Market news

-

23:29

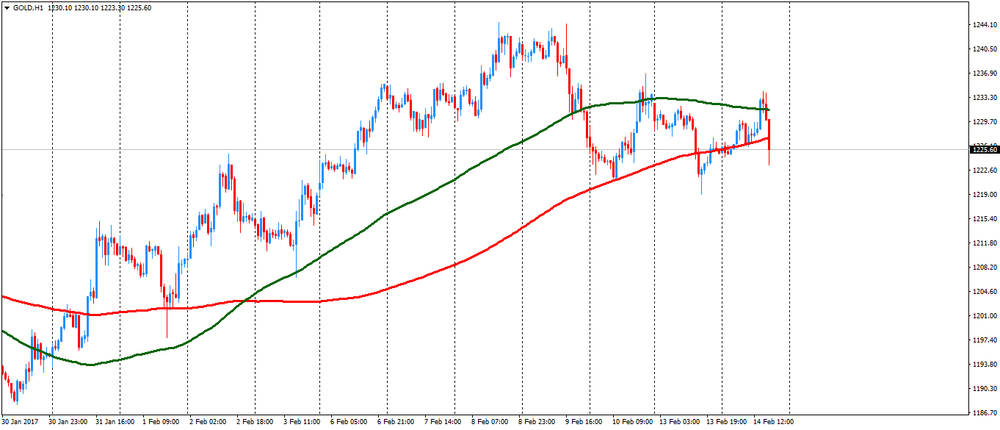

Commodities. Daily history for Feb 14’2017:

(raw materials / closing price /% change)

Oil 53.03 -0.32%

Gold 1,229.20 +0.31%

-

23:28

Stocks. Daily history for Feb 14’2017:

(index / closing price / change items /% change)

Nikkei -220.17 19238.98 -1.13%

TOPIX -15.08 1539.12 -0.97%

Hang Seng -7.97 23703.01 -0.03%

CSI 300 -0.47 3435.80 -0.01%

Euro Stoxx 50 +3.66 3308.89 +0.11%

FTSE 100 -10.36 7268.56 -0.14%

DAX -2.62 11771.81 -0.02%

CAC 40 +7.63 4895.82 +0.16%

DJIA +92.25 20504.41 +0.45%

S&P 500 +9.33 2337.58 +0.40%

NASDAQ +18.62 5782.57 +0.32%

S&P/TSX +29.45 15786.03 +0.19%

-

23:27

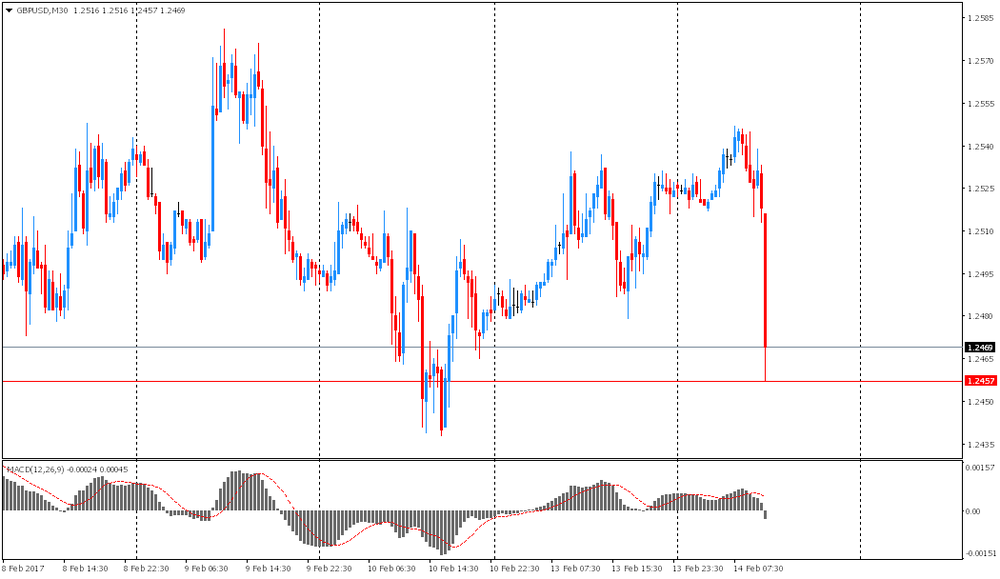

Currencies. Daily history for Feb 14’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0576 -0,20%

GBP/USD $1,2466 -0,47%

USD/CHF Chf1,0061 +0,05%

USD/JPY Y114,24 +0,46%

EUR/JPY Y120,83 +0,25%

GBP/JPY Y142,42 0,00%

AUD/USD $0,7661 +0,29%

NZD/USD $0,7166 -0,11%

USD/CAD C$1,3074 +0,03%

-

22:59

Schedule for today, Wednesday, Feb 15’2017 (GMT0)

00:30 Australia New Motor Vehicle Sales (MoM) January 0.3% 0.2%

00:30 Australia New Motor Vehicle Sales (YoY) January 0.2%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December 2.7% 2.7%

09:30 United Kingdom Average Earnings, 3m/y December 2.8% 2.8%

09:30 United Kingdom Claimant count January -10.1 0.8

09:30 United Kingdom ILO Unemployment Rate December 4.8% 4.8%

10:00 Eurozone Trade balance unadjusted December 25.9 22.8

13:30 Canada Wholesale Sales, m/m December 0.2%

13:30 Canada Manufacturing Shipments (MoM) December 1.5% 0.2%

13:30 U.S. NY Fed Empire State manufacturing index February 6.5 7

13:30 U.S. Retail sales January 0.6% 0.1%

13:30 U.S. Retail Sales YoY January 4.1%

13:30 U.S. Retail sales excluding auto January 0.2% 0.4%

13:30 U.S. CPI, m/m January 0.3% 0.3%

13:30 U.S. CPI, Y/Y January 2.1% 2.4%

13:30 U.S. CPI excluding food and energy, m/m January 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y January 2.2% 2.1%

14:15 U.S. Capacity Utilization January 75.5% 75.5%

14:15 U.S. Industrial Production (MoM) January 0.8% 0.1%

14:15 U.S. Industrial Production YoY January 0.5%

15:00 U.S. NAHB Housing Market Index February 67 67

15:00 U.S. Business inventories December 0.7% 0.4%

15:00 U.S. Federal Reserve Chair Janet Yellen Testifies

15:30 U.S. Crude Oil Inventories February 13.83

21:00 U.S. Total Net TIC Flows December 23.7

21:00 U.S. Net Long-term TIC Flows December 30.8

-

21:06

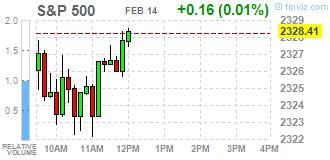

Major US stock indexes rose moderately by the end of today's session

Major US stock indexes finished trading higher, renewing record highs, after Federal Reserve Chairman Janet Yellen reiterated its view that further monetary tightening is warranted if the economy will maintain its growth trajectory.

During his speech to the semi-annual report to the US Senate Banking Committee, the head of the Federal Reserve said that further increases in interest rates will be appropriate if inflation and the labor market will continue to gradually move in the direction of the central bank's forecasts. Ms. Yellen also said that the FOMC members will consider the possibility of further rate hikes in the upcoming meetings. In addition, she stressed the importance of fiscal policy to improve the long-term economic growth, but noted that this is only one of many factors affecting the economic outlook.

The focus of the market was also a report of the US Department of Labor members, who showed that producer prices rose more than expected in January, recording the biggest gain in four years amid rising energy costs and some services. According to the report, the final demand producer price index jumped 0.6% last month, which was the highest growth since September 2012, and following the growth of 0.2% in December. Despite the surge, the producer price index increased in the 12 months prior to January only 1.6%. This followed a similar gain in the 12 months to December. Economists had forecast growth of the producer price index by 0.3% last month and an increase year on year to 1.5%. The gain largely reflects an increase in prices for commodities such as crude oil, which is currently rising against the backdrop of an ever-growing global economy.

Oil prices rose nearly 0.6% against the efforts by the countries oil producers to reduce the level of black gold. Recall the last OPEC report showed that the cartel has reduced oil production by 890.2 thousand barrels per day as compared to December - up to 32.139 million barrels. Total production (including countries outside OPEC) decreased by 1,146 million barrels of promised 1,254,000. Thus, the OPEC agreement executed on 90%. However, increasing the volume of production from the US continues to put pressure on the price of oil.

DOW index components closed mostly in positive territory (22 of 30). Most remaining shares fell Chevron Corporation (CVX, -1.14%). leaders of growth were shares of JPMorgan Chase & Co. (JPM, + 1.71%).

Sector S & P index closed trading mixed. Most consumer goods sector fell (-0.9%). Maximizing demonstrated the health sector (+ 0.7%).

At the close:

Dow + 0.44% 20,501.33 +89.17

Nasdaq + 0.32% 5,782.57 +18.61

S & P + 0.40% 2,337.45 +9.20

-

20:00

DJIA +0.27% 20,467.63 +55.47 Nasdaq +0.16% 5,772.96 +9.00 S&P +0.23% 2,333.63 +5.38

-

17:14

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes fluctuated near records on Tuesday after the Fed's Chair Janet Yellen reiterated her thought that further tightening is warranted if the economy maintains its growth trajectory.

A majority of Dow stocks in negative area (16 of 30). Top loser - Chevron Corporation (CVX, -1.69%). Top gainer - The Goldman Sachs Group (GS, +1.13%).

All S&P sectors, but for Financials (+0.34%), in negative area. Top loser - Consumer goods (-0.3%).

At the moment:

Dow 20385.00 +2.00 +0.01%

S&P 500 2324.25 -2.00 -0.09%

Nasdaq 100 5254.75 -4.50 -0.09%

Crude Oil 53.12 +0.19 +0.36%

Gold 1226.40 +0.60 +0.05%

U.S. 10yr 2.50 +0.07

-

17:00

European stocks closed: FTSE 100 -10.36 7268.56 -0.14% DAX -2.62 11771.81 -0.02% CAC 40 +7.63 4895.82 +0.16%

-

16:42

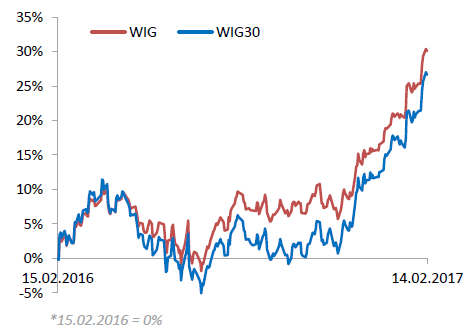

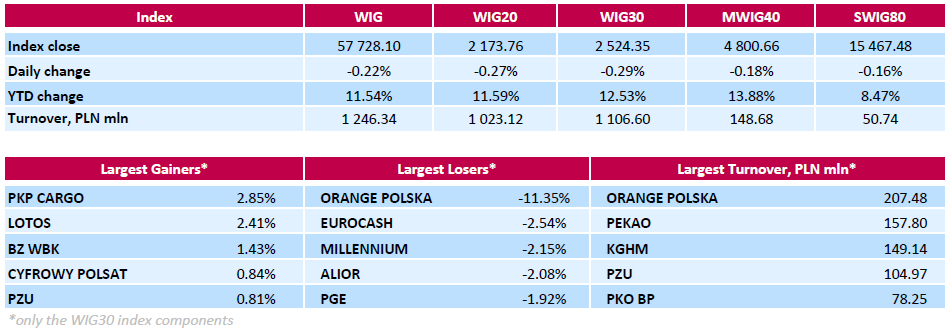

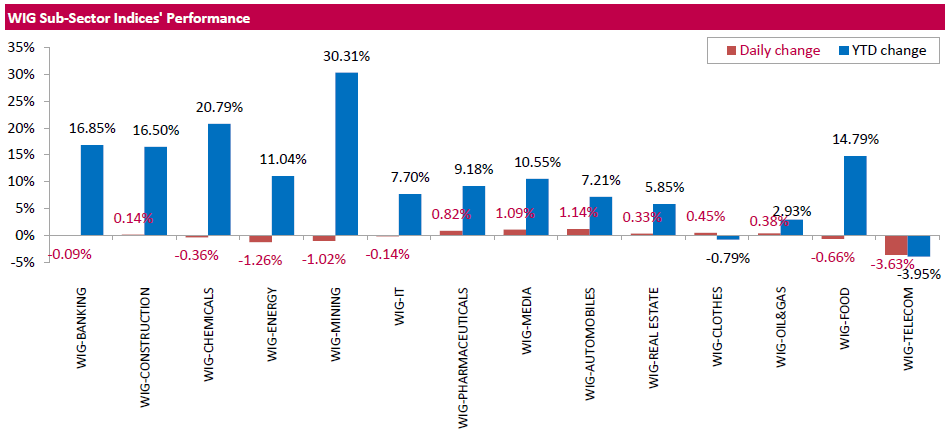

WSE: Session Results

Polish equity market closed lower on Tuesday. The broad market measure, the WIG Index, lost 0.22%. From a sector perspective, telecoms stocks (-3.63%) underperformed, while automobiles names (1.14%) fared the best.

The large-cap stocks' measure, the WIG30 Index, fell by 0.29%. In the index basket, telecommunication services provider ORANGE POLSKA (WSE: OPL) was hit the hardest, down 11.35%, as the company announced it ended Q4 with net loss of PLN 1.898 bln, while analysts' consensus estimate suggested loss of PLN 108.1 mln. For the full 2016 year, the company reported net loss of PNL 1.746 bln, while analyst's expected net profit of PLN 48 mln. Other major underperformers were FMCG-wholesaler EUROCASH (WSE: EUR) and two banking names MILLENNIUM (WSE: MIL) and ALIOR (WSE: ALR), tumbling by 2.54%, 2.15% and 2.08% respectively. On the other side of the ledger, railway freight transport operator PKP CARGO (WSE: PKP) and oil refiner LOTOS (WSE: LTS) recorded the biggest daily gains, surging by 2.85% and 2.41% respectively.

-

16:04

Yellen: Fed Will Not Sell Morgage-Backed Securites, Will Allow Maturing Assets to Run Off

-

15:16

-

15:13

Yellen: officials will consider further rate increases 'at our upcoming meetings'. Dollar trading up

-

Changes in Fiscal Policy Could Potentially Affect Economic Outlook

-

Too Early to Know What Policy Changes Will Occur, How Economic Effects Will Unfold

-

Emphasizes Importance of Fiscal Policies To Improve Long-Term Growth, Productivity

-

Fiscal Policy Only One of Many Factors Affecting Economic Outlook

-

Hope Fiscal Policies Consistent With Putting Fiscal Accounts On 'Sustainable Trajectory'

-

U.S. Monetary Policy Remains Accommodative

-

Overall FOMC Policy Will Be Directed to Achieve Fed's Dual Mandate

-

-

14:53

WSE: After start on Wall Street

The American market started trading slightly down, which corresponds to the global sentiment. Investors are waiting for Janet Yellen, who at 16.00 (Warsaw time) will present a semi-annual report on the monetary policy in front of the US Senate Banking Committee.

An hour before the close of trading in Warsaw the WIG20 index was at the level of 2,175 points (-0,17%) and the turnover in the segment of the largest companies was amounted to PLN 753 million.

-

14:34

U.S. Stocks open: Dow -0.10%, Nasdaq -0.20%, S&P -0.14%

-

14:29

Before the bell: S&P futures -0.01%, NASDAQ futures -0.04%

U.S. stock-index futures were flat as investors awaited the Fed's Chair speech.

Global Stocks:

Nikkei 19,238.98 -220.17 -1.13%

Hang Seng 23,703.01 -7.97 -0.03%

Shanghai 3,218.38 +1.55 +0.05%

FTSE 7,277.70 -1.22 -0.02%

CAC 4,890.07 +1.88 +0.04%

DAX 11,765.53 -8.90 -0.08%

Crude $53.21 (+0.53%)

Gold $1,233.80 (+0.65%)

-

14:02

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

38.5

0.02(0.052%)

26926

Amazon.com Inc., NASDAQ

AMZN

836.2

-0.33(-0.0394%)

8735

AMERICAN INTERNATIONAL GROUP

AIG

66.39

0.25(0.378%)

450

Apple Inc.

AAPL

133.12

-0.17(-0.1275%)

118722

Barrick Gold Corporation, NYSE

ABX

19.66

0.24(1.2358%)

51470

Boeing Co

BA

168.05

0.02(0.0119%)

1922

Caterpillar Inc

CAT

98.51

0.01(0.0102%)

1476

Chevron Corp

CVX

113.11

0.28(0.2482%)

1657

Cisco Systems Inc

CSCO

31.98

0.01(0.0313%)

1969

Citigroup Inc., NYSE

C

59.06

0.11(0.1866%)

28426

E. I. du Pont de Nemours and Co

DD

77.59

-0.23(-0.2956%)

101

Exxon Mobil Corp

XOM

83.2

0.20(0.241%)

7161

Facebook, Inc.

FB

133.9

-0.15(-0.1119%)

34832

Ford Motor Co.

F

12.67

0.11(0.8758%)

338116

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

15.76

-0.20(-1.2531%)

180224

General Electric Co

GE

30.1

0.06(0.1997%)

18388

General Motors Company, NYSE

GM

36.85

1.33(3.7444%)

1476937

Goldman Sachs

GS

246.52

0.25(0.1015%)

1733

Google Inc.

GOOG

820.5

1.26(0.1538%)

1498

Intel Corp

INTC

35.85

0.05(0.1397%)

160041

International Business Machines Co...

IBM

179.4

0.04(0.0223%)

562

Johnson & Johnson

JNJ

115.91

0.03(0.0259%)

336

JPMorgan Chase and Co

JPM

88.29

0.14(0.1588%)

16005

McDonald's Corp

MCD

125.4

-0.14(-0.1115%)

1594

Merck & Co Inc

MRK

64.74

-0.03(-0.0463%)

827

Microsoft Corp

MSFT

64.43

0.10(0.1554%)

11030

Nike

NKE

55.8

-0.29(-0.517%)

1306

Pfizer Inc

PFE

32.69

0.08(0.2453%)

537

Procter & Gamble Co

PG

88.3

-0.01(-0.0113%)

408

Starbucks Corporation, NASDAQ

SBUX

56

-0.11(-0.196%)

2069

Tesla Motors, Inc., NASDAQ

TSLA

279.45

-1.15(-0.4098%)

34810

The Coca-Cola Co

KO

40.55

-0.07(-0.1723%)

7666

Twitter, Inc., NYSE

TWTR

15.9

0.09(0.5693%)

58265

Verizon Communications Inc

VZ

48.53

-0.02(-0.0412%)

11859

Visa

V

86.52

0.08(0.0925%)

1110

Walt Disney Co

DIS

109.35

-0.30(-0.2736%)

1554

Yandex N.V., NASDAQ

YNDX

23.09

0.12(0.5224%)

5914

-

13:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: 1.0600-05 (EUR 693m) 1.0650 (955m) 1.0700 (887m) 1.0780 (1.33bln) 1.0950 (880m)

USD/JPY: 112.00 (USD 607m) 112.50 (350m) 114.00 (670m) 115.00 (465m)

GBP/USD: 1.2565-70 (GBP 437m) 1.2600 (469m)

AUD/USD: 0.7400 (AUD 571m)

USD/CAD 1.2975 (USD 485m)

-

13:50

US producer prices increased 0.6 percent in January

The Producer Price Index for final demand increased 0.6 percent in January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.2 percent in December and 0.5 percent in November. (See table A.) On an unadjusted basis, the final demand index climbed 1.6 percent for the 12 months ended January 2017.

In January, over 60 percent of the advance in the final demand index is attributable to a 1.0-percent increase in prices for final demand goods. The index for final demand services moved up 0.3 percent.

Prices for final demand less foods, energy, and trade services rose 0.2 percent in January after inching up 0.1 percent in December. For the 12 months ended in January, the index for final demand less foods, energy, and trade services climbed 1.6 percent. -

13:30

U.S.: PPI excluding food and energy, m/m, January 0.4% (forecast 0.2%)

-

13:30

U.S.: PPI, m/m, January 0.6% (forecast 0.3%)

-

13:30

U.S.: PPI excluding food and energy, Y/Y, January 1.2% (forecast 1.1%)

-

13:30

U.S.: PPI, y/y, January 1.6% (forecast 1.5%)

-

13:00

Orders

EUR/USD

Offers: 1.0650 1.0680 1.0700-05 1.0730 1.0750

Bids: 1.0600 1.0580-85 1.0550 1.0520 1.0500

GBP/USD

Offers: 1.2550 1.2580 1.2600 1.2630 1.2650 1.2685 1.2700

Bids: 1.2500 1.2480 1.2450 1.2430 1.2400 1.2380 1.2345-50

EUR/GBP

Offers: 0.8485 0.8500 0.8520 0.8535 0.8550-60 0.8600

Bids: 0.8450 0.8430 0.8400 0.8385 0.8350 0.8300

EUR/JPY

Offers: 120.85 121.00 121.35 121.50 121.80 122.00 122.50

Bids: 102.30 120.00 119.75 119.50 119.30 119.00

USD/JPY

Offers: 113.60 113.80 114.00 114.20 114.50 114.75 115.00

Bids: 113.20 113.00 112.80 112.50 112.00

AUD/USD

Offers: 0.7685-90 0.7700 0.7730 0.7750 0.7780 0.7800

Bids: 0.7660 0.7620 0.7600 0.7580 0.7550 0.7520 0.7500

Информационно-аналитический отдел TeleTrade

-

12:32

ECB Could Buy EUR1.57B of Greek Bond Notional Each Month - Dow Jones

-

11:07

The ZEW Indicator of Economic Sentiment for Germany records a decrease of 6.2 points in February

The ZEW Indicator of Economic Sentiment for Germany records a decrease of 6.2 points in February 2017. The indicator now stands at 10.4 points.

"The downturn in expectations is likely to be the result of the recently published unfavourable figures for industrial production, retail sales and exports. Political uncertainty regarding Brexit, the future US economic policy as well as the considerable number of upcoming elections in Europe further depresses expectations. Nevertheless, the economic environment in Germany has not significantly worsened," comments ZEW President Professor Achim Wambach.

-

11:06

-

11:04

Euro area industrial production tops expectations in December

In December 2016 compared with November 2016, seasonally adjusted industrial production fell by 1.6% in the euro area (EA19) and by 1.0% in the EU28, according to estimates from Eurostat, the statistical office of the European Union. In November 2016 industrial production rose by 1.5% in the euro area and by 1.6% in the EU28.

In December 2016 compared with December 2015, industrial production increased by 2.0% in the euro area and by 2.9% in the EU28. The average industrial production for the year 2016, compared with 2015, rose by 1.3% in the euro area and by 1.4% in the EU28.

-

11:02

Seasonally adjusted GDP rose by 0.4% in the euro area

Seasonally adjusted GDP rose by 0.4% in the euro area (EA19) and by 0.5% in the EU28 during the fourth quarter of 2016, compared with the previous quarter, according to a flash estimate published by Eurostat, the statistical office of the European Union. In the third quarter of 2016, GDP also grew by 0.4% and 0.5% respectively.

Compared with the same quarter of the previous year, seasonally adjusted GDP rose by 1.7% in the euro area and by 1.8% in the EU28 in the fourth quarter of 2016, after +1.8% and +1.9% respectively in the previous quarter.

During the fourth quarter of 2016, GDP in the United States increased by 0.5% compared with the previous quarter (after +0.9% in the third quarter of 2016). Compared with the same quarter of the previous year, GDP grew by 1.9% (after +1.7% in the previous quarter).

-

10:01

Eurozone: ZEW Economic Sentiment, February 17.1 (forecast 22.3)

-

10:00

Eurozone: GDP (QoQ), Quarter IV 0.4% (forecast 0.5%)

-

10:00

Eurozone: Industrial Production (YoY), December 2% (forecast 1.7%)

-

10:00

Eurozone: GDP (YoY), Quarter IV 1.7% (forecast 1.8%)

-

10:00

Eurozone: Industrial production, (MoM), December -1.6% (forecast -1.5%)

-

10:00

Germany: ZEW Survey - Economic Sentiment, February 10.4 (forecast 15)

-

09:38

Both the annual and monthly rate of UK producer price inflation increased in January

Factory gate prices (output prices) rose 3.5% on the year to January 2017, which is the seventh consecutive period of annual price increases and the highest they have been since December 2011.

Prices for materials and fuels paid by UK manufacturers for processing (input prices) rose 20.5% on the year, which is the fastest rate of annual growth since September 2008.

Prices of imported materials and fuels increased 20.2% on the year, largely a result of sterling depreciation and a recovery in global crude oil prices.

-

09:35

UK CPI and Core CPI inflation below expectations. GBP/USD down 50 pips so far

The Consumer Prices Index (CPI) rose by 1.8% in the year to January 2017, compared with a 1.6% rise in the year to December 2016.

The rate in January 2017 was the highest since June 2014.

The main contributors to the increase in the rate were rising prices for motor fuels and to a lesser extent food prices, which were unchanged between December 2016 and January 2017, having fallen a year ago.

These upward pressures were partially offset by prices for clothing and footwear, which fell by more than they did a year ago.

-

09:30

United Kingdom: Producer Price Index - Output (MoM), January 0.6% (forecast 0.3%)

-

09:30

United Kingdom: HICP, m/m, January -0.5% (forecast -0.5%)

-

09:30

United Kingdom: Producer Price Index - Input (MoM), January 1.7% (forecast 1%)

-

09:30

United Kingdom: Retail prices, Y/Y, January 2.6% (forecast 2.8%)

-

09:30

United Kingdom: Producer Price Index - Output (YoY) , January 3.5% (forecast 3.2%)

-

09:30

United Kingdom: HICP ex EFAT, Y/Y, January 1.6% (forecast 1.8%)

-

09:30

United Kingdom: Producer Price Index - Input (YoY) , January 20.5% (forecast 18.3%)

-

09:30

United Kingdom: HICP, Y/Y, January 1.8% (forecast 1.9%)

-

09:30

United Kingdom: Retail Price Index, m/m, January -0.6% (forecast -0.4%)

-

09:16

Italian GDP up 0.2% in Q4 2016

In the fourth quarter of 2016 the seasonally and calendar adjusted, chained volume measure of Gross Domestic Product (GDP) increased by 0.2 per cent with respect to the third quarter of 2016 and by 1.1 per cent in comparison with the fourth quarter of 2015.

-

08:41

Swiss CPI flat in January

The country's consumer price index remained unchanged at 100.0 points in January 2017 compared to the previous month (December 2015 = 100 points). Compared to the previous year, the rate of inflation was 0.3 percent. This is evident from the figures of the Federal Statistical Office (FSO).

The stable monthly result for January 2017 contains opposing tendencies, which are balanced out altogether. Lower prices were observed in January for clothing and shoes, mainly due to the sale. Air travel was also more favorable, while the prices for the hotel industry, fuel and heating oil rose.

-

08:40

Major stock markets in Europe trading lower: FTSE -0.2%, DAX -0.2%, CAC40 -0.1%

-

08:17

WSE: After opening

WIG20 index opened at 2181.34 points (+0.08%)*

WIG 57905.43 0.08%

WIG30 2532.58 0.03%

mWIG40 4813.48 0.08%

*/ - change to previous close

The cash market opened with an increase but Orange (WSE: OPL) did not take part in this quotation due to the suspension of trading. The level of turnover was high and at the first was focused on KGHM, but after the start of trading of Orange values, they generate the highest activity and lowering market, which consequently loses more than 0.7%. The environment is calmer and the German DAX is trading at neutral levels.

After fifteen minutes of trading the WIG20 index was at the level of 2,164 points (-0,69%).

-

08:15

Switzerland: Consumer Price Index (YoY), January 0.3% (forecast 0.3%)

-

08:15

Switzerland: Consumer Price Index (MoM) , January 0% (forecast -0.1%)

-

08:15

Switzerland: Producer & Import Prices, y/y, January 0.8% (forecast 0.5%)

-

08:15

Switzerland: Producer & Import Prices, m/m, January 0.4% (forecast 0.3%)

-

08:01

Today’s events

-

At 13:50 GMT FOMC member Jeffrey Lacker will give a speech

-

At 15:00 GMT the Federal Reserve Board of Governors Chairman Janet Yellen speaks

-

At 15:00 GMT the Federal Reserve's Monetary Policy Report

-

At 18:00 GMT FOMC member Robert Kaplan will deliver a speech

-

At 18:15 GMT FOMC member Dennis Lockhart will give a speech

-

-

07:38

Trade of the week from Citi: Sell EUR/USD

Currency investors should consider selling EUR/USD this week, advises CitiFX in its weekly FX pick to clients.

Sell at 1.0615, target 1.0375, stop loss 1.0730," Citi advises.

Citi weekly trades provide short term guidance on where they see 1-2 week opportunities in G10 FX markets. Unless Citi explicitly extends them, they will be closed out automatically at COB the second Friday after they are introduced.

Copyright © 2017 CitiFX, eFXnews™

-

07:32

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.3%, CAC40 -0.2%, FTSE -0.1%

-

07:27

WSE: Before opening

Yesterday's session on Wall Street brought another consecutive record highs in main indices and the market continues the "Trump rally". The Dow Jones Industrial rose at the close of 0.70 percent, the S&P500 went up by 0.52 percent and the Nasdaq Comp. gained 0.52 percent.

In the morning, we may notice a scratch on the growth wave of capital markets, it is the Japanese Nikkei, which falls by more than 1%. On the other Asian parquets there is also some caution, though losses are rather cosmetic. Contracts in the US in the morning go slightly down and may cool the mood of the Old Continent.

On the Warsaw market worse can cope today Orange (WSE: OPL), which due to a large write-off reported a loss in the fourth quarter of nearly PLN 2 billion. In addition, they do not intend to recommend the payment of a dividend. This can be a tough day for Orange, as dividend is the main incentive to hold its shares.

In the afternoon, Janet Yellen will present a semi-annual report on monetary policy. An important issue will be the attitude to March as the date for a potential increase in interest rates.

In Europe, we will see a series of data on GDP and ZEW index in Germany, which, however, should not affect moods noticeably.

-

07:24

Fed's Kaplan: Future Rate Rises Likely 'Gradual and Patient'

-

Fed Should Raise Rates as Goals Achieved

-

Moving Sooner Rather Than Later Is Best

-

Moving Sooner Reduces Risk of Falling Behind Curve

-

Fed Making 'Good Progress' in Achieving Goals

-

May Be Scope for Further Job Market Improvement

-

Likely to Achieve 2% Inflation Over Medium Term

-

Expects Economy to Grow by 2.3% in 2017

-

Oil Supply and Demand Likely in Balance in 1H 2017

-

-

07:18

Options levels on tuesday, February 14, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0706 (2036)

$1.0680 (2868)

$1.0645 (1370)

Price at time of writing this review: $1.0614

Support levels (open interest**, contracts):

$1.0572 (3471)

$1.0554 (3628)

$1.0529 (5201)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 69211 contracts, with the maximum number of contracts with strike price $1,0800 (5071);

- Overall open interest on the PUT options with the expiration date March, 13 is 81444 contracts, with the maximum number of contracts with strike price $1,0000 (5109);

- The ratio of PUT/CALL was 1.18 versus 1.17 from the previous trading day according to data from February, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.2702 (2986)

$1.2704 (2149)

$1.2608 (2150)

Price at time of writing this review: $1.2534

Support levels (open interest**, contracts):

$1.2491 (2901)

$1.2394 (1944)

$1.2297 (3610)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 33321 contracts, with the maximum number of contracts with strike price $1,2500 (3520);

- Overall open interest on the PUT options with the expiration date March, 13 is 37160 contracts, with the maximum number of contracts with strike price $1,2300 (3610);

- The ratio of PUT/CALL was 1.12 versus 1.11 from the previous trading day according to data from February, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

Chinese inflatin above expectations in January

The Consumer Price Index, published by China's National Bureau of Statistics was 1.0% m/m, which is higher than the previous value of 0.2% and economists' forecast of 0.7%. In annual terms, consumer prices rose by 2.5% after rising 2.1% previously.

Prices of non-food products rose by 2.5% y / y, while the price of food + 2.7% y / y

Consumer Price Index - a key indicator of inflation and changes in purchasing trends. Significant growth in the consumer price index is a sign that inflation is becoming a destabilizing factor in the economy and could potentially push the People's Bank of China to tighten monetary policy and fiscal policy.

According to the chief economist at Bank of Communications Lian Ping, a stimulus for the growth of inflation was the celebration of the Lunar New Year which led to an increase in consumption by the population and, consequently, to an increase in prices of food and manufactured goods.

-

07:12

US Said To Eye New Currency Strategy To Pressure China - WSJ

-

07:10

BoJ Gov Kuroda: Won't Change Yield Curve Control Just Because Global Interest Rates Rise @Livesquawk

-

07:08

German CPI down 0.6% in January, as expected

Consumer prices in Germany rose by 1.9% in January 2017 compared with January 2016. The inflation rate as measured by the consumer price index continued to increase at the beginning of the year. In December 2016, it had already been +1.7%. An inflation rate of +1.9% was last recorded in July 2013. Compared with December 2016, the consumer price index fell by 0.6% in January 2017. The Federal Statistical Office (Destatis) thus confirms its provisional overall results of 30 January 2017.

-

07:07

The German economy continued its moderate growth at the end of 2016

The German economy continued its moderate growth at the end of 2016. In the fourth quarter of 2016, the gross domestic product (GDP) rose 0.4% on the previous quarter after adjustment for price, seasonal and calendar variations. The economic situation in Germany in 2016 thus was characterised by solid and steady growth (+0.7% in the first quarter, +0.5% in the second quarter and +0.1% in the third quarter). The Federal Statistical Office (Destatis) also reports that this results in a 1.9% increase (calendar-adjusted: +1.8%) for the whole year of 2016. The provisional annual GDP result released in January has been confirmed.

The quarter-on-quarter comparison (upon adjustment for price, seasonal and calendar variations) shows that positive contributions came from domestic demand. General government final consumption expenditure was markedly up, while household final consumption expenditure rose slightly again. A largely positive development was also observed for capital formation. Especially fixed capital formation in construction was markedly up on the third quarter of 2016. According to provisional calculations, the development of foreign trade, however, had a downward effect on growth because the price-adjusted quarter-on-quarter increase in imports was markedly larger than that of exports.

-

07:01

Germany: GDP (YoY), Quarter IV 1.2% (forecast 1.7%)

-

07:00

Germany: CPI, y/y , January 1.9% (forecast 1.9%)

-

07:00

Germany: CPI, m/m, January -0.6% (forecast -0.6%)

-

07:00

Germany: GDP (QoQ), Quarter IV 0.4% (forecast 0.5%)

-

06:28

Global Stocks

European stocks rose on Monday, with the benchmark index ending at a more-than-one-year closing high, as investors interpreted U.S. President Donald Trump's recent meetings with international dignitaries as signaling a softer foreign-policy stance. On Monday, investors turned their attention back to the U.S. and the latest actions by Trump. The U.S. president over the weekend eased concerns of trade wars with Japan, saying the "United States of America stands behind Japan, its great ally, 100%" as he met with the country's prime minister, Shinzo Abe.

Asian stocks largely slipped Tuesday amid caution ahead of U.S. Federal Reserve Chairwoman Janet Yellen's upcoming congressional testimony, as signs build that the Trump-driven reflation trade is back. In the U.S. overnight, the Dow Jones Industrial Average, the S&P 500, the Nasdaq Composite and the Russell 2000 all reached record highs.

U.S. stocks extended gains on Monday, with major indexes closing at records for a third session in a row as financial and industrial stocks paved the way to higher ground. "Even though we have social unrest and building geopolitical tensions, the market refuses to fall in any meaningful fashion, which means there remains a very strong underlying bid in the market," said Adam Sarhan, chief executive officer of 50 Park Investments.

-

04:32

Japan: Industrial Production (YoY), December 3.2% (forecast 3%)

-

04:31

Japan: Industrial Production (MoM) , December 0.7% (forecast 0.5%)

-

01:30

China: CPI y/y, January 2.5% (forecast 2.4%)

-

01:30

China: PPI y/y, January 6.9% (forecast 6.3%)

-

00:30

Australia: National Australia Bank's Business Confidence, January 10

-