Market news

-

23:31

Currencies. Daily history for Feb 02’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0758 -0,09%

GBP/USD $1,2526 -0,26%

USD/CHF Chf0,9926 -0,03%

USD/JPY Y112,79 -0,39%

EUR/JPY Y121,34 -0,49%

GBP/JPY Y141,29 -0,01%

AUD/USD $0,7656 +0,95%

NZD/USD $0,7286 +0,11%

USD/CAD C$1,3025 -0,17%

-

23:01

Schedule for today, Friday, Feb 03’2017 (GMT0)

01:45 China Markit/Caixin Manufacturing PMI January 51.9 51.8

08:50 France Services PMI (Finally) January 52.9 53.9

08:55 Germany Services PMI (Finally) January 54.3 53.2

09:00 Eurozone Services PMI (Finally) January 53.7 53.6

09:30 United Kingdom Purchasing Manager Index Services January 56.2 55.8

10:00 Eurozone Retail Sales (MoM) December -0.4% 0.3%

10:00 Eurozone Retail Sales (YoY) December 2.3% 1.8%

13:30 U.S. Average workweek January 34.3 34.3

13:30 U.S. Average hourly earnings January 0.4% 0.3%

13:30 U.S. Unemployment Rate January 4.7% 4.7%

13:30 U.S. Nonfarm Payrolls January 156 175

14:15 U.S. FOMC Member Charles Evans Speaks

14:45 U.S. Services PMI (Finally) January 53.9 55.1

15:00 U.S. Factory Orders December -2.4% 1%

15:00 U.S. ISM Non-Manufacturing January 57.2 57

-

22:30

Australia: AIG Services Index, January 54.5

-

15:35

The dollar fell to its lowest level in more than two months against other currencies on rising doubts about Trump

-

14:43

BOE Carney: Trump fiscal stimulus to boost global growth outlook

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0500 (EUR 1.41bln) 1.0525 (313m) 1.0650 (754m)

USD/JPY 113.30-40 (USD 959m)

GBP/USD 1.2500 (GBP 370m)

EUR/GBP 0.8515 (EUR 526m)

AUD/USD 0.7575-85 (AUD 365m)

AUD/NZD 1.0450 (AUD 890m)

AUD/JPY 85.00 (AUD 491m)

-

13:36

US nonfarm business sector labor productivity increased at a 1.3-percent annual rate

Nonfarm business sector labor productivity increased at a 1.3-percent annual rate during the fourth quarter of 2016, the U.S. Bureau of Labor Statistics reported today, as output increased 2.2 percent and hours worked increased 0.9 percent. (All quarterly percent changes in this release are seasonally adjusted annual rates.) From the fourth quarter of 2015 to the fourth quarter of 2016, productivity increased 1.0 percent, reflecting increases in output and hours worked of 2.2 percent and 1.1 percent, respectively. Annual average productivity increased 0.2 percent from 2015 to 2016.

-

13:35

US initial jobless claims lower than expected

In the week ending January 28, the advance figure for seasonally adjusted initial claims was 246,000, a decrease of 14,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 259,000 to 260,000. The 4-week moving average was 248,000, an increase of 2,250 from the previous week's revised average. The previous week's average was revised up by 250 from 245,500 to 245,750.

-

13:30

U.S.: Initial Jobless Claims, 246 (forecast 250)

-

13:30

U.S.: Unit Labor Costs, q/q, Quarter IV 1.7% (forecast 1.9%)

-

13:30

U.S.: Nonfarm Productivity, q/q, Quarter IV 1.3% (forecast 1%)

-

13:30

U.S.: Continuing Jobless Claims, 2064 (forecast 2065)

-

13:14

-

13:01

Orders

UR/USD

Offers: 1.0830 1.0850-55 1.0885 1.0900

Bids: 1.0780 1.0760 1.0730 1.0700 1.0680 1.0655-60

GBP/USD

Offers: 1.2700-05 1.2725-30 1.2750 1.2775 1.2800 1.2830 1.2850

Bids: 1.2650-60 1.620-25 1.2600 1.2580 1.2550 1.2520 1.2500

EUR/GBP

Offers: 0.8530 0.8550 0.8580 0.8600 0.8620 0.8635 0.8650

Bids: 0.8500 0.8475-80 0.8450 0.8430 0.8400

EUR/JPY

Offers: 121.85 122.00 1.2230 122.60 122.80 123.00

Bids: 121.30 121.00 120.80 120.50 120.00

USD/JPY

Offers: 113.00 113.20 113.50 113.80 114.00 114.30 114.50

Bids: 112.45-50 112.20-25 112.00 111.85 111.50 111.00

AUD/USD

Offers: 0.7685 0.7700 0.7730 0.7750 0.7780 0.7800

Bids: 0.7650 0.7630 0.7600 0.7580 0.7550 0.7520 0.7500

-

12:10

BOE Sees Inflation rate At 2.7% in 1Q 2018, 2.6% in 1Q 2019, 2.4% in 1Q 2020, Little Changed

-

Increased Labor Slack Weakens Inflationary Pressures

-

Stronger Growth Due to Fiscal Stimulus, Improved Global Outlook

-

0 Voted to Increase Rate

-

9 Voted to Keep Rate Unchanged

-

Cuts Estimate Of Sustainable Unemployment Rate to 4.5% Vs 5%

-

2018 Growth Forecast to 1.6% Vs 1.5%; 2019 Forecast to 1.7% Vs 1.6%

-

Could Cut Key Rate If Consumer Spending Weaker Than Expected

-

Could Raise Key Rate If Wages Growth Faster Than Expected

-

Monetary Policy Can Move In Either Direction

-

-

12:07

Bank of England MPC voted unanimously to maintain interest rate at 0.25%

The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. At its meeting ending on 1 February 2017, the Committee voted unanimously to maintain Bank Rate at 0.25%.

The Committee voted unanimously to continue with the programme of sterling non-financial investment-grade corporate bond purchases, financed by the issuance of central bank reserves, totalling up to £10 billion. The Committee also voted unanimously to maintain the stock of UK government bond purchases, financed by the issuance of central bank reserves, at £435 billion.

-

12:01

United Kingdom: Asset Purchase Facility, 435 (forecast 435)

-

12:00

United Kingdom: BoE Interest Rate Decision, 0.25% (forecast 0.25%)

-

11:20

Barclays expects Bank of England to raise GDP forecasts at today’s meeting

"On Thursday, we expect the BoE to maintain its current policy parameters but likely higher GDP growth forecasts should support rate hike expectations and GBP. Given the strong performance of the UK economy over Q4, the Bank is likely to adjust higher its growth forecasts but may also note some concern about the sustainability of consumption, given the high level of household debt. The inflation forecasts are likely to stay unchanged as Q4 inflation was close to the bank's forecast while a lessening of imported price pressures and higher UK interest rates are counterbalanced by higher inflation globally" - efxnews.

-

10:32

Formidable resistance at 1.2775 for GBP/USD - NAB

"The key question is the extent to which this good political news is now already in the price of the pound? The sharp rally in GBP/USD reflects some disappointment with the USD as much as a less bleak near-term outlook for the GBP and, with the better growth and monetary policy outlook in the United States, we expect the USD to now gradually begin to find more investor support. The December 2016 high of GBP/USD1.2775 should provide formidable technical resistance to the recent rally and though the Bank of England on Thursday may try to talk tougher on inflation, no-one seriously expects a rate hike at any point over the next 12 months".

-

10:10

Euro area producer prices rose more than expected in December

In December 2016, compared with November 2016, industrial producer prices rose by 0.7% in the euro area (EA19) and by 0.9% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In November 2016 prices increased by 0.3% in the euro area and by 0.2% in the EU28.

In December 2016, compared with December 2015, industrial producer prices rose by 1.6% in the euro area and by 2.4% in the EU28. The average industrial producer price for the year 2016, compared with 2015, decreased by 2.3% in the euro area and by 1.9% in the EU28.

-

10:00

Eurozone: Producer Price Index (YoY), December 1.6% (forecast 1.3%)

-

10:00

Eurozone: Producer Price Index, MoM , December 0.7% (forecast 0.4%)

-

09:34

UK January data revealed a slowdown in construction sector growth

January data revealed a slowdown in construction sector growth, with business activity and incoming new work both expanding at weaker rates than at the end of 2016. Despite this, survey respondents signalled that confidence regarding the year-ahead outlook picked up to its strongest since December 2015, largely reflecting new project starts and a resilient economic backdrop. This contributed to the fastest rise in employment numbers since May 2016. Meanwhile, exchange rate depreciation against the euro and the US dollar resulted in the strongest rate of input cost inflation since August 2008.

The seasonally adjusted Markit/CIPS UK Construction Purchasing Managers' Index® (PMI® ) registered 52.2 in January, down from 54.2 in December.

-

09:30

United Kingdom: PMI Construction, January 52.2 (forecast 53.8)

-

08:59

Swiss retail sales down 3.5% in December

Turnover in the retail sector, adjusted for sales days and holidays, fell by 4.3% in nominal terms in December 2016 compared with the previous year. To put this into perspective, however, it should be noted that unadjusted turnover fell by only 0.7%. Seasonally adjusted, nominal turnover fell by 2.0% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

-

08:42

ANZ: Too Early To Call A Sustainable Turn In GBP - efxnews

"Sterling has stabilised in recent weeks in part supported by speculation of a bi-lateral trade agreement with the US...However, outside of the potential for 'squeezes' in the market, the backdrop to the pound remains highly uncertain. PM May will trigger Article 50 before the end of March and the tone of the negotiations will be important in assessing sterling's near term path. Meanwhile, whilst growth has impressed (Q4 GDP rose 0.6% q/q) and monetary policy is very supportive, there is a reasonable prospect that growth may slow from here. Hiring trends in the economy have slowed, real income growth will be eroded by rising inflation and investment may suffer. Whilst sterling has discounted a lot, it is still too early to call a sustainable turn".

-

08:15

Switzerland: Retail Sales Y/Y, December -3.5% (forecast 0.5%)

-

08:15

Switzerland: Retail Sales (MoM), December -2.4%

-

07:36

Bank of America Merrill expects no meaningful impact on GBP after super Tuesday

"If the Bank of England (BoE) set interest rates on today's growth and inflation they would likely hike rates on Thursday. But rate setters look forward to set policy. Given the weak sterling they are still balancing a likely inflation overshoot against likely growth weakness. So we expect a neutral bias on policy from the BoE, and expect them to hold rates and not extend QE this week. We think the risks are skewed to a hawkish message. Carney will likely emphasize that there are limits to the BoE's inflation tolerance and conclude with a simple data watching position: steady as she goes for six months, but if growth does not slow then rate hikes will become more likely. Expectations going into next week's BoE meeting seem to have become increasingly polarized. While few on the Street seem to be forecasting an extension of QE at Thursday's meeting, market pricing in rates and our own sentiment surveys suggest investors remain split on QE. Consequently, we expect a hawkish reaction from the market to our central scenario of an end to QE and a relatively neutral BoE...Our economists' baseline scenario is unlikely to have a meaningful impact on GBP as this is pretty much the consensus view for the meeting".

-

07:35

The Federal Reserve took a wait-and-see approach

The Federal Reserve on Wednesday kept interest rates on hold, taking a wait-and-see approach as President Donald Trump and Congress negotiate on fiscal stimulus plans, says rttnews.

The decision to keep rates on hold was unanimous, and came as no surprise to experts.

Markets were hoping the Fed would offer clues about when the next interest rate would come, but policy makers gave no indication as to whether further tightening imminent.

The central bank said the economy "continued to expand at a moderate pace" and that job gains "remained solid." Houehold spending has continued to rise moderately and measures of consumer and business sentiment have improved of late.

-

07:31

Japanese Prime Minister Shinzo Abe: We are ready to resort to intervention in the currency market if necessary

Shinzo Abe said (in response to recent accusations of Donald Trump), that the Government of Japan is ready to resort to intervention on the foreign exchange market if necessary. Abe noted that it is not clear what kind of monetary policy will the Trump administration hold. He also added that in general, is undesirable for the United States and Japan leaders to discuss foreign exchange markets at the summit.

-

07:30

Options levels on thursday, February 2, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0880 (2975)

$1.0855 (2511)

$1.0839 (2206)

Price at time of writing this review: $1.0793

Support levels (open interest**, contracts):

$1.0704 (1357)

$1.0675 (1429)

$1.0641 (2368)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 64938 contracts, with the maximum number of contracts with strike price $1,0800 (4176);

- Overall open interest on the PUT options with the expiration date March, 13 is 74095 contracts, with the maximum number of contracts with strike price $1,0000 (5108);

- The ratio of PUT/CALL was 1.14 versus 1.19 from the previous trading day according to data from January, 31

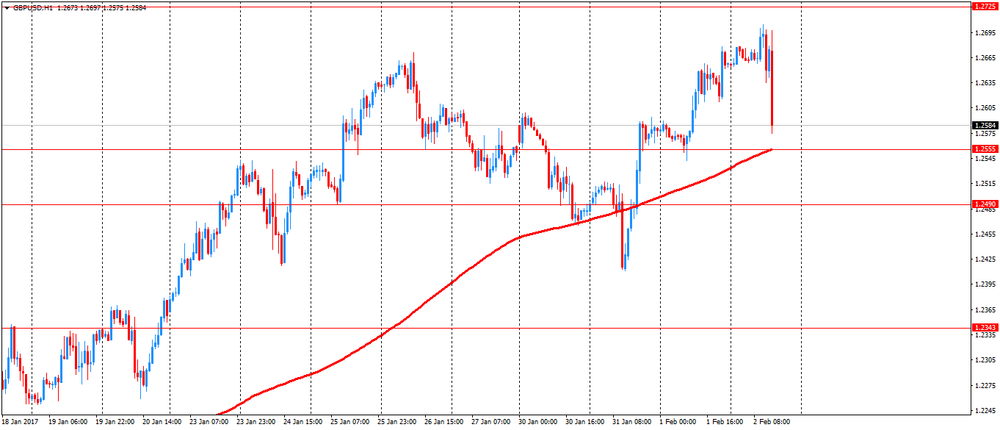

GBP/USD

Resistance levels (open interest**, contracts)

$1.2904 (1519)

$1.2807 (1783)

$1.2710 (2004)

Price at time of writing this review: $1.2665

Support levels (open interest**, contracts):

$1.2584 (969)

$1.2489 (1634)

$1.2392 (1092)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 24701 contracts, with the maximum number of contracts with strike price $1,2500 (3256);

- Overall open interest on the PUT options with the expiration date March, 13 is 26913 contracts, with the maximum number of contracts with strike price $1,1500 (3230);

- The ratio of PUT/CALL was 1.09 versus 1.12 from the previous trading day according to data from January, 31

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:21

Australian trade balance showed $2,193m surplus in December

In trend terms, the balance on goods and services was a surplus of $2,193m in December 2016, an increase of $916m (72%) on the surplus in November 2016.

In seasonally adjusted terms, the balance on goods and services was a surplus of $3,511m in December 2016, an increase of $1,471m (72%) on the surplus in November 2016.

In seasonally adjusted terms, goods and services credits rose $1,679m (5%) to $32,630m. Non-rural goods rose $1,249m (6%), non-monetary gold rose $319m (23%), rural goods rose $104m (3%) and net exports of goods under merchanting rose $1m (20%). Services credits rose $6m.

-

07:19

Iran is rapidly taking over more and more of Iraq even after the U.S. has squandered three trillion dollars there. Obvious long ago! @realDonaldTrump

-

05:02

Japan: Consumer Confidence, January 43.2 (forecast 43.7)

-

00:30

Australia: Trade Balance , December 3.51 (forecast 2.2)

-

00:30

Australia: Building Permits, m/m, December -1.2% (forecast -2.0%)

-