Market news

-

23:50

Japan: Industrial Production (MoM) , October 0.1% (forecast -0.1%)

-

23:30

Commodities. Daily history for Nov 29’2016:

(raw materials / closing price /% change)

Oil 45.23 0.00%

Gold 1,187.10 -0.07%

-

23:29

Stocks. Daily history for Nov 29’2016:

(index / closing price / change items /% change)

Nikkei 225 18,307.04 -49.85 -0.27%

Shanghai Composite 3,283.36 +6.36 +0.19%

S&P/ASX 200 5,457.50 0.00 0.00%

FTSE 100 6,772.00 -27.47 -0.40%

CAC 40 4,551.46 +41.07 +0.91%

Xetra DAX 10,620.49 +37.82 +0.36%

S&P 500 2,204.66 +2.94 +0.13%

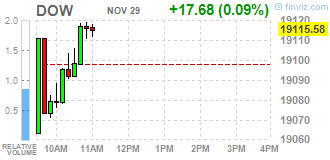

Dow Jones Industrial Average 19,121.60 +23.70 +0.12%

S&P/TSX Composite 14,999.81 -15.55 -0.10%

-

23:28

Currencies. Daily history for Nov 29’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0648 +0,34%

GBP/USD $1,2490 +0,60%

USD/CHF Chf1,0115 -0,14%

USD/JPY Y112,38 +0,40%

EUR/JPY Y119,65 +0,71%

GBP/JPY Y140,35 +0,98%

AUD/USD $0,7482 +0,03%

NZD/USD $0,7124 +0,73%

USD/CAD C$1,343 +0,15%

-

23:00

Schedule for today,Wednesday, Nov 30’2016

00:00 New Zealand ANZ Business Confidence November 24.5

00:05 United Kingdom Gfk Consumer Confidence November -3 -4

00:30 Australia Private Sector Credit, m/m October 0.4% 0.4%

00:30 Australia Private Sector Credit, y/y October 5.4%

00:30 Australia Building Permits, m/m October -8.7% 1.5%

05:00 Japan Construction Orders, y/y October 16.3%

05:00 Japan Housing Starts, y/y October 10% 11.2%

07:00 United Kingdom BOE Financial Stability Report

07:00 Germany Retail sales, real adjusted October -1.4% 1%

07:00 Germany Retail sales, real unadjusted, y/y October 0.4% 1%

07:00 Switzerland UBS Consumption Indicator October 1.59

08:00 Switzerland KOF Leading Indicator November 104.7 104

08:55 Germany Unemployment Change November -14 -5

08:55 Germany Unemployment Rate s.a. November 6% 6%

10:00 Eurozone Harmonized CPI, Y/Y (Preliminary) November 0.5% 0.6%

10:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Preliminary) November 0.8% 0.8%

12:30 Eurozone ECB President Mario Draghi Speaks

13:15 U.S. ADP Employment Report November 147 165

13:30 Canada Industrial Product Price Index, m/m October 0.4% 0.6%

13:30 Canada Industrial Product Price Index, y/y October -0.5%

13:30 Canada GDP (m/m) September 0.2% 0.1%

13:30 Canada GDP QoQ Quarter III -0.4%

13:30 Canada GDP (YoY) Quarter III -1.6% 3.4%

13:30 U.S. Personal spending October 0.5% 0.5%

13:30 U.S. Personal Income, m/m October 0.3% 0.4%

13:30 U.S. PCE price index ex food, energy, m/m October 0.1% 0.1%

13:30 U.S. PCE price index ex food, energy, Y/Y October 1.7%

14:45 U.S. Chicago Purchasing Managers' Index November 50.6 52

15:00 U.S. Pending Home Sales (MoM) October 1.5% 0.4%

15:30 U.S. Crude Oil Inventories November -1.255

16:45 U.S. FOMC Member Jerome Powell Speaks

19:00 U.S. Fed's Beige Book

22:30 Australia AIG Manufacturing Index November 50.9

23:50 Japan Capital Spending Quarter III 3.1%

-

20:01

DJIA 19134.47 36.57 0.19%, NASDAQ 5395.14 26.33 0.49%, S&P 500 2208.37 6.65 0.30%

-

17:02

European stocks closed: FTSE 6772.00 -27.47 -0.40%, DAX 10620.49 37.82 0.36%, CAC 4551.46 41.07 0.91%

-

16:45

WSE: Session Results

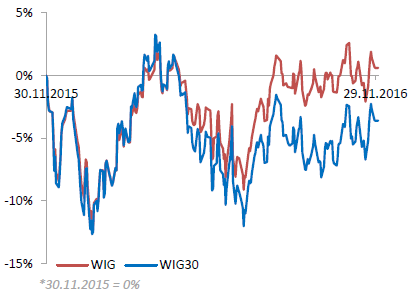

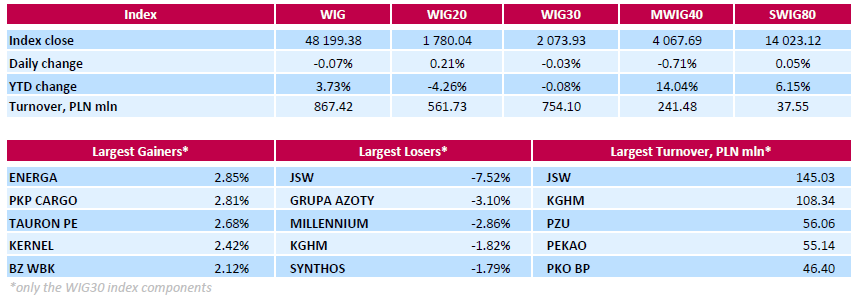

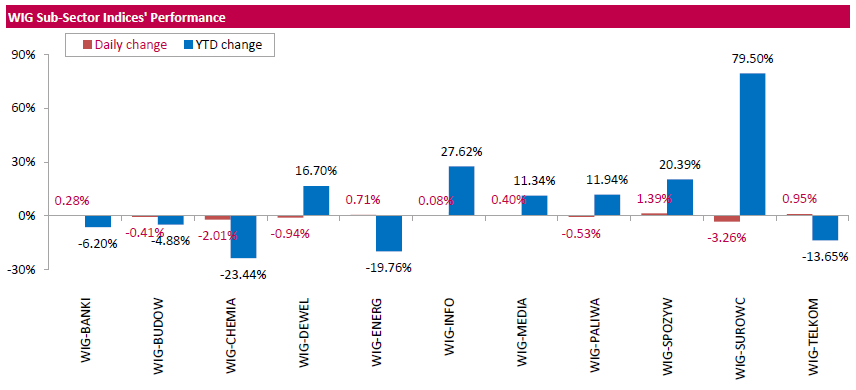

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index, edged down 0.07%. Sector performance within the WIG Index was mixed. Materials (-3.26%) fell the most, while food sector (+1.39%) fared the best.

The large-cap stocks' measure, the WIG30 Index, inched down 0.03%. In the index basket, coking coal miner JSW (WSE: JSW) topped the decliners' list, tumbling by 7.52%. It was reported that the company's shareholders decided to announce break in proceedings of EGM until December 1. The shareholders were supposed to vote on the transfer of JSW's troubled mine Krupinski to state restructuring company SRK, which will wind it down. Among other major laggards were chemical producer GRUPA AZOTY (WSE: ATT), bank MILLENNIUM (WSE: MIL) and copper producer KGHM (WSE: KGH), plunging by 3.1%, 2.86% and 1.82% respectively. On the other side of the ledger, utilities name ENERGA (WSE: ENG) and railway freight transport operator PKP CARGO (WSE: PKP) led the gainers, jumping by 2.85% and 2.81% respectively.

-

16:09

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Tuesday as a sharp drop in oil prices weighed on energy stocks, while a rise in healthcare stocks helped limit losses. Oil fell nearly 4% as major exporters struggled to agree to a production freeze to reduce global oversupply ahead of an OPEC meeting on Wednesday.

Most of Dow stocks in positive area (17 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +3.61%). Top loser - Chevron Corporation (CVX, -1.60%).

Most S&P sectors in positive area. Top gainer - Financials (+0.7%). Top loser - Basic Materials (-1.4%).

At the moment:

Dow 19102.00 +22.00 +0.12%

S&P 500 2204.25 +3.50 +0.16%

Nasdaq 100 4877.25 +16.25 +0.33%

Oil 45.32 -1.76 -3.74%

Gold 1191.30 -2.50 -0.21%

U.S. 10yr 2.34 +0.02

-

15:59

Fed's Dudley: with proper reform, Puerto Rico can have solid future

-

15:44

Iraq agrees to freeze oil production, not cut from 4.55 mbpd - Dow Jones

-

15:42

US Conference Board Consumer Confidence increased significantly in November

The Conference Board Consumer Confidence Index, which had declined in October, increased significantly in November. The Index now stands at 107.1 (1985=100), up from 100.8 in October. The Present Situation Index increased from 123.1 to 130.3, while the Expectations Index improved from 86.0 last month to 91.7.

"Consumer confidence improved in November after a moderate decline in October, and is once again at pre-recession levels," said Lynn Franco, Director of Economic Indicators at The Conference Board. (The Index stood at 111.9 in July 2007.) "A more favorable assessment of current conditions coupled with a more optimistic short-term outlook helped boost confidence. And while the majority of consumers were surveyed before the presidential election, it appears from the small sample of post-election responses that consumers' optimism was not impacted by the outcome. With the holiday season upon us, a more confident consumer should be welcome news for retailers."

-

15:00

U.S.: Consumer confidence , November 107.1 (forecast 101.2)

-

14:51

WSE: After start on Wall Street

The afternoon data on GDP growth in the US were better than expected, although Wall Street reacted to it carefully. The first transactions show rather stabilizing after yesterday's fall than rise.

The Warsaw market, which reacted by weakening of the WIG20 to this data returned to the levels observed before 14:30. The level of turnover remained stable, which may mean that today's session will confirm the consolidation.

One hour before the close of trading on the Warsaw market, the WIG20 index was at the level 1,774 points (- 0.10%).

-

14:32

U.S. Stocks open: Dow +0.01%, Nasdaq +0.09%, S&P 0.00%

-

14:25

Before the bell: S&P futures +0.01%, NASDAQ futures -0.04%

U.S. stock-index futures were little changed as investors assessed revised data on the U.S. GDP for the third quarter and awaited tomorrow's crucial oil talks of OPEC members in Vienna.

Global Stocks:

Nikkei 18,307.04 -49.85 -0.27%

Hang Seng 22,737.07 -93.50 -0.41%

Shanghai 3,283.36 +6.36 +0.19%

FTSE 6,760.97 -38.50 -0.57%

CAC 4,538.63 +28.24 +0.63%

DAX 10,595.42 +12.75 +0.12%

Crude $45.72 (-2.89%)

Gold $1,182.00 (-0.74%)

-

14:12

US national home prices topped out

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, surpassed the peak set in July 2006 as the housing boom topped out. The National index reported a 5.5% annual gain in September, up from 5.1% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.2% the previous month.

The 20-City Composite reported a yearover-year gain of 5.1%, unchanged from August. Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last eight months. In September, Seattle led the way with an 11.0% year-over-year price increase, followed by Portland with 10.9%, and Denver with an 8.7% increase. 12 cities reported greater price increases in the year ending September 2016 versus the year ending August 2016.

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, September 5.5% (forecast 5.2%)

-

13:56

Iran won't cut oil production, Zanganeh says

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.21

-0.65(-2.1063%)

12300

Amazon.com Inc., NASDAQ

AMZN

769.37

2.60(0.3391%)

11054

AT&T Inc

T

39.68

0.14(0.3541%)

7529

Barrick Gold Corporation, NYSE

ABX

15.05

-0.35(-2.2727%)

63015

Caterpillar Inc

CAT

94.2

-0.70(-0.7376%)

4058

Chevron Corp

CVX

109.74

-0.76(-0.6878%)

1550

Cisco Systems Inc

CSCO

30.1

0.18(0.6016%)

534

Citigroup Inc., NYSE

C

55.51

0.04(0.0721%)

42745

Deere & Company, NYSE

DE

101.5

-0.20(-0.1967%)

6418

Exxon Mobil Corp

XOM

85.86

-0.61(-0.7054%)

3560

Facebook, Inc.

FB

120.45

0.04(0.0332%)

25434

Ford Motor Co.

F

11.95

0.03(0.2517%)

5602

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.22

-0.56(-3.5488%)

255768

Home Depot Inc

HD

130.25

0.30(0.2309%)

1000

HONEYWELL INTERNATIONAL INC.

HON

30.1

0.18(0.6016%)

534

Intel Corp

INTC

35.66

0.15(0.4224%)

1341

International Business Machines Co...

IBM

164.25

-0.27(-0.1641%)

173

JPMorgan Chase and Co

JPM

78.78

0.46(0.5873%)

300

McDonald's Corp

MCD

30.1

0.18(0.6016%)

534

Pfizer Inc

PFE

31.84

0.30(0.9512%)

24037

Procter & Gamble Co

PG

83.39

0.32(0.3852%)

425

Starbucks Corporation, NASDAQ

SBUX

57.79

0.20(0.3473%)

1515

Tesla Motors, Inc., NASDAQ

TSLA

196.1

-0.02(-0.0102%)

7693

The Coca-Cola Co

KO

41.45

0.05(0.1208%)

5674

Twitter, Inc., NYSE

TWTR

11.95

0.03(0.2517%)

5602

UnitedHealth Group Inc

UNH

157.2

5.09(3.3463%)

27685

Verizon Communications Inc

VZ

51.44

0.32(0.626%)

205

Walt Disney Co

DIS

99.25

0.28(0.2829%)

6316

Yahoo! Inc., NASDAQ

YHOO

41.52

0.07(0.1689%)

675

-

13:46

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0620-30 (EUR 947m) 1.0640 (653m)

USDJPY 110.00 (USD 400m)

GBPUSD 1.2655 (GBP 433m)

USDCNY 6.9000 (USD 580m) 6.9300 (602m)

USDCAD 1.3400 (USD 1.03bln) 1.3600 (890m)

-

13:41

Upgrades and downgrades before the market open

Upgrades:

Pfizer (PFE) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Nomura

Johnson & Johnson (JNJ) downgraded to Equal Weight from Overweight at Barclays

Other:

McDonald's (MCD) removed from US Focus List at Credit Suisse; holds Outperform, target $128

Altria (MO) resumed with a Equal-Weight at Morgan Stanley; target $65

-

13:41

Canada's current account deficit narrowed $0.7 billion in the third quarter. USD/CAD retreats and waits the OPEC meeting

Canada's current account deficit (on a seasonally adjusted basis) narrowed $0.7 billion in the third quarter to $18.3 billion, following three straight quarterly increases.

In the financial account (unadjusted for seasonal variation), strong foreign investment in Canadian corporate bonds led the inflow of funds in the quarter.

The deficit on international trade in goods narrowed $2.7 billion to $8.3 billion in the third quarter, following a record deficit of $11.1 billion in the second quarter. Exports outpaced imports as exports saw the highest growth since the first quarter of 2014.

otal exports of goods increased $5.9 billion to $130.1 billion in the third quarter. Energy products were the major contributor with exports up $2.3 billion on higher prices and volumes. In addition, exports of metal and non-metallic mineral products increased by $1.0 billion, mostly from higher prices. Consumer goods were up $0.7 billion on higher volumes, following a $1.6 billion reduction in the second quarter.

-

13:36

Big jump for US GDP in Q3

Real gross domestic product increased at an annual rate of 3.2 percent in the third quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.4 percent.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.9 percent. With the second estimate for the third quarter, the general picture of economic growth remains the same; the increase in personal consumption expenditures was larger than previously estimated.

-

13:30

U.S.: GDP, q/q, Quarter III 3.2% (forecast 3%)

-

13:30

Canada: Current Account, bln, Quarter III -18.3 (forecast -16.8)

-

13:30

U.S.: PCE price index ex food, energy, q/q, Quarter III 1.7% (forecast 1.5%)

-

13:09

German inflation rose less than forecasts in November

The inflation rate in Germany as measured by the consumer price index is expected to be +0.8% in November 2016. Based on the results available so far, the Federal Statistical Office (Destatis) also reports that the consumer prices are expected to increase by 0.1% on October of the year.

The harmonised index of consumer prices for Germany calculated for European purposes is expected to be up 0.7% year on year.However, it is not expected to change from October 2016. The final results for November 2016 will be released on 13 December 2016.

-

13:00

Germany: CPI, y/y , November 0.8% (forecast 0.8%)

-

13:00

Germany: CPI, m/m, November 0.1% (forecast 0.1%)

-

13:00

-

12:45

Orders

EUR/USD

Offers 1.0620-25 1.0650 1.0685 1.0700 1.0730 1.0750 1.0780 1.0800

Bids 1.0580-85 1.0560 1.0530 1.0515 1.0500

GBP/USD

Offers 1.2420-25 1.2440-45 1.2475 1.2500 1.2520 1.2530-35 1.2550-55 1.2570 1.2585 1.2600

Bids 1.2400 1.2380 1.2360 1 .2340 1.2315-20 1.2300 1.2285 1.2250

EUR/GBP

Offers 0.8560 0.8575-80 0.8600 0.8630-35 0.8650

Bids 0.8520 0.8500 0.8475-80 0.8450 0.8420 0.8400

EUR/JPY

Offers 119.30 119.50 119.80-85 120.00 120.45-50 121.00 121.50

Bids 118.80 118.50 118.00 117.80 117.60 117.30 117.00

USD/JPY

Offers 112.50 112.80 113.00 113.25-30 113.60 113.80 114.00

Bids 112.00 111.80-85 111.50 111.30-35 111.00 110.85 110.50 110.30 110.00

AUD/USD

Offers 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids 0.7460 0.7450 0.7430 0.7400 0.7370 0.7355-60 0.7325-30 0.7300

-

12:25

-

12:04

WSE: Mid session comment

The morning trading phase has not brought major changes in the Warsaw market. Low volatility suggests that markets are waiting to enter the game by Americans and data from the US. At the halfway point of today's session, the WIG 20 index was at the level of 1,780 points (+ 0.24%). The turnover in the segment of the largest companies was amounted to PLN 230 million.

-

11:53

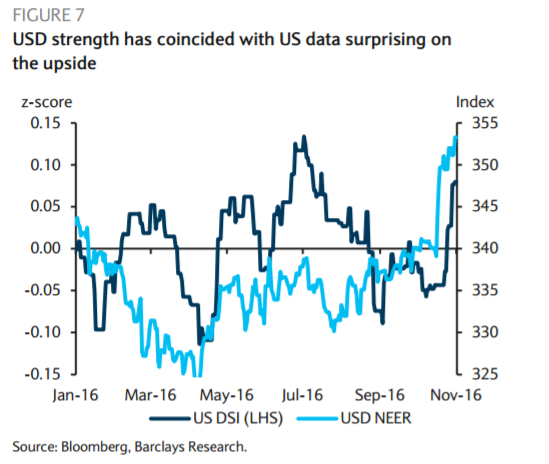

EUR/USD ahead of NFP and Italian Referendum - Barclays

"We see asymmetric risks to the USD this week as the employment report (Friday) takes central stage. A number close to our expectation of 175k or even lower would keep the Fed on track as it is assumed that a deceleration in job creation is normal as the labour market is near full employment. On the other hand, a higher number (closer to 200k) would signal that the momentum is still strong, and that additional stimulus would probably lead the Fed to act faster, accelerating USD trend. We expect the unemployment rate to decline to 4.8% from 4.9%, average hourly earnings to rise 0.2% m/m and 2.8% y/y, and the average workweek to remain unchanged at 34.4 hours.

In addition, we expect the ISM manufacturing (Thursday) to remain soft and decreasing slightly from 51.9 to 51.5 as employment in the manufacturing sector remained weak through October.

Next Sunday's Italian referendum on Senate reform is an important event for markets this week but a "no" outcome appears largely priced in EURUSD, in our view. Polls suggest that most voters oppose PM Renzi's proposal and should that be realised, we expect him to step down. While recent EURUSD depreciation has largely been driven by USD strength, we think a portion of recent EUR weakness reflects a discount to various political risks over the coming year, including elections in the Netherlands, France and Germany. Given these residual risks we think any sustained EURUSD appreciation is unlikely. The reaction to a surprise "yes" vote is uncertain with, bi-modal implications: it simultaneously increases the likelihood of Prime Minister Renzi's reform agenda (if the PD, Mr. Renzi's party, wins the next election) and the likelihood of radical change and rejection of the euro if 5SM wins.

On the data front, November euro area headline/core inflation (Wednesday) is expected to remain unchanged at 0.5%/0.8%, while euro area final November manufacturing PMI (Thursday) is expected to be confirmed at 53.7".

Copyright © 2016 Barclays Capital, eFXnews™

-

11:48

-

11:03

Eurozone economic confidence improved to a 11-month high

Eurozone economic confidence improved to a 11-month high in November, survey data from the European Commission showed Tuesday, cited by rttnews.

The industrial confidence index dropped unexpectedly to -1.1 November from -0.6 points in October. The reading was forecast to rise to -0.5.

At the same time, the consumer sentiment indicator improved to -6.1, as initially estimated, from -8 in October. The increase in confidence was fueled by significantly brighter expectations regarding the future general economic situation and future unemployment.

-

10:19

German North Rhine Westphalia Nov CPI 0.0% MM; +0.8% YY

-

10:15

Economic Sentiment broadly unchanged in the euro area and slightly up in the EU

After two months of sharp increases, the Economic Sentiment Indicator (ESI) in November moved broadly sideways in the euro area (+0.1 points to 106.5) and edged up only slightly in the EU (+0.4 points to 107.3), the European Comision says.

-

10:00

Eurozone: Economic sentiment index , November 106.5 (forecast 107)

-

10:00

Eurozone: Industrial confidence, November -1.1 (forecast -1)

-

10:00

Eurozone: Business climate indicator , November 0.42 (forecast 0.57)

-

10:00

Eurozone: Consumer Confidence, November -6.1 (forecast -6.0)

-

09:46

United Kingdom: Net Lending to Individuals, bln, October 4.9 (forecast 4.8)

-

09:43

Oil is trading lower

This morning, the New York futures for Brent dropped in price 0.61% to $ 48.91 and WTI fell 0.49% to $ 46.85 per barrel. Thus, the black gold is traded in the red zone on the background of the ongoing debate about the details of the OPEC deal. According to Reuters latest information, the OPEC countries failed to reach a compromise on the details of the transaction to restrict production, clouding prospects for a definitive agreement at the formal meeting of the cartel on 30 November. Today, the American Petroleum Institute will release weekly data on stocks.

-

09:38

Important improvement for UK money and credit data. GBP/USD resumes the rally

UK broad money, M4ex, is defined as M4 excluding intermediate other financial corporations (OFCs). M4ex increased by £11.7 billion in October, compared to the average monthly increase of £14.5 billion over the previous six months. The three-month annualised and twelve-month growth rates were 6.9% and 7.8% respectively.

Households' holdings of M4 increased by £5.0 billion in October, compared to the average monthly increase of £7.5 billion over the previous six months. The three-month annualised and twelve-month growth rates were 5.4% and 6.7% respectively. M4 lending to households increased by £4.2 billion in October, compared to the average monthly increase of £3.5 billion over the previous six months. The three-month annualised and twelve-month growth rates were 3.9% and 4.0% respectively.

Loans to financial and non-financial businesses decreased by £8.2 billion in October, compared to the average monthly increase of £2.3 billion over the previous six months. The decrease was mainly in loans to businesses in the financial services industry (£10.5 billion). The twelve-month growth rate was 1.0%.

The number of loan approvals for house purchase was 67,518 in October, compared to the average of 63,914 over the previous six months. The number of approvals for remortgaging was 43,513, compared to the average of 42,115 over the previous six months. The number of approvals for other purposes was 13,427, compared to the average of 12,726 over the previous six months

-

09:30

United Kingdom: Mortgage Approvals, October 67.52 (forecast 65)

-

09:30

United Kingdom: Consumer credit, mln, October 1618 (forecast 1500)

-

08:47

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0620-30 (EUR 947m) 1.0640 (653m)

USD/JPY 110.00 (USD 400m)

GBP/USD 1.2655 (GBP 433m)

USD/CNY 6.9000 (USD 580m) 6.9300 (602m)

USD/CAD 1.3400 (USD 1.03bln) 1.3600 (890m)

-

08:37

Major stock markets trading in the red zone: FTSE -0.2%, DAX -0.2%, CAC40 -0.1%, FTMIB -0.1%, IBEX flat

-

08:18

WSE: After opening

WIG20 index opened at 1777.84 points (+0.09%)*

WIG 48300.04 0.14%

WIG30 2076.48 0.09%

mWIG40 4113.80 0.41%

*/ - change to previous close

The future contracts December series on the WIG20 (FW20Z1620) started trading at the point at which ended yesterday. After a weaker Monday, which was marked by profit taking after the recent increases in core markets, today the atmosphere is calm for now. Markets need withdrawal to catch his breath, and maybe this breath was caught yesterday.

The beginning of the session on the cash market was held at a slight plus.

After the first transactions the index of the biggest companies went down. The level of turnover is low. A little a drop in the German DAX by 0.2 percent also does not favor the bulls in Warsaw.

After fifteen minutes of trading the WIG20 index was at the level of 1,771 (-0,25%).

-

08:16

Spanish CPI rose above expectations

According to the flash estimate published by the INE, the annual inflation of the CPI in November 2016 is 0.7%.

This indicator provides a preview of the CPI that, if confirmed, would imply the maintenance of its annual change, given that in October this change was 0.7%. In this behavior, it is noteworthy the drop in the prices of fuels (gasoil and gasoline).

In turn, the annual change of the HICP flash estimate in November stands at 0.5%. If confirmed, the annual change of the HICP would remain the same as in the previous month.

-

08:12

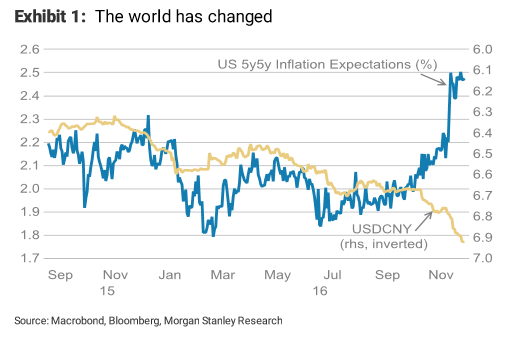

Top 10 trades for 2017 according to Morgan Stanley

"USD has entered its last leg within a secular bull market. We expect USD to be driven by widening rate and investment return differentials.

USD strength should be front-loaded against low-yielding currencies, particularly JPY and KRW.

Later in the cycle we see USD strength broadening out with the help of rising US real rates, specifically hitting high-yielding currencies. Higher real rates should eventually tighten financial conditions, increasing the headwinds for the US economy and marking the turning point for USD after 1Q18.

1) Long USD/JPY: Yield differentials driving outflows from Japan and higher inflation expectations.

2) Long USD/KRW: Diverging growth and monetary policy to increase outflows from Korea.

3) Short EUR/GBP: No new negative UK news allows the undervalued GBP to recover.

4) Long USD/NOK: Norway government's slower fiscal support to make long NOK positions adjust.

5) Short AUD/CAD: Reflects the diverging US-China economic growth stories.

6) Short SGD/INR: Relative external sector dependence, China exposure and debt overhangs.

7) Long USD/CNH: RMB weakens from capital outflows and diverging monetary policy from the US.

8) Long BRL/COP: We expect reform momentum and high yields to cushion external risks.

9) Long RUB/ZAR: Continued tight monetary policy should help RUB outperform.

10) Long CHF/JPY: Yield differentials weaken JPY, while CHF is a good eurozone political risk hedge".

Copyright © 2016 Morgan Stanley, eFXnews

-

08:07

Germany's Saxony Nov CPI 0.0% On Mo, +0.8% On Year

-

08:06

Today’s events

-

At 10:00 GMT Italy will place 10-year bonds

-

At 14:15 GMT FOMC member William Dudley will make a speech

-

At 17:40 GMT FOMC member Jerome Powell will deliver a speech

-

At 20:00 GMT RBNZ Financial Stability Report

-

-

07:51

French household consumption expenditure on goods bounced back - Insee

In October 2016, household consumption expenditure on goods bounced back in volume*: +0.9% after −0.4%. In particular, spendings on energy and purchases of household durables and of clothing picked up markedly.

Energy consumption bounced back sharply (+3.6% after −1.8%). Expenditure on heating in gas and electricity surged owing to relatively cool temperatures for October, after a mild climate for the season in September. Likewise, the consumption of refined products recovered (+2.6% after −3.1%), in part due to oil consumption.

-

07:39

Options levels on tuesday, November 29, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0831 (4510)

$1.0759 (1653)

$1.0704 (1176)

Price at time of writing this review: $1.0592

Support levels (open interest**, contracts):

$1.0501 (4333)

$1.0440 (4970)

$1.0365 (1969)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 78550 contracts, with the maximum number of contracts with strike price $1,1400 (6390);

- Overall open interest on the PUT options with the expiration date December, 9 is 68290 contracts, with the maximum number of contracts with strike price $1,0500 (4970);

- The ratio of PUT/CALL was 0.87 versus 0.88 from the previous trading day according to data from November, 28

GBP/USD

Resistance levels (open interest**, contracts)

$1.2701 (2033)

$1.2603 (1393)

$1.2505 (1822)

Price at time of writing this review: $1.2403

Support levels (open interest**, contracts):

$1.2296 (4036)

$1.2198 (1107)

$1.2099 (1184)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35197 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36758 contracts, with the maximum number of contracts with strike price$1,2300 (4036);

- The ratio of PUT/CALL was 1.04 versus 1.05 from the previous trading day according to data from November, 28

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:30

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.1%, CAC40 -0.1%, FTSE -0.2%

-

07:28

Bank of Canada Governor Poloz expects full utilization of the economy by 2018

During a press conference, Steven Poloz said that he is confident in the economy's prospects. "We expect that the economy will reach full capacity utilization by mid-2018". He added that the economic recovery will contribute to growth in the service sector. Contributing to the economic recovery monetary and fiscal policy.

-

07:26

Japan's unemployment rate remained unchanged in October

The unemployment rate published by the Ministry of Health, Labour and Welfare and the Bureau of Statistics of Japan, was 3.0% in October, in line with analysts' forecast and the previous value. Also, the ratio of vacancies and job seekers in October rose to 1.40 from 1.38. This means that for every 100 job seekers there were 140 jobs.

According to data published by Ministry of Internal Affairs and Communications, household expenditures in October fell by 0.4% year on year. In September, expenses decreased by -2.1%. Economists had expected a decrease of 0.6% in October compared with the same period of the previous year. Household spending is an indicator that assesses the total expenditure of households and used as an indicator of consumer optimism.

-

07:24

Japanese retail sales mixed

Retail sales increased in October by 2.5% after rising 0.3% in September. The increase marked the second consecutive month, and points to some improvement of the trend in recent years. However, on an annualized basis, this indicator continues to decrease for the eighth month in a row. According to published data, retail sales decreased by -0.1% compared to the same period of the previous year. Sales of Japan's major stores also fell by -1.0% compared with the same period last year.

The report of the Ministry of Economy and Trade says that consumers were cautious in their spending in the conditions of slow growth in wages, although the decline was less significant than in previous months.

-

07:22

WSE: Before opening

The main indexes of stock exchanges in New York remained in the red yesterday, after being established the historic highs in the past week. Dow Jones Industrial at the end of the day lost 0.28 percent, the S&P 500 fell by 0.53 percent and the Nasdaq Comp. went down by 0.56 percent. The withdrawal of the main indices was accompanied by weakening of the dollar, the strength of which was one element of the bulls rally on Wall Street after the US presidential election. The corrective mood moved also to Asia, where the Nikkei lost 0.3 percent, but futures on the S&P500 are looking for stability.

Serious movements may not be seen as well on the zloty and emerging markets. The Eurodollar recorded modest changes, so the start of the day in Europe can be considered as a stable.

In the macro calendar the highlight of the day is reading of the US GDP. Data recall that this week is an input in the December and meeting of investors with economic indices readings and monthly data from the US labor market. This week will also be interesting because of reports from Europe due to systemic referendum in Italy this weekend. Also important will be the December decision of the European Central Bank on the change in the program of quantitative easing.

The Warsaw market is still in the shadow of the core markets and is dependent on the global relation to the emerging markets. Important is the relationship of the dollar to other currencies and the condition of the zloty against the dollar. From the technical analysis point of view the end of the previous week and the first session of this week clearly show that the market is not ready to break the WIG20 beyond a few weeks of consolidation.

-

07:15

German import prices decreased by 0.6% in October

As reported by the Federal Statistical Office (Destatis), the index of import prices decreased by 0.6% in October 2016 compared with the corresponding month of the preceding year. In September and in August 2016 the annual rates of change were -1.8% and -2.6%, respectively. From September to October 2016 the index rose by 0.9%.

The index of import prices, excluding crude oil and mineral oil products, decreased by 0.7% compared with the level of a year earlier.

The index of export prices decreased by 0.1% in October 2016 compared with the corresponding month of the preceding year. In September and in August 2016 the annual rates of change were -0.6% and -0.9%, respectively. From September to October 2016 the export price index rose by 0.3%

-

06:03

Global Stocks

U.K. stocks dropped for the first time in three sessions on Monday, with oil producers among the biggest decliners on growing concerns OPEC will fail to reach an output deal at a closely watched meeting this week.

U.S. stocks closed lower on Monday as investors found few reasons to keep pushing shares higher following an extended rally that took major indexes to a string of records and lifted major indexes for three straight weeks.

Expectations that a production deal among the Organization of the Petroleum Exporting Countries would unravel dominated Asian trade on Monday, adding volatility to regional stocks and currencies.

-