Market news

-

23:27

Stocks. Daily history for Feb 13’2017:

(index / closing price / change items /% change)

Nikkei +80.22 19459.15 +0.41%

TOPIX +7.64 1554.20 +0.49%

Hang Seng +136.00 23710.98 +0.58%

CSI 300 +22.78 3436.27 +0.67%

Euro Stoxx 50 +34.40 3305.23 +1.05%

FTSE 100 +20.17 7278.92 +0.28%

DAX +107.46 11774.43 +0.92%

CAC 40 +59.87 4888.19 +1.24%

DJIA +0.00 20412.16 +0.00%

S&P 500 +12.15 2328.25 +0.52%

NASDAQ +29.83 5763.96 +0.52%

S&P/TSX +27.46 15756.58 +0.17%

-

21:06

Major US stock indexes finished trading in the "green zone"

Major US stock indexes again renewed record highs, and the total capitalization of the S & P 500 index companies reached $ 20 trillion for the first time in history against the backdrop of Trump comments on tax reform. The US president vowed on Thursday that will make an important statement about the tax reform in the next few weeks, sparking a rally that stalled amid concerns about protectionist attitudes and the lack of clarity with regard to political reforms.

Later, important data, including the producer price index (Tuesday), retail sales, consumer price index and industrial production (Wednesday), as well as the laying of new homes (Thursday) will be released this week. In addition, the focus of attention of market participants gradually shifted to the semi-annual report of the Federal Reserve Chairman Janet Yellen. The head of the Federal Reserve will act to Congress on Tuesday and Wednesday.

Oil prices fell nearly 2 percent, as positive from the OPEC report was offset by signs of increasing production of oil in the United States and a stronger dollar. The pressure on oil futures continued to Baker Hughes' report on the number in the US rig. Recall, on Friday in Baker Hughes reported that according to the results ended February 10 working weeks, the number of drilling rigs in the country has increased by 12 units, or 1.6%, to 741 units, including oil - 8 units, or 1 , 4%, to 591 pieces (up to October 2015), the number of gas-producing plants has increased by 4 points, or 2.8%, to 149 units.

DOW index components closed mostly in positive territory (25 of 30). leaders of growth were shares of Caterpillar Inc. (CAT, + 2.32%). Most remaining shares fell Verizon Communications Inc. (VZ, -0.82%).

All business sectors S & P index ended the session in positive territory. The leader turned out to be the financial sector (+ 0.9%).

At the close:

Dow + 0.70% 20,412.13 +142.76

Nasdaq + 0.52% 5,763.96 +29.83

S & P + 0.52% 2,328.24 +12.14

-

20:00

DJIA +0.75% 20,420.56 +151.19 Nasdaq +0.54% 5,765.35 +31.22 S&P +0.54% 2,328.69 +12.59

-

18:26

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes hit record intraday highs on Monday, with the S&P 500's market capitalization topping $20 trillion for the first time ever, as the "Trump trade" was jump-started on renewed optimism about the economy. President Donald Trump vowed last Thursday to make a major tax announcement in the next few weeks, rekindling a rally that has stalled amid concerns over his protectionist stance and lack of clarity on policy reforms.

Most of Dow stocks in positive area (23 of 30). Top loser - Verizon Communications Inc. (VZ, -1.01%). Top gainer - Caterpillar Inc. (CAT, +2.56%).

Most of S&P sectors in positive area. Top gainer - Financials (+0.9%). Top loser - Conglomerates (-0.6%).

At the moment:

Dow 20365.00 +142.00 +0.70%

S&P 500 2325.75 +13.00 +0.56%

Nasdaq 100 5254.50 +27.75 +0.53%

Oil 52.87 -0.99 -1.84%

Gold 1225.30 -10.60 -0.86%

U.S. 10yr 2.44 +0.03

-

17:00

European stocks closed: FTSE 100 +20.17 7278.92 +0.28% DAX +107.46 11774.43 +0.92% CAC 40 +59.87 4888.19 +1.24%

-

16:33

WSE: Session Results

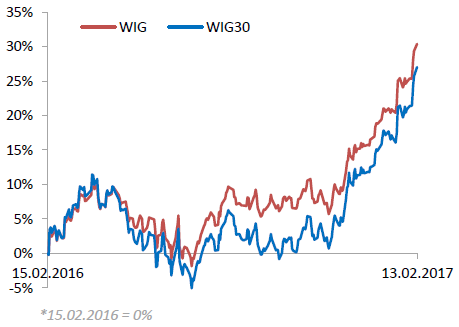

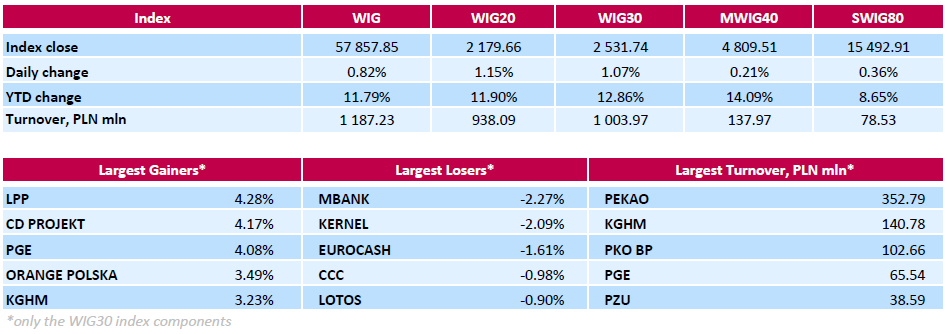

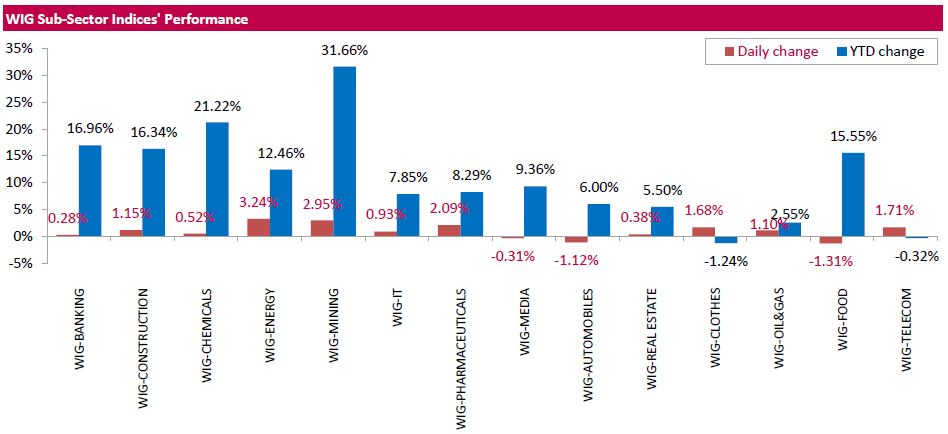

Polish equity market closed higher on Monday. The broad market measure, the WIG Index, surged by 0.82%. The WIG sub-sector indices were mainly higher with energy stocks (+3.24%) outperforming.

The large-cap stocks' measure, the WIG30 Index, advanced 1.07%. Over 2/3 of all index components returned gains, with the way up led by clothing retailer LPP (WSE: LPP), videogame developer CD PROJEKT (WSE: CDR) and genco PGE (WSE: PGE), jumping by 4.28%, 4.17% and 4.08% respectively. PGE released it estimated its 2016 net profit to amount to PLN 2.45 bln ($604.95 mln) compared to a PLN 3-billion loss in 2015. Other major gainers were telecommunication services provider ORANGE POLSKA (WSE: OPL), copper producer KGHM (WSE: KGH) and three utilities names ENEA (WSE: ENA), ENERGA (WSE: ENG) and TAURON PE (WSE: TPE), surging by 2.38%-3.49%. On the other side of the ledger, bank MBANK (WSE: MBK) and agricultural producer KERNEL (WSE: KER) topped decliners' list, falling by 2.27% and 2.09% respectively.

-

14:51

WSE: After start on Wall Street

The Americans started the new week on continued upward movement, encouraged by, among others, today's optimism in Europe. All three major indexes begin trading from new historical records.

In Warsaw market, an hour before the close of trading the WIG20 index was at the level of 2,175 points (+0,98%) and the turnover in the segment of blue chips was amounted to PLN 750 million.

-

14:34

U.S. Stocks open: Dow +0.37%, Nasdaq +0.38%, S&P +0.31%

-

14:29

Before the bell: S&P futures +0.22%, NASDAQ futures +0.17%

U.S. stock-index futures advanced, as stocks continued to be supported by President Donald Trump's promise to unveil a "phenomenal" tax reform plan in the coming weeks.

Global Stocks:

Nikkei 19,459.15 +80.22 +0.41%

Hang Seng 23,710.98 +136.00 +0.58%

Shanghai 3,217.22 +20.52 +0.64%

FTSE 7,271.98 +13.23 +0.18%

CAC 4,892.47 +64.15 +1.33%

DAX 11,787.62 +120.65 +1.03%

Crude $53.45 (-0.76%)

Gold $1,228.00 (-0.64%)

-

13:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

179.72

0.72(0.4022%)

833

ALTRIA GROUP INC.

MO

29.84

0.12(0.4038%)

20870

Amazon.com Inc., NASDAQ

AMZN

832.51

5.05(0.6103%)

27010

American Express Co

AXP

78.68

0.20(0.2548%)

401

AMERICAN INTERNATIONAL GROUP

AIG

65.81

0.20(0.3048%)

738

Apple Inc.

AAPL

29.84

0.12(0.4038%)

20870

AT&T Inc

T

244.21

1.49(0.6139%)

9445

Barrick Gold Corporation, NYSE

ABX

19.18

-0.31(-1.5906%)

48403

Boeing Co

BA

165

-1.23(-0.7399%)

9011

Chevron Corp

CVX

113.41

0.36(0.3184%)

3206

E. I. du Pont de Nemours and Co

DD

77.14

0.31(0.4035%)

1482

Facebook, Inc.

FB

244.21

1.49(0.6139%)

9445

Ford Motor Co.

F

12.54

0.03(0.2398%)

30737

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

29.84

0.12(0.4038%)

20870

General Electric Co

GE

29.84

0.12(0.4038%)

20870

General Motors Company, NYSE

GM

29.84

0.12(0.4038%)

20870

Goldman Sachs

GS

244.21

1.49(0.6139%)

9445

Google Inc.

GOOG

117.64

-2.09(-1.7456%)

5526

Home Depot Inc

HD

140.5

0.65(0.4648%)

1379

Intel Corp

INTC

35.41

0.07(0.1981%)

5557

International Business Machines Co...

IBM

178.92

0.24(0.1343%)

2501

International Paper Company

IP

117.64

-2.09(-1.7456%)

5526

Johnson & Johnson

JNJ

244.21

1.49(0.6139%)

9445

JPMorgan Chase and Co

JPM

87.34

0.34(0.3908%)

17616

Microsoft Corp

MSFT

64.11

0.11(0.1719%)

12664

Nike

NKE

29.84

0.12(0.4038%)

20870

Pfizer Inc

PFE

32.39

0.04(0.1236%)

5315

Procter & Gamble Co

PG

88.35

0.38(0.432%)

1543

Tesla Motors, Inc., NASDAQ

TSLA

117.64

-2.09(-1.7456%)

5526

The Coca-Cola Co

KO

40.72

0.14(0.345%)

18129

Travelers Companies Inc

TRV

117.64

-2.09(-1.7456%)

5526

Twitter, Inc., NYSE

TWTR

15.62

0.04(0.2567%)

209770

United Technologies Corp

UTX

117.64

-2.09(-1.7456%)

5526

UnitedHealth Group Inc

UNH

160.69

-0.06(-0.0373%)

2854

Verizon Communications Inc

VZ

29.84

0.12(0.4038%)

20870

Visa

V

86.22

0.32(0.3725%)

2043

Wal-Mart Stores Inc

WMT

29.84

0.12(0.4038%)

20870

Walt Disney Co

DIS

109.22

-0.04(-0.0366%)

5752

Yandex N.V., NASDAQ

YNDX

29.84

0.12(0.4038%)

20870

-

13:55

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Travelers (TRV) downgraded to Mkt Perform from Outperform at FBR & Co.; target $119

Boeing (BA) downgraded to Underperform from Neutral at Buckingham Research

Other:

Apple (AAPL) target raised to $150 from $133 at Goldman

-

12:03

WSE: Mid session comment

The light consolidation on the Warsaw market in the first hour of trading was a base for further expansion of the upward move, which ultimately resulted in increases above 1% for the WIG20 index. The driving force behind growth is today the energy sector, where an actuating impulse proved to be the results of PGE.

At the halfway point of quotations the WIG20 index stood at the level of 2,181 points (+1,26%). The turnover is satisfactory and in the segment of the largest companies was amounted to more than PLN 350 million.

-

11:51

Major European stock indices trading in positive territory

The stock indexes in Western Europe are rising for a fifth straight session, while the British FTSE 100 rose to 4 weeks high due to the rise in quotations of mining companies.

The composite index of the largest companies in the region Stoxx Europe 600 rose by 0.3% - to 368.50 points.

Mining stocks rise in price on Monday due to the rise in copper and iron ore prices.

Mining sector index gained 1.3%, before reaching August 2014 highs, after the price of copper rose to 20 months high because of concerns about supplies.

Price of Rio Tinto shares rose by 12%, BHP Billiton +2,1%, Anglo American rose 1,9%, Fresnillo +1.5%.

Investors also reacted to the results of the meeting between Donald Trump and Japanese Prime Minister Shinzo Abe. "The United States supports its ally", - said D.Tramp, which reduced fears about the complications of trade relations between the two countries.

Today will be held a meeting between D.Trump with the Prime Minister of Canada Justin Trudeau.

"Investors have calmed down since Trump previous position caused some concern, not to mention the prospects of the deterioration of trade relations with the region and the overall protection of foreign policy", - says Ekrlem Craig, senior analyst at Oanda.

The market value of pharmaceutical company Stada Arzneimittel AG jumped 13% after the company announced the 2 proposals to purchase one of which - from a private investment company Cinven Partners LLP.

Share of Royal Bank of Scotland rose 1.3%. The Bank has announced plans to cut $ 1 billion in costs annually.

Saab shares fell by 5.5%, as the company's financial performance for the fourth quarter of last year fell short of market expectations.

At the moment:

FTSE 7262.45 3.70 0.05%

DAX 11734.46 67.49 0.58%

CAC 4864.25 35.93 0.74%

-

08:59

Major stock markets in Europe trading in the green zone: FTSE 100 7,270.18 11.43 0.16%, DAX 11,696.73 29.76 0.26%, CAC 40 4,845.27 16.95 0.35%, IBEX 35 9,407.80 29.70 0.32%, Stoxx 600 368.23 0.84 0.23%

-

08:17

WSE: After opening

WIG20 index opened at 2161.17 points (+0.30%)*

WIG 57658.42 0.48%

WIG30 2518.87 0.55%

mWIG40 4809.77 0.22%

*/ - change to previous close

The cash market (the WIG20 index) opened with increase of 0.3% at a high turnover focused on gaining KGHM shares. It also stands out the PGE, which published better than expected results. This situation supports other energy companies. As a result, we are dealing with another positive opening and enlargement of growth after the first transaction.

After fifteen minutes of trading the WIG20 index was at the level of 2,163 points (+0,39%).

-

07:31

Positive start of trading expected on the major stock exchanges in Europe: DAX + 0.6%, CAC40 + 0.5%, FTSE + 0.2%

-

07:20

WSE: Before opening

Friday's session on the New York stock exchange ended with increases in the major indexes. Dow Jones, S & P 500 and Nasdaq once again reached historical peaks. The market received a positive announcement rapid presentation by Donald Trump's plan for tax cuts, which are to stimulate the economy to faster growth.

This morning brings a slight growth in Asian markets, which results in a slight increase of contracts in the US and promises an optimistic start in Europe. In addition, the price of copper is rising an is the highest since May 2015.

-

06:31

Global Stocks

European stocks advanced for a fourth straight day on Friday, boosted by optimism over strong export data from China and a round of upbeat corporate results. Mining companies helped propel the index higher on Friday, after China said its exports jumped 7.9% in January, up from a 6.1% drop in December. As China is a major user of natural resources, any hint of strong economic growth in the country tends to buoy the commodity sector.

U.S. stock-market indexes registered fresh records Friday and posted a third straight weekly gain, as investors focused on President Donald Trump's pledge to move quickly on changes to the tax code-which has the potential to deliver a jolt to corporate earnings. Friday's record closes come a day after all three main indexes closed at all-time highs, after Trump promised to announce a "phenomenal" tax policy in a few weeks.

Global stocks kicked off the week on a positive note, with markets in Asia extending gains, as recent actions by President Donald Trump helped soothe investor worries about ties between the U.S. and its key Asian trading partners. At a joint appearance over the weekend with Japanese Prime Minister Shinzo Abe, Trump said that the "United States of America stands behind Japan, its great ally, 100%," following the launch of a ballistic missile by North Korea that landed in the Sea of Japan.

-