Market news

-

23:28

Stocks. Daily history for Feb 15’2017:

(index / closing price / change items /% change)

Nikkei +199.00 19437.98 +1.03%

TOPIX +14.57 1553.69 +0.95%

Hang Seng +291.86 23994.87 +1.23%

CSI 300 -14.09 3421.71 -0.41%

Euro Stoxx 50 +14.82 3323.71 +0.45%

FTSE 100 +33.85 7302.41 +0.47%

DAX +22.12 11793.93 +0.19%

CAC 40 +29.04 4924.86 +0.59%

DJIA +107.45 20611.86 +0.52%

S&P 500 +11.67 2349.25 +0.50%

NASDAQ +36.87 5819.44 +0.64%

S&P/TSX +58.92 15844.95 +0.37%

-

21:05

Major US stock indexes rose moderately by the end of today's session

Major Wall Street stock indexes finished trading in positive territory, recording-session fifth consecutive increase, after the president of the Donald Trump repeated his promise to cut taxes, as well as thanks to upbeat economic data that increased the chances of a rate hike and raise bank stocks.

According to the report published by the US Department of Commerce on Wednesday, despite the pullback in sales, retail sales of cars rose more than expected in January. The report said that retail sales rose 0.4% in January, followed upwardly revised 1.0% gain in December.

At the same time, a jump in gasoline prices helped push inflation to the strongest monthly gain in nearly four years in January. This is a sign that the steadily increasing pressure on prices that can support additional steps the Fed to raise interest rates this year. The Consumer Price Index, a measure of what Americans pay for everything from seafood to living expenses, increased a seasonally adjusted 0.6% in January compared with the previous month.

In addition, the Federal Reserve said that industrial output fell by 0.3 percent in January, after rising by a revised 0.6 percent in December. Economists had expected production to increase by 0.1 percent compared with growth of 0.8 percent, which was originally reported in the previous month. The decline in production was due to a decrease in the release of public services, which fell by 5.7 percent in January after gaining 5.1 percent in December. Rollback was caused by the fact that the unseasonably warm weather reduced demand for heating. On the other hand, output grew by 2.8 percent in January after a sharp fall of 1.4 percent in December. Manufacturing output increased by 0.2 percent for the second month in a row.

DOW index components ended the day mostly in positive territory (25 of 30). leaders of growth were shares of The Procter & Gamble Company (PG, + 3.54%). Most remaining shares fell Merck & Co., Inc. (MRK, -0.70%).

Almost all sectors of the S & P showed an increase. Leaders of growth were the health sector (+ 1.1%). Most of the basic materials sector fell (-0.4%).

At the close:

Dow + 0.52% 20,611.11 +106.70

Nasdaq + 0.64% 5,819.44 +36.87

S & P + 0.50% 2,349.18 +11.60

-

20:00

DJIA +0.48% 20,602.24 +97.83 Nasdaq +0.55% 5,814.39 +31.82 S&P +0.44% 2,347.87 +10.29

-

18:20

Wall Street. Major U.S. stock-indexes slightly increased

Major U.S. stock-indexes hit records on its fifth day on Wednesday, as President Donald Trump repeated his promise of tax cuts and on upbeat economic data that increased the odds of a rate hike and lifted bank stocks. Trump, in a meeting with top executives at U.S. retail companies, said he would lower taxes substantially and simplify the tax code - echoing a vow he made last Thursday that renewed optimism about the economy and revived the "Trump trade".

Most of Dow stocks in positive area (19 of 30). Top loser - Merck & Co., Inc. (MRK, -1.02%). Top gainer - The Procter & Gamble Company (PG, +2.93%).

Most of S&P sectors are also in positive area. Top loser - Utilities (-0.6%). Top gainer - Financials (+0.5%).

At the moment:

Dow 20385.00 +2.00 +0.01%

S&P 500 2324.25 -2.00 -0.09%

Nasdaq 100 5254.75 -4.50 -0.09%

Crude Oil 53.04 -0.16 -0.30%

Gold 1232.40 +7.00 +0.57%

U.S. 10yr 2.50 +0.03

-

17:00

European stocks closed: FTSE 100 +33.85 7302.41 +0.47% DAX +22.12 11793.93 +0.19% CAC 40 +29.04 4924.86 +0.59%

-

14:34

U.S. Stocks open: Dow +0.09%, Nasdaq -0.01%, S&P -0.06%

-

14:29

Before the bell: S&P futures -0.24%, NASDAQ futures -0.19%

U.S. stock-index futures fell after a recent spate of record highs, as investors assessed economic data and awaited Yellen's testimony.

Global Stocks:

Nikkei 19,437.98 +199.00 +1.03%

Hang Seng 23,994.87 +291.86 +1.23%

Shanghai 3,212.72 -5.21 -0.16%

FTSE 7,303.73 +35.17 +0.48%

CAC 4,924.81 +28.99 +0.59%

DAX 11,778.24 +6.43 +0.05%

Crude $52.99 (-0.39%)

Gold $1,220.10 (-0.43%)

-

14:00

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

180.65

0.225(0.1247%)

705

ALCOA INC.

AA

141.66

0.30(0.2122%)

514

Amazon.com Inc., NASDAQ

AMZN

835.57

-0.82(-0.098%)

10681

Apple Inc.

AAPL

82.7

-0.12(-0.1449%)

2229

AT&T Inc

T

40.69

-0.06(-0.1472%)

1605

Barrick Gold Corporation, NYSE

ABX

82.7

-0.12(-0.1449%)

2229

Caterpillar Inc

CAT

98

-0.09(-0.0918%)

1246

Deere & Company, NYSE

DE

82.7

-0.12(-0.1449%)

2229

Exxon Mobil Corp

XOM

82.7

-0.12(-0.1449%)

2229

Ford Motor Co.

F

12.64

-0.01(-0.079%)

11136

General Electric Co

GE

30.27

-0.01(-0.033%)

12705

General Motors Company, NYSE

GM

37

-0.24(-0.6445%)

16565

Goldman Sachs

GS

250.54

1.08(0.4329%)

39103

Home Depot Inc

HD

141.66

0.30(0.2122%)

514

Intel Corp

INTC

141.66

0.30(0.2122%)

514

International Business Machines Co...

IBM

180.1

-0.03(-0.0167%)

3501

JPMorgan Chase and Co

JPM

89.96

0.40(0.4466%)

53721

Merck & Co Inc

MRK

64.9

-0.76(-1.1575%)

17422

Nike

NKE

56.33

-0.12(-0.2126%)

2319

Pfizer Inc

PFE

141.66

0.30(0.2122%)

514

Starbucks Corporation, NASDAQ

SBUX

56.23

-0.35(-0.6186%)

614

Tesla Motors, Inc., NASDAQ

TSLA

278.8

-2.18(-0.7759%)

67963

Verizon Communications Inc

VZ

141.66

0.30(0.2122%)

514

Visa

V

87.1

0.415(0.4787%)

1819

Yahoo! Inc., NASDAQ

YHOO

82.7

-0.12(-0.1449%)

2229

-

13:45

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Visa (V) initiated with Buy ratings at Loop Capital

-

13:41

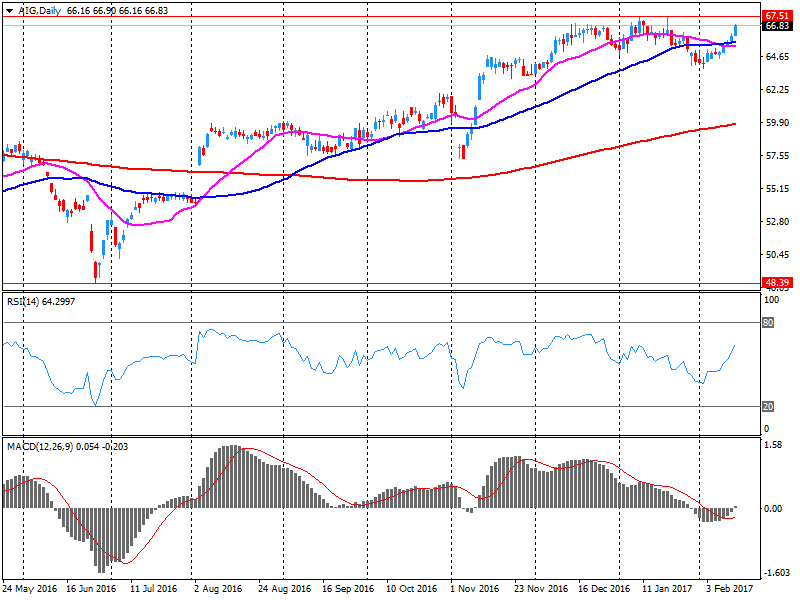

Company News: American Intl (AIG) posts Q4 earnings and authorizes additional $3.5 bln share repurchase

American Intl (AIG) reported Q4 FY 2016 loss of $2.96 per share (versus loss of $1.10 in Q4 FY 2015), missing analysts' consensus estimate of profit of $1.16. The company stated the Q4 results included a $5.6 bln or ($3.56) per share impact from prior year adverse reserve development.

AIG also announced its board of directors authorized an additional increase to its previous repurchase authorization of AIG Common Stock of $3.5 bln, resulting in an aggregate remaining authorization of approximately $4.7 bln.

AIG fell to $63.58 (-4.95%) in pre-market trading.

-

12:02

WSE: Mid session comment

The first half of today's trading brought the attack of supply, which determined the mood and the balance of power in the forenoon trading phase. The mood in the environment also support the supply side - the German DAX reduced earlier upsurge.

At the halfway point of today's quotations the WIG20 index was at the level of 2,173 points (-0.03%).

-

08:52

Green start for major stock exchanges in Europe: FTSE 100 7,293.96 25.40 0.35%, DAX 11,825.96 54.15 0.46%, CAC 40 4,907.19 11.37 0.23%, IBEX 35 9,561.20 51.00 0.54%

-

08:17

WSE: After opening

WIG20 index opened at 2180.23 points (+0.30%)*

WIG 57850.31 0.21%

WIG30 2530.16 0.23%

mWIG40 4801.48 0.02%

*/ - change to previous close

The beginning of trading in the Warsaw market, as well as in European markets, took place in an optimistic atmosphere. New records in the United States help for the continuation of the rally and the mood of investors remain very positive. One downside is the fact that the increase in the index is done at low turnover.

After fifteen minutes of trading the WIG 20 index was at the level of 2,183 points (+0,42%).

-

07:26

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.7%, CAC40 + 0.5%, FTSE + 0.4%

-

07:20

WSE: Before opening

Tuesday's session on Wall Street brought slight increases in the indices, pulled up by financial companies. The Dow Jones Industrial rose at the close of 0.45 percent, the S&P500 went up by 0.40 percent and noted already fifteenth historical peak since the presidential election in the US won by Donald Trump. The Nasdaq Composite gained 0.32 percent.

Janet Yellen in front of the Banking Committee of the US Senate has signaled the possibility of interest rate hike at the March meeting of the Federal Open Market Committee.

In the morning, about 1 percent increases the valuation of the Japanese Nikkei index, which indicates that the atmosphere in the markets remained good, and this should give upward start of the day in Europe. In today's macro calendar the most important macro reports will come from the US economy.

In the currency market this morning brings an attempt to stabilize the exchange rate of PLN. Polish currency is valued as follows: PLN 4.3012 per euro, PLN 4.0653 against the US dollar. Yields on Polish debt amounts to 3.863% in case of 10-year bonds.

-

06:33

Global Stocks

European stock markets struggled to extend its winning run on Tuesday, closing only marginally higher after disappointing economic growth from Germany and the eurozone. The subdued trading activity Tuesday came as investors digested the latest readings on economic growth for Germany and the eurozone, which both came in weaker than expected.

U.S. stocks notched a fourth straight record close Tuesday with a rally in banks after Federal Reserve Chairwoman Janet Yellen signaled that the central bank could gradually raise interest rates sooner rather than later. During Yellen's testimony before the Senate Banking Committee, stocks flipped between small gains and losses but started carving out fresh intraday highs as the testimony wrapped up, adding to three straight days of record closes for the Dow industrials, S&P 500 and the Nasdaq.

Global investors plowed back into Asian equities Wednesday, following a bullish session in the U.S. overnight, after Federal Reserve Chairwoman Janet Yellen sounded upbeat during testimony on Capitol Hill.

-