Market news

-

23:29

Currencies. Daily history for Feb 01’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0768 -0,27%

GBP/USD $1,2558 -0,16%

USD/CHF Chf0,9929 +0,39%

USD/JPY Y113,23 +0,39%

EUR/JPY Y121,93 +0,13%

GBP/JPY Y141,31 -0,38%

AUD/USD $0,7583 0,00%

NZD/USD $0,7278 -0,44%

USD/CAD C$1,3047 +0,15%

-

23:01

Schedule for today, Thursday, Feb 02’2017 (GMT0)

00:30 Australia Building Permits, m/m December 7.0% -2.0%

00:30 Australia Trade Balance December 1.24 2.2

05:00 Japan Consumer Confidence January 43.1 43.7

08:15 Switzerland Retail Sales (MoM) December 0.7%

08:15 Switzerland Retail Sales Y/Y December 0.9% 0.5%

09:30 United Kingdom PMI Construction January 54.2 53.8

10:00 Eurozone Producer Price Index, MoM December 0.3% 0.4%

10:00 Eurozone Producer Price Index (YoY) December 0.1% 1.3%

12:00 United Kingdom BoE Interest Rate Decision 0.25% 0.25%

12:00 United Kingdom Bank of England Minutes

12:00 United Kingdom Asset Purchase Facility 435 435

12:00 United Kingdom BOE Inflation Letter

12:15 Eurozone ECB President Mario Draghi Speaks

12:30 United Kingdom BOE Gov Mark Carney Speaks

13:30 U.S. Continuing Jobless Claims 2100 2065

13:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter IV 0.7% 1.9%

13:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter IV 3.1% 1%

13:30 U.S. Initial Jobless Claims 259 250

22:30 Australia AIG Services Index January 57.7

-

19:00

U.S.: Fed Interest Rate Decision , 0.75% (forecast 0.75%)

-

15:33

U.S. commercial crude oil inventories increased by 6.5 million barrels

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) increased by 6.5 million barrels from the previous week. At 494.8 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 3.9 million barrels last week, and are above the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories increased by 1.6 million barrels last week and are well above the upper limit of the average range for this time of year. Propane/propylene inventories fell 5.6 million barrels last week but are in the upper half of the average range. Total commercial petroleum inventories increased by 5.3 million barrels last week.

-

15:30

U.S.: Crude Oil Inventories, January 6.466

-

15:06

US ISM manufacturing PMI above expectations in January

The report was issued today by Bradley J. Holcomb, CPSM, CPSD, chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee; "The January PMI registered 56 percent, an increase of 1.5 percentage points from the seasonally adjusted December reading of 54.5 percent. The New Orders Index registered 60.4 percent, an increase of 0.1 percentage point from the seasonally adjusted December reading of 60.3 percent.

The Production Index registered 61.4 percent, 2 percentage points higher than the seasonally adjusted December reading of 59.4 percent. The Employment Index registered 56.1 percent, an increase of 3.3 percentage points from the seasonally adjusted December reading of 52.8 percent. Inventories of raw materials registered 48.5 percent, an increase of 1.5 percentage points from the December reading of 47 percent".

-

15:00

U.S.: ISM Manufacturing, January 56 (forecast 55)

-

15:00

U.S.: Construction Spending, m/m, December -0.2% (forecast 0.2%)

-

14:47

US manufacturers signalled a strong start to 2017 - Markit

US manufacturers signalled a strong start to 2017, with both output and new order growth accelerating since the end of last year. Improving business conditions were also reflecting in a sustained upturn in payroll numbers and the steepest rise in stocks of finished goods since the index began in 2007. Meanwhile, manufacturers reported that confidence regarding the year-ahead business outlook was the strongest since March 2016, which was mainly linked to hopes of a continued upturn in domestic economic conditions.

At 55.0 in January, up from 54.3 in December, the seasonally adjusted Markit final US Manufacturing Purchasing Managers' Index (PMI) signalled a robust and accelerated improvement in overall business conditions across the manufacturing sector.

-

14:45

U.S.: Manufacturing PMI, January 55 (forecast 55.1)

-

14:23

Le Pen leading with 27% on poll for first round voting in France contribute to EUR pressure

-

13:46

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

-

13:23

Strong ADP employment report and USD rallies

Private sector employment increased by 246,000 jobs from December 2016 to January 2017 according to the January ADP National Employment Report

"The U.S. labor market is hitting on all cylinders and we saw small and midsized businesses perform exceptionally well," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Further analysis shows that services gains have rebounded from their tepid December pace, adding 201,000 jobs. The goods producers added 46,000 jobs, which is the strongest job growth that sector has seen in the last two years."

-

13:02

Orders

EUR/USD

Offers: 1.0800 1.0830 1.0850-55 1.0885 1.0900

Bids: 1.0750 1.0720 1.0700 1.0680 1.0655-60 1.0625-30 1.0600

GBP/USD

Offers: 1.2600 1.2630 1.2660 1.2680 1.2700

Bids: 1.2550 1.2520 1.2500 1.2475-80 1.2450

EUR/GBP

Offers: 0.8600 0.8620 0.8635 0.8650 0.8685 0.8700

Bids: 0.8550 0.8525-30 0.8500 0.8470-75 0.8450

EUR/JPY

Offers: 122.60 122.80 123.00 123.30 123.50

Bids: 122.00 121.80 121.65 121.20 121.00

USD/JPY

Offers: 113.80 114.00 114.30 114.50 114.80 115.00 115.30-35 115.50

Bids: 113.20 113.00 112.80-85 112.50 112.30 112.00

AUD/USD

Offers: 0.7600 0.7630 0.7650 90.7675 0.7700

Bids: 0.7550 0.7520 0.7500 0.7480-85 0.7450

-

11:02

We do not expect fireworks from the upcoming FOMC meeting - Bank of America

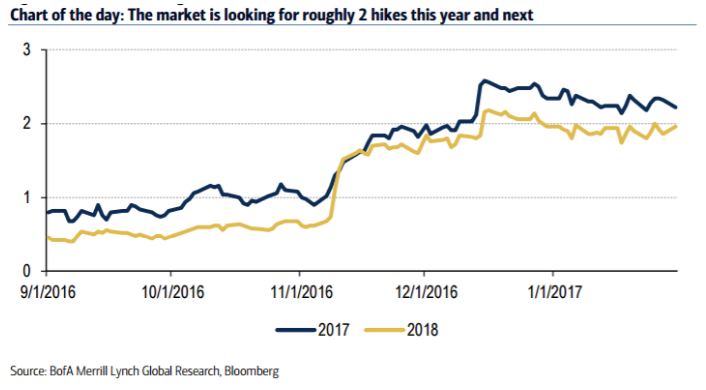

"We do not expect fireworks from the upcoming FOMC meeting. The Federal Reserve will be releasing its statement without a press conference or Summary of Economic Projections (SEP), which offers market participants less information to digest. We do not expect policy changes, with the FOMC holding rates at the 50-75bp range and maintaining the reinvestment policy. However, we do expect changes to the language. In particular, we think the Fed will highlight the reduction in labor market slack and perhaps note that confidence measures have improved. In our view, these changes would be perceived as a bit more hawkish. The market is pricing in just over two hikes this year and another two in 2018 (Chart of the day).

We similarly look for four hikes over this year and next, but believe the risk is for a faster cycle to start next year. If the communication sounds modestly more hawkish, we expect it to result in a further steepening of the near-term path of monetary policy and believe it could increase market-implied probabilities for a March hike.

FX: refocus on Fed could provide a reprieve for USD even with little expected.

The minor tweaks to language, as described above, could lend a slightly more optimistic tone, potentially suggesting some upside risks to FOMC pricing. While FX moves are likely to be limited, a more confident tone could provide some reprieve to the USD as the market refocuses attention on the balance of risks around Fed policy, which we continue see as skewed toward faster hikes on growth-positive fiscal stimulus.

With Inauguration Day out of the way, we continue to expect President Trump's fiscal and tax plans to support the USD, albeit in a choppier manner given the administration's greater penchant to talk it down.

Additionally, the decline in real rates that has taken the dollar with it recently, should be short-lived (Liquid Insight: The Trump trade divergence), particularly if the Fed turns increasingly hawkish amid rising inflation and further declines in the unemployment rate.

We continue to see USD/JPY as the best expression of these themes, and reiterated that view by opening a tactical long USD/JPY spot trade last week".

Copyright © 2017 BofAML, eFXnews™

-

09:48

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

Информационно-аналитический отдел TeleTrade

-

09:40

Romania decriminalises corruption offences - Euronews

Thousands of angry protesters in central Bucharest have called for Romania's government to resign after it decriminalised a number of graft offences by emergency decree, says euronews.

The measure also pardons convicts sentenced to less than five years for committing certain non-violent crimes.

The government claims the measure which takes offences causing less than 44,000 euros of damage, off the statute books, will ease prison overcrowding.

-

09:37

Strong start of the year for UK's manufacturing sector

The UK manufacturing sector made a strong start to 2017. Output rose at the fastest rate since May 2014, as new order intakes expanded at a robust pace. Price pressures intensified, however, as input cost inflation surged to a survey record high and output charges also increased at one of the steepest rates in the series history.

The seasonally adjusted Markit/CIPS Purchasing Managers' Index (PMI) posted 55.9 in January, only a couple of ticks below December's two-anda-half year high of 56.1. The headline PMI has remained above the neutral mark of 50.0 for six straight months.

-

09:30

United Kingdom: Purchasing Manager Index Manufacturing , January 55.9 (forecast 55.9)

-

09:04

69-month high for Euro Zone manufacturing PMI - Markit

The start of 2017 saw a marked improvement in business conditions at eurozone manufacturers. Output growth held steady at December's 32-month record, underpinned by the strongest inflows of new business and the fastest job creation since the first half of 2011. Price pressures continued to intensify, however, with rates of inflation in input costs and output charges both gathering pace.

At 55.2 in January, up from 54.9 in December, the final Markit Eurozone Manufacturing PMI rose to a 69-month high and was above its earlier flash estimate of 55.1. The headline PMI has signalled expansion in each month since July 2013.

-

09:00

Eurozone: Manufacturing PMI, January 55.2 (forecast 55.1)

-

08:59

German manufacturers enjoyed a positive start to 2017

German manufacturers enjoyed a positive start to 2017, with output, new orders and employment all rising at improved rates. As a result, overall operating conditions strengthened substantially. This was signalled by the seasonally adjusted Markit/BME Germany Manufacturing Purchasing Managers' Index® (PMI® ) - a single-figure snapshot of the performance of the manufacturing economy - climbing to a three-year high of 56.4 in January. The acceleration in growth continued a trend observed at the end of 2016 - the index had reached a 35-month peak in December (55.6).

Commenting on the final Markit/BME Germany Manufacturing PMI® survey data, Philip Leake, Economist at IHS Markit said: "Germany's manufacturing sector started 2017 in much the same way that it finished 2016, with growth accelerating. In fact, operating conditions improved to the greatest extent in three years, underpinned by marked expansions of both output and new work. The sector's impressive performance bodes well for GDP growth in the first quarter, building on the strongest expansion in five years across 2016 as a whole (based on an initial estimate of 1.9% from the Federal Statistics Office)".

-

08:55

Germany: Manufacturing PMI, January 56.4 (forecast 56.5)

-

08:50

France: Manufacturing PMI, January 53.6 (forecast 53.4)

-

08:38

Sharp rises in output and new orders recorded for the Spanish manufacturing sector - Markit

The Spanish manufacturing sector started 2017 in a similar fashion to how it ended 2016, with sharp rises in output and new orders recorded. The key highlight from the latest survey was the sharpest rise in employment since July 1998, while business sentiment picked up. On the price front, rates of both input cost and output price inflation quickened markedly amid reports of higher raw material costs.

The headline PMI ticked up to 55.6 in January from 55.3 in the previous month.

-

08:30

Switzerland: Manufacturing PMI, January 54.6 (forecast 55.8)

-

07:51

Options levels on wednesday, February 1, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0880 (2975)

$1.0855 (2511)

$1.0839 (2206)

Price at time of writing this review: $1.0785

Support levels (open interest**, contracts):

$1.0704 (1357)

$1.0675 (1429)

$1.0641 (2368)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 64938 contracts, with the maximum number of contracts with strike price $1,0800 (4176);

- Overall open interest on the PUT options with the expiration date March, 13 is 74095 contracts, with the maximum number of contracts with strike price $1,0000 (5108);

- The ratio of PUT/CALL was 1.14 versus 1.19 from the previous trading day according to data from January, 31

GBP/USD

Resistance levels (open interest**, contracts)

$1.2807 (1783)

$1.2710 (2004)

$1.2615 (1608)

Price at time of writing this review: $1.2565

Support levels (open interest**, contracts):

$1.2489 (1634)

$1.2392 (1092)

$1.2294 (1803)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 24701 contracts, with the maximum number of contracts with strike price $1,2500 (3256);

- Overall open interest on the PUT options with the expiration date March, 13 is 26913 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- The ratio of PUT/CALL was 1.09 versus 1.12 from the previous trading day according to data from January, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:50

Goldman Sachs expects FOMC to hold rates

"The FOMC will very likely keep policy unchanged on Wednesday, and make only modest revisions to the post-meeting statement.

We expect constructive comments on economic activity, and possibly, a shift to say that headline PCE inflation will reach 2% "relatively soon" (instead of "over the medium term").

We expect the balance of risk assessment and characterization of current policy ("accommodative") to remain unchanged".

Copyright © 2017 Goldman Sachs, eFXnews™

-

07:48

Today’s events

-

At 10:00 GMT European Commission forecasts for the economy

-

At 19:00 GMT FOMC decision on the basic interest rate

-

China celebrates Spring Festival

-

-

07:21

UK house price growth remained broadly stable at the start of 2017 - HPI

The annual rate of house price growth remained broadly stable at the start of 2017 at 4.3%, only modestly below the growth rate in December of 4.5%. House prices increased by 0.2% over the month, after taking account of seasonal factors.

The outlook for the housing market remains clouded, reflecting the uncertainty surrounding economic prospects more broadly. On the one hand, there are grounds for optimism. The economy has remained far stronger than expected in the wake of the Brexit vote.

-

07:13

New Zeeland unemployment rate rose to 5.2 percent in the December 2016 quarter. NZD/USD down 90 pips on the asian session

The unemployment rate rose to 5.2 percent in the December 2016 quarter (up from 4.9 percent in the previous quarter) while employment and the labour force continued to grow, Statistics New Zealand said today.

"The December quarter saw a large number of people enter the labour force," labour and income statistics manager Mark Gordon said. "But while the number of people in employment has risen, so has the number of unemployed people ."

This means there were more people available to work, and who had either actively sought work or had a new job to start within the next four weeks.

The labour force participation rate increased 0.4 percentage points over the latest quarter, to reach an all-time high of 70.5 percent.

-

07:09

President Donald Trump nominates Neil Gorsuch to the U.S. Supreme Court

-

07:01

United Kingdom: Nationwide house price index, y/y, January 4.3% (forecast 4.4%)

-

07:01

United Kingdom: Nationwide house price index , January 0.2% (forecast 0.3%)

-

01:00

China: Manufacturing PMI , January 51.3 (forecast 51.2)

-

01:00

China: Non-Manufacturing PMI, January 54.6

-

00:30

Japan: Manufacturing PMI, January 52.7 (forecast 52.8)

-