Market news

-

23:50

Japan: Current Account, bln, August 2001 (forecast 1539)

-

22:29

Commodities. Daily history for Oct 10’2016:

(raw materials / closing price /% change)

Oil 51.16-0.37%

Gold 1,261.40+0.08%

-

22:28

Stocks. Daily history for Oct 10’2016:

(index / closing price / change items /% change)

Nikkei 225 16,860.09 -39.01 -0.23%

Shanghai Composite 3,048.14 +43.44 +1.45%

S&P/ASX 200 5,475.43 +8.04 +0.15%

FTSE 100 7,097.50 +53.11 +0.75%

CAC 40 4,497.26 +47.35 +1.06%

Xetra DAX 10,624.08 +133.22 +1.27%

S&P 500 2,163.66 +9.92 +0.46%

Dow Jones Industrial Average 18,329.04 +88.55 +0.49%

S&P/TSX Composite 14,566.26 -29.24 -0.20%

-

22:28

Currencies. Daily history for Oct 10’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1137 -0,57%

GBP/USD $1,2363 -0,57%

USD/CHF Chf0,9826 +0,53%

USD/JPY Y103,93 +0,98%

EUR/JPY Y115,42 +0,16%

GBP/JPY Y128,11 +0,15%

AUD/USD $0,7605 +0,28%

NZD/USD $0,7139 -0,38%

USD/CAD C$1,3163 -0,97%

-

22:00

Schedule for today, Tuesday, Oct 11’2016

00:30 Australia Home Loans August -4.2%

00:30 Australia National Australia Bank's Business Confidence September 6

05:00 Japan Eco Watchers Survey: Current September 45.6

05:00 Japan Eco Watchers Survey: Outlook September 47.4

09:00 Eurozone ZEW Economic Sentiment October 5.4

09:00 Germany ZEW Survey - Economic Sentiment October 0.5 4

12:15 Canada Housing Starts September 182.7

14:00 U.S. Labor Market Conditions Index September -0.7

23:30 Australia Westpac Consumer Confidence October 0.3%

23:50 Japan Core Machinery Orders August 4.9% -5.5%

23:50 Japan Core Machinery Orders, y/y August 5.2% 6.5%

-

20:08

Major US stock indices closed above zero

Major US stock indexes rose on Monday, driven by rising oil prices, as well as on the background of the fact that the Democrat Hillary Clinton was the winner of the second round of the presidential debates.

Clinton is expected as US President will be more positive for the market, because of its position known better than her Republican rival, Donald Trump, according to Reuters data.

Brent prices rose sharply, reaching a peak in mid-October 2015, as Russia said it was ready to join a proposed deal to curb oil production in an attempt to stop the fall in prices. Quotes of WTI crude oil also increased significantly, reaching its highest level in four months.

Among the corporate nature of the message it is worth noting the news that Twitter search for new solutions to the situation after the failure of potential buyers - Google (Alphabet Inc .; GOOG), Salesforce.com Inc. and Walt Disney (DIS), - the acquisition of the company under the pressure of its own investors. This was reported in his article Bloomberg. According to the agency, on Saturday, Twitter's board of directors should hold a meeting with the independent consultants to discuss the sale, but the event was canceled. As reported by Bloomberg informed sources, Twitter is considering other options, including the separation of assets that are not of importance to the company's core business.

DOW index components ended the day mostly in positive territory (19 vs. 11). More rest up shares Exxon Mobil Corporation (XOM, + 1.99%). Outsider were shares of Wal-Mart Stores Inc. (WMT, -1.15%).

All Sector S & P Index showed an increase. The leader turned out to be the basic materials sector (+ 1.6%).

At the close:

Dow + 0.49% 18,329.25 +88.76

Nasdaq + 0.69% 5,328.67 +36.26

S & P + 0.46% 2,163.66 +9.92

-

19:00

DJIA +0.58% 18,347.05 +106.56 Nasdaq +0.84% 5,336.72 +44.31 S&P +0.56% 2,165.88 +12.14

-

16:01

European stocks closed: FTSE 100 +53.11 7097.50 +0.75% DAX +133.22 10624.08 +1.27% CAC 40 +47.35 4497.26 +1.06%

-

15:47

Oil up more than 3 percent

Brent prices rose sharply, reaching mid-October 2015 highs, as Russia said it was ready to join a proposed deal to limit oil production in an attempt to stop the fall in prices. Quotes of WTI crude also increased significantly, reaching the highest level in four months.

Russian President Vladimir Putin said that the freezing of production or even a reduction in oil production is likely to be the only right decision to maintain the stability of the energy sector. "Russia is ready to join the joint measures to limit production, and calls on other oil-exporting countries followo t this example", - said Putin, speaking at the World Energy Congress in Istanbul.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) rose to 51.36 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of Brent crude rose to 53.30 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:30

WSE: Session Results

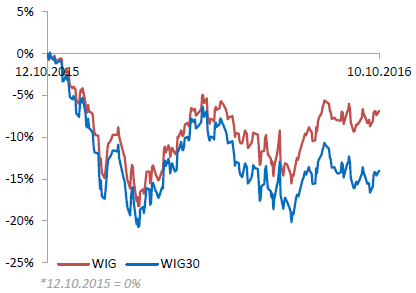

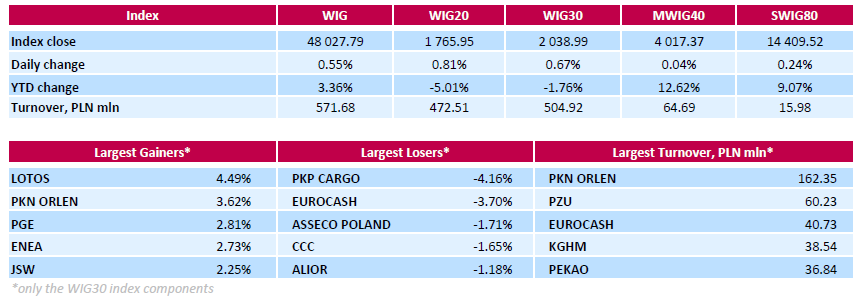

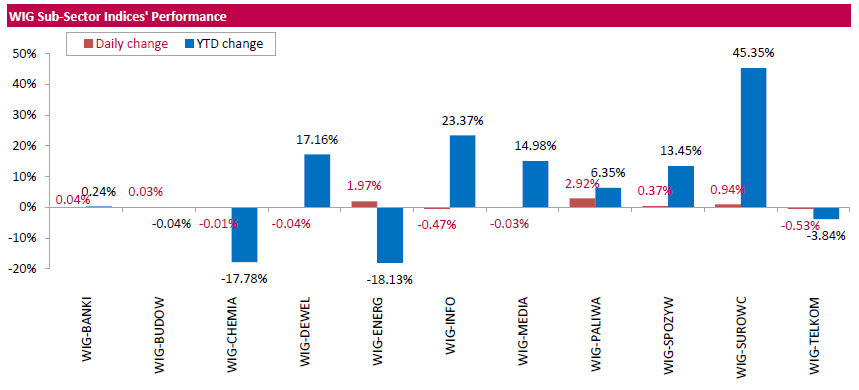

Polish equity market advanced on Monday. The broad market measure, the WIG Index, added 0.55%. Sector performance in the WIG index was mixed. Oil and gas sector (+2.92%) fared the best, while telecoms (-0.53%) lagged behind.

The large-cap companies' measure, the WIG30 Index, rose 0.67%. Within the index components, two oil refiners LOTOS (WSE: LTS) and PKN ORLEN (WSE: PKN) led the gainers, recording advances of a respective 4.49% and 3.62%. Other major outperformers were coking coal producer JSW (WSE: JSW) and three utilities names PGE (WSE: PGE), ENEA (WSE: ENA) and ENERGA (WSE: ENG), jumping by 1.48%-2.81%. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) and FMCG-wholesaler EUROCASH (WSE: EUR) recorded the biggest drops, tumbling 4.16% and 3.7% respectively. They were followed by IT-company ASSECO POLAND (WSE: ACP) and footwear retailer CCC (WSE: CCC), declining 1.71% and 1.65% respectively.

-

15:29

Gold moderately higher

Gold has risen in price moderately after the biggest drop recorded in the last week of November 2015. Support for precious metal had increased demand for safe-haven assets due to the uncertainty regarding the upcoming elections in the United States.

Analysts say that the candidate of the Republican Party, Trump, at debate on Sunday was better than expected. However, according to preliminary surveys, the probability of Clinton's victory increased markedly. Heigh probability of Clinton's victory stabilizes markets, and on the other hand, when there is the probable victory of Trump's there is much more uncertainty about the future of American foreign policy, trade, economics, and even the Fed.

In addition, the Commodity Futures Trading Commission said that last week hedge funds and money managers cut their net long positions in gold to a four-month low. However, the gold reserves of the largest investment fund SPDR Gold Trust rose on Friday to 11.3 tonnes, recording the highest daily gain since early July.

The cost of the October futures for gold on the COMEX fell to $ 1260.1 per ounce.

-

15:02

-

14:34

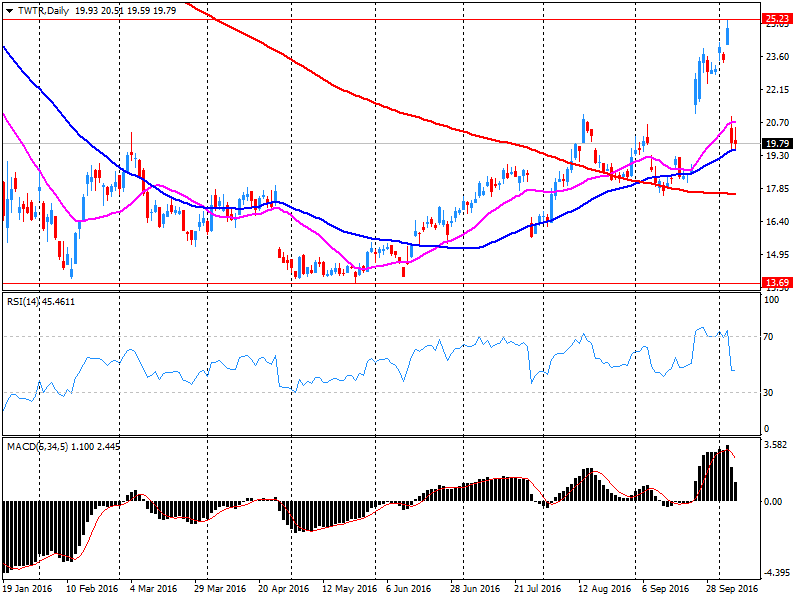

Shares of Twitter (TWTR) have fallen by 13.6% on reports that potential buyers have lost interest

On Saturday, Twitter's board of directors should hold a meeting with the independent consultants to discuss the sale, but the event was canceled. Potential buyers - Google (Alphabet Inc .; GOOG), Salesforce.com Inc. and Walt Disney (DIS)

According to informed sources, Twitter is considering other options, including the separation of assets that are not of importance to the company's core business.

TWTR shares fell in premarket trading to $ 17.15 (-13.60%).

-

14:28

US Conference Bd: Sep Employment Trends Index +1.1% To 128.51

-

13:55

WSE: After start on Wall Street

Before the opening of the session in the US sentiment in the environment definitely improved and the increase in the valuation of the German DAX slightly exceeded 1%. Afternoon trading phase brings also a strong increase in the oil market. Quotations on Wall Street started with anticipated increases (+ 0.41%), which means comeback to Friday's levels. These factors have been spotted on the Warsaw Stock Exchange and an hour before the end of trading, the Warsaw WIG20 index gained almost one percent and stood at 1,768 points.

-

13:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 776m) 1.1117-20 (766m) 1.1180 (346m) 1.1200-05 (472m) 1.1225 (686m) 1.1220 (304m) 1.1285-90 (336m) 1.1310 (238m) 1.1350 (489m)

USD/JPY: 101.50 (USD 402m) 101.95-00 (475m) 102.50 (1.15bln) 103.00-10 (486m) 103.50 (500m)

GBP/USD: 1.2000 (GBP 475m) 1.2400 (604m) 1.2500 (770m) 1.2600 (270m) 1.2700 (757m)

USD/CHF 0.9640-50 (USD 775m) )

AUD/USD: 0.7450 (AUD 300m) 0.7550 (351m) 0.7600 (1.14bln) 0.7825 (256m)

-

13:33

U.S. Stocks open: Dow +0.63%, Nasdaq +0.53%, S&P +0.53%

-

13:28

Before the bell: S&P futures +0.56%, NASDAQ futures +0.49%

U.S. stock-index futures rose as oil prices rallied, while early reaction to the second presidential debate favored Democratic candidate Hillary Clinton.

Global Stocks:

Nikkei Closed

Hang Seng Closed

Shanghai 3,048.14 +43.44 +1.45%

FTSE 7,084.46 +40.07 +0.57%

CAC 4,489.92 +40.01 +0.90%

DAX 10,604.52 +113.66 +1.08%

Crude $50.46 (+1.30%)

Gold $1260.60 (+0.69%)

-

13:16

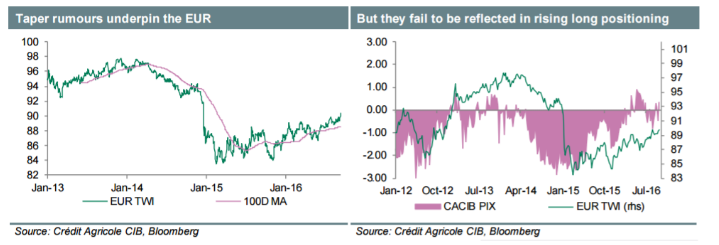

EUR: Taper Rumors Underpin EUR; Staying Bullish On Crosses - Credit Agricole

"Market concerns that ECB may be closer to tapering QE than anticipated have been supporting the single currency on the crosses. Although the central bank's press agency denied such an idea, we do believe that it will become a bigger topic by the middle of next year.

Nonetheless, it must still be noted that the ECB is unlikely to consider a change to interest rates anytime soon and such prospects are likely to ensure that the EUR does not face sustainable upside for now.

From a broader basis we remain of the view that a gradual uptrend will continue unabated.

In terms of data the focus will be on the final September CPI and the German ZEW economic sentiment survey. While final inflation data is unlikely to provide any surprises the ZEW faces some upside risks given its closer correlation with German stocks.

We keep our long EUR/CAD position".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

13:03

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.58

0.21(0.6694%)

6202

ALTRIA GROUP INC.

MO

62.15

0.23(0.3714%)

1064

Amazon.com Inc., NASDAQ

AMZN

843.1

3.67(0.4372%)

16725

AMERICAN INTERNATIONAL GROUP

AIG

60.2

0.25(0.417%)

1020

Apple Inc.

AAPL

115.38

1.32(1.1573%)

383436

AT&T Inc

T

38.96

0.09(0.2315%)

2586

Barrick Gold Corporation, NYSE

ABX

15.92

0.19(1.2079%)

44639

Boeing Co

BA

134.24

0.39(0.2914%)

302

Caterpillar Inc

CAT

88.89

0.42(0.4747%)

3135

Cisco Systems Inc

CSCO

31.59

0.11(0.3494%)

1860

Citigroup Inc., NYSE

C

49.5

0.22(0.4464%)

9793

Deere & Company, NYSE

DE

87.75

1.45(1.6802%)

4589

E. I. du Pont de Nemours and Co

DD

68.48

-0.58(-0.8398%)

519

Exxon Mobil Corp

XOM

87.61

0.87(1.003%)

3736

Facebook, Inc.

FB

129.48

0.49(0.3799%)

33815

Ford Motor Co.

F

12.32

0.03(0.2441%)

7990

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.3

0.17(1.6782%)

60807

General Electric Co

GE

29.18

0.10(0.3439%)

3839

General Motors Company, NYSE

GM

32.55

0.21(0.6493%)

1442

Goldman Sachs

GS

170.79

0.96(0.5653%)

825

Google Inc.

GOOG

778.55

3.47(0.4477%)

3337

HONEYWELL INTERNATIONAL INC.

HON

107.3

0.36(0.3366%)

7438

Intel Corp

INTC

38.28

0.21(0.5516%)

3822

International Business Machines Co...

IBM

156.5

0.83(0.5332%)

492

JPMorgan Chase and Co

JPM

68.45

0.34(0.4992%)

21707

McDonald's Corp

MCD

114.23

0.78(0.6875%)

328

Merck & Co Inc

MRK

64.88

2.11(3.3615%)

190275

Microsoft Corp

MSFT

58.04

0.24(0.4152%)

7435

Procter & Gamble Co

PG

90.1

0.10(0.1111%)

2329

Starbucks Corporation, NASDAQ

SBUX

53.61

0.15(0.2806%)

2051

Tesla Motors, Inc., NASDAQ

TSLA

201.3

4.69(2.3854%)

73396

The Coca-Cola Co

KO

41.9

0.19(0.4555%)

1286

Twitter, Inc., NYSE

TWTR

17.25

-2.60(-13.0982%)

6873252

United Technologies Corp

UTX

98.85

-1.73(-1.72%)

4693

Verizon Communications Inc

VZ

50.05

0.13(0.2604%)

3675

Wal-Mart Stores Inc

WMT

68.72

-0.64(-0.9227%)

1211

Walt Disney Co

DIS

92.9

0.07(0.0754%)

1875

Yahoo! Inc., NASDAQ

YHOO

43.31

0.09(0.2082%)

28091

Yandex N.V., NASDAQ

YNDX

22.02

-0.11(-0.4971%)

500

-

13:00

Upgrades and downgrades before the market open

Upgrades:

Deere (DE) upgraded to Outperform from Market Perform at Wells Fargo

Downgrades:

United Tech (UTX) downgraded to Neutral from Buy at Citigroup

Other:

McDonald's (MCD) resumed with a Outperform at Telsey Advisory Group; target $130

Honeywell (HON) target lowered to $133 from $138 at RBC Capital Mkts

HP (HPQ) target raised to $16 from $14 at RBC Capital Mkts

Alphabet A (GOOGL) target raised to $1000 from $990 at Axiom Capital

Honeywell (HON) removed from Conviction Buy List at Goldman; remains Buy; target $122

-

12:44

Putin: Russia ready to join oil output limit decision - Bloomberg. USD/CAD moves lower

-

12:43

Deutsche Bank (DB) and the US Department of Justice failed to reach an agreement

This was reported by the German newspaper Bild. The bank's chief executive officer met with senior officials in the US Department of Justice on Friday to discuss a huge fine, which the bank has to pay for toxic trade of mortgage-backed securities in the global financial crisis period. The talks ended without an agreement.

Bild also reported that Deutsche Bank is considering the possibility of filing claims for damages to the former managers of the bank, including former CEO of Deutsche Bank Josef Ackermann.

DB's shares rose in premarket trading to $ 13.76 (+ 0.88%).

-

11:55

Orders

EUR/USD

Offers : 1.1200 1.1220 1.1235 1.1250 1.1280 1.1300

Bids : 1.1165 1.1150 1.1130 1.1100 1.1080-85 1.1050

GBP/USD

Offers : 1.2430 1.2445-50 1.2480 1.2500 1.2550 1.2600 1.2630 1.2650 1.2700

Bids : 1.2345-50 1.2300 1.2250 1.2285 1.2200 1.2160 1.2100

EUR/GBP

Offers :0.9050-55 0.9085 0.9100 0.9155 0.9200

Bids : 0.9000-10 0.8985 0.8960-65 0.8900 0.8850-55 0.8835 0.8800

EUR/JPY

Offers : 115.60 115.80 116.25-30 116.50 117.00 117.30 117.50

Bids : 115.20 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers : 103.35-40 103.55-60 103.80 104.00-05 104.20 104.30 104.50

Bids : 102.80-85 102.70 102.50 102.25-30 102.00 101.85 101.50

AUD/USD

Offers : 0.7600-10 0.7630 0.7650 0.7685 0.7700 0.7720

Bids : 0.7575-80 0.7550 0.7530 0.7500 0.7485 0.7450

-

11:51

Sterling Ranks 142 of 148 Currencies This Year

-

11:08

Romania's Trade Deficit Rises

Romania's trade balance showed a deficit of 6.13 billion euros ($6.86 billion) in the period from January to August, EUR1.3 billion higher than a year earlier, the country's statistics board said Monday, news agency Mediafax reports.

Imports grew 6.8% in the first eight months, to EUR43.57 billion, while exports grew at a lower rate of 4%, totaling EUR37.43 billion.

Vehicles and other transport equipment made up 47.2% of Romania's exports and 37.5% of its imports in the first eight months, while other manufactured goods accounted for 32.8% of exports and 31.2% of imports.

The European Union remained Romania's main trading partner, being the source of 77.1% of the country's imports and receiving 75% of its exports.

-

11:07

WSE: Mid session comment

The first half of today's trading brought confirmation of the artificial nature of the initial strong growth in the WIG20 index. After nearly two hours of trading bulls were not able to keep the tempo, which confirmed the weakness of the demand side.

On the Warsaw market the top form presents today PKN Orlen (WSE: PKN). Shares of the company stand out at the first part of the session and currently grow by over 3%. Share price is the highest since June 23.

The beginning of the session in Europe has been slightly declining, where stood out the particular weakness of the banking sector, after the chief executive of Deutsche Bank, being in Washington at the end of last week did not reach an agreement with the Department of Justice on penalties imposed on the bank.

Next hours brought a better mood with new maxima in the CAC40 and the DAX, what helped for trading on the Warsaw market. Apparently Trump's problems have not led to greater explosion of optimism.

The second half of the session the WIG20 welcomed at the level of 1,764 points (+ 0.71%), with the turnover of PLN 240 million.

-

11:02

Major stock indices in Europe trading in the green zone

European stocks rose after a decline earlier in the session. Investors remain cautious after Friday's weak data on the number of jobs created in the US, while oil prices are falling.

US Labor Department reported that 156,000 jobs were created, while the analysts expected 175,000 and unemployment rate rose to 5.0% last month from 4.9%.

Nevertheless, it is expected that the weak performance does not hinder the interest rate increase by the Federal Reserve this year.

The composite index of the largest companies in the region Stoxx Europe 600 rose 0,1% - to 339.91 points.

The cost of Deutsche Bank shares fell by 3.2%. The German Bank continues to negotiate with the US Department of Justice for settlement in the case of irregularities in the sale of mortgage-backed securities during the period from 2005 to 2007 - Bloomberg citing informed sources.

On Sunday, the German newspaper Bild reported that the CEO of Deutsche Bank, John Cryan was unable to reach an agreement with the Ministry of Justice to reduce the amount of the fine.

On Friday, the international rating agency S & P Global Ratings confirmed the ratings of Deutsche Bank AG, noting that the amount of fines is likely to be lower than originally announced - $ 14 billion.

Shares of BNP Paribas fell to 1,5%, Credit Suisse - 0.8%.

EasyJet shares, previously warned about the negative impact of the weak pound to its figures, fell by 2.8%, as thousands of passengers were left stranded abroad over the weekend after the airline canceled all its flights to Greece and from Greece caused by a planned four-day strike by air traffic control.

Shares of Air France-KLM fell 1.3%, despite the fact that the French airline announced an increase in the volume of passengers in September by 2.8% - to 8.5 million.

Mining stocks rise in price in the course of trading: the price of Fresnillo rose to 1,6% Antofagasta +0,6%, Anglo American +0.9%.

Shares of Randgold Resources rose 1.8%. Previously, the company announced that was forced to close its office in Mali because of a tax dispute with the authorities.

At the moment:

FTSE 7056.53 12.14 0.17%

DAX 10543.68 52.82 0.50%

CAC 4463.32 13.41 0.30%

-

09:52

Rusian Energy Minister, Novak: hoping for clarification on OPEC's oil stabilisation steps

-

Planning to meet OPEC sec gen Wednesday

-

Expects clarification from OPEC on its further steps in stabilising the oil market

-

Is discussing possible output freeze with Russian oil companies

-

Possible decision on Russian output freeze to depend on OPEC decisions

-

If OPEC proposes for Russia to cut output, Moscow would consider

-

Russia prefers a freeze rather than a cut

*forexlive -

-

09:04

Saudi Arabia's energy minister optimistic about the prospects of a deal to reduce oil production at the OPEC meeting in November

-

the balance of forces in the oil market has changed dramatically since 2014

-

countries outside OPEC should be involved in the market balancing

-

I do not rule out a rise in prices for oil in the area of $ 60 / barrel by the end of this year

-

responsible manufacturers should try to balance supply and demand on the market

-

OPEC should be cautious, do not overly restrict the supply and shock market

-

-

08:36

Oil is trading lower

This morning, New York futures for Brent have fallen 0.70% to $ 49.46 and WTI down 0.62% to $ 51.61 per barrel. Thus, the black gold is traded in the red zone because of doubts that OPEC's plan to limit the production can take control of a global glut that persists in the markets for more than two years. OPEC members to agree on plans to limit production at 32,50-33,0 million barrels per day in late November. At the moment, it produced a record 33.6 million barrels per day.

To achieve consensus among OPEC members, some of whom, such as Saudi Arabia and Iran, are political opponents, the representatives of the organization will hold a series of meetings over the next six weeks, the first meeting will be held in Istanbul this week. Although analysts believe that the agreement will lead to an increase in raw material prices, some are skeptical of its implementation.

Another reason for the pressure on oil was the growth in the number of US rigs, indicating a possible increase in production by US producers at prices near $ 50 a barrel.

-

08:33

Important shift in indices data - Sentix

The October 2016 survey marks an important shift in the sentix indices data. In general, the moderate recovery path of the global economy continues. The economic momentum for the German, Chinese and the Latin American economy certainly marks a bright spot on the global landscape. Although the economic momentum is less dynamic for the euro area, investors remain confident. Besides short-term changes, the sentix Investment Theme Indices reveal significant developments in investors' long-term perceptions on the global economy.

-

Economic indices for the euro zone continue to rise in October. The overall index for the euro zone climbs to +8.5 points. Expectations have hit the highest value since December 2015.

-

Investors have strongly increased their economic expectations on a selective basis. Especially the sentix indices for Germany and Asia ex. Japan show a significant increase in expectations!

-

Latin America's turnaround continues to solidify. Economic Expectations improve to +10.75 points - highest value since January 2014!

-

-

08:10

Major stock exchanges in Europe trading mixed: FTSE 100 7,044.47 +0.08 0.00%, DAX 10,468.60 -22.26 -0.21%

-

08:09

Italian industrial production up 1.7% in August

In August 2016 the seasonally adjusted industrial production index increased by 1.7% compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was +0.4

The calendar adjusted industrial production index increased by 4.1% compared with August 2015 (calendar working days being 22 versus 21 days in August 2015); in the period January- August 2016 the percentage change was +1.0 compared with the same period of 2015.

The unadjusted industrial production index increased by 7.4% compared with August 2015.

-

07:44

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1100 (EUR 776m) 1.1117-20 (766m) 1.1180 (346m) 1.1200-05 (472m) 1.1225 (686m) 1.1220 (304m) 1.1285-90 (336m) 1.1310 (238m) 1.1350 (489m)

USD/JPY: 101.50 (USD 402m) 101.95-00 (475m) 102.50 (1.15bln) 103.00-10 (486m) 103.50 (500m)

GBP/USD: 1.2000 (GBP 475m) 1.2400 (604m) 1.2500 (770m) 1.2600 (270m) 1.2700 (757m)

USD/CHF 0.9640-50 (USD 775m) )

AUD/USD: 0.7450 (AUD 300m) 0.7550 (351m) 0.7600 (1.14bln) 0.7825 (256m)

-

07:17

WSE: After opening

WIG20 index opened at 1757.71 points (+0.34%)*

WIG 47929.53 0.35%

WIG30 2034.33 0.44%

mWIG40 4018.09 0.06%

*/ - change to previous close

The new week was began by contracts on the WIG20 with a slight increase of 4 points above Friday's closing. Today's morning did not bring any major changes in the main European markets and futures on the DAX and CAC40 oscillate at neutral levels

The cash market started the day with an increase of 0.34% to 1,757 points with Monday's, modest turnover. With the first transaction market recovered Friday's decline and returned to the starting point, means the area of 1,760 points. Surrounded the German DAX initially rose much less, but pretty soon improved its image, which supports the preservation of the Warsaw Stock Exchange. However the turnover is weak and detracts the credibility of the observed changes.

After fifteen minutes of trading the WIG20 index reached the level of 1,767 points (+0,90%).

-

07:11

Today’s events

-

Britain will hold an auction of 10-year government bonds

-

Japan celebrates Day of Health and Sports

-

Eurogroup meeting day 1

-

Canada celebrates Thanksgiving

-

-

06:44

ECB's Lane Sees Volatile Markets, Economy Amid Brexit Talks

-

06:44

Fed's Fischer: Labor Market 'Solid, Showing Continued Improvement'

-

06:44

Kuroda: Central Banks Need to Broaden Focus to Whole Yield Curve

-

06:40

Positive start of trading expected on the major stock exchanges in Europe: DAX futures + 0.1%, CAC40 + 0.2%, FTSE + 0.2%

-

06:33

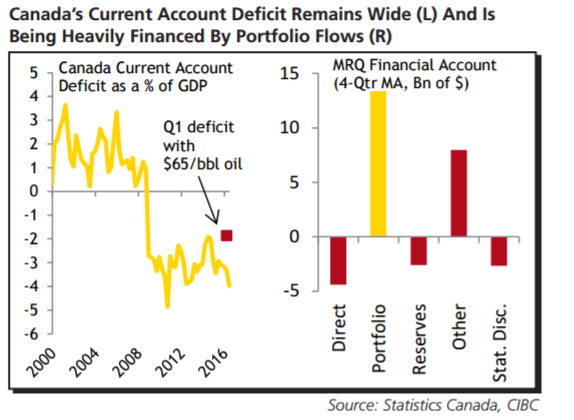

CAD: Look For USD/CAD To Hit 1.35 Before 2016 Comes To A Close - CIBC

"The recent uptick in Canada's international goods trade balance has helped paint a brighter picture of third quarter growth. But, much of that recovery is coming from a resumption of oil exports after the Alberta wildfires. Even after stripping out the effects of both the fires and weak oil prices, Canada's current account deficit as a percentage of GDP remains wide. It appears that the world is not enough for Canadian trade as weak global demand post-crisis continues to restrain non-energy exports.

Looking ahead, with the Fed aiming to hike rates before year-end, demand for the portfolio flows financing Canada's current account deficit could wane, showing up in the form of a weaker loonie.

Look for CAD to hit 1.35 before 2016 comes to a close".

Copyright © 2016 CIBC, eFXnews™

-

06:28

EU policymakers stand ready to deploy all measures at their disposal to defend growth

According to Rttnews, stimulus measures adopted thus far has worked and the monetary policy transmission across the euro area has improved, yet policymakers stand ready to deploy all measures at their disposal to defend growth and bring inflation back to the 2 percent target, European Central Bank President Mario Draghi said Friday.

"Our very accommodative monetary policy stance provides the impetus that is necessary for the euro area recovery to strengthen and for inflation to gradually return to levels that we consider consistent with our objective," Draghi said in his statement presented at the International Monetary and Financial Committee meeting being held in Washington.

"Looking forward, we will preserve the very substantial amount of monetary support that is necessary to secure a return of inflation rates towards levels that are below, but close to, 2% without undue delay. If warranted, we will act by using all the instruments available within our mandate."

Despite the resilient Eurozone recovery, the prospects for euro area growth remain moderate mainly due to subdued foreign demand, the political and economic uncertainties and the sluggish implementation of structural reforms, he said.

-

06:24

WSE: Before opening

We start a week at beginning of which there are new events that may affect the behavior of the markets. We are talking about the next debate Trump - Clinton and the subsequent controversies surrounding Donald Trump (published on Friday night video recording from 2005), which over the weekend led to comments suggesting his withdrawal from the race for the presidential nomination. Strengthen of the Mexican peso and the increase in the valuation of contracts in the US indicate decreasing the chances of this candidate in the upcoming elections.

In Asia, we observe a clear weakening of the yuan by approx. 0.5%, which is a negative premise for the markets. There is no on the market the resting Japanese, but on the other hand, the market returned Chinese and the Shanghai index rose more than 1%.

The Warsaw market in recent days become resistant to the mood from the environment and focuses on behavior of individual companies and local information impact on them.

-

06:22

Swiss unemployment rate stable at 3.2% in September

According to surveys conducted by the State Secretariat for Economic Affairs (SECO) in late September 2016 were 142'675 unemployed at the regional employment centers (RAV), 183 less than in the previous month. The unemployment rate remained at 3.2% in June. Compared to the previous month, unemployment increased by 4'449 persons (+ 3.2%). Youth unemployment in September 2016 Youth unemployment (15 to 24 years) decreased by 613 persons (-3.0%) to 20'027. Compared with the previous month, this represents a decrease of 591 persons (-2.9%).

-

06:20

Major improvement for German exports and imports in August

Germany exported goods to the value of 96.5 billion euros and imported goods to the value of 76.5 billion euros in August 2016. Based on provisional data, the Federal Statistical Office (Destatis) also reports that German exports increased by 9.8% and imports by 5.3% in August 2016 year on year. Compared with July 2016, exports were up by 5.4% and imports by 3.0% in calendar and seasonally adjusted terms.

The foreign trade balance showed a surplus of 20.0 billion euros in August 2016. In August 2015, the surplus amounted to +15.2 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 22.2 billion euros in August 2016.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 17.9 billion euros in August 2016, which takes into account the balances of trade in goods including supplementary trade items (+22.2 billion euros), services (-5.6 billion euros), primary income (+5.8 billion euros) and secondary income (-4.5 billion euros). In August 2015, the German current account showed a surplus of 14.4 billion euros.

-

06:16

Germany: Current Account , August 17.9

-

06:00

Germany: Trade Balance (non s.a.), bln, August 20.0 (forecast 20)

-

05:46

Switzerland: Unemployment Rate (non s.a.), September 3.2% (forecast 3.2%)

-

05:05

Options levels on monday, October 10, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1352 (3558)

$1.1322 (2104)

$1.1277 (2093)

Price at time of writing this review: $1.1191

Support levels (open interest**, contracts):

$1.1138 (1604)

$1.1084 (3060)

$1.1050 (3818)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 31724 contracts, with the maximum number of contracts with strike price $1,1400 (3576);

- Overall open interest on the PUT options with the expiration date November, 4 is 35999 contracts, with the maximum number of contracts with strike price $1,0950 (3913);

- The ratio of PUT/CALL was 1.13 versus 1.07 from the previous trading day according to data from October, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.2707 (1244)

$1.2610 (965)

$1.2514 (476)

Price at time of writing this review: $1.2404

Support levels (open interest**, contracts):

$1.2385 (1344)

$1.2289 (499)

$1.2192 (494)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 22245 contracts, with the maximum number of contracts with strike price $1,2800 (2191);

- Overall open interest on the PUT options with the expiration date November, 4 is 22844 contracts, with the maximum number of contracts with strike price $1,2600 (1484);

- The ratio of PUT/CALL was 1.03 versus 0.66 from the previous trading day according to data from October, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-