Market news

-

23:32

Commodities. Daily history for Feb 02’2017:

(raw materials / closing price /% change)

Oil 53.64 +0.19%

Gold 1,217.50 -0.16%

-

23:32

Stocks. Daily history for Feb 02’2017:

(index / closing price / change items /% change)

Nikkei -233.50 18914.58 -1.22%

TOPIX -17.36 1510.41 -1.14%

Hang Seng -133.87 23184.52 -0.57%

FTSE 100 +33.10 7140.75 +0.47%

DAX -31.55 11627.95 -0.27%

CAC 40 -0.29 4794.29 -0.01%

DJIA -6.03 19884.91 -0.03%

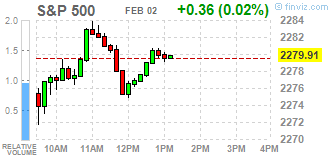

S&P 500 +1.30 2280.85 +0.06%

NASDAQ -6.45 5636.20 -0.11%

-

23:31

Currencies. Daily history for Feb 02’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0758 -0,09%

GBP/USD $1,2526 -0,26%

USD/CHF Chf0,9926 -0,03%

USD/JPY Y112,79 -0,39%

EUR/JPY Y121,34 -0,49%

GBP/JPY Y141,29 -0,01%

AUD/USD $0,7656 +0,95%

NZD/USD $0,7286 +0,11%

USD/CAD C$1,3025 -0,17%

-

23:01

Schedule for today, Friday, Feb 03’2017 (GMT0)

01:45 China Markit/Caixin Manufacturing PMI January 51.9 51.8

08:50 France Services PMI (Finally) January 52.9 53.9

08:55 Germany Services PMI (Finally) January 54.3 53.2

09:00 Eurozone Services PMI (Finally) January 53.7 53.6

09:30 United Kingdom Purchasing Manager Index Services January 56.2 55.8

10:00 Eurozone Retail Sales (MoM) December -0.4% 0.3%

10:00 Eurozone Retail Sales (YoY) December 2.3% 1.8%

13:30 U.S. Average workweek January 34.3 34.3

13:30 U.S. Average hourly earnings January 0.4% 0.3%

13:30 U.S. Unemployment Rate January 4.7% 4.7%

13:30 U.S. Nonfarm Payrolls January 156 175

14:15 U.S. FOMC Member Charles Evans Speaks

14:45 U.S. Services PMI (Finally) January 53.9 55.1

15:00 U.S. Factory Orders December -2.4% 1%

15:00 U.S. ISM Non-Manufacturing January 57.2 57

-

22:30

Australia: AIG Services Index, January 54.5

-

21:08

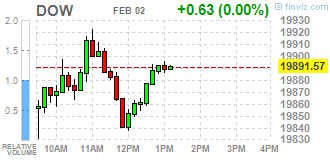

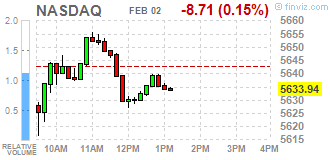

Major US stock indexes showed little change

Major US stock indexes finished trading around as investors on their guard against the latest protectionist decisions President Donald Trump. In recent weeks, Trump's priorities, such as the imposition of travel restrictions to the United States and out of the trade agreement, have caused uncertainty and made them unpredictable for investors.

As it became known today, the number of Americans who applied for unemployment benefits fell more than expected last week, pointing to a tightening of labor market conditions, which should support the economy this year. Primary applications for state unemployment benefits fell by 14,000 and amounted to a seasonally adjusted 246,000 for the week ending January 28, reported Thursday the Ministry of Labour.

However, the report published by Challenger Gray & Christmas Inc, showed that the number of job cuts in the USA in January was 45,934 compared to 33,627 in December. However, compared with the same period of 2016, the number of job cuts decreased significantly (then figure was 75,114).

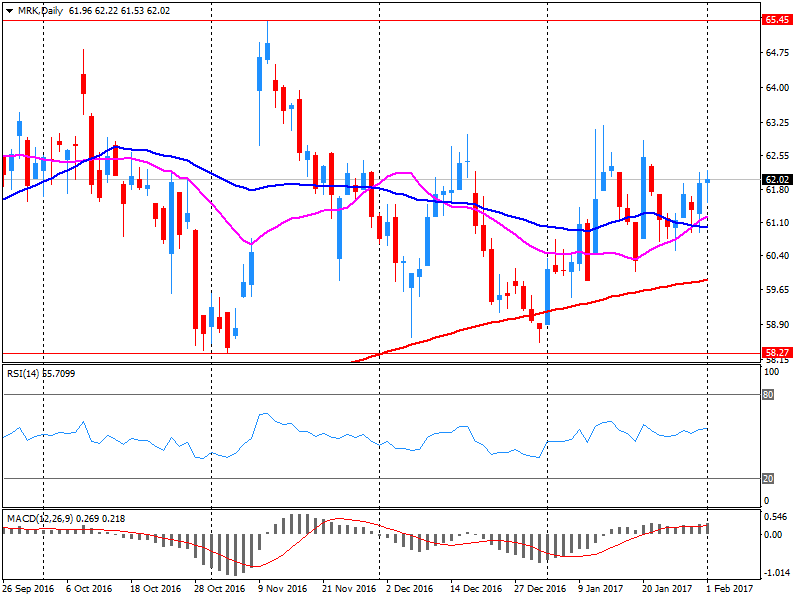

DOW index components closed mostly in the red (17 of 30). Most remaining shares fell Caterpillar Inc. (CAT, -1.46%). leaders of growth were shares of Merck & Co., Inc. (MRK, + 3.19%).

Sector S & P index finished the session mixed. The leader turned utilities sector (+ 0.8%). the health sector fell the most (-0.7%).

At the close:

Dow -0.03% 19,884.98 -5.96

Nasdaq -0.11% 5,636.20 -6.45

S & P + 0.06% 2,280.85 +1.30

-

20:00

DJIA -0.18% 19,855.04 -35.90 Nasdaq -0.26% 5,628.05 -14.60 S&P -0.13% 2,276.57 -2.98

-

18:14

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Thursday, as investors turned wary following President Donald Trump's latest protectionist comments. Trump in a meeting with key lawmakers said he would like to speed up talks to either renegotiate or replace the North American Free Trade Agreement (NAFTA). Investors are also assessing possible consequences of Trump's other comments, including labeling a refugee swap agreement with staunch ally Australia as a "dumb deal" and putting Iran "on notice" for firing a ballistic missile.

Most of Dow stocks in negative area (17 of 30). Top loser - UnitedHealth Group Incorporated (UNH, -1.22%). Top gainer - Merck & Co., Inc. (MRK, +2.69%).

S&P sectors mixed. Top loser - Utilities (+0.8%). Top loser - Healthcare (-0.6%).

At the moment:

Dow 19820.00 +4.00 +0.02%

S&P 500 2275.25 +0.75 +0.03%

Nasdaq 100 5140.00 -8.50 -0.17%

Oil 53.65 -0.23 -0.43%

Gold 1217.00 +8.70 +0.72%

U.S. 10yr 2.47 -0.01

-

17:01

European stocks closed: FTSE 100 +33.10 7140.75 +0.47% DAX -31.55 11627.95 -0.27% CAC 40 -0.29 4794.29 -0.01%

-

16:40

WSE: Session Results

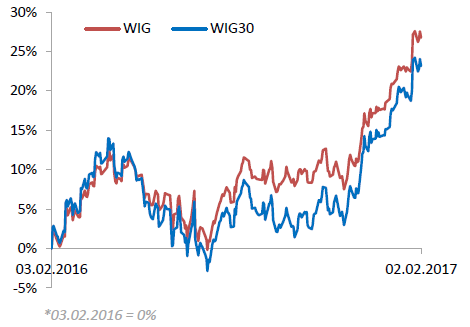

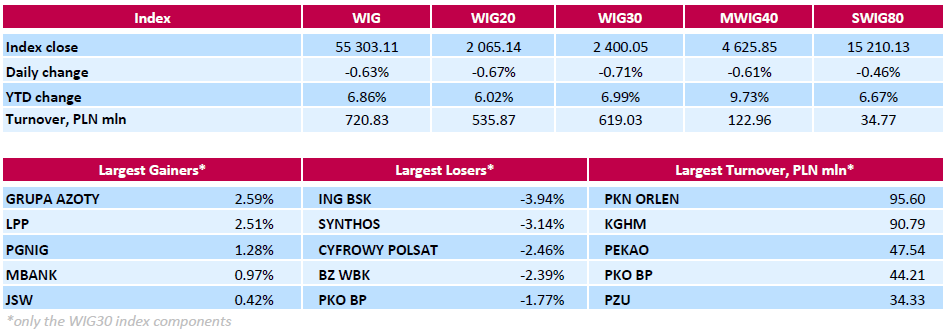

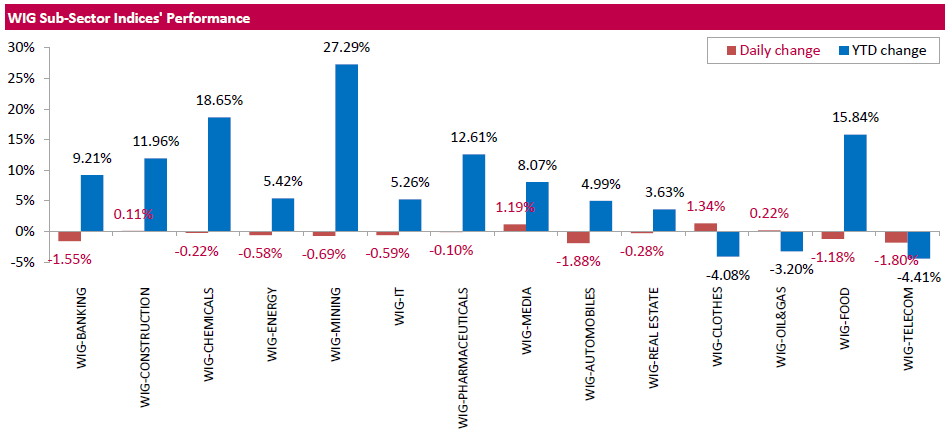

Polish equity market closed lower on Thursday. The broad market measure, the WIG Index, declined by 0.63%. The WIG sub-sector indices mostly closed in negative territory, with WIG-AUTOMOBILES Index (-1.88%) lagging behind.

The large-cap stocks' gauge, the WIG30 Index, fell by 0.71%. A majority of the index components declined, with banking name ING BSK (WSE: ING) underperforming with a 3.94% drop, weighted down by worse-than-forecast Q4 earnings result. The bank reported its net profit amounted to PLN 254.9 mln (+23.9 y/y) in Q4, missing analysts' consensus estimate of PLN 271.8 mln. Other major laggards were chemical producer SYNTHOS (WSE: SNS), media group CYFROWY POLSAT (WSE: CPS) and bank BZ WBK (WSE: BZW), which tumbled by 3.14%, 2.46% and 2.39% respectively. At the same time, chemical producer GRUPA AZOTY (WSE: ATT) and clothing retailer LPP (WSE: LPP) led a handful of gainers, advancing 2.59% and 2.51% respectively. The later was helped by monthly sales report, which revealed the group's revenues totaled about PLN 508 mln in January 2017, up 22% y/y.

-

15:35

The dollar fell to its lowest level in more than two months against other currencies on rising doubts about Trump

-

14:54

WSE: After start on Wall Street

Quotations in the US began with discounts. Today's macro data brought little new to the valuations and investors are clearly waiting for tomorrow's monthly report from the labor market. From the Warsaw market today blows boredom and probably this image will be continued to the end of the session.

An hour before the close of trading WIG20 index was at the level of 2,074 points (-0.24%).

-

14:43

BOE Carney: Trump fiscal stimulus to boost global growth outlook

-

14:33

U.S. Stocks open: Dow -0.25%, Nasdaq -0.41%, S&P -0.29%

-

14:29

Before the bell: S&P futures -0.25%, NASDAQ futures -0.22%

U.S. stock-index futures fell after the Federal Reserve gave little insight into whether it would raise interest rates at its next meeting, even as the central bank painted an upbeat picture of the economy.

Global Stocks:

Nikkei 18,914.58 -233.50 -1.22%

Hang Seng 23,184.52 -133.87 -0.57%

Shanghai - Closed

FTSE 7,162.58 +54.93 +0.77%

CAC 4,802.89 +8.31 +0.17%

DAX 11,638.98 -20.52 -0.18%

Crude $54.02 (+0.26%)

Gold $1,225.20 (+1.40%)

-

13:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

36.68

0.42(1.1583%)

9017

ALTRIA GROUP INC.

MO

71.5

0.11(0.1541%)

2849

Amazon.com Inc., NASDAQ

AMZN

837

4.65(0.5587%)

45263

Apple Inc.

AAPL

128.29

-0.46(-0.3573%)

170494

AT&T Inc

T

42

-0.06(-0.1427%)

2659

Barrick Gold Corporation, NYSE

ABX

19

0.52(2.8139%)

154158

Boeing Co

BA

163.81

-0.16(-0.0976%)

2018

Caterpillar Inc

CAT

95

-0.11(-0.1157%)

1266

Chevron Corp

CVX

111.21

0.21(0.1892%)

1006

Cisco Systems Inc

CSCO

30.55

0.05(0.1639%)

20174

Citigroup Inc., NYSE

C

55.35

-0.54(-0.9662%)

21505

Deere & Company, NYSE

DE

107.39

0.24(0.224%)

1000

E. I. du Pont de Nemours and Co

DD

76.15

-0.19(-0.2489%)

600

Exxon Mobil Corp

XOM

83.08

0.14(0.1688%)

6643

Facebook, Inc.

FB

134.47

1.24(0.9307%)

1741995

FedEx Corporation, NYSE

FDX

185.27

-1.00(-0.5369%)

164

Ford Motor Co.

F

12.29

-0.03(-0.2435%)

24489

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.62

-0.22(-1.3064%)

18840

General Electric Co

GE

29.64

-0.05(-0.1684%)

1940

General Motors Company, NYSE

GM

36.12

-0.02(-0.0553%)

1725

Goldman Sachs

GS

228.67

-2.00(-0.867%)

6417

Google Inc.

GOOG

793.28

-2.415(-0.3035%)

2036

Intel Corp

INTC

36.35

-0.17(-0.4655%)

50774

International Business Machines Co...

IBM

173.82

-0.47(-0.2697%)

365

International Paper Company

IP

55.41

-1.09(-1.9292%)

1715

Johnson & Johnson

JNJ

112.83

-0.40(-0.3533%)

710

JPMorgan Chase and Co

JPM

84.15

-0.80(-0.9417%)

13308

McDonald's Corp

MCD

122.17

-0.25(-0.2042%)

201

Merck & Co Inc

MRK

62.34

0.24(0.3865%)

180948

Microsoft Corp

MSFT

63.38

-0.20(-0.3146%)

35843

Nike

NKE

52.79

-0.23(-0.4338%)

1868

Pfizer Inc

PFE

31.51

-0.16(-0.5052%)

2484

Starbucks Corporation, NASDAQ

SBUX

53.85

-0.05(-0.0928%)

9753

Tesla Motors, Inc., NASDAQ

TSLA

247.75

-1.49(-0.5978%)

11288

The Coca-Cola Co

KO

41.18

-0.08(-0.1939%)

7846

Twitter, Inc., NYSE

TWTR

17.38

0.14(0.8121%)

57988

United Technologies Corp

UTX

108.01

-0.17(-0.1571%)

1253

Verizon Communications Inc

VZ

48.46

0.07(0.1447%)

3629

Visa

V

82.77

0.33(0.4003%)

2291

Wal-Mart Stores Inc

WMT

66.2

-0.03(-0.0453%)

1305

Walt Disney Co

DIS

111.05

-0.25(-0.2246%)

4596

Yandex N.V., NASDAQ

YNDX

23.43

0.07(0.2997%)

934

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

-

13:49

Upgrades and downgrades before the market open

Upgrades:

Apple (AAPL) upgraded to Hold from Sell at BGC

Alcoa (AA) upgraded to Overweight from Neutral at JP Morgan

Downgrades:

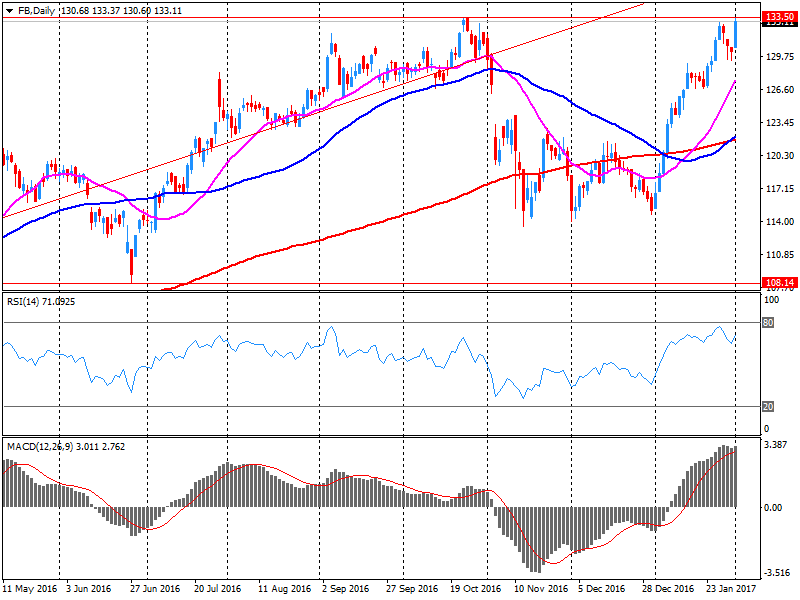

Facebook (FB) downgraded to Hold at Pivotal Research Group; target lowered to $135

Other:

Facebook (FB) target raised to $148 from $146 at Mizuho

-

13:37

Company News: Facebook (FB) posts stronger-than-expected Q4 results

Facebook reported Q4 FY 2016 earnings of $1.41 per share (versus $0.79 in Q4 FY 2015), beating analysts' consensus estimate of $1.31.

The company's quarterly revenues amounted to $8.809 bln (+50.8% y/y), beating analysts' consensus estimate of $8.495 bln.

FB rose to $134.40 (+0.88%) in pre-market trading.

-

13:36

US nonfarm business sector labor productivity increased at a 1.3-percent annual rate

Nonfarm business sector labor productivity increased at a 1.3-percent annual rate during the fourth quarter of 2016, the U.S. Bureau of Labor Statistics reported today, as output increased 2.2 percent and hours worked increased 0.9 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates.) From the fourth quarter of 2015 to the fourth quarter of 2016, productivity increased 1.0 percent, reflecting increases in output and hours worked of 2.2 percent and 1.1 percent, respectively. Annual average productivity increased 0.2 percent from 2015 to 2016.

-

13:35

US initial jobless claims lower than expected

In the week ending January 28, the advance figure for seasonally adjusted initial claims was 246,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 259,000 to 260,000. The 4-week moving average was 248,000, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 245,500 to 245,750.

-

13:30

U.S.: Initial Jobless Claims, 246 (forecast 250)

-

13:30

U.S.: Unit Labor Costs, q/q, Quarter IV 1.7% (forecast 1.9%)

-

13:30

U.S.: Nonfarm Productivity, q/q, Quarter IV 1.3% (forecast 1%)

-

13:30

U.S.: Continuing Jobless Claims, 2064 (forecast 2065)

-

13:26

Company News: Merck (MRK) posts Q4 EPS in line with analysts' estimates

Merck reported Q4 FY 2016 earnings of $0.89 per share (versus $0.93 in Q4 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $10.115 bln (-1% y/y), missing analysts' consensus estimate of $10.234 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $3.72-3.87 (versus analysts' consensus estimate of $3.87) and revenues of $38.60-40.10 bln (versus analysts' consensus estimate of $40.19 bln).

MRK fell to $62.00 (-0.16%) in pre-market trading.

-

13:14

-

13:08

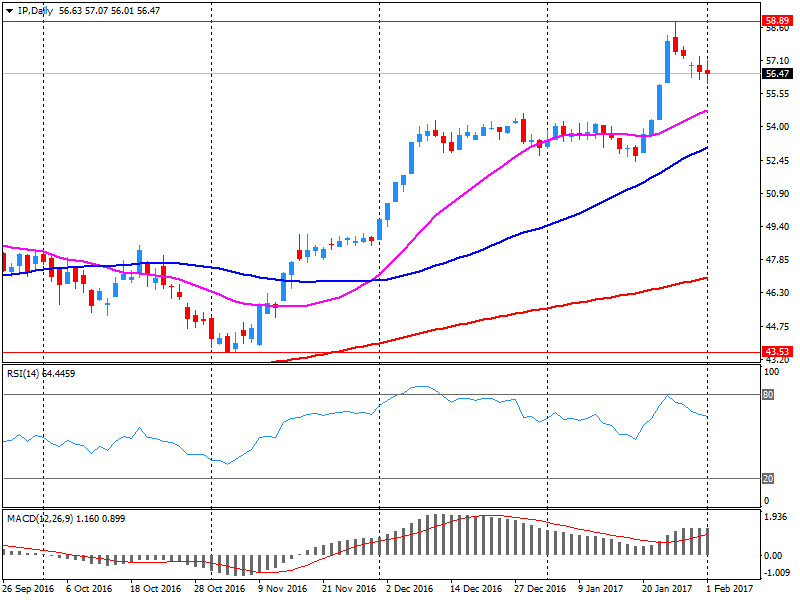

Company News: Intl Paper (IP) Q4 results beat analysts’ expectations

Intl Paper reported Q4 FY 2016 earnings of $0.73 per share (versus $0.87 in Q4 FY 2015), beating analysts' consensus estimate of $0.71.

The company's quarterly revenues amounted to $5.381 bln (-1.1% y/y), beating analysts' consensus estimate of $5.320 bln.

IP rose to $57.00 (+0.89%) in pre-market trading.

-

13:01

Orders

UR/USD

Offers: 1.0830 1.0850-55 1.0885 1.0900

Bids: 1.0780 1.0760 1.0730 1.0700 1.0680 1.0655-60

GBP/USD

Offers: 1.2700-05 1.2725-30 1.2750 1.2775 1.2800 1.2830 1.2850

Bids: 1.2650-60 1.620-25 1.2600 1.2580 1.2550 1.2520 1.2500

EUR/GBP

Offers: 0.8530 0.8550 0.8580 0.8600 0.8620 0.8635 0.8650

Bids: 0.8500 0.8475-80 0.8450 0.8430 0.8400

EUR/JPY

Offers: 121.85 122.00 1.2230 122.60 122.80 123.00

Bids: 121.30 121.00 120.80 120.50 120.00

USD/JPY

Offers: 113.00 113.20 113.50 113.80 114.00 114.30 114.50

Bids: 112.45-50 112.20-25 112.00 111.85 111.50 111.00

AUD/USD

Offers: 0.7685 0.7700 0.7730 0.7750 0.7780 0.7800

Bids: 0.7650 0.7630 0.7600 0.7580 0.7550 0.7520 0.7500

-

12:10

BOE Sees Inflation rate At 2.7% in 1Q 2018, 2.6% in 1Q 2019, 2.4% in 1Q 2020, Little Changed

-

Increased Labor Slack Weakens Inflationary Pressures

-

Stronger Growth Due to Fiscal Stimulus, Improved Global Outlook

-

0 Voted to Increase Rate

-

9 Voted to Keep Rate Unchanged

-

Cuts Estimate Of Sustainable Unemployment Rate to 4.5% Vs 5%

-

2018 Growth Forecast to 1.6% Vs 1.5%; 2019 Forecast to 1.7% Vs 1.6%

-

Could Cut Key Rate If Consumer Spending Weaker Than Expected

-

Could Raise Key Rate If Wages Growth Faster Than Expected

-

Monetary Policy Can Move In Either Direction

-

-

12:07

Bank of England MPC voted unanimously to maintain interest rate at 0.25%

The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 1 February 2017, the Committee voted unanimously to maintain Bank Rate at 0.25%.

The Committee voted unanimously to continue with the programme of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, totalling up to £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

-

12:03

WSE: Mid session comment

The first half of today's trading has not brought major changes. Both the Warsaw market and on exchanges Euroland prevail slight descent down. Above-average weakness stands out the banking sector. The level of turnover on both the broad market and the sector's largest companies is mediocre.

After four hours of trading the WIG20 index was at the level of 2,074 points (-0,25%).

-

12:01

United Kingdom: Asset Purchase Facility, 435 (forecast 435)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.25% (forecast 0.25%)

-

11:20

Barclays expects Bank of England to raise GDP forecasts at today’s meeting

"On Thursday, we expect the BoE to maintain its current policy parameters but likely higher GDP growth forecasts should support rate hike expectations and GBP. Given the strong performance of the UK economy over Q4, the Bank is likely to adjust higher its growth forecasts but may also note some concern about the sustainability of consumption, given the high level of household debt. The inflation forecasts are likely to stay unchanged as Q4 inflation was close to the bank's forecast while a lessening of imported price pressures and higher UK interest rates are counterbalanced by higher inflation globally" - efxnews.

-

10:32

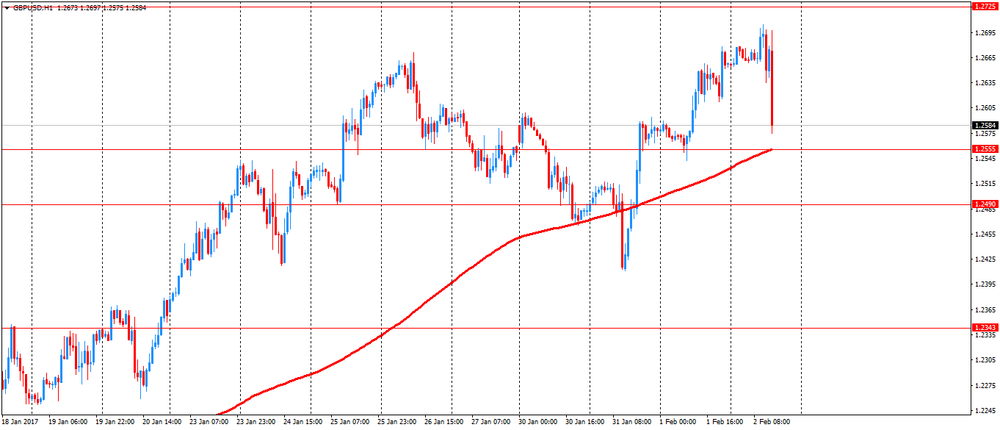

Formidable resistance at 1.2775 for GBP/USD - NAB

"The key question is the extent to which this good political news is now already in the price of the pound? The sharp rally in GBP/USD reflects some disappointment with the USD as much as a less bleak near-term outlook for the GBP and, with the better growth and monetary policy outlook in the United States, we expect the USD to now gradually begin to find more investor support. The December 2016 high of GBP/USD1.2775 should provide formidable technical resistance to the recent rally and though the Bank of England on Thursday may try to talk tougher on inflation, no-one seriously expects a rate hike at any point over the next 12 months".

-

10:10

Euro area producer prices rose more than expected in December

In December 2016, compared with November 2016, industrial producer prices rose by 0.7% in the euro area (EA19) and by 0.9% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In November 2016 prices increased by 0.3% in the euro area and by 0.2% in the EU28.

In December 2016, compared with December 2015, industrial producer prices rose by 1.6% in the euro area and by 2.4% in the EU28. The average industrial producer price for the year 2016, compared with 2015, decreased by 2.3% in the euro area and by 1.9% in the EU28.

-

10:00

Eurozone: Producer Price Index (YoY), December 1.6% (forecast 1.3%)

-

10:00

Eurozone: Producer Price Index, MoM , December 0.7% (forecast 0.4%)

-

09:34

UK January data revealed a slowdown in construction sector growth

January data revealed a slowdown in construction sector growth, with business activity and incoming new work both expanding at weaker rates than at the end of 2016. Despite this, survey respondents signalled that confidence regarding the year-ahead outlook picked up to its strongest since December 2015, largely reflecting new project starts and a resilient economic backdrop. This contributed to the fastest rise in employment numbers since May 2016. Meanwhile, exchange rate depreciation against the euro and the US dollar resulted in the strongest rate of input cost inflation since August 2008.

The seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index® (PMI® ) registered 52.2 in January, down from 54.2 in December.

-

09:30

United Kingdom: PMI Construction, January 52.2 (forecast 53.8)

-

08:59

Swiss retail sales down 3.5% in December

Turnover in the retail sector, adjusted for sales days and holidays, fell by 4.3% in nominal terms in December 2016 compared with the previous year. To put this into perspective, however, it should be noted that unadjusted turnover fell by only 0.7%. Seasonally adjusted, nominal turnover fell by 2.0% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

-

08:42

ANZ: Too Early To Call A Sustainable Turn In GBP - efxnews

"Sterling has stabilised in recent weeks in part supported by speculation of a bi-lateral trade agreement with the US...However, outside of the potential for 'squeezes' in the market, the backdrop to the pound remains highly uncertain. PM May will trigger Article 50 before the end of March and the tone of the negotiations will be important in assessing sterling's near term path. Meanwhile, whilst growth has impressed (Q4 GDP rose 0.6% q/q) and monetary policy is very supportive, there is a reasonable prospect that growth may slow from here. Hiring trends in the economy have slowed, real income growth will be eroded by rising inflation and investment may suffer. Whilst sterling has discounted a lot, it is still too early to call a sustainable turn".

-

08:16

WSE: After opening

WIG20 index opened at 2078.01 points (-0.05%)*

WIG 55633.43 -0.03%

WIG30 2416.41 -0.04%

mWIG40 4653.69 -0.01%

*/ - change to previous close

The cash market (the WIG20 index) started the day from a modest discount of 0.05% with a moderate turnover. The German DAX is falling more than 0.3%, and against this background neutral beginning in Warsaw looks quite good.

After fifteen minutes of trading, the WIG20 index was at the level of 2,078 points (-0,01%).

-

08:15

Switzerland: Retail Sales Y/Y, December -3.5% (forecast 0.5%)

-

08:15

Switzerland: Retail Sales (MoM), December -2.4%

-

07:37

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.2%

-

07:36

Bank of America Merrill expects no meaningful impact on GBP after super Tuesday

"If the Bank of England (BoE) set interest rates on today's growth and inflation they would likely hike rates on Thursday. But rate setters look forward to set policy. Given the weak sterling they are still balancing a likely inflation overshoot against likely growth weakness. So we expect a neutral bias on policy from the BoE, and expect them to hold rates and not extend QE this week. We think the risks are skewed to a hawkish message. Carney will likely emphasize that there are limits to the BoE's inflation tolerance and conclude with a simple data watching position: steady as she goes for six months, but if growth does not slow then rate hikes will become more likely. Expectations going into next week's BoE meeting seem to have become increasingly polarized. While few on the Street seem to be forecasting an extension of QE at Thursday's meeting, market pricing in rates and our own sentiment surveys suggest investors remain split on QE. Consequently, we expect a hawkish reaction from the market to our central scenario of an end to QE and a relatively neutral BoE...Our economists' baseline scenario is unlikely to have a meaningful impact on GBP as this is pretty much the consensus view for the meeting".

-

07:35

The Federal Reserve took a wait-and-see approach

The Federal Reserve on Wednesday kept interest rates on hold, taking a wait-and-see approach as President Donald Trump and Congress negotiate on fiscal stimulus plans, says rttnews.

The decision to keep rates on hold was unanimous, and came as no surprise to experts.

Markets were hoping the Fed would offer clues about when the next interest rate would come, but policy makers gave no indication as to whether further tightening imminent.

The central bank said the economy "continued to expand at a moderate pace" and that job gains "remained solid." Houehold spending has continued to rise moderately and measures of consumer and business sentiment have improved of late.

-

07:31

Japanese Prime Minister Shinzo Abe: We are ready to resort to intervention in the currency market if necessary

Shinzo Abe said (in response to recent accusations of Donald Trump), that the Government of Japan is ready to resort to intervention on the foreign exchange market if necessary. Abe noted that it is not clear what kind of monetary policy will the Trump administration hold. He also added that in general, is undesirable for the United States and Japan leaders to discuss foreign exchange markets at the summit.

-

07:30

Options levels on thursday, February 2, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0880 (2975)

$1.0855 (2511)

$1.0839 (2206)

Price at time of writing this review: $1.0793

Support levels (open interest**, contracts):

$1.0704 (1357)

$1.0675 (1429)

$1.0641 (2368)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 64938 contracts, with the maximum number of contracts with strike price $1,0800 (4176);

- Overall open interest on the PUT options with the expiration date March, 13 is 74095 contracts, with the maximum number of contracts with strike price $1,0000 (5108);

- The ratio of PUT/CALL was 1.14 versus 1.19 from the previous trading day according to data from January, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.2904 (1519)

$1.2807 (1783)

$1.2710 (2004)

Price at time of writing this review: $1.2665

Support levels (open interest**, contracts):

$1.2584 (969)

$1.2489 (1634)

$1.2392 (1092)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 24701 contracts, with the maximum number of contracts with strike price $1,2500 (3256);

- Overall open interest on the PUT options with the expiration date March, 13 is 26913 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- The ratio of PUT/CALL was 1.09 versus 1.12 from the previous trading day according to data from January, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:21

Australian trade balance showed $2,193m surplus in December

In trend terms, the balance on goods and services was a surplus of $2,193m in December 2016, an increase of $916m (72%) on the surplus in November 2016.

In seasonally adjusted terms, the balance on goods and services was a surplus of $3,511m in December 2016, an increase of $1,471m (72%) on the surplus in November 2016.

In seasonally adjusted terms, goods and services credits rose $1,679m (5%) to $32,630m. Non-rural goods rose $1,249m (6%), non-monetary gold rose $319m (23%), rural goods rose $104m (3%) and net exports of goods under merchanting rose $1m (20%). Services credits rose $6m.

-

07:19

Iran is rapidly taking over more and more of Iraq even after the U.S. has squandered three trillion dollars there. Obvious long ago! @realDonaldTrump

-

07:18

WSE: Before opening

Wednesday's session on the New York stock markets ended with slight increases in the major indexes. Heavily went up course of Apple (over 6%), which the day before, after the session, presented better than expected the quarterly results.

The Dow Jones Industrial rose at the close of 0.13 percent, the S&P 500 went up by 0.03 percent and the Nasdaq Comp. gained 0.50 percent. The fourth week in a row there was an increase in crude oil inventories in the US.

Important was also the decision of the Federal Open Market Committee. The noticeable was the lack of guidance to raise rates in March, which resulted in a slight weakening of the US currency and an increase in raw material prices.

In the night futures on US indices began to fall , while the Japanese Nikkei lost 1.2% in the morning. Thus, beginning in Europe can present a slightly down.

-

06:31

Global Stocks

U.K. stocks closed lower Tuesday, locking in a monthly loss, weighed down in part by a jump in the British pound, though gains by miners helped limit the drop. Pound strength can unsettle U.K. stock investors, as it cuts into profit made overseas by British multinational companies.

U.S. stocks closed up modestly Wednesday after the Federal Reserve stood pat on interest rates and offered a positive view of the economy, while shares of Apple rallied a day after the iPhone maker reported strong earnings. Apple, as the largest U.S. company by market cap, which means it has a heavy weighting in major indexes, was offsetting weakness elsewhere in the market. Seven of the S&P 500's 11 primary sectors were lower on the day, continuing a recent bout of fragility seen this week.

Global investors continued to search for direction Thursday after the U.S. Federal Reserve's latest policy statement, which held interest rates steady, as expected. For weeks, investors have been flipping between optimism and concern. This week started with worry, but the mood became more upbeat, with strong economic data out of the U.S., China and Europe.

-

05:02

Japan: Consumer Confidence, January 43.2 (forecast 43.7)

-

00:30

Australia: Trade Balance , December 3.51 (forecast 2.2)

-

00:30

Australia: Building Permits, m/m, December -1.2% (forecast -2.0%)

-