Market news

-

21:07

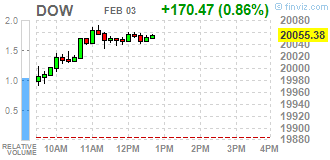

Major US stock indices ended the session in positive territory

Major US stock indices showed positive dynamics on Friday. Support to the market have exceeded the expectations of the data on the number of people employed in non-agricultural sectors of the US economy.

Thus, the number of jobs in the US rose more than expected in January as construction companies and retailers have increased hiring that is likely to give the administration Trump touched, while it seeks to boost the economy and employment. The number of people employed in non-agricultural sectors of the economy increased by 227,000 jobs last month, showing the greatest increase in the past four months, reported on Friday the Ministry of Labour. But the unemployment rate rose by one-tenth of a percentage point to 4.8%, while wages increased slightly, suggesting that there are still some weaknesses in the labor market.

Furthermore, moved by a reliable increase in the volume of new orders in the United States, service providers have started the year with the fastest growth in business activity since the end of 2015. Large willingness to transactions with customers and internal signs of an upturn in economic conditions also contributed to increased business optimism in the service sector. January data made it clear that the services sector companies are more confident about their prospects for growth than at any time since May 2015. The seasonally adjusted final PMI for the services the US from Markit rebounded to 55.6 in January, up from December's three-month low of 53.9.

However, the index of business activity in the US service sector, which is calculated by the Institute of Supply Management (ISM), fell to 56.5 points in January from 57.2 in December. According to the forecast, the rate was reduced to 57 points.

New orders for US manufactured goods rose more than expected in December. Scope of supply also increased, which generally provide more evidence of improvement in manufacturing activity. This was reported by the US Department of Commerce. According to the data, factory orders rose in December by 1.3%, partially offset by a decrease of 2.3% in November (revised from -2.4%). Analysts had expected orders to increase by 1.0%. Meanwhile, the overall supply of industrial goods increased by 2.2% (the maximum growth since December 2010), after rising 0.3% in November.

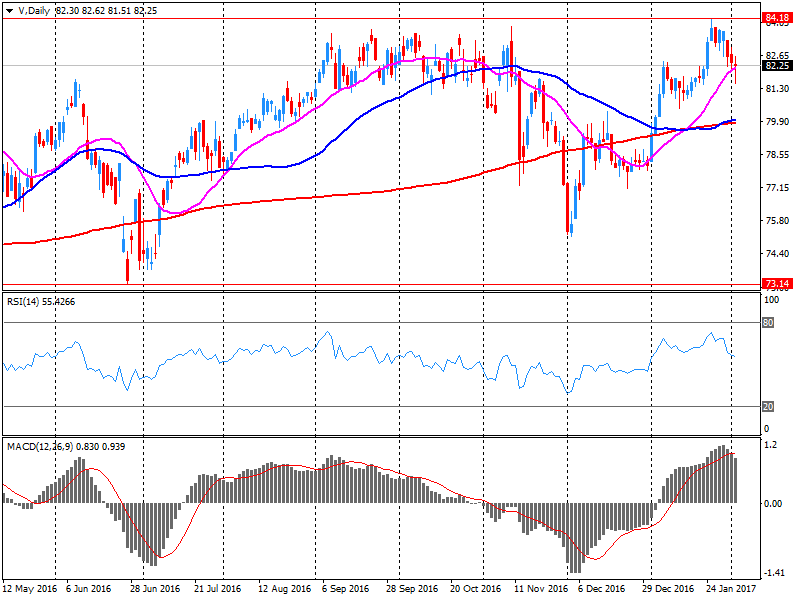

DOW index components closed mostly in positive territory (23 of 30). Most remaining shares fell NIKE, Inc. (NKE, -0.93%). leaders of growth were shares of Visa Inc. (V, + 4.78%).

All business sectors S & P index finished trading in positive territory. The leader turned out to be the financial sector (+ 1.7%).

-

20:00

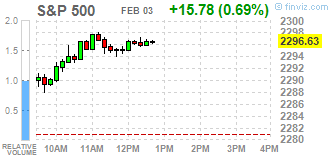

DJIA +0.88% 20,059.89 +174.98 Nasdaq +0.42% 5,660.11 +23.91 S&P +0.68% 2,296.29 +15.44

-

17:46

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes in positive area on Friday, as U.S. job growth surged more than expected in January as construction firms and retailers ramped up hiring, which likely gives the Trump administration a head start as it seeks to boost the economy and employment. Nonfarm payrolls increased by 227 000 jobs last month, the largest gain in four months, the Labor Department said on Friday. But the unemployment rate rose one-tenth of a percentage point to 4,8% and wages rose only by three cents, suggesting that there was still some slack in the labor market.

Most of Dow stocks in positive area (21 of 30). Top loser - Intel Corporation (INTC, -0.42%). Top gainer - Visa Inc. (V, +5.01%).

All S&P sectors in positive area. Top gainer - Financials (+1.6%).

At the moment:

Dow 19983.00 +162.00 +0.82%

S&P 500 2292.50 +17.00 +0.75%

Nasdaq 100 5151.75 +20.75 +0.40%

Oil 53.87 +0.33 +0.62%

Gold 1221.00 +1.60 +0.13%

U.S. 10yr 2.44 -0.02

-

17:00

European stocks closed: FTSE 100 +47.55 7188.30 +0.67% DAX +23.54 11651.49 +0.20% CAC 40 +31.13 4825.42 +0.65%

-

16:37

WSE: Session Results

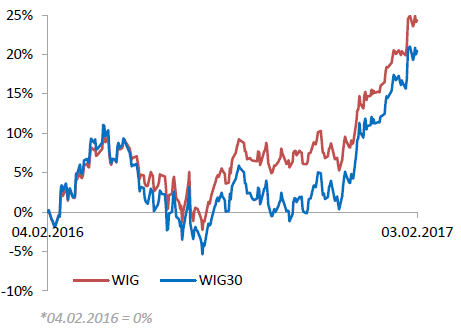

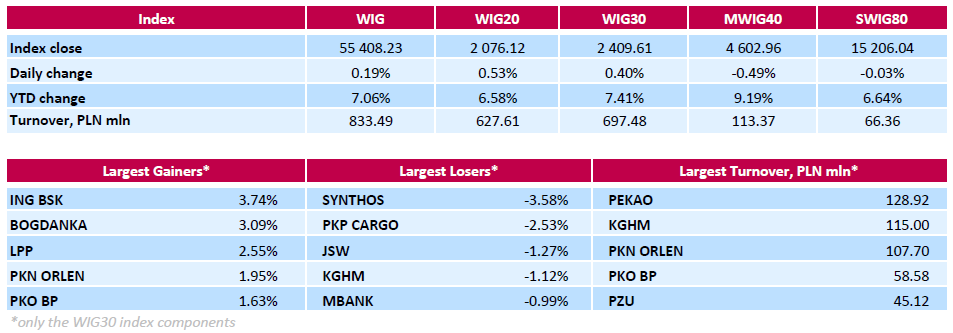

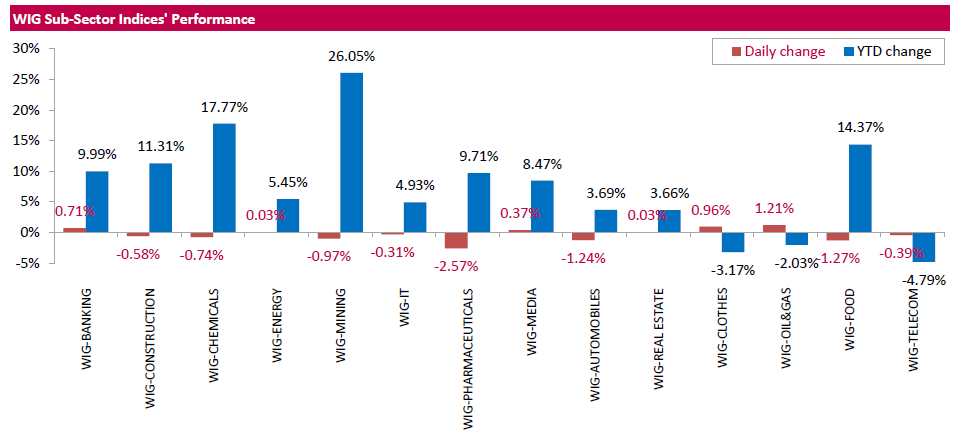

Polish equity market ended Friday on an optimistic note. The broad measure, the WIG index, recorded a 0.19% uptick. The WIG sub-sector indices mostly closed in negative territory, with WIG-PHARMASEUTICALS Index (-2.57%) lagging behind.

The large-cap stocks advanced 0.4%, as measured by the WIG30 Index. In the index basket, banking name ING BSK (WSE: ING) led the way up, climbing by 3.74% and almost fully erasing its yesterday's losses. It was followed by thermal coal miner BOGDANKA (WSE: LWB), clothing retailer LPP (WSE: LPP) and oil refiner PKN ORLEN (WSE: PKN), adding 3.09%, 2.55% and 1.95% respectively. The later (PKN ORLEN) reported yesterday that its fuel's refining margin edged up to $5/bbl in January from $4.90 in December, while its petrochemical margin slipped to EUR 855/t from 862 in the previous month. On the other side of the ledger, chemical producer SYNTHOS (WSE: SNS) posted the sharpest decline, down 3.58%. The other notable losers were railway freight transport operator PKP CARGO (WSE: PKP), coking coal miner JSW (WSE: JSW), copper producer KGHM (WSE: KGH) and bank MBANK (WSE: MBK), slumping by 0.99%-2.53%. Elsewhere, genco ENERGA (WSE: ENG) was under selling pressure, which pushed its quotations down by 0.79%, after the company reported it had recognized an impairment loss of PLN 132 mln ($33 mln) on its coal-fueled power plant in Ostroleka due to low prices of electricity, and this would weigh on the its 2016 operating profit.

-

15:39

US factory orders rose below expectations in December

New orders for manufactured durable goods in December decreased $1.0 billion or 0.4 percent to $227.0 billion, the U.S. Census Bureau announced today. This decrease, down two consecutive months, followed a 4.8 percent November decrease. Excluding transportation, new orders increased 0.5 percent. Excluding defense, new orders increased 1.7 percent. Transportation equipment, also down two consecutive months, drove the decrease, $1.7 billion or 2.2 percent to $73.7 billion.

-

15:23

US Tsy: Sanctions 13 Individuals, 12 Entities Under US Iran Sanctions Authority – Reuters

-

15:09

US ISM Non-Manufacturing Business Activity index below the December figure

The report was issued today by Anthony Nieves, chair of the Institute for Supply Management (ISM) Non-Manufacturing Business Survey Committee:

"The NMI registered 56.5 percent which is 0.1 percentage point lower than the seasonally adjusted December reading of 56.6. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index decreased to 60.3 percent, 0.6 percentage point lower than the seasonally adjusted December reading of 60.9 percent, reflecting growth for the 90th consecutive month, at a slightly slower rate in January.

The New Orders Index registered 58.6 percent, 2.1 percentage points lower than the seasonally adjusted reading of 60.7 percent in December. The Employment Index increased 2 percentage points in January to 54.7 percent from the seasonally adjusted December reading of 52.7 percent. The Prices Index increased 2.9 percentage points from the seasonally adjusted December reading of 56.1 percent to 59 percent; indicating prices increased for the 10th consecutive month, at a faster rate in January".

-

15:00

U.S.: Factory Orders , December 1.3% (forecast 1%)

-

15:00

U.S.: ISM Non-Manufacturing, January 56.5 (forecast 57)

-

14:51

WSE: After start on Wall Street

Today's quotations on Wall Street began with no surprises. After the data from the labor market indices have gone up significantly. In the case of the WSE there was virtually no response to the US data. Both the level of volatility and turnover indicate that investors have already started the weekend.

An hour before the close of trading the WIG20 index was at the level of 2,069 points (+ 0.22%).

-

14:49

Markit U.S. Services Business Activity Index rebounded to 55.6 in January

The seasonally adjusted final Markit U.S. Services Business Activity Index rebounded to 55.6 in January, up from December's three-month low of 53.9. Moreover, the latest reading was comfortably above the average for Q4 2016 (54.4) and signalled the fastest rate of business activity growth since November 2015.

Higher levels of business activity were mainly linked to improved sales growth and a more supportive economic backdrop. January's survey data revealed a robust and accelerated increase in new work received by service sector companies. The rate of expansion was the fastest since July 2015. Anecdotal evidence linked the rise to greater levels of business and consumer spending at the start of 2017.

-

14:45

U.S.: Services PMI, January 55.6 (forecast 55.1)

-

14:31

U.S. Stocks open: Dow +0.57%, Nasdaq +0.26%, S&P +0.44%

-

14:19

Before the bell: S&P futures +0.41%, NASDAQ futures +0.30%

U.S. stock-index futures rose, supported by much better-than-estimated U.S. nonfarm payrolls data.

Global Stocks:

Nikkei 18,918.20 +3.62 +0.02%

Hang Seng 23,129.21 -55.31 -0.24%

Shanghai 3,140.65 -18.51 -0.59%

FTSE 7,176.08 +35.33 +0.49%

CAC 4,840.95 +46.66 +0.97%

DAX 11,673.96 +46.01 +0.40%

Crude $53.74 (+0.37%)

Gold $1,215.80 (-0.30%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

37.91

0.23(0.6104%)

56083

ALTRIA GROUP INC.

MO

77.36

0.85(1.111%)

857

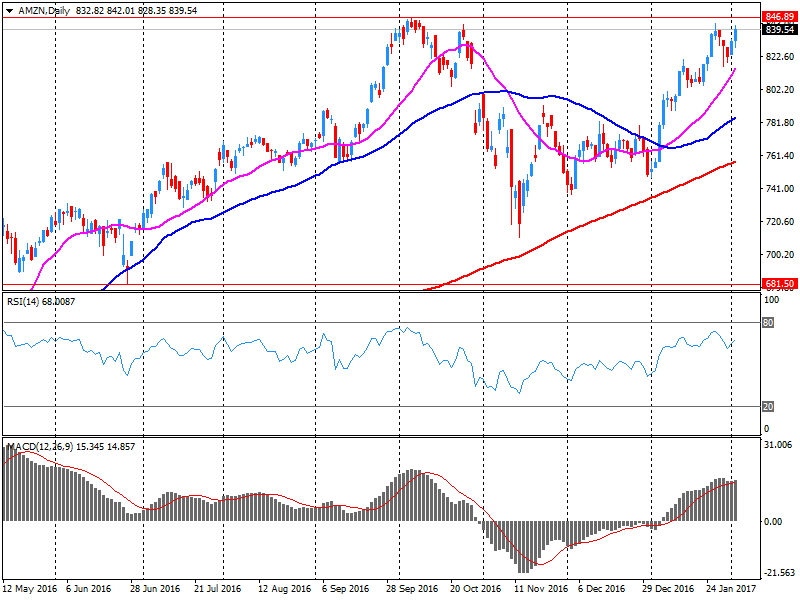

Amazon.com Inc., NASDAQ

AMZN

31.3

0.12(0.3849%)

262648

American Express Co

AXP

77.36

0.85(1.111%)

857

Apple Inc.

AAPL

77.36

0.85(1.111%)

857

AT&T Inc

T

41.11

-0.07(-0.17%)

2289

Barrick Gold Corporation, NYSE

ABX

18.92

-0.02(-0.1056%)

119844

Boeing Co

BA

163.5

1.24(0.7642%)

352

Caterpillar Inc

CAT

94.15

0.38(0.4052%)

678

Chevron Corp

CVX

163.5

1.24(0.7642%)

352

Cisco Systems Inc

CSCO

31.3

0.12(0.3849%)

262648

Citigroup Inc., NYSE

C

57.17

1.19(2.1258%)

247625

Exxon Mobil Corp

XOM

83.7

0.25(0.2996%)

5952

Facebook, Inc.

FB

130.9

0.06(0.0459%)

218884

Ford Motor Co.

F

12.45

0.17(1.3844%)

238789

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.57

-0.24(-1.4277%)

53570

General Motors Company, NYSE

GM

163.5

1.24(0.7642%)

352

Goldman Sachs

GS

234.45

4.04(1.7534%)

36104

Google Inc.

GOOG

163.5

1.24(0.7642%)

352

HONEYWELL INTERNATIONAL INC.

HON

77.36

0.85(1.111%)

857

Intel Corp

INTC

36.61

0.19(0.5217%)

1753

International Business Machines Co...

IBM

174.95

0.37(0.2119%)

2361

International Paper Company

IP

53.4

0.05(0.0937%)

3238

JPMorgan Chase and Co

JPM

86.1

1.51(1.7851%)

111641

McDonald's Corp

MCD

123.1

-0.12(-0.0974%)

1962

Merck & Co Inc

MRK

64.35

0.17(0.2649%)

2149

Microsoft Corp

MSFT

63.4

0.23(0.3641%)

61867

Nike

NKE

52.9

0.10(0.1894%)

2036

Pfizer Inc

PFE

77.36

0.85(1.111%)

857

Procter & Gamble Co

PG

87.95

0.19(0.2165%)

800

Starbucks Corporation, NASDAQ

SBUX

53.99

0.12(0.2228%)

358

The Coca-Cola Co

KO

41.54

0.14(0.3382%)

534

Twitter, Inc., NYSE

TWTR

163.5

1.24(0.7642%)

352

United Technologies Corp

UTX

77.36

0.85(1.111%)

857

Verizon Communications Inc

VZ

48.44

0.16(0.3314%)

10387

Visa

V

85.75

3.45(4.192%)

119049

Walt Disney Co

DIS

110.91

0.30(0.2712%)

4906

Yahoo! Inc., NASDAQ

YHOO

43.54

-0.15(-0.3433%)

335

Yandex N.V., NASDAQ

YNDX

23.48

0.15(0.6429%)

3900

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

-

13:43

Upgrades and downgrades before the market open

Upgrades:

Ford Motor (F) upgraded to Overweight from Equal Weight at Barclays

Altria (MO) downgraded to Hold from Buy at Berenberg

Intl Paper (IP) downgraded to Neutral from Buy at DA Davidson

Downgrades:

Other:

Amazon (AMZN) target lowered to $905 from $920 at Mizuho

Amazon (AMZN) target lowered to $900 from $950 at RBC Capital Mkts

Amazon (AMZN) target raised to $912 from $888 at Stifel

Visa (V) target raised to $105 from $93 at Stifel

-

13:33

Total US nonfarm payroll employment increased by 227,000 in January. Average hourly earnings above expectations

Total nonfarm payroll employment increased by 227,000 in January, and the unemployment rate was little changed at 4.8 percent, the U.S. Bureau of Labor Statistics reported today. Job gains occurred in retail trade, construction, and financial activities.

Both the number of unemployed persons, at 7.6 million, and the unemployment rate, at 4.8 percent, were little changed in January.

The average workweek for all employees on private nonfarm payrolls was unchanged at 34.4 hours in January. In manufacturing, the workweek edged up by 0.1 hour to 40.8 hours, while overtime edged down by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls was 33.6 hours for the sixth consecutive month.

In January, average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $26.00, following a 6-cent increase in December. Over the year, average hourly earnings have risen by 2.5 percent. In January, average hourly earnings of private-sector production and nonsupervisory employees increased by 4 cents to $21.84.

-

13:30

U.S.: Unemployment Rate, January 4.8% (forecast 4.7%)

-

13:30

U.S.: Nonfarm Payrolls, January 227 (forecast 175)

-

13:06

-

13:00

Orders

EUR/USD

Offers: 1.0830 1.0850-55 1.0885 1.0900

Bids: 1.0780 1.0760 1.0730 1.0700 1.0680 1.0655-60

GBP/USD

Offers: 1.2560 1.2580 1.2600 1.2620 1.2650 1.2680 1.2700-05

Bids: 1.2520 1.2500 1.2485 1.2450 1.2430 1.2400

EUR/GBP

Offers: 0.8600 0.8620 0.8635 0.8650

Bids: 0.8550-60 0.8530 0.8500 0.8475-80 0.8450

EUR/JPY

Offers: 121.80-85 122.00 1.2230 122.60 122.80 123.00

Bids: 121.25-30 121.00 120.80 120.50 120.00

USD/JPY

Offers: 113.20 113.50 113.80 114.00 114.30 114.50

Bids: 112.80 112.45-50 112.20-25 112.00

AUD/USD

Offers: 0.7685 0.7700 0.7730 0.7750 0.7780 0.7800

Bids: 0.7630 0.7600 0.7580 0.7550 0.7520 0.7500

Информационно-аналитический отдел TeleTrade

-

12:50

Company News: Amazon (AMZN) beats on EPS, misses on revenues

Amazon reported Q4 FY 2016 earnings of $1.54 per share (versus $1.00 in Q4 FY 2015), beating analysts' consensus estimate of $1.42.

The company's quarterly revenues amounted to $43.741 bln (+22.4% y/y), missing analysts' consensus estimate of $44.690 bln.

The company also issued downside guidance for Q1 FY 2017, projecting revenues of $33.25-35.75 bln (+14%-23% y/y) versus analysts' consensus estimate of $36 bln.

AMZN fell to $806.65 (-3.96%) in pre-market trading.

-

12:00

WSE: Mid session comment

The morning phase of the session was in line with our previous expectations. The behavior of the WIG20 index was virtually a copy of the German DAX. Volatility is low same like the turnover. Any recovery is expected around the area, when data from the US labor market will appear.

At the halfway point of today's session the WIG20 index was at the level of 2,069 points (+0,18%) and the turnover in the segment of blue chips was amounted to PLN 250 million.

-

11:58

BofA Merrill: We look for nonfarm payroll job growth of 160,000 in January

"We look for nonfarm payroll job growth of 160,000 in January, about unchanged from 156,000 in the prior month and the 3-month moving average of 165,000. There have been some discussions in the news about a hiring freeze of federal workers, but this should have only a very minimal impact on the jobs report, as the average monthly gain in federal jobs over the past year was 3,000 and the freeze only went into effect January 22. The unemployment rate is likely to hold at 4.7%, which assumes little change in the labor force participation rate. However, there is certainly scope for changes in the labor force.

Given that the unemployment rate is already at or below most measures of full employment, there is a great deal of attention placed on the trend going forward. A further decline in the unemployment rate-even if prompted by a drop in the labor force participation rate-would strengthen the case for the Fed to hike rates, putting upward pressure on our forecast of 1 hike for this year".

-

11:19

Goldman Sachs: We expect a January non-farm payrolls print of 200k

"We expect a January non-farm payrolls print of 200k (consensus +175k, last +156k). We also expect the unemployment rate to fall one-tenth to 4.6% − which would mark a return to the cycle low - in part driven by reduced year-end retail layoffs. We expect average hourly earnings to rise 0.3% month over month and 2.8% year over year reflecting firming wage growth and state-level minimum wage hikes".

-

10:48

Retail trade fell by 0.3% in the euro area

In December 2016 compared with November 2016, the seasonally adjusted volume of retail trade fell by 0.3% in the euro area (EA19) and by 0.8% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In November the retail trade volume decreased by 0.6% in the euro area and by 0.1% in the EU28. In December 2016 compared with December 2015 the calendar adjusted retail sales index increased by 1.1% in the euro area and by 2.3% in the EU28. The average retail trade for the year 2016, compared with 2015, rose by 1.8% in the euro area and by 2.8% in the EU28.

-

10:00

Eurozone: Retail Sales (MoM), December -0.3% (forecast 0.3%)

-

10:00

Eurozone: Retail Sales (YoY), December 1.1% (forecast 1.8%)

-

09:30

United Kingdom: Purchasing Manager Index Services, January 54.5 (forecast 55.8)

-

09:04

Euro zone services sector has signalled expansion in each of the past 43 months

The eurozone economy made a strong start to 2017, with output growth maintained at December's five-and-a-half year high and job creation accelerating to a near-nine year record. The final Markit Eurozone PMI Composite Output Index posted 54.4 in January, unchanged from December and a tick above the earlier flash estimate of 54.3. The headline index has signalled expansion in each of the past 43 months.

-

09:00

Solid expansion for German services sector

At 53.4 in January, the final seasonally adjusted Markit Germany Services PMI Business Activity Index pointed to a solid expansion of output during January. That said, the latest figure was down from 54.3 in December and below the average over 2016 as a whole (54.1). Surveyed firms linked greater activity to new business gains, although there were also reports of lower demand in some cases.

-

09:00

Eurozone: Services PMI, January 53.7 (forecast 53.6)

-

08:59

Major stock markets in Europe trading mixed: FTSE -0.1%, DAX + 0.1%, CAC40 + 0.2%, FTMIB + 0.3%, IBEX flat

-

08:55

Germany: Services PMI, January 53.4 (forecast 53.2)

-

08:50

France: Services PMI, January 54.1 (forecast 53.9)

-

08:22

The Spanish service sector remained in growth territory at the start of 2017 - Markit

The Spanish service sector remained in growth territory at the start of 2017 amid a sharper expansion of new business. Business activity and employment rose solidly again while expectations regarding the 12-month outlook were the highest since last April. Companies recorded a steeper increase in input costs, but the rate of inflation of output prices remained marginal.

The headline seasonally adjusted Business Activity Index posted at 54.2 in January, down from 55.0 in the previous month but still signalling a solid monthly increase in activity

-

08:19

WSE: After opening

WIG20 index opened at 2065.59 points (+0.02%)*

WIG 55296.40 -0.01%

WIG30 2398.23 -0.08%

mWIG40 4629.62 0.08%

*/ - change to previous close

The beginning of trade both in Europe and on the Warsaw market was held with modest changes in indices, so no surprises. Traditionally, market activity is focused on the shares of KGHM. Investors are waiting for the US data, thus we do not expect greater volatility before the afternoon phase of the session.

After fifteen minutes of trading WIG 20 index stood at 2,063 points (-0.06%).

-

07:27

Options levels on friday, February 3, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0884 (4014)

$1.0840 (3059)

$1.0812 (2482)

Price at time of writing this review: $1.0757

Support levels (open interest**, contracts):

$1.0695 (1761)

$1.0638 (2892)

$1.0604 (2617)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 66172 contracts, with the maximum number of contracts with strike price $1,0800 (4014);

- Overall open interest on the PUT options with the expiration date March, 13 is 76719 contracts, with the maximum number of contracts with strike price $1,0000 (5258);

- The ratio of PUT/CALL was 1.16 versus 1.14 from the previous trading day according to data from February, 2

GBP/USD

Resistance levels (open interest**, contracts)

$1.2805 (2985)

$1.2708 (2702)

$1.2612 (1802)

Price at time of writing this review: $1.2522

Support levels (open interest**, contracts):

$1.2391 (1877)

$1.2294 (3284)

$1.2196 (1327)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 29400 contracts, with the maximum number of contracts with strike price $1,2500 (3305);

- Overall open interest on the PUT options with the expiration date March, 13 is 33407 contracts, with the maximum number of contracts with strike price $1,2300 (3284);

- The ratio of PUT/CALL was 1.14 versus 1.09 from the previous trading day according to data from February, 2

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:23

WSE: Before opening

The main US stock indexes recorded on Thursday minor changes. In the spotlight are the decisions of central banks in the UK and the United States. On Wall Street last earnings season. Half of the companies listed on the S&P500 has made its results, of which 67 percent positively surprised. Markets are waiting for Friday's data from the US labor market, one of the most important macro reports each month. Thus today's trading in Europe will have two phases. The first will be waiting for US data, and the other - reaction to these data in solidarity with other markets.

On the Warsaw stock market, from a technical point of view, we are dealing with the consolidation after growth waves. In the currency market, the morning trade brings correction of recent appreciation of the zloty. Polish currency is valued by the market as follows: PLN 4.3148 per euro, 4.0150 PLN against the US dollar. Yields on Polish debt amounts to 3.827% in the case of 10-year bonds.

-

07:12

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.2%

-

07:11

Bank of Japan, Kuroda: monetary policy is not a means of financing the budget

Today the chairman of the Bank of Japan Kuroda said in a speech in Parliament that he intends to continue powerful monetary easing and to achieve the inflation target of 2% as soon as possible. Also he said that monetary policy is not a means of financing the budget.

-

07:05

Chinese manufacturers reported a further rise in client demand during January - Markit

The seasonally adjusted Purchasing Managers' Index (PMI) - a composite indicator designed to provide a single-figure snapshot of operating conditions in the manufacturing economy - posted 51.0 in January to signal a further improvement in the health of the sector. However, the reading was down from December's 47-month record of 51.9, and was consistent with only a marginal rate of improvement.

Manufacturers reported a further rise in client demand during January, as highlighted by a sustained increase in new orders. That said, the rate of expansion slowed since December's recent peak and was moderate overall. This was despite a renewed upturn in new export business, which increased at a solid pace that was the fastest since September 2014.

-

07:00

BoE's Broadbent: UK consumers face a more challenging environment in 2017, to be helped by higher business confidence after Trump victory @Livesquawk

-

06:28

Global Stocks

European stocks lost ground Thursday, with Deutsche Bank AG among the companies whose shares investors are chopping down in the wake of financial updates. U.K. stocks, however, bucked the negative trend on Thursday, moving higher after the Bank of England struck a more dovish tone in its latest policy update than analysts had expected.

U.S. stocks closed mostly lower after bouncing around Thursday as concerns about President Donald Trump's approach on foreign affairs amid spats with key allies and trade partners cast a pall over the market. A round of headlines from Trump's administration included a decision to put Iran "on notice" over potential new sanctions and testy exchanges with the heads of two of the U.S.'s best allies and trade partners: Australia and Mexico.

Stock investors were struggling for footing Friday as encouraging economic data this week was counterbalanced by concern of political risk surrounding the administration of U.S. President Donald Trump. "Everyone is talking about it...the U.S. could be moving away from globalization," said Chris Weston, chief market strategist at IG.

-

01:45

China: Markit/Caixin Manufacturing PMI, January 51.0 (forecast 51.8)

-