Market news

-

23:51

Japan: Core Machinery Orders, y/y, August 11.6% (forecast 6.5%)

-

23:51

Japan: Core Machinery Orders, August -2.2% (forecast -5.5%)

-

23:37

Australia: Westpac Consumer Confidence, October 1.1%

-

22:30

Commodities. Daily history for Oct 11’2016:

Commodities. Daily history for Oct 11'2016:

(raw materials / closing price /% change)

Oil 50.86 +0.14%

Gold 1,254.40 -0.12%

-

22:29

Stocks. Daily history for Oct 11’2016:

Stocks. Daily history for Oct 11'2016:

(index / closing price / change items /% change)

Nikkei 225 17,024.76 +164.67 +0.98%

Shanghai Composite 3,066.09 +17.95 +0.59%

S&P/ASX 200 5,479.80 +4.37 +0.08%

FTSE 100 7,070.88 -26.62 -0.38%

CAC 40 4,471.74 -25.52 -0.57%

Xetra DAX 10,577.16 -46.92 -0.44%

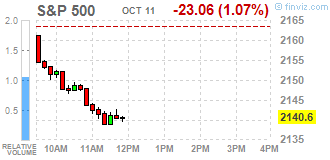

S&P 500 2,136.73 -26.93 -1.24%

Dow Jones Industrial Average 18,128.66 -200.38 -1.09%

S&P/TSX Composite 14,549.60 -16.66 -0.11%

-

22:28

Currencies. Daily history for Oct 11’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1054 -0,75%

GBP/USD $1,2116 -2,04%

USD/CHF Chf0,9883 +0,58%

USD/JPY Y103,54 -0,38%

EUR/JPY Y114,45 -0,85%

GBP/JPY Y125,43 -2,14%

AUD/USD $0,7535 -0,93%

NZD/USD $0,7052 -1,23%

USD/CAD C$1,3253 +0,68%

-

22:00

Schedule for today, Wednesday, Oct 12’2016

06:00 Japan Prelim Machine Tool Orders, y/y September -8.4%

09:00 Eurozone Industrial production, (MoM) August -1.1% 1.5%

09:00 Eurozone Industrial Production (YoY) August -0.5% 1.1%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) October 2.7

12:00 U.S. FOMC Member Dudley Speak

13:40 U.S. FOMC Member Esther George Speaks

14:00 U.S. JOLTs Job Openings August 5.871 5.72

18:00 U.S. FOMC meeting minutes

21:30 New Zealand Business NZ PMI September 55.1

-

20:07

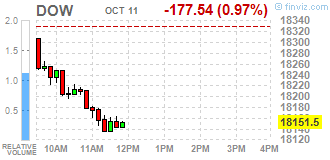

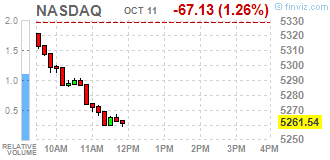

Major US stock indices closed in the red zone

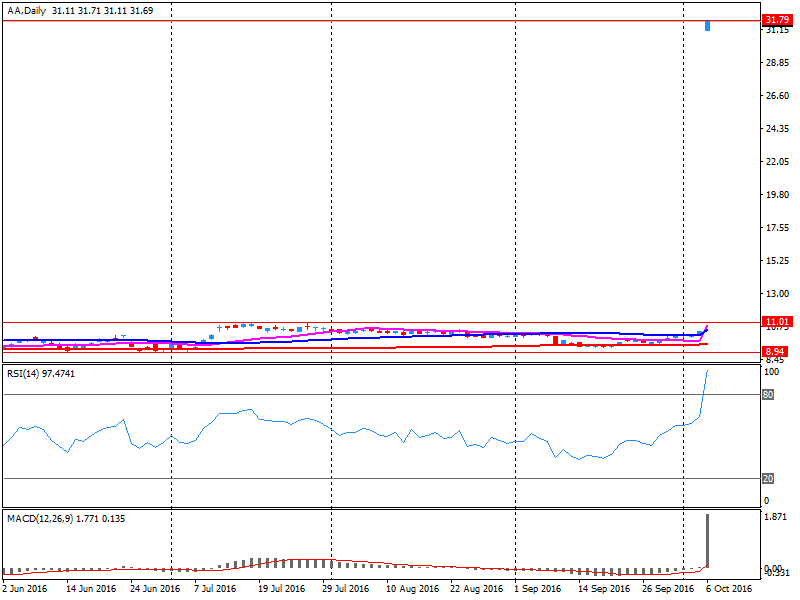

Major US stock indices fell amid falling in all sectors after a report Alcoa began the season of quarterly reports on disappointing note.

Shares of the aluminum giant Alcoa (AA) fell by 11.4%, which was the worst day dynamics of day-to-five years. According to the published report, Alcoa profit for the third quarter of fiscal year 2016 was $ 0.32 per share, in line with the average forecast of analysts. At the same time, the company's quarterly revenue was $ 5.213 billion., Several confounding market expectations at the level of $ 5.292 billion. It is worth noting that this was the last time when Alcoa reported back as one company. November 1, the company will split its business into two independent companies involved in raw materials (Alcoa) and high value-added production output (Arconic).

The cost of oil futures declined moderately, departing from the multi-month highs, which was caused by the publication of the report of the International Energy Agency (IEA). The IEA report says that world oil supply rose in September, but it was noticed the decline in world oil reserves in the vaults. "Forecast of supply and demand suggests that the market itself will remain in a supersaturated state during the first half of next year if OPEC will stick to the set threshold production, market re-balancing can occur more quickly." - Says the IEA review. In addition, the IEA revised its forecast for oil demand in 2016 to 96.3 million barrels a day, which implies an increase of 1.2 million. To the previous year (previously expected to grow by 1.3 million.).

Almost all the components of DOW index closed in negative territory (28 of 30). More rest rose stocks Apple Inc. (AAPL, + 0.32%). Outsider were shares of Merck & Co., Inc. (MRK, -3.11%).

All business sectors S & P index showed a drop. the health sector decreased most (-2.4%).

At the close:

Dow -1.08% 18,131.23 -197.81

Nasdaq -1.54% 5,246.79 -81.88

S & P -1.24% 2,136.82 -26.84

-

19:00

DJIA -1.24% 18,101.23 -227.81 Nasdaq -1.70% 5,238.18 -90.49 S&P -1.39% 2,133.60 -30.06

-

16:00

European stocks closed: FTSE 100 -26.62 7070.88 -0.38% DAX -46.92 10577.16 -0.44% CAC 40 -25.52 4471.74 -0.57%

-

16:00

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell on Tuesday amid broad declines across sectors after Alcoa kicked off the earnings season on a disappointing note. Alcoa's (AA) shares fell nearly 11%, their worst day in five years after the aluminum producer reported quarterly revenue and profit that fell short of the market's expectation.

Most of Dow stocks in negative area (28 of 30). Top gainer - Apple Inc. (AAPL, +1.10%). Top loser - Merck & Co., Inc. (MRK, -2.25%).

All S&P sectors also in negative area. Top loser - Healthcare (-1.9%).

At the moment:

Dow 18068.00 -191.00 -1.05%

S&P 500 2135.25 -23.75 -1.10%

Nasdaq 100 4834.50 -58.75 -1.20%

Oil 50.52 -0.83 -1.62%

Gold 1258.80 -1.60 -0.13%

U.S. 10yr 1.75 +0.02

-

15:47

Oil resumed the decline

The cost of oil futures declined moderately, departing from the multi-month highs, which was caused by the publication International Energy Agency's report.

The IEA report says that world oil supply rose in September, but it was noticed the decline in world oil reserves. "Forecast of supply and demand suggests that the market itself will remain in a supersaturated state during the first half of next year if OPEC will stick to the set threshold production, market re-balancing can occur more quickly". In addition, the IEA revised its forecast for oil demand in 2016 to 96.3 million barrels a day, which implies an increase of 1.2 million.

According to Goldman Sachs, oil prices may return to $ 43 a barrel if the oil-producing countries fail to agree on production cuts, as the excess supply in the market will continue for the 4th quarter of 2016. Experts believe that despite the "increased likelihood of" the conclusion of the planned agreement on limiting production OPEC and producers outside the cartel, including Russia, any reduction in its volume will not be enough to balance the market in 2017. "The increase in production in Libya, Nigeria and Iraq, reducing the chances that such an agreement would lead to balancing the market in 2017."

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 50.74 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 52.20 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:29

WSE: Session Results

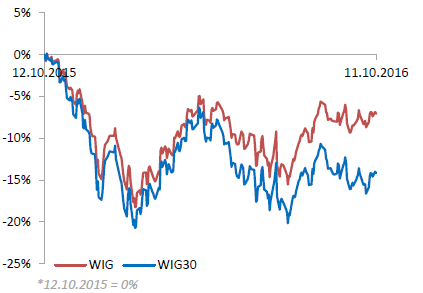

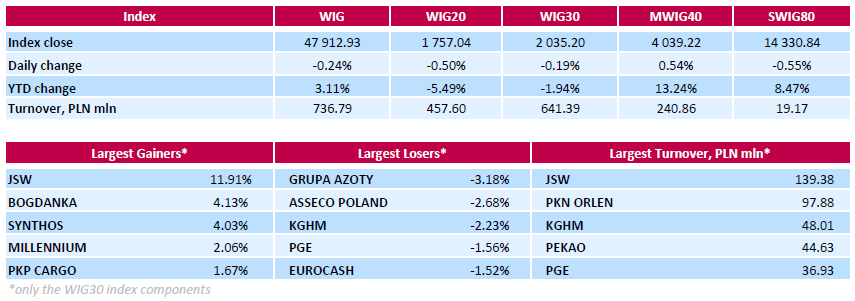

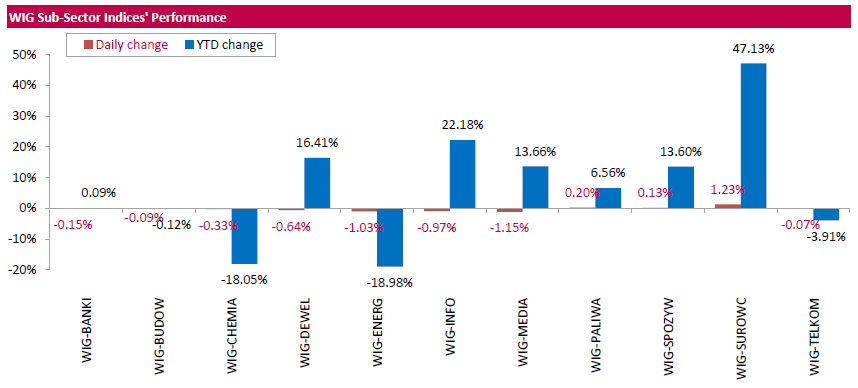

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, lost 0.24%. The WIG sub-sector indices were mainly lower with media (-1.15%) underperforming. At the same time, materials (+1.23%) fared the best.

The large-cap stocks fell by 0.19%. Within the index components, chemical producer GRUPA AZOTY (WSE: ATT) recorded the biggest drop, down 3.18%. It was followed by IT-company ASSECO POLAND (WSE: ACP) and copper producer KGHM (WSE: KGH), plunging by 2.68% and 2.23% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) became the session's best performer, as its quotations skyrocketed by 11.91%, buoyed by rising prices of coking coal. Thermal coal miner BOGDANKA (WSE: LWB), chemical producer SYNTHOS (WSE: SNS) and bank MILLENNIUM (WSE: MIL) did well too, posting 2.06%-4.13% gains.

-

15:23

Gold moderately lower amid some USD weakness

"The drop in demand for safe-haven assets, the risk of profit-taking and the possibility of strengthening dollar put further pressure on gold," - said Norbert Rücker from Julius Baer.

The US Dollar Index, showing the US dollar against a basket of six major currencies, was up 0.62%, thus reaching 11-week high. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

Chicago Fed Evans pointed out that the US economy is on solid ground, and rising interest rates in December, may be justified. "It would not be surprising if at the December meeting, I will agree to raise rates", - said Evans. He also noted that the potential for global economic growth has slowed, and neutral rate - one that neither stimulates nor hinders the economy - has moved lower, so it is worth reviewing the old political guidelines.

According to Pimco, the Fed could raise rates two or three times before the end of 2017. "We expect that the growth of the US economy in 2017 will return to a range of 2% -2.5% per year due to increased investment activity and rising consumer spending. Economic growth and inflation from 1-1.5% to 2-2 , 5% in 2017 will allow the Fed, according to some other market indicators, increase the rate two or three times before the end of 2017 ".

The cost of the October futures for gold on the COMEX fell to $ 1253.8 per ounce.

-

15:09

NY Fed: Sept 3-Years Ahead Inflation Expectations Down To 2.6%, From August 2.7%

-

14:28

U.S. 10-Year Government Bond Yield Rises To 4-Month High

-

13:54

WSE: After start on Wall Street

Alcoa released its results, however, before the session, and although at first glance they do not look bad, they are negatively received by investors (EPS $ 0.32 (consensus $ 0.33); revenues $ 5,213 billion (consensus $ 5,325 billion). We may observe a decrease in revenues and the shares in the before-session trade lost almost 5%. As a rule, Alcoa has little bearing on the behavior of the overall market, but today we may see a slight negative reaction, which is aggravated by the stronger dollar. Trading in the US began with a discount of 0.14%, which after the first transactions slightly increased. Certainly, such behavior of Americans is not conducive to global risk appetite, which may cool the mood in the final phase of the session.

An hour before the close of trading the WIG20 index reached the level of 1,764 points (-0.09%).

-

13:53

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.96bln) 1.1100 (509m)1.1225-30 (868m) 1.1255 (270m) 1.1275 (247m) 1.1285-90 (503m)

USD/JPY: 101.50-55 (USD 566m) 102.25 (476m) 102.80 (303m) 102.90-103.00 (1.12bln) 103.50 (405m)

AUD/USD: 0.7500 (AUD 424m) 0.7548-50 (522m) 0.7575 (226m) 0.7730 (269m) 0.7750 (350m)

USD/CAD: 1.2815 (USD 205m) 1.3005-10($262mn)

USD/SGD: 1.3500 (USD 600m) 1.3700 (1.03bn)

-

13:36

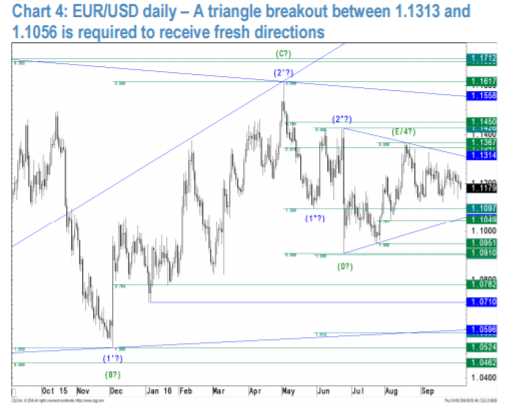

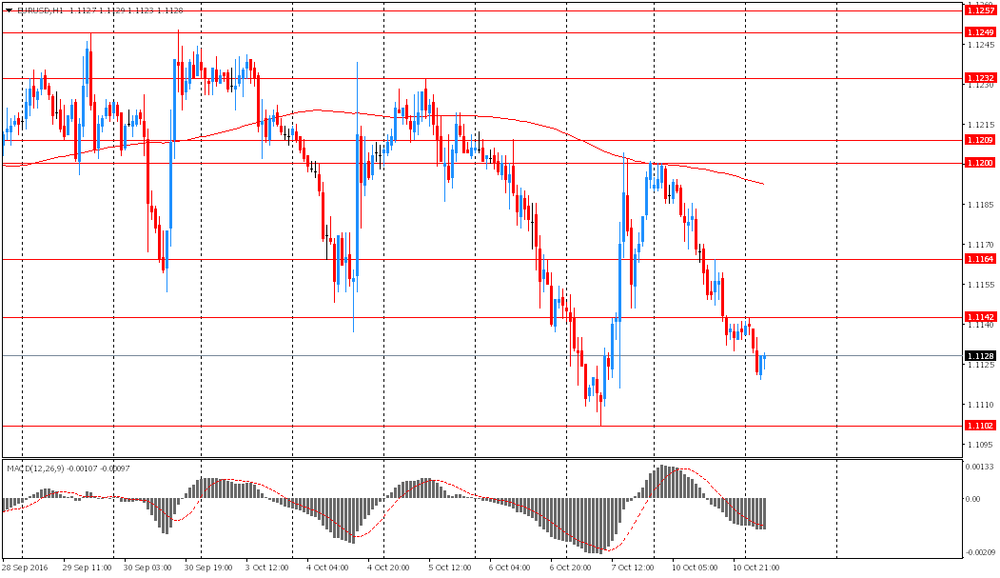

JP Morgan Watching Breakout Signals on EUR/USD

"EUR/USD failure to stabilize above a projected E-wave target at 1.1347 (int. 61.8 %) seven weeks ago leaves EUR/USD at great risk of having completed a 1 ½ year old consolidation triangle with very negative implications.

Only a break above 1.1367 (August high) and ultimately above 1.1426/50 (pivot/int. 76.4 %) would constitute a game change in favor of a re-test of former highs at 1.1617 and at 1.1712 with the option to extend to the classical wave IV target on big scale at 1.1811 (int. 38.2 % on highest scale).

So considering the classical overshooting at 76.4 % retracements it would most likely take a break above the 1.1500 handle to eliminate the imminent sell-off risk. It would take breaks above 1.1876 and 1.2042 (2010 & 2012 lows) though to call for a long-term trend reversal.

In the short.-run we are now watching the daily triangle between 1.1313 and 1.1056 closely as a breakout would provide an early indication whether we are dealing with a stronger recovery or with the potential resumption of the downtrend.

A decisive hourly close above 1.1347 (i.e. above 1.1370) would thereafter bring 1.1426/50 (pivot/int. 76.4 %) and possibly former highs at 1.1617 and 1.1712 back into focus whereas breaks below 1.1056/49 (daily triangle/minor 76.4 %) would challenge the essential countertrend decline target zone between 1.0782 and 1.0710 (int. 76.4 % on higher scale/pivot).

It would take a break below the latter though to confirm the resumption of the long-term downtrend in favor of an extension to 1.0072 (76.4 % of the 2000-2008 rally) and to wave 3 projections between 0.9652 and 0.9298".

Copyright © 2016 eFXplus™

-

13:33

U.S. Stocks open: Dow -0.22%, Nasdaq -0.20%, S&P -0.23%

-

13:31

Bank of Greece Governor: Greece Has Still Some Time Before It Can To Return to Debt Market

-

Calls on Greece To Speed Up Completion Of Bailout Review

-

-

13:17

Before the bell: S&P futures -0.24%, NASDAQ futures -0.10%

U.S. stock-index futures slipped amid growing speculation that the Federal Reserve will raise interest rates this year, undermining demand for riskier assets, while quarterly results from Alcoa Inc. (AA) disappointed.

Global Stocks:

Nikkei 17,024.76 +164.67 +0.98%

Hang Seng 23,549.52 -302.30 -1.27%

Shanghai 3,066.09 +17.95 +0.59%

FTSE 7,102.36 +4.86 +0.07%

CAC 4,506.50 +9.24 +0.21%

DAX 10,649.94 +25.86 +0.24%

Crude $51.03 (-0.62%)

Gold $1256.80 (-0.29%)

-

12:47

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

170.78

-0.36(-0.2104%)

200

ALCOA INC.

AA

30.27

-1.24(-3.9353%)

181866

ALTRIA GROUP INC.

MO

61.86

0.11(0.1781%)

1735

Amazon.com Inc., NASDAQ

AMZN

841.01

-0.70(-0.0832%)

7591

American Express Co

AXP

61.7

-0.20(-0.3231%)

600

Apple Inc.

AAPL

117.98

1.93(1.6631%)

1952878

AT&T Inc

T

39

-0.01(-0.0256%)

2699

Barrick Gold Corporation, NYSE

ABX

15.42

-0.16(-1.027%)

208583

Boeing Co

BA

135.5

-0.34(-0.2503%)

6250

Caterpillar Inc

CAT

89.01

0.79(0.8955%)

24176

Cisco Systems Inc

CSCO

31.39

-0.08(-0.2542%)

3617

Citigroup Inc., NYSE

C

49.41

-0.14(-0.2825%)

27298

Facebook, Inc.

FB

130.14

-0.10(-0.0768%)

35661

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.06

-0.13(-1.2758%)

101940

General Electric Co

GE

28.82

-0.04(-0.1386%)

10248

Google Inc.

GOOG

787.5

1.56(0.1985%)

1021

Intel Corp

INTC

37.97

-0.05(-0.1315%)

1402

Johnson & Johnson

JNJ

119.6

-0.20(-0.1669%)

200

JPMorgan Chase and Co

JPM

68.35

-0.29(-0.4225%)

1156

Merck & Co Inc

MRK

63.87

-0.03(-0.047%)

1015

Microsoft Corp

MSFT

57.89

-0.15(-0.2584%)

23348

Nike

NKE

52.17

0.38(0.7337%)

6539

Pfizer Inc

PFE

33.51

-0.10(-0.2975%)

2870

Starbucks Corporation, NASDAQ

SBUX

53.07

-0.23(-0.4315%)

1632

Tesla Motors, Inc., NASDAQ

TSLA

201.25

0.30(0.1493%)

2802

The Coca-Cola Co

KO

41.69

-0.04(-0.0959%)

797

Twitter, Inc., NYSE

TWTR

17.94

0.38(2.164%)

683095

United Technologies Corp

UTX

99.12

-0.86(-0.8602%)

300

Verizon Communications Inc

VZ

50

-0.19(-0.3786%)

200

Visa

V

82.85

-0.27(-0.3248%)

1098

Yahoo! Inc., NASDAQ

YHOO

43.81

-0.11(-0.2505%)

21920

-

12:45

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded to Buy from Neutral at Goldman

Twitter (TWTR) upgraded to Hold from Sell at Evercore ISI; target $17

Downgrades:

Other:

NIKE (NKE) initiated with a Positive at Susquehanna

-

12:18

Canadian Housing Starts Trend Increases in September

The trend measure of housing starts in Canada was 199,503 units in September compared to 196,465 in August, according to Canada Mortgage and Housing Corporation (CMHC). The trend is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

"Housing starts were on an upward trend in September, as residential construction increased across the country with the exception of Ontario, where the multiples segment softened to levels that are more consistent with household formation," said Bob Dugan, CMHC Chief Economist. "Quebec saw the largest gain in housing starts due to the development of new rental apartments intended for seniors. That said, Quebec's growing apartment stock emphasizes the importance of inventory management."

-

12:14

Canada: Housing Starts, September 220.6 (forecast 190)

-

12:13

Company News: Alcoa Inc. (AA) posts Q3 EPS in line with analysts' estimates

Alcoa reported Q3 FY 2016 earnings of $0.32 per share (versus $0.07 in Q3 FY 2015), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $5.213 bln (-6.5% y/y), slightly missing analysts' consensus estimate of $5.292 bln.

It should be noted it was the last time that Alcoa reported as a single company. The company will execute the separation of its upstream (Alcoa) and downstream (Arconic) businesses on November 1st .

AA fell to $29.94 (-4.98%) in pre-market trading.

-

11:45

Orders

EUR/USD

Offers : 1.1130 1.1150 1.1180 1.1200 1.1220 1.1235 1.1250 1.1280 1.1300

Bids : 1.1100 1.1080-85 1.1050 1.1030 1.1000

GBP/USD

Offers : 1.2325-30 1.2350 1.2380 1.2400 1.2430 1.2445-50 1.2480 1.2500

Bids : 1.2250 1.2230-35 1.2200 1.2160 1.2100 1.2085 1.2050 1.2000

EUR/GBP

Offers : 0.9055 0.9085 0.9100 0.9155 0.9200 0.9220 0.9250 0.9285 0.9300

Bids : 0.9030 0.9000-10 0.8985 0.8960-65 0.8900 0.8850-55 0.8835 0.8800

EUR/JPY

Offers : 115.80 116.00 116.25-30 116.50 117.00 117.30 117.50 118.00

Bids : 115.20 115.00 114.80 114.50 114.20 114.00

USD/JPY

Offers : 104.00-05 104.20 104.30 104.50 104.80 105.00

Bids : 103.65 103.50 103.30 103.00 102.80-85 102.70 102.50 102.25-30 102.00

AUD/USD

Offers : 0.7585 0.7600 0.7630 0.7650 0.7685 0.7700 0.7720

Bids : 0.7550 0.7530-40 0.7500 0.7485 0.7450 0.7420-25 0.7400

-

11:32

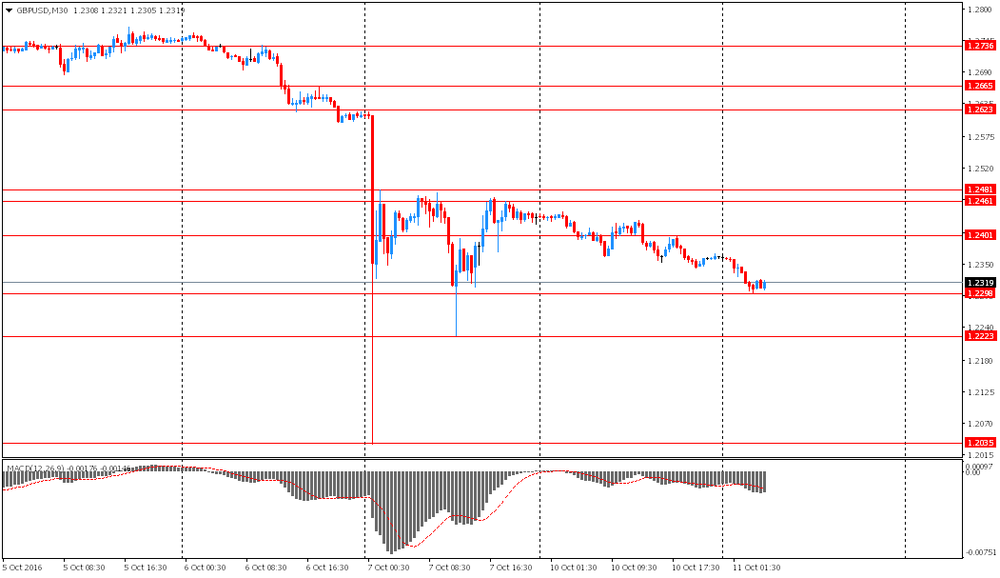

BOE's Saunders: Inflation Likely to Exceed 2% in Coming Years

-

10:54

Major stock indices in Europe little changed

Stock indices in Western Europe rose moderately in low activity. Market participants are studying the prospects of interest rate increase by the Federal Reserve and the agreement of OPEC and other oil producers to restrict production.

Traders estimate a Fed hike at 68% in in December up from 50%. Meanwhile, in November the likelihood of tighter monetary policy is much lower - only 17%.

Istanbul continues 23rd World Energy Congress. The International Energy Agency (IEA) expects a more rapid restoration of the balance in the oil market as a result of the agreements on production cuts.

However, the IEA notes record volumes of oil production of OPEC countries - 33.64 million barrels per day. December contracts for Brent fell during trading 0,4% - to $ 52.94 per barrel.

In addition, the market's attention focused on corporate reporting. The US earnings season unofficially kicks off October 11 with the quarterly results of Alcoa Inc. The process will begin in Europe later, and 150 companies from Stoxx 600 will report.

The market value of the British manufacturer of heat-resistant plastics Victrex Plc jumped 6.7% due to positive financial results.

Airbus securities decreased by 2% after the loss of the Polish contract for the supply of helicopters. Analysts at JPMorgan Chase & Co. expect weak results of the company for the third quarter.

The banking sector is again trading in the red zone because of concerns related to the stability of European financial companies: UniCredit lost 1.7% of its capitalization, Deutsche Bank and Banca Popolare di Milano - 1,4%, Raiffeisen Bank - 1,3%.

At the moment:

FTSE 7105.84 8.34 0.12%

DAX 10632.39 8.31 0.08%

CAC 4505.62 8.36 0.19%

-

10:36

WSE: Afternoon comment

In the morning we met the reading of the German economic sentiment index (ZEW), which rose in October to 6.2 points versus 0.5 points a month earlier. Analysts expected 4 point. Thus, the data performs well, although this should not be surprising in light of the previous very good read of the Ifo index. These data go unnoticed in the market, because nothing did not bring any new to the situation.

In the first half of trading the Warsaw market again weakened against the major European indices, which maintain the levels of neutral.

Weakens also the Polish zloty against the dollar. The Polish zloty, with a daily decline of 0.7 percent against the US currency is on Tuesday one of the weakest currencies of emerging economies.

-

10:27

The International Energy Agency OPEC production in September up to a record high of 33.64 million b / d

-

The excess supply of oil will remain after the first half of 2017 if OPEC does not cut output

-

World oil supply 0.6 million bbl / d in September

-

Oil supply outside OPEC in September, nearly 0.5 million bbl / d in the backdrop of rising production in Russia

-

IEA raises forecast for oil demand in 2017 to 0.2 million b / d, to 97.5 million barrels / d

-

World oil demand in 2017 will grow by 1.2 million bbl / d

-

World reserves of oil in storage in August fell by 10 million barrels, the first time since March,

-

OPEC oil supply rose, with increased production in Libya and Iraq

-

-

09:45

BOE's Saunders: Drop in Pound Reflects Prospect of EU Exit

-

Theoretical Risk QE's Distributional Effects Could Reduce Effectiveness

-

-

09:44

Russian Energy Min Novak: Discussed Plan Of Joint Actions Within Framework Of Algiers Agreements With Saudi Arabia - Reuters

-

09:18

South African Finance Minister Pravin Gordhan Issued with Summons for Fraud

-

09:17

Moderate Increase in Expectations - ZEW

The ZEW Indicator of Economic Sentiment for Germany increased in October 2016. The index gained 5.7 points compared to the previous month, now standing at a level of 6.2 points (long-term average: 24.1 points). "The improved economic sentiment is a sign of a relatively robust economic activity in Germany. However, positive impulses from industry and exports should not distract from existing political and economic risks. In particular, the risks concerning the German banking sector are currently a burden to the economic outlook," comments ZEW President Professor Achim Wambach.

The assessment of the current situation in Germany has also increased. Gaining 4.4 points, the index now stands at 59.5 points.

Financial market experts' sentiment concerning the economic development of the eurozone has improved notably. The respective indicator has increased by 6.9 points to a reading of 12.3 points. On the other hand, the indicator for the current situation in the eurozone declined by 2.3 points in October 2016 to a level of minus 12.8 points.

-

09:00

Germany: ZEW Survey - Economic Sentiment, October 6.2 (forecast 4.3)

-

09:00

Eurozone: ZEW Economic Sentiment, October 12.3 (forecast 6.3)

-

08:49

EUR: En-Route To 1.08; ECB Faces A Communication Challenge - Barclays

"Volatility in euro markets rose last week on media reports, that the ECB may be discussing tapering its asset purchase program, scheduled to end in March 2017. However, such speculation was quickly denied by Vice President Vitor Constancio. The ECB's communication this week, including speeches by ECB's Mersch (Tuesday, Wednesday) and Coeure (Wednesday) will likely also attempt to curb speculation of premature tapering. A unified message regarding the ECB's ability to continue easing should keep EURUSD in check, in our view. We continue to envision EURUSD at 1.08 by year-end.

The accounts of the GC meeting released last week offer some comfort to our view that the ECB will announce changes to the technical parameters and an extension of QE beyond March 2017, at its December meeting (see ECB minutes: Monetary support still warranted, 6 October 2016). At this stage, we think changes to the size or composition of the PSPP are unlikely before March 2017 and in any case with related communication that reassures markets that policy will remain accommodative for the foreseeable future (see ECB Watching: Reducing QE is not tapering).

In other words, the ECB faces a communications challenge that will be crucial for the future path of the EUR and euro area rates. The challenge is essentially to succeed where the Fed did not during the Taper Tantrum, by convincing markets that a slower pace of balance sheet expansion is still stimulatory".

Copyright © 2016 Barclays Capital, eFXnews™

-

08:19

Oil is trading lower

This morning, the New York futures for Brent have fallen in price by 0.5% to $ 52.8 and WTI down 0.49% to $ 51.1 per barrel. Thus, the black gold is traded lower today while remaining near yearly highs. Earlier, oil rose to the 2016 highs, since Russia and Saudi Arabia have announced the possibility to conclude an agreement on the limitation of production among the OPEC countries and non-member producers.

-

07:48

Major stock exchanges trading in the red zone: FTSE -0.1%, DAX -0.2%, CAC 40 -0.1%, FTMIB -0.4%, IBEX -0.4%

-

07:42

Romanian CPI inflation declines more than expected

According to rttnews, Romania's consumer prices decreased at a faster-than-expected pace in September, figures from the National Institute of Statistics showed Tuesday.

The consumer price index dropped 0.6 percent year-over-year in September, following a 0.2 percent fall in August. It was forecast to decline at a stable pace of 0.2 percent.

Prices of non-food products fell 1.1 percent annually in September and costs for services by 1.2 percent. A the same time, grocery prices rose 0.5 percent.

On a monthly basis, consumer prices edged down 0.1 percent in September, defying economists' expectations for an increase of 0.3 percent.

-

07:24

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.1000 (EUR 1.96bln) 1.1100 (509m)1.1225-30 (868m) 1.1255 (270m) 1.1275 (247m) 1.1285-90 (503m)

USD/JPY: 101.50-55 (USD 566m) 102.25 (476m) 102.80 (303m) 102.90-103.00 (1.12bln) 103.50 (405m)

AUD/USD: 0.7500 (AUD 424m) 0.7548-50 (522m) 0.7575 (226m) 0.7730 (269m) 0.7750 (350m)

USD/CAD: 1.2815 (USD 205m) 1.3005-10($262mn)

USD/SGD: 1.3500 (USD 600m) 1.3700 (1.03bn)

-

07:21

Today’s events

-

At 09:00 GMT the Bank of England Member of the Commission Michael Saunders will make a speech

-

At 16:00 GMT the ECB member Yves Mersch of the Board will make a speech

-

-

07:16

WSE: After opening

WIG20 index opened at 1767.37 points (+0.08%)*

WIG 48142.35 0.24%

WIG30 2044.37 0.26%

mWIG40 4046.94 0.74%

*/ - change to previous close

The cash market opens up with a modest increase of 0.08% with the turnover clearly focused on growing by more than 10% the shares of JSW. At the opening the German DAX lost 0.15%. The beginning of trading may therefore be regarded as relatively neutral and balanced, where the worse sentiment in the world do not reflect too wide coverage.

The first transaction did not bring any major changes. On the main floor bulls soon after the opening tried to reach the highs yesterday's session, but quite quickly this attempt turns into a revocation signaled earlier by the contracts. In this way, we adjust to changes in Europe, where declines of 0.2 percent in the major indexes are standard at this time.

-

06:52

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.4%, CAC40 -0.1%, FTSE -0.2%

-

06:33

Options levels on tuesday, October 11, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1299 (2159)

$1.1245 (2061)

$1.1210 (248)

Price at time of writing this review: $1.1126

Support levels (open interest**, contracts):

$1.1074 (3137)

$1.1043 (3900)

$1.1009 (4032)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 32060 contracts, with the maximum number of contracts with strike price $1,1300 (3780);

- Overall open interest on the PUT options with the expiration date November, 4 is 38122 contracts, with the maximum number of contracts with strike price $1,0950 (4567);

- The ratio of PUT/CALL was 1.19 versus 1.13 from the previous trading day according to data from October, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.2606 (1047)

$1.2509 (468)

$1.2413 (317)

Price at time of writing this review: $1.2317

Support levels (open interest**, contracts):

$1.2287 (602)

$1.2191 (575)

$1.2094 (1062)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 22700 contracts, with the maximum number of contracts with strike price $1,2800 (2258);

- Overall open interest on the PUT options with the expiration date November, 4 is 23555 contracts, with the maximum number of contracts with strike price $1,2600 (1487);

- The ratio of PUT/CALL was 1.04 versus 1.03 from the previous trading day according to data from October, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:32

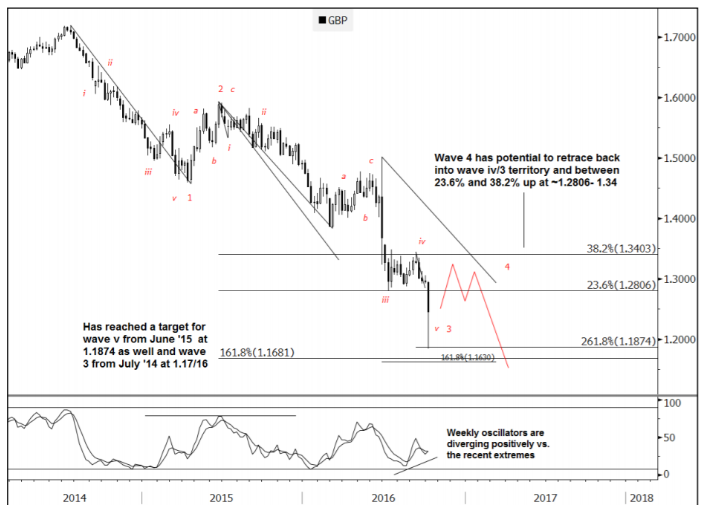

GBP/USD: A Corrective 4th Wave Before Next Leg Lower - Goldman Sachs

"GBP was front and center last week as the currency has broken a primary trendline formed across the lows since '93 (1.2788)

Going back even further, GBPUSD started a multi-year corrective process at the peak in '07, within which it is currently in the later stages of a final C wave. Because of the impulsive nature of wave A (from '07 through '08), it's actually not too surprising to see an equally impulsive sell-off in wave C (since Jun. '14).

In the nearer term, it may have just recently completed a 3 rd of 5-waves from Jun. '14 (i.e. within the larger degree C leg). It has come close enough to reaching the ideal target at 1.1681 (1.618 from Jul. '15). '

As such, a period of counter-trend corrective price action seems likely, before the next leg lower. Put another way, it's now likely based and started a corrective process/ 4 th wave.

A 4 th wave typically retraces back into wave iv/3 territory; in this case 1.2798-1.3445. It also often retraces between 23.6% and 38.2% of the length of wave 3; also ~1.28 and 1.34.

Bottom line, GBPUSD may consolidate in the near-term, but it is likely to continue declining over time".

Copyright © 2016 Goldman Sachs, eFXnews™

-

06:28

Asian session review: NZD traded lower

The New Zealand dollar has fallen vs the US dollar on the backdrop of today's speech by Deputy Governor of the Reserve Bank of New Zealand, Mr. McDermott. The official noted that the quarterly inflation rate in September was likely low, to the lower boundary of the minimum target range. In addition, McDermott has suggested that further easing of the monetary policy is posible in the future, until inflation stabilized in the middle of the target range.

The yen fell despite the positive data on the balance of payments of Japan. The Current Account released by Japan's Ministry of Finance, in August was Y2000,8 bln, higher than forecast (Y1502,7 bln) and the previous value of Y1938,2 billion. The high value of the index is a positive factor for the Japanese currency. The report noted that in August, Japan's largest current account surplus in the balance of payments since 2007 has been registered. The overall rate increased due to improved foreign trade balance due to lower import prices.

Today, Charles Evans said that the Fed has made progress with employment, but the situation remains unsatisfactory with inflation. Evans said that US will probably not have reached full employment. "More underutilized production capacities observed in the labor market", - said the representative of the Federal Reserve. He also added that the natural rate of unemployment is around 4.7%, but it is likely that unemployment will reach 4.5% by 2020.

EUR / USD: during the Asian session the pair fell to $ 1.1120

GBP / USD: during the Asian session the pair fell to $ 1.2300

USD / JPY: rose to Y104.00 in the Asian session

-

06:27

WSE: Before opening

Monday's session on Wall Street ended with increases in the major indexes. The Dow Jones Industrial at the end of the day gained 0.49 percent, the S&P500 rose by 0.46 percent and the Nasdaq Comp. increased 0.69 percent. The main reason for this situation was the increase in oil prices, which was the most expensive over a year. On Monday afternoon price of a barrel of Brent grew up to more than 53.6 USD. In the wake of the strongest oil prices on Wall Street climbed up the sector of fuel and raw materials.

In the morning, futures in the US are losing value. In Asia the Nikkei gains due to the weakening yen and lose indexes in South Korea and Hong Kong.

It seems that the beginning of the session in Europe will not be conducted in the best mood, and it's hard to count on growth, for which yesterday parquets in Europe together with the Warsaw Stock Exchange were prepared.

The macro calendar remains almost empty today, and the only notable publication will be the ZEW index. This week begins the US season for the presentation of the quarterly results for the company. Today, after the US session its results will give Alcoa. Most large US companies will publish their reports by the end of October.

-

06:22

Fed's Evans Says December Rate Hike "Could Be Fine"

-

High US Dollar Has Been Headwind to Economy

-

Decision on Rates will Come Down to Job Market, Inflation

-

Wouldn't Be Surprised If He Was Agreeble to December Hike

-

Might be Well Served to Wait for Inflation Pickup

-

Good GDP Growth in 2H

-

Non-Farm Payrolls Report was a Good Number

-

US Economy on Solid Footing

-

-

06:16

Deputy Governor of the Reserve Bank of New Zealand, McDermott: the quarterly inflation rate in September was low

During his speech today Deputy Governor of the Reserve Bank of New Zealand, noted that quarterly inflation rate in September was likely low, to the lower boundary of the minimum target range. In addition, McDermott has suggested that further easing of the monetary policy is posible in the future, until inflation stabilized in the middle of the target range.

-

06:13

Australian business confidence stable in September

Business confidence in Australia was fairly unchanged in September, the latest survey from National Australia Bank revealed on Tuesday with an index score of +6.

That was unchanged from the August reading, although it beat forecasts for +5.

The index for business conditions came in at +8, topping expectations for +7, which would have been unchanged.

-

05:03

Global Stocks

European stocks closed with gains Monday, boosted by oil's rally and merger hopes in Italy's struggling banking sector. German newspaper Bild this weekend reported the bank's chief executive, John Cryan, wasn't able to secure a deal while he was in Washington, D.C., late last week.

U.S. stocks closed higher Monday as rising optimism that OPEC would reach a deal to cut production-a move seen as necessary for addressing oversupply-delivered a jolt to energy shares.

The outlook for Asian stocks was positive following gains in the US, where energy shares jumped on prospects major crude producers will work to cut output and ease a supply glut. Oil was above US$51 (RM211.02) a barrel and the yen held declines. Shares in Australia and New Zealand rose as futures Japan's Nikkei 225 Stock Average futures signaled gains following a 0.5 per cent bounce in the S&P 500 Index.

-

05:02

Japan: Eco Watchers Survey: Outlook, September 48.5

-

05:01

Japan: Eco Watchers Survey: Current , September 44.8 (forecast 45.9)

-

00:30

Australia: National Australia Bank's Business Confidence, September 8

-

00:30

Australia: Home Loans , August -3.0%

-