Market news

-

22:28

Stocks. Daily history for Apr 18’2017:

(index / closing price / change items /% change)

Nikkei +63.33 18418.59 +0.35%

TOPIX +5.84 1471.53 +0.40%

Hang Seng -337.12 23924.54 -1.39%

CSI 300 -17.19 3462.63 -0.49%

Euro Stoxx 50 -38.48 3409.78 -1.12%

FTSE 100 -180.09 7147.50 -2.46%

DAX -108.56 12000.44 -0.90%

CAC 40 -80.85 4990.25 -1.59%

DJIA -113.64 20523.28 -0.55%

S&P 500 -6.82 2342.19 -0.29%

NASDAQ -7.31 5849.47 -0.12%

S&P/TSX -62.32 15622.57 -0.40%

-

20:06

Major US stock indexes finished trading in negative territory

Major US stock indexes declined on Tuesday, as corporate heavyweights Goldman Sachs and Johnson & Johnson disappoint investors with their quarterly results, while geopolitical tensions continued to affect the sentiment of market participants.

In addition, as it became known, in March, US housing construction fell, as the construction of single-family houses in the Midwest recorded the largest decline in three years, probably due to bad weather. The laying of new houses fell by 6.8% to an annual rate of 1.22 million units, the Commerce Ministry said on Tuesday. The laying of new homes for February was revised to 1.30 million units from the previously reported 1.29 million units.

At the same time, the demand for heating increased industrial production in March. The Federal Reserve said that industrial production rose by 0.5% in March, with the increase attributable to record growth in the volume of public utilities. The release of utility services in March rose by a record 8.6%, as colder temperatures returned after warm weather in the first two months of the year, the Fed said.

Quotes of oil moderately decreased, reaching a 2-week low, which was due to news that the volume of oil shale in the US is likely to increase sharply in May. According to the forecasts of the US Energy Ministry, the production of shale oil in the fields of the largest oil and gas producing regions of the USA in May will grow by 124 thousand barrels per day in comparison with April - up to 5.193 million barrels.

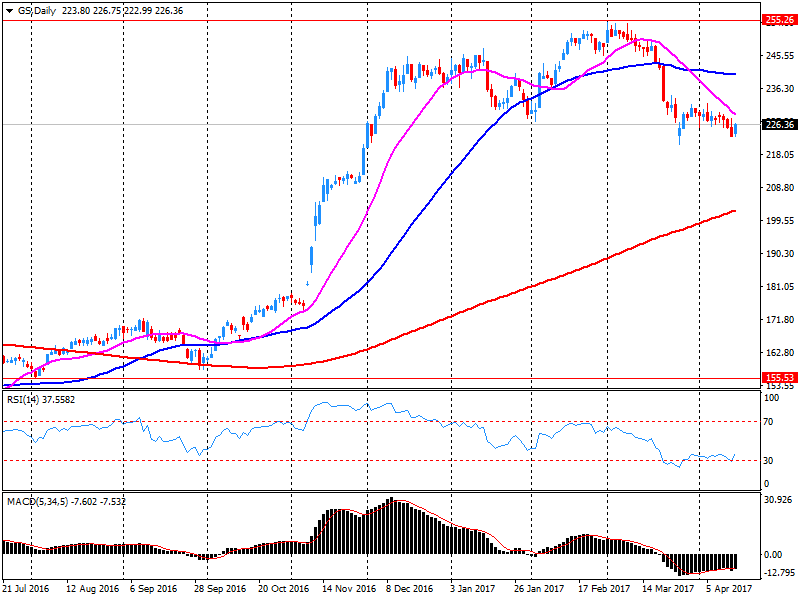

Components of the DOW index finished the session in different directions (16 in negative territory, 14 in positive territory). The Goldman Sachs Group, Inc. fell more than the rest. (GS, -4.72%). The leader of growth was shares UnitedHealth Group Incorporated (UNH, + 1.06%).

Most sectors of the S & P index showed a decline. The main materials sector fell most of all (-0.8%). The growth leader was the conglomerate sector (+ 0.4%).

At closing:

DJIA -0.55% 20,523.96 -112.96

Nasdaq -0.12% 5,849.47 -7.32

S & P -0.29% 2,342.22 -6.79

-

19:00

DJIA -0.59% 20,514.64 -122.28 Nasdaq -0.23% 5,843.55 -13.24 S&P -0.33% 2,341.22 -7.79

-

16:00

European stocks closed: FTSE 100 -180.09 7147.50 -2.46% DAX -108.56 12000.44 -0.90% CAC 40 -80.85 4990.25 -1.59%

-

13:34

U.S. Stocks open: Dow -0.47%, Nasdaq -0.37%, S&P -0.39%

-

13:29

Before the bell: S&P futures -0.33%, NASDAQ futures -0.28%

U.S. stock-index fell as investors weighed a possible delay in tax reforms, while keeping an eye on quarterly earnings and global politics.

Stocks:

Nikkei 18,418.59 +63.33 +0.35%

Hang Seng 23,924.54 -337.12 -1.39%

Shanghai 3,196.60 -25.57 -0.79%

FTSE 7,194.96 -132.63 -1.81%

CAC 5,008.08 -63.02 -1.24%

DAX 12,035.85 -73.15 -0.60%

-

12:51

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

190

-0.36(-0.19%)

105

ALCOA INC.

AA

31.13

-0.18(-0.57%)

4167

Amazon.com Inc., NASDAQ

AMZN

900.01

-1.98(-0.22%)

16312

AMERICAN INTERNATIONAL GROUP

AIG

59.71

-0.22(-0.37%)

100

Apple Inc.

AAPL

141.5

-0.33(-0.23%)

52126

AT&T Inc

T

40.32

0.02(0.05%)

3899

Barrick Gold Corporation, NYSE

ABX

19.88

0.04(0.20%)

44392

Boeing Co

BA

179

-0.02(-0.01%)

1053

Cisco Systems Inc

CSCO

32.5

-0.11(-0.34%)

1100

Citigroup Inc., NYSE

C

58.69

-0.30(-0.51%)

26677

Exxon Mobil Corp

XOM

81.28

-0.30(-0.37%)

2390

Facebook, Inc.

FB

141.15

-0.27(-0.19%)

32724

Ford Motor Co.

F

11.15

0.02(0.18%)

84609

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.53

-0.22(-1.73%)

135437

General Electric Co

GE

29.57

-0.07(-0.24%)

5194

General Motors Company, NYSE

GM

33.8

-0.10(-0.30%)

1041

Goldman Sachs

GS

220.22

-6.04(-2.67%)

324768

Home Depot Inc

HD

147.3

-0.01(-0.01%)

136

Intel Corp

INTC

35.45

-0.03(-0.08%)

1074

International Business Machines Co...

IBM

170.55

-0.55(-0.32%)

868

Johnson & Johnson

JNJ

123.92

-1.80(-1.43%)

56488

JPMorgan Chase and Co

JPM

85.39

-0.47(-0.55%)

27017

McDonald's Corp

MCD

131.95

0.60(0.46%)

1928

Merck & Co Inc

MRK

62.82

0.02(0.03%)

1096

Microsoft Corp

MSFT

65.3

-0.18(-0.27%)

6278

Nike

NKE

55.93

-0.31(-0.55%)

3534

Procter & Gamble Co

PG

90.3

-0.09(-0.10%)

236

Starbucks Corporation, NASDAQ

SBUX

58.1

0.02(0.03%)

625

Tesla Motors, Inc., NASDAQ

TSLA

299.46

-1.98(-0.66%)

24635

The Coca-Cola Co

KO

42.83

-0.24(-0.56%)

5035

UnitedHealth Group Inc

UNH

171

3.82(2.29%)

17515

Verizon Communications Inc

VZ

48.85

0.04(0.08%)

952

Yahoo! Inc., NASDAQ

YHOO

47.25

-0.14(-0.30%)

1400

Yandex N.V., NASDAQ

YNDX

24

-0.27(-1.11%)

985

-

12:47

Upgrades and downgrades before the market open

Upgrades:

McDonald's (MCD) upgraded to Outperform from Mkt Perform at Bernstein; target raised to $160 from $129

Downgrades:

Other:

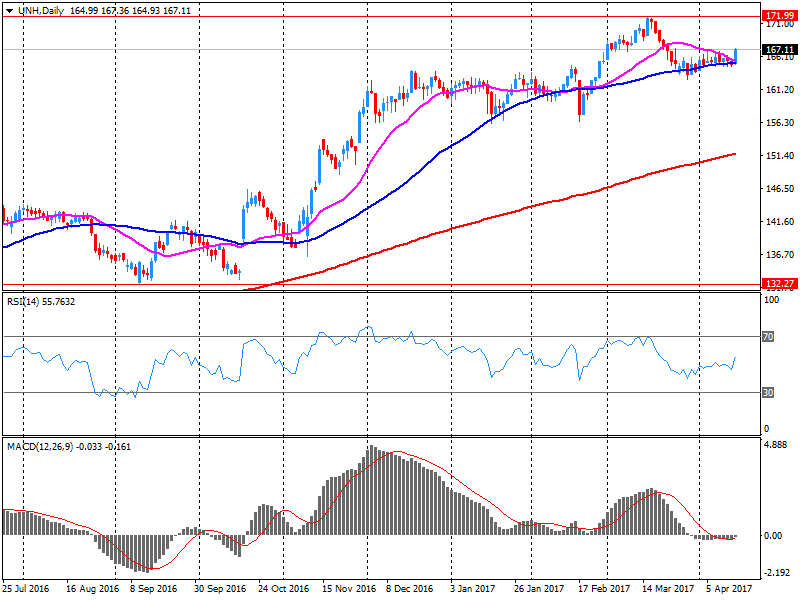

UnitedHealth (UNH) target raised to $200 from $178 at Mizuho

-

12:38

Company News: UnitedHealth (UNH) Q1 financials beat analysts’ forecasts

UnitedHealth reported Q1 FY 2017 earnings of $2.37 per share (versus $1.81 in Q1 FY 2016), beating analysts' consensus estimate of $2.17.

The company's quarterly revenues amounted to $48.723 bln (+9.4% y/y), beating analysts' consensus estimate of $48.211 bln.

The company also sued raised guidance for FY 2017, projecting EPS of $9.65-9.85 (versus previously forecast $9.30-9.60 and analysts' consensus estimate of $9.51) and revenues of $200 bln (versus previously forecast $197-199 bln and analysts' consensus estimate of $198.94 bln).

UNH rose to $171.00 (+2.29%) in pre-market trading.

-

12:24

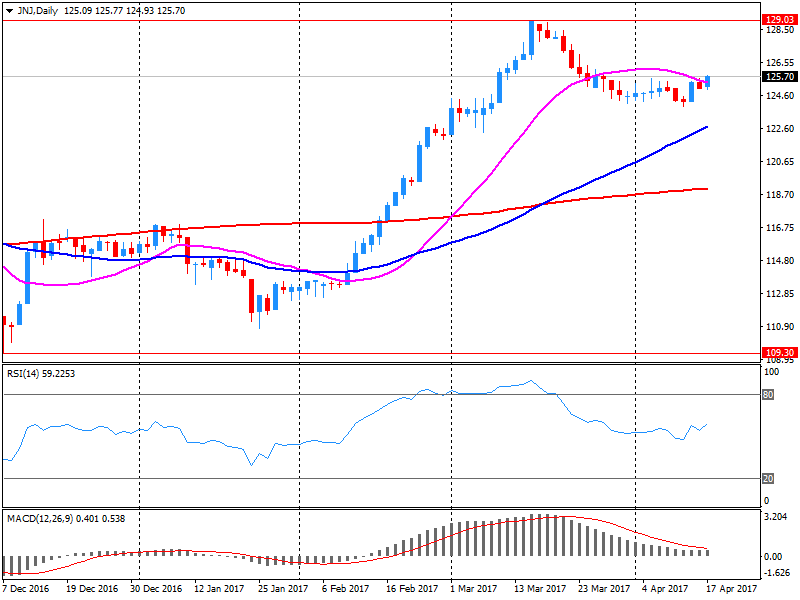

Company News: Johnson & Johnson (JNJ) Q1 EPS beat analysts’ estimate

Johnson & Johnson reported Q1 FY 2017 earnings of $1.83 per share (versus $1.68 in Q1 FY 2016), beating analysts' consensus estimate of $1.77.

The company's quarterly revenues amounted to $17.766 bln (+1.6% y/y), missing analysts' consensus estimate of $18.020 bln.

The company also issued guidance for FY 2017, projecting EPS of $7.00-7.15 versus analysts' consensus estimate of $7.08 and revenues of $75.4-76.1 bln versus analysts' consensus estimate of $75.21 bln.

JNJ fell to $124.20 (-1.21%) in pre-market trading.

-

12:11

Company News: Goldman Sachs (GS) quarterly results miss analysts’ estimates

Goldman Sachs reported Q1 FY 2017 earnings of $5.15 per share (versus $2.68 in Q1 FY 2016), missing analysts' consensus estimate of $5.19.

The company's quarterly revenues amounted to $8.026 bln (+26.6% y/y), missing analysts' consensus estimate of $8.329 bln.

GS fell to $219.25 (-3.10%) in pre-market trading.

-

12:03

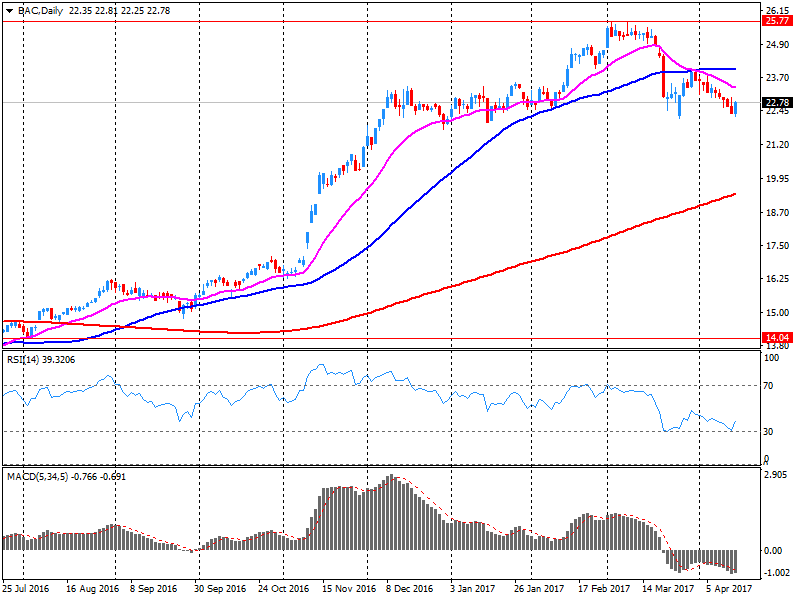

Company News: Bank of America (BAC) quarterly results beat analysts’ forecasts

Bank of America reported Q1 FY 2017 earnings of $0.41 per share (versus $0.21 in Q1 FY 2016), beating analysts' consensus estimate of $0.35.

The company's quarterly revenues amounted to $22.445 bln (+6.9% y/y), beating analysts' consensus estimate of $21.766 bln.

BAC rose to $23.00 (+0.83%) in pre-market trading.

-

06:55

A positive start of trading on the main European stock markets is expected: DAX + 0.6%, CAC40 + 0.4%, FTSE + 0.2%

-

05:39

Global Stocks

European stocks slid Thursday, with banks leading the charge south after President Donald Trump's comments about the dollar and interest rates.

U.S. stocks bounced back on Monday to close near session highs, halting three straight sessions of declines for major benchmarks, as banks enjoyed their best daily rally in six weeks.

A stronger dollar and overnight gains in U.S. stocks helped many Asia-Pacific equities as trading returned in full following the Easter Monday holiday. Chinese steel mills are hunting for higher-grade product to minimize their coking-coal needs after prices of metallurgical coal surged because Cyclone Debbie curbed shipments from Australia. Fortescue responded by offering deeper discounts on its iron ore.

-