Market news

-

23:31

Stocks. Daily history for Feb 01’2017:

(index / closing price / change items /% change)

Nikkei +106.74 19148.08 +0.56%

TOPIX +6.10 1527.77 +0.40%

Euro Stoxx 50 +28.24 3258.92 +0.87%

FTSE 100 +8.50 7107.65 +0.12%

DAX +124.19 11659.50 +1.08%

CAC 40 +45.68 4794.58 +0.96%

DJIA +26.85 19890.94 +0.14%

S&P 500 +0.68 2279.55 +0.03%

NASDAQ +27.87 5642.65 +0.50%

S&P/TSX +16.43 15402.39 +0.11%

-

21:06

Major US stock indexes showed a slight increase

Major US stock indexes finished trading in positive territory thanks to optimistic statistical data on the US, and the reporting of a number of companies, including Apple Inc. At the same time, market participants drew attention to the outcome of the February meeting of the US Federal Reserve.

Data from Automatic Data Processing have shown that employment growth in the US private sector accelerated in January, more than expected. According to the report, in January, the number of employees increased by 246 thousand. People in comparison to the revised downward index for December at the level of 151 thousand. (Originally reported growth of 153 thousand.). Analysts had expected the number of people employed will increase by 165 thousand.

In addition, US producers signaled a strong start in 2017, while the growth of output and new orders accelerated since the end of last year. Improving the business environment is also reflected in the steady rise of the number and the payroll and the steepest increase in stocks of finished goods from the beginning of reference of the index in 2007. The seasonally adjusted PMI manufacturing index reached 55.0 in January, compared with 54.3 in December. The last reading was slightly less than the preliminary estimate of 55.1, and pointed to the fastest productivity growth since March 2015.

However, a report published by the Institute for Supply Management (ISM), showed that in January of activity in the US manufacturing sector has grown considerably, exceeding average forecasts of experts, and reaching the highest level since November, 2014. The PMI for the manufacturing was 56.0 points versus 54.7 points in December. Analysts had expected that this figure will rise to only 55.0 points.

As for the Fed meeting, CBA leaders unanimously voted to keep the federal funds rate by between 0.50% and 0.75%. Investors did not expect that the Fed will take any action, but hoped to get a signal with respect to the plans of the Central Bank to the next meeting. In a statement, the Fed said an improvement in the economy, and indicators of consumer confidence and trust companies. Also, the Fed noted that the risks for the most part the economic outlook are balanced. Central Bank representatives have promised to closely monitor the indicators of inflation, global economic and financial situation.

DOW index components ended the day mostly in negative territory (20 of 30). Most remaining shares fell Microsoft Corporation (MSFT, -1.70%). leaders of growth were shares of Apple Inc. (AAPL, + 6.87%).

Sector S & P Index showed mixed trends. The leader turned out to be the sector of consumer goods (+ 0.9%). Most utilities sector fell (-1.5%).

At the close:

Dow + 0.13% 19,889.05 +24.96

Nasdq + 0.50% 5,642.65 +27.86

S & P + 0.02% 2,279.43 +0.56

-

20:00

DJIA -0.02% 19,860.44 -3.65 Nasdq +0.35% 5,634.55 +19.76 S&P -0.16% 2,275.33 -3.54

-

17:00

European stocks closed: FTSE 100 +8.50 7107.65 +0.12% DAX +124.19 11659.50 +1.08% CAC 40 +45.68 4794.58 +0.96%

-

16:40

WSE: Session Results

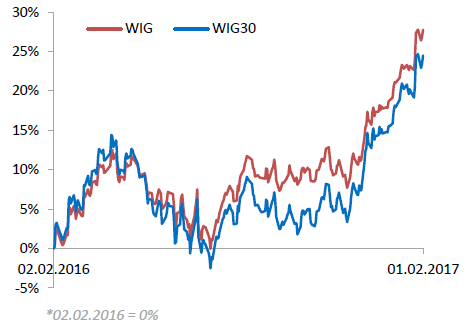

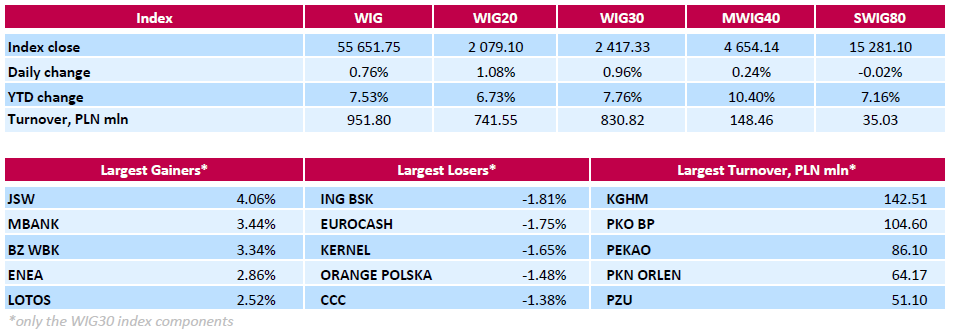

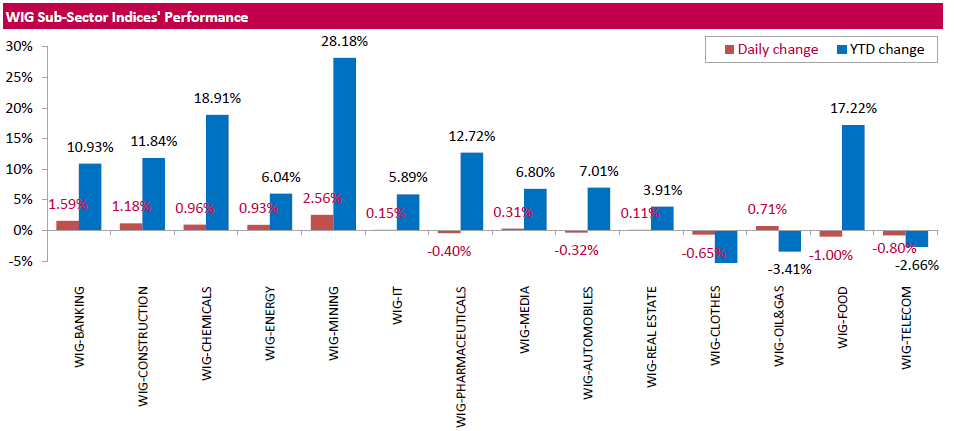

Polish equity market closed higher on Wednesday. The broad measure, the WIG index, added 0.76%. Sector-wise, mining stocks (+2.56%) outperformed, while food names (-1%) recorded the worst result.

The large-cap benchmark, the WIG30 Index, surged by 0.96%. Within the index components, coking coal miner JSW (WSE: JSW) led the advancers, climbing by 4.06%. It was followed by genco ENEA (WSE: ENA), oil refiner LOTOS (WSE: LTS), copper producer KGHM (WSE: KGH) and two banking names MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which gained between 2.3% and 3.44%. On the other side of the ledger, bank ING BSK (WSE: ING) was the weakest performer, tumbling by 1.81%. Other largest decliners were FMCG-wholesaler EUROCASH (WSE: EUR), agricultural producer KERNEL (WSE: KER), telecommunication services provider ORANGE POLSKA (WSE: OPL) and footwear retailer CCC (WSE: CCC), dropping by 1.38%-1.75%. It should be noted that CCC stock fell despite the company reported its revenue boosted by 15.4% y/y to PLN 201 mln in January 2017.

-

14:51

WSE: After start on Wall Street

The ADP report from the US labor market was a big positive surprise. The increase in the number of jobs by 246 thousand was considerably higher than forecast at 165 thousand. And this fact has been noted by the market. On currency market we may see the stronger dollar. Similarly reacted shares in the US and Euroland. The German DAX increased growth to 1.5 percent and the Warsaw WIG20 is not left behind.

An hour before the close of trading in Warsaw, the WIG20 index was at the level of 2.086 points (+ 1.47%).

-

14:32

U.S. Stocks open: Dow +0.40%, Nasdaq +0.67%, S&P +0.38%

-

14:20

Before the bell: S&P futures +0.30%, NASDAQ futures +0.64%

U.S. stock-index futures rose, supported by strong quarterly results from Apple (AAPL), while investors awaited the outcomes of the Federal Reserve's two-day meeting.

Global Stocks:

Nikkei 19,148.08 +106.74 +0.56%

Hang Seng 23,318.39 -42.39 -0.18%

Shanghai - Closed

FTSE 7,143.09 +43.94 +0.62%

CAC 4,814.67 +65.77 +1.38%

DAX 11,681.64 +146.33 +1.27%

Crude $53.23 (+0.80%)

Gold $1,207.70 (-0.31%)

-

13:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

174.53

-0.29(-0.1659%)

2221

ALCOA INC.

AA

111.53

0.18(0.1617%)

1079

American Express Co

AXP

76.77

0.39(0.5106%)

400

Apple Inc.

AAPL

174.53

-0.29(-0.1659%)

2221

AT&T Inc

T

42.05

-0.11(-0.2609%)

22150

Barrick Gold Corporation, NYSE

ABX

18.26

-0.18(-0.9761%)

53867

Boeing Co

BA

164.13

0.71(0.4345%)

6327

Caterpillar Inc

CAT

95.88

0.22(0.23%)

1570

Chevron Corp

CVX

111.53

0.18(0.1617%)

1079

Cisco Systems Inc

CSCO

30.69

-0.03(-0.0977%)

13751

Citigroup Inc., NYSE

C

56.4

0.57(1.021%)

22709

Deere & Company, NYSE

DE

107.3

0.25(0.2335%)

550

E. I. du Pont de Nemours and Co

DD

75.55

0.05(0.0662%)

810

Exxon Mobil Corp

XOM

84.17

0.28(0.3338%)

6580

Facebook, Inc.

FB

131.97

1.65(1.2661%)

320646

FedEx Corporation, NYSE

FDX

174.53

-0.29(-0.1659%)

2221

Ford Motor Co.

F

12.39

0.03(0.2427%)

85891

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.61

-0.04(-0.2402%)

100533

General Electric Co

GE

29.78

0.08(0.2694%)

9533

Goldman Sachs

GS

230.99

1.67(0.7282%)

20669

Google Inc.

GOOG

174.53

-0.29(-0.1659%)

2221

Hewlett-Packard Co.

HPQ

174.53

-0.29(-0.1659%)

2221

Home Depot Inc

HD

138.17

0.59(0.4288%)

5055

Intel Corp

INTC

36.98

0.16(0.4345%)

34644

International Business Machines Co...

IBM

174.98

0.46(0.2636%)

1679

Johnson & Johnson

JNJ

113.35

0.10(0.0883%)

2081

JPMorgan Chase and Co

JPM

85.39

0.76(0.898%)

56196

McDonald's Corp

MCD

122.61

0.04(0.0326%)

303

Microsoft Corp

MSFT

64.75

0.10(0.1547%)

80527

Nike

NKE

53.02

0.12(0.2268%)

4592

Pfizer Inc

PFE

31.57

0.16(0.5094%)

52564

Starbucks Corporation, NASDAQ

SBUX

56.4

0.57(1.021%)

22709

Tesla Motors, Inc., NASDAQ

TSLA

253.52

1.59(0.6311%)

14709

The Coca-Cola Co

KO

83.05

0.34(0.4111%)

2227

Travelers Companies Inc

TRV

117.91

0.13(0.1104%)

1570

Twitter, Inc., NYSE

TWTR

56.4

0.57(1.021%)

22709

United Technologies Corp

UTX

109.58

-0.09(-0.0821%)

1990

UnitedHealth Group Inc

UNH

83.05

0.34(0.4111%)

2227

Visa

V

83.05

0.34(0.4111%)

2227

Wal-Mart Stores Inc

WMT

83.05

0.34(0.4111%)

2227

Walt Disney Co

DIS

110.92

0.27(0.244%)

3564

Yahoo! Inc., NASDAQ

YHOO

44.25

0.18(0.4084%)

4517

Yandex N.V., NASDAQ

YNDX

23.29

0.15(0.6482%)

3615

-

13:51

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised to $135 from $130 at Mizuho

Apple (AAPL) target raised to $140 from $125 at RBC Capital Mkts

Apple (AAPL) target raised to $130 from $115 at Stifel

-

13:22

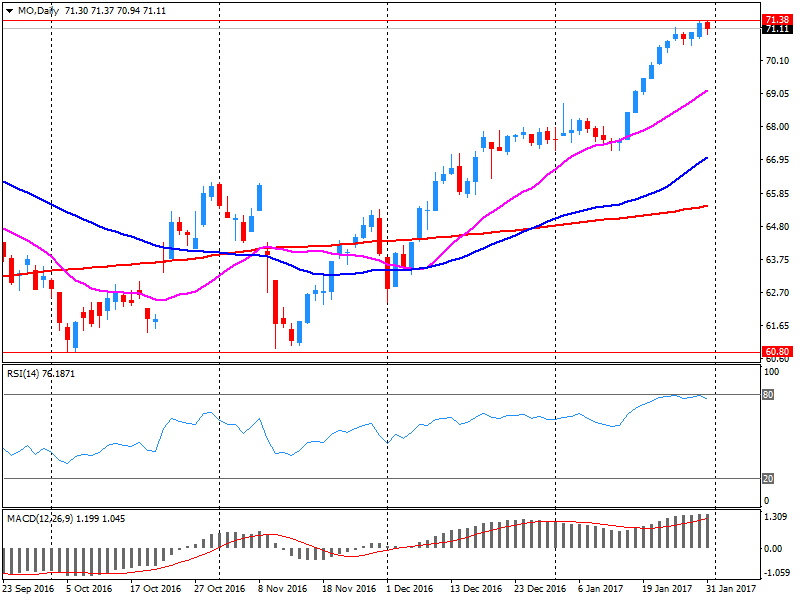

Company News: Altria (MO) posts Q4 results

Altria reported Q4 FY 2016 earnings of $0.68 per share (versus $0.67 in Q4 FY 2015), beating analysts' consensus estimate of $0.67.

The company's quarterly revenues amounted to $4.733 bln (+0.1% y/y), missing analysts' consensus estimate of $4.798 bln.

The company also issued downside guidance for FY 2017, projecting EPS of $3.26-3.32 (+7.5-9.5% y/y) versus analysts' consensus estimate of $3.34.

MO fell to $70.11 (-1.5%) in pre-market trading.

-

12:01

WSE: Mid session comment

The forenoon part of today's session may be divided into two parts, the rapid growth in the first quarter and maintaining growth in the later part of trading. The WIG20 index is trading about 1 percent on plus and almost perfectly mimics the behavior of the German DAX.

At the halfway point of today's quotations the WIG20 index was at the level of 2,077 points (+0,99%).

-

11:38

Major stock indices in Europe on the rise

The stock indices in Western Europe are gaining, investors assess the statistical data from the euro zone and the reporting of large companies.

Procurement Managers Index (PMI) in manufacturing in the 19 euro-zone countries rose to 55.2 - its highest level in nearly six years. The value of the indicator above 50 points indicates strengthening business activity in this sector.

UK PMI for the production sector fell to 55.9 in January from two and a half year high of 56.1 in December. The index was in line with economists' expectations.

The composite index of the largest companies in the region Stoxx Europe 600 rose by 0.85% - to 363.17 points.

The price of Swedish auto maker Volvo jumped 6,4% as the company increased its profit last quarter by almost 2 times.

The market value of Siemens AG increased by 3.4%. Europe's largest industrial conglomerate increased its net profit in the 1st quarter and improved the outlook for the year as a whole.

Shares of Spanish bank BBVA rose 0.7%. The bank's profit in the last quarter fell by 28% - up to 678 million euros, which nevertheless turned out better than expectations (554 million euros).

Wizz Air Holdings reported a fall in net profit in the last quarter by 22%, despite revenue growth of 9%. On this news stock prices in early trading fell by 6.6%.

The capitalization of the Swiss pharmaceutical company Roche Holding AG rose by 1.1% due to an increase in profits in October-December by 8% and revenue by 5%.

Electrolux shares decreased by 1.4%. The company has returned to a profitable level in the 4th quarter, its profit amounted to 1.27 SEK and coincided with market expectations. Meanwhile, its revenue decreased by 1%.

At the moment:

FTSE 7150.34 51.19 0.72%

DAX 11645.41 110.10 0.95%

CAC 4802.53 53.63 1.13%

-

08:35

Major stock markets in Europe trading in the green zone: DAX futures + 0.6%, CAC40 + 0.8%, FTSE + 0.5%

-

08:17

WSE: After opening

WIG20 index opened 2065.94 (+0.44%)*

WIG 55603.28 0.67

WIG30 2414.14 0.83

mWIG40 4656.24 0.28

*/ - change to previous close

The Warsaw market, same like European stock exchanges started the day having to rebuild the Wall Street in the second half of yesterday's session. The opening gap at top looks like an attempt to end the four-day correction and put the chart of the WIG20 towards 2,100 points.

After fifteen minutes of trading WIG20 index was at 2,076 points (+ 0.97%).

-

07:25

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.2%, FTSE + 0.2%

-

07:23

WSE: Before opening

Most major indices on the New York stock markets closed yesterday's session in the red. The Dow Jones Industrial dropped at the closing of 0.54 percent, the S&P500 went down by 0.09 percent and in the contrast, the Nasdaq Comp. gained 0.02 percent. From the point of view of European markets a slight change of the S&P500 seems to be the most important. After the close of trading in Europe, the index recovered a large portion of earlier losses, which should support increases in Europe.

In the US, after the session, its results published Apple Inc., which recorded in the quarter covering the holidays better than expected sales results.

The beginning of the new month will bring data from the US labor market and the stock exchange today will get reading of ADP report. In addition, today ends the year's first meeting of the monetary authorities in the United States. On the Warsaw market yesterday's increases were supported by the weaken dollar and the appreciation of the zloty, but each of these currencies remain sensitive to what today appears in the FOMC statement.

-

06:33

Global Stocks

European stocks ended in the red Tuesday, analysts blaming the selling in part on a surging euro as investors sifted through a mixed round of corporate updates. The benchmark ended with a January loss, giving up ground as the month wrapped up. On Monday, the gauge fell 1.1%, its biggest daily percentage drop since November, retreating alongside U.S. stocks, as some investors were spooked by President Donald Trump's executive order that banned citizens of seven predominantly Muslim countries from entering the U.S.

U.S. stocks trimmed earlier losses but still ended mostly lower on Tuesday, as declines in industrial, technology and financials shares outweighed gains in health-care and utilities sectors. The main indexes still posted a third consecutive round of monthly gains. The selling pressure in early trade came amid signs that momentum following President Donald Trump's election victory in November was fading, and as a January gauge of consumer confidence retreated from its highest level in 15 years.

Asset prices stabilized in Asia-Pacific trading Wednesday after two days of declines for the dollar and equities, as investors position themselves ahead of the Federal Reserve's policy statement. But investor caution persisted.

-