Market news

-

23:28

Stocks. Daily history for Feb 14’2017:

(index / closing price / change items /% change)

Nikkei -220.17 19238.98 -1.13%

TOPIX -15.08 1539.12 -0.97%

Hang Seng -7.97 23703.01 -0.03%

CSI 300 -0.47 3435.80 -0.01%

Euro Stoxx 50 +3.66 3308.89 +0.11%

FTSE 100 -10.36 7268.56 -0.14%

DAX -2.62 11771.81 -0.02%

CAC 40 +7.63 4895.82 +0.16%

DJIA +92.25 20504.41 +0.45%

S&P 500 +9.33 2337.58 +0.40%

NASDAQ +18.62 5782.57 +0.32%

S&P/TSX +29.45 15786.03 +0.19%

-

21:06

Major US stock indexes rose moderately by the end of today's session

Major US stock indexes finished trading higher, renewing record highs, after Federal Reserve Chairman Janet Yellen reiterated its view that further monetary tightening is warranted if the economy will maintain its growth trajectory.

During his speech to the semi-annual report to the US Senate Banking Committee, the head of the Federal Reserve said that further increases in interest rates will be appropriate if inflation and the labor market will continue to gradually move in the direction of the central bank's forecasts. Ms. Yellen also said that the FOMC members will consider the possibility of further rate hikes in the upcoming meetings. In addition, she stressed the importance of fiscal policy to improve the long-term economic growth, but noted that this is only one of many factors affecting the economic outlook.

The focus of the market was also a report of the US Department of Labor members, who showed that producer prices rose more than expected in January, recording the biggest gain in four years amid rising energy costs and some services. According to the report, the final demand producer price index jumped 0.6% last month, which was the highest growth since September 2012, and following the growth of 0.2% in December. Despite the surge, the producer price index increased in the 12 months prior to January only 1.6%. This followed a similar gain in the 12 months to December. Economists had forecast growth of the producer price index by 0.3% last month and an increase year on year to 1.5%. The gain largely reflects an increase in prices for commodities such as crude oil, which is currently rising against the backdrop of an ever-growing global economy.

Oil prices rose nearly 0.6% against the efforts by the countries oil producers to reduce the level of black gold. Recall the last OPEC report showed that the cartel has reduced oil production by 890.2 thousand barrels per day as compared to December - up to 32.139 million barrels. Total production (including countries outside OPEC) decreased by 1,146 million barrels of promised 1,254,000. Thus, the OPEC agreement executed on 90%. However, increasing the volume of production from the US continues to put pressure on the price of oil.

DOW index components closed mostly in positive territory (22 of 30). Most remaining shares fell Chevron Corporation (CVX, -1.14%). leaders of growth were shares of JPMorgan Chase & Co. (JPM, + 1.71%).

Sector S & P index closed trading mixed. Most consumer goods sector fell (-0.9%). Maximizing demonstrated the health sector (+ 0.7%).

At the close:

Dow + 0.44% 20,501.33 +89.17

Nasdaq + 0.32% 5,782.57 +18.61

S & P + 0.40% 2,337.45 +9.20

-

20:00

DJIA +0.27% 20,467.63 +55.47 Nasdaq +0.16% 5,772.96 +9.00 S&P +0.23% 2,333.63 +5.38

-

17:14

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes fluctuated near records on Tuesday after the Fed's Chair Janet Yellen reiterated her thought that further tightening is warranted if the economy maintains its growth trajectory.

A majority of Dow stocks in negative area (16 of 30). Top loser - Chevron Corporation (CVX, -1.69%). Top gainer - The Goldman Sachs Group (GS, +1.13%).

All S&P sectors, but for Financials (+0.34%), in negative area. Top loser - Consumer goods (-0.3%).

At the moment:

Dow 20385.00 +2.00 +0.01%

S&P 500 2324.25 -2.00 -0.09%

Nasdaq 100 5254.75 -4.50 -0.09%

Crude Oil 53.12 +0.19 +0.36%

Gold 1226.40 +0.60 +0.05%

U.S. 10yr 2.50 +0.07

-

17:00

European stocks closed: FTSE 100 -10.36 7268.56 -0.14% DAX -2.62 11771.81 -0.02% CAC 40 +7.63 4895.82 +0.16%

-

16:42

WSE: Session Results

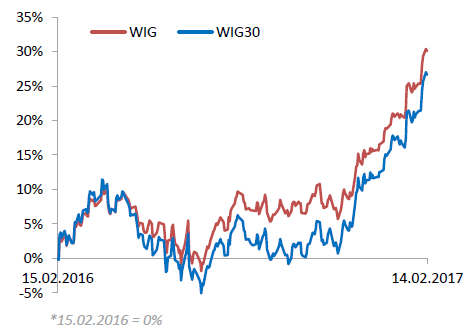

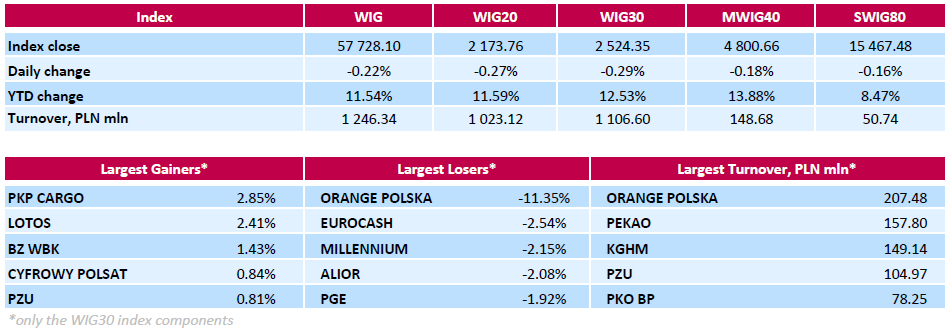

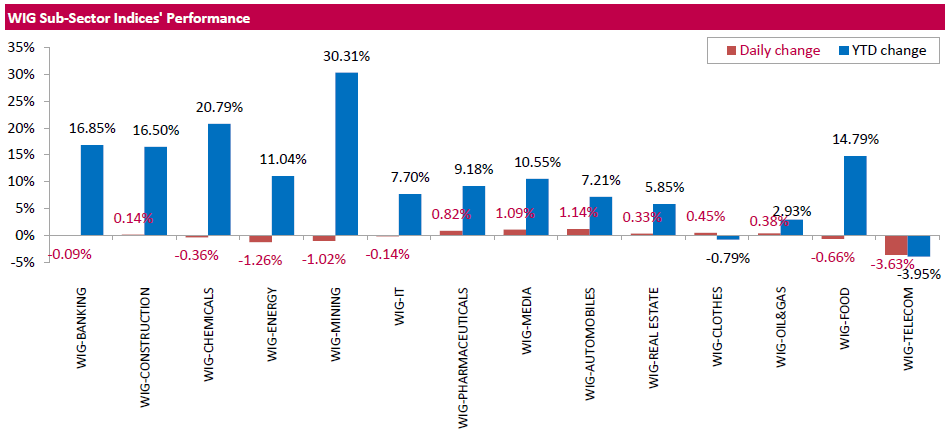

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, lost 0.22%. From a sector perspective, telecoms stocks (-3.63%) underperformed, while automobiles names (1.14%) fared the best.

The large-cap stocks' measure, the WIG30 Index, fell by 0.29%. In the index basket, telecommunication services provider ORANGE POLSKA (WSE: OPL) was hit the hardest, down 11.35%, as the company announced it ended Q4 with net loss of PLN 1.898 bln, while analysts' consensus estimate suggested loss of PLN 108.1 mln. For the full 2016 year, the company reported net loss of PNL 1.746 bln, while analyst's expected net profit of PLN 48 mln. Other major underperformers were FMCG-wholesaler EUROCASH (WSE: EUR) and two banking names MILLENNIUM (WSE: MIL) and ALIOR (WSE: ALR), tumbling by 2.54%, 2.15% and 2.08% respectively. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) and oil refiner LOTOS (WSE: LTS) recorded the biggest daily gains, surging by 2.85% and 2.41% respectively.

-

14:53

WSE: After start on Wall Street

The American market started trading slightly down, which corresponds to the global sentiment. Investors are waiting for Janet Yellen, who at 16.00 (Warsaw time) will present a semi-annual report on the monetary policy in front of the US Senate Banking Committee.

An hour before the close of trading in Warsaw the WIG20 index was at the level of 2,175 points (-0,17%) and the turnover in the segment of the largest companies was amounted to PLN 753 million.

-

14:34

U.S. Stocks open: Dow -0.10%, Nasdaq -0.20%, S&P -0.14%

-

14:29

Before the bell: S&P futures -0.01%, NASDAQ futures -0.04%

U.S. stock-index futures were flat as investors awaited the Fed's Chair speech.

Global Stocks:

Nikkei 19,238.98 -220.17 -1.13%

Hang Seng 23,703.01 -7.97 -0.03%

Shanghai 3,218.38 +1.55 +0.05%

FTSE 7,277.70 -1.22 -0.02%

CAC 4,890.07 +1.88 +0.04%

DAX 11,765.53 -8.90 -0.08%

Crude $53.21 (+0.53%)

Gold $1,233.80 (+0.65%)

-

14:02

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

38.5

0.02(0.052%)

26926

Amazon.com Inc., NASDAQ

AMZN

836.2

-0.33(-0.0394%)

8735

AMERICAN INTERNATIONAL GROUP

AIG

66.39

0.25(0.378%)

450

Apple Inc.

AAPL

133.12

-0.17(-0.1275%)

118722

Barrick Gold Corporation, NYSE

ABX

19.66

0.24(1.2358%)

51470

Boeing Co

BA

168.05

0.02(0.0119%)

1922

Caterpillar Inc

CAT

98.51

0.01(0.0102%)

1476

Chevron Corp

CVX

113.11

0.28(0.2482%)

1657

Cisco Systems Inc

CSCO

31.98

0.01(0.0313%)

1969

Citigroup Inc., NYSE

C

59.06

0.11(0.1866%)

28426

E. I. du Pont de Nemours and Co

DD

77.59

-0.23(-0.2956%)

101

Exxon Mobil Corp

XOM

83.2

0.20(0.241%)

7161

Facebook, Inc.

FB

133.9

-0.15(-0.1119%)

34832

Ford Motor Co.

F

12.67

0.11(0.8758%)

338116

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.76

-0.20(-1.2531%)

180224

General Electric Co

GE

30.1

0.06(0.1997%)

18388

General Motors Company, NYSE

GM

36.85

1.33(3.7444%)

1476937

Goldman Sachs

GS

246.52

0.25(0.1015%)

1733

Google Inc.

GOOG

820.5

1.26(0.1538%)

1498

Intel Corp

INTC

35.85

0.05(0.1397%)

160041

International Business Machines Co...

IBM

179.4

0.04(0.0223%)

562

Johnson & Johnson

JNJ

115.91

0.03(0.0259%)

336

JPMorgan Chase and Co

JPM

88.29

0.14(0.1588%)

16005

McDonald's Corp

MCD

125.4

-0.14(-0.1115%)

1594

Merck & Co Inc

MRK

64.74

-0.03(-0.0463%)

827

Microsoft Corp

MSFT

64.43

0.10(0.1554%)

11030

Nike

NKE

55.8

-0.29(-0.517%)

1306

Pfizer Inc

PFE

32.69

0.08(0.2453%)

537

Procter & Gamble Co

PG

88.3

-0.01(-0.0113%)

408

Starbucks Corporation, NASDAQ

SBUX

56

-0.11(-0.196%)

2069

Tesla Motors, Inc., NASDAQ

TSLA

279.45

-1.15(-0.4098%)

34810

The Coca-Cola Co

KO

40.55

-0.07(-0.1723%)

7666

Twitter, Inc., NYSE

TWTR

15.9

0.09(0.5693%)

58265

Verizon Communications Inc

VZ

48.53

-0.02(-0.0412%)

11859

Visa

V

86.52

0.08(0.0925%)

1110

Walt Disney Co

DIS

109.35

-0.30(-0.2736%)

1554

Yandex N.V., NASDAQ

YNDX

23.09

0.12(0.5224%)

5914

-

08:40

Major stock markets in Europe trading lower: FTSE -0.2%, DAX -0.2%, CAC40 -0.1%

-

08:17

WSE: After opening

WIG20 index opened at 2181.34 points (+0.08%)*

WIG 57905.43 0.08%

WIG30 2532.58 0.03%

mWIG40 4813.48 0.08%

*/ - change to previous close

The cash market opened with an increase but Orange (WSE: OPL) did not take part in this quotation due to the suspension of trading. The level of turnover was high and at the first was focused on KGHM, but after the start of trading of Orange values, they generate the highest activity and lowering market, which consequently loses more than 0.7%. The environment is calmer and the German DAX is trading at neutral levels.

After fifteen minutes of trading the WIG20 index was at the level of 2,164 points (-0,69%).

-

07:32

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.1%

-

07:27

WSE: Before opening

Yesterday's session on Wall Street brought another consecutive record highs in main indices and the market continues the "Trump rally". The Dow Jones Industrial rose at the close of 0.70 percent, the S&P500 went up by 0.52 percent and the Nasdaq Comp. gained 0.52 percent.

In the morning, we may notice a scratch on the growth wave of capital markets, it is the Japanese Nikkei, which falls by more than 1%. On the other Asian parquets there is also some caution, though losses are rather cosmetic. Contracts in the US in the morning go slightly down and may cool the mood of the Old Continent.

On the Warsaw market worse can cope today Orange (WSE: OPL), which due to a large write-off reported a loss in the fourth quarter of nearly PLN 2 billion. In addition, they do not intend to recommend the payment of a dividend. This can be a tough day for Orange, as dividend is the main incentive to hold its shares.

In the afternoon, Janet Yellen will present a semi-annual report on monetary policy. An important issue will be the attitude to March as the date for a potential increase in interest rates.

In Europe, we will see a series of data on GDP and ZEW index in Germany, which, however, should not affect moods noticeably.

-

06:28

Global Stocks

European stocks rose on Monday, with the benchmark index ending at a more-than-one-year closing high, as investors interpreted U.S. President Donald Trump's recent meetings with international dignitaries as signaling a softer foreign-policy stance. On Monday, investors turned their attention back to the U.S. and the latest actions by Trump. The U.S. president over the weekend eased concerns of trade wars with Japan, saying the "United States of America stands behind Japan, its great ally, 100%" as he met with the country's prime minister, Shinzo Abe.

Asian stocks largely slipped Tuesday amid caution ahead of U.S. Federal Reserve Chairwoman Janet Yellen's upcoming congressional testimony, as signs build that the Trump-driven reflation trade is back. In the U.S. overnight, the Dow Jones Industrial Average, the S&P 500, the Nasdaq Composite and the Russell 2000 all reached record highs.

U.S. stocks extended gains on Monday, with major indexes closing at records for a third session in a row as financial and industrial stocks paved the way to higher ground. "Even though we have social unrest and building geopolitical tensions, the market refuses to fall in any meaningful fashion, which means there remains a very strong underlying bid in the market," said Adam Sarhan, chief executive officer of 50 Park Investments.

-