Market news

-

23:26

Currencies. Daily history for Feb 13’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0597 -0,38%

GBP/USD $1,2524 +0,32%

USD/CHF Chf1,0056 +0,29%

USD/JPY Y113,72 +0,33%

EUR/JPY Y120,53 -0,03%

GBP/JPY Y142,42 +0,65%

AUD/USD $0,7639 -0,45%

NZD/USD $0,7174 -0,28%

USD/CAD C$1,307 -0,11%

-

23:03

Schedule for today, Tuesday, Feb 14’2017 (GMT0)

00:30 Australia National Australia Bank's Business Confidence January 6

01:30 China PPI y/y January 5.5% 6.3%

01:30 China CPI y/y January 2.1% 2.4%

04:30 Japan Industrial Production (MoM) (Finally) December 1.5% 0.5%

04:30 Japan Industrial Production (YoY) (Finally) December 4.6% 3%

07:00 Germany CPI, m/m (Finally) January 0.7% -0.6%

07:00 Germany CPI, y/y (Finally) January 1.7% 1.9%

07:00 Germany GDP (QoQ) (Preliminary) Quarter IV 0.2% 0.5%

07:00 Germany GDP (YoY) (Preliminary) Quarter IV 1.5% 1.7%

08:15 Switzerland Producer & Import Prices, m/m January 0.2%

08:15 Switzerland Producer & Import Prices, y/y January 0.0%

08:15 Switzerland Consumer Price Index (MoM) January -0.1%

08:15 Switzerland Consumer Price Index (YoY) January 0.0% 0.3%

09:30 United Kingdom Producer Price Index - Output (MoM) January 0.1% 0.4%

09:30 United Kingdom Producer Price Index - Output (YoY) January 2.7% 3.2%

09:30 United Kingdom Producer Price Index - Input (MoM) January 1.8% 0.6%

09:30 United Kingdom Producer Price Index - Input (YoY) January 15.8% 18%

09:30 United Kingdom Retail Price Index, m/m January 0.6% -0.4%

09:30 United Kingdom Retail prices, Y/Y January 2.5% 2.8%

09:30 United Kingdom HICP, m/m January 0.5% -0.5%

09:30 United Kingdom HICP, Y/Y January 1.6% 1.9%

09:30 United Kingdom HICP ex EFAT, Y/Y January 1.6% 1.8%

10:00 Eurozone Industrial production, (MoM) December 1.5% -1.5%

10:00 Eurozone Industrial Production (YoY) December 3.2% 1.7%

10:00 Eurozone ZEW Economic Sentiment February 23.2

10:00 Eurozone GDP (QoQ) (Revised) Quarter IV 0.3% 0.5%

10:00 Eurozone GDP (YoY) (Revised) Quarter IV 1.7% 1.8%

10:00 Germany ZEW Survey - Economic Sentiment February 16.6 15

13:30 U.S. PPI, m/m January 0.3% 0.3%

13:30 U.S. PPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. PPI, y/y January 1.6% 1.6%

13:30 U.S. PPI excluding food and energy, Y/Y January 1.6% 1.1%

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

23:30 Australia Westpac Consumer Confidence February 97.4

-

21:46

New Zealand: Food Prices Index, y/y, January 1.4%

-

14:48

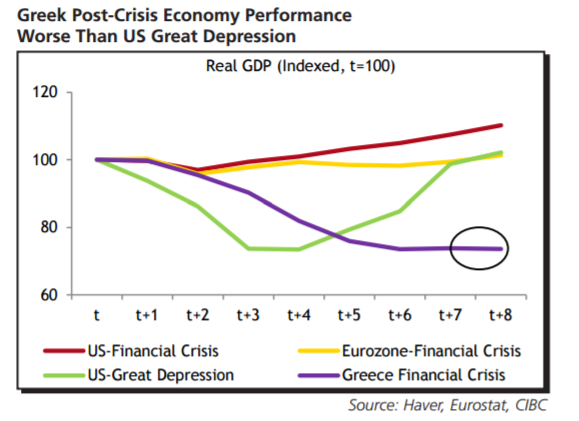

Forces likely to keep euro subdued near term - CIBC

"Although Eurozone growth has accelerated recently, there's reason to remain cautious on the currency in the near-term.

With the economy only recently eclipsing its pre-crisis high-water mark, the material output gap will keep monetary policy stimulative for some time. The rise of populism will also weigh on the euro ahead of a number of key elections in the region this year, and Greek debt negotiations are making headlines again.

Relative to its pre-crisis level, the Greek economy is now down by a magnitude similar to the US during the worst of the Great Depression. Greece's plight has been more protracted, in part because Eurozone monetary policy remains too restrictive for the hardest hit countries. If debt negotiations heat up further, expect renewed speculation as to whether Greece would be better off leaving the union".

CIBC targets EUR/USD at 1.04 by the end of Q1.

Copyright © 2017 CIBC, eFXnews™

-

13:49

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

-

13:42

ING Sees EUR/USD Fall to $1.05 This Week, USD/JPY at 115

-

13:00

Orders

EUR/USD

Offers: 1.0680 1.0700-05 1.0730 1.0750

Bids: 1.0620 1.0600 1.0580 1.0550 1.0520 1.0500

GBP/USD

Offers: 1.2550 1.2580 1.2600 1.2630 1.2650 1.2685 1.2700

Bids: 1.2500 1.2480 1.2450 1.2430 1.2400 1.2380 1.2345-50

EUR/GBP

Offers: 0.8520 0.8535 0.8550 0.8585 0.8600 0.8630-35 0.8650

Bids: 0.8480-85 0.8465 0.8450 0.8430 0.8400

EUR/JPY

Offers: 121.35 121.50 121.80 122.00 122.50

Bids: 121.00 120.80 120.50 102.30 120.00 119.75 119.50

USD/JPY

Offers: 113.80 114.00 114.20 114.50 114.75 115.00

Bids: 113.20 113.00 112.80 112.50 112.00

AUD/USD

Offers: 0.7685-90 0.7700 0.7730 0.7750 0.7780 0.7800

Bids: 0.7660 0.7620 0.7600 0.7580 0.7550 0.7520 0.7500

Информационно-аналитический отдел TeleTrade

-

10:07

EU Sees GDP Growth Throughout Bloc in 2016-2018 For The First Time Since 2008 - Dow Jones. Economic forecasts

-

EU Deficit at 1.6% in 2018, In Line With Previous Forecast

-

EU Deficit at 1.7% in 2017, In Line With Previous Forecast

-

EU Unemployment at 7.8% in 2018, Down From 7.9% Previously Forecast

-

EU Unemployment at 8.1% in 2017, Down From 8.3% Previously Forecast

-

EU Inflation at 1.7% in 2018, In Line With Previous Forecast

-

EU Inflation at 1.8% in 2017, Up From 1.6% Previously Forecast

-

Eurozone Inflation at 1.7% in 2017, Up From 1.4% Previously Forecast

-

Eurozone Growth at 1.8% in 2018, Up From 1.7% Previously Forecast

-

European Commission Sees Uncertainty Slowing Business Investment

-

European Commission: Impact in Economy of Brexit Vote Yet to be Felt

-

EU Sees German 2017 GDP +1.6% on Year

-

-

09:53

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

Информационно-аналитический отдел TeleTrade

-

09:38

India’s prospects of still-higher oil prices and core inflation being sticky should prevent the central bank from lowering interest rates any further - DBS

-

08:39

Moody's Investors Service says that liquidity conditions in China's financial system appear to be tightening

"We expect that a combination of tighter liquidity conditions and stricter regulatory scrutiny on the banks' off-balance-sheet activities will curb the banks' incentives to engage in regulatory arbitrage and gradually dampen the fast-growing component of shadow banking activities," says Michael Taylor, a Moody's Managing Director and Chief Credit Officer for Asia Pacific.

On the other hand, demand from shadow bank borrowers will be relatively inelastic to higher interest rates, given the continuing financing needs in sectors such as property, local government financing vehicles and overcapacity industries.

Moody's also says that the composition of credit flows are undergoing important shifts, even while economy-wide leverage continues to increase.

In recent months, credit flows have been sustained by bank lending and "core" shadow banking. Mortgage loans have continued to contribute a rising share of headline bank lending, while in Q4 2016, the growth rate of trust loans registered its first significant increase since mid-2014.

-

08:10

US, South Korea and Japan request UN meeting on North Korea missile launch @Livesquawk

-

08:09

Today’s events

-

At 10:00 GMT Italy will hold an auction of 30-year bonds

-

At 10:00 GMT The European Commission will publish the EU economic forecast

-

At 11:00 GMT the Bundesbank Monthly Report

-

-

07:30

RBS gives 4 reasons for structurally bullish USD against EUR & JPY

"We remain bullish on the dollar expecting the euro and yen to trade in weaker ranges of 1.00-1.10 and 115-125 this year.

First, US data flow remains consistent with the Federal Open Market Committee hiking interest rates three times in 2017. January's employment report showed payrolls rising by 227k. Though revisions shaved 39k off the prior two months' payrolls, current job gains are 'well above the pace of 75,000 to 125,000 per month that is probably consistent with keeping the unemployment rate stable over the longer run' as Fed Chair Yellen observed in her January 19 economic outlook speech.

Second, Fed officials continue to see further rate rises this year. The January 31-February 1 FOMC statement was little changed from December's. But policymakers acknowledged the improvement in 'animal spirits' seen since November's elections by adding the line 'measures of consumer and business sentiment have improved of late.' Short term rates markets have little priced for the next FOMC meeting on March 14-15.

Third, market expectations for near term fiscal loosening may have ebbed as the White House and Congress negotiate on border adjustment and corporate and income tax policies. But if the Trump administration finds agreement with the Republican leadership in the next few weeks, the dollar, stocks and Treasury yields will rally sharply again. The new president is due to give a state of the union address on February 28.

Last, the Trump administration's latest immigration policies are unlikely to lead to a sharp re-allocation of Middle East funds away from the US as occurred in 2002 after the Bush administration's response to the September 11 2001 terror attacks. The new restrictions on arrivals from seven Middle East and North African countries did not include citizens from the largest holders of capital in the region - Saudi Arabia, Kuwait, Qatar and the United Arab Emirates.

The main risk in the near term for dollar bulls remains the lack of a clear, near term catalyst from either the Fed or the new US administration to spark a new round of greenback buying.

The next key events will be Yellen's 'Humphrey-Hawkins' testimony on February 14-15 and the FOMC minutes on February 22".

Copyright © 2017 RBS, eFXnews™

-

07:27

ECB's Villeroy: French Don't Wish to Exit from Eurozone

-

French Economic Growth Seen at 1.3% in 2017

-

Exit from Eurozone Would Cost France EUR30B Per Year

-

-

07:25

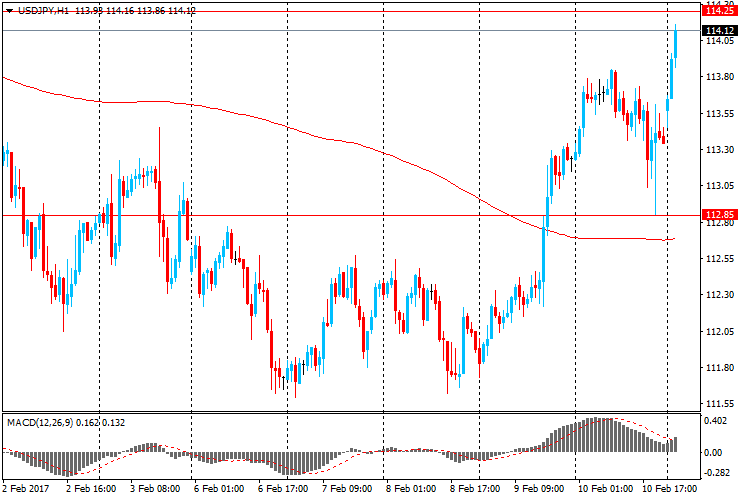

The yen fell after the publication of weaker-than-expected Japanese GDP data

USD / JPY has risen more than 50 points, breaking the level of Y114.00, after Japan's GDP for the fourth quarter, which turned out to be weaker than expected.

According to the Cabinet of Ministers of Japan, Japan's GDP in the fourth quarter, seasonally adjusted, increased by 0.2%, lower than economists forecast and the previous value of 0.3%. On an annualized basis, Japan's economy grew by 1.0%, which is below the forecast of 1.1%. However, the value of the third quarter was revised from 1.3% to 1.4% GDP report expresses the total value of all final goods and services in monetary terms, made by Japan for a certain period of time. This is the main macroeconomic indicators of market activity because it assesses the growth or decline of the economy.

Nominal GDP increased by 0.3% after +0.2% prior. This was an increase for the fourth quarter in a row. The GDP deflator, indicating the rate of inflation, dropped by 0.1%, while analysts expected a decline of -0.2%.

Consumer spending in the fourth quarter remained flat after rising 0.3% in the third quarter, but business spending increased by 0.9% after declining 0.3% previously.

Exports expanded rapidly since the fourth quarter of 2014. The contribution of external demand to GDP was + 0.2%, domestic demand flat.

-

07:16

German selling prices in wholesale trade increased by 4.0% in January

As reported by the Federal Statistical Office (Destatis), the selling prices in wholesale trade increased by 4.0% in January 2017 from the corresponding month of the preceding year. In December 2016 and in November 2016 the annual rates of change were +2.8% and +0.8%, respectively. From December 2016 to January 2017 the index rose by 0.8%.

-

06:02

Options levels on monday, February 13, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0751 (2697)

$1.0702 (2711)

$1.0672 (1349)

Price at time of writing this review: $1.0627

Support levels (open interest**, contracts):

$1.0592 (3471)

$1.0569 (3657)

$1.0541 (4868)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 67892 contracts, with the maximum number of contracts with strike price $1,0800 (4937);

- Overall open interest on the PUT options with the expiration date March, 13 is 79417 contracts, with the maximum number of contracts with strike price $1,0000 (5089);

- The ratio of PUT/CALL was 1.17 versus 1.17 from the previous trading day according to data from February, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (2986)

$1.2704 (2184)

$1.2607 (2146)

Price at time of writing this review: $1.2499

Support levels (open interest**, contracts):

$1.2392 (1894)

$1.2295 (3568)

$1.2197 (1482)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33369 contracts, with the maximum number of contracts with strike price $1,2500 (3518);

- Overall open interest on the PUT options with the expiration date March, 13 is 37066 contracts, with the maximum number of contracts with strike price $1,2300 (3568);

- The ratio of PUT/CALL was 1.11 versus 1.13 from the previous trading day according to data from February, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-