Market news

-

22:29

Stocks. Daily history for Oct 11’2016:

Stocks. Daily history for Oct 11'2016:

(index / closing price / change items /% change)

Nikkei 225 17,024.76 +164.67 +0.98%

Shanghai Composite 3,066.09 +17.95 +0.59%

S&P/ASX 200 5,479.80 +4.37 +0.08%

FTSE 100 7,070.88 -26.62 -0.38%

CAC 40 4,471.74 -25.52 -0.57%

Xetra DAX 10,577.16 -46.92 -0.44%

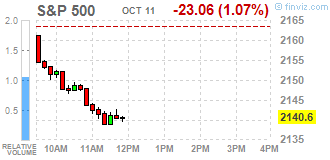

S&P 500 2,136.73 -26.93 -1.24%

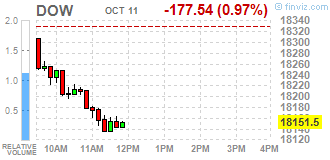

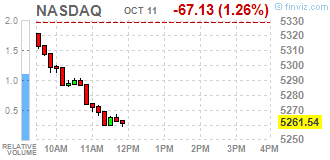

Dow Jones Industrial Average 18,128.66 -200.38 -1.09%

S&P/TSX Composite 14,549.60 -16.66 -0.11%

-

20:07

Major US stock indices closed in the red zone

Major US stock indices fell amid falling in all sectors after a report Alcoa began the season of quarterly reports on disappointing note.

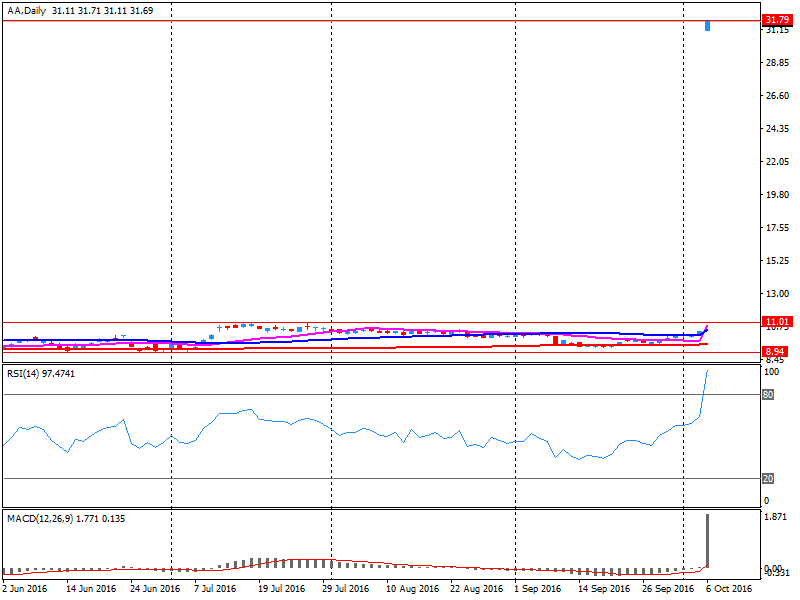

Shares of the aluminum giant Alcoa (AA) fell by 11.4%, which was the worst day dynamics of day-to-five years. According to the published report, Alcoa profit for the third quarter of fiscal year 2016 was $ 0.32 per share, in line with the average forecast of analysts. At the same time, the company's quarterly revenue was $ 5.213 billion., Several confounding market expectations at the level of $ 5.292 billion. It is worth noting that this was the last time when Alcoa reported back as one company. November 1, the company will split its business into two independent companies involved in raw materials (Alcoa) and high value-added production output (Arconic).

The cost of oil futures declined moderately, departing from the multi-month highs, which was caused by the publication of the report of the International Energy Agency (IEA). The IEA report says that world oil supply rose in September, but it was noticed the decline in world oil reserves in the vaults. "Forecast of supply and demand suggests that the market itself will remain in a supersaturated state during the first half of next year if OPEC will stick to the set threshold production, market re-balancing can occur more quickly." - Says the IEA review. In addition, the IEA revised its forecast for oil demand in 2016 to 96.3 million barrels a day, which implies an increase of 1.2 million. To the previous year (previously expected to grow by 1.3 million.).

Almost all the components of DOW index closed in negative territory (28 of 30). More rest rose stocks Apple Inc. (AAPL, + 0.32%). Outsider were shares of Merck & Co., Inc. (MRK, -3.11%).

All business sectors S & P index showed a drop. the health sector decreased most (-2.4%).

At the close:

Dow -1.08% 18,131.23 -197.81

Nasdaq -1.54% 5,246.79 -81.88

S & P -1.24% 2,136.82 -26.84

-

19:00

DJIA -1.24% 18,101.23 -227.81 Nasdaq -1.70% 5,238.18 -90.49 S&P -1.39% 2,133.60 -30.06

-

16:00

European stocks closed: FTSE 100 -26.62 7070.88 -0.38% DAX -46.92 10577.16 -0.44% CAC 40 -25.52 4471.74 -0.57%

-

16:00

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Tuesday amid broad declines across sectors after Alcoa kicked off the earnings season on a disappointing note. Alcoa's (AA) shares fell nearly 11%, their worst day in five years after the aluminum producer reported quarterly revenue and profit that fell short of the market's expectation.

Most of Dow stocks in negative area (28 of 30). Top gainer - Apple Inc. (AAPL, +1.10%). Top loser - Merck & Co., Inc. (MRK, -2.25%).

All S&P sectors also in negative area. Top loser - Healthcare (-1.9%).

At the moment:

Dow 18068.00 -191.00 -1.05%

S&P 500 2135.25 -23.75 -1.10%

Nasdaq 100 4834.50 -58.75 -1.20%

Oil 50.52 -0.83 -1.62%

Gold 1258.80 -1.60 -0.13%

U.S. 10yr 1.75 +0.02

-

15:29

WSE: Session Results

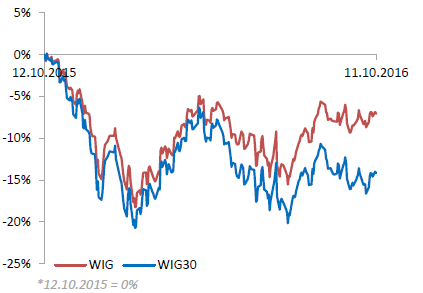

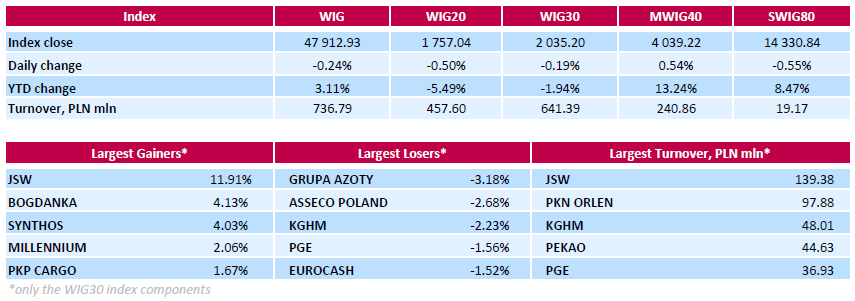

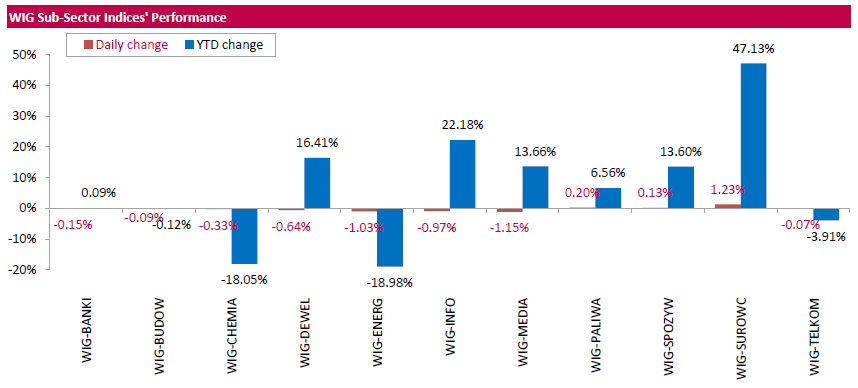

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, lost 0.24%. The WIG sub-sector indices were mainly lower with media (-1.15%) underperforming. At the same time, materials (+1.23%) fared the best.

The large-cap stocks fell by 0.19%. Within the index components, chemical producer GRUPA AZOTY (WSE: ATT) recorded the biggest drop, down 3.18%. It was followed by IT-company ASSECO POLAND (WSE: ACP) and copper producer KGHM (WSE: KGH), plunging by 2.68% and 2.23% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) became the session's best performer, as its quotations skyrocketed by 11.91%, buoyed by rising prices of coking coal. Thermal coal miner BOGDANKA (WSE: LWB), chemical producer SYNTHOS (WSE: SNS) and bank MILLENNIUM (WSE: MIL) did well too, posting 2.06%-4.13% gains.

-

13:54

WSE: After start on Wall Street

Alcoa released its results, however, before the session, and although at first glance they do not look bad, they are negatively received by investors (EPS $ 0.32 (consensus $ 0.33); revenues $ 5,213 billion (consensus $ 5,325 billion). We may observe a decrease in revenues and the shares in the before-session trade lost almost 5%. As a rule, Alcoa has little bearing on the behavior of the overall market, but today we may see a slight negative reaction, which is aggravated by the stronger dollar. Trading in the US began with a discount of 0.14%, which after the first transactions slightly increased. Certainly, such behavior of Americans is not conducive to global risk appetite, which may cool the mood in the final phase of the session.

An hour before the close of trading the WIG20 index reached the level of 1,764 points (-0.09%).

-

13:33

U.S. Stocks open: Dow -0.22%, Nasdaq -0.20%, S&P -0.23%

-

13:17

Before the bell: S&P futures -0.24%, NASDAQ futures -0.10%

U.S. stock-index futures slipped amid growing speculation that the Federal Reserve will raise interest rates this year, undermining demand for riskier assets, while quarterly results from Alcoa Inc. (AA) disappointed.

Global Stocks:

Nikkei 17,024.76 +164.67 +0.98%

Hang Seng 23,549.52 -302.30 -1.27%

Shanghai 3,066.09 +17.95 +0.59%

FTSE 7,102.36 +4.86 +0.07%

CAC 4,506.50 +9.24 +0.21%

DAX 10,649.94 +25.86 +0.24%

Crude $51.03 (-0.62%)

Gold $1256.80 (-0.29%)

-

12:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

170.78

-0.36(-0.2104%)

200

ALCOA INC.

AA

30.27

-1.24(-3.9353%)

181866

ALTRIA GROUP INC.

MO

61.86

0.11(0.1781%)

1735

Amazon.com Inc., NASDAQ

AMZN

841.01

-0.70(-0.0832%)

7591

American Express Co

AXP

61.7

-0.20(-0.3231%)

600

Apple Inc.

AAPL

117.98

1.93(1.6631%)

1952878

AT&T Inc

T

39

-0.01(-0.0256%)

2699

Barrick Gold Corporation, NYSE

ABX

15.42

-0.16(-1.027%)

208583

Boeing Co

BA

135.5

-0.34(-0.2503%)

6250

Caterpillar Inc

CAT

89.01

0.79(0.8955%)

24176

Cisco Systems Inc

CSCO

31.39

-0.08(-0.2542%)

3617

Citigroup Inc., NYSE

C

49.41

-0.14(-0.2825%)

27298

Facebook, Inc.

FB

130.14

-0.10(-0.0768%)

35661

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.06

-0.13(-1.2758%)

101940

General Electric Co

GE

28.82

-0.04(-0.1386%)

10248

Google Inc.

GOOG

787.5

1.56(0.1985%)

1021

Intel Corp

INTC

37.97

-0.05(-0.1315%)

1402

Johnson & Johnson

JNJ

119.6

-0.20(-0.1669%)

200

JPMorgan Chase and Co

JPM

68.35

-0.29(-0.4225%)

1156

Merck & Co Inc

MRK

63.87

-0.03(-0.047%)

1015

Microsoft Corp

MSFT

57.89

-0.15(-0.2584%)

23348

Nike

NKE

52.17

0.38(0.7337%)

6539

Pfizer Inc

PFE

33.51

-0.10(-0.2975%)

2870

Starbucks Corporation, NASDAQ

SBUX

53.07

-0.23(-0.4315%)

1632

Tesla Motors, Inc., NASDAQ

TSLA

201.25

0.30(0.1493%)

2802

The Coca-Cola Co

KO

41.69

-0.04(-0.0959%)

797

Twitter, Inc., NYSE

TWTR

17.94

0.38(2.164%)

683095

United Technologies Corp

UTX

99.12

-0.86(-0.8602%)

300

Verizon Communications Inc

VZ

50

-0.19(-0.3786%)

200

Visa

V

82.85

-0.27(-0.3248%)

1098

Yahoo! Inc., NASDAQ

YHOO

43.81

-0.11(-0.2505%)

21920

-

12:45

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded to Buy from Neutral at Goldman

Twitter (TWTR) upgraded to Hold from Sell at Evercore ISI; target $17

Downgrades:

Other:

NIKE (NKE) initiated with a Positive at Susquehanna

-

12:13

Company News: Alcoa Inc. (AA) posts Q3 EPS in line with analysts' estimates

Alcoa reported Q3 FY 2016 earnings of $0.32 per share (versus $0.07 in Q3 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.213 bln (-6.5% y/y), slightly missing analysts' consensus estimate of $5.292 bln.

It should be noted it was the last time that Alcoa reported as a single company. The company will execute the separation of its upstream (Alcoa) and downstream (Arconic) businesses on November 1st .

AA fell to $29.94 (-4.98%) in pre-market trading.

-

10:54

Major stock indices in Europe little changed

Stock indices in Western Europe rose moderately in low activity. Market participants are studying the prospects of interest rate increase by the Federal Reserve and the agreement of OPEC and other oil producers to restrict production.

Traders estimate a Fed hike at 68% in in December up from 50%. Meanwhile, in November the likelihood of tighter monetary policy is much lower - only 17%.

Istanbul continues 23rd World Energy Congress. The International Energy Agency (IEA) expects a more rapid restoration of the balance in the oil market as a result of the agreements on production cuts.

However, the IEA notes record volumes of oil production of OPEC countries - 33.64 million barrels per day. December contracts for Brent fell during trading 0,4% - to $ 52.94 per barrel.

In addition, the market's attention focused on corporate reporting. The US earnings season unofficially kicks off October 11 with the quarterly results of Alcoa Inc. The process will begin in Europe later, and 150 companies from Stoxx 600 will report.

The market value of the British manufacturer of heat-resistant plastics Victrex Plc jumped 6.7% due to positive financial results.

Airbus securities decreased by 2% after the loss of the Polish contract for the supply of helicopters. Analysts at JPMorgan Chase & Co. expect weak results of the company for the third quarter.

The banking sector is again trading in the red zone because of concerns related to the stability of European financial companies: UniCredit lost 1.7% of its capitalization, Deutsche Bank and Banca Popolare di Milano - 1,4%, Raiffeisen Bank - 1,3%.

At the moment:

FTSE 7105.84 8.34 0.12%

DAX 10632.39 8.31 0.08%

CAC 4505.62 8.36 0.19%

-

10:36

WSE: Afternoon comment

In the morning we met the reading of the German economic sentiment index (ZEW), which rose in October to 6.2 points versus 0.5 points a month earlier. Analysts expected 4 point. Thus, the data performs well, although this should not be surprising in light of the previous very good read of the Ifo index. These data go unnoticed in the market, because nothing did not bring any new to the situation.

In the first half of trading the Warsaw market again weakened against the major European indices, which maintain the levels of neutral.

Weakens also the Polish zloty against the dollar. The Polish zloty, with a daily decline of 0.7 percent against the US currency is on Tuesday one of the weakest currencies of emerging economies.

-

07:16

WSE: After opening

WIG20 index opened at 1767.37 points (+0.08%)*

WIG 48142.35 0.24%

WIG30 2044.37 0.26%

mWIG40 4046.94 0.74%

*/ - change to previous close

The cash market opens up with a modest increase of 0.08% with the turnover clearly focused on growing by more than 10% the shares of JSW. At the opening the German DAX lost 0.15%. The beginning of trading may therefore be regarded as relatively neutral and balanced, where the worse sentiment in the world do not reflect too wide coverage.

The first transaction did not bring any major changes. On the main floor bulls soon after the opening tried to reach the highs yesterday's session, but quite quickly this attempt turns into a revocation signaled earlier by the contracts. In this way, we adjust to changes in Europe, where declines of 0.2 percent in the major indexes are standard at this time.

-

06:52

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.1%, FTSE -0.2%

-

06:27

WSE: Before opening

Monday's session on Wall Street ended with increases in the major indexes. The Dow Jones Industrial at the end of the day gained 0.49 percent, the S&P500 rose by 0.46 percent and the Nasdaq Comp. increased 0.69 percent. The main reason for this situation was the increase in oil prices, which was the most expensive over a year. On Monday afternoon price of a barrel of Brent grew up to more than 53.6 USD. In the wake of the strongest oil prices on Wall Street climbed up the sector of fuel and raw materials.

In the morning, futures in the US are losing value. In Asia the Nikkei gains due to the weakening yen and lose indexes in South Korea and Hong Kong.

It seems that the beginning of the session in Europe will not be conducted in the best mood, and it's hard to count on growth, for which yesterday parquets in Europe together with the Warsaw Stock Exchange were prepared.

The macro calendar remains almost empty today, and the only notable publication will be the ZEW index. This week begins the US season for the presentation of the quarterly results for the company. Today, after the US session its results will give Alcoa. Most large US companies will publish their reports by the end of October.

-

05:03

Global Stocks

European stocks closed with gains Monday, boosted by oil's rally and merger hopes in Italy's struggling banking sector. German newspaper Bild this weekend reported the bank's chief executive, John Cryan, wasn't able to secure a deal while he was in Washington, D.C., late last week.

U.S. stocks closed higher Monday as rising optimism that OPEC would reach a deal to cut production-a move seen as necessary for addressing oversupply-delivered a jolt to energy shares.

The outlook for Asian stocks was positive following gains in the US, where energy shares jumped on prospects major crude producers will work to cut output and ease a supply glut. Oil was above US$51 (RM211.02) a barrel and the yen held declines. Shares in Australia and New Zealand rose as futures Japan's Nikkei 225 Stock Average futures signaled gains following a 0.5 per cent bounce in the S&P 500 Index.

-