Market news

-

23:29

Stocks. Daily history for Nov 29’2016:

(index / closing price / change items /% change)

Nikkei 225 18,307.04 -49.85 -0.27%

Shanghai Composite 3,283.36 +6.36 +0.19%

S&P/ASX 200 5,457.50 0.00 0.00%

FTSE 100 6,772.00 -27.47 -0.40%

CAC 40 4,551.46 +41.07 +0.91%

Xetra DAX 10,620.49 +37.82 +0.36%

S&P 500 2,204.66 +2.94 +0.13%

Dow Jones Industrial Average 19,121.60 +23.70 +0.12%

S&P/TSX Composite 14,999.81 -15.55 -0.10%

-

20:01

DJIA 19134.47 36.57 0.19%, NASDAQ 5395.14 26.33 0.49%, S&P 500 2208.37 6.65 0.30%

-

17:02

European stocks closed: FTSE 6772.00 -27.47 -0.40%, DAX 10620.49 37.82 0.36%, CAC 4551.46 41.07 0.91%

-

16:45

WSE: Session Results

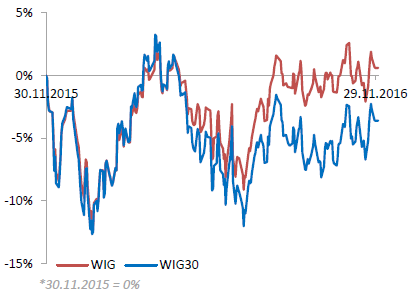

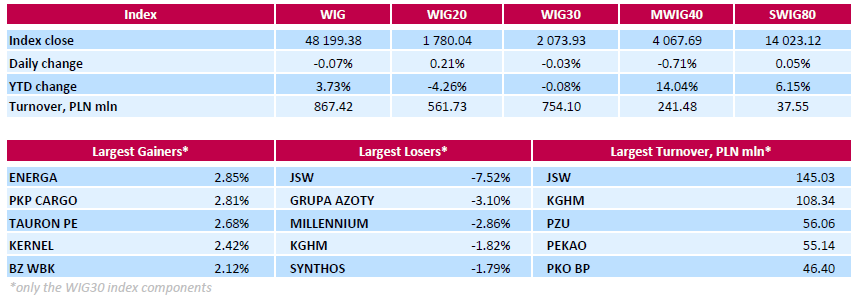

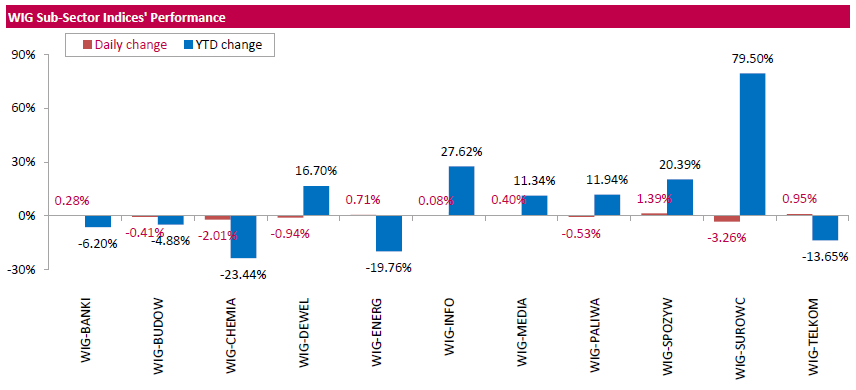

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index, edged down 0.07%. Sector performance within the WIG Index was mixed. Materials (-3.26%) fell the most, while food sector (+1.39%) fared the best.

The large-cap stocks' measure, the WIG30 Index, inched down 0.03%. In the index basket, coking coal miner JSW (WSE: JSW) topped the decliners' list, tumbling by 7.52%. It was reported that the company's shareholders decided to announce break in proceedings of EGM until December 1. The shareholders were supposed to vote on the transfer of JSW's troubled mine Krupinski to state restructuring company SRK, which will wind it down. Among other major laggards were chemical producer GRUPA AZOTY (WSE: ATT), bank MILLENNIUM (WSE: MIL) and copper producer KGHM (WSE: KGH), plunging by 3.1%, 2.86% and 1.82% respectively. On the other side of the ledger, utilities name ENERGA (WSE: ENG) and railway freight transport operator PKP CARGO (WSE: PKP) led the gainers, jumping by 2.85% and 2.81% respectively.

-

16:09

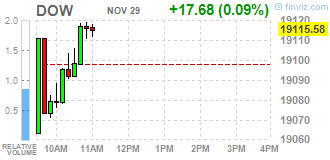

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes slightly rose on Tuesday as a sharp drop in oil prices weighed on energy stocks, while a rise in healthcare stocks helped limit losses. Oil fell nearly 4% as major exporters struggled to agree to a production freeze to reduce global oversupply ahead of an OPEC meeting on Wednesday.

Most of Dow stocks in positive area (17 of 30). Top gainer - UnitedHealth Group Incorporated (UNH, +3.61%). Top loser - Chevron Corporation (CVX, -1.60%).

Most S&P sectors in positive area. Top gainer - Financials (+0.7%). Top loser - Basic Materials (-1.4%).

At the moment:

Dow 19102.00 +22.00 +0.12%

S&P 500 2204.25 +3.50 +0.16%

Nasdaq 100 4877.25 +16.25 +0.33%

Oil 45.32 -1.76 -3.74%

Gold 1191.30 -2.50 -0.21%

U.S. 10yr 2.34 +0.02

-

14:51

WSE: After start on Wall Street

The afternoon data on GDP growth in the US were better than expected, although Wall Street reacted to it carefully. The first transactions show rather stabilizing after yesterday's fall than rise.

The Warsaw market, which reacted by weakening of the WIG20 to this data returned to the levels observed before 14:30. The level of turnover remained stable, which may mean that today's session will confirm the consolidation.

One hour before the close of trading on the Warsaw market, the WIG20 index was at the level 1,774 points (- 0.10%).

-

14:32

U.S. Stocks open: Dow +0.01%, Nasdaq +0.09%, S&P 0.00%

-

14:25

Before the bell: S&P futures +0.01%, NASDAQ futures -0.04%

U.S. stock-index futures were little changed as investors assessed revised data on the U.S. GDP for the third quarter and awaited tomorrow's crucial oil talks of OPEC members in Vienna.

Global Stocks:

Nikkei 18,307.04 -49.85 -0.27%

Hang Seng 22,737.07 -93.50 -0.41%

Shanghai 3,283.36 +6.36 +0.19%

FTSE 6,760.97 -38.50 -0.57%

CAC 4,538.63 +28.24 +0.63%

DAX 10,595.42 +12.75 +0.12%

Crude $45.72 (-2.89%)

Gold $1,182.00 (-0.74%)

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

30.21

-0.65(-2.1063%)

12300

Amazon.com Inc., NASDAQ

AMZN

769.37

2.60(0.3391%)

11054

AT&T Inc

T

39.68

0.14(0.3541%)

7529

Barrick Gold Corporation, NYSE

ABX

15.05

-0.35(-2.2727%)

63015

Caterpillar Inc

CAT

94.2

-0.70(-0.7376%)

4058

Chevron Corp

CVX

109.74

-0.76(-0.6878%)

1550

Cisco Systems Inc

CSCO

30.1

0.18(0.6016%)

534

Citigroup Inc., NYSE

C

55.51

0.04(0.0721%)

42745

Deere & Company, NYSE

DE

101.5

-0.20(-0.1967%)

6418

Exxon Mobil Corp

XOM

85.86

-0.61(-0.7054%)

3560

Facebook, Inc.

FB

120.45

0.04(0.0332%)

25434

Ford Motor Co.

F

11.95

0.03(0.2517%)

5602

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.22

-0.56(-3.5488%)

255768

Home Depot Inc

HD

130.25

0.30(0.2309%)

1000

HONEYWELL INTERNATIONAL INC.

HON

30.1

0.18(0.6016%)

534

Intel Corp

INTC

35.66

0.15(0.4224%)

1341

International Business Machines Co...

IBM

164.25

-0.27(-0.1641%)

173

JPMorgan Chase and Co

JPM

78.78

0.46(0.5873%)

300

McDonald's Corp

MCD

30.1

0.18(0.6016%)

534

Pfizer Inc

PFE

31.84

0.30(0.9512%)

24037

Procter & Gamble Co

PG

83.39

0.32(0.3852%)

425

Starbucks Corporation, NASDAQ

SBUX

57.79

0.20(0.3473%)

1515

Tesla Motors, Inc., NASDAQ

TSLA

196.1

-0.02(-0.0102%)

7693

The Coca-Cola Co

KO

41.45

0.05(0.1208%)

5674

Twitter, Inc., NYSE

TWTR

11.95

0.03(0.2517%)

5602

UnitedHealth Group Inc

UNH

157.2

5.09(3.3463%)

27685

Verizon Communications Inc

VZ

51.44

0.32(0.626%)

205

Walt Disney Co

DIS

99.25

0.28(0.2829%)

6316

Yahoo! Inc., NASDAQ

YHOO

41.52

0.07(0.1689%)

675

-

13:41

Upgrades and downgrades before the market open

Upgrades:

Pfizer (PFE) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Goldman Sachs (GS) downgraded to Neutral from Buy at Nomura

Johnson & Johnson (JNJ) downgraded to Equal Weight from Overweight at Barclays

Other:

McDonald's (MCD) removed from US Focus List at Credit Suisse; holds Outperform, target $128

Altria (MO) resumed with a Equal-Weight at Morgan Stanley; target $65

-

12:04

WSE: Mid session comment

The morning trading phase has not brought major changes in the Warsaw market. Low volatility suggests that markets are waiting to enter the game by Americans and data from the US. At the halfway point of today's session, the WIG 20 index was at the level of 1,780 points (+ 0.24%). The turnover in the segment of the largest companies was amounted to PLN 230 million.

-

08:37

Major stock markets trading in the red zone: FTSE -0.2%, DAX -0.2%, CAC40 -0.1%, FTMIB -0.1%, IBEX flat

-

08:18

WSE: After opening

WIG20 index opened at 1777.84 points (+0.09%)*

WIG 48300.04 0.14%

WIG30 2076.48 0.09%

mWIG40 4113.80 0.41%

*/ - change to previous close

The future contracts December series on the WIG20 (FW20Z1620) started trading at the point at which ended yesterday. After a weaker Monday, which was marked by profit taking after the recent increases in core markets, today the atmosphere is calm for now. Markets need withdrawal to catch his breath, and maybe this breath was caught yesterday.

The beginning of the session on the cash market was held at a slight plus.

After the first transactions the index of the biggest companies went down. The level of turnover is low. A little a drop in the German DAX by 0.2 percent also does not favor the bulls in Warsaw.

After fifteen minutes of trading the WIG20 index was at the level of 1,771 (-0,25%).

-

07:30

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.1%, CAC40 -0.1%, FTSE -0.2%

-

07:22

WSE: Before opening

The main indexes of stock exchanges in New York remained in the red yesterday, after being established the historic highs in the past week. Dow Jones Industrial at the end of the day lost 0.28 percent, the S&P 500 fell by 0.53 percent and the Nasdaq Comp. went down by 0.56 percent. The withdrawal of the main indices was accompanied by weakening of the dollar, the strength of which was one element of the bulls rally on Wall Street after the US presidential election. The corrective mood moved also to Asia, where the Nikkei lost 0.3 percent, but futures on the S&P500 are looking for stability.

Serious movements may not be seen as well on the zloty and emerging markets. The Eurodollar recorded modest changes, so the start of the day in Europe can be considered as a stable.

In the macro calendar the highlight of the day is reading of the US GDP. Data recall that this week is an input in the December and meeting of investors with economic indices readings and monthly data from the US labor market. This week will also be interesting because of reports from Europe due to systemic referendum in Italy this weekend. Also important will be the December decision of the European Central Bank on the change in the program of quantitative easing.

The Warsaw market is still in the shadow of the core markets and is dependent on the global relation to the emerging markets. Important is the relationship of the dollar to other currencies and the condition of the zloty against the dollar. From the technical analysis point of view the end of the previous week and the first session of this week clearly show that the market is not ready to break the WIG20 beyond a few weeks of consolidation.

-

06:03

Global Stocks

U.K. stocks dropped for the first time in three sessions on Monday, with oil producers among the biggest decliners on growing concerns OPEC will fail to reach an output deal at a closely watched meeting this week.

U.S. stocks closed lower on Monday as investors found few reasons to keep pushing shares higher following an extended rally that took major indexes to a string of records and lifted major indexes for three straight weeks.

Expectations that a production deal among the Organization of the Petroleum Exporting Countries would unravel dominated Asian trade on Monday, adding volatility to regional stocks and currencies.

-