Market news

-

23:27

Currencies. Daily history for Mar 06’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0580 -0,33%

GBP/USD $1,2223 -0,61%

USD/CHF Chf1,012 +0,34%

USD/JPY Y113,88 -0,02%

EUR/JPY Y120,49 -0,35%

GBP/JPY Y139,32 -0,52%

AUD/USD $0,7578 -0,17%

NZD/USD $0,6992 -0,64%

USD/CAD C$1,3409 +0,25%

-

22:59

Schedule for today,Tuesday, Mar 07’2017 (GMT0)

03:30 Australia Announcement of the RBA decision on the discount rate 1.5% 1.5%

07:00 Germany Factory Orders s.a. (MoM) January 5.2% -2.7%

08:00 Switzerland Foreign Currency Reserves February 643.67

08:30 United Kingdom Halifax house price index February -0.9% 0.3%

08:30 United Kingdom Halifax house price index 3m Y/Y February 5.7% 5.3%

10:00 Eurozone GDP (QoQ) (Finally) Quarter IV 0.3% 0.4%

10:00 Eurozone GDP (YoY) (Finally) Quarter IV 1.7% 1.7%

13:30 Canada Trade balance, billions January 0.92

13:30 U.S. International Trade, bln January -44.3 -47.3

15:00 Canada Ivey Purchasing Managers Index February 57.2

20:00 U.S. Consumer Credit January 14.16 17.2

23:50 Japan Current Account, bln January 1112 239

23:50 Japan GDP, q/q (Finally) Quarter IV 0.3% 0.4%

23:50 Japan GDP, y/y (Finally) Quarter IV 1.3% 1.6%

-

22:30

Australia: AiG Performance of Construction Index, February 53.1

-

16:02

Russian foreign ministry urges restraint 'for all sides involved' after latest North Korean missile tests - Statement

-

15:27

Iraq says OPEC will likely need to extend output cuts - Bloomberg

-

15:02

US factory orders rose more than expected in January

New orders for manufactured durable goods in January increased $4.0 billion or 1.8 percent to $230.4 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 0.8 percent December decrease. Excluding transportation, new orders decreased 0.2 percent. Excluding defense, new orders increased 1.5 percent. Transportation equipment, also up following two consecutive monthly decreases, drove the increase, $4.3 billion or 6.0 percent to $76.4 billion.

Shipments of manufactured durable goods in January, down following two consecutive monthly increases, decreased $0.2 billion or 0.1 percent to $238.3 billion. This followed a 1.6 percent December increase. Machinery, also down following two consecutive monthly increases, drove the decrease, $0.5 billion or 1.6 percent to $30.7 billion.

-

15:00

U.S.: Factory Orders , January 1.2% (forecast 1%)

-

14:32

Fitch: "advanced country growth is expected to pick up to 1.9% in 2017 and 2% in 2018 from 1.6% in 2016"

-

Global growth shows resilience to political uncertainty

-

"Near-term outlook for growth in advanced countries has improved despite persistent political uncertainties"

-

In eurozone re-emergence of concerns about fragmentation of currency-bloc could result in tighter credit conditions, significantly reduced growth

-

"Bank of japan has held short-term interest rates steady at -0.1% and we no longer expect further cuts into more negative territory"

-

Now expects US Fed to raise rates three times this year and by a total of seven times over 2017 and 2018

-

-

14:30

Germany's Merkel says no justification for erdogan's nazi comparison

-

Nazi comparisons only lead to trivialising nazi crimes against humanity

-

There are major differences of opinion between Germany and Turkey about freedom of press, mass arrests and journalist Deniz Yucel

-

-

14:20

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0500,1.0550 (485m) 1.0575 (600m) 1.0600 (1bln) 1.0625-30 (2.3bln) 1.0650 (603m) 1.0700 (181m) 1.0730 (266m)

USDJPY: 112.75 (USD 575m) 113.00 (420m) 113.50 (912m) 113.75 (300m) 114.00 (2.3bln) 115.00 (2.63bln)

USDCHF 0.9960 (USD 300m) 1.0030 (457m)

AUDUSD: 0.7600 (AUD 186m) 0.7630 (249m) 0.7650 (230m) 0.7680 (200m) 0.7700 (282m)

USDCAD 1.3400 (USD 355m)

NZDUSD 0.7000 (NZD 280m) 0.7100 (468m)

EURJPY: 120.55 (EUR 191m)

-

13:54

Moody's: Bosnia and Herzegovina's rating reflects challenging political landscape, external deficits and high unemployment

-

13:26

Trump trade adviser Navarro says if U.S can reduce trade deficits through negotiations, growth rate should increase

-

13:07

Allies of France's Sarkozy ask presidential candidate Fillon to choose replacement candidate - says participant in meeting with Sarkozy

-

13:07

EUR positions getting vulnerable to squeeze - Scotiabank

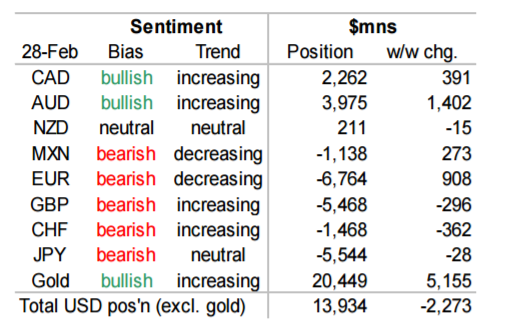

"This week's changes in sentiment were relatively limited, with a build in bullish net long positions in AUD and CAD alongside a narrowing in the net short EUR position. JPY, GBP and CHF were largely unchanged.

The cumulative impact delivered a continued erosion in the aggregate USD long with a $2.3bn w/w decline to $13.9bn-its lowest level since early October 2016.

CAD sentiment improved for a 7th consecutive week, pushing the value of the net long position up $0.4bn w/w to $2.3bn. In contract terms, the 30K net CAD long represents the highest level since February 2013. Note that much of the recent improvement has been driven by a build in bullish gross longs leaving those newly established positions vulnerable to the recent decline in spot.

AUD bulls have also been responsible for the bulk of the recent improvement in sentiment, with gross shorts relatively steady since early October.

EUR saw the second largest w/w swing after AUD with a $0.9bn narrowing in the net short to $6.8bn. Investors have added sizeable risk to both the long and short side over the past two weeks, suggesting uncertainty and leaving those with newly EUR established positions vulnerable to a squeeze.

GBP risk has also been added to both sides".

Copyright © 2017 Scotiabank, eFXnews™

-

13:03

ECB unlikely to boost bond lending at thursday's meeting - sources

-

10:16

Juppe says he won't run in French presidential race @zerohedge

-

09:38

Investors’ economic expectations are on the rise for all major world regions - Sentix

The Sentix headline index for the Eurozone economy increases 3.3 points in March - the highest index level in 10 years. Investors rate the current situation exceptionally favourable. The current situation index rises 3.3 points to the highest level since March 2011.

Investors' economic expectations are on the rise for all major world regions. Therefore, last month's drop is just a temporary correction. We believe that there is no imminent threat to economic prosperity. Besides the positive development of advanced economies, economic momentum remains strong for the emerging markets. Even Latin America manages to gain momentum.

-

09:31

Eurozone: Sentix Investor Confidence, March 20.7 (forecast 16.0)

-

09:14

Stagnation in eurozone retail sales

February saw a further broad stagnation in eurozone retail sales. Following a similar story to the previous month, increases in both France and Germany were offset by another marked contraction in Italy.

The headline Markit Eurozone Retail PMI - which tracks the month-on-month changes in like-for-like retail sales in the bloc's biggest three economies combined - dipped to 49.9 in February, from 50.1 in January, and signalled little change in the level of sales in the eurozone retail sector.

Alex Gill, economist at IHS Markit which compiles the Eurozone Retail PMI survey, said: "A divergence in retail sector performance across the euro area persisted in February, with German and French retailers enjoying a further rise in sales while their counterparts in Italy endured a fourteenth successive decline. That said, retail companies across the eurozone took on additional staff members, partly indicative of firms' optimism with regard to their near-term outlook for sales growth. Meanwhile, strong competitive pressures, combined with a further marked rise in average input costs, continued to squeeze gross margins."

-

09:04

-

08:45

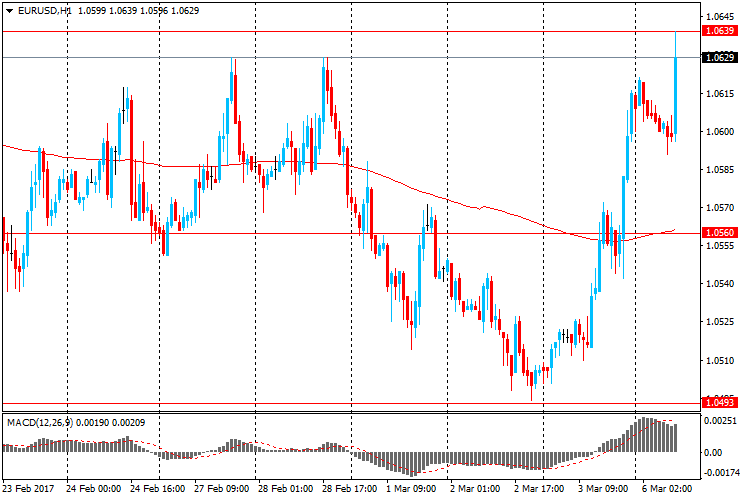

Euro hits two-week high of $1.0640 , up 0.1 percent on day

-

07:25

We now see a more compelling case for the RBA to begin normalizing policy next year - Bank of America Merrill

"We now see a more compelling case for the RBA to begin normalizing policy next year taking into account stronger-than-expected GDP data and improved economic prospects. There has been a notable change in tone from the RBA this year as downside risks have abated. The Bank's confidence that the GDP would rebound from a weak reading in 3Q has been justified. We now see growth moving above trend into 2018 and look for inflation to get back into the target band faster than previously thought.

So we have penciled in the start of a move to normalize policy in February and August 2018 that would unwind the two rates cuts seen over 2016.

However, it is too early to expect any guidance from the Bank that a shift in bias is imminent when the board meets this week. Inflation is still below the band and wages growth remains weak. We do not see inflation threatening the inflation target at this stage, but risks are likely to become more balanced to justify winding back stimulus. Policy would still be accommodative. The RBA confirmed our view that the trade-weighted exchange rate is no longer overvalued.

Policy normalisation will support AUD/USD in 2018 but not before a decline toward 0.70 later this year driven by a stronger USD and weaker China data".

Copyright © 2017 BofAML, eFXnews™

-

07:20

German Banking Association BDB says Euro Zone upswing means ultra-loose ECB policy no longer necessary

-

BDB sees German GDP growth of 1.4 pct in 2017, 1.6 pct in 2018

-

EECB should deal with this risk through clear communication strategy

-

Brexit, protectionism, elections in France, Netherlands and Germany are economic risks

-

-

07:18

France's Fillon does not say whether he will step down or not in rally speech - Reuters

-

07:17

North Korea fires unidentified projectile into the Sea of Japan - Yonhap

-

07:16

Australian retail sales rose in line with expectations in January

Australian retail turnover rose 0.4 per cent in January 2017, seasonally adjusted, according to the latest Australian Bureau of Statistics (ABS) Retail Trade figures.

This follows a fall of 0.1 per cent in December 2016.

In seasonally adjusted terms, there were rises in household goods retailing (1.4 per cent), cafes, restaurants and takeaway food services (1.1 per cent), food retailing (0.2 per cent), and other retailing (0.1 per cent). These rises were offset by falls in clothing, footwear and personal accessory retailing (-0.4 per cent) and department stores (-0.5 per cent).

The main contribution to the rise in household goods retailing was the Electrical and electronic goods industry subgroup, which rose 2.4 per cent in January in seasonally adjusted terms.

-

06:06

Options levels on monday, March 6, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0802 (1031)

$1.0771 (122)

$1.0725 (31)

Price at time of writing this review: $1.0602

Support levels (open interest**, contracts):

$1.0517 (467)

$1.0468 (590)

$1.0412 (1324)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 31937 contracts, with the maximum number of contracts with strike price $1,1450 (3872);

- Overall open interest on the PUT options with the expiration date June, 9 is 37459 contracts, with the maximum number of contracts with strike price $1,0350 (3876);

- The ratio of PUT/CALL was 1.17 versus 1.12 from the previous trading day according to data from March, 3

GBP/USD

Resistance levels (open interest**, contracts)

$1.2611 (275)

$1.2515 (683)

$1.2419 (188)

Price at time of writing this review: $1.2286

Support levels (open interest**, contracts):

$1.2181 (316)

$1.2085 (535)

$1.1988 (756)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 11294 contracts, with the maximum number of contracts with strike price $1,3000 (923);

- Overall open interest on the PUT options with the expiration date June, 9 is 14257 contracts, with the maximum number of contracts with strike price $1,1500 (3103);

- The ratio of PUT/CALL was 1.26 versus 1.07 from the previous trading day according to data from March, 3

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:31

Australia: ANZ Job Advertisements (MoM), February -0.7%

-

00:30

Australia: Retail Sales, M/M, January 0.4% (forecast 0.4%)

-

00:01

Australia: MI Inflation Gauge, m/m, January -0.3%

-