Market news

-

22:29

Stocks. Daily history for Apr 26’2017:

(index / closing price / change items /% change)

Nikkei +210.10 19289.43 +1.10%

TOPIX +18.20 1537.41 +1.20%

Hang Seng +122.49 24578.43 +0.50%

CSI 300 +4.35 3445.78 +0.13%

Euro Stoxx 50 -4.45 3578.71 -0.12%

FTSE 100 +13.08 7288.72 +0.18%

DAX +5.76 12472.80 +0.05%

CAC 40 +10.00 5287.88 +0.19%

DJIA -21.03 20975.09 -0.10%

S&P 500 -1.16 2387.45 -0.05%

NASDAQ -0.26 6025.23 +0.00%

S&P/TSX -95.65 15649.54 -0.61%

-

20:08

The main US stock indices fell on the results of today's session

Major US stock indices fell slightly on Wednesday, responding to details of the tax reform plan of the US President's administration Trump.

According to the plan, the maximum tax rate for individuals will be reduced to 35% from the current 39.6%. In addition, together 7 tax categories for individuals will now be 3 categories - with rates of 10%, 25% and 35%. The plan also implies a reduction in the tax rate for the company to 15% from 35%. The tax rate on income for companies on individual declarations will also be reduced to 15% (now these revenues are subject to separate tax rates). At the same time, it is planned to abolish the targeted tax deductions that were mostly used by the richest, as well as the inheritance tax and the minimum alternative tax. The plan also includes tax breaks for American families, especially middle-income families, and a doubling of the standard tax deduction that Americans can claim for reimbursement from the budget. In addition, it is planned to reduce taxes for families with children and expenses for dependent care.

Investors also evaluated the quarterly reports of companies such as Arconic (ARNC), Twitter (TWTR), United Tech (UTX), Procter & Gamble (PG), AT & T (T) and Boeing (BA).

Companies from the S & P 500 index so far reported on profits for the first quarter, which in aggregate exceeded the consensus estimates by 6.8%. If the current growth rate of earnings per share of companies from the S & P 500 will hold, they will become the strongest since the end of 2011, according to FactSet.

Most components of the DOW index finished trading in different directions (15 in negative territory, 15 in positive territory). The leader of growth was shares United Technologies Corporation (UTX, + 1.32%). Most fell shares The Procter & Gamble Company (PG, -2.60%).

The S & P index sector also finished trading mixed. The growth leader was the conglomerate sector (+ 0.5%). Most fell sector of consumer goods (-0.6%).

At closing:

DJIA -0.08% 20.978.93 -17.19

Nasdaq -0.00% 6,025.23 -0.26

S & P -0.04% 2,387.70 -0.91

-

19:00

DJIA +0.15% 21,027.50 +31.38 Nasdaq +0.16% 6,034.83 +9.34 S&P +0.22% 2,393.90 +5.29

-

16:00

European stocks closed: FTSE 100 +13.08 7288.72 +0.18% DAX +5.76 12472.80 +0.05% CAC 40 +10.00 5287.88 +0.19%

-

13:34

U.S. Stocks open: Dow +0.17%, Nasdaq +0.14%, S&P +0.11%

-

13:27

Before the bell: S&P futures +0.03%, NASDAQ futures +0.05%

U.S. stock-index futures were little changed amid a flood of corporate earnings, while investors awaited President Donald Trump's plan on tax reform.

Stocks:

Nikkei 19,289.43 +210.10 +1.10%

Hang Seng 24,578.43 +122.49 +0.50%

Shanghai 3,140.85 +6.28 +0.20%

FTSE 7,271.97 -3.67 -0.05%

CAC 5,281.02 +3.14 +0.06%

DAX 12,463.57 -3.47 -0.03%

Crude $49.11 (-0.91%)

Gold $1,265.40 (-0.14%)

-

12:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.99

-0.50(-1.37%)

4278

Amazon.com Inc., NASDAQ

AMZN

909.5

1.88(0.21%)

24520

Apple Inc.

AAPL

144.55

0.02(0.01%)

149600

AT&T Inc

T

39.9

-0.04(-0.10%)

86414

Barrick Gold Corporation, NYSE

ABX

17.04

0.15(0.89%)

210095

Boeing Co

BA

181

-2.51(-1.37%)

47346

Caterpillar Inc

CAT

104

-0.42(-0.40%)

38980

Chevron Corp

CVX

106.51

-0.22(-0.21%)

4561

Cisco Systems Inc

CSCO

33.49

0.07(0.21%)

28716

Citigroup Inc., NYSE

C

59.96

-0.25(-0.42%)

17823

E. I. du Pont de Nemours and Co

DD

82.1

-0.11(-0.13%)

4747

Exxon Mobil Corp

XOM

81.42

-0.31(-0.38%)

64017

Facebook, Inc.

FB

146.8

0.31(0.21%)

53658

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.93

-0.17(-1.30%)

35911

General Electric Co

GE

29.49

0.04(0.14%)

147602

General Motors Company, NYSE

GM

34

0.01(0.03%)

2100

Goldman Sachs

GS

226.1

-0.53(-0.23%)

6417

Intel Corp

INTC

36.98

0.11(0.30%)

186897

International Business Machines Co...

IBM

160.58

0.19(0.12%)

7680

JPMorgan Chase and Co

JPM

88.33

0.07(0.08%)

31715

McDonald's Corp

MCD

141.45

-0.25(-0.18%)

20485

Microsoft Corp

MSFT

68.12

0.20(0.29%)

60830

Pfizer Inc

PFE

33.82

0.06(0.18%)

36177

Procter & Gamble Co

PG

89

-1.00(-1.11%)

26584

Starbucks Corporation, NASDAQ

SBUX

61.04

0.08(0.13%)

9842

Tesla Motors, Inc., NASDAQ

TSLA

312.22

-1.57(-0.50%)

37419

The Coca-Cola Co

KO

43

-0.11(-0.26%)

26203

Twitter, Inc., NYSE

TWTR

15.95

1.29(8.80%)

7819500

United Technologies Corp

UTX

117.87

1.00(0.86%)

15659

Visa

V

91.8

-0.31(-0.34%)

52189

Wal-Mart Stores Inc

WMT

75.06

0.01(0.01%)

46302

Yandex N.V., NASDAQ

YNDX

24.03

0.11(0.46%)

12727

-

12:41

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

McDonald's (MCD) target raised to $150 from $140 at Telsey Advisory Group

3M (MMM) target raised to $202 from $190 at Stifel

-

11:55

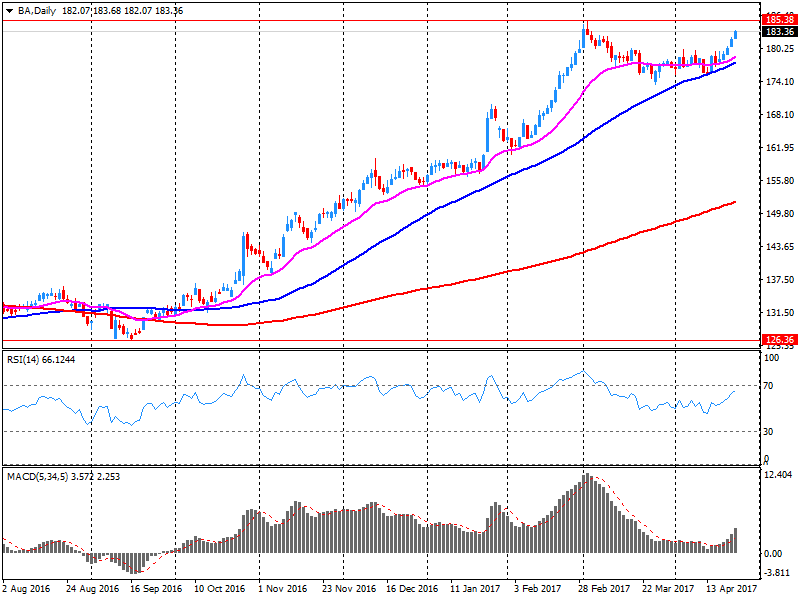

Company News: Boeing (BA) posts mixed Q1 results

Boeing (BA) reported Q1 FY 2017 earnings of $2.01 per share (versus $1.74 in Q1 FY 2016), beating analysts' consensus estimate of $1.91.

The company's quarterly revenues amounted to $20.976 bln (-7.3% y/y), missing analysts' consensus estimate of $21.266 bln.

BA fell to $182.80 (-0.39%) in pre-market trading.

-

11:41

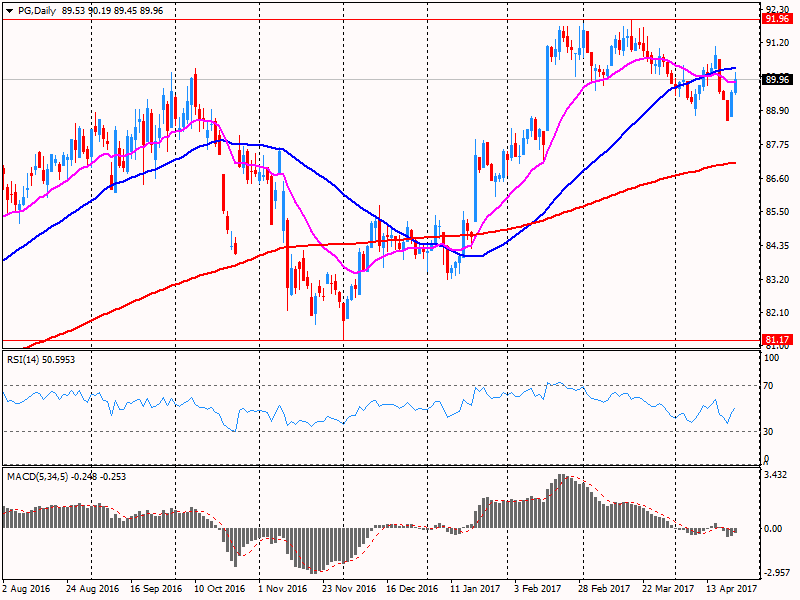

Company News: Procter & Gamble (PG) quarterly earnings beat analysts’ estimate

Procter & Gamble (PG) reported Q3 FY 2017 earnings of $0.96 per share (versus $0.86 in Q3 FY 2016), beating analysts' consensus estimate of $0.94.

The company's quarterly revenues amounted to $15.605 bln (-1% y/y), slightly below analysts' consensus estimate of $15.705 bln.

PG fell to $89.07 (-1.03%) in pre-market trading.

-

11:30

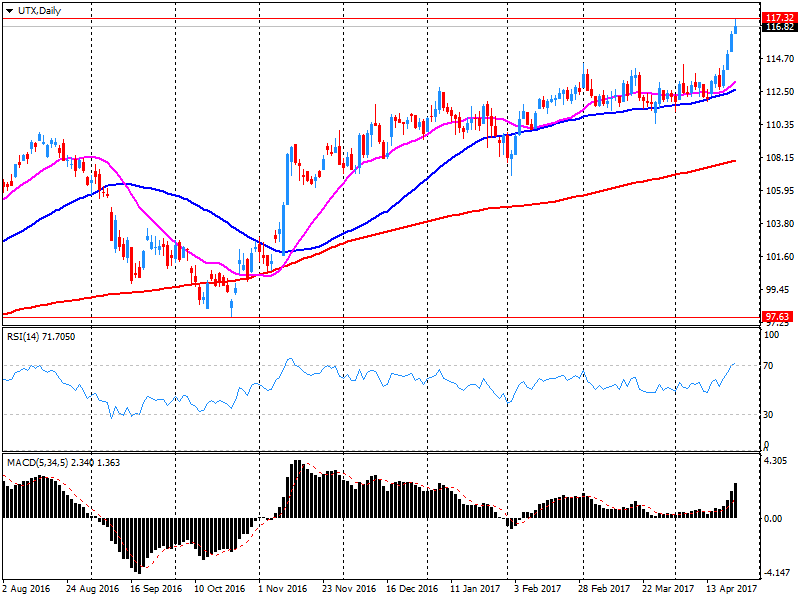

Company News: United Tech (UTX) Q1 results beat analysts’ forecasts

United Tech (UTX) reported Q1 FY 2017 earnings of $1.48 per share (versus $1.47 in Q1 FY 2016), beating analysts' consensus estimate of $1.39.

The company's quarterly revenues amounted to $13.815 bln (+3.4% y/y), beating analysts' consensus estimate of $13.501 bln.

UTX rose to $117.90 (+0.88%) in pre-market trading.

-

11:23

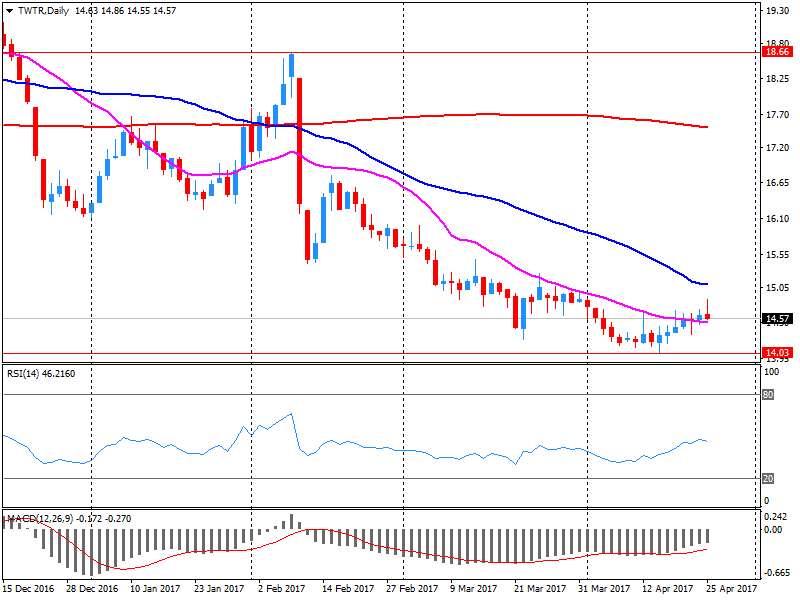

Company News: Twitter (TWTR) Q1 results beat analysts’ estimate

Twitter (TWTR) reported Q1 FY 2017 earnings of $0.11 per share (versus $0.15 in Q1 FY 2016), beating analysts' consensus estimate of $0.01.

The company's quarterly revenues amounted to $0.548 bln (-7.8% y/y), beating analysts' consensus estimate of $0.513 bln.

TWTR rose to $16.03 (+9.35%) in pre-market trading.

-

11:18

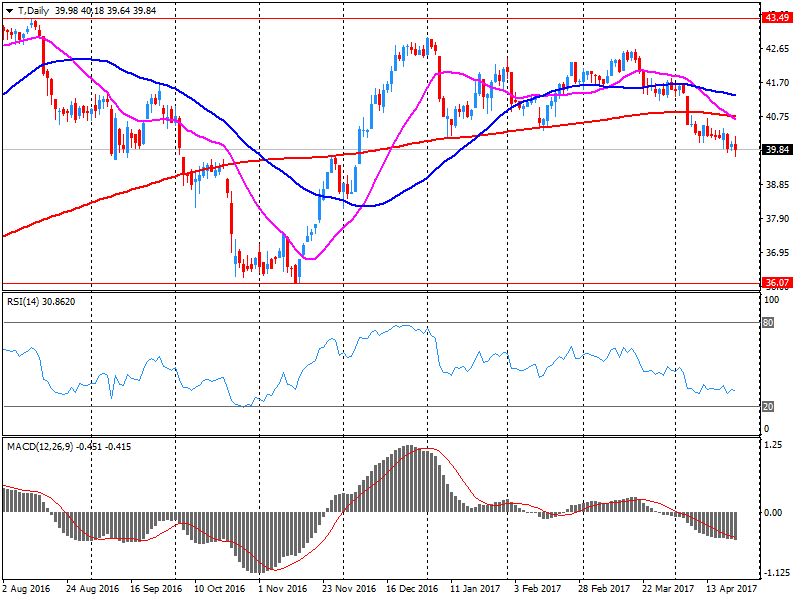

Company News: AT&T (T) posts Q1 EPS in line with analysts' estimates

AT&T (T) reported Q1 FY 2017 earnings of $0.74 per share (versus $0.72 in Q1 FY 2016), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $39.400 bln (-2.8% y/y), missing analysts' consensus estimate of $40.500 bln.

T rose to $40.01 (+0.18%) in pre-market trading.

-

11:08

Company News: Arconic (ARNC) Q1 results beat analysts’ expectations

Arconic (ARNC) reported Q1 FY 2017 earnings of $0.33 per share, beating analysts' consensus estimate of $0.24.

The company's quarterly revenues amounted to $3.055 bln (-4.3% y/y), beating analysts' consensus estimate of $2.996 bln.

ARNC rose to $28.00 (+3.78%) in pre-market trading.

-

08:10

Major stock exchanges in Europe trading mixed: FTSE 7266.65 -8.99 -0.12%, DAX 12461.24 -5.80 -0.05%, CAC 5279.14 +1.26 + 0.02%

-

05:29

Global Stocks

European stocks higher Tuesday, with French stocks closing at a nine-year high as relief over a potentially market-friendly outcome in France's presidential election continued to boost sentiment.

The U.S. stock market extended its rally Tuesday, with the Dow jumping by triple-digits and the Nasdaq closing above 6,000 for the first time ever, as investors welcomed upbeat earnings and the possibility of corporate tax cuts. "Today is one of the busiest days in terms of corporate earnings releases, with 36 companies reporting before and after the market and so far earnings have been strong," said Michael Antonelli, equity sales trader at Robert W. Baird & Co.

Equities in Asia extended gains for a third session early Wednesday as sustained political optimism, currency tailwinds and the growing prospect of a U.S. tax overhaul whetted appetite for risk. Sparked by the success of centrist, market-friendly French presidential candidate Emmanuel Macron in the first round of the election on Sunday, investors have shed prevote caution and piled into risk assets.

-