Market news

-

22:30

Commodities. Daily history for Oct 12’2016:

(raw materials / closing price /% change)

Oil 50.01 -0.34%

Gold 1,256.80 +0.24%

-

22:29

Stocks. Daily history for Oct 12’2016:

(index / closing price / change items /% change)

Nikkei 225 16,840.00 -184.76 -1.09%

Shanghai Composite 3,059.13 -6.12 -0.20%

S&P/ASX 200 5,474.62 0.00 0.00%

FTSE 100 7,024.01 -46.87 -0.66%

CAC 40 4,452.24 -19.50 -0.44%

Xetra DAX 10,523.07 -54.09 -0.51%

S&P 500 2,139.18 +2.45 +0.11%

Dow Jones Industrial Average 18,144.20 +15.54 +0.09%

S&P/TSX Composite 14,618.97 +69.37 +0.48%

-

22:28

Currencies. Daily history for Oct 12’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1007 -0,43%

GBP/USD $1,2196 +0,66%

USD/CHF Chf0,9905 +0,22%

USD/JPY Y104,24 +0,67%

EUR/JPY Y114,74 +0,25%

GBP/JPY Y127,11 +1,32%

AUD/USD $0,7564 +0,38%

NZD/USD $0,7047 -0,07%

USD/CAD C$1,3267 +0,11%

-

22:00

Schedule for today, Thursday, Oct 13’2016

00:00 Australia Consumer Inflation Expectation October 3.3%

02:00 China Trade Balance, bln September 52.05 53

04:30 Japan Tertiary Industry Index August 0.3% -0.2%

06:00 Germany CPI, m/m (Finally) September 0.0% 0.1%

06:00 Germany CPI, y/y (Finally) September 0.4% 0.7%

12:30 Canada New Housing Price Index, MoM August 0.4% 0.3%

12:30 U.S. Continuing Jobless Claims 2058

12:30 U.S. Initial Jobless Claims 249 254

15:00 U.S. Crude Oil Inventories October -2.976 1.5

18:00 U.S. Federal budget September -107 25

-

21:30

New Zealand: Business NZ PMI, September 57.7

-

20:07

Major US stock indices closed without a single dynamic

Major US stock indexes finished trading in different directions, but near zero. Investors' attention was focused on the minutes of the Fed meeting, as well as the dynamics of the oil market.

Minutes of the September Fed meeting showed that Fed officials expect rate hikes soon enough, but there were differences with regards to the timing of the next increase. "Several Fed officials said that the decision to leave rates unchanged in September, was not unanimous. Meanwhile, some officials were concerned that the delay in raising interest rates may reduce the credibility of the Federal Reserve, "- reports showed. Also noted in the report that many Fed officials see little signs of emerging inflationary pressures. "Fed officials also agreed that labor market conditions" significantly "improved over the last year. Several executives indicated that too strong a drop in the unemployment rate is also undesirable, "- reported in the minutes.

Oil futures fell by about 1% after OPEC announced increase oil production up to a maximum of eight. Such news offset optimism about the agreement, which aims to control the market glut.

A certain pressure on the indices provided investors' concerns about corporate profits amid disappointing nachalla reporting season. According to a survey of analysts conducted by FactSet, profit companies from the S & P 500 are expected in the 3rd quarter decreased sixth consecutive quarter.

Focus was also an overview of vacancies and labor turnover (JOLTS), published by the US Bureau of Labor Statistics. It was reported that in August the number of vacancies decreased to 5.443 million. The indicator was revised up to 5.831 million. With 5.871 million in July. Analysts had expected the number of vacancies will fall to 5.72 million.

DOW index components closed in different directions (11 red, 19 black). Most remaining shares rose NIKE, Inc. (NKE, + 1.37%). Outsider were shares of Cisco Systems, Inc. (CSCO, -2.24%).

Sector S & P index finished the session mixed. The leader turned utilities sector (+ 0.9%). the health sector fell the most (-0.7%).

At the close:

Dow + 0.09% 18,144.68 +16.02

Nasdaq -0.15% 5,239.02 -7.77

S & P + 0.12% 2,139.25 +2.52

-

19:00

DJIA +0.19% 18,162.39 +33.73 Nasdaq -0.04% 5,244.80 -1.99 S&P +0.21% 2,141.12 +4.39

-

16:00

European stocks closed: FTSE 100 -46.87 7024.01 -0.66% DAX -54.09 10523.07 -0.51% CAC 40 -19.50 4452.24 -0.44%

-

15:47

WSE: Session Results

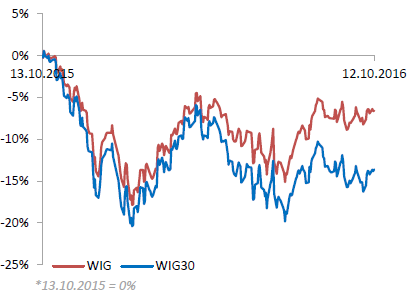

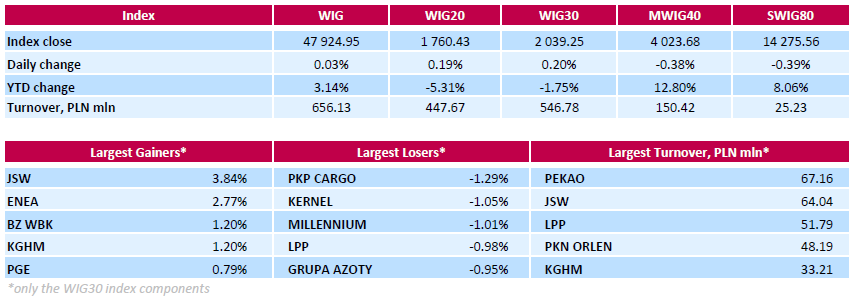

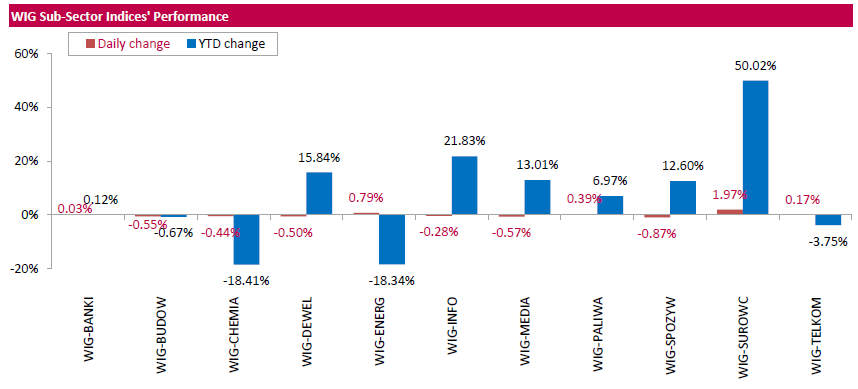

Polish equity market closed flat on Wednesday. The broad market measure, the WIG Index inched up 0.03%. Sector-wise, food stocks were depressed the most (-0.87%), while materials outperformed (+1.97%).

The large-cap stocks' measure, the WIG30 Index, gained 0.2%. Within the Index components, coking coal producer JSW (WSE: JSW) and genco ENEA (WSE: ENA) led the gainers, jumping by 3.84% and 2.77% respectively. They were followed by bank BZ WBK (WSE: BZW) and copper producer KGHM (WSE: KGH), which added 1.2% each. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) topped the list of the session's underperformers, tumbling 1.29%. Other biggest losers were agricultural producer KERNEL (WSE: KER) and bank MILLENNIUM (WSE: MIL), dropping 1.05% and 1.01% respectively.

-

15:43

Oil futures fell more than 1 percent

Oil futures fell more than 1 percent after OPEC announced oil production set new highs. Such news offset optimism about the agreement, which aims to control the market glut.

Increase in the dollar index to a seven-month high also weakened demand for oil. As oil prices are tied to the dollar, a stronger dollar makes oil more expensive for holders of foreign currencies.

Later today, the American Petroleum Institute will present its assessment on US petroleum inventories last week, and tomorrow US Department of Energy wil publish crude oil inventories. This week, both will report a day later, because Monday was a federal holiday in the United States.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 49.99 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 51.87 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

15:37

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Wednesday due to losses in energy and technology shares. Investors are focusing on the release of the minutes from the Federal Reserve's September policy meeting that will reveal policymakers' views on the progress of the U.S. economy and its ability to absorb an interest rate hike this year.

Dow stocks mixed (16 in negative area, 14 in positive area). Top gainer - NIKE, Inc. (NKE, +1.31%). Top loser - Cisco Systems, Inc. (CSCO, -2.25%).

S&P sectors also mixed. Top gainer - Utilities (+0.4%). Top loser - Healthcare (-0.6%).

At the moment:

Dow 18043.00 -27.00 -0.15%

S&P 500 2131.25 -3.25 -0.15%

Nasdaq 100 4812.50 -14.50 -0.30%

Oil 50.02 -0.77 -1.52%

Gold 1253.50 -2.40 -0.19%

U.S. 10yr 1.79 +0.03

-

15:25

The price of gold little changed today

Gold fell slightly in the course of today's trading, helped by the strengthening US dollar. Pressure on prices also having a growing expectation that the Fed will raise interest rates in coming months.

The US Dollar Index, showing the US dollar against a basket of six major currencies, traded with an increase of 0.3%. Since gold prices are tied to the dollar, a stronger dollar makes the precious metal more expensive for holders of foreign currencies.

Investors also await the publication of the Fed's September meeting minutes hoping to get signals about the pace of rate. Protocols are likely to confirm that the rate hike in December seems likely, but also to show that rates are likely to remain low in the future. Such a scenario is ambiguous for the dollar,.

According to the futures market, a hike in December has 69.5% probability.

Investors tend to buy gold as a hedge against political and financial uncertainty. Proof of this are the messages that the gold reserves in funds in general have stabilized this week above 57 million ounces.

The cost of the October futures for gold on the COMEX fell to $ 1253.0 per ounce.

-

14:58

September FOMC Minutes Preview - Barclays

"FOMC minutes: Given the three dissents in favor of a rate hike at the FOMC's September meeting, we expect the minutes to reveal widening divisions within the committee over the appropriate stance of policy. On one side are those who believe a rate hike in September would have been warranted given that the economy is operating near mandate-consistent levels and mediumterm risks are rising. These concerns were expressed by regional Fed presidents Rosengren, Mester, and George in remarks leading up to, and following, the meeting.

On the other side are those FOMC members, primarily within the Board, who point to a slower removal of labor market slack, via trends in participation and other variables, and a lack of evidence that inflation or financial instability are rising, as supporting a further delay in policy normalization".

Copyright © 2016 Barclays Capital, eFXnews™

-

14:31

Fed's Dudley Says Gradual Rate Rise Remains Best Way Forward

-

14:03

Job openings in the US decline in August

The number of job openings decreased to 5.4 million on the last business day of August, the U.S. Bureau of Labor Statistics reported today. Hires and separations were little changed at 5.2 million and 5.0 million, respectively. Within separations, the quits rate was 2.1 percent and the layoffs and discharges

rate was 1.1 percent. This release includes estimates of the number and rate of job openings, hires, and separations for the nonfarm sector by industry and by four geographic regions.The number of hires was 5.2 million in August, little changed from July. The hires rate was 3.6 percent in August. The number of hires was little changed for total private and for government. Hires was also little changed in all industries and regions.

-

14:00

U.S.: JOLTs Job Openings, August 5.443 (forecast 5.72)

-

13:47

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0850 (EUR 350m) 1.0900 (726m) 1.1000 (275m) 1.1030 (453m) 1.1140(352m) 1.1150 (569m) 1.1160 (279m) 1.1200 (549m) 1.1215 (328m) 1.1230 (248m)

USD/JPY: 101.00 (USD 1.17bln) 102.50 (457m) 103.00 (250m) 103.40-50 (604m) 104.10 (662m)

GBP/USD 1.2500 (GBP 212m)

USD/CHF 0.9715 (930m)

EUR/GBP 0.9000 (EUR 360m)

EUR/JPY 115.00 (EUR 864m)

USD/CAD: 1.3200 (USD 2.4bln) 1.3300.05 (420m) 1.3450 (250m)

NZD/USD 0.7150 (NZD 623m)

AUD/JPY 78.40 (AUD 324m)

-

13:33

U.S. Stocks open: Dow +0.02%, Nasdaq +0.02%, S&P +0.09%

-

13:32

Rabobank Experts expect an extension of the ECB's asset purchase program

At the meeting in December, the European Central Bank is likely to extend the asset purchase program, under which is buying euro 80 billion a month, until September 2017, says Rabobank.

Elwin de Groot of Rabobank also expects preliminary signals of tapering the asset purchase program in September 2017, although he stressed that the unfolding will take place very gradually and will depend on economic data.

In addition, Rabobank forecast a change in the parameters of the program, which will avoid problems with the lack of assets.

Rabobank no longer expects a deposit rate cut.

-

13:28

Before the bell: S&P futures -0.19%, NASDAQ futures -0.24%

U.S. stock-index futures slipped slipped, with investors wary that minutes from the Federal Reserve's latest policy meeting due for release later could reveal a more hawkish tone from officials.

Global Stocks:

Nikkei 16,840.00 -184.76 -1.09%

Hang Seng 23,407.05 -142.47 -0.60%

Shanghai 3,059.13 -6.12 -0.20%

FTSE 7,052.29 -18.59 -0.26%

CAC 4,456.68 -15.06 -0.34%

DAX 10,529.71 -47.45 -0.45%

Crude $50.83 (+0.08%)

Gold $1,254.70 (-0.10%)

-

13:01

US Fed's Dudley says they do not conduct policy with an eye on politics - Forexlive

-

Fed could have been more aggressive at recession outset

-

global economy is growing faster on average than US

-

weight of economic activity shifted from Europe to Asia

-

global economy is doing ok

-

-

12:46

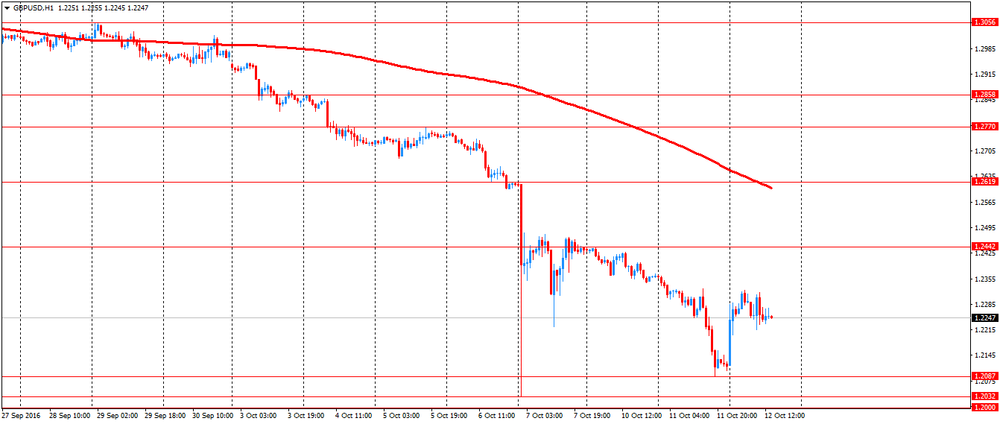

European session review: the pound continue to be volatile

The following data was published:

(Time / country / index / period / previous value / forecast)

9:00 Eurozone Industrial Production m / m in August -0.7% Revised to -1.1% 1.5% 1.6%

9:00 Eurozone Industrial Production y / y in August -0.5% 1.1% 1.8%

9:00 Switzerland investor expectations index according to ZEW and Credit Suisse in October 2.7 5.2

12:00 US Speech by the Federal Open Market Committee member William Dudley

The pound rose sharply against the US dollar, recovering almost all the ground lost the day before. The cause of this trend was the closing of short positions on the message of the possible softer Brexit. Bloomberg agency said that British Prime Minister Theresa May has agreed to hold a vote in parliament about its plans, which may limit its ability to enforce "rigid script", in which Britain would lose free access to the common European market in exchange for limiting migration.

According to experts, if the hard Brexit is selected, Britain's GDP could fall by 9.5%.

However, despite the recent rally, the pound remains under pressure. Recently, French President Francois Hollande joined the negative sentiment of EU representatives, encouraging tough negotiations with the United Kingdom. Later, the French Prime Minister said that Hollande was right, calling for a tougher approach to Brexit.

The view from France is important because the EU position is determined mainly by Germany and France.

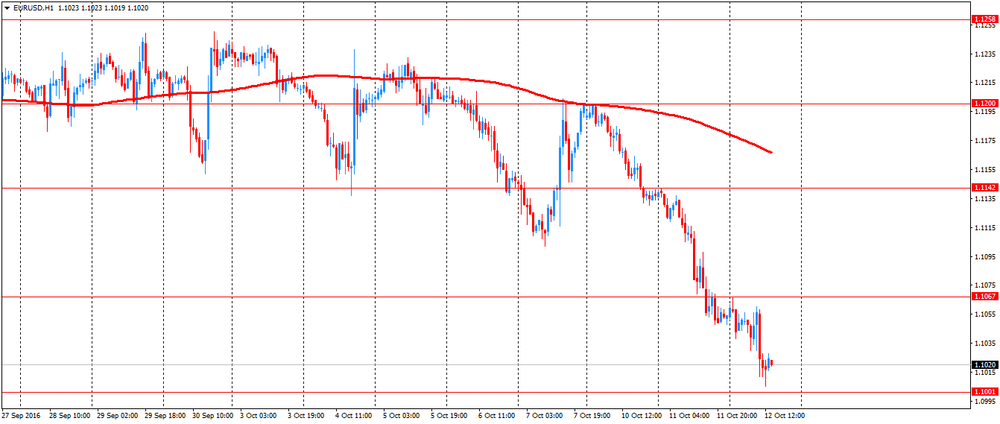

The US dollar rose against major currencies. Experts point out that the US dollar strengthened amid growing expectations of interest rate increases by the Federal Reserve at the end of this year. Higher US bond yields and low European yelds, also support the dollar against the EUR.

Later today, investors will examine statements by the Fed and the minutes of the September meeting in search for signals about the pace of rate hikes.

Protocols are likely to confirm that the rate hike in December seems likely, but also to show that rates are likely to remain low in the future. Such a scenario is ambiguous for the dollar,.

According to the futures market, a hike in December has 69.5% probability.

Industrial output in the euro zone rebounded in August, as most of the sub-sectors grew in July - Eurostat data.

Industrial production expanded by 1.6 percent in August from July, when it fell a revised 0.7 percent. It was forecasts an increase of 1.5 percent.

Among the components, the production of energy and capital goods increased by 3.3 percent and 3.5 percent respectively, while the production of consumer durables advanced 4.3 percent, production of consumer non-durable goods fell by 0.6 percent. Production of intermediate goods increased by 1.4 percent.

In annual terms, industrial output grew by 1.8 percent, in contrast to the fall of 0.5 percent in July. The annual rate is also faster than the expected increase of 1.1 percent.

EUR / USD: during the European session, the pair fell to $ 1.1005

GBP / USD: during the European session, the pair rose to $ 1.2317

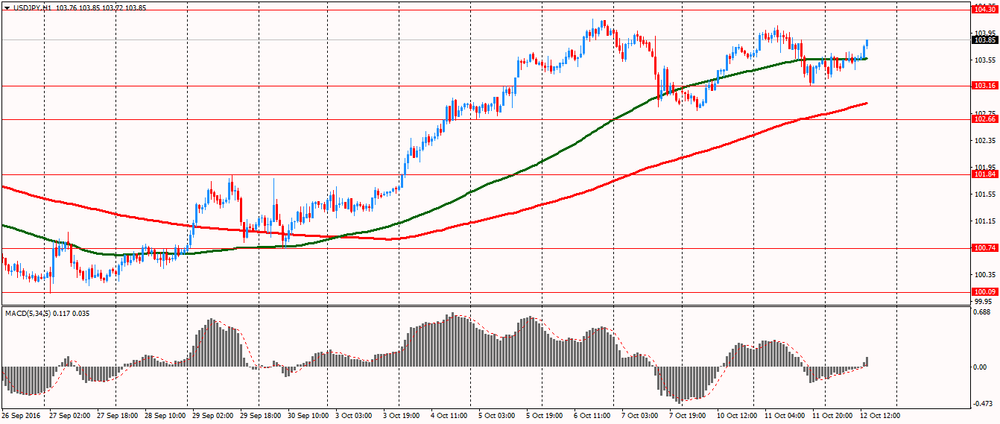

USD / JPY: during the European session, the pair rose to Y103.85

-

12:44

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

27.78

-0.13(-0.4658%)

25136

ALTRIA GROUP INC.

MO

62.07

0.08(0.1291%)

110

Amazon.com Inc., NASDAQ

AMZN

831.32

0.32(0.0385%)

6792

Apple Inc.

AAPL

116.66

0.36(0.3095%)

181185

AT&T Inc

T

39.18

0.08(0.2046%)

504

Barrick Gold Corporation, NYSE

ABX

15.5

-0.02(-0.1289%)

45771

Cisco Systems Inc

CSCO

30.6

-0.44(-1.4175%)

67022

Citigroup Inc., NYSE

C

49.14

0.15(0.3062%)

1779

Deere & Company, NYSE

DE

87.28

0.23(0.2642%)

1200

Exxon Mobil Corp

XOM

87.75

0.01(0.0114%)

1701

Facebook, Inc.

FB

128.85

-0.03(-0.0233%)

35362

Ford Motor Co.

F

12

0.01(0.0834%)

19160

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

9.89

0.02(0.2026%)

32125

General Electric Co

GE

28.95

0.03(0.1037%)

7019

Intel Corp

INTC

37.2

-0.07(-0.1878%)

1033

JPMorgan Chase and Co

JPM

68.4

0.09(0.1318%)

6276

Procter & Gamble Co

PG

88.88

0.34(0.384%)

596

Starbucks Corporation, NASDAQ

SBUX

52.9

-0.02(-0.0378%)

1163

Tesla Motors, Inc., NASDAQ

TSLA

201.4

1.30(0.6497%)

8356

The Coca-Cola Co

KO

41.6

0.06(0.1444%)

4833

Twitter, Inc., NYSE

TWTR

18.1

0.10(0.5556%)

168988

Visa

V

82.17

0.13(0.1585%)

150

Wal-Mart Stores Inc

WMT

67.5

0.11(0.1632%)

1125

Yahoo! Inc., NASDAQ

YHOO

42.69

0.01(0.0234%)

478

Yandex N.V., NASDAQ

YNDX

21.54

0.14(0.6542%)

900

-

12:40

Upgrades and downgrades before the market open

Upgrades:

Procter & Gamble (PG) upgraded to Buy from Hold at Argus

Downgrades:

Alcoa (AA) downgraded to Neutral from Buy at BofA/Merrill

Other:

Apple (AAPL) target raised to $130 from $120 at Mizuho

Alcoa (AA) target lowered to $31 from $33 at RBC Capital Mkts

Amazon (AMZN) target raised to $1000 from $835 at Cantor Fitzgerald

-

11:49

Orders

EUR/USD

Offers : 1.1070 1.1085 1.1100 1.1130 1.1150 1.1180 1.1200 1.1220 1.1235 1.1250

Bids : 1.1020-30 1.1000 1.0980 1.0965 1.0950 1.0920 1.0900

GBP/USD

Offers : 1.2325-30 1.2350 1.2380 1.24001.2430 1.2445-50 1.2480 1.2500

Bids : 1.2260 1.2220 1.2200 1.2160 1.2100 1.2085 1.2050 1.2000

EUR/GBP

Offers : 0.9030-35 0.9055 0.9085 0.9100 0.9155 0.9200 0.9220 0.9250

Bids : 0.8960-65 0.8900 0.8850-55 0.8835 0.8800-10

EUR/JPY

Offers : 114. 80 115.00 115.50 115.80 116.00 116.25-30 116.50 117.00

Bids : 114.20 114.00 113.70 113.50 113.00 112.60 112.00

USD/JPY

Offers : 103.80 103.95-104.00 104.20 104.30 104.50 104.80 105.00

Bids : 103.35 103.20 103.00 102.80-85 102.70 102.50 102.25-30 102.00

AUD/USD

Offers : 0.7600 0.7630 0.7650 0.7685 0.7700 0.7720

Bids : 0.7550 0.7530 0.7500 0.7485 0.7450 0.7420-25 0.7400

-

11:46

OPEC Monthly Report: The OPEC Reference Basket slipped slightly in September to $42.89/b, down 21¢

Crude Oil Price Movements

The OPEC Reference Basket slipped slightly in September to $42.89/b, down 21¢. ICE Brent ended up 8¢ at $47.24/b and NYMEX WTI increased 43¢ to $45.23/b. Crude oil prices were supported by efforts to address excess global supplies and consecutive draws in US crude stockpiles. The Brent-WTI spread narrowed to $2.01/b.

World Economy

World economic growth remains unchanged at 2.9% for 2016 and 3.1% for 2017. The OECD growth forecast remains at 1.6% and 1.7% for 2016 and 2017, respectively. Forecasts for China and India are also unchanged at 6.5% and 7.5% for 2016 and 6.1% and 7.2% for 2017. Brazil and Russia are forecast to grow by 0.4% and 0.7% in 2017, following contractions of 3.4% and 0.6% this year.

World Oil Demand

World oil demand in 2016 is seen increasing by 1.24 mb/d to average 94.40 mb/d, after a marginal upward revision of around 10 tb/d from the September MOMR, mainly to reflect the latest data. Positive revisions were primarily a result of higher-than-expected demand in the Other Asia region, while downward revisions were a result of lower-than-expected performance from OECD America. In 2017, world oil demand is anticipated to rise by 1.15 mb/d, unchanged from the September MOMR, to average 95.56 mb/d.

World Oil Supply

Non-OPEC oil supply in 2016 is now expected to contract by 0.68 mb/d, following a downward revision of around 70 tb/d from the September MOMR to average 56.30 mb/d. This is mainly due to base line revisions. In 2017, non-OPEC supply was revised up slightly by 40 tb/d to show growth of 0.24 mb/d to average 56.54 mb/d, mainly due to new projects coming on stream in Russia. OPEC NGLs are expected to average 6.43 mb/d in 2017, an increase of 0.15 mb/d over the current year. OPEC crude production, according to secondary sources, increased by 0.22 mb/d in September to average 33.39 mb/d.

-

11:42

UK PM May: Idea that parliament would not debate Brexit was completely wrong

-

10:37

Major stock indices in Europe trading in the red zone

Stock indexes in Western Europe trading lower after shares of Ericsson collapsed. Investors were also cautious on the eve FOMC minutes

Market participants are waiting for the publication of September Fed meeting minnutes looking for hints of the future steps the central bank could take, as the chances of a rate hike in December exceeded 70% on Tuesday.

Some support for markets was data on industrial production in the euro area. Industrial output in the euro zone rebounded in August, as most of the sub-sectors grew in July, showed Eurostat. Industrial production expanded by 1.6 percent in August from July, when it fell a revised 0.7 percent. Among the components, the production of energy and capital goods increased by 3.3 percent and 3.5 percent respectively while the production of consumer durables advanced 4.3 percent, production of consumer non-durable goods fell by 0.6 percent. Production of intermediate goods increased by 1.4 percent. In annual terms, industrial output grew by 1.8 percent, in contrast to the fall of 0.5 percent in July. The annual rate is also faster than the expected increase of 1.1 percent.

The composite index of the largest companies in the region Stoxx Europe 600 fell by 0.08% - to 339.89 points.

Share of the Swedish Ericsson collapsed by more than 17%. The world's largest manufacturer of equipment for wireless networks, announced that financial results for the third quarter will be worse than expected. Revenue, in July-September amounted to $ 5.79 billion, which is 14% less than the same period last year. At the same time, operating income fell by 93%

This message caused the decline in prices of other securities of the industry, including Nokia, by -5.4%.

Research firm Gartner released a forecast that capex semiconductor manufacturers will decline by 0.3% in 2016.

At the same time, the market capitalization of the German chemical company BASF SE increased at th opening of the market by 1.6% on a less sharp fall in operating profit in the last quarter, compared with analysts' forecasts.

In addition, Peugeot shares rose 1.2% due to higher sales in China (29% in September compared to the same month last year).

Shares of British Old Mutual fell 1.4% after reports that the insurance company has already tried to start negotiations with Old Mutual Wealth buyers, the British division, which analysts estimated at 3-4 billion pounds.

EasyJet shares rose 2.3% after the airline said Tuesday that it plans to improve the existing base in Germany, before starting to expand to other airports, such as Frankfurt.

At the moment:

FTSE 7045.70 -25.18 -0.36%

DAX 10561.92 -15.24 -0.14%

CAC 4462.37 -9.37 -0.21%

-

10:09

BOE's Cunliffe: Issue of Euro Clearing Has Political Significance

-

Fragmenting Clearing System Would Raise Costs

-

Clearing is Multi-Currency Activity

-

-

10:07

Rusian Ministry of Economic Development expects GDP growth of more than 1% in 2017 with low inflation - Ulyukayev

Ministry of Economic Development expects GDP growth to exceed 1% already in 2017 with low inflation said Minister Alexei Ulyukayev in an interview to television channel "Russia 24".

"We proceed from the fact that at low inflation parameters we will have a more substantial growth, already in 2017 more than 1% - 1.2% and a yield of 2%," - he said

-

09:17

BoE’s Cunliffe: Cannot Rule Out Financial Market Instability As More News About Brexit Comes -Livesquawk

-

09:16

August EuroZone Industrial Production higher than expected

In August 2016 compared with July 2016, seasonally adjusted industrial production rose by 1.6% in the euro area (EA19) and by 1.4% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In July 2016 industrial production fell by 0.7% in both zones. In August 2016 compared with August 2015, industrial production increased by 1.8% in both zones.

The increase of 1.6% in industrial production in the euro area in August 2016, compared with July 2016, is due to production of durable consumer goods rising by 4.3%, capital goods by 3.5%, energy by 3.3% and intermediate goods by 1.4%, while production of non-durable consumer goods fell by 0.6%.

In the EU28, the increase of 1.4% is due to production of capital goods rising by 3.8%, durable consumer goods by 2.7%, energy by 1.9% and intermediate goods by 0.9%, while production of non-durable consumer goods fell by 0.5%. Among Member States for which data are available, the highest increases in industrial production were registered in the Czech Republic (+12.1%), the Netherlands (+4.4%) and Germany (+3.1%), and the largest decreases in Ireland (-13.4%), Finland (-3.5%) and Sweden (-2.9%).

-

09:00

Switzerland: Credit Suisse ZEW Survey (Expectations), October 5.2

-

09:00

Eurozone: Industrial Production (YoY), August 1.8% (forecast 1.1%)

-

09:00

Eurozone: Industrial production, (MoM), August 1.6% (forecast 1.5%)

-

08:50

Bank of England Sterling Broad Effective Exchange Rate Index Drops to Lowest Ever, Passing 1993 and 2008 Lows

-

08:26

Much Better Places for Long USD Than In EUR/USD says Credit Agricole

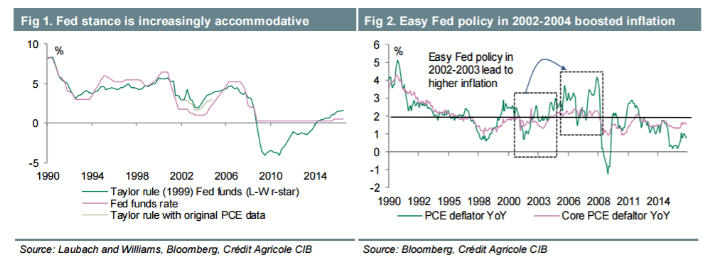

"FX markets appear to be shaken out of their summer lethargy by a rethinking of central bank policy mind-sets and rising long-term yields. We don't believe the September non-farm payrolls report will reverse the momentum, with the USD the ultimate beneficiary over the balance of 2016.

The BoJ and ECB are struggling with asset scarcity. We don't think ECB tapering is imminent but the Fed's experience suggests that the currency trough should not be too far away from the first verbal hint. If you want to be long USD, there are much better places than EUR/USD.

USD/JPY has turned more sensitive to relative yields than to equities, which means that the upside relies mainly on the strength of the incoming US data.

The market has spent a lot of time focusing on the implications of data for Fed policy but not enough on what policy can do to the data. Standard measures of the current policy stance, such as the Taylor rule, suggest policy is the most accommodative since 2002-2004, which should give greater confidence in some further (albeit still gradual) Fed tightening. Our US rates strategists estimate that 10Y yields are now below fair value and the curve is structurally too flat. This is echoed by expectations of a steeper German curve as well.

Vol-adjusted G10 carry is low by historical standards and higheryielding currencies are among the most expensive according to our fair-value model. Diminishing prospects of further easing in the carry funders, steeper yield curves and various political risks suggest the AUD and NZD will underperform over the coming months".

Copyright © 2016 Credit Agricole CIB, eFXnews™

-

08:16

Zurbruegg: We Feel Comfortable With Policy Stance For Swiss Economic Development -- Reuters

-

08:15

Oil is trading higher

This morning, the New York futures for Brent rose 0.45% to $ 51.02. and crude oil futures for WTI increased in value by 0.63% to $ 52.74 per barrel.

Today, the American Petroleum Institute will publish the evaluation of crude oil and petroleum products in the United States. Tomorrow the US Department of Energy will report. This week, both will report a day later, because Monday was a federal holiday in the United States.

Last week, US crude oil inventories fell, which led to an increase in forecasts about the demand.

-

07:54

Major stock exchanges trading in the red zone: FTSE -0.2%, DAX -0.1%, CAC40 -0.2%, FTMIB flat, IBEX + 0.1%

-

07:21

Today’s events

-

At 09:00 GMT the Bank of England Deputy Governor for Financial Stability John Cunliffe deliver a speech

-

At 09:15 GMT the ECB board member Benoit Coeure deliver a speech

-

At 12:00 GMT FOMC member William Dudley will make a speech

-

At 13:40 GMT FOMC members Easter George will deliver a speech

-

At 17:01 GMT the United States will hold an auction of 10-year bonds

-

At 18:00 GMT Fed meeting minutes

-

-

07:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0850 (EUR 350m) 1.0900 (726m) 1.1000 (275m) 1.1030 (453m) 1.1140(352m) 1.1150 (569m) 1.1160 (279m) 1.1200 (549m) 1.1215 (328m) 1.1230 (248m)

USD/JPY: 101.00 (USD 1.17bln) 102.50 (457m) 103.00 (250m) 103.40-50 (604m) 104.10 (662m)

GBP/USD 1.2500 (GBP 212m)

USD/CHF 0.9715 (930m)

EUR/GBP 0.9000 (EUR 360m)

EUR/JPY 115.00 (EUR 864m)

USD/CAD: 1.3200 (USD 2.4bln) 1.3300.05 (420m) 1.3450 (250m)

NZD/USD 0.7150 (NZD 623m)

AUD/JPY 78.40 (AUD 324m)

-

06:52

French CPI inflation down significantly in August

In September 2016, the Consumer Prices Index (CPI) dipped by 0.3% over a month, after a increase of 0.3% in August. Seasonally adjusted, it rose by 0.1%, after a slight fall in August. Year-on-year, the CPI grew by 0.4%, after +0.2% in the three previous months.

This month-on-month drop mainly came from the seasonal retreat in the prices of some tourism-related services after the summer school holiday period. Moreover, food prices diminished, especially fresh foodstuffs prices. Furthermore, a rebound in petroleum product prices after two months of decline, and a further rise in manufactured products prices mitigated the overall decrease.

-

06:40

Flat start of trading expected on the major stock exchanges in Europe: DAX + 0.1%, CAC40 flat, FTSE flat

-

06:38

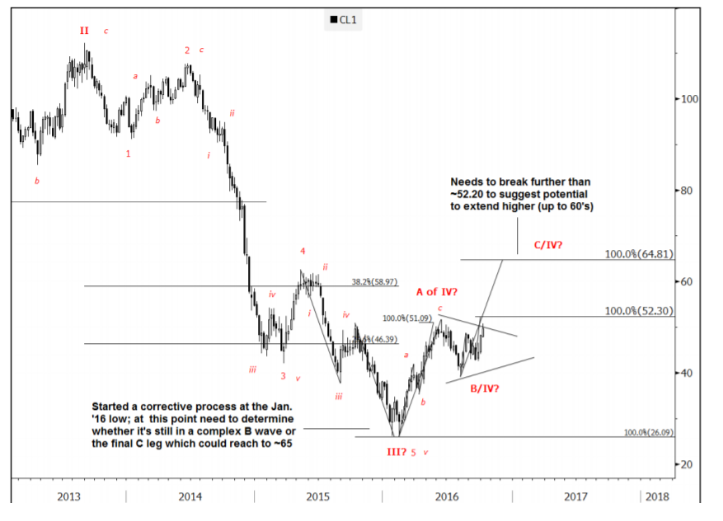

The Next Levels To Watch In Gold & Oil - Goldman Sachs

"The Gold market has been in a corrective process since the December '15 low.

It's since seen the A and B legs of an incomplete ABC. Again, it's common for B waves to be more contracted/complex. As such, the market needs to break meaningfully past 1,303 (early-September low) to suggest potential to have started its final C wave advance.

The next downside level to watch is 38.2% retrace at 1,250. A break lower will open up risks to 50% retrace at ~1,211-1,200. Need above 1,303 to consider the start of a recovery.

The Oil market has been in a corrective process since the January low.

It's since seen the A and B legs of an incomplete ABC. As is often discussed, it's common for B waves to be more contracted/complex. As such, the market needs to break meaningfully past 52.30 to suggest potential to have started its final C wave advance.

This 52.30 level is derived from an ABC off the July low. The implied target for wave C (from current levels) is somewhere near 60/64.

Until this break above 52.30 is attained it seems sensible to treat this as a range trade; i.e. highs in the ~50/52 region and lows down at 43/42".

Copyright © 2016 Goldman Sachs, eFXnews™

-

06:33

Bank of Japan Governor, Haruhiko Kuroda: We will reduce the negative rate if needed

Today Governor of the Bank of Japan Haruhiko Kuroda said that currently negative rates are a major tool in the monetary policy of the Central Bank. Kuroda adress the readiness to lower negative rate if necessary, until the benefits of the policy outweigh its costs. In addition, stated that the purchase of government bonds will continue in the volume of about 80 trillion yen per year.

-

06:30

Options levels on wednesday, October 12, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.1246 (2855)

$1.1187 (853)

$1.1145 (526)

Price at time of writing this review: $1.1046

Support levels (open interest**, contracts):

$1.0993 (3976)

$1.0966 (4330)

$1.0935 (8242)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 33136 contracts, with the maximum number of contracts with strike price $1,1300 (3783);

- Overall open interest on the PUT options with the expiration date November, 4 is 43813 contracts, with the maximum number of contracts with strike price $1,1000 (8242);

- The ratio of PUT/CALL was 1.32 versus 1.19 from the previous trading day according to data from October, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.2505 (622)

$1.2407 (496)

$1.2310 (985)

Price at time of writing this review: $1.2265

Support levels (open interest**, contracts):

$1.2180 (608)

$1.2085 (1183)

$1.1989 (334)

Comments:

- Overall open interest on the CALL options with the expiration date November, 4 is 25819 contracts, with the maximum number of contracts with strike price $1,2800 (2155);

- Overall open interest on the PUT options with the expiration date November, 4 is 26071 contracts, with the maximum number of contracts with strike price $1,2600 (1478);

- The ratio of PUT/CALL was 1.01 versus 1.04 from the previous trading day according to data from October, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:27

Core machine orders in Japan were down 2.2 percent

Core machine orders in Japan were down 2.2 percent on month in August, the Cabinet Office said on Wednesday.

That topped expectations for a decline of 4.6 percent following the 4.9 percent increase in July.

On a yearly basis, core machine orders jumped 11.6 percent - also exceeding expectations for 7.9 percent following the 5.2 percent gain in the previous month.

-

06:22

Moody's: Australia's economy displays resilience to commodity price declines, but external financing risks linger

Moody's Investors Service says that Australia (Aaa stable) will be the fastest growing Aaa-rated commodity exporting economy in 2016 -- a reflection of its resilience to shocks, as export volumes have increased strongly despite falls in metals prices, and the services sector has benefited from a weaker domestic currency. Moody's expects Australia to maintain higher GDP expansion than Canada and Norway, and a similar rate to New Zealand (all Aaa stable) over coming years.

Aaa-rated Australia, Canada, New Zealand and Norway all export commodities, ranging from oil to iron ore to milk. While commodity prices have risen in recent months, they have not recovered from the sharp falls seen in 2013 and 2014. Moody's assumes that commodity prices will remain well below their previous peaks over the next few years.

Still, Australia - like New Zealand - faces external financing risks. Trade and current account deficits spanning several decades reflect a reliance on external financing, and leave both countries vulnerable to shifts in investor sentiment. But the robustness of Australia's institutions, deep capital markets and low foreign currency debt mitigate the risk of any abrupt tightening in financing conditions.

Moody's conclusions are contained in its just-released report on Australia, entitled "Government of Australia - Comparison with Commodity-Exporting Aaa Peers Reveals Economic Resilience, but also External Financing Risks."

-

06:14

German wholesale trade decreased in September

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade decreased by 0.3% in September 2016 from the corresponding month of the preceding year. In August and in July 2016 the annual rates of change were -1.2% and -1.4%, respectively.

From August 2016 to September 2016 the index rose by 0.4%.

-

06:01

Japan: Prelim Machine Tool Orders, y/y , September -6.3%

-

04:55

Global Stocks

European stocks ended in the red Tuesday, but luxury shares were solidly higher on an earnings report from LVMH Moët Hennessy Louis Vuitton SE.

U.S. stocks on Tuesday posted their biggest percentage drop since early September after aluminum giant Alcoa Inc.'s results cast a shadow over the broader market as third-quarter earnings season got under way. A stronger dollar and a retreat in oil prices also hurt sentiment.

Asian shares were trading broadly lower Wednesday amid heightened odds of a December rate rise by the U.S. Federal Reserve, leading to worries that foreign investors will pull money out of Asia. "People are starting to wake up that the hike is coming," said Hao Hong, head of research at Bocom International. "The Fed is running out of excuses not to hike."

-