Market news

-

23:28

Stocks. Daily history for Mar 06’2017:

(index / closing price / change items /% change)

Nikkei -90.03 19379.14 -0.46%

TOPIX -3.15 1554.90 -0.20%

Hang Seng +43.56 23596.28 +0.18%

CSI 300 +18.62 3446.48 +0.54%

Euro Stoxx 50 -15.93 3387.46 -0.47%

FTSE 100 -24.14 7350.12 -0.33%

DAX -68.96 11958.40 -0.57%

CAC 40 -22.94 4972.19 -0.46%

DJIA -51.37 20954.34 -0.24%

S&P 500 -7.81 2375.31 -0.33%

NASDAQ -21.58 5849.18 -0.37%

S&P/TSX +21.25 15629.75 +0.14%

-

21:07

Major US stock indexes finished trading in negative territory

Major US stock indices moderately declined amid losses in various sectors, as investors' appetite for risk was curbed by geopolitical tensions in Asia and President Donald Trump's accusation that his predecessor, Barack Obama, was tapping his phone.

Some investors are concerned that the charges can distract Trump from his economic agenda. Promises to cut taxes and ease regulatory pressure have had an impact on the record Wall Street rally after the election.

In addition, as it became known, new orders for goods produced in the US, increased in the second consecutive month in January. This change signals that recovery in the manufacturing sector is gaining momentum, as rising commodity prices stimulate increased demand for cars. The Ministry of Trade reported that in February production orders increased by 1.2% after rising by 1.3% in December. Economists had expected orders to grow by 1.0%.

Components of the DOW index closed mostly in the red (17 out of 30). More shares fell The Travelers Companies, Inc. (TRV, -1.22%). Caterpillar Inc. was the growth leader. (CAT, + 0.73%).

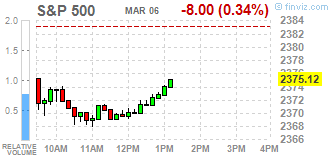

Almost all sectors of the S & P index finished trading in the red. Most of all, the consumer goods sector fell (-0.4%). The increase was recorded only by the conglomerate sector (+ 0.3%).

At closing:

Dow -0.24% 20.956.19 -49.52

Nasdaq -0.37% 5,849.18 -21.57

S & P -0.32% 2,375.43 -7.69

-

20:01

DJIA -0.22% 20,959.88 -45.83 Nasdaq -0.38% 5,848.54 -22.21 S&P -0.34% 2,375.13 -7.99

-

18:14

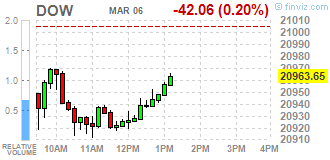

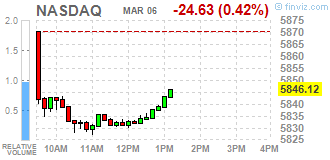

Wall Street. Major U.S. stock-indexes in negative area

Major U.S. stock-indexes lower on Monday amid losses across sectors as investors' appetite for risk was curbed by geopolitical tensions in Asia and President Donald Trump's accusation that his predecessor, Barack Obama, wiretapped him. Some investors worried that the accusation could distract Trump from his economic agenda of introducing tax cuts and simplifying regulations, which have powered a record-setting rally on Wall Street since the election. However, the lack of detail on Trump's proposals and setbacks in filling his Cabinet have made investors jittery amid lofty market valuations.

Most of Dow stocks in negative area (20 of 30). Top loser - JPMorgan Chase & Co. (JPM, -1.31%). Top gainer - E. I. du Pont de Nemours and Company (DD, +0.45%).

Most of S&P sectors also in negative area. Top loser - Financials (-0.7%). Top gainer - Conglomerates (+0.2%).

At the moment:

Dow 20938.00 -43.00 -0.20%

S&P 500 2372.50 -8.75 -0.37%

Nasdaq 100 5352.00 -20.00 -0.37%

Oil 53.11 -0.22 -0.41%

Gold 1225.80 -0.70 -0.06%

U.S. 10yr 2.50 +0.01

-

17:00

European stocks closed: FTSE 100 -24.14 7350.12 -0.33% DAX -68.96 11958.40 -0.57% CAC 40 -22.94 4972.19 -0.46%

-

14:31

U.S. Stocks open: Dow -0.35%, Nasdaq -0.42%, S&P -0.44%

-

14:23

Before the bell: S&P futures -0.34%, NASDAQ futures -0.29%

U.S. stock-index futures fell amid rising geopolitical tensions in Asia and President Donald Trump's accusation that his predecessor Barack Obama wiretapped his office just before the 2016 presidential elections.

Global Stocks:

Nikkei 19,379.14 -90.03 -0.46%

Hang Seng 23,596.28 +43.56 +0.18%

Shanghai 3,234.40 +16.09 +0.50%

FTSE 7,344.69 -29.57 -0.40%

CAC 4,975.72 -19.41 -0.39%

DAX 11,975.50 -51.86 -0.43%

Crude $53.22 (-0.21%)

Gold $1,234.20 (+0.63%)

-

13:51

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) both upgraded to Buy from Hold at Jefferies

HP (HPQ) upgraded to Outperform from Market Perform at Wells Fargo

FedEx (FDX) upgraded to Outperform from Market Perform at BMO Capital

General Motors (GM) upgraded to Buy from Neutral at Instinet

Downgrades:

Procter & Gamble (PG) downgraded to Neutral from Buy at B. Riley & Co.

Other:

-

09:39

Major stock markets in Europe trading in the red zone: FTSE 100 7,347.65 -26.61 -0.36%, CAC 40 4,975.20 -19.93 -0.40%, Xetra DAX 11,945.63 -81.73 -0.68%

-

06:32

Global Stocks

European stocks closed in the red on Friday, with caution setting in as investors were reluctant to make big bets ahead of comments from prominent officials from the U.S. central bank, which could influence investing strategies.

U.S. stocks eked out gains on Friday, extending a weekly advance, as comments from Janet Yellen and other key Federal Reserve officials confirmed growing expectations of a March interest-rate increase. The central bank's policy-setting Federal Open Market Committee is set to convene at its two-day meeting starting March 14.

Shares were mixed in Asia early Monday following North Korea's launch of four ballistic missiles, three of which landed in Japan's 200-nautical mile exclusive economic zone. Hong Kong's benchmark climbed 0.3 percent after the opening of the annual session of the National People's Congress in Beijing.

-