Market news

-

22:28

Stocks. Daily history for Oct 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,860.09 -39.01 -0.23%

Shanghai Composite 3,048.14 +43.44 +1.45%

S&P/ASX 200 5,475.43 +8.04 +0.15%

FTSE 100 7,097.50 +53.11 +0.75%

CAC 40 4,497.26 +47.35 +1.06%

Xetra DAX 10,624.08 +133.22 +1.27%

S&P 500 2,163.66 +9.92 +0.46%

Dow Jones Industrial Average 18,329.04 +88.55 +0.49%

S&P/TSX Composite 14,566.26 -29.24 -0.20%

-

20:08

Major US stock indices closed above zero

Major US stock indexes rose on Monday, driven by rising oil prices, as well as on the background of the fact that the Democrat Hillary Clinton was the winner of the second round of the presidential debates.

Clinton is expected as US President will be more positive for the market, because of its position known better than her Republican rival, Donald Trump, according to Reuters data.

Brent prices rose sharply, reaching a peak in mid-October 2015, as Russia said it was ready to join a proposed deal to curb oil production in an attempt to stop the fall in prices. Quotes of WTI crude oil also increased significantly, reaching its highest level in four months.

Among the corporate nature of the message it is worth noting the news that Twitter search for new solutions to the situation after the failure of potential buyers - Google (Alphabet Inc .; GOOG), Salesforce.com Inc. and Walt Disney (DIS), - the acquisition of the company under the pressure of its own investors. This was reported in his article Bloomberg. According to the agency, on Saturday, Twitter's board of directors should hold a meeting with the independent consultants to discuss the sale, but the event was canceled. As reported by Bloomberg informed sources, Twitter is considering other options, including the separation of assets that are not of importance to the company's core business.

DOW index components ended the day mostly in positive territory (19 vs. 11). More rest up shares Exxon Mobil Corporation (XOM, + 1.99%). Outsider were shares of Wal-Mart Stores Inc. (WMT, -1.15%).

All Sector S & P Index showed an increase. The leader turned out to be the basic materials sector (+ 1.6%).

At the close:

Dow + 0.49% 18,329.25 +88.76

Nasdaq + 0.69% 5,328.67 +36.26

S & P + 0.46% 2,163.66 +9.92

-

19:00

DJIA +0.58% 18,347.05 +106.56 Nasdaq +0.84% 5,336.72 +44.31 S&P +0.56% 2,165.88 +12.14

-

16:01

European stocks closed: FTSE 100 +53.11 7097.50 +0.75% DAX +133.22 10624.08 +1.27% CAC 40 +47.35 4497.26 +1.06%

-

15:30

WSE: Session Results

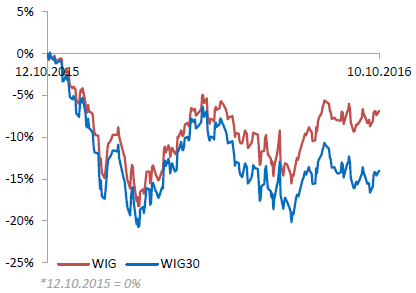

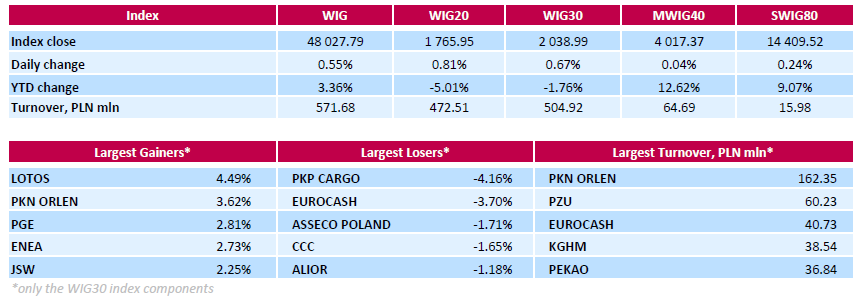

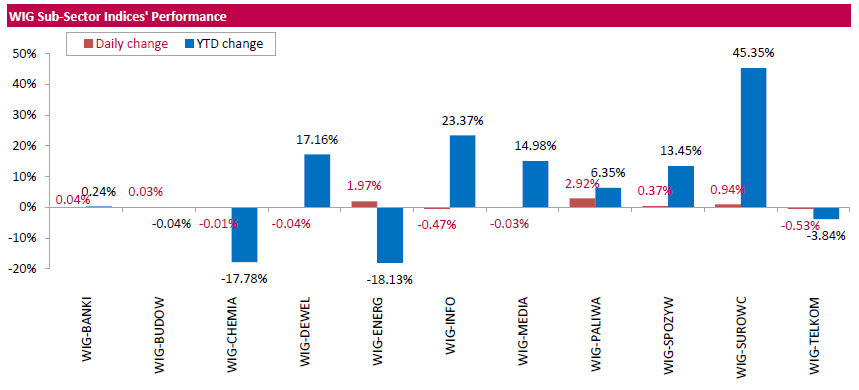

Polish equity market advanced on Monday. The broad market measure, the WIG Index, added 0.55%. Sector performance in the WIG index was mixed. Oil and gas sector (+2.92%) fared the best, while telecoms (-0.53%) lagged behind.

The large-cap companies' measure, the WIG30 Index, rose 0.67%. Within the index components, two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN) led the gainers, recording advances of a respective 4.49% and 3.62%. Other major outperformers were coking coal producer JSW (WSE: JSW) and three utilities names PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG), jumping by 1.48%-2.81%. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) and FMCG-wholesaler EUROCASH (WSE: EUR) recorded the biggest drops, tumbling 4.16% and 3.7% respectively. They were followed by IT-company ASSECO POLAND (WSE: ACP) and footwear retailer CCC (WSE: CCC), declining 1.71% and 1.65% respectively.

-

13:55

WSE: After start on Wall Street

Before the opening of the session in the US sentiment in the environment definitely improved and the increase in the valuation of the German DAX slightly exceeded 1%. Afternoon trading phase brings also a strong increase in the oil market. Quotations on Wall Street started with anticipated increases (+ 0.41%), which means comeback to Friday's levels. These factors have been spotted on the Warsaw Stock Exchange and an hour before the end of trading, the Warsaw WIG20 index gained almost one percent and stood at 1,768 points.

-

13:33

U.S. Stocks open: Dow +0.63%, Nasdaq +0.53%, S&P +0.53%

-

13:28

Before the bell: S&P futures +0.56%, NASDAQ futures +0.49%

U.S. stock-index futures rose as oil prices rallied, while early reaction to the second presidential debate favored Democratic candidate Hillary Clinton.

Global Stocks:

Nikkei Closed

Hang Seng Closed

Shanghai 3,048.14 +43.44 +1.45%

FTSE 7,084.46 +40.07 +0.57%

CAC 4,489.92 +40.01 +0.90%

DAX 10,604.52 +113.66 +1.08%

Crude $50.46 (+1.30%)

Gold $1260.60 (+0.69%)

-

13:03

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.58

0.21(0.6694%)

6202

ALTRIA GROUP INC.

MO

62.15

0.23(0.3714%)

1064

Amazon.com Inc., NASDAQ

AMZN

843.1

3.67(0.4372%)

16725

AMERICAN INTERNATIONAL GROUP

AIG

60.2

0.25(0.417%)

1020

Apple Inc.

AAPL

115.38

1.32(1.1573%)

383436

AT&T Inc

T

38.96

0.09(0.2315%)

2586

Barrick Gold Corporation, NYSE

ABX

15.92

0.19(1.2079%)

44639

Boeing Co

BA

134.24

0.39(0.2914%)

302

Caterpillar Inc

CAT

88.89

0.42(0.4747%)

3135

Cisco Systems Inc

CSCO

31.59

0.11(0.3494%)

1860

Citigroup Inc., NYSE

C

49.5

0.22(0.4464%)

9793

Deere & Company, NYSE

DE

87.75

1.45(1.6802%)

4589

E. I. du Pont de Nemours and Co

DD

68.48

-0.58(-0.8398%)

519

Exxon Mobil Corp

XOM

87.61

0.87(1.003%)

3736

Facebook, Inc.

FB

129.48

0.49(0.3799%)

33815

Ford Motor Co.

F

12.32

0.03(0.2441%)

7990

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.3

0.17(1.6782%)

60807

General Electric Co

GE

29.18

0.10(0.3439%)

3839

General Motors Company, NYSE

GM

32.55

0.21(0.6493%)

1442

Goldman Sachs

GS

170.79

0.96(0.5653%)

825

Google Inc.

GOOG

778.55

3.47(0.4477%)

3337

HONEYWELL INTERNATIONAL INC.

HON

107.3

0.36(0.3366%)

7438

Intel Corp

INTC

38.28

0.21(0.5516%)

3822

International Business Machines Co...

IBM

156.5

0.83(0.5332%)

492

JPMorgan Chase and Co

JPM

68.45

0.34(0.4992%)

21707

McDonald's Corp

MCD

114.23

0.78(0.6875%)

328

Merck & Co Inc

MRK

64.88

2.11(3.3615%)

190275

Microsoft Corp

MSFT

58.04

0.24(0.4152%)

7435

Procter & Gamble Co

PG

90.1

0.10(0.1111%)

2329

Starbucks Corporation, NASDAQ

SBUX

53.61

0.15(0.2806%)

2051

Tesla Motors, Inc., NASDAQ

TSLA

201.3

4.69(2.3854%)

73396

The Coca-Cola Co

KO

41.9

0.19(0.4555%)

1286

Twitter, Inc., NYSE

TWTR

17.25

-2.60(-13.0982%)

6873252

United Technologies Corp

UTX

98.85

-1.73(-1.72%)

4693

Verizon Communications Inc

VZ

50.05

0.13(0.2604%)

3675

Wal-Mart Stores Inc

WMT

68.72

-0.64(-0.9227%)

1211

Walt Disney Co

DIS

92.9

0.07(0.0754%)

1875

Yahoo! Inc., NASDAQ

YHOO

43.31

0.09(0.2082%)

28091

Yandex N.V., NASDAQ

YNDX

22.02

-0.11(-0.4971%)

500

-

13:00

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Outperform from Market Perform at Wells Fargo

Downgrades:

United Tech (UTX) downgraded to Neutral from Buy at Citigroup

Other:

McDonald's (MCD) resumed with a Outperform at Telsey Advisory Group; target $130

Honeywell (HON) target lowered to $133 from $138 at RBC Capital Mkts

HP (HPQ) target raised to $16 from $14 at RBC Capital Mkts

Alphabet A (GOOGL) target raised to $1000 from $990 at Axiom Capital

Honeywell (HON) removed from Conviction Buy List at Goldman; remains Buy; target $122

-

11:07

WSE: Mid session comment

The first half of today's trading brought confirmation of the artificial nature of the initial strong growth in the WIG20 index. After nearly two hours of trading bulls were not able to keep the tempo, which confirmed the weakness of the demand side.

On the Warsaw market the top form presents today PKN Orlen (WSE: PKN). Shares of the company stand out at the first part of the session and currently grow by over 3%. Share price is the highest since June 23.

The beginning of the session in Europe has been slightly declining, where stood out the particular weakness of the banking sector, after the chief executive of Deutsche Bank, being in Washington at the end of last week did not reach an agreement with the Department of Justice on penalties imposed on the bank.

Next hours brought a better mood with new maxima in the CAC40 and the DAX, what helped for trading on the Warsaw market. Apparently Trump's problems have not led to greater explosion of optimism.

The second half of the session the WIG20 welcomed at the level of 1,764 points (+ 0.71%), with the turnover of PLN 240 million.

-

07:17

WSE: After opening

WIG20 index opened at 1757.71 points (+0.34%)*

WIG 47929.53 0.35%

WIG30 2034.33 0.44%

mWIG40 4018.09 0.06%

*/ - change to previous close

The new week was began by contracts on the WIG20 with a slight increase of 4 points above Friday's closing. Today's morning did not bring any major changes in the main European markets and futures on the DAX and CAC40 oscillate at neutral levels

The cash market started the day with an increase of 0.34% to 1,757 points with Monday's, modest turnover. With the first transaction market recovered Friday's decline and returned to the starting point, means the area of 1,760 points. Surrounded the German DAX initially rose much less, but pretty soon improved its image, which supports the preservation of the Warsaw Stock Exchange. However the turnover is weak and detracts the credibility of the observed changes.

After fifteen minutes of trading the WIG20 index reached the level of 1,767 points (+0,90%).

-

06:24

WSE: Before opening

We start a week at beginning of which there are new events that may affect the behavior of the markets. We are talking about the next debate Trump - Clinton and the subsequent controversies surrounding Donald Trump (published on Friday night video recording from 2005), which over the weekend led to comments suggesting his withdrawal from the race for the presidential nomination. Strengthen of the Mexican peso and the increase in the valuation of contracts in the US indicate decreasing the chances of this candidate in the upcoming elections.

In Asia, we observe a clear weakening of the yuan by approx. 0.5%, which is a negative premise for the markets. There is no on the market the resting Japanese, but on the other hand, the market returned Chinese and the Shanghai index rose more than 1%.

The Warsaw market in recent days become resistant to the mood from the environment and focuses on behavior of individual companies and local information impact on them.

-