Market news

-

23:30

Commodities. Daily history for Jan 31’2017:

(raw materials / closing price /% change)

Oil 52.80 -0.02%

Gold 1,209.30 +0.06%

-

23:29

Stocks. Daily history for Jan 31’2017:

(index / closing price / change items /% change)

Nikkei -327.51 19041.34 -1.69%

TOPIX -22.10 1521.67 -1.43%

FTSE 100 -19.33 7099.15 -0.27%

DAX -146.58 11535.31 -1.25%

CAC 40 -35.74 4748.90 -0.75%

DJIA -107.04 19864.09 -0.54%

S&P 500 -2.03 2278.87 -0.09%

NASDAQ +1.07 5614.79 +0.02%

-

23:28

Currencies. Daily history for Jan 31’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0797 +0,96%

GBP/USD $1,2578 +0,76%

USD/CHF Chf0,989 -0,62%

USD/JPY Y112,79 -0,87%

EUR/JPY Y121,77 +0,10%

GBP/JPY Y141,84 -0,12%

AUD/USD $0,7583 +0,40%

NZD/USD $0,7310 +0,36%

USD/CAD C$1,3028 -0,67%

-

23:02

Schedule for today, Wednesday, Feb 01’2017 (GMT0)

00:30 Japan Manufacturing PMI (Finally) January 52.4 52.8

01:00 China Manufacturing PMI January 51.4 51.2

01:00 China Non-Manufacturing PMI January 54.5

07:00 United Kingdom Nationwide house price index, y/y January 4.5% 4.4%

07:00 United Kingdom Nationwide house price index January 0.8% 0.3%

08:30 Switzerland Manufacturing PMI January 56 55.8

08:50 France Manufacturing PMI (Finally) January 53.5 53.4

08:55 Germany Manufacturing PMI (Finally) January 55.6 56.5

09:00 Eurozone Manufacturing PMI (Finally) January 54.9 55.1

09:30 United Kingdom Purchasing Manager Index Manufacturing January 56.1 55.9

13:15 U.S. ADP Employment Report January 153 165

14:45 U.S. Manufacturing PMI (Finally) January 54.3 55.1

15:00 U.S. Construction Spending, m/m December 0.9% 0.2%

15:00 U.S. ISM Manufacturing January 54.7 55

15:30 U.S. Crude Oil Inventories January 2.84

19:00 U.S. Fed Interest Rate Decision 0.75% 0.75%

20:00 U.S. Total Vehicle Sales, mln January 18.43 17.9

22:30 Australia AIG Manufacturing Index January 55.4

-

21:45

New Zealand: Employment Change, q/q, Quarter IV 0.8%

-

21:45

New Zealand: Unemployment Rate, Quarter IV 5.2% (forecast 4.8%)

-

21:06

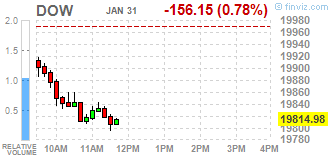

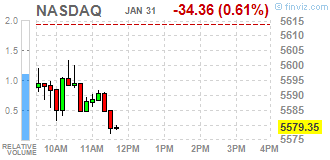

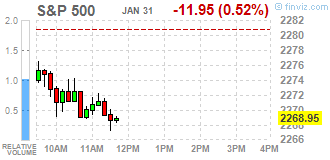

Major US stock indexes finished trading mostly in the red

Major US stock indexes continued to fall on Tuesday, weighed down by a decrease in the technological and financial sectors, amid disappointing weak consumer confidence data.

The data from the Conference Board showed that consumer confidence indicator decreased moderately by the end of January, reaching 111.8 points (1985 = 100) compared to 113.3 points in December (revised from 113.7 points). Analysts predicted that the figure will be 113.0 points.

Market participants, who not so long ago pushed Wall Street to record highs on expectations of new financial incentives under the new administration, disappointed because of the insulating Trump policy, including restrictions on entry into the United States.

In addition, as it became known today, to compensate for the costs of civilian workers increased by 0.5%, seasonally adjusted, 3-month period ending in December 2016. US Bureau of Labor Statistics reported that the salary (which is about 70% reimbursement of expenses) increased by 0.5%, and bonuses (which make up the remaining 30% compensation) increased by 0.4%.

At the same time, house prices rose strongly in November, with the increase in prices did not show any signs of slowing down, even after mortgage rates began to rise during the month. House Price Index from the S & P / Case-Shiller, covering the whole country, increased by 5.6% in the 12 months ended in November, slightly above the revised growth of 5.5% compared to the previous year, which was reported in October.

Oil prices rose slightly, reacted to the news of a sharp reduction in OPEC oil production, as well as the weakening of the dollar across the board. Reuters survey showed that the volume of oil production by OPEC countries fell by more than 1 million. Barrels per day in January. Recall, the Organization of Petroleum Exporting Countries agreed to cut production by about 1.2 million. Barrels per day from January 1, to maintain prices and reduce oversupply.

DOW index components closed mostly in the red (22 of 30). Most remaining shares tumbled The Goldman Sachs Group, Inc. (GS, -1.87%). leaders of growth were shares of Pfizer Inc. (PFE, + 1.20%).

Almost all sectors of the S & P ended the session in negative territory. Most of the basic materials sector fell (-1.9%). The leader turned out to be the health sector (+ 2.0%).

At the close:

Dow -0.53% 19,864.94 -106.19

Nasdaq + 0.02% 5,614.79 +1.08

S & P -0.09% 2,278.91 -1.99

-

20:00

DJIA -0.71% 19,829.51 -141.62 Nasdaq -0.27% 5,598.30 -15.41 S&P -0.33% 2,273.36 -7.54

-

17:00

European stocks closed: FTSE 100 -19.33 7099.15 -0.27% DAX -146.58 11535.31 -1.25% CAC 40 -35.74 4748.90 -0.75%

-

16:49

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes extended losses in late morning trade on Tuesday, weighed down by technology and industrial stocks, amid disappointing earnings and weak consumer confidence data. The selling comes a day after Wall Street suffered its worst day of 2017, as investors turned wary about the consequences of President Donald Trump's isolationist policies such as curbing travel to the United States.

Most of Dow stocks in negative area (25 of 30). Top loser - The Goldman Sachs Group, Inc. (GS, -1.78%). Top gainer - Merck & Co., Inc. (MRK, +0.63%).

Almost all S&P sectors also in negative area. Top loser - Utilities (+1.0%). Top loser - Services (-0.8%).

At the moment:

Dow 19730.00 -158.00 -0.79%

S&P 500 2262.75 -13.25 -0.58%

Nasdaq 100 5085.25 -39.25 -0.77%

Oil 53.43 +0.80 +1.52%

Gold 1214.70 +18.70 +1.56%

U.S. 10yr 2.44 -0.05

-

16:38

WSE: Session Results

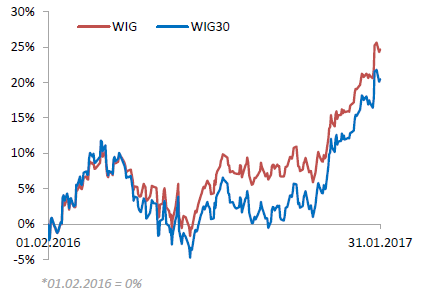

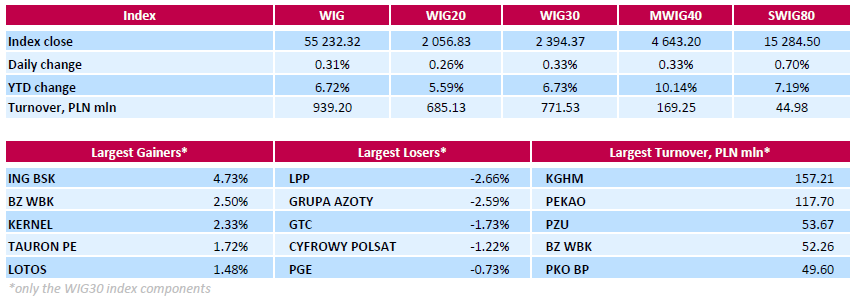

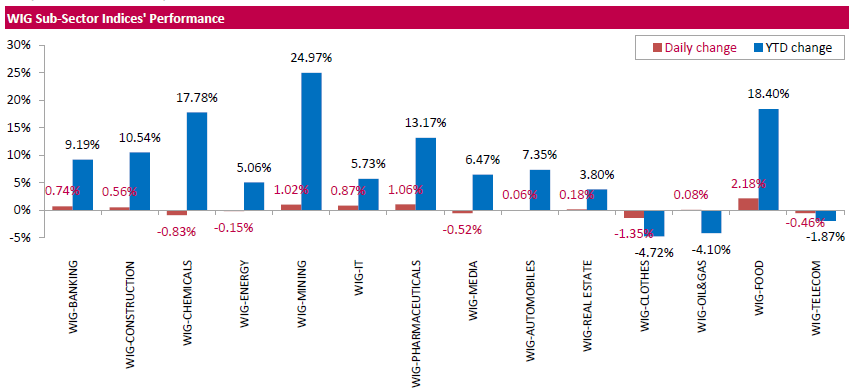

Polish equity market closed higher on Tuesday. The broad market measure, the WIG index, added 0.31%. Sector-wise, food stocks (+2.18%) fared the best, while clothes sector names (-1.35%) fell the most.

The large-cap benchmark, the WIG30 Index, rose by 0.33%. Within the index components, the gainers were led by banking sector name ING BSK (WSE: ING), which jumped by 4.73%, recovering after a 5.4% drop, recorded in the previous two days. Other major advancers were bank BZ WBK (WSE: BZW), agricultural producer KERNEL (WSE: KER) and genco TAURON PE (WSE: TPE), climbing by 2.5%, 2.33% and 1.72% respectively. The former was supported by the bank's CEO Michal Gajewski statement that the BZ WBK's loan portfolio increased by 7.9% in 2016 to PLN 107.9 bln in 2016. In addition, Mr. Gajewski expressed hope that the bank would outperform the 3.7% loan book growth forecast for the market in 2017. On the other side of the ledger, clothing retailer LPP (WSE: LPP) topped the list of the decliners with a 2.66% drop, followed by chemical producer GRUPA AZOTY (WSE: ATT) and property developer GTC (WSE: GTC), falling by 2.59% and 1.73% respectively.

-

16:11

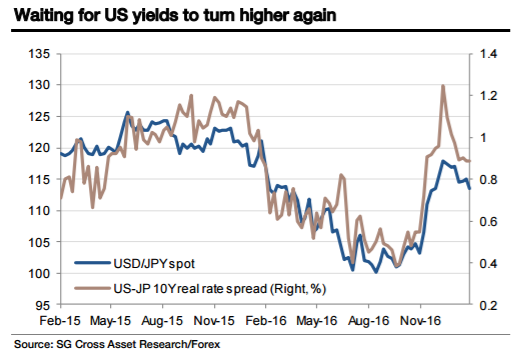

How far can the Dollar fall? - Societe Generale

"President Trump's travel ban - and his associated decision to fire the acting Attorney General - dominates sentiment and remains good for Treasuries, the yen (and gold), but bad for bonds and the dollar. How long will market sentiment to be affected? How far can the dollar and yields fall on this?

I'm not sure serious analysis is possible, and I don't trust my gut instincts on something as far from the usual state of affairs, but my bias is still that we'll get back to the Trump economic program, and the implications for Fed policy, before too long. More prosaically, markets will focus on the US jobs data due Friday.

So how to trade?

We still want to fade this bout of Yen weakness too, with the BoJ holding policy and still anchoring yields. This till leaves me looking fondly at long EUR/JPY as an idea, even if we still think it is 2 1/2 months too early for that trade really.

GBP looks rangebound, with mortgage approvals and the debate on the Brexit bill.

Visually, AUD looks as though it's topping out but at the same time, Australia looks a haven of calm (or at least, Sydney seems an appealing destination as I sit in Heathrow this morning, on the way to Frankfurt instead!)".

Copyright © 2017 Societe Generale, eFXnews™

-

15:04

The US Conference Board Consumer Confidence Index retreated in January

The Conference Board Consumer Confidence Index, which had increased in December, retreated in January. The Index now stands at 111.8 (1985=100), down from 113.3 in December. The Present Situation Index increased from 123.5 to 129.7, but the Expectations Index decreased from 106.4 last month to 99.8.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was January 19.

-

15:00

U.S.: Consumer confidence , January 111.8 (forecast 113.0)

-

14:57

Trump: Other countries take advantage by devaluation. So much for the strong dollar @zerohedge. New multi week lows for USD vs majors

-

14:53

WSE: After start on Wall Street

The market in the US started on 0.28% minus (The S&P500 index) which after the first transaction has been slightly offset. Unfortunately, a weak Chicago PMI reading intensified the process of weakening of the dollar and contributed to the reduction of US indexes.

An hour before the close of trading WIG20 index was at the level of 2,061 points (+ 0.47%)

-

14:45

U.S.: Chicago Purchasing Managers' Index , January 50.3 (forecast 55)

-

14:33

U.S. Stocks open: Dow -0.34%, Nasdaq -0.35%, S&P -0.26%

-

14:27

Before the bell: S&P futures -0.26%, NASDAQ futures -0.27%

U.S. stock-index futures fell as investors focused on President Donald Trump's policies that could prove detrimental to the markets.

Global Stocks:

Nikkei 19,041.34 -327.51 -1.69%

Hang Seng - Closed

Shanghai - Closed

FTSE 7,156.82 +38.34 +0.54%

CAC 4,802.58 +17.94 +0.37%

DAX 11,695.95 +14.06 +0.12%

Crude $52.90 (+0.51%)

Gold $1,204.20 (+0.92%)

-

14:10

S&P US National Home Price index reported a 5.6% annual gain

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.6% annual gain in November, up from 5.5% last month. The 10-City Composite posted a 4.5% annual increase, up from 4.3% the previous month. The 20-City Composite reported a year-over-year gain of 5.3%, up from 5.1% in October.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last 10 months. In November, Seattle led the way with a 10.4% year-over-year price increase, followed by Portland with 10.1%, and Denver with an 8.7% increase. Eight cities reported greater price increases in the year ending November 2016 versus the year ending October 2016.

-

14:00

U.S.: S&P/Case-Shiller Home Price Indices, y/y, November 5.3% (forecast 5.1%)

-

13:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

35.88

-0.67(-1.8331%)

850

ALTRIA GROUP INC.

MO

798.52

-3.80(-0.4736%)

6059

Amazon.com Inc., NASDAQ

AMZN

165.65

0.08(0.0483%)

738

American Express Co

AXP

233.3

-0.60(-0.2565%)

1228

Apple Inc.

AAPL

121.21

-0.42(-0.3453%)

88347

AT&T Inc

T

41.7

-0.12(-0.2869%)

491

Barrick Gold Corporation, NYSE

ABX

18.36

0.35(1.9434%)

53506

Boeing Co

BA

165.65

0.08(0.0483%)

738

Chevron Corp

CVX

111

-0.82(-0.7333%)

1876

Cisco Systems Inc

CSCO

165.65

0.08(0.0483%)

738

Citigroup Inc., NYSE

C

233.3

-0.60(-0.2565%)

1228

Deere & Company, NYSE

DE

106.49

-0.57(-0.5324%)

402

E. I. du Pont de Nemours and Co

DD

165.65

0.08(0.0483%)

738

Exxon Mobil Corp

XOM

85.05

0.19(0.2239%)

117711

Facebook, Inc.

FB

130.54

-0.44(-0.3359%)

36288

FedEx Corporation, NYSE

FDX

190.42

-2.83(-1.4644%)

3341

Ford Motor Co.

F

61.4

-0.03(-0.0488%)

275

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.62

0.37(2.2769%)

187238

General Electric Co

GE

233.3

-0.60(-0.2565%)

1228

General Motors Company, NYSE

GM

233.3

-0.60(-0.2565%)

1228

Goldman Sachs

GS

233.3

-0.60(-0.2565%)

1228

Google Inc.

GOOG

798.52

-3.80(-0.4736%)

6059

Hewlett-Packard Co.

HPQ

165.65

0.08(0.0483%)

738

HONEYWELL INTERNATIONAL INC.

HON

118.52

-0.59(-0.4953%)

1452

Intel Corp

INTC

37.5

0.08(0.2138%)

384

International Business Machines Co...

IBM

175.51

-0.29(-0.165%)

654

JPMorgan Chase and Co

JPM

85.69

-0.34(-0.3952%)

4693

Merck & Co Inc

MRK

61.4

-0.03(-0.0488%)

275

Microsoft Corp

MSFT

61.4

-0.03(-0.0488%)

275

Nike

NKE

51.84

-1.24(-2.3361%)

163727

Pfizer Inc

PFE

31.06

-0.25(-0.7985%)

97712

Tesla Motors, Inc., NASDAQ

TSLA

249.16

-1.47(-0.5865%)

7055

Travelers Companies Inc

TRV

233.3

-0.60(-0.2565%)

1228

Twitter, Inc., NYSE

TWTR

16.9

-0.04(-0.2361%)

13181

United Technologies Corp

UTX

165.65

0.08(0.0483%)

738

UnitedHealth Group Inc

UNH

162

-0.09(-0.0555%)

725

Verizon Communications Inc

VZ

49.31

-0.06(-0.1215%)

1816

Visa

V

82.66

-1.04(-1.2425%)

17961

Wal-Mart Stores Inc

WMT

66.36

-0.06(-0.0903%)

6423

Yahoo! Inc., NASDAQ

YHOO

798.52

-3.80(-0.4736%)

6059

Yandex N.V., NASDAQ

YNDX

798.52

-3.80(-0.4736%)

6059

-

13:47

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

AT&T (T) initiated with a Hold at Evercore ISI

Verizon (VZ) initiated with a Hold at Evercore ISI

Apple (AAPL) target lowered to $164 from $173 at Maxim Group

-

13:45

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

-

13:40

US employment cost index rose 0.5% in Q4

Compensation costs for civilian workers increased 0.5 percent, seasonally adjusted, for the 3-month period ending in December 2016, the U.S. Bureau of Labor Statistics reported today. Wages and salaries (which make up about 70 percent of compensation costs) increased 0.5 percent, and benefits (which make up the remaining 30 percent of compensation) increased 0.4 percent.

Compensation costs for civilian workers increased 2.2 percent for the 12-month period ending in December 2016. In December 2015, compensation costs increased 2.0 percent. Wages and salaries increased 2.3 percent for the current 12-month period, and increased 2.1 percent for the 12-month period ending in December 2015. Benefit costs increased 2.1 percent for the 12-month period ending in December 2016. In December 2015, the increase was 1.7 percent.

-

13:34

Canadian gross domestic product rose for the fifth time in six months

Real gross domestic product rose for the fifth time in six months, up 0.4% in November. The increase in November came mainly from higher output in manufacturing, mining, quarrying, and oil and gas extraction, finance and insurance and construction.

Goods-producing industries rose by 0.9%, almost offsetting a 1.0% decline in October. There were increases in output in manufacturing, mining, quarrying, and oil and gas extraction and construction. The utilities and the agriculture and forestry sectors declined.

Service-producing industries were up 0.2%, mainly due to finance and insurance, retail trade, and transportation and warehousing. There was a decline in real estate and rental and leasing, while wholesale trade edged down.

-

13:30

Canada: GDP (m/m) , November 0.4% (forecast 0.3%)

-

13:30

Canada: Industrial Product Price Index, y/y, December 2.2%

-

13:30

Canada: Industrial Product Price Index, m/m, December 0.4% (forecast 0.6%)

-

13:27

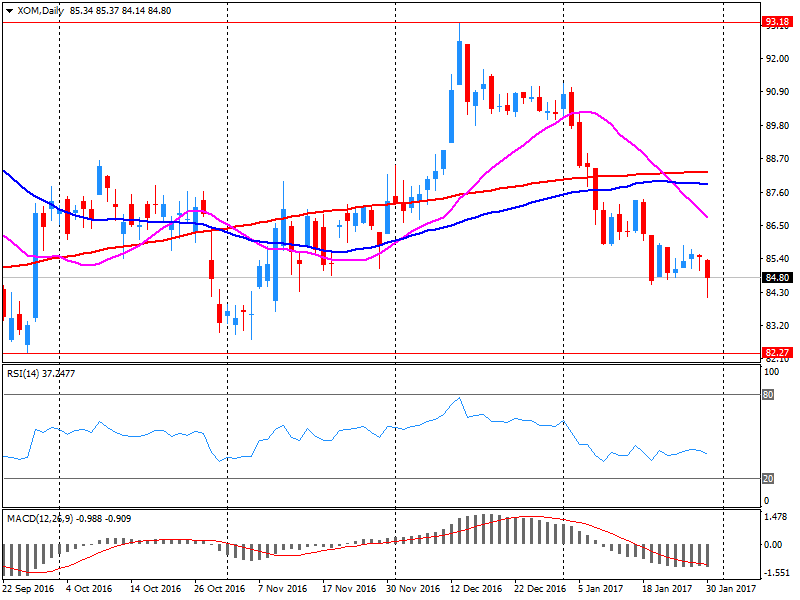

Company News: Exxon Mobil (XOM) Q4 EPS miss analysts’ forecast

Exxon Mobil reported Q4 FY 2016 earnings of $0.41 per share (versus $0.67 in Q4 FY 2015), missing analysts' consensus estimate of $0.71..

The company's quarterly revenues amounted to $61.016 bln (+2% y/y), generally in-line with analysts' consensus estimate of $60.905 bln.

XOM fell to $84.78 (-0.09%) in pre-market trading.

-

13:03

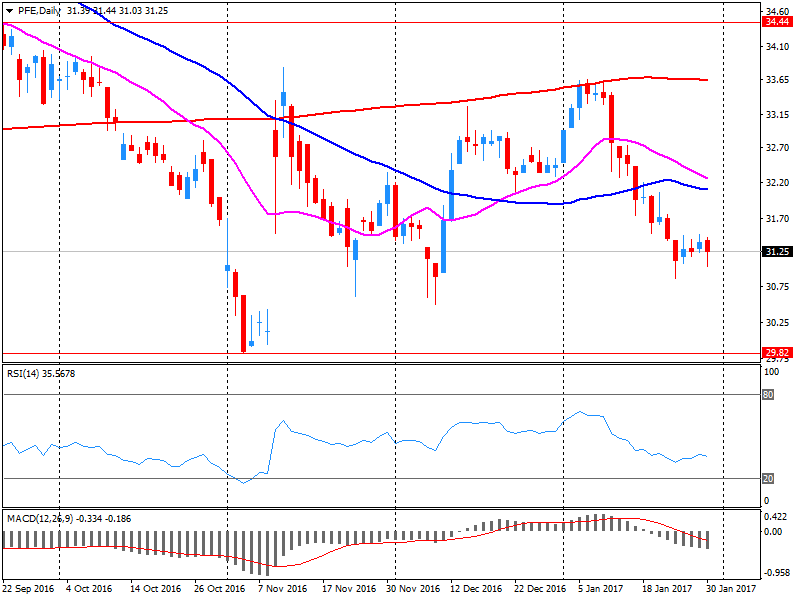

Company News: Pfizer (PFE) Q4 EPS miss analysts’ estimate

Pfizer reported Q4 FY 2016 earnings of $0.47 per share (versus $0.53 in Q4 FY 2015), missing analysts' consensus estimate of $0.51.

The company's quarterly revenues amounted to $13.627 bln (-3% y/y), generally in-line with analysts' consensus estimate of $13.690 bln.

The company also issued in-line guidance for FY 2017, projecting EPS of 2.50-2.60 (versus analysts' consensus estimate of $2.60) and revenues of $52-54 bln (versus analysts' consensus estimate of $54.86 bln).

PFE fell to $30.88 (-1.37%) in pre-market trading.

-

13:01

Orders

EUR/USD

Offers: 1.0730 1.0750 1.0765 1.0780 1.0800 1.0830 1.0850-55

Bids: 1.0680 1.0655-60 1.0625-30 1.0600 1.0580 1.0565 1.0550

GBP/USD

Offers: 1.2520 1.2550 1.2565 1.2580 1.2600 1.2630 1.2660 1.2680 1.2700

Bids: 1.2475-80 1.2450 1.2430 1.2400 1.2380 1.2365 1.2350

EUR/GBP

Offers: 0.8580-85 0.8600 0.8620 0.8650

Bids: 0.8550 0.8525-30 0.8500 0.8470-75 0.8450

EUR/JPY

Offers: 122.00-05 122.30 122.60 123.00 123.30 123.50

Bids: 121.65 121.20 121.00 120.80 120.50 120.00

USD/JPY

Offers: 114.00 114.30 114.50 114.80 115.00 115.30-35 115.50 115.65 115.80 116.00

Bids: 113.50 113.20 113.00 112.80-85 112.50 112.30 112.00

AUD/USD

Offers: 0.7580-85 0.7600 0.7630 0.7650

Bids: 0.7520 0.7500 0.7480-85 0.7450 0.7430 0.7400

Информационно-аналитический отдел TeleTrade

-

12:55

Euro Surges After Trump Trade Advisor Accuses Germany Of Using "Grossly Undervalued" Currency - zerohedge

-

12:03

WSE: Mid session comment

The first hour of today's trading has brought improvement in the climate on European markets, including Warsaw. The reading of the dynamics of Polish GDP surprised slightly positive and was amounted (according to preliminary estimates) of 2.8% compared to the expected level of 2.7%. Stronger was the consumption and investment decline has slowed, which sounds well for the start of this year. The most important is that in the first three quarters of the previous year GDP growth has surprised negatively, and now we have a positive message.

Readings of GDP in the euro zone also had a positive surprise. GDP growth rate of euro area countries in the fourth quarter was 1.8%, which is the result of slightly better-than-expected at 1.7%. At the same time the annualized growth was 2%, which is slightly better result than in the US. The market for the readings came with the reserve and on major European stock exchanges rises remain moderate.

At the halfway point of quotations the WIG20 index was at the level of 2,066 points (+0,73%).

-

11:51

EUR/USD rallies after better than expected inflation, unemployment and GDP data. Up 70 pips so far approaching 1.08 important resistance area

-

10:52

Trade of the week by Citi: Sell Gbp/Usd

Currency investors should consider selling GBP/USD this week, advises CitiFX in its weekly FX pick to clients.

"Sell at 1.2548, target 1.2310, stop loss 1.2685," Citi advises.

Copyright © 2017 CitiFX, eFXnews™

-

10:04

Seasonally adjusted GDP rose by 0.5% in the euro area

Seasonally adjusted GDP rose by 0.5% in the euro area (EA19) and by 0.6% in the EU28 during the fourth quarter of 2016, compared with the previous quarter, according to a preliminary flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2016, GDP had grown by 0.4% in the euro area and by 0.5% in the EU28.

Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.8% in the euro area and by 1.9% in the EU28 in the fourth quarter of 2016, after also +1.8% and +1.9% in the previous quarter. Over the whole year 2016, GDP grew by 1.7% in the euro area and by 1.9% in the EU28.

-

10:04

Euro area unemployment rate declined more than expected in December

The euro area (EA19) seasonally-adjusted unemployment rate was 9.6% in December 2016, down from 9.7% in November 2016 and down from 10.5% in December 2015. This is the lowest rate recorded in the euro area since May 2009. The EU28 unemployment rate was 8.2% in December 2016, stable compared to November 2016 and down from 9.0% in December 2015. This remains the lowest rate recorded in the EU28 since February 2009. These figures are published by Eurostat, the statistical office of the European Union.

Eurostat estimates that 20.065 million men and women in the EU28, of whom 15.571 million were in the euro area, were unemployed in December 2016. Compared with November 2016, the number of persons unemployed decreased by 159 000 in the EU28 and by 121 000 in the euro area. Compared with December 2015, unemployment fell by 1.839 million in the EU28 and by 1.256 million in the euro area.

-

10:02

Euro area annual inflation is expected to be 1.8% in January

Euro area annual inflation is expected to be 1.8% in January 2017, up from 1.1% in December 2016, according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, energy is expected to have the highest annual rate in January (8.1%, compared with 2.6% in December), followed by food, alcohol & tobacco (1.7%, compared with 1.2% in December), services (1.2%, compared with 1.3% in December) and non-energy industrial goods (0.5%, compared with 0.3% in December).

-

10:00

Eurozone: Harmonized CPI, Y/Y, January 1.8% (forecast 1.6%)

-

10:00

Eurozone: GDP (QoQ), Quarter IV 0.5% (forecast 0.4%)

-

10:00

Eurozone: GDP (YoY), Quarter IV 1.8% (forecast 1.7%)

-

10:00

Eurozone: Unemployment Rate , December 9.6% (forecast 9.8%)

-

10:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, January 0.9%

-

09:30

United Kingdom: Consumer credit, mln, December 1039 (forecast 1700)

-

09:30

United Kingdom: Mortgage Approvals, December 67.9 (forecast 69)

-

09:26

Italian unemployment rate rose 0.2% in December

In December 2016, 22.783 million persons were employed, unchanged with November. Unemployed were 3.103 million, +0.3% over the previous month.

Employment rate was 57.3%, unemployment rate was 12.0% and inactivity rate was 34.8%, all unchanged over the previous month.

Youth unemployment rate (aged 15-24) was 40.1%, +0.2 percentage points over November and youth unemployment ratio in the same age group was 10.9%, +0.1 percentage points in a month.

-

08:55

Germany: Unemployment Rate s.a. , January 5.9% (forecast 6%)

-

08:55

Germany: Unemployment Change, January -26 (forecast -5)

-

08:50

Major European stock markets trading higher: FTSE + 0.1%, DAX + 0.1%, CAC40 + 0.1%, FTMIB + 0.2%, IBEX + 0.1%

-

08:22

Draghi: Financial Integration Essential for Well-Functioning Single Currency

-

Financial Integration and Single Currency 'Two Sides of Same Coin'

-

-

08:17

WSE: After opening

WIG20 index opened at 2052.23 points (+0.04%)*

WIG 55104.36 0.08%

WIG30 2389.38 0.12%

mWIG40 4629.88 0.04%

*/ - change to previous close

The cash market began the last day of the month from cosmetics increase at a moderate turnover, traditionally concentrated on the shares of KGHM and the increased interest in shares of Polimex (WSE: PXM), which in recent days also has become the norm. In Germany the DAX opened with a modest increase, leading to a peaceful start of the European part of today's trading. Due to the last day of the month and the related date of assets valuation, the preferred scenario for today is growth.

After fifteen minutes of trading the WIG20 index was at the level of 2,052 points (+0,06%).

-

08:11

French CPI should accelerate sharply in January 2017 - Insee

Year on year, the Consumer Price Index (CPI) should accelerate sharply in January 2017 (+1.4% after +0.6% in December 2016), according to the provisional estimate made at the end of January. Inflation should thus reach its highest level since November 2012. This faster rise should come especially from the sharp acceleration in energy prices, linked on the one hand to the soaring prices of Brent crude and on the other hand to an increased taxation of petroleum products.

Over one month, the CPI is set to drop by 0.2% in January 2017, after an increase of 0.3% in December. This fall should be due to the seasonal decline in manufactured product prices, essentially those of clothing and footwear. However, this decrease should be less strong than in January 2016, mainly because the winter sales began later this year. The overall drop over the month should be mitigated by the sharp acceleration in energy prices and, to a lesser extent, in food prices.

-

07:30

Options levels on tuesday, January 31, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0777 (2518)

$1.0751 (2235)

$1.0734 (449)

Price at time of writing this review: $1.0689

Support levels (open interest**, contracts):

$1.0642 (1339)

$1.0620 (1357)

$1.0595 (2235)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 61387 contracts, with the maximum number of contracts with strike price $1,0800 (3940);

- Overall open interest on the PUT options with the expiration date March, 13 is 73181 contracts, with the maximum number of contracts with strike price $1,0000 (5072);

- The ratio of PUT/CALL was 1.19 versus 1.18 from the previous trading day according to data from January, 30

GBP/USD

Resistance levels (open interest**, contracts)

$1.2805 (1779)

$1.2707 (1785)

$1.2611 (1620)

Price at time of writing this review: $1.2495

Support levels (open interest**, contracts):

$1.2388 (993)

$1.2292 (1832)

$1.2194 (1142)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 23928 contracts, with the maximum number of contracts with strike price $1,2500 (2724);

- Overall open interest on the PUT options with the expiration date March, 13 is 26808 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- The ratio of PUT/CALL was 1.12 versus 1.13 from the previous trading day according to data from January, 30

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:25

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.5%, CAC40 -0.4%, FTSE -0.3%

-

07:24

GBP defied the bears once again and bounced off its multi-year lows - Credit Agricole

"GBP defied the bears once again and bounced off its multi-year lows after political uncertainty in the UK started to subside when PM May committed to a vote in Parliament on the Brexit deal. This was seen as reducing the risk of undue delay to the triggering of Article 50 and, potentially, mitigating the threat of an eventual very 'hard Brexit'.

UK data remains fairly resilient as well and, coupled with accelerating inflation, means that the BoE will be firmly on hold for the foreseeable future. UK rates and gilt yields could still regain their pre-Brexit highs as a result. GBP remains one of the most undervalued G10 currencies and the market is still running sizeable shorts.

However, the outlook for GBP should remain challenging regardless. We believe that the UK's economic resilience will falter going forward but that the BoE will not be able to respond, constrained by uncomfortably high inflation. Fiscal stimulus should be limited by the UK's sizeable budget deficit, while the vast current account deficit and falling real gilt yields should keep alive concerns about a potential balance-of-payments crisis as well.

Our updated GBP forecasts reflect this 'tug of war' between FX undervaluation, short market positioning and resilient UK fundamentals on the one hand, and the still challenging economic outlook as well as the looming twin deficits in the UK on the other. We believe that a hard Brexit is largely in the price in the case of GBP/USD and revise our Q1- Q217 forecasts to the upside. At the same time, we now see a more muted recovery over the very long term.

We lower our forecast for EUR/GBP for Q1-Q217 to reflect the growing political risks in the Eurozone and the somewhat reduced political risks in the UK. At the same time, the risk of a hard Brexit has increased in our view, and that could be a supportive factor for the cross over the long term. We subsequently revise our EUR/GBP projections for 2018 to the upside".

Copyright © 2017 Credit Agricole CIB, eFXnews™

-

07:22

Japanese industrial production in December above expectations

According to preliminary data released by the Ministry of Economy, Trade and Industry of Japan, total production of factories and mining enterprises was 0.5%, while analysts had expected an increase of 0.3%. In November, industrial production growth was 1.5%. In annual terms, the index of industrial production increased by 3.0%, lower than the previous value of 4.6%.

Industrial production in Japan rose in December for the second month in a row due to a gradual increase in global demand for Japanese exports.

-

07:19

The Bank of Japan left monetary policy unchanged

At the end of the two-day meeting the Bank of Japan left rates unchanged at -0.1% and kept the amount of asset purchases at 80 trillion yen per year. The target level for the yield of 10-year bonds remained near 0%. The Bank of Japan also left unchanged the volume of ETF purchases at 6 trillion yen per year

According to the forecasts of the Central Bank core consumer price index increased by 1.7% in fiscal year 2018 compared to the previous forecast of + 1.7%.

The base consumer price index is likely to grow by 1.5% in fiscal year 2017 compared to the previous forecast of + 1.5%. The base consumer price index probably fell to 0.2% in fiscal year 2016 compared to the previous forecast of -0.1%. The Bank of Japan expects that inflation will reach 2% in fiscal year 2018

The Bank of Japan expects real GDP growth at 1.4% this year compared to the previous forecast of + 1.0% and by 1.5% in 2017 compared to the previous forecast of + 1.3%. The central bank expects real GDP to grow by 1.1% in fiscal year 2018 compared to the previous forecast of + 0.9%

Also, the Bank noted that the risks to the outlook for inflation and GDP shifted to the downside, although the pace of growth slightly above previous forecasts due to the state of foreign economies and a weak yen.

-

07:18

WSE: Before opening

Monday's session on the New York stock exchange ended with declines in major indices. At the close the Dow Jones Industrial fell by 0.61 percent, the Nasdaq Composite lost 0.83 percent and the S&P 500 went down by 0.60 percent. Investors are still negatively react to the presidential decree to limit immigration.

The Asian markets are dominated by declines. The weaker yen does not support the Tokyo Stock Exchange, although the main impact on the Nikkei's discount of 1.7% has probably the passive attitude of the BoJ, which left its policy unchanged. Today's macro calendar doesn't contain any deeper content. An important may be the initial estimate of GDP growth for Poland in around 2016 and the level of the US index regarding consumer confidence - the Conference Board. This week the market is waiting for quarterly reports of large technology companies. Today, the results will give Apple, Facebook tomorrow and Amazon on Thursday.

-

07:14

Trump fires acting US Attorney Gen. Yates of duties, names Dana Boente to take over @CNBCnow

-

07:13

German retail trade in December 2016 was in real terms 1.1%

According to provisional data turnover in retail trade in December 2016 was in real terms 1.1% smaller and in nominal terms 0.6% larger than that in December 2015. The number of days open for sale was 26 in December 2016 and 25 in December 2015.

Compared with the previous year, turnover in retail trade was in the whole year 2016 in real terms 1.6 % and in nominal terms 2.2 % larger than in 2015.

When adjusted for calendar and seasonal variations (Census-X-12-ARIMA), the December turnover was in real terms 0.9 % and in nominal terms 0.3 % smaller than that in November 2016.

-

07:01

Germany: Retail sales, real unadjusted, y/y, December -1.1% (forecast 0.3%)

-

07:01

Germany: Retail sales, real unadjusted, y/y, December -1.1% (forecast 0.3%)

-

07:00

Germany: Retail sales, real adjusted , December -0.9% (forecast 0.6%)

-

06:31

France: GDP, Y/Y, Quarter IV 1.1%

-

06:30

France: GDP, q/q, Quarter IV 0.4% (forecast 0.4%)

-

06:14

Global Stocks

European stocks finished with their biggest drop in two months Monday, with airlines and other leisure shares taking a hit after the Trump administration suspended entry by citizens of seven Muslim-majority countries into the U.S.

U.S. stocks posted their biggest decline for 2017 as investors fretted over the negative implications of President Donald Trump's decision to temporarily halt immigrants from certain countries with large numbers of Muslims. There are also concerns that the fast pace of executive orders from the new president could sow more confusion and uncertainty in the market going forward.

The Asia-Pacific markets that were open for business during the Lunar New Year holiday extended their declines Tuesday, tracking moves overnight in the U.S., as investor risk aversion around President Donald Trump's immigration policy kicked in. The losses marked a turn from the gains racked up in global equity markets last week, when the Dow Jones Industrial Average crossed the 20,000 point line for the first time ever; the Nikkei also reached multiweek highs.

-

05:16

Japan: Construction Orders, y/y, December 7.1%

-

05:02

Japan: Housing Starts, y/y, December 3.9% (forecast 8.4%)

-

02:59

Japan: BoJ Interest Rate Decision, -0.1% (forecast -0.1%)

-

00:46

Australia: National Australia Bank's Business Confidence, December 6

-

00:46

Australia: Private Sector Credit, m/m, December 0.7%

-

00:46

Australia: Private Sector Credit, y/y, December 5.6%

-

00:04

United Kingdom: Gfk Consumer Confidence, January -5 (forecast -8)

-