Market news

-

23:50

Japan: Retail sales, y/y, October -0.1% (forecast -1.2%)

-

23:30

Japan: Household spending Y/Y, October -0.4% (forecast -0.6%)

-

23:30

Japan: Unemployment Rate, October 3% (forecast 3%)

-

23:30

Commodities. Daily history for Nov 28’2016:

(raw materials / closing price /% change)

Oil 46.90 -0.38%

Gold 1,193.20 +0.20%

-

23:29

Stocks. Daily history for Nov 28’2016:

(index / closing price / change items /% change)

Nikkei 225 18,356.89 -24.33 -0.13%

Shanghai Composite 3,277.10 +15.16 +0.46%

S&P/ASX 200 5,464.40 0.00 0.00%

FTSE 100 6,799.47 -41.28 -0.60%

CAC 40 4,510.39 -39.88 -0.88%

Xetra DAX 10,582.67 -116.60 -1.09%

S&P 500 2,201.72 -11.63 -0.53%

Dow Jones Industrial Average 19,097.90 -54.24 -0.28%

S&P/TSX Composite 15,015.36 -60.08 -0.40%

-

23:28

Currencies. Daily history for Nov 28’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0612 +0,19%

GBP/USD $1,2415 -0,40%

USD/CHF Chf1,0129 -0,14%

USD/JPY Y111,93 -1,00%

EUR/JPY Y118,80 -0,80%

GBP/JPY Y138,98 -1,36%

AUD/USD $0,7480 +0,52%

NZD/USD $0,7072 +0,42%

USD/CAD C$1,341 -0,83%

-

23:00

Schedule for today,Tuesday, Nov 29’2016

01:00 Canada BOC Gov Stephen Poloz Speaks

09:30 United Kingdom Mortgage Approvals October 62.93 65

09:30 United Kingdom Consumer credit, mln October 1405 1550

09:30 United Kingdom Net Lending to Individuals, bln October 4.7

10:00 Eurozone Consumer Confidence (Finally) November -8 -6.1

10:00 Eurozone Business climate indicator November 0.55 0.57

10:00 Eurozone Industrial confidence November -0.6 -0.5

10:00 Eurozone Economic sentiment index November 106.3 107

13:00 Germany CPI, m/m (Preliminary) November 0.2% 0.1%

13:00 Germany CPI, y/y (Preliminary) November 0.8% 0.8%

13:30 Canada Current Account, bln Quarter III -19.9

13:30 U.S. PCE price index ex food, energy, q/q (Revised) Quarter III 1.8% 1.7%

13:30 U.S. GDP, q/q (Revised) Quarter III 1.4% 3%

14:00 U.S. S&P/Case-Shiller Home Price Indices, y/y September 5.1% 5.2%

14:15 U.S. FOMC Member Dudley Speak 15:00 U.S. Consumer confidence November 98.6 100

17:40 U.S. FOMC Member Jerome Powell Speaks

21:45 New Zealand Building Permits, m/m October 0.2%

23:50 Japan Industrial Production (MoM) (Preliminary) October 0.6% -0.1%

23:50 Japan Industrial Production (YoY) (Preliminary) October 1.5%

-

20:00

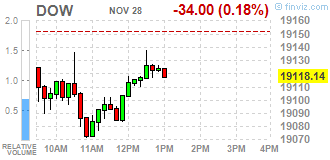

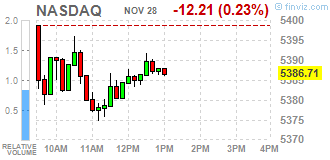

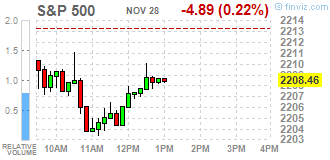

DJIA 19118.79 -33.35 -0.17%, NASDAQ 5378.01 -20.91 -0.39%, S&P 500 2206.39 -6.96 -0.31%

-

18:05

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Monday, weighed down by financial and consumer discretionary stocks, as some investors cashed in following a record-setting week. The three major U.S. indexes closed higher for the third week in a row on Friday, with the S&P 500 notching its seventh record close since 8 of Nov. Oil prices bounced back in volatile trading after falling as much as 2,5% as the market reacted to the shaky prospect of major producers being able to agree output cuts at a meeting on Wednesday.

Most of Dow stocks in negative area (19 of 30). Top gainer - Verizon Communications Inc. (VZ, +0.79%). Top loser - UnitedHealth Group Incorporated (UNH, -1.09%).

Most of S&P sectors also in negative area. Top gainer - Utilities (+1.5%). Top loser - Basic Materials (-1.1%).

At the moment:

Dow 19095.00 -49.00 -0.26%

S&P 500 2206.75 -4.50 -0.20%

Nasdaq 100 4872.50 +4.00 +0.08%

Oil 47.26 +1.20 +2.61%

Gold 1188.50 +10.10 +0.86%

U.S. 10yr 2.33 -0.04

-

17:00

European stocks closed: FTSE 6799.47 -41.28 -0.60%, DAX 10582.67 -116.60 -1.09%, CAC 4510.39 -39.88 -0.88%

-

16:33

WSE: Session Results

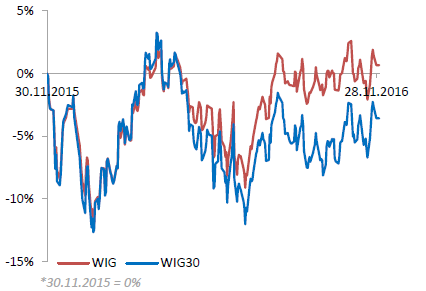

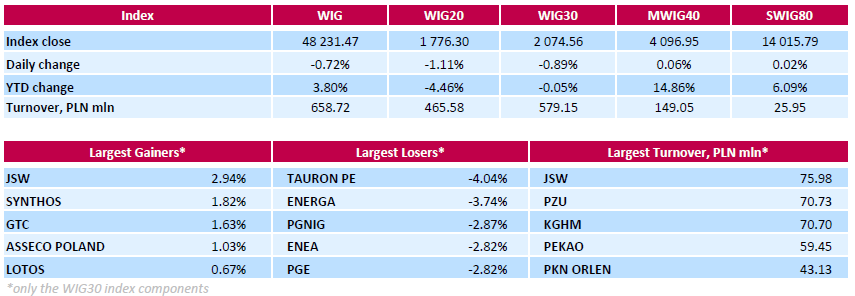

Polish equities closed lower on Monday. The broad market benchmark, the WIG Index, lost 0.72%. Sector performance within the WIG Index was mixed. Utilities (-2.50%) fell the most, while materials (+0.75%) fared the best.

The large-cap stocks plunged by 0.89%, as measured by the WIG30 Index. Within the index components, four utilities names TAURON PE (WSE: TPE), PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG) were among the major laggards, tumbling between 2.82% and 4.04%. Other biggest decliners were oil and gas producer PGNIG (WSE: PGN), bank MBANK (WSE: MBK) and FMCG-wholesaler EUROCASH (WSE: EUR), which lost 2.87%, 2.23% and 2.22% respectively. On the other side of the ledger, coking coal miner JSW (WSE: JSW) topped the list of gainers with a 2.94% advance, followed by chemical producer SYNTHOS (WSE: SNS) and property developer GTC (WSE: GTC), which rose by 1.82% and 1.63%.

-

15:57

Draghi: Italy's growth gradually recovering, but no room for complacency

-

Italian Debt is Sustainable

-

But Greatest Risk Comes from Impaired Growth, Recovery Not Firming

-

Protracted Period of Time with Low Rates Are "Fertile Terrain" for Financial Stability Risks

-

'Not Obvious' That High Interest Rate Would Stimulate Reforms

-

Still Serious Concerns About Sustainability of Greek Public Debt

-

-

15:24

Gold price stabilizes

Gold climbed on Monday following a three-week rout, as the dollar weakened and reports of potential import restrictions in China pushed up demand, says Dow Jones.

Gold for December delivery was recently up 0.6% at $1,185.80 a troy ounce on the Comex division of the New York Mercantile Exchange.

The WSJ Dollar Index was recently down 0.2% at 91.68. Gold fell to the lowest level since February last week, weighed down by a resurgent dollar and stock-market euphoria that has sapped the metal's safe-haven appeal.

Fed fund futures used to bet on central bank policy imply a 95.9% probability of a rate-rise in December.

Analysts at Deutsche Bank also said gold could get a post-Fed-meeting boost.

"History teaches us that gold can rally after the Fed has hiked," they wrote in a note to clients. "Since 1976, in five instances out of eight, gold rallied with rising Fed rates."

-

14:57

WSE: After start on Wall Street

The weakening of the zloty, fall in the valuation of the Eurodollar and the end of the fall in bonds yields is a mix prejudicial to our market, same like for the emerging markets sector.

Therefore, the supply is spreading and the index of the largest companies in the afternoon phase of the session remained near session lows. The weaker today is the energy sector, where, as we may see, on any durable rise is still hard.

The market in the United States opened with decrease of less than 0.2%, which during the first trades increasing slightly.

An hour before the end of trading in Warsaw, the WIG20 index was at the level of 1,777 points (-1,04%).

-

14:45

Draghi: US Recovery at Far More Advanced Stage Than Euro Area

-

Geopolitical Uncertainty Has Become Major Source of Uncertainty

-

-

14:32

U.S. Stocks open: Dow -0.24%, Nasdaq -0.24%, S&P -0.25%

-

14:15

ECB, Draghi: ECB stimulus key ingredient of ongoing recovery

-

Eurozone Has Weathered Brexit Fallout with "Encouraging Resilience"

-

Monetary Policy Could be More Effective If Supported by "Decisive Action" from Other Policies

-

Economy Continues to Expand at Moderate, Steady Pace

-

-

14:14

Before the bell: S&P futures -0.28%, NASDAQ futures -0.16%

U.S. stock-index futures fell as the Donald Trump effect lost its sway over global financial markets and investors shifted to new risks, including those related to upcoming official gathering of OPEC and constitutional referendum in Italy.

Global Stocks:

Nikkei 18,356.89 -24.33 -0.13%

Hang Seng 22,830.57 +107.12 +0.47%

Shanghai 3,277.10 +15.16 +0.46%

FTSE 6,809.86 -30.89 -0.45%

CAC 4,524.18 -26.09 -0.57%

DAX 10,621.83 -77.44 -0.72%

Crude $46.39 (+0.72%)

Gold $1,187.30 (+0.76%)

-

13:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

776.55

-3.82(-0.4895%)

17854

Apple Inc.

AAPL

111.57

-0.22(-0.1968%)

34240

AT&T Inc

T

39.15

-0.06(-0.153%)

1675

Barrick Gold Corporation, NYSE

ABX

14.99

0.25(1.6961%)

67052

Boeing Co

BA

148.81

-1.23(-0.8198%)

2173

Chevron Corp

CVX

110.8

-0.20(-0.1802%)

1629

Cisco Systems Inc

CSCO

30.11

0.02(0.0665%)

20883

Citigroup Inc., NYSE

C

56.25

-0.53(-0.9334%)

16037

Deere & Company, NYSE

DE

103.5

-0.42(-0.4042%)

3791

Exxon Mobil Corp

XOM

86.5

-0.62(-0.7117%)

7920

Facebook, Inc.

FB

119.9

-0.48(-0.3987%)

34831

FedEx Corporation, NYSE

FDX

191.15

-0.38(-0.1984%)

1025

Ford Motor Co.

F

12.01

-0.03(-0.2492%)

19795

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.83

-0.17(-1.0625%)

186101

General Electric Co

GE

31.22

-0.22(-0.6997%)

8617

Goldman Sachs

GS

210.2

-1.18(-0.5582%)

4632

Google Inc.

GOOG

758.5

-3.18(-0.4175%)

1329

Home Depot Inc

HD

131.28

-0.29(-0.2204%)

530

Intel Corp

INTC

35.2

-0.24(-0.6772%)

7489

International Business Machines Co...

IBM

162.6

-0.54(-0.331%)

439

Johnson & Johnson

JNJ

114.4

0.27(0.2366%)

1115

JPMorgan Chase and Co

JPM

78.25

-0.58(-0.7358%)

8724

McDonald's Corp

MCD

120.52

-0.14(-0.116%)

405

Merck & Co Inc

MRK

62.23

0.02(0.0321%)

495

Microsoft Corp

MSFT

60.41

-0.12(-0.1982%)

4383

Nike

NKE

51.84

0.32(0.6211%)

2214

Pfizer Inc

PFE

31.6

-0.09(-0.284%)

3112

Tesla Motors, Inc., NASDAQ

TSLA

196

-0.65(-0.3305%)

3856

The Coca-Cola Co

KO

41.68

0.15(0.3612%)

374

Twitter, Inc., NYSE

TWTR

17.94

-0.12(-0.6644%)

32897

Verizon Communications Inc

VZ

50.49

-0.18(-0.3552%)

3873

Visa

V

80.02

-0.11(-0.1373%)

637

Wal-Mart Stores Inc

WMT

71.18

-0.05(-0.0702%)

1926

Walt Disney Co

DIS

98.6

-0.22(-0.2226%)

6105

Yandex N.V., NASDAQ

YNDX

18.71

0.08(0.4294%)

900

-

13:49

Option expiries for today's 10:00 ET NY cut

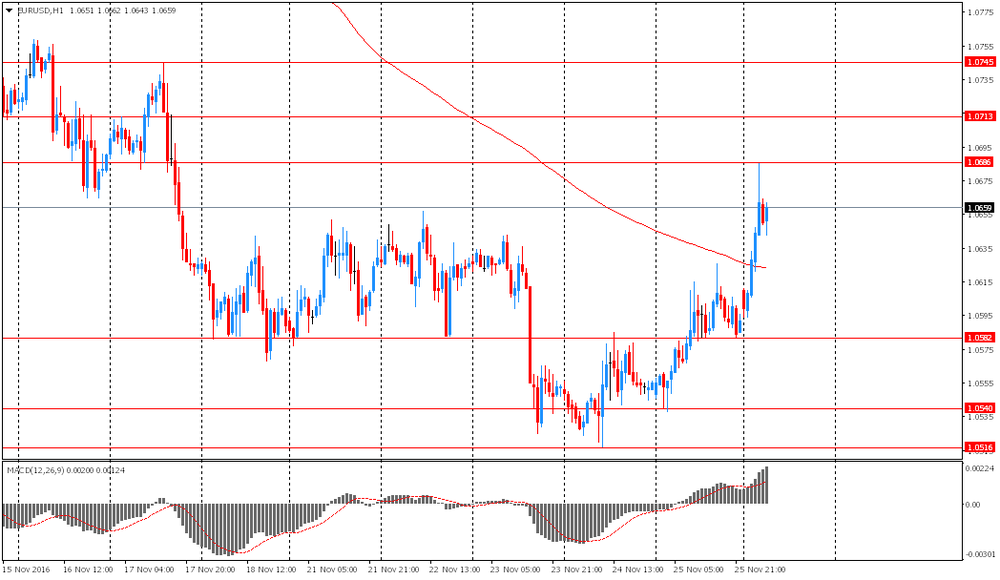

EUR/USD 1.0500 (EUR 3,114 M) 1.0525 (EUR 554 M) 1.0550-1.0565 (EUR 390 M) 1.0585-1.0600 (EUR 784 M) 1.0625 (EUR 200 M) 1.0650 (EUR 1,435 M) 1.0665-1.0680 (EUR 541 M) 1.0700 (EUR 2,803 M) 1.0745-1.0760 (EUR 572 M) 1.0770-1.0785 (EUR 642 M) 1.0800 (EUR 707 M)

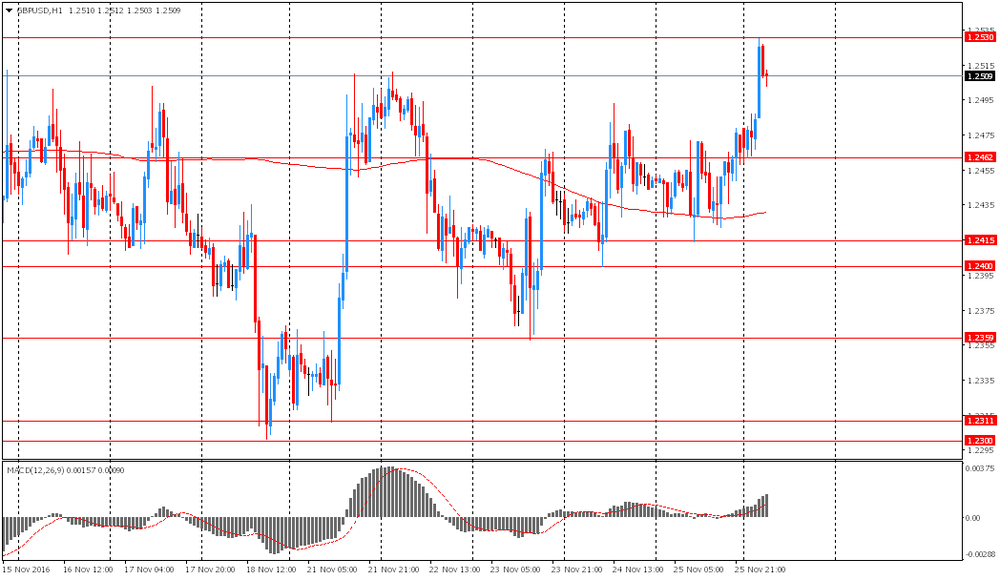

GBP/USD 1.2500 (GBP 291 M)

EUR/GBP 0.8600 (EUR 253 M)

USD/JPY 112.00 (USD 514 M)

AUD/USD 0.7347-0.7360 (AUD 198 M) 0.7500-0.7505 (AUD 341 M) 0.7615-0.7630 (AUD 243 M)

USD/CAD 1.3500-1.3505 (USD 231 M) 1.3600 (USD 302 M) 1.3695-1.3700 (USD 316 M)

NZD/USD 0.7000-0.7010 (NZD 256 M)

-

13:43

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Neutral from Underweight at Piper Jaffray

Downgrades:

Citigroup (C) downgraded to Hold from Buy at Jefferies

Other:

-

13:21

Iraq says it will co-operate with OPEC members to reach an agreement acceptable to all - Forexlive. USD/CAD down 60 pips so far

-

13:03

Putin does not plan to meet with oil companies leaders before the OPEC meeting

President Vladimir Putin of the Russian Federation not scheduled meetings with representatives of the oil companies in anticipation of, or at the end of the OPEC meeting to be held in Vienna

-

12:49

Orders

EUR/USD

Offers 1.0685 1.0700 1.0730 1.0750 1.0780 1.0800

Bids 1.0630 1.0600 1.0580-85 1.0560 1.0530 1.0515 1.0500

GBP/USD

Offers 1.2520 1.2530-35 1.2550-55 1.2570 1.2585 1.2600 1.2630 1.2650 1.2700

Bids 1.2480-85 1.2460 1.2430 1.2400 1.2380 1.2360 1 .2340 1.2315-20 1.2300

EUR/GBP

Offers 0.8545-50 0.8580-85 0.8600 0.8630-35 0.8650

Bids 0.8500-8495 0.8475-80 0.8450 0.8420 0.8400 0.8380-85 0.8350

EUR/JPY

Offers 119.50 119.80-85 120.00 120.45-50 121.00 121.50

Bids 119.00 118.80 118.50 118.00 117.80 117.60 117.30 117.00

USD/JPY

Offers 112.20 112.30-35 112.50 112.80 113.00 113.25-30 113.60 113.80 114.00

Bids 111.85 111.50 111.30-35 111.00 110.85 110.50 110.30 110.00

AUD/USD

Offers 0.7500-05 0.7520 0.7545-50 0.7580 0.7600

Bids 0.7460 0.7430 0.7400 0.7370 0.7355-60 0.7325-30 0.7300

-

12:02

WSE: Mid session comment

The first half of today's trading has not brought more activity, which at the halfway point of the session amounted to approx. PLN 300 million registered for the whole market and in the segment of blue chips approx. PLN 200 million.

Changing of prices looks also negative in the wake of decreasing contracts in the US and a weak attitude of the European environment, where the DAX went down almost 0,9%. The mood in Europe broke down, among others, under the influence of return of concerns about the result of the Italian referendum.

In today's report Organization for Economic Co-operation and Development (OECD) lowered its forecast regarding growth of Polish Gross Domestic Product in 2016 to 2.6 percent against 3.0 percent projected in June.

In the middle of today's session the WIG20 index was at the level of 1,781 points (-0.82%).

-

11:51

Major stock indices in Europe show a negative trend

European stocks traded in the red zone, in response to growing concerns about the risks to the financial stability of the Italian creditors before the referendum. The negative dynamics of the oil market also put preasure.

On December 4 the Italians will vote on the issue of constitutional reform. Prime Minister Renzi says will strengthen the future government by limiting the powers of the Senate. This vote is seen by experts as defining for the political fate of Renzi. He has previously warned he could resign if the Italians would say "no" to the reforms. Opinion polls show that the majority of Italians are against the constitutional changes, which, as the economists say, Italy desperately needs, if it wants the government to optimize and accelerate the growth of the economy.

Certain influence on the dynamics of trade have data for the euro area. The ECB said that the money supply increased at a slower pace, while private sector loan growth has improved in October. According to the data, the M3 monetary aggregate up to October rose by 4.4 percent year on year, after increasing by 5.1 percent in September. On average over the past three months (to October) the growth rate of monetary aggregate M3 amounted to 4.8 percent. Private sector credit volume increased by 2.3 percent, after rising 2 percent in September. Annual growth of loans to households remained stable in October - at the level of 1.8 percent. At the same time, lending to non-financial corporations has increased by 2.1 percent compared to 2 percent increase in September.

The composite index of the largest companies in the region Stoxx Europe 600 dropped 0.63 percent. The trading volume today is 14 percent lower than the average of 30 days.

The capitalization of UniCredit SpA and Banca Monte dei Paschi fell more than 3.8 percent after Financial Times reported that up to eight Italian banks may fail in the event of the defeat of Prime Minister Matteo Renzi on constitutional referendum

Against this background, the Italian MIB Index has fallen by 1.6 percent, which is one of the worst results in Western European markets.

Shares of Royal Bank of Scotland fell 2.8 percent amid reports that the bank may face difficulties when trying to sell Williams & Glyn.

Eni SpA shares and Tullow Oil Plc fell more than 1 percent, as oil prices fell below $ 46 per barrel.

At the moment:

FTSE 100 6801.95 -38.80 -0.57%

DAX -80.11 10619.16 -0.75%

CAC 40 4522.52 -27.75 -0.61%

-

11:34

OECD revised the forecast for world economic growth in 2017

-

OECD has improved the outlook for global GDP growth for 2017 from 3.2% to 3.3%

-

The forecast for global GDP growth for 2016 remained unchanged at 2.9%

-

The forecast for US GDP growth in 2016 increased to 1.5% from 1.4%, and in 2017 - to 2.3% from 2.1%

-

The forecast for GDP growth in the euro area improved to 1.7% in 2016 from 1.5% and in 2017 - to 1.6% from 1.4%

-

The forecast for GDP growth in Japan for 2016 increased to 0.8% from 0.6%, and in 2017 - to 1.0% from 0.7%

-

The forecast for GDP growth in the UK increased to 2.0% in 2016 to 1.8% and in 2017 - to 1.2% from 1.0%

-

The forecast for China's GDP growth improved to 6.7% in 2016 to 6.5% and in 2017 - to 6.4% from 6.2%

-

-

11:03

The Bank of Japan posted the first loss in four years

The Bank of Japan posted a net loss of 200.2 billon yen ($1.8 billion) in six months through September 30 due to the impact of the strong yen, the first time it posted a loss in four years.

The central bank cited by Dow Jones said losses related to foreign exchange fluctuations totaled ¥ 697.6 billion in the fiscal first half, compared with a profit of ¥ 27.2 billion in the same period a year earlier.

-

10:38

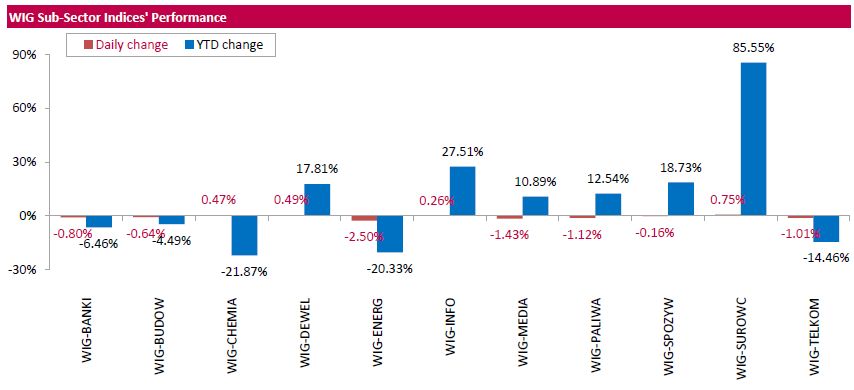

Rate differentials rather than Oil correlation support the dollar - Goldman Sachs

"Historically, the Dollar has been negatively correlated with oil prices, meaning low oil prices have coincided with a strong Dollar, while high oil prices have typically come when the Dollar has been weak.

We argue that the importance of this empirical relationship is overstated for two reasons.

First, many of the counterpart currencies in broad Dollar indices belong to commodity exporting countries, so that falling (rising) oil prices push down (up) their terms of trade, which weakens (strengthens) their currencies. The negative correlation thus exists almost by construction, i.e. is a bit like looking at the correlation of oil prices with their reciprocal (commodity exporters' terms of trade). In short, the correlation isn't really about the Dollar per se, but about commodity exporters.

Second, fluctuations in oil prices often coincide with other developments that have effects on the Dollar, including global demand shocks or monetary policy changes. Both of these are present in Exhibit 1, which shows the drop in oil prices during the global financial crisis, which - being a negative demand shock originating in the US - moved rate differentials against the Dollar, and the pronounced drop in oil prices in 2014, which coincided with the BoJ and ECB increasing monetary stimulus, moving rate differentials in favor of the Dollar. This is perhaps one reason why the correlation of the Dollar with oil prices is less pronounced in changes than in levels

We examine the correlation of the Dollar with oil prices using daily data, controlling for interest differentials, risk appetite and other factors. It concludes that rate differentials are the most important driver behind recent Dollar moves, followed by oil prices.

We conclude that it is primarily the forces of economic divergence that are driving recent Dollar direction, in line with our forecasts which anticipate more Dollar appreciation (around 7 percent) on these grounds".

Copyright © 2016 Goldman Sachs, eFXnews™

-

10:09

Spanish fiscal consolidation pressures will continue - Moody's

The 2017 outlook for Spanish regions is stable but fiscal consolidation pressures will continue and structural reforms may be deferred under the minority government, Moody's Investors cited by rttnews.

"Spain's improving economic prospects will help reduce budgetary pressure for the regions," Marisol Blázquez, a Moody's Analyst and author of the report, said.

"Spain's positive economic growth should gradually increase the regions' tax revenues and central government transfers, helping them to rebalance their budgets."

-

09:35

Huge offers on GBP/USD. The pair lost 50 pips in a couple of minutes

-

09:34

Oil prices fell amid signs that OPEC will dither on supply cuts

Since the beginning of today's trading oil prices fell more than 1%. The cost of Brent crude oil on the London Mercantile Exchange fell by 1.8% to $ 46.40 per barrel and WTI crude oil in New York was $ 45.32 per barrel, down $ 1.6%.

The price of oil started to decline amid growing doubts about the ability of the Petroleum Exporting Countries to agree on production cuts.

A meeting of OPEC with countries that are not part of the organization for discussion on the limitation of oil production measures was canceled, since Saudi Arabia has refused to participate in it.

On Sunday, Minister of Energy of Saudi Arabia Khalid al-Falih said that the oil market is balanced by the natural way in 2017, even if the producers did not intervene, and therefore to maintain the current level of production can be justified.

"We believe that the price balance will be restored, and we expect that demand will improve in 2017. Then prices will be balanced, and it will happen without the intervention of OPEC" - said the Minister of Energy of Saudi Arabia Khalid al-Falih.

-

09:06

Euro Area broad monetary aggregate M3 decreased - ECB

The annual growth rate of the broad monetary aggregate M3 decreased to 4.4% in October 2016, from 5.1% in September, averaging 4.8% in the three months up to October. The components of M3 showed the following developments. The annual growth rate of the narrower aggregate, including currency in circulation and overnight deposits (M1), decreased to 7.9% in October, from 8.4% in September.

The annual growth rate of short-term deposits other than overnight deposits (M2-M1) was more negative at -1.5% in October, from -1.0% in September. The annual growth rate of marketable instruments (M3-M2) decreased to 1.7% in October, from 5.5% in September. Within M3, the annual growth rate of deposits placed by households stood at 5.2% in October, compared with 5.1% in September, while the annual growth rate of deposits placed by non-financial corporations decreased to 5.5% in October, from 7.4% in September.

-

09:00

Eurozone: M3 money supply, adjusted y/y, October 4.4% (forecast 5%)

-

09:00

Eurozone: Private Loans, Y/Y, October 1.8%

-

08:42

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 3.1bln) 1.0600 (656m) 1.0650 (1.43bln) 1.0700 (2.8bln)

USD/JPY 112.00 (USD 534m)

USD/CAD 1.3800 (USD 562m)

-

08:37

Major stock markets trading in the red zone: FTSE -0.3%, DAX -0.4%, CAC40 -0.1%, FTMIB -0.6%, IBEX -0.2%

-

08:18

WSE: After opening

WIG20 index opened at 1794.64 points (-0.09%)*

WIG 48602.54 0.05%

WIG30 2092.84 -0.02%

mWIG40 4102.98 0.21%

*/ - change to previous close

The cash market (the WIG 20 index) opens from a discount of 0.09% to 1,794 points with the turnover traditionally focused on the KGHM shares, which are also the only one among the blue chips that today stand out positively and noticeably increase in value. The German DAX opened at a discount of 0.4%, which is a poor result, but at the same time reflecting the decreasing level of contracts in the United States. We may see that the developed markets represent somewhat weaker form. For the Warsaw market at that moment the weaker dollar helps to maintain a relatively neutral posture, but still below the level of 1,800 points.

After fifteen minutes of trading the WIG20 index was at the level of 1,790 points (-0,34%).

-

08:05

Today’s events

-

At 09:00 GMT the ECB Board Member Peter Preat will make a speech

-

At 12:15 GMT the ECB board member Benoit Coeure deliver a speech

-

At 14:00 GMT the ECB president Mario Draghi will deliver a speech

-

At 15:30 GMT the Bank of England Member of the Commission Gertjan Vlige deliver a speech

-

At 16:00 GMT the ECB president Mario Draghi will deliver a speech

-

-

07:52

Orion Health (OHE.NZ) crashes 18% to NZ$2.05 after it reported a NZ$19.5 million first-half loss and falling cash reserves - Dow Jones

-

07:48

USD set to continue the decline after London opens. The rate hike looks priced in

-

07:31

WSE: Before opening

Ahead of us the new week, which will start the new month - December. The beginning of a new month means the monthly report from the US labor market, the last before the expected December's interest rate hike in the United States and a series of PMI / ISM for the manufacturing sector.

However, the most attention attracts the OPEC meeting. On Friday afternoon Saudi Arabia said that will not participate in the meeting scheduled for today with the producers outside the cartel of oil. In addition, on Sunday, Minister of oil of this country stated that the reduction of production is not needed, due to the expected balance of the market next year. This resulted in a sharp drop in oil prices on Friday and today they remain at lower levels. This caused a correction in yields of US bonds and the dollar. As a result we may see a good performance of Asian parquets this morning as well as markets of developing countries, which with further increase in the price of copper should also be good news for the Warsaw Stock Exchange.

For the Warsaw market will be important to fight the psychological level of 1,800 points by the WIG20 index.

-

07:30

Asian session review: USD sold at the start of the week

Among the events of the weekend, Saudi Arabia has refused to take part in the scheduled meeting of OPEC+, including Russia. Yesterday, the energy Minister Khalid al-Falih said that the oil market will balance by a natural way in 2017, even if the producers did not intervene, and therefore to maintain the current level of production can be justified. This statement has increased doubts about the achievement of productive arrangements to cut oil production at the OPEC meeting on Wednesday.

The US dollar fell sharply against all major currencies against the backdrop of profit taking after a strong US dollar exchange rate over the past three weeks. According to the futures market a Fed hike has 93.5% probability so dollar gains caused by rate hike pricing can be limited.

EUR / USD: during the Asian session, the pair rose to $ 1.0685

GBP / USD: during the Asian session, the pair rose to $ 1.2530

USD / JPY: fell to Y113.35

-

07:24

Barclays says GBP is oversold but vulnerable to further flash crashes

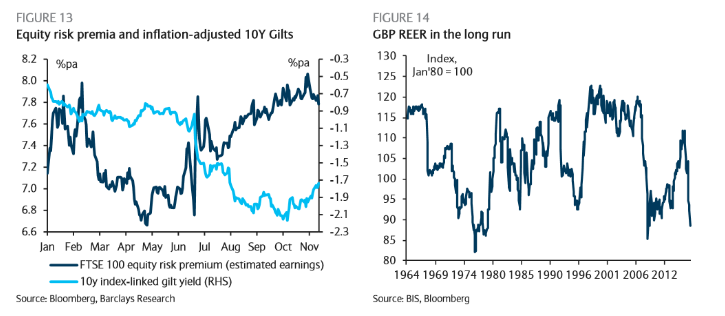

"The key question for sterling's evolution from here is whether or not the Brexit uncertainty discount is sufficient.

While the ultimate resolution of Brexit may have an impact on GBP's equilibrium value, at current levels, GBP represents clear long-term value, having been cheaper on a real effective basis only twice in the last half century: briefly at the depths of the Global Financial Crisis, and during its mid-70s balance of payments crisis (Figure 14).

In our view, this is more than sufficient discount, but that does not mean that GBP cannot get cheaper still.

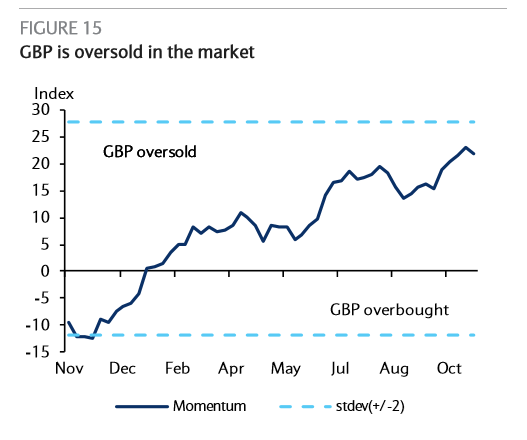

While the medium-term value of GBP is extremely compelling, there is a strong incentive for buyers of long-term UK investments to wait for the Government to announce its Brexit negotiation plans. This leaves GBP exposed to further "flash crashes", particularly in periods of illiquidity as important constitutional questions regarding the Government's path to trigger Article 50 remain in question.

That said, positioning in GBP appears quite short and momentum indicators are indicative of oversold GBP positions (Figure 15),limiting the ability of GBP to extend significantly lower, even over short horizons".

Copyright © 2016 Barclays Capital, eFXnews™

-

07:17

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.2%, CAC40 + 0.1%, FTSE + 0.3%

-

07:08

Bank of England's Mark Carney 'in plot to make Theresa May abandon Brexit timetable' - Independent

-

06:06

Options levels on monday, November 28, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0830 (3541)

$1.0758 (1334)

$1.0703 (1096)

Price at time of writing this review: $1.0652

Support levels (open interest**, contracts):

$1.0497 (4514)

$1.0435 (4443)

$1.0360 (2126)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 76928 contracts, with the maximum number of contracts with strike price $1,1400 (6380);

- Overall open interest on the PUT options with the expiration date December, 9 is 68079 contracts, with the maximum number of contracts with strike price $1,0600 (4514);

- The ratio of PUT/CALL was 0.88 versus 0.85 from the previous trading day according to data from November, 25

GBP/USD

Resistance levels (open interest**, contracts)

$1.2801 (1189)

$1.2702 (1930)

$1.2604 (1431)

Price at time of writing this review: $1.2496

Support levels (open interest**, contracts):

$1.2393 (1413)

$1.2296 (4036)

$1.2198 (1048)

Comments:

- Overall open interest on the CALL options with the expiration date December, 9 is 35084 contracts, with the maximum number of contracts with strike price $1,3400 (2560);

- Overall open interest on the PUT options with the expiration date December, 9 is 36704 contracts, with the maximum number of contracts with strike price $1,2300 (4036);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from November, 25

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-