Market news

-

22:27

Stocks. Daily history for Apr 19’2017:

(index / closing price / change items /% change)

Nikkei +13.61 18432.20 +0.07%

TOPIX -0.11 1471.42 -0.01%

Hang Seng -98.66 23825.88 -0.41%

CSI 300 -16.55 3446.08 -0.48%

Euro Stoxx 50 +11.21 3420.99 +0.33%

FTSE 100 -33.14 7114.36 -0.46%

DAX +16.01 12016.45 +0.13%

CAC 40 +13.48 5003.73 +0.27%

DJIA -118.79 20404.49 -0.58%

S&P 500 -4.02 2338.17 -0.17%

NASDAQ +13.56 5863.04 +0.23%

S&P/TSX -69.69 15552.88 -0.45%

-

20:05

Major US stock indices showed mixed dynamics

The major US stock indexes finished trading in different directions, responding to a new portion of corporate reporting and the collapse of oil quotations.

In the focus of investors' attention were shares of companies such as IBM (IBM), Yahoo! (YHOO), Morgan Stanley (MS), which published their quarterly reports.

The cost of oil decreased by almost 4%, which was due to the growth of the US dollar and an ambiguous report from the US Energy Ministry, which pointed to less than expected reduction in oil reserves, along with an unexpected increase in gasoline stocks. The US Energy Ministry reported that in the week of April 8-14, oil reserves fell by 1 million barrels to 532.3 million barrels. Analysts had expected a drop of 1.5 million barrels. Gasoline stocks increased by 1.5 million barrels to 237.7 million barrels. A decrease of 2 million barrels was expected. Distillate stocks fell by 2 million barrels to 148.3 million barrels. The utilization factor of oil refining capacity increased by 1.9%, to 92.9%. Meanwhile, oil production increased to 9.252 million barrels per day from 9.235 million barrels a day a week earlier.

A small influence on the course of trading was provided by the Fed's Beige Book. The report noted that economic activity grew in all 12 districts, while the growth rate varied from modest to moderate. Also in the Beige Book, it was reported that improving the labor market conditions in the US exerts upward pressure on wages, as companies are increasingly reporting difficulties in To find low-skilled employees. Meanwhile, companies expect that the price increase in the next few months will be from small to moderate

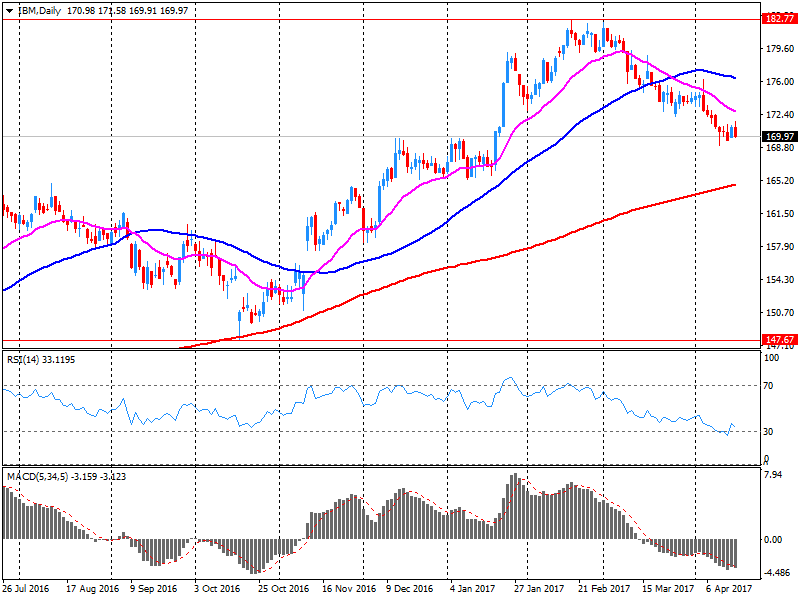

Most components of the DOW index recorded a decline (23 out of 30). The shares of International Business Machines Corporation (IBM, -5.19%) fell more than others. The leader of growth was shares of Intel Corporation (INTC, + 0.48%).

The S & P indexes closed mostly in negative territory. Most of all, the main materials sector fell (-1.6%). The leader of growth was the healthcare sector (+ 0.2%).

At closing:

DJIA -0.59% 20,402.57 -120.71

Nasdaq + 0.23% 5,863.03 +13.56

S & P -0.18% 2,337.97 -4.22

-

19:00

DJIA -0.53% 20,415.24 -108.04 Nasdaq +0.28% 5,865.69 +16.22 S&P -0.15% 2,338.77 -3.42

-

16:00

European stocks closed: FTSE 100 -33.14 7114.36 -0.46% DAX +16.01 12016.45 +0.13% CAC 40 +13.48 5003.73 +0.27%

-

13:32

U.S. Stocks open: Dow +0.08%, Nasdaq +0.49%, S&P +0.38%

-

13:22

Before the bell: S&P futures +0.35%, NASDAQ futures +0.46%

U.S. stock-index rose as investors moved on to the next set of financial reports, a day after Wall Street lost some ground due to weak quarterly results from some corporate heavyweights.

Stocks:

Nikkei 18,432.20 +13.61 +0.07%

Hang Seng 23,825.88 -98.66 -0.41%

Shanghai 3,171.31 -25.41 -0.79%

FTSE 7,118.73 -28.77 -0.40%

CAC 5,000.85 +10.60 +0.21%

DAX 12,015.23 +14.79 +0.12%

Crude $52.35 (-0.11%)

Gold $1,286.60 (-0.58%)

-

12:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32

0.24(0.76%)

21038

ALTRIA GROUP INC.

MO

72.5

0.16(0.22%)

244

Amazon.com Inc., NASDAQ

AMZN

908.73

4.95(0.55%)

99750

American Express Co

AXP

76

0.21(0.28%)

28775

AMERICAN INTERNATIONAL GROUP

AIG

59.59

0.09(0.15%)

176

Apple Inc.

AAPL

141.89

0.69(0.49%)

936579

AT&T Inc

T

40.32

0.07(0.17%)

8209

Barrick Gold Corporation, NYSE

ABX

19.54

-0.17(-0.86%)

23131

Caterpillar Inc

CAT

94.86

0.47(0.50%)

48255

Cisco Systems Inc

CSCO

32.75

0.08(0.24%)

846101

Citigroup Inc., NYSE

C

58.8

0.38(0.65%)

26159

Exxon Mobil Corp

XOM

81

-0.05(-0.06%)

28254

Facebook, Inc.

FB

141.91

0.95(0.67%)

439493

Ford Motor Co.

F

11.19

0.05(0.45%)

59562

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.57

0.10(0.80%)

16535

General Electric Co

GE

29.9

0.06(0.20%)

229085

General Motors Company, NYSE

GM

33.79

0.10(0.30%)

816

Goldman Sachs

GS

217

1.41(0.65%)

59218

Google Inc.

GOOG

841.37

4.55(0.54%)

58806

Hewlett-Packard Co.

HPQ

18.48

0.26(1.43%)

38120

Home Depot Inc

HD

147.5

-0.26(-0.18%)

27772

Intel Corp

INTC

35.88

0.12(0.32%)

800596

International Business Machines Co...

IBM

160.89

-9.16(-5.39%)

291027

International Paper Company

IP

51.8

0.35(0.68%)

592

Johnson & Johnson

JNJ

121.99

0.17(0.14%)

29840

JPMorgan Chase and Co

JPM

85.7

0.54(0.63%)

50197

Microsoft Corp

MSFT

65.53

0.14(0.21%)

1289934

Nike

NKE

56.02

-0.09(-0.16%)

29020

Pfizer Inc

PFE

33.99

0.15(0.44%)

28681

Procter & Gamble Co

PG

90.29

0.18(0.20%)

30483

Starbucks Corporation, NASDAQ

SBUX

58.27

-0.08(-0.14%)

237850

Tesla Motors, Inc., NASDAQ

TSLA

303.65

3.40(1.13%)

47962

The Coca-Cola Co

KO

43.73

0.25(0.58%)

110892

Twitter, Inc., NYSE

TWTR

14.49

0.05(0.35%)

4674

UnitedHealth Group Inc

UNH

169.1

0.51(0.30%)

28169

Verizon Communications Inc

VZ

49.38

0.16(0.33%)

28599

Visa

V

89.99

0.26(0.29%)

4411

Wal-Mart Stores Inc

WMT

74.11

0.22(0.30%)

28126

Walt Disney Co

DIS

114.49

0.30(0.26%)

28194

Yahoo! Inc., NASDAQ

YHOO

47.75

0.19(0.40%)

157225

-

12:54

Upgrades and downgrades before the market open

Upgrades:

Coca-Cola (KO) upgraded to Outperform from Neutral at Credit Suisse

Int'l Paper (IP) upgraded to Outperform at RBC Capital Mkts; target raised to $56

Goldman Sachs (GS) upgraded to Neutral from Sell at Citigroup

HP (HPQ) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Other:

IBM (IBM) target lowered to $180 from $185 at RBC Capital Mkts

Goldman Sachs (GS) target lowered to $240 from $250 at RBC Capital Mkts

AT&T (T) initiated with a Hold at SunTrust

Verizon (VZ) with a Hold at SunTrust

-

12:15

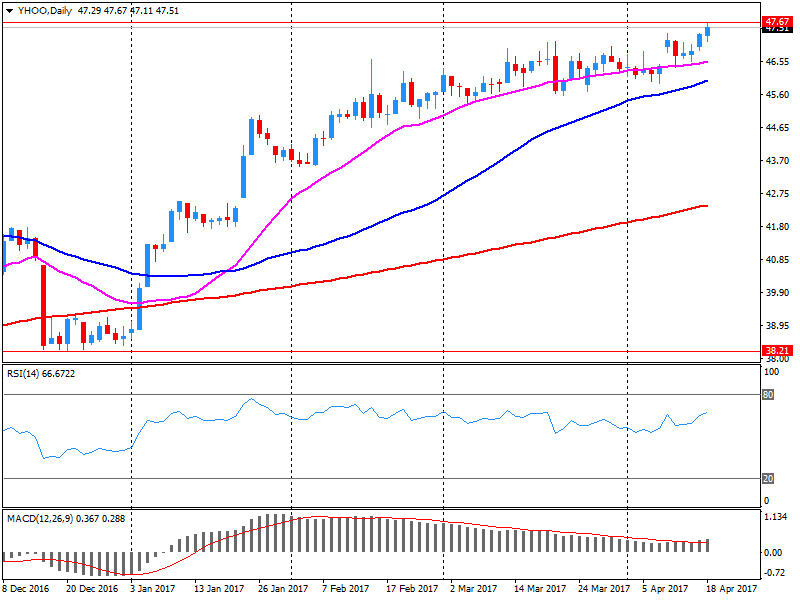

Company News: Yahoo! (YHOO) posts better-than-expected quarterly results

Yahoo! (YHOO) reported Q1 FY 2017 earnings of $0.18 per share (versus $0.08 in Q1 FY 2016), beating analysts' consensus estimate of $0.14.

The company's quarterly revenues amounted to $0.834 bln (-2.9% y/y), beating analysts' consensus estimate of $0.814 bln.

YHOO rose to $47.90 (+0.71%) in pre-market trading.

-

12:08

Company News: IBM (IBM) reports worse-than-expected quarterly revenues

IBM (IBM) reported Q1 FY 2017 earnings of $2.38 per share (versus $2.35 in Q1 FY 2016), beating analysts' consensus estimate of $2.35.

The company's quarterly revenues amounted to $18.155 bln (-2.8% y/y), slightly missing analysts' consensus estimate of $18.371 bln.

The company reaffirmed guidance for FY 2017, projecting EPS of at least $13.80 versus analysts' consensus estimate of $13.78.

IBM fell to 161.52 (-5.02%) in pre-market trading.

-

07:59

The main stock markets in Europe trading mixed: FTSE 7138.91 -8.59 -0.12%, DAX 12011.11 +10.67 + 0.09%, CAC 4988.26 -1.99 -0.04%

-

06:51

Mixed start of trading expected on the main European stock exchanges: DAX -0.1%, CAC40 flat, FTSE -0.5%

-

05:38

Global Stocks

European stocks moved sharply lower on Tuesday, with U.K. stocks leading the charge south after U.K. Prime Minister Theresa May unexpectedly called an early general election. A slump in commodity shares and nerves ahead of the first round of voting in France's presidential election on Sunday also added selling pressure on European equity benchmarks.

U.S. stocks on Tuesday finished squarely in negative territory, but off session lows, as a spate of tepid corporate earnings weighed on the broader market. A decline in shares of Goldman Sachs Group Inc. GS, -4.72% shaved more than 70 points off the Dow industrials after the investment bank's first-quarter results missed Wall Street expectations.

Equities investors in Asia tempered their risk appetite on Wednesday, tracking declines in the U.S., as geopolitical concerns continued to weigh on markets. British Prime Minister Theresa May's announcement of a general election in June, aimed at shoring up her mandate to take Britain out of the EU, added to already simmering market worries around North Korea, Syria and Russia.

-