from $118 at RBC Capital Mkts

Boeing (BA) target raised to $146 from $138 at RBC Capital Mkts

-

11:29

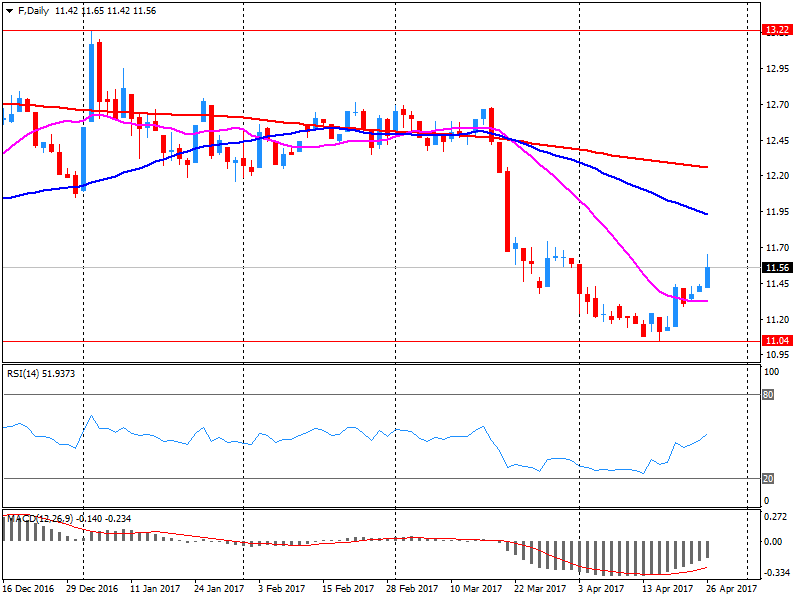

Company News: Ford Motor (F) Q1 results beat analysts’ forecasts

Ford Motor (F) reported Q1 FY 2017 earnings of $0.39 per share (versus $0.68 in Q1 FY 2016), beating analysts' consensus estimate of $0.34.

The company's quarterly revenues amounted to $36.475 bln (+3.5% y/y), beating analysts' consensus estimate of $34.619 bln.

F rose to $11.85 (+2.16%) in pre-market trading.

-

11:22

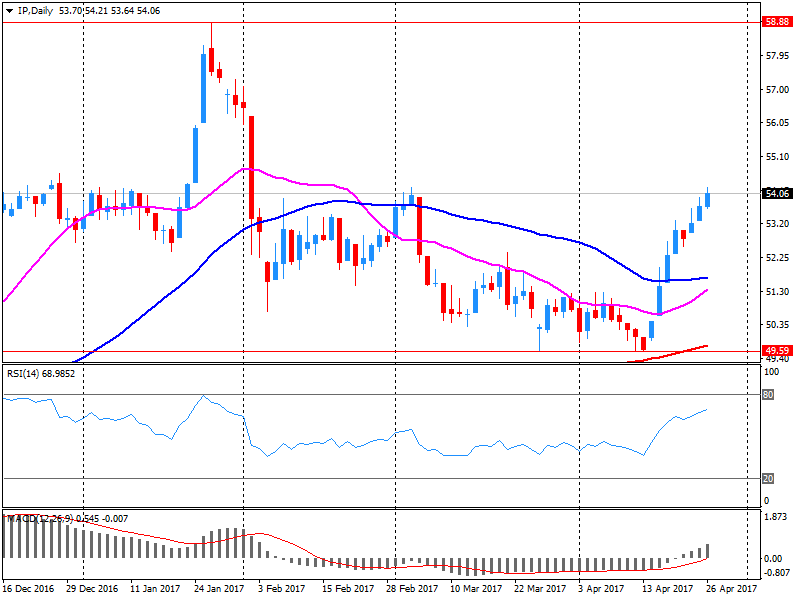

Company News: Intl Paper (IP) Q1 results beat analysts’ estimates

Intl Paper (IP) reported Q1 FY 2017 earnings of $0.60 per share (versus $0.80 in Q1 FY 2016), beating analysts' consensus estimate of $0.56.

The company's quarterly revenues amounted to $5.511 bln (+7.8% y/y), beating analysts' consensus estimate of $5.443 bln.

IP closed Wednesday's trading session at $54.07 (+0.71%).

-

11:09

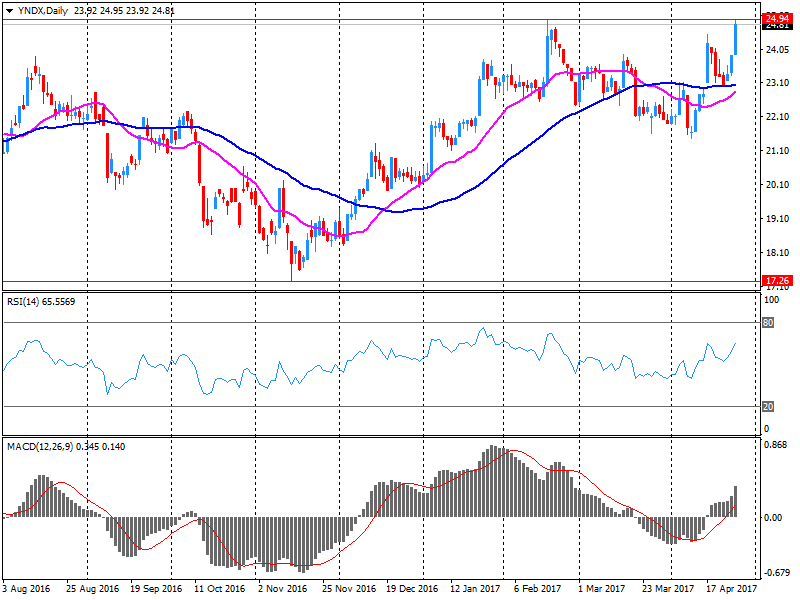

Company News: Yandex N.V. (YNDX) Q1 results beat analysts’ expectations

Yandex N.V. (YNDX) reported Q1 FY 2017 earnings of RUB11.41 per share (versus RUB9.81 in Q1 FY 2016), beating analysts' consensus estimate of RUB9.23.

The company's quarterly revenues amounted to RUB20.652 bln (+25.4% y/y), beating analysts' consensus estimate of RUB20.279 bln.

YNDX rose to $25.65 (+3.18%) in pre-market trading.

-

06:41

Negative start of trading on the main European stock markets is expected: DAX -0.4%, CAC40 -0.2%, FTSE -0.1%

-

05:31

Global Stocks

European stocks ended a choppy session in positive territory on Wednesday, building on the previous days' rally as investors waited for U.S. President Donald Trump's tax-revamp plan.

U.S. stocks closed little-changed on Wednesday, losing altitude in the final minutes of trade, following a highly anticipated announcement of President Donald Trump's ambitious tax proposal that had helped to fuel a breakout for equities in recent days.

Stock markets in Asia were broadly lower early Thursday, tracking overnight weakness on Wall Street with investors cautious early in the day before the Bank of Japan made its policy statement, in which it maintained its easy monetary policy.

-