Market news

-

20:01

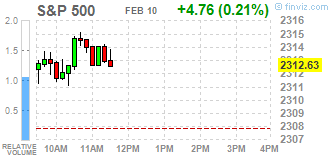

DJIA 20267.89 95.49 0.47%, NASDAQ 5735.15 19.97 0.35%, S&P 500 2316.03 8.16 0.35%

-

17:00

European stocks closed: FTSE 7258.75 29.25 0.40%, DAX 11666.97 24.11 0.21%, CAC 4828.32 2.08 0.04%

-

16:38

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes hit record highs on Friday, a day after President Donald Trump said he would release a major tax reform plan in the coming weeks. Trump's promise of a "phenomenal" tax plan helped reignite a post-election rally, which had stalled in recent weeks on concerns over his protectionist stand and the lack of clarity on his policies. The biggest theme for investors is that Trump's tax plan will move quickly and he has always maintained that it is going to be very aggressive, said Uriel Cohen, founder of Alpine Global in New York.

Most of Dow stocks in positive area (20 of 30). Top loser - Wal-Mart Stores, Inc. (WMT, -1.59%). Top gainer - NIKE, Inc. (NKE, +1.95%).

Most of S&P sectors in positive area. Top gainer - Basic Materials (+1.1%). Top loser - Conglomerates (-0.4%).

At the moment:

Dow 20195.00 +59.00 +0.29%

S&P 500 2310.00 +5.75 +0.25%

Nasdaq 100 5222.75 +10.50 +0.20%

Oil 54.00 +1.00 +1.89%

Gold 1232.90 -3.90 -0.32%

U.S. 10yr 2.42 +0.03

-

16:30

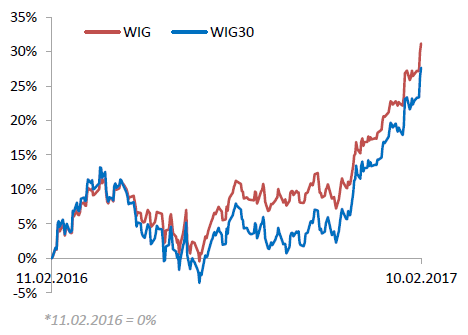

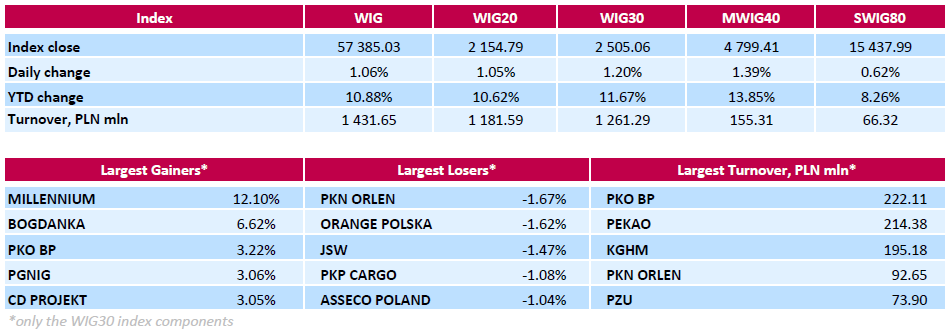

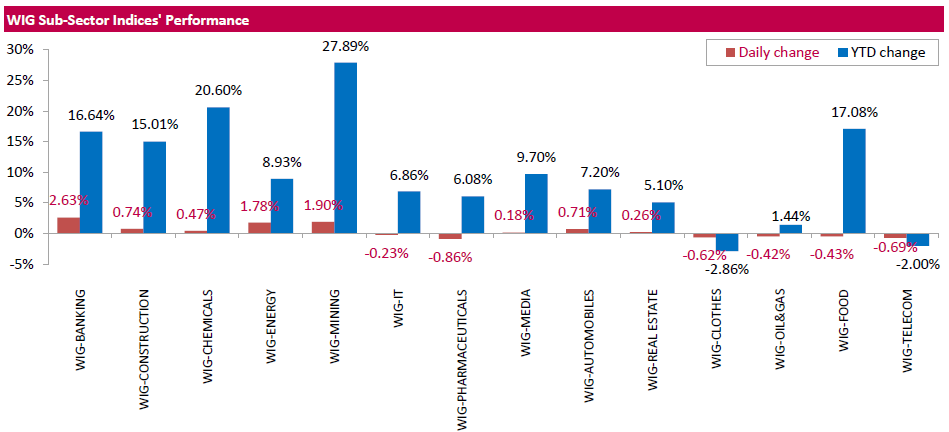

WSE: Session Results

Polish equity market closed higher on Friday with the broad market measure, the WIG Index, surging by 1.06%. Sector performance within the WIG Index was mixed. Banking sector stocks (+2.63%) outperformed, helped by comments by ruling party leader Jaroslaw Kaczynski that the Polish borrowers seeking compensation for being sold expensive Swiss franc-denominated mortgages should go to courts to demand compensation from banks because the government has to protect the stability of the financial system. At the same time, pharmaceuticals names (-0.86%) recorded the biggest drop.

Large-cap stocks' measure WIG30 rose by 1.2%. Nearly 2/3 of the 30 companies in the index basket advanced, and bank MILLENNIUM (WSE: MIL) fared particularly well, climbing by 12.1%. Apart from Kaczynski's comments on FX loans, the stock was also supported by the bank's CEO Joao Bras Jorge statement that MILLENNIUM was not expected to be faced with the need for additional external capital to comply with the new recommendations of the financial stability committee KSF. All potential increases in risk weights for loan exposures would be covered by the bank's retaining earnings, the CEO said, adding that the full 2016 profit would stay at the bank. Other major gainers were thermal coal miner BOGDANKA (WSE: LWB), bank PKO BP (WSE: PKO), oil and gas producer PGNIG (WSE: PGN) and videogame developer CD PROJEKT (WSE: CDR), jumping by 3.05%-6.62%. On the contrary, oil refiner PKN ORLEN (WSE: PKN), became the session's largest decliner with a 1.67% drop, followed by telecommunication services provider ORANGE POLSKA (WSE: OPL) and coking coal producer JSW (WSE: JSW), tumbling by 1.62% and 1.47% respectively.

-

14:33

U.S. Stocks open: Dow +0.25%, Nasdaq +0.24%, S&P +0.22%

-

14:28

Before the bell: S&P futures +0.11%, NASDAQ futures +0.11%

U.S. stock-index futures were slightly higher on Friday, a day after averages hit record high, supported by President Donald Trump's promise to unveil a "phenomenal" tax reform plan in the coming weeks.

Global Stocks:

Nikkei 19,378.93 +471.26 +2.49%

Hang Seng 23,574.98 +49.84 +0.21%

Shanghai 3,197.33 +14.15 +0.44%

FTSE 7,253.05 +23.55 +0.33%

CAC 4,826.67 +0.43 +0.01%

DAX 11,660.18 +17.32 +0.15%

Crude $53.86 (+1.62%)

Gold $1,227.90 (-0.72%)

-

13:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

31.58

0.08(0.254%)

5768

AMERICAN INTERNATIONAL GROUP

AIG

65.4

0.08(0.1225%)

250

Apple Inc.

AAPL

31.58

0.08(0.254%)

5768

Barrick Gold Corporation, NYSE

ABX

31.58

0.08(0.254%)

5768

Boeing Co

BA

163.11

-1.17(-0.7122%)

522

Caterpillar Inc

CAT

94.11

0.15(0.1596%)

4156

Cisco Systems Inc

CSCO

31.58

0.08(0.254%)

5768

Ford Motor Co.

F

12.42

0.04(0.3231%)

33282

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

16.14

0.75(4.8733%)

825055

General Electric Co

GE

31.58

0.08(0.254%)

5768

General Motors Company, NYSE

GM

35.22

0.14(0.3991%)

3512

Goldman Sachs

GS

242.6

1.05(0.4347%)

5556

Google Inc.

GOOG

811.5

1.94(0.2396%)

1718

HONEYWELL INTERNATIONAL INC.

HON

121

0.34(0.2818%)

200

JPMorgan Chase and Co

JPM

87.6

0.40(0.4587%)

18144

McDonald's Corp

MCD

31.58

0.08(0.254%)

5768

Microsoft Corp

MSFT

31.58

0.08(0.254%)

5768

Nike

NKE

55.4

0.09(0.1627%)

4511

Pfizer Inc

PFE

32.68

0.30(0.9265%)

554

UnitedHealth Group Inc

UNH

31.58

0.08(0.254%)

5768

Verizon Communications Inc

VZ

48.78

-0.03(-0.0615%)

4778

Visa

V

85.68

0.10(0.1169%)

4991

Wal-Mart Stores Inc

WMT

68.4

-0.68(-0.9844%)

33400

Yahoo! Inc., NASDAQ

YHOO

45.3

0.22(0.488%)

3200

Yandex N.V., NASDAQ

YNDX

23.16

0.20(0.8711%)

301

-

13:53

Upgrades and downgrades before the market open

Upgrades:

Ford Motor (F) upgraded to Hold from Underperform at Jefferies; target raised to $12 from $10

Downgrades:

Starbucks (SBUX) downgraded to Hold from Buy at Argus

Intel (INTC) downgraded to Hold from Buy at Canaccord Genuity

Twitter (TWTR) downgraded to Sell from Neutral at Citigroup

Twitter (TWTR) downgraded to Sell from Neutral at UBS

Twitter (TWTR) downgraded to Sell from Hold at Loop Capital

Twitter (TWTR) downgraded to Underweight from Neutral at Atlantic Equities

Other:

Wal-Mart (WMT) initiated with a Positive at Susquehanna; target $80

Twitter (TWTR) target lowered to $12 from $15 at Mizuho

-

12:10

WSE: Mid session comment

In the second half of the session the market Warsaw market entered with an increase of 0.8% and more than PLN 500 million turnover for the WIG20 index. We may also talk about consolidation, taking into account the approximately three-hour suspension of the index in the region of 2,150 points. At a special awards is worth today the attitude of the banks.

-

11:44

Major European stock indices trading in the green zone

The market has a corporate accountability as well as upbeat data from China.

China Customs Office reported that China's exports grew by 7.9% per annum in January, imports rose by 16.7% per annum. In January China's exports amounted to 182.76 billion dollars, and imports to 131.41 billion. Analysts forecasted growth of exports by 3.3% and imports by 10%. China's exports by the end of 2016 decreased by 7.7% and amounted to 2.097 trillion dollars. At the same time, imports decreased by 5.5% to 1.587 trillion dollars in 2016. The total volume of China's foreign trade grew by 11.4% in January - up to 314.16 billion dollars. The trade surplus in January amounted to 51.35 billion dollars. Analysts had forecast a surplus of 47.9 billion dollars.

Investors' attention is also drawn by stats from UK. The Office for National Statistics (ONS) reported that in the period from October to December 2016 production in manufacturing increased by 1.2 per cent compared with the previous three months. Compared with December 2015, production in the manufacturing industry increased by 4.0 percent, registering the strongest increase since April 2014. The volume of industrial production as a whole increased by 1.1 per cent, which was also higher than the expectations of experts (+0.2 percent). On an annual basis, industrial production increased by 4.3 percent (the strongest growth since January 2011) after increasing by 2.2 per cent November (revised from 2.0 percent).

A separate report from the ONS showed that the overall deficit of trade in goods decreased to 3.304 billion pounds compared with 3.559 billion pounds in November (revised from 4.17 billion gbp). The ONS explained that the recent decline in the deficit was mainly due to an increase in exports to countries outside the EU, at 1.1 billion pounds. In addition, the report showed that exports and imports were at record levels. Exports amounted to 48.822 billion pounds, while imports amounted to 52.126 billion gbp. Exports of goods increased by 4.4 percent on a monthly basis, to a record 28.545 billion gbp. Imports of goods rose by 1.4 percent in November to a record 39.435 billion gbp. The visible trade deficit amounted to 10.89 billion pounds, which was less than forecasts (11.45 billion gbp). The trade deficit with countries outside the EU, amounted to 2.114 billion pounds, compared with analysts' estimates of 3.5 billion gbp.

The composite index Stoxx Europe 600 decreased by 0.02%, to 366.70.

The capitalization of the mining company Boliden rose 7.5% after reports that the base operating profit of $ 236,760,000, far exceeding expectations.

Shares of steelmaker ArcelorMittal rose 3.8% after the company said that higher steel prices helped reduce the losses for the full year.

Renault shares rose 1.9% after record results in 2016, and increasing operating profit by 3 percent.

Kering - French producer of luxury goods - rose by 3.7% after figures on income exceeded analysts' expectations.

At the moment:

FTSE 100 +22.10 7251.60 + 0.31%

DAX +23.85 11666.71 + 0.20%

CAC 40 +2.09 4828.33 + 0.04%

-

08:56

Major stock markets in Europe trading in the green zone: FTSE + 0.5%, DAX + 0.5%, CAC40 + 0.3%, FTMIB + 0.4%, IBEX + 0.6%

-

08:17

WSE: After opening

WIG20 index opened at 2144.56 points (+0.57%)*

WIG 57193.08 0.72%

WIG30 2495.56 0.82%

mWIG40 4754.93 0.45%

*/ - change to previous close

The Warsaw market started the day in an upbeat mood while WIG20 tested the resistance at 2,152 points. The direction of change is so far not threatened. Distribution of activity in the segment of the largest companies is practically stedy.

After fifteen minutes of trading the WIG20 index was at the level of 2,153 points (+ 0.99%).

-

07:45

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.3%, CAC40 + 0.4%, FTSE + 0.1%

-

07:20

WSE: Before opening

Indices on the New York stock exchanges once again have set record highs. The Dow Jones Industrial rose at the close of 0.59 percent, the S&P 500 was firmer by 0.58 percent and the Nasdaq Comp. gained 0.58 percent.

The growth impulse came with the statement of the new president, who during the meeting with the presidents of companies from the aviation sector announced that will soon announce "phenomenal" information on the issue of tax cuts for American companies.

In the morning contracts on the S&P500 are listed on cosmetics positive territory, but boosters of the Nikkei index of almost 2.5 percent and an increase in contracts on the DAX signal that the European stock exchanges will start day with increases.

Yesterday's session on the Warsaw market brought breakout above the level of 2,100 and an increase of 2.3% with a turnover of over 1 billion in WIG20 reinforces the chance of demand for the next upward march.

-

06:30

Global Stocks

European stocks ended higher for a third straight session on Thursday, with upbeat earnings from French lender Société Générale SA and oil giant Total SA giving heart to market bulls. Even with three days of gains, equity markets in Europe have been trading in tight ranges recently, as investors absorb heightened political risks and a deluge of earnings reports.

U.S. stocks finished higher Thursday with the major indexes all notching the latest in a series of record closes, with energy and financial stocks leading the way.

Stocks and the dollar rebounded Friday, with Asian markets coming back to life after a listless Thursday as President Donald Trump said he would soon announce tax-reform measures. Japan led gains in the region, as a sharp drop in the yen steered the Nikkei Stock Average toward one of its biggest gains so far this year. The Nikkei NIK, +2.37% rose 440 points, or 2.3%, in early trade, a tad shy of its 2.5% advance seen in the year's opening session after an extended New Year's break.

-