Market news

-

21:07

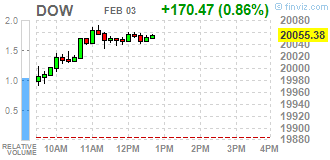

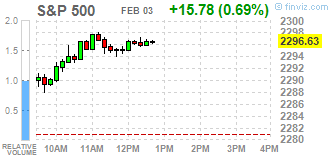

Major US stock indices ended the session in positive territory

Major US stock indices showed positive dynamics on Friday. Support to the market have exceeded the expectations of the data on the number of people employed in non-agricultural sectors of the US economy.

Thus, the number of jobs in the US rose more than expected in January as construction companies and retailers have increased hiring that is likely to give the administration Trump touched, while it seeks to boost the economy and employment. The number of people employed in non-agricultural sectors of the economy increased by 227,000 jobs last month, showing the greatest increase in the past four months, reported on Friday the Ministry of Labour. But the unemployment rate rose by one-tenth of a percentage point to 4.8%, while wages increased slightly, suggesting that there are still some weaknesses in the labor market.

Furthermore, moved by a reliable increase in the volume of new orders in the United States, service providers have started the year with the fastest growth in business activity since the end of 2015. Large willingness to transactions with customers and internal signs of an upturn in economic conditions also contributed to increased business optimism in the service sector. January data made it clear that the services sector companies are more confident about their prospects for growth than at any time since May 2015. The seasonally adjusted final PMI for the services the US from Markit rebounded to 55.6 in January, up from December's three-month low of 53.9.

However, the index of business activity in the US service sector, which is calculated by the Institute of Supply Management (ISM), fell to 56.5 points in January from 57.2 in December. According to the forecast, the rate was reduced to 57 points.

New orders for US manufactured goods rose more than expected in December. Scope of supply also increased, which generally provide more evidence of improvement in manufacturing activity. This was reported by the US Department of Commerce. According to the data, factory orders rose in December by 1.3%, partially offset by a decrease of 2.3% in November (revised from -2.4%). Analysts had expected orders to increase by 1.0%. Meanwhile, the overall supply of industrial goods increased by 2.2% (the maximum growth since December 2010), after rising 0.3% in November.

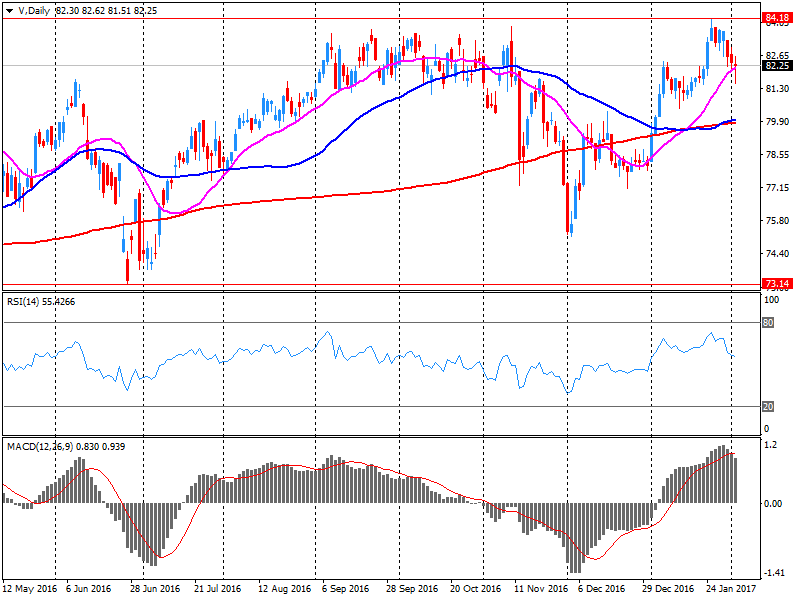

DOW index components closed mostly in positive territory (23 of 30). Most remaining shares fell NIKE, Inc. (NKE, -0.93%). leaders of growth were shares of Visa Inc. (V, + 4.78%).

All business sectors S & P index finished trading in positive territory. The leader turned out to be the financial sector (+ 1.7%).

-

20:00

DJIA +0.88% 20,059.89 +174.98 Nasdaq +0.42% 5,660.11 +23.91 S&P +0.68% 2,296.29 +15.44

-

17:46

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes in positive area on Friday, as U.S. job growth surged more than expected in January as construction firms and retailers ramped up hiring, which likely gives the Trump administration a head start as it seeks to boost the economy and employment. Nonfarm payrolls increased by 227 000 jobs last month, the largest gain in four months, the Labor Department said on Friday. But the unemployment rate rose one-tenth of a percentage point to 4,8% and wages rose only by three cents, suggesting that there was still some slack in the labor market.

Most of Dow stocks in positive area (21 of 30). Top loser - Intel Corporation (INTC, -0.42%). Top gainer - Visa Inc. (V, +5.01%).

All S&P sectors in positive area. Top gainer - Financials (+1.6%).

At the moment:

Dow 19983.00 +162.00 +0.82%

S&P 500 2292.50 +17.00 +0.75%

Nasdaq 100 5151.75 +20.75 +0.40%

Oil 53.87 +0.33 +0.62%

Gold 1221.00 +1.60 +0.13%

U.S. 10yr 2.44 -0.02

-

17:00

European stocks closed: FTSE 100 +47.55 7188.30 +0.67% DAX +23.54 11651.49 +0.20% CAC 40 +31.13 4825.42 +0.65%

-

16:37

WSE: Session Results

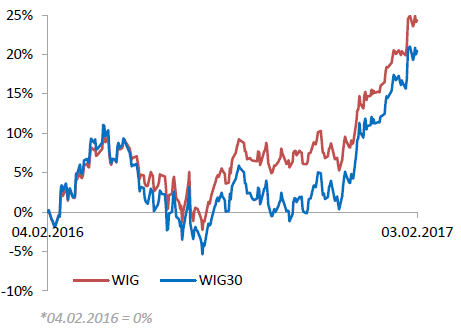

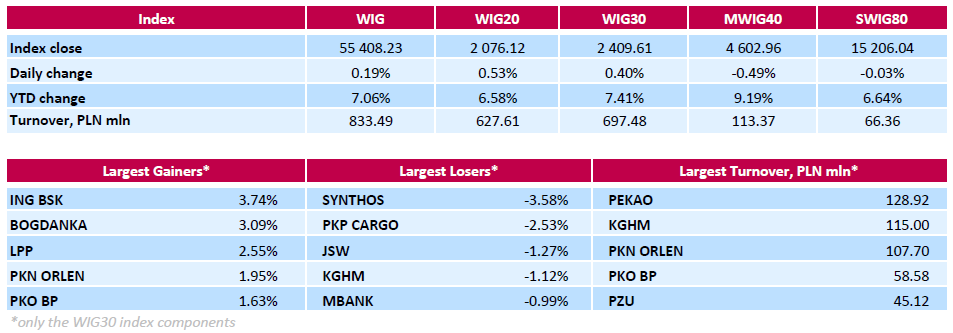

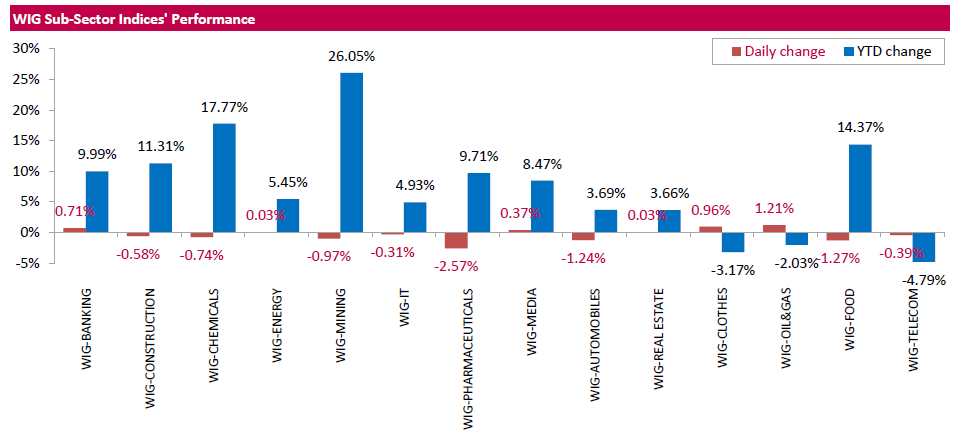

Polish equity market ended Friday on an optimistic note. The broad measure, the WIG index, recorded a 0.19% uptick. The WIG sub-sector indices mostly closed in negative territory, with WIG-PHARMASEUTICALS Index (-2.57%) lagging behind.

The large-cap stocks advanced 0.4%, as measured by the WIG30 Index. In the index basket, banking name ING BSK (WSE: ING) led the way up, climbing by 3.74% and almost fully erasing its yesterday's losses. It was followed by thermal coal miner BOGDANKA (WSE: LWB), clothing retailer LPP (WSE: LPP) and oil refiner PKN ORLEN (WSE: PKN), adding 3.09%, 2.55% and 1.95% respectively. The later (PKN ORLEN) reported yesterday that its fuel's refining margin edged up to $5/bbl in January from $4.90 in December, while its petrochemical margin slipped to EUR 855/t from 862 in the previous month. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) posted the sharpest decline, down 3.58%. The other notable losers were railway freight transport operator PKP CARGO (WSE: PKP), coking coal miner JSW (WSE: JSW), copper producer KGHM (WSE: KGH) and bank MBANK (WSE: MBK), slumping by 0.99%-2.53%. Elsewhere, genco ENERGA (WSE: ENG) was under selling pressure, which pushed its quotations down by 0.79%, after the company reported it had recognized an impairment loss of PLN 132 mln ($33 mln) on its coal-fueled power plant in Ostroleka due to low prices of electricity, and this would weigh on the its 2016 operating profit.

-

14:51

WSE: After start on Wall Street

Today's quotations on Wall Street began with no surprises. After the data from the labor market indices have gone up significantly. In the case of the WSE there was virtually no response to the US data. Both the level of volatility and turnover indicate that investors have already started the weekend.

An hour before the close of trading the WIG20 index was at the level of 2,069 points (+ 0.22%).

-

14:31

U.S. Stocks open: Dow +0.57%, Nasdaq +0.26%, S&P +0.44%

-

14:19

Before the bell: S&P futures +0.41%, NASDAQ futures +0.30%

U.S. stock-index futures rose, supported by much better-than-estimated U.S. nonfarm payrolls data.

Global Stocks:

Nikkei 18,918.20 +3.62 +0.02%

Hang Seng 23,129.21 -55.31 -0.24%

Shanghai 3,140.65 -18.51 -0.59%

FTSE 7,176.08 +35.33 +0.49%

CAC 4,840.95 +46.66 +0.97%

DAX 11,673.96 +46.01 +0.40%

Crude $53.74 (+0.37%)

Gold $1,215.80 (-0.30%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

37.91

0.23(0.6104%)

56083

ALTRIA GROUP INC.

MO

77.36

0.85(1.111%)

857

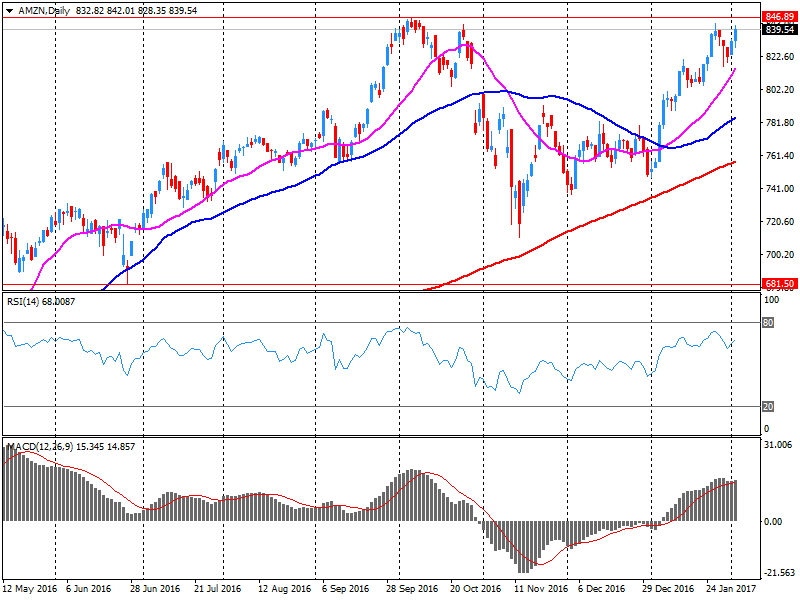

Amazon.com Inc., NASDAQ

AMZN

31.3

0.12(0.3849%)

262648

American Express Co

AXP

77.36

0.85(1.111%)

857

Apple Inc.

AAPL

77.36

0.85(1.111%)

857

AT&T Inc

T

41.11

-0.07(-0.17%)

2289

Barrick Gold Corporation, NYSE

ABX

18.92

-0.02(-0.1056%)

119844

Boeing Co

BA

163.5

1.24(0.7642%)

352

Caterpillar Inc

CAT

94.15

0.38(0.4052%)

678

Chevron Corp

CVX

163.5

1.24(0.7642%)

352

Cisco Systems Inc

CSCO

31.3

0.12(0.3849%)

262648

Citigroup Inc., NYSE

C

57.17

1.19(2.1258%)

247625

Exxon Mobil Corp

XOM

83.7

0.25(0.2996%)

5952

Facebook, Inc.

FB

130.9

0.06(0.0459%)

218884

Ford Motor Co.

F

12.45

0.17(1.3844%)

238789

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.57

-0.24(-1.4277%)

53570

General Motors Company, NYSE

GM

163.5

1.24(0.7642%)

352

Goldman Sachs

GS

234.45

4.04(1.7534%)

36104

Google Inc.

GOOG

163.5

1.24(0.7642%)

352

HONEYWELL INTERNATIONAL INC.

HON

77.36

0.85(1.111%)

857

Intel Corp

INTC

36.61

0.19(0.5217%)

1753

International Business Machines Co...

IBM

174.95

0.37(0.2119%)

2361

International Paper Company

IP

53.4

0.05(0.0937%)

3238

JPMorgan Chase and Co

JPM

86.1

1.51(1.7851%)

111641

McDonald's Corp

MCD

123.1

-0.12(-0.0974%)

1962

Merck & Co Inc

MRK

64.35

0.17(0.2649%)

2149

Microsoft Corp

MSFT

63.4

0.23(0.3641%)

61867

Nike

NKE

52.9

0.10(0.1894%)

2036

Pfizer Inc

PFE

77.36

0.85(1.111%)

857

Procter & Gamble Co

PG

87.95

0.19(0.2165%)

800

Starbucks Corporation, NASDAQ

SBUX

53.99

0.12(0.2228%)

358

The Coca-Cola Co

KO

41.54

0.14(0.3382%)

534

Twitter, Inc., NYSE

TWTR

163.5

1.24(0.7642%)

352

United Technologies Corp

UTX

77.36

0.85(1.111%)

857

Verizon Communications Inc

VZ

48.44

0.16(0.3314%)

10387

Visa

V

85.75

3.45(4.192%)

119049

Walt Disney Co

DIS

110.91

0.30(0.2712%)

4906

Yahoo! Inc., NASDAQ

YHOO

43.54

-0.15(-0.3433%)

335

Yandex N.V., NASDAQ

YNDX

23.48

0.15(0.6429%)

3900

-

13:43

Upgrades and downgrades before the market open

Upgrades:

Ford Motor (F) upgraded to Overweight from Equal Weight at Barclays

Altria (MO) downgraded to Hold from Buy at Berenberg

Intl Paper (IP) downgraded to Neutral from Buy at DA Davidson

Downgrades:

Other:

Amazon (AMZN) target lowered to $905 from $920 at Mizuho

Amazon (AMZN) target lowered to $900 from $950 at RBC Capital Mkts

Amazon (AMZN) target raised to $912 from $888 at Stifel

Visa (V) target raised to $105 from $93 at Stifel

-

13:06

-

12:50

Company News: Amazon (AMZN) beats on EPS, misses on revenues

Amazon reported Q4 FY 2016 earnings of $1.54 per share (versus $1.00 in Q4 FY 2015), beating analysts' consensus estimate of $1.42.

The company's quarterly revenues amounted to $43.741 bln (+22.4% y/y), missing analysts' consensus estimate of $44.690 bln.

The company also issued downside guidance for Q1 FY 2017, projecting revenues of $33.25-35.75 bln (+14%-23% y/y) versus analysts' consensus estimate of $36 bln.

AMZN fell to $806.65 (-3.96%) in pre-market trading.

-

12:00

WSE: Mid session comment

The morning phase of the session was in line with our previous expectations. The behavior of the WIG20 index was virtually a copy of the German DAX. Volatility is low same like the turnover. Any recovery is expected around the area, when data from the US labor market will appear.

At the halfway point of today's session the WIG20 index was at the level of 2,069 points (+0,18%) and the turnover in the segment of blue chips was amounted to PLN 250 million.

-

08:59

Major stock markets in Europe trading mixed: FTSE -0.1%, DAX + 0.1%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX flat

-

08:19

WSE: After opening

WIG20 index opened at 2065.59 points (+0.02%)*

WIG 55296.40 -0.01%

WIG30 2398.23 -0.08%

mWIG40 4629.62 0.08%

*/ - change to previous close

The beginning of trade both in Europe and on the Warsaw market was held with modest changes in indices, so no surprises. Traditionally, market activity is focused on the shares of KGHM. Investors are waiting for the US data, thus we do not expect greater volatility before the afternoon phase of the session.

After fifteen minutes of trading WIG 20 index stood at 2,063 points (-0.06%).

-

07:23

WSE: Before opening

The main US stock indexes recorded on Thursday minor changes. In the spotlight are the decisions of central banks in the UK and the United States. On Wall Street last earnings season. Half of the companies listed on the S&P500 has made its results, of which 67 percent positively surprised. Markets are waiting for Friday's data from the US labor market, one of the most important macro reports each month. Thus today's trading in Europe will have two phases. The first will be waiting for US data, and the other - reaction to these data in solidarity with other markets.

On the Warsaw stock market, from a technical point of view, we are dealing with the consolidation after growth waves. In the currency market, the morning trade brings correction of recent appreciation of the zloty. Polish currency is valued by the market as follows: PLN 4.3148 per euro, 4.0150 PLN against the US dollar. Yields on Polish debt amounts to 3.827% in the case of 10-year bonds.

-

07:12

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.2%

-

06:28

Global Stocks

European stocks lost ground Thursday, with Deutsche Bank AG among the companies whose shares investors are chopping down in the wake of financial updates. U.K. stocks, however, bucked the negative trend on Thursday, moving higher after the Bank of England struck a more dovish tone in its latest policy update than analysts had expected.

U.S. stocks closed mostly lower after bouncing around Thursday as concerns about President Donald Trump's approach on foreign affairs amid spats with key allies and trade partners cast a pall over the market. A round of headlines from Trump's administration included a decision to put Iran "on notice" over potential new sanctions and testy exchanges with the heads of two of the U.S.'s best allies and trade partners: Australia and Mexico.

Stock investors were struggling for footing Friday as encouraging economic data this week was counterbalanced by concern of political risk surrounding the administration of U.S. President Donald Trump. "Everyone is talking about it...the U.S. could be moving away from globalization," said Chris Weston, chief market strategist at IG.

-