Market news

-

23:32

Commodities. Daily history for Feb 01’2017:

(raw materials / closing price /% change)

Oil 53.58 -0.56%

Gold 1,211.10 +0.23%

-

23:31

Stocks. Daily history for Feb 01’2017:

(index / closing price / change items /% change)

Nikkei +106.74 19148.08 +0.56%

TOPIX +6.10 1527.77 +0.40%

Euro Stoxx 50 +28.24 3258.92 +0.87%

FTSE 100 +8.50 7107.65 +0.12%

DAX +124.19 11659.50 +1.08%

CAC 40 +45.68 4794.58 +0.96%

DJIA +26.85 19890.94 +0.14%

S&P 500 +0.68 2279.55 +0.03%

NASDAQ +27.87 5642.65 +0.50%

S&P/TSX +16.43 15402.39 +0.11%

-

23:29

Currencies. Daily history for Feb 01’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0768 -0,27%

GBP/USD $1,2558 -0,16%

USD/CHF Chf0,9929 +0,39%

USD/JPY Y113,23 +0,39%

EUR/JPY Y121,93 +0,13%

GBP/JPY Y141,31 -0,38%

AUD/USD $0,7583 0,00%

NZD/USD $0,7278 -0,44%

USD/CAD C$1,3047 +0,15%

-

23:01

Schedule for today, Thursday, Feb 02’2017 (GMT0)

00:30 Australia Building Permits, m/m December 7.0% -2.0%

00:30 Australia Trade Balance December 1.24 2.2

05:00 Japan Consumer Confidence January 43.1 43.7

08:15 Switzerland Retail Sales (MoM) December 0.7%

08:15 Switzerland Retail Sales Y/Y December 0.9% 0.5%

09:30 United Kingdom PMI Construction January 54.2 53.8

10:00 Eurozone Producer Price Index, MoM December 0.3% 0.4%

10:00 Eurozone Producer Price Index (YoY) December 0.1% 1.3%

12:00 United Kingdom BoE Interest Rate Decision 0.25% 0.25%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 435 435

12:00 United Kingdom BOE Inflation Letter

12:15 Eurozone ECB President Mario Draghi Speaks

12:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 U.S. Continuing Jobless Claims 2100 2065

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV 0.7% 1.9%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter IV 3.1% 1%

13:30 U.S. Initial Jobless Claims 259 250

22:30 Australia AIG Services Index January 57.7

-

21:06

Major US stock indexes showed a slight increase

Major US stock indexes finished trading in positive territory thanks to optimistic statistical data on the US, and the reporting of a number of companies, including Apple Inc. At the same time, market participants drew attention to the outcome of the February meeting of the US Federal Reserve.

Data from Automatic Data Processing have shown that employment growth in the US private sector accelerated in January, more than expected. According to the report, in January, the number of employees increased by 246 thousand. People in comparison to the revised downward index for December at the level of 151 thousand. (Originally reported growth of 153 thousand.). Analysts had expected the number of people employed will increase by 165 thousand.

In addition, US producers signaled a strong start in 2017, while the growth of output and new orders accelerated since the end of last year. Improving the business environment is also reflected in the steady rise of the number and the payroll and the steepest increase in stocks of finished goods from the beginning of reference of the index in 2007. The seasonally adjusted PMI manufacturing index reached 55.0 in January, compared with 54.3 in December. The last reading was slightly less than the preliminary estimate of 55.1, and pointed to the fastest productivity growth since March 2015.

However, a report published by the Institute for Supply Management (ISM), showed that in January of activity in the US manufacturing sector has grown considerably, exceeding average forecasts of experts, and reaching the highest level since November, 2014. The PMI for the manufacturing was 56.0 points versus 54.7 points in December. Analysts had expected that this figure will rise to only 55.0 points.

As for the Fed meeting, CBA leaders unanimously voted to keep the federal funds rate by between 0.50% and 0.75%. Investors did not expect that the Fed will take any action, but hoped to get a signal with respect to the plans of the Central Bank to the next meeting. In a statement, the Fed said an improvement in the economy, and indicators of consumer confidence and trust companies. Also, the Fed noted that the risks for the most part the economic outlook are balanced. Central Bank representatives have promised to closely monitor the indicators of inflation, global economic and financial situation.

DOW index components ended the day mostly in negative territory (20 of 30). Most remaining shares fell Microsoft Corporation (MSFT, -1.70%). leaders of growth were shares of Apple Inc. (AAPL, + 6.87%).

Sector S & P Index showed mixed trends. The leader turned out to be the sector of consumer goods (+ 0.9%). Most utilities sector fell (-1.5%).

At the close:

Dow + 0.13% 19,889.05 +24.96

Nasdq + 0.50% 5,642.65 +27.86

S & P + 0.02% 2,279.43 +0.56

-

20:00

DJIA -0.02% 19,860.44 -3.65 Nasdq +0.35% 5,634.55 +19.76 S&P -0.16% 2,275.33 -3.54

-

19:00

U.S.: Fed Interest Rate Decision , 0.75% (forecast 0.75%)

-

17:00

European stocks closed: FTSE 100 +8.50 7107.65 +0.12% DAX +124.19 11659.50 +1.08% CAC 40 +45.68 4794.58 +0.96%

-

16:40

WSE: Session Results

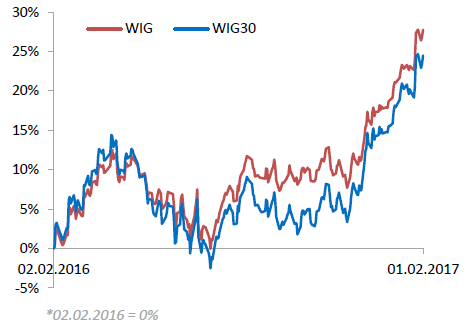

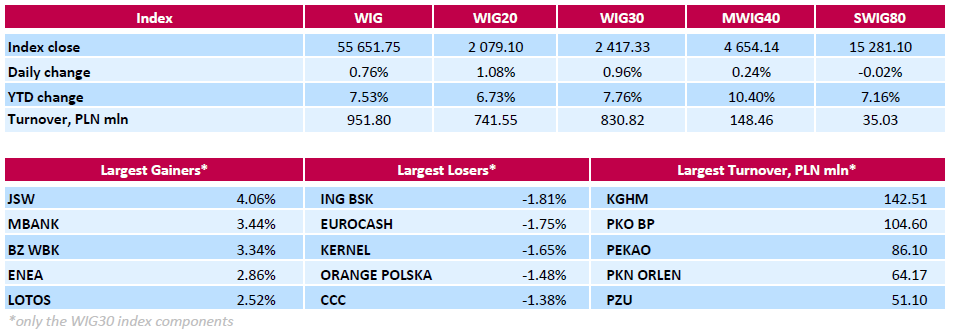

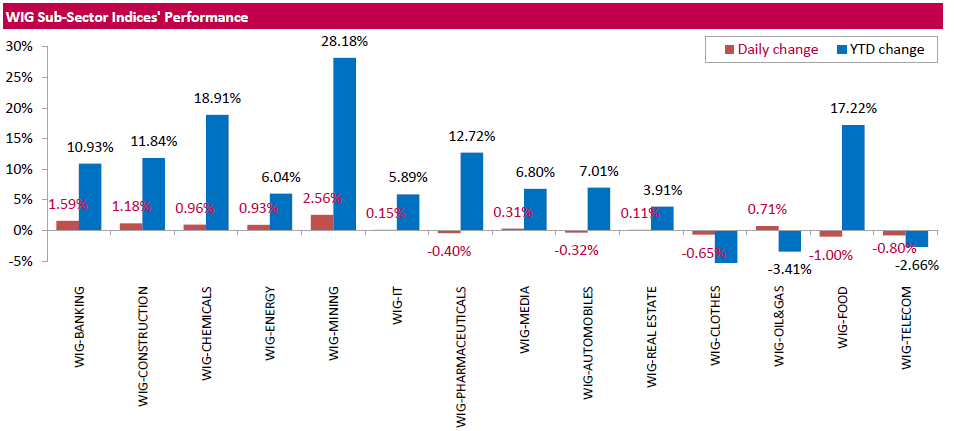

Polish equity market closed higher on Wednesday. The broad measure, the WIG index, added 0.76%. Sector-wise, mining stocks (+2.56%) outperformed, while food names (-1%) recorded the worst result.

The large-cap benchmark, the WIG30 Index, surged by 0.96%. Within the index components, coking coal miner JSW (WSE: JSW) led the advancers, climbing by 4.06%. It was followed by genco ENEA (WSE: ENA), oil refiner LOTOS (WSE: LTS), copper producer KGHM (WSE: KGH) and two banking names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which gained between 2.3% and 3.44%. On the other side of the ledger, bank ING BSK (WSE: ING) was the weakest performer, tumbling by 1.81%. Other largest decliners were FMCG-wholesaler EUROCASH (WSE: EUR), agricultural producer KERNEL (WSE: KER), telecommunication services provider ORANGE POLSKA (WSE: OPL) and footwear retailer CCC (WSE: CCC), dropping by 1.38%-1.75%. It should be noted that CCC stock fell despite the company reported its revenue boosted by 15.4% y/y to PLN 201 mln in January 2017.

-

15:33

U.S. commercial crude oil inventories increased by 6.5 million barrels

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 6.5 million barrels from the previous week. At 494.8 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 3.9 million barrels last week, and are above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories increased by 1.6 million barrels last week and are well above the upper limit of the average range for this time of year. Propane/propylene inventories fell 5.6 million barrels last week but are in the upper half of the average range. Total commercial petroleum inventories increased by 5.3 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, January 6.466

-

15:06

US ISM manufacturing PMI above expectations in January

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee; "The January PMI registered 56 percent, an increase of 1.5 percentage points from the seasonally adjusted December reading of 54.5 percent. The New Orders Index registered 60.4 percent, an increase of 0.1 percentage point from the seasonally adjusted December reading of 60.3 percent.

The Production Index registered 61.4 percent, 2 percentage points higher than the seasonally adjusted December reading of 59.4 percent. The Employment Index registered 56.1 percent, an increase of 3.3 percentage points from the seasonally adjusted December reading of 52.8 percent. Inventories of raw materials registered 48.5 percent, an increase of 1.5 percentage points from the December reading of 47 percent".

-

15:00

U.S.: ISM Manufacturing, January 56 (forecast 55)

-

15:00

U.S.: Construction Spending, m/m, December -0.2% (forecast 0.2%)

-

14:51

WSE: After start on Wall Street

The ADP report from the US labor market was a big positive surprise. The increase in the number of jobs by 246 thousand was considerably higher than forecast at 165 thousand. And this fact has been noted by the market. On currency market we may see the stronger dollar. Similarly reacted shares in the US and Euroland. The German DAX increased growth to 1.5 percent and the Warsaw WIG20 is not left behind.

An hour before the close of trading in Warsaw, the WIG20 index was at the level of 2.086 points (+ 1.47%).

-

14:47

US manufacturers signalled a strong start to 2017 - Markit

US manufacturers signalled a strong start to 2017, with both output and new order growth accelerating since the end of last year. Improving business conditions were also reflecting in a sustained upturn in payroll numbers and the steepest rise in stocks of finished goods since the index began in 2007. Meanwhile, manufacturers reported that confidence regarding the year-ahead business outlook was the strongest since March 2016, which was mainly linked to hopes of a continued upturn in domestic economic conditions.

At 55.0 in January, up from 54.3 in December, the seasonally adjusted Markit final US Manufacturing Purchasing Managers' Index (PMI) signalled a robust and accelerated improvement in overall business conditions across the manufacturing sector.

-

14:45

U.S.: Manufacturing PMI, January 55 (forecast 55.1)

-

14:32

U.S. Stocks open: Dow +0.40%, Nasdaq +0.67%, S&P +0.38%

-

14:23

Le Pen leading with 27% on poll for first round voting in France contribute to EUR pressure

-

14:20

Before the bell: S&P futures +0.30%, NASDAQ futures +0.64%

U.S. stock-index futures rose, supported by strong quarterly results from Apple (AAPL), while investors awaited the outcomes of the Federal Reserve's two-day meeting.

Global Stocks:

Nikkei 19,148.08 +106.74 +0.56%

Hang Seng 23,318.39 -42.39 -0.18%

Shanghai - Closed

FTSE 7,143.09 +43.94 +0.62%

CAC 4,814.67 +65.77 +1.38%

DAX 11,681.64 +146.33 +1.27%

Crude $53.23 (+0.80%)

Gold $1,207.70 (-0.31%)

-

13:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

174.53

-0.29(-0.1659%)

2221

ALCOA INC.

AA

111.53

0.18(0.1617%)

1079

American Express Co

AXP

76.77

0.39(0.5106%)

400

Apple Inc.

AAPL

174.53

-0.29(-0.1659%)

2221

AT&T Inc

T

42.05

-0.11(-0.2609%)

22150

Barrick Gold Corporation, NYSE

ABX

18.26

-0.18(-0.9761%)

53867

Boeing Co

BA

164.13

0.71(0.4345%)

6327

Caterpillar Inc

CAT

95.88

0.22(0.23%)

1570

Chevron Corp

CVX

111.53

0.18(0.1617%)

1079

Cisco Systems Inc

CSCO

30.69

-0.03(-0.0977%)

13751

Citigroup Inc., NYSE

C

56.4

0.57(1.021%)

22709

Deere & Company, NYSE

DE

107.3

0.25(0.2335%)

550

E. I. du Pont de Nemours and Co

DD

75.55

0.05(0.0662%)

810

Exxon Mobil Corp

XOM

84.17

0.28(0.3338%)

6580

Facebook, Inc.

FB

131.97

1.65(1.2661%)

320646

FedEx Corporation, NYSE

FDX

174.53

-0.29(-0.1659%)

2221

Ford Motor Co.

F

12.39

0.03(0.2427%)

85891

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.61

-0.04(-0.2402%)

100533

General Electric Co

GE

29.78

0.08(0.2694%)

9533

Goldman Sachs

GS

230.99

1.67(0.7282%)

20669

Google Inc.

GOOG

174.53

-0.29(-0.1659%)

2221

Hewlett-Packard Co.

HPQ

174.53

-0.29(-0.1659%)

2221

Home Depot Inc

HD

138.17

0.59(0.4288%)

5055

Intel Corp

INTC

36.98

0.16(0.4345%)

34644

International Business Machines Co...

IBM

174.98

0.46(0.2636%)

1679

Johnson & Johnson

JNJ

113.35

0.10(0.0883%)

2081

JPMorgan Chase and Co

JPM

85.39

0.76(0.898%)

56196

McDonald's Corp

MCD

122.61

0.04(0.0326%)

303

Microsoft Corp

MSFT

64.75

0.10(0.1547%)

80527

Nike

NKE

53.02

0.12(0.2268%)

4592

Pfizer Inc

PFE

31.57

0.16(0.5094%)

52564

Starbucks Corporation, NASDAQ

SBUX

56.4

0.57(1.021%)

22709

Tesla Motors, Inc., NASDAQ

TSLA

253.52

1.59(0.6311%)

14709

The Coca-Cola Co

KO

83.05

0.34(0.4111%)

2227

Travelers Companies Inc

TRV

117.91

0.13(0.1104%)

1570

Twitter, Inc., NYSE

TWTR

56.4

0.57(1.021%)

22709

United Technologies Corp

UTX

109.58

-0.09(-0.0821%)

1990

UnitedHealth Group Inc

UNH

83.05

0.34(0.4111%)

2227

Visa

V

83.05

0.34(0.4111%)

2227

Wal-Mart Stores Inc

WMT

83.05

0.34(0.4111%)

2227

Walt Disney Co

DIS

110.92

0.27(0.244%)

3564

Yahoo! Inc., NASDAQ

YHOO

44.25

0.18(0.4084%)

4517

Yandex N.V., NASDAQ

YNDX

23.29

0.15(0.6482%)

3615

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $135 from $130 at Mizuho

Apple (AAPL) target raised to $140 from $125 at RBC Capital Mkts

Apple (AAPL) target raised to $130 from $115 at Stifel

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

-

13:23

Strong ADP employment report and USD rallies

Private sector employment increased by 246,000 jobs from December 2016 to January 2017 according to the January ADP National Employment Report

"The U.S. labor market is hitting on all cylinders and we saw small and midsized businesses perform exceptionally well," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Further analysis shows that services gains have rebounded from their tepid December pace, adding 201,000 jobs. The goods producers added 46,000 jobs, which is the strongest job growth that sector has seen in the last two years."

-

13:22

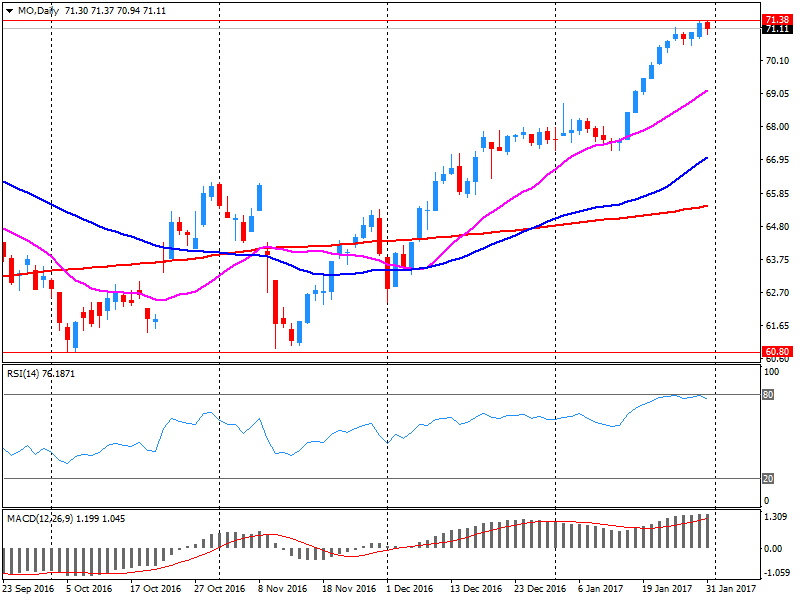

Company News: Altria (MO) posts Q4 results

Altria reported Q4 FY 2016 earnings of $0.68 per share (versus $0.67 in Q4 FY 2015), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $4.733 bln (+0.1% y/y), missing analysts' consensus estimate of $4.798 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $3.26-3.32 (+7.5-9.5% y/y) versus analysts' consensus estimate of $3.34.

MO fell to $70.11 (-1.5%) in pre-market trading.

-

13:02

Orders

EUR/USD

Offers: 1.0800 1.0830 1.0850-55 1.0885 1.0900

Bids: 1.0750 1.0720 1.0700 1.0680 1.0655-60 1.0625-30 1.0600

GBP/USD

Offers: 1.2600 1.2630 1.2660 1.2680 1.2700

Bids: 1.2550 1.2520 1.2500 1.2475-80 1.2450

EUR/GBP

Offers: 0.8600 0.8620 0.8635 0.8650 0.8685 0.8700

Bids: 0.8550 0.8525-30 0.8500 0.8470-75 0.8450

EUR/JPY

Offers: 122.60 122.80 123.00 123.30 123.50

Bids: 122.00 121.80 121.65 121.20 121.00

USD/JPY

Offers: 113.80 114.00 114.30 114.50 114.80 115.00 115.30-35 115.50

Bids: 113.20 113.00 112.80-85 112.50 112.30 112.00

AUD/USD

Offers: 0.7600 0.7630 0.7650 90.7675 0.7700

Bids: 0.7550 0.7520 0.7500 0.7480-85 0.7450

-

12:01

WSE: Mid session comment

The forenoon part of today's session may be divided into two parts, the rapid growth in the first quarter and maintaining growth in the later part of trading. The WIG20 index is trading about 1 percent on plus and almost perfectly mimics the behavior of the German DAX.

At the halfway point of today's quotations the WIG20 index was at the level of 2,077 points (+0,99%).

-

11:38

Major stock indices in Europe on the rise

The stock indices in Western Europe are gaining, investors assess the statistical data from the euro zone and the reporting of large companies.

Procurement Managers Index (PMI) in manufacturing in the 19 euro-zone countries rose to 55.2 - its highest level in nearly six years. The value of the indicator above 50 points indicates strengthening business activity in this sector.

UK PMI for the production sector fell to 55.9 in January from two and a half year high of 56.1 in December. The index was in line with economists' expectations.

The composite index of the largest companies in the region Stoxx Europe 600 rose by 0.85% - to 363.17 points.

The price of Swedish auto maker Volvo jumped 6,4% as the company increased its profit last quarter by almost 2 times.

The market value of Siemens AG increased by 3.4%. Europe's largest industrial conglomerate increased its net profit in the 1st quarter and improved the outlook for the year as a whole.

Shares of Spanish bank BBVA rose 0.7%. The bank's profit in the last quarter fell by 28% - up to 678 million euros, which nevertheless turned out better than expectations (554 million euros).

Wizz Air Holdings reported a fall in net profit in the last quarter by 22%, despite revenue growth of 9%. On this news stock prices in early trading fell by 6.6%.

The capitalization of the Swiss pharmaceutical company Roche Holding AG rose by 1.1% due to an increase in profits in October-December by 8% and revenue by 5%.

Electrolux shares decreased by 1.4%. The company has returned to a profitable level in the 4th quarter, its profit amounted to 1.27 SEK and coincided with market expectations. Meanwhile, its revenue decreased by 1%.

At the moment:

FTSE 7150.34 51.19 0.72%

DAX 11645.41 110.10 0.95%

CAC 4802.53 53.63 1.13%

-

11:02

We do not expect fireworks from the upcoming FOMC meeting - Bank of America

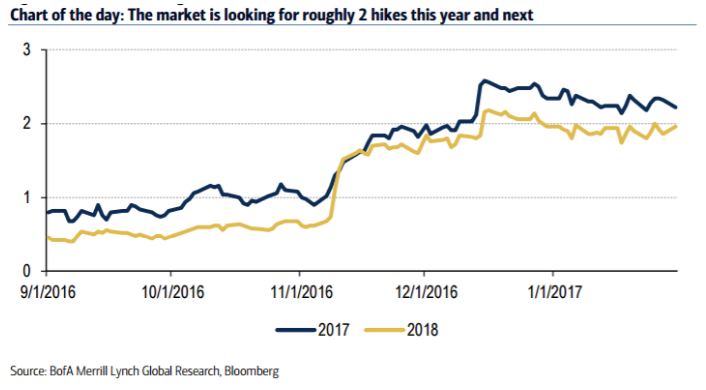

"We do not expect fireworks from the upcoming FOMC meeting. The Federal Reserve will be releasing its statement without a press conference or Summary of Economic Projections (SEP), which offers market participants less information to digest. We do not expect policy changes, with the FOMC holding rates at the 50-75bp range and maintaining the reinvestment policy. However, we do expect changes to the language. In particular, we think the Fed will highlight the reduction in labor market slack and perhaps note that confidence measures have improved. In our view, these changes would be perceived as a bit more hawkish. The market is pricing in just over two hikes this year and another two in 2018 (Chart of the day).

We similarly look for four hikes over this year and next, but believe the risk is for a faster cycle to start next year. If the communication sounds modestly more hawkish, we expect it to result in a further steepening of the near-term path of monetary policy and believe it could increase market-implied probabilities for a March hike.

FX: refocus on Fed could provide a reprieve for USD even with little expected.

The minor tweaks to language, as described above, could lend a slightly more optimistic tone, potentially suggesting some upside risks to FOMC pricing. While FX moves are likely to be limited, a more confident tone could provide some reprieve to the USD as the market refocuses attention on the balance of risks around Fed policy, which we continue see as skewed toward faster hikes on growth-positive fiscal stimulus.

With Inauguration Day out of the way, we continue to expect President Trump's fiscal and tax plans to support the USD, albeit in a choppier manner given the administration's greater penchant to talk it down.

Additionally, the decline in real rates that has taken the dollar with it recently, should be short-lived (Liquid Insight: The Trump trade divergence), particularly if the Fed turns increasingly hawkish amid rising inflation and further declines in the unemployment rate.

We continue to see USD/JPY as the best expression of these themes, and reiterated that view by opening a tactical long USD/JPY spot trade last week".

Copyright © 2017 BofAML, eFXnews™

-

10:21

Oil is trading lower

This morning, the New York futures for Brent fell slightly to $ 55.46 and WTI fell 0.13% to $ 52.73. According to the American Petroleum Institute US crude stocks rose by 5.8 million barrels in the week to 488 million, while analysts had expected an increase of 3.3 million barrels.

Recall that the OPEC members for the first time in eight years, agreed to cut production by about 1.2 million barrels per day in order to restore balance in the global market and maintain prices for raw materials, and Russia pledged to reduce total production by 600,000 barrels per day.

-

09:48

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

Информационно-аналитический отдел TeleTrade

-

09:40

Romania decriminalises corruption offences - Euronews

Thousands of angry protesters in central Bucharest have called for Romania's government to resign after it decriminalised a number of graft offences by emergency decree, says euronews.

The measure also pardons convicts sentenced to less than five years for committing certain non-violent crimes.

The government claims the measure which takes offences causing less than 44,000 euros of damage, off the statute books, will ease prison overcrowding.

-

09:37

Strong start of the year for UK's manufacturing sector

The UK manufacturing sector made a strong start to 2017. Output rose at the fastest rate since May 2014, as new order intakes expanded at a robust pace. Price pressures intensified, however, as input cost inflation surged to a survey record high and output charges also increased at one of the steepest rates in the series history.

The seasonally adjusted Markit/CIPS Purchasing Managers' Index (PMI) posted 55.9 in January, only a couple of ticks below December's two-anda-half year high of 56.1. The headline PMI has remained above the neutral mark of 50.0 for six straight months.

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , January 55.9 (forecast 55.9)

-

09:04

69-month high for Euro Zone manufacturing PMI - Markit

The start of 2017 saw a marked improvement in business conditions at eurozone manufacturers. Output growth held steady at December's 32-month record, underpinned by the strongest inflows of new business and the fastest job creation since the first half of 2011. Price pressures continued to intensify, however, with rates of inflation in input costs and output charges both gathering pace.

At 55.2 in January, up from 54.9 in December, the final Markit Eurozone Manufacturing PMI rose to a 69-month high and was above its earlier flash estimate of 55.1. The headline PMI has signalled expansion in each month since July 2013.

-

09:00

Eurozone: Manufacturing PMI, January 55.2 (forecast 55.1)

-

08:59

German manufacturers enjoyed a positive start to 2017

German manufacturers enjoyed a positive start to 2017, with output, new orders and employment all rising at improved rates. As a result, overall operating conditions strengthened substantially. This was signalled by the seasonally adjusted Markit/BME Germany Manufacturing Purchasing Managers' Index® (PMI® ) - a single-figure snapshot of the performance of the manufacturing economy - climbing to a three-year high of 56.4 in January. The acceleration in growth continued a trend observed at the end of 2016 - the index had reached a 35-month peak in December (55.6).

Commenting on the final Markit/BME Germany Manufacturing PMI® survey data, Philip Leake, Economist at IHS Markit said: "Germany's manufacturing sector started 2017 in much the same way that it finished 2016, with growth accelerating. In fact, operating conditions improved to the greatest extent in three years, underpinned by marked expansions of both output and new work. The sector's impressive performance bodes well for GDP growth in the first quarter, building on the strongest expansion in five years across 2016 as a whole (based on an initial estimate of 1.9% from the Federal Statistics Office)".

-

08:55

Germany: Manufacturing PMI, January 56.4 (forecast 56.5)

-

08:50

France: Manufacturing PMI, January 53.6 (forecast 53.4)

-

08:38

Sharp rises in output and new orders recorded for the Spanish manufacturing sector - Markit

The Spanish manufacturing sector started 2017 in a similar fashion to how it ended 2016, with sharp rises in output and new orders recorded. The key highlight from the latest survey was the sharpest rise in employment since July 1998, while business sentiment picked up. On the price front, rates of both input cost and output price inflation quickened markedly amid reports of higher raw material costs.

The headline PMI ticked up to 55.6 in January from 55.3 in the previous month.

-

08:35

Major stock markets in Europe trading in the green zone: DAX futures + 0.6%, CAC40 + 0.8%, FTSE + 0.5%

-

08:30

Switzerland: Manufacturing PMI, January 54.6 (forecast 55.8)

-

08:17

WSE: After opening

WIG20 index opened 2065.94 (+0.44%)*

WIG 55603.28 0.67

WIG30 2414.14 0.83

mWIG40 4656.24 0.28

*/ - change to previous close

The Warsaw market, same like European stock exchanges started the day having to rebuild the Wall Street in the second half of yesterday's session. The opening gap at top looks like an attempt to end the four-day correction and put the chart of the WIG20 towards 2,100 points.

After fifteen minutes of trading WIG20 index was at 2,076 points (+ 0.97%).

-

07:51

Options levels on wednesday, February 1, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0880 (2975)

$1.0855 (2511)

$1.0839 (2206)

Price at time of writing this review: $1.0785

Support levels (open interest**, contracts):

$1.0704 (1357)

$1.0675 (1429)

$1.0641 (2368)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 64938 contracts, with the maximum number of contracts with strike price $1,0800 (4176);

- Overall open interest on the PUT options with the expiration date March, 13 is 74095 contracts, with the maximum number of contracts with strike price $1,0000 (5108);

- The ratio of PUT/CALL was 1.14 versus 1.19 from the previous trading day according to data from January, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.2807 (1783)

$1.2710 (2004)

$1.2615 (1608)

Price at time of writing this review: $1.2565

Support levels (open interest**, contracts):

$1.2489 (1634)

$1.2392 (1092)

$1.2294 (1803)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 24701 contracts, with the maximum number of contracts with strike price $1,2500 (3256);

- Overall open interest on the PUT options with the expiration date March, 13 is 26913 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- The ratio of PUT/CALL was 1.09 versus 1.12 from the previous trading day according to data from January, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:50

Goldman Sachs expects FOMC to hold rates

"The FOMC will very likely keep policy unchanged on Wednesday, and make only modest revisions to the post-meeting statement.

We expect constructive comments on economic activity, and possibly, a shift to say that headline PCE inflation will reach 2% "relatively soon" (instead of "over the medium term").

We expect the balance of risk assessment and characterization of current policy ("accommodative") to remain unchanged".

Copyright © 2017 Goldman Sachs, eFXnews™

-

07:48

Today’s events

-

At 10:00 GMT European Commission forecasts for the economy

-

At 19:00 GMT FOMC decision on the basic interest rate

-

China celebrates Spring Festival

-

-

07:25

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.2%

-

07:23

WSE: Before opening

Most major indices on the New York stock markets closed yesterday's session in the red. The Dow Jones Industrial dropped at the closing of 0.54 percent, the S&P500 went down by 0.09 percent and in the contrast, the Nasdaq Comp. gained 0.02 percent. From the point of view of European markets a slight change of the S&P500 seems to be the most important. After the close of trading in Europe, the index recovered a large portion of earlier losses, which should support increases in Europe.

In the US, after the session, its results published Apple Inc., which recorded in the quarter covering the holidays better than expected sales results.

The beginning of the new month will bring data from the US labor market and the stock exchange today will get reading of ADP report. In addition, today ends the year's first meeting of the monetary authorities in the United States. On the Warsaw market yesterday's increases were supported by the weaken dollar and the appreciation of the zloty, but each of these currencies remain sensitive to what today appears in the FOMC statement.

-

07:21

UK house price growth remained broadly stable at the start of 2017 - HPI

The annual rate of house price growth remained broadly stable at the start of 2017 at 4.3%, only modestly below the growth rate in December of 4.5%. House prices increased by 0.2% over the month, after taking account of seasonal factors.

The outlook for the housing market remains clouded, reflecting the uncertainty surrounding economic prospects more broadly. On the one hand, there are grounds for optimism. The economy has remained far stronger than expected in the wake of the Brexit vote.

-

07:13

New Zeeland unemployment rate rose to 5.2 percent in the December 2016 quarter. NZD/USD down 90 pips on the asian session

The unemployment rate rose to 5.2 percent in the December 2016 quarter (up from 4.9 percent in the previous quarter) while employment and the labour force continued to grow, Statistics New Zealand said today.

"The December quarter saw a large number of people enter the labour force," labour and income statistics manager Mark Gordon said. "But while the number of people in employment has risen, so has the number of unemployed people ."

This means there were more people available to work, and who had either actively sought work or had a new job to start within the next four weeks.

The labour force participation rate increased 0.4 percentage points over the latest quarter, to reach an all-time high of 70.5 percent.

-

07:09

President Donald Trump nominates Neil Gorsuch to the U.S. Supreme Court

-

07:01

United Kingdom: Nationwide house price index, y/y, January 4.3% (forecast 4.4%)

-

07:01

United Kingdom: Nationwide house price index , January 0.2% (forecast 0.3%)

-

06:33

Global Stocks

European stocks ended in the red Tuesday, analysts blaming the selling in part on a surging euro as investors sifted through a mixed round of corporate updates. The benchmark ended with a January loss, giving up ground as the month wrapped up. On Monday, the gauge fell 1.1%, its biggest daily percentage drop since November, retreating alongside U.S. stocks, as some investors were spooked by President Donald Trump's executive order that banned citizens of seven predominantly Muslim countries from entering the U.S.

U.S. stocks trimmed earlier losses but still ended mostly lower on Tuesday, as declines in industrial, technology and financials shares outweighed gains in health-care and utilities sectors. The main indexes still posted a third consecutive round of monthly gains. The selling pressure in early trade came amid signs that momentum following President Donald Trump's election victory in November was fading, and as a January gauge of consumer confidence retreated from its highest level in 15 years.

Asset prices stabilized in Asia-Pacific trading Wednesday after two days of declines for the dollar and equities, as investors position themselves ahead of the Federal Reserve's policy statement. But investor caution persisted.

-

01:00

China: Manufacturing PMI , January 51.3 (forecast 51.2)

-

01:00

China: Non-Manufacturing PMI, January 54.6

-

00:30

Japan: Manufacturing PMI, January 52.7 (forecast 52.8)

-