Market news

-

23:28

Currencies. Daily history for Jan 31’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0797 +0,96%

GBP/USD $1,2578 +0,76%

USD/CHF Chf0,989 -0,62%

USD/JPY Y112,79 -0,87%

EUR/JPY Y121,77 +0,10%

GBP/JPY Y141,84 -0,12%

AUD/USD $0,7583 +0,40%

NZD/USD $0,7310 +0,36%

USD/CAD C$1,3028 -0,67%

-

23:02

Schedule for today, Wednesday, Feb 01’2017 (GMT0)

00:30 Japan Manufacturing PMI (Finally) January 52.4 52.8

01:00 China Manufacturing PMI January 51.4 51.2

01:00 China Non-Manufacturing PMI January 54.5

07:00 United Kingdom Nationwide house price index, y/y January 4.5% 4.4%

07:00 United Kingdom Nationwide house price index January 0.8% 0.3%

08:30 Switzerland Manufacturing PMI January 56 55.8

08:50 France Manufacturing PMI (Finally) January 53.5 53.4

08:55 Germany Manufacturing PMI (Finally) January 55.6 56.5

09:00 Eurozone Manufacturing PMI (Finally) January 54.9 55.1

09:30 United Kingdom Purchasing Manager Index Manufacturing January 56.1 55.9

13:15 U.S. ADP Employment Report January 153 165

14:45 U.S. Manufacturing PMI (Finally) January 54.3 55.1

15:00 U.S. Construction Spending, m/m December 0.9% 0.2%

15:00 U.S. ISM Manufacturing January 54.7 55

15:30 U.S. Crude Oil Inventories January 2.84

19:00 U.S. Fed Interest Rate Decision 0.75% 0.75%

20:00 U.S. Total Vehicle Sales, mln January 18.43 17.9

22:30 Australia AIG Manufacturing Index January 55.4

-

21:45

New Zealand: Employment Change, q/q, Quarter IV 0.8%

-

21:45

New Zealand: Unemployment Rate, Quarter IV 5.2% (forecast 4.8%)

-

16:11

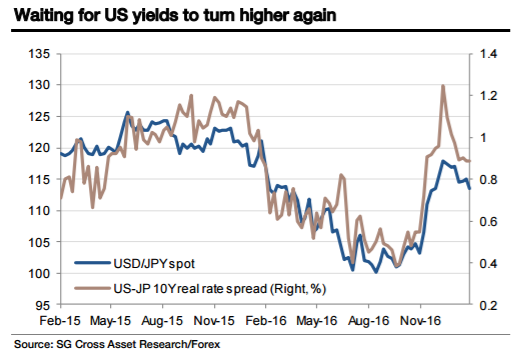

How far can the Dollar fall? - Societe Generale

"President Trump's travel ban - and his associated decision to fire the acting Attorney General - dominates sentiment and remains good for Treasuries, the yen (and gold), but bad for bonds and the dollar. How long will market sentiment to be affected? How far can the dollar and yields fall on this?

I'm not sure serious analysis is possible, and I don't trust my gut instincts on something as far from the usual state of affairs, but my bias is still that we'll get back to the Trump economic program, and the implications for Fed policy, before too long. More prosaically, markets will focus on the US jobs data due Friday.

So how to trade?

We still want to fade this bout of Yen weakness too, with the BoJ holding policy and still anchoring yields. This till leaves me looking fondly at long EUR/JPY as an idea, even if we still think it is 2 1/2 months too early for that trade really.

GBP looks rangebound, with mortgage approvals and the debate on the Brexit bill.

Visually, AUD looks as though it's topping out but at the same time, Australia looks a haven of calm (or at least, Sydney seems an appealing destination as I sit in Heathrow this morning, on the way to Frankfurt instead!)".

Copyright © 2017 Societe Generale, eFXnews™

-

15:04

The US Conference Board Consumer Confidence Index retreated in January

The Conference Board Consumer Confidence Index, which had increased in December, retreated in January. The Index now stands at 111.8 (1985=100), down from 113.3 in December. The Present Situation Index increased from 123.5 to 129.7, but the Expectations Index decreased from 106.4 last month to 99.8.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was January 19.

-

15:00

U.S.: Consumer confidence , January 111.8 (forecast 113.0)

-

14:57

Trump: Other countries take advantage by devaluation. So much for the strong dollar @zerohedge. New multi week lows for USD vs majors

-

14:45

U.S.: Chicago Purchasing Managers' Index , January 50.3 (forecast 55)

-

14:10

S&P US National Home Price index reported a 5.6% annual gain

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.6% annual gain in November, up from 5.5% last month. The 10-City Composite posted a 4.5% annual increase, up from 4.3% the previous month. The 20-City Composite reported a year-over-year gain of 5.3%, up from 5.1% in October.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last 10 months. In November, Seattle led the way with a 10.4% year-over-year price increase, followed by Portland with 10.1%, and Denver with an 8.7% increase. Eight cities reported greater price increases in the year ending November 2016 versus the year ending October 2016.

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, November 5.3% (forecast 5.1%)

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

-

13:40

US employment cost index rose 0.5% in Q4

Compensation costs for civilian workers increased 0.5 percent, seasonally adjusted, for the 3-month period ending in December 2016, the U.S. Bureau of Labor Statistics reported today. Wages and salaries (which make up about 70 percent of compensation costs) increased 0.5 percent, and benefits (which make up the remaining 30 percent of compensation) increased 0.4 percent.

Compensation costs for civilian workers increased 2.2 percent for the 12-month period ending in December 2016. In December 2015, compensation costs increased 2.0 percent. Wages and salaries increased 2.3 percent for the current 12-month period, and increased 2.1 percent for the 12-month period ending in December 2015. Benefit costs increased 2.1 percent for the 12-month period ending in December 2016. In December 2015, the increase was 1.7 percent.

-

13:34

Canadian gross domestic product rose for the fifth time in six months

Real gross domestic product rose for the fifth time in six months, up 0.4% in November. The increase in November came mainly from higher output in manufacturing, mining, quarrying, and oil and gas extraction, finance and insurance and construction.

Goods-producing industries rose by 0.9%, almost offsetting a 1.0% decline in October. There were increases in output in manufacturing, mining, quarrying, and oil and gas extraction and construction. The utilities and the agriculture and forestry sectors declined.

Service-producing industries were up 0.2%, mainly due to finance and insurance, retail trade, and transportation and warehousing. There was a decline in real estate and rental and leasing, while wholesale trade edged down.

-

13:30

Canada: GDP (m/m) , November 0.4% (forecast 0.3%)

-

13:30

Canada: Industrial Product Price Index, y/y, December 2.2%

-

13:30

Canada: Industrial Product Price Index, m/m, December 0.4% (forecast 0.6%)

-

13:01

Orders

EUR/USD

Offers: 1.0730 1.0750 1.0765 1.0780 1.0800 1.0830 1.0850-55

Bids: 1.0680 1.0655-60 1.0625-30 1.0600 1.0580 1.0565 1.0550

GBP/USD

Offers: 1.2520 1.2550 1.2565 1.2580 1.2600 1.2630 1.2660 1.2680 1.2700

Bids: 1.2475-80 1.2450 1.2430 1.2400 1.2380 1.2365 1.2350

EUR/GBP

Offers: 0.8580-85 0.8600 0.8620 0.8650

Bids: 0.8550 0.8525-30 0.8500 0.8470-75 0.8450

EUR/JPY

Offers: 122.00-05 122.30 122.60 123.00 123.30 123.50

Bids: 121.65 121.20 121.00 120.80 120.50 120.00

USD/JPY

Offers: 114.00 114.30 114.50 114.80 115.00 115.30-35 115.50 115.65 115.80 116.00

Bids: 113.50 113.20 113.00 112.80-85 112.50 112.30 112.00

AUD/USD

Offers: 0.7580-85 0.7600 0.7630 0.7650

Bids: 0.7520 0.7500 0.7480-85 0.7450 0.7430 0.7400

Информационно-аналитический отдел TeleTrade

-

12:55

Euro Surges After Trump Trade Advisor Accuses Germany Of Using "Grossly Undervalued" Currency - zerohedge

-

11:51

EUR/USD rallies after better than expected inflation, unemployment and GDP data. Up 70 pips so far approaching 1.08 important resistance area

-

10:52

Trade of the week by Citi: Sell Gbp/Usd

Currency investors should consider selling GBP/USD this week, advises CitiFX in its weekly FX pick to clients.

"Sell at 1.2548, target 1.2310, stop loss 1.2685," Citi advises.

Copyright © 2017 CitiFX, eFXnews™

-

10:04

Seasonally adjusted GDP rose by 0.5% in the euro area

Seasonally adjusted GDP rose by 0.5% in the euro area (EA19) and by 0.6% in the EU28 during the fourth quarter of 2016, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2016, GDP had grown by 0.4% in the euro area and by 0.5% in the EU28.

Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.8% in the euro area and by 1.9% in the EU28 in the fourth quarter of 2016, after also +1.8% and +1.9% in the previous quarter. Over the whole year 2016, GDP grew by 1.7% in the euro area and by 1.9% in the EU28.

-

10:04

Euro area unemployment rate declined more than expected in December

The euro area (EA19) seasonally-adjusted unemployment rate was 9.6% in December 2016, down from 9.7% in November 2016 and down from 10.5% in December 2015. This is the lowest rate recorded in the euro area since May 2009. The EU28 unemployment rate was 8.2% in December 2016, stable compared to November 2016 and down from 9.0% in December 2015. This remains the lowest rate recorded in the EU28 since February 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 20.065 million men and women in the EU28, of whom 15.571 million were in the euro area, were unemployed in December 2016. Compared with November 2016, the number of persons unemployed decreased by 159 000 in the EU28 and by 121 000 in the euro area. Compared with December 2015, unemployment fell by 1.839 million in the EU28 and by 1.256 million in the euro area.

-

10:02

Euro area annual inflation is expected to be 1.8% in January

Euro area annual inflation is expected to be 1.8% in January 2017, up from 1.1% in December 2016, according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in January (8.1%, compared with 2.6% in December), followed by food, alcohol & tobacco (1.7%, compared with 1.2% in December), services (1.2%, compared with 1.3% in December) and non-energy industrial goods (0.5%, compared with 0.3% in December).

-

10:00

Eurozone: Harmonized CPI, Y/Y, January 1.8% (forecast 1.6%)

-

10:00

Eurozone: GDP (QoQ), Quarter IV 0.5% (forecast 0.4%)

-

10:00

Eurozone: GDP (YoY), Quarter IV 1.8% (forecast 1.7%)

-

10:00

Eurozone: Unemployment Rate , December 9.6% (forecast 9.8%)

-

10:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, January 0.9%

-

09:30

United Kingdom: Consumer credit, mln, December 1039 (forecast 1700)

-

09:30

United Kingdom: Mortgage Approvals, December 67.9 (forecast 69)

-

09:26

Italian unemployment rate rose 0.2% in December

In December 2016, 22.783 million persons were employed, unchanged with November. Unemployed were 3.103 million, +0.3% over the previous month.

Employment rate was 57.3%, unemployment rate was 12.0% and inactivity rate was 34.8%, all unchanged over the previous month.

Youth unemployment rate (aged 15-24) was 40.1%, +0.2 percentage points over November and youth unemployment ratio in the same age group was 10.9%, +0.1 percentage points in a month.

-

08:55

Germany: Unemployment Rate s.a. , January 5.9% (forecast 6%)

-

08:55

Germany: Unemployment Change, January -26 (forecast -5)

-

08:22

Draghi: Financial Integration Essential for Well-Functioning Single Currency

-

Financial Integration and Single Currency 'Two Sides of Same Coin'

-

-

08:11

French CPI should accelerate sharply in January 2017 - Insee

Year on year, the Consumer Price Index (CPI) should accelerate sharply in January 2017 (+1.4% after +0.6% in December 2016), according to the provisional estimate made at the end of January. Inflation should thus reach its highest level since November 2012. This faster rise should come especially from the sharp acceleration in energy prices, linked on the one hand to the soaring prices of Brent crude and on the other hand to an increased taxation of petroleum products.

Over one month, the CPI is set to drop by 0.2% in January 2017, after an increase of 0.3% in December. This fall should be due to the seasonal decline in manufactured product prices, essentially those of clothing and footwear. However, this decrease should be less strong than in January 2016, mainly because the winter sales began later this year. The overall drop over the month should be mitigated by the sharp acceleration in energy prices and, to a lesser extent, in food prices.

-

07:30

Options levels on tuesday, January 31, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0777 (2518)

$1.0751 (2235)

$1.0734 (449)

Price at time of writing this review: $1.0689

Support levels (open interest**, contracts):

$1.0642 (1339)

$1.0620 (1357)

$1.0595 (2235)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 61387 contracts, with the maximum number of contracts with strike price $1,0800 (3940);

- Overall open interest on the PUT options with the expiration date March, 13 is 73181 contracts, with the maximum number of contracts with strike price $1,0000 (5072);

- The ratio of PUT/CALL was 1.19 versus 1.18 from the previous trading day according to data from January, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.2805 (1779)

$1.2707 (1785)

$1.2611 (1620)

Price at time of writing this review: $1.2495

Support levels (open interest**, contracts):

$1.2388 (993)

$1.2292 (1832)

$1.2194 (1142)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 23928 contracts, with the maximum number of contracts with strike price $1,2500 (2724);

- Overall open interest on the PUT options with the expiration date March, 13 is 26808 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- The ratio of PUT/CALL was 1.12 versus 1.13 from the previous trading day according to data from January, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:24

GBP defied the bears once again and bounced off its multi-year lows - Credit Agricole

"GBP defied the bears once again and bounced off its multi-year lows after political uncertainty in the UK started to subside when PM May committed to a vote in Parliament on the Brexit deal. This was seen as reducing the risk of undue delay to the triggering of Article 50 and, potentially, mitigating the threat of an eventual very 'hard Brexit'.

UK data remains fairly resilient as well and, coupled with accelerating inflation, means that the BoE will be firmly on hold for the foreseeable future. UK rates and gilt yields could still regain their pre-Brexit highs as a result. GBP remains one of the most undervalued G10 currencies and the market is still running sizeable shorts.

However, the outlook for GBP should remain challenging regardless. We believe that the UK's economic resilience will falter going forward but that the BoE will not be able to respond, constrained by uncomfortably high inflation. Fiscal stimulus should be limited by the UK's sizeable budget deficit, while the vast current account deficit and falling real gilt yields should keep alive concerns about a potential balance-of-payments crisis as well.

Our updated GBP forecasts reflect this 'tug of war' between FX undervaluation, short market positioning and resilient UK fundamentals on the one hand, and the still challenging economic outlook as well as the looming twin deficits in the UK on the other. We believe that a hard Brexit is largely in the price in the case of GBP/USD and revise our Q1- Q217 forecasts to the upside. At the same time, we now see a more muted recovery over the very long term.

We lower our forecast for EUR/GBP for Q1-Q217 to reflect the growing political risks in the Eurozone and the somewhat reduced political risks in the UK. At the same time, the risk of a hard Brexit has increased in our view, and that could be a supportive factor for the cross over the long term. We subsequently revise our EUR/GBP projections for 2018 to the upside".

Copyright © 2017 Credit Agricole CIB, eFXnews™

-

07:22

Japanese industrial production in December above expectations

According to preliminary data released by the Ministry of Economy, Trade and Industry of Japan, total production of factories and mining enterprises was 0.5%, while analysts had expected an increase of 0.3%. In November, industrial production growth was 1.5%. In annual terms, the index of industrial production increased by 3.0%, lower than the previous value of 4.6%.

Industrial production in Japan rose in December for the second month in a row due to a gradual increase in global demand for Japanese exports.

-

07:19

The Bank of Japan left monetary policy unchanged

At the end of the two-day meeting the Bank of Japan left rates unchanged at -0.1% and kept the amount of asset purchases at 80 trillion yen per year. The target level for the yield of 10-year bonds remained near 0%. The Bank of Japan also left unchanged the volume of ETF purchases at 6 trillion yen per year

According to the forecasts of the Central Bank core consumer price index increased by 1.7% in fiscal year 2018 compared to the previous forecast of + 1.7%.

The base consumer price index is likely to grow by 1.5% in fiscal year 2017 compared to the previous forecast of + 1.5%. The base consumer price index probably fell to 0.2% in fiscal year 2016 compared to the previous forecast of -0.1%. The Bank of Japan expects that inflation will reach 2% in fiscal year 2018

The Bank of Japan expects real GDP growth at 1.4% this year compared to the previous forecast of + 1.0% and by 1.5% in 2017 compared to the previous forecast of + 1.3%. The central bank expects real GDP to grow by 1.1% in fiscal year 2018 compared to the previous forecast of + 0.9%

Also, the Bank noted that the risks to the outlook for inflation and GDP shifted to the downside, although the pace of growth slightly above previous forecasts due to the state of foreign economies and a weak yen.

-

07:14

Trump fires acting US Attorney Gen. Yates of duties, names Dana Boente to take over @CNBCnow

-

07:13

German retail trade in December 2016 was in real terms 1.1%

According to provisional data turnover in retail trade in December 2016 was in real terms 1.1% smaller and in nominal terms 0.6% larger than that in December 2015. The number of days open for sale was 26 in December 2016 and 25 in December 2015.

Compared with the previous year, turnover in retail trade was in the whole year 2016 in real terms 1.6 % and in nominal terms 2.2 % larger than in 2015.

When adjusted for calendar and seasonal variations (Census-X-12-ARIMA), the December turnover was in real terms 0.9 % and in nominal terms 0.3 % smaller than that in November 2016.

-

07:01

Germany: Retail sales, real unadjusted, y/y, December -1.1% (forecast 0.3%)

-

07:01

Germany: Retail sales, real unadjusted, y/y, December -1.1% (forecast 0.3%)

-

07:00

Germany: Retail sales, real adjusted , December -0.9% (forecast 0.6%)

-

06:31

France: GDP, Y/Y, Quarter IV 1.1%

-

06:30

France: GDP, q/q, Quarter IV 0.4% (forecast 0.4%)

-

05:16

Japan: Construction Orders, y/y, December 7.1%

-

05:02

Japan: Housing Starts, y/y, December 3.9% (forecast 8.4%)

-

02:59

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-

00:46

Australia: National Australia Bank's Business Confidence, December 6

-

00:46

Australia: Private Sector Credit, m/m, December 0.7%

-

00:46

Australia: Private Sector Credit, y/y, December 5.6%

-

00:04

United Kingdom: Gfk Consumer Confidence, January -5 (forecast -8)

-