Market news

-

23:27

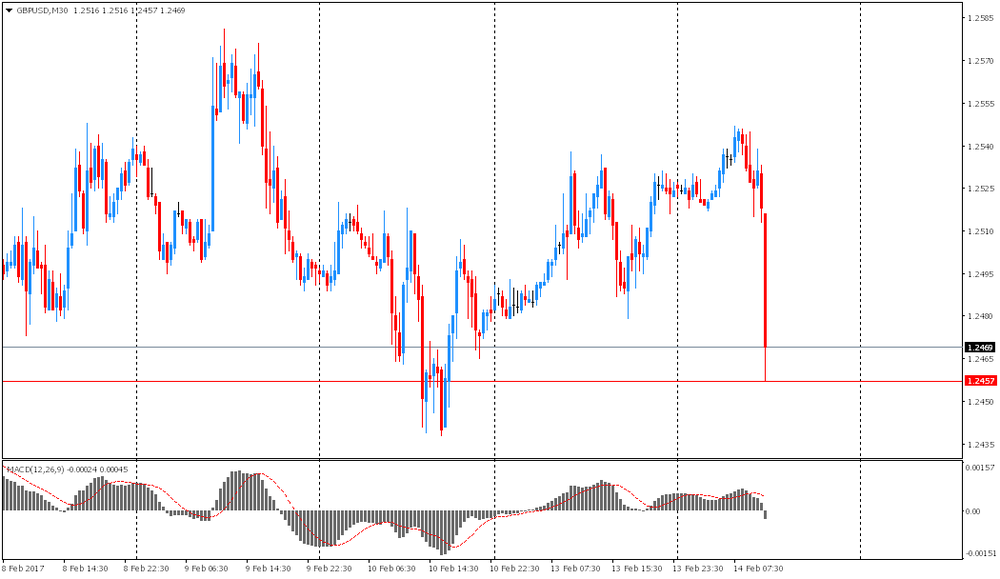

Currencies. Daily history for Feb 14’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0576 -0,20%

GBP/USD $1,2466 -0,47%

USD/CHF Chf1,0061 +0,05%

USD/JPY Y114,24 +0,46%

EUR/JPY Y120,83 +0,25%

GBP/JPY Y142,42 0,00%

AUD/USD $0,7661 +0,29%

NZD/USD $0,7166 -0,11%

USD/CAD C$1,3074 +0,03%

-

22:59

Schedule for today, Wednesday, Feb 15’2017 (GMT0)

00:30 Australia New Motor Vehicle Sales (MoM) January 0.3% 0.2%

00:30 Australia New Motor Vehicle Sales (YoY) January 0.2%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December 2.7% 2.7%

09:30 United Kingdom Average Earnings, 3m/y December 2.8% 2.8%

09:30 United Kingdom Claimant count January -10.1 0.8

09:30 United Kingdom ILO Unemployment Rate December 4.8% 4.8%

10:00 Eurozone Trade balance unadjusted December 25.9 22.8

13:30 Canada Wholesale Sales, m/m December 0.2%

13:30 Canada Manufacturing Shipments (MoM) December 1.5% 0.2%

13:30 U.S. NY Fed Empire State manufacturing index February 6.5 7

13:30 U.S. Retail sales January 0.6% 0.1%

13:30 U.S. Retail Sales YoY January 4.1%

13:30 U.S. Retail sales excluding auto January 0.2% 0.4%

13:30 U.S. CPI, m/m January 0.3% 0.3%

13:30 U.S. CPI, Y/Y January 2.1% 2.4%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.2% 2.1%

14:15 U.S. Capacity Utilization January 75.5% 75.5%

14:15 U.S. Industrial Production (MoM) January 0.8% 0.1%

14:15 U.S. Industrial Production YoY January 0.5%

15:00 U.S. NAHB Housing Market Index February 67 67

15:00 U.S. Business inventories December 0.7% 0.4%

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories February 13.83

21:00 U.S. Total Net TIC Flows December 23.7

21:00 U.S. Net Long-term TIC Flows December 30.8

-

16:04

Yellen: Fed Will Not Sell Morgage-Backed Securites, Will Allow Maturing Assets to Run Off

-

15:13

Yellen: officials will consider further rate increases 'at our upcoming meetings'. Dollar trading up

-

Changes in Fiscal Policy Could Potentially Affect Economic Outlook

-

Too Early to Know What Policy Changes Will Occur, How Economic Effects Will Unfold

-

Emphasizes Importance of Fiscal Policies To Improve Long-Term Growth, Productivity

-

Fiscal Policy Only One of Many Factors Affecting Economic Outlook

-

Hope Fiscal Policies Consistent With Putting Fiscal Accounts On 'Sustainable Trajectory'

-

U.S. Monetary Policy Remains Accommodative

-

Overall FOMC Policy Will Be Directed to Achieve Fed's Dual Mandate

-

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

-

13:50

US producer prices increased 0.6 percent in January

The Producer Price Index for final demand increased 0.6 percent in January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.2 percent in December and 0.5 percent in November. (See table A.) On an unadjusted basis, the final demand index climbed 1.6 percent for the 12 months ended January 2017.

In January, over 60 percent of the advance in the final demand index is attributable to a 1.0-percent increase in prices for final demand goods. The index for final demand services moved up 0.3 percent.

Prices for final demand less foods, energy, and trade services rose 0.2 percent in January after inching up 0.1 percent in December. For the 12 months ended in January, the index for final demand less foods, energy, and trade services climbed 1.6 percent. -

13:30

U.S.: PPI excluding food and energy, m/m, January 0.4% (forecast 0.2%)

-

13:30

U.S.: PPI, m/m, January 0.6% (forecast 0.3%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, January 1.2% (forecast 1.1%)

-

13:30

U.S.: PPI, y/y, January 1.6% (forecast 1.5%)

-

13:00

Orders

EUR/USD

Offers: 1.0650 1.0680 1.0700-05 1.0730 1.0750

Bids: 1.0600 1.0580-85 1.0550 1.0520 1.0500

GBP/USD

Offers: 1.2550 1.2580 1.2600 1.2630 1.2650 1.2685 1.2700

Bids: 1.2500 1.2480 1.2450 1.2430 1.2400 1.2380 1.2345-50

EUR/GBP

Offers: 0.8485 0.8500 0.8520 0.8535 0.8550-60 0.8600

Bids: 0.8450 0.8430 0.8400 0.8385 0.8350 0.8300

EUR/JPY

Offers: 120.85 121.00 121.35 121.50 121.80 122.00 122.50

Bids: 102.30 120.00 119.75 119.50 119.30 119.00

USD/JPY

Offers: 113.60 113.80 114.00 114.20 114.50 114.75 115.00

Bids: 113.20 113.00 112.80 112.50 112.00

AUD/USD

Offers: 0.7685-90 0.7700 0.7730 0.7750 0.7780 0.7800

Bids: 0.7660 0.7620 0.7600 0.7580 0.7550 0.7520 0.7500

Информационно-аналитический отдел TeleTrade

-

12:32

ECB Could Buy EUR1.57B of Greek Bond Notional Each Month - Dow Jones

-

11:07

The ZEW Indicator of Economic Sentiment for Germany records a decrease of 6.2 points in February

The ZEW Indicator of Economic Sentiment for Germany records a decrease of 6.2 points in February 2017. The indicator now stands at 10.4 points.

"The downturn in expectations is likely to be the result of the recently published unfavourable figures for industrial production, retail sales and exports. Political uncertainty regarding Brexit, the future US economic policy as well as the considerable number of upcoming elections in Europe further depresses expectations. Nevertheless, the economic environment in Germany has not significantly worsened," comments ZEW President Professor Achim Wambach.

-

11:06

-

11:04

Euro area industrial production tops expectations in December

In December 2016 compared with November 2016, seasonally adjusted industrial production fell by 1.6% in the euro area (EA19) and by 1.0% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In November 2016 industrial production rose by 1.5% in the euro area and by 1.6% in the EU28.

In December 2016 compared with December 2015, industrial production increased by 2.0% in the euro area and by 2.9% in the EU28. The average industrial production for the year 2016, compared with 2015, rose by 1.3% in the euro area and by 1.4% in the EU28.

-

11:02

Seasonally adjusted GDP rose by 0.4% in the euro area

Seasonally adjusted GDP rose by 0.4% in the euro area (EA19) and by 0.5% in the EU28 during the fourth quarter of 2016, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2016, GDP also grew by 0.4% and 0.5% respectively.

Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.7% in the euro area and by 1.8% in the EU28 in the fourth quarter of 2016, after +1.8% and +1.9% respectively in the previous quarter.

During the fourth quarter of 2016, GDP in the United States increased by 0.5% compared with the previous quarter (after +0.9% in the third quarter of 2016). Compared with the same quarter of the previous year, GDP grew by 1.9% (after +1.7% in the previous quarter).

-

10:01

Eurozone: ZEW Economic Sentiment, February 17.1 (forecast 22.3)

-

10:00

Eurozone: GDP (QoQ), Quarter IV 0.4% (forecast 0.5%)

-

10:00

Eurozone: Industrial Production (YoY), December 2% (forecast 1.7%)

-

10:00

Eurozone: GDP (YoY), Quarter IV 1.7% (forecast 1.8%)

-

10:00

Eurozone: Industrial production, (MoM), December -1.6% (forecast -1.5%)

-

10:00

Germany: ZEW Survey - Economic Sentiment, February 10.4 (forecast 15)

-

09:38

Both the annual and monthly rate of UK producer price inflation increased in January

Factory gate prices (output prices) rose 3.5% on the year to January 2017, which is the seventh consecutive period of annual price increases and the highest they have been since December 2011.

Prices for materials and fuels paid by UK manufacturers for processing (input prices) rose 20.5% on the year, which is the fastest rate of annual growth since September 2008.

Prices of imported materials and fuels increased 20.2% on the year, largely a result of sterling depreciation and a recovery in global crude oil prices.

-

09:35

UK CPI and Core CPI inflation below expectations. GBP/USD down 50 pips so far

The Consumer Prices Index (CPI) rose by 1.8% in the year to January 2017, compared with a 1.6% rise in the year to December 2016.

The rate in January 2017 was the highest since June 2014.

The main contributors to the increase in the rate were rising prices for motor fuels and to a lesser extent food prices, which were unchanged between December 2016 and January 2017, having fallen a year ago.

These upward pressures were partially offset by prices for clothing and footwear, which fell by more than they did a year ago.

-

09:30

United Kingdom: HICP, Y/Y, January 1.8% (forecast 1.9%)

-

09:30

United Kingdom: Retail Price Index, m/m, January -0.6% (forecast -0.4%)

-

09:30

United Kingdom: Producer Price Index - Output (MoM), January 0.6% (forecast 0.3%)

-

09:30

United Kingdom: HICP, m/m, January -0.5% (forecast -0.5%)

-

09:30

United Kingdom: Producer Price Index - Input (MoM), January 1.7% (forecast 1%)

-

09:30

United Kingdom: Retail prices, Y/Y, January 2.6% (forecast 2.8%)

-

09:30

United Kingdom: Producer Price Index - Output (YoY) , January 3.5% (forecast 3.2%)

-

09:30

United Kingdom: HICP ex EFAT, Y/Y, January 1.6% (forecast 1.8%)

-

09:30

United Kingdom: Producer Price Index - Input (YoY) , January 20.5% (forecast 18.3%)

-

09:16

Italian GDP up 0.2% in Q4 2016

In the fourth quarter of 2016 the seasonally and calendar adjusted, chained volume measure of Gross Domestic Product (GDP) increased by 0.2 per cent with respect to the third quarter of 2016 and by 1.1 per cent in comparison with the fourth quarter of 2015.

-

08:41

Swiss CPI flat in January

The country's consumer price index remained unchanged at 100.0 points in January 2017 compared to the previous month (December 2015 = 100 points). Compared to the previous year, the rate of inflation was 0.3 percent. This is evident from the figures of the Federal Statistical Office (FSO).

The stable monthly result for January 2017 contains opposing tendencies, which are balanced out altogether. Lower prices were observed in January for clothing and shoes, mainly due to the sale. Air travel was also more favorable, while the prices for the hotel industry, fuel and heating oil rose.

-

08:15

Switzerland: Consumer Price Index (YoY), January 0.3% (forecast 0.3%)

-

08:15

Switzerland: Consumer Price Index (MoM) , January 0% (forecast -0.1%)

-

08:15

Switzerland: Producer & Import Prices, y/y, January 0.8% (forecast 0.5%)

-

08:15

Switzerland: Producer & Import Prices, m/m, January 0.4% (forecast 0.3%)

-

08:01

Today’s events

-

At 13:50 GMT FOMC member Jeffrey Lacker will give a speech

-

At 15:00 GMT the Federal Reserve Board of Governors Chairman Janet Yellen speaks

-

At 15:00 GMT the Federal Reserve's Monetary Policy Report

-

At 18:00 GMT FOMC member Robert Kaplan will deliver a speech

-

At 18:15 GMT FOMC member Dennis Lockhart will give a speech

-

-

07:38

Trade of the week from Citi: Sell EUR/USD

Currency investors should consider selling EUR/USD this week, advises CitiFX in its weekly FX pick to clients.

Sell at 1.0615, target 1.0375, stop loss 1.0730," Citi advises.

Citi weekly trades provide short term guidance on where they see 1-2 week opportunities in G10 FX markets. Unless Citi explicitly extends them, they will be closed out automatically at COB the second Friday after they are introduced.

Copyright © 2017 CitiFX, eFXnews™

-

07:24

Fed's Kaplan: Future Rate Rises Likely 'Gradual and Patient'

-

Fed Should Raise Rates as Goals Achieved

-

Moving Sooner Rather Than Later Is Best

-

Moving Sooner Reduces Risk of Falling Behind Curve

-

Fed Making 'Good Progress' in Achieving Goals

-

May Be Scope for Further Job Market Improvement

-

Likely to Achieve 2% Inflation Over Medium Term

-

Expects Economy to Grow by 2.3% in 2017

-

Oil Supply and Demand Likely in Balance in 1H 2017

-

-

07:18

Options levels on tuesday, February 14, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0706 (2036)

$1.0680 (2868)

$1.0645 (1370)

Price at time of writing this review: $1.0614

Support levels (open interest**, contracts):

$1.0572 (3471)

$1.0554 (3628)

$1.0529 (5201)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 69211 contracts, with the maximum number of contracts with strike price $1,0800 (5071);

- Overall open interest on the PUT options with the expiration date March, 13 is 81444 contracts, with the maximum number of contracts with strike price $1,0000 (5109);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from February, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (2986)

$1.2704 (2149)

$1.2608 (2150)

Price at time of writing this review: $1.2534

Support levels (open interest**, contracts):

$1.2491 (2901)

$1.2394 (1944)

$1.2297 (3610)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33321 contracts, with the maximum number of contracts with strike price $1,2500 (3520);

- Overall open interest on the PUT options with the expiration date March, 13 is 37160 contracts, with the maximum number of contracts with strike price $1,2300 (3610);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from February, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

Chinese inflatin above expectations in January

The Consumer Price Index, published by China's National Bureau of Statistics was 1.0% m/m, which is higher than the previous value of 0.2% and economists' forecast of 0.7%. In annual terms, consumer prices rose by 2.5% after rising 2.1% previously.

Prices of non-food products rose by 2.5% y / y, while the price of food + 2.7% y / y

Consumer Price Index - a key indicator of inflation and changes in purchasing trends. Significant growth in the consumer price index is a sign that inflation is becoming a destabilizing factor in the economy and could potentially push the People's Bank of China to tighten monetary policy and fiscal policy.

According to the chief economist at Bank of Communications Lian Ping, a stimulus for the growth of inflation was the celebration of the Lunar New Year which led to an increase in consumption by the population and, consequently, to an increase in prices of food and manufactured goods.

-

07:12

US Said To Eye New Currency Strategy To Pressure China - WSJ

-

07:10

BoJ Gov Kuroda: Won't Change Yield Curve Control Just Because Global Interest Rates Rise @Livesquawk

-

07:08

German CPI down 0.6% in January, as expected

Consumer prices in Germany rose by 1.9% in January 2017 compared with January 2016. The inflation rate as measured by the consumer price index continued to increase at the beginning of the year. In December 2016, it had already been +1.7%. An inflation rate of +1.9% was last recorded in July 2013. Compared with December 2016, the consumer price index fell by 0.6% in January 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 30 January 2017.

-

07:07

The German economy continued its moderate growth at the end of 2016

The German economy continued its moderate growth at the end of 2016. In the fourth quarter of 2016, the gross domestic product (GDP) rose 0.4% on the previous quarter after adjustment for price, seasonal and calendar variations. The economic situation in Germany in 2016 thus was characterised by solid and steady growth (+0.7% in the first quarter, +0.5% in the second quarter and +0.1% in the third quarter). The Federal Statistical Office (Destatis) also reports that this results in a 1.9% increase (calendar-adjusted: +1.8%) for the whole year of 2016. The provisional annual GDP result released in January has been confirmed.

The quarter-on-quarter comparison (upon adjustment for price, seasonal and calendar variations) shows that positive contributions came from domestic demand. General government final consumption expenditure was markedly up, while household final consumption expenditure rose slightly again. A largely positive development was also observed for capital formation. Especially fixed capital formation in construction was markedly up on the third quarter of 2016. According to provisional calculations, the development of foreign trade, however, had a downward effect on growth because the price-adjusted quarter-on-quarter increase in imports was markedly larger than that of exports.

-

07:01

Germany: GDP (YoY), Quarter IV 1.2% (forecast 1.7%)

-

07:00

Germany: CPI, y/y , January 1.9% (forecast 1.9%)

-

07:00

Germany: CPI, m/m, January -0.6% (forecast -0.6%)

-

07:00

Germany: GDP (QoQ), Quarter IV 0.4% (forecast 0.5%)

-

04:32

Japan: Industrial Production (YoY), December 3.2% (forecast 3%)

-

04:31

Japan: Industrial Production (MoM) , December 0.7% (forecast 0.5%)

-

01:30

China: CPI y/y, January 2.5% (forecast 2.4%)

-

01:30

China: PPI y/y, January 6.9% (forecast 6.3%)

-

00:30

Australia: National Australia Bank's Business Confidence, January 10

-