Market news

-

23:50

Japan: Trade Balance Total, bln, March 615 (forecast 575.8)

-

22:46

New Zealand: CPI, y/y, Quarter I 2.2% (forecast 2%)

-

22:45

New Zealand: CPI, q/q , Quarter I 1.0% (forecast 0.8%)

-

22:28

Commodities. Daily history for Apr 19’02’2017:

(raw materials / closing price /% change)

Oil 50.58 +0.28%

Gold 1,282.00 -0.11%

-

22:27

Stocks. Daily history for Apr 19’2017:

(index / closing price / change items /% change)

Nikkei +13.61 18432.20 +0.07%

TOPIX -0.11 1471.42 -0.01%

Hang Seng -98.66 23825.88 -0.41%

CSI 300 -16.55 3446.08 -0.48%

Euro Stoxx 50 +11.21 3420.99 +0.33%

FTSE 100 -33.14 7114.36 -0.46%

DAX +16.01 12016.45 +0.13%

CAC 40 +13.48 5003.73 +0.27%

DJIA -118.79 20404.49 -0.58%

S&P 500 -4.02 2338.17 -0.17%

NASDAQ +13.56 5863.04 +0.23%

S&P/TSX -69.69 15552.88 -0.45%

-

22:27

Currencies. Daily history for Apr 19’2017:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0710 -0,19%

GBP/USD $1,2781 -0,48%

USD/CHF Chf0,998 +0,20%

USD/JPY Y108,84 +0,38%

EUR/JPY Y116,57 +0,20%

GBP/JPY Y139,11 -0,09%

AUD/USD $0,7494 -0,84%

NZD/USD $0,7002 -0,51%

USD/CAD C$1,348 +0,75%

-

21:59

Schedule for today, Thursday, Apr 20’2017 (GMT0)

01:30 Australia NAB Quarterly Business Confidence 5

06:00 Germany Producer Price Index (MoM) March 0.2% 0.1%

06:00 Germany Producer Price Index (YoY) March 3.1% 3.2%

12:00 U.S. FOMC Member Jerome Powell Speaks

12:30 U.S. Continuing Jobless Claims 2028 2020

12:30 U.S. Philadelphia Fed Manufacturing Survey April 32.8 25

12:30 U.S. Initial Jobless Claims 234 242

14:00 Eurozone Consumer Confidence (Preliminary) April -5 -4.8

14:00 U.S. Leading Indicators March 0.6% 0.2%

15:30 United Kingdom BOE Gov Mark Carney Speaks

17:15 U.S. Treasury Sec Mnuchin Speaks

-

20:05

Major US stock indices showed mixed dynamics

The major US stock indexes finished trading in different directions, responding to a new portion of corporate reporting and the collapse of oil quotations.

In the focus of investors' attention were shares of companies such as IBM (IBM), Yahoo! (YHOO), Morgan Stanley (MS), which published their quarterly reports.

The cost of oil decreased by almost 4%, which was due to the growth of the US dollar and an ambiguous report from the US Energy Ministry, which pointed to less than expected reduction in oil reserves, along with an unexpected increase in gasoline stocks. The US Energy Ministry reported that in the week of April 8-14, oil reserves fell by 1 million barrels to 532.3 million barrels. Analysts had expected a drop of 1.5 million barrels. Gasoline stocks increased by 1.5 million barrels to 237.7 million barrels. A decrease of 2 million barrels was expected. Distillate stocks fell by 2 million barrels to 148.3 million barrels. The utilization factor of oil refining capacity increased by 1.9%, to 92.9%. Meanwhile, oil production increased to 9.252 million barrels per day from 9.235 million barrels a day a week earlier.

A small influence on the course of trading was provided by the Fed's Beige Book. The report noted that economic activity grew in all 12 districts, while the growth rate varied from modest to moderate. Also in the Beige Book, it was reported that improving the labor market conditions in the US exerts upward pressure on wages, as companies are increasingly reporting difficulties in To find low-skilled employees. Meanwhile, companies expect that the price increase in the next few months will be from small to moderate

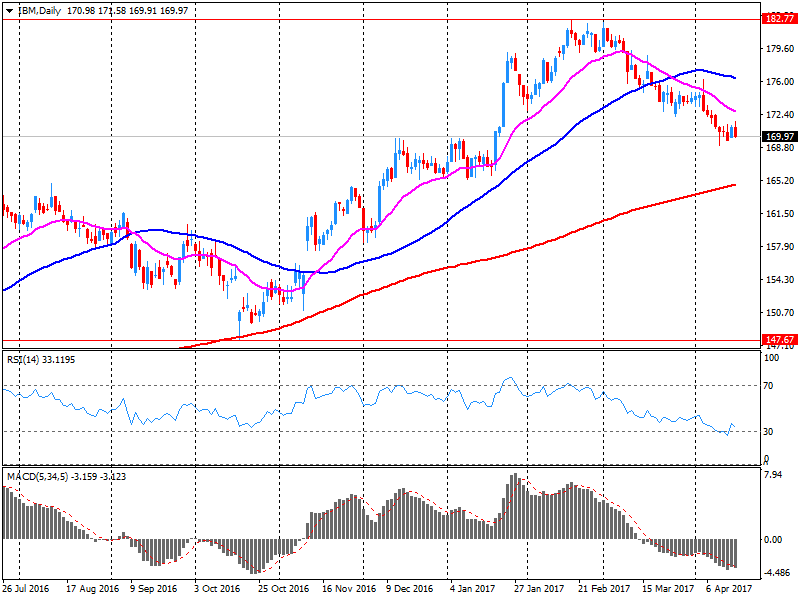

Most components of the DOW index recorded a decline (23 out of 30). The shares of International Business Machines Corporation (IBM, -5.19%) fell more than others. The leader of growth was shares of Intel Corporation (INTC, + 0.48%).

The S & P indexes closed mostly in negative territory. Most of all, the main materials sector fell (-1.6%). The leader of growth was the healthcare sector (+ 0.2%).

At closing:

DJIA -0.59% 20,402.57 -120.71

Nasdaq + 0.23% 5,863.03 +13.56

S & P -0.18% 2,337.97 -4.22

-

19:00

DJIA -0.53% 20,415.24 -108.04 Nasdaq +0.28% 5,865.69 +16.22 S&P -0.15% 2,338.77 -3.42

-

16:00

European stocks closed: FTSE 100 -33.14 7114.36 -0.46% DAX +16.01 12016.45 +0.13% CAC 40 +13.48 5003.73 +0.27%

-

14:35

US crude oil inventories decreased by 1.0 million barrels from the previous week

U.S. commercial crude oil inventories (excluding those in the Strategic Petroleum Reserve) decreased by 1.0 million barrels from the previous week. At 532.3 million barrels, U.S. crude oil inventories are near the upper limit of the average range for this time of year.

Total motor gasoline inventories increased by 1.5 million barrels last week, and are near the upper limit of the average range. Finished gasoline inventories decreased while blending components inventories increased last week.

Distillate fuel inventories decreased by 2.0 million barrels last week but are in the upper half of the average range for this time of year. Propane/propylene inventories fell 0.7 million barrels last week and are in the lower half of the average range. Total commercial petroleum inventories decreased by 1.7 million barrels last week.

-

14:30

U.S.: Crude Oil Inventories, April -1.034 (forecast -1.500)

-

14:01

May wins U.K. Parliament vote to allow June 8 snap election @zerohedge

-

13:41

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0600 (EUR 545m) 1.0650 (665m) 1.0685 (600m) 1.0700 (1.3bln) 1.0750 (986m) 1.0770 (1.55bln) 1.0800 (1.15bln)

USDJPY: 108.00 (USD 370m) 108.50 (250m) 109.50 (260m) 110.00 (660m)

GBPUSD: 1.2750 (GBP 365m)

AUDUSD: 0.7450 (AUD 443m) 0.7575 (AUD 504m) 0.7680-90 (1.1bln)

USDCAD: 1.3250-60 (USD 285m) 1.3330-40 (425m) 1.3500 (326m)

EURJPY: 116.25-35 (EUR 375m) 117.50 (200m)

-

13:32

U.S. Stocks open: Dow +0.08%, Nasdaq +0.49%, S&P +0.38%

-

13:22

Before the bell: S&P futures +0.35%, NASDAQ futures +0.46%

U.S. stock-index rose as investors moved on to the next set of financial reports, a day after Wall Street lost some ground due to weak quarterly results from some corporate heavyweights.

Stocks:

Nikkei 18,432.20 +13.61 +0.07%

Hang Seng 23,825.88 -98.66 -0.41%

Shanghai 3,171.31 -25.41 -0.79%

FTSE 7,118.73 -28.77 -0.40%

CAC 5,000.85 +10.60 +0.21%

DAX 12,015.23 +14.79 +0.12%

Crude $52.35 (-0.11%)

Gold $1,286.60 (-0.58%)

-

13:13

Ecb's Coeure says personally don't see risks as tilted to downside

-

Taking support away would change picture

-

Still have to be convinced that return of inflation to 2 pct is sustainable

-

Not much discussion today about adding to ecb balance sheet

-

Says that european and french people want to keep the euro

-

-

12:57

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32

0.24(0.76%)

21038

ALTRIA GROUP INC.

MO

72.5

0.16(0.22%)

244

Amazon.com Inc., NASDAQ

AMZN

908.73

4.95(0.55%)

99750

American Express Co

AXP

76

0.21(0.28%)

28775

AMERICAN INTERNATIONAL GROUP

AIG

59.59

0.09(0.15%)

176

Apple Inc.

AAPL

141.89

0.69(0.49%)

936579

AT&T Inc

T

40.32

0.07(0.17%)

8209

Barrick Gold Corporation, NYSE

ABX

19.54

-0.17(-0.86%)

23131

Caterpillar Inc

CAT

94.86

0.47(0.50%)

48255

Cisco Systems Inc

CSCO

32.75

0.08(0.24%)

846101

Citigroup Inc., NYSE

C

58.8

0.38(0.65%)

26159

Exxon Mobil Corp

XOM

81

-0.05(-0.06%)

28254

Facebook, Inc.

FB

141.91

0.95(0.67%)

439493

Ford Motor Co.

F

11.19

0.05(0.45%)

59562

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.57

0.10(0.80%)

16535

General Electric Co

GE

29.9

0.06(0.20%)

229085

General Motors Company, NYSE

GM

33.79

0.10(0.30%)

816

Goldman Sachs

GS

217

1.41(0.65%)

59218

Google Inc.

GOOG

841.37

4.55(0.54%)

58806

Hewlett-Packard Co.

HPQ

18.48

0.26(1.43%)

38120

Home Depot Inc

HD

147.5

-0.26(-0.18%)

27772

Intel Corp

INTC

35.88

0.12(0.32%)

800596

International Business Machines Co...

IBM

160.89

-9.16(-5.39%)

291027

International Paper Company

IP

51.8

0.35(0.68%)

592

Johnson & Johnson

JNJ

121.99

0.17(0.14%)

29840

JPMorgan Chase and Co

JPM

85.7

0.54(0.63%)

50197

Microsoft Corp

MSFT

65.53

0.14(0.21%)

1289934

Nike

NKE

56.02

-0.09(-0.16%)

29020

Pfizer Inc

PFE

33.99

0.15(0.44%)

28681

Procter & Gamble Co

PG

90.29

0.18(0.20%)

30483

Starbucks Corporation, NASDAQ

SBUX

58.27

-0.08(-0.14%)

237850

Tesla Motors, Inc., NASDAQ

TSLA

303.65

3.40(1.13%)

47962

The Coca-Cola Co

KO

43.73

0.25(0.58%)

110892

Twitter, Inc., NYSE

TWTR

14.49

0.05(0.35%)

4674

UnitedHealth Group Inc

UNH

169.1

0.51(0.30%)

28169

Verizon Communications Inc

VZ

49.38

0.16(0.33%)

28599

Visa

V

89.99

0.26(0.29%)

4411

Wal-Mart Stores Inc

WMT

74.11

0.22(0.30%)

28126

Walt Disney Co

DIS

114.49

0.30(0.26%)

28194

Yahoo! Inc., NASDAQ

YHOO

47.75

0.19(0.40%)

157225

-

12:54

Upgrades and downgrades before the market open

Upgrades:

Coca-Cola (KO) upgraded to Outperform from Neutral at Credit Suisse

Int'l Paper (IP) upgraded to Outperform at RBC Capital Mkts; target raised to $56

Goldman Sachs (GS) upgraded to Neutral from Sell at Citigroup

HP (HPQ) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Other:

IBM (IBM) target lowered to $180 from $185 at RBC Capital Mkts

Goldman Sachs (GS) target lowered to $240 from $250 at RBC Capital Mkts

AT&T (T) initiated with a Hold at SunTrust

Verizon (VZ) with a Hold at SunTrust

-

12:41

IMF says U.S companies may be tempted to channel cash from Trump tax cuts into financial risk-taking, not capital investments

-

12:15

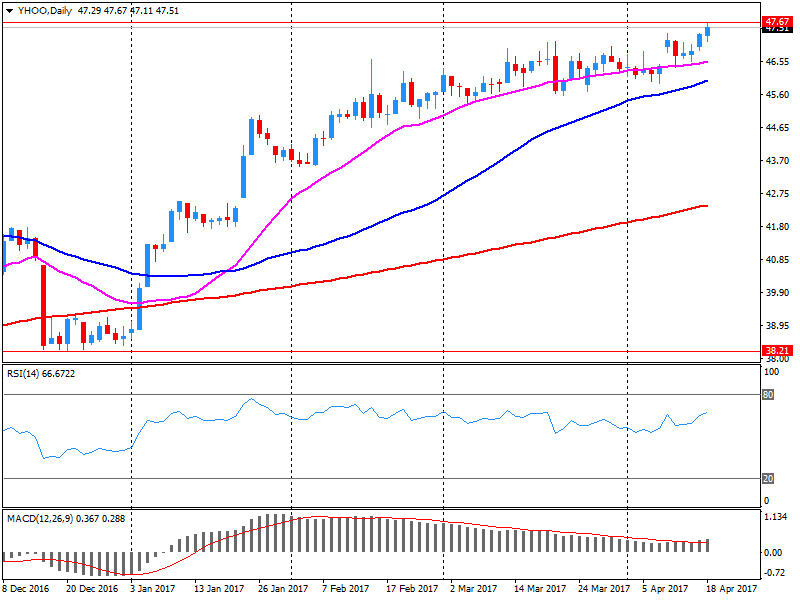

Company News: Yahoo! (YHOO) posts better-than-expected quarterly results

Yahoo! (YHOO) reported Q1 FY 2017 earnings of $0.18 per share (versus $0.08 in Q1 FY 2016), beating analysts' consensus estimate of $0.14.

The company's quarterly revenues amounted to $0.834 bln (-2.9% y/y), beating analysts' consensus estimate of $0.814 bln.

YHOO rose to $47.90 (+0.71%) in pre-market trading.

-

12:08

Company News: IBM (IBM) reports worse-than-expected quarterly revenues

IBM (IBM) reported Q1 FY 2017 earnings of $2.38 per share (versus $2.35 in Q1 FY 2016), beating analysts' consensus estimate of $2.35.

The company's quarterly revenues amounted to $18.155 bln (-2.8% y/y), slightly missing analysts' consensus estimate of $18.371 bln.

The company reaffirmed guidance for FY 2017, projecting EPS of at least $13.80 versus analysts' consensus estimate of $13.78.

IBM fell to 161.52 (-5.02%) in pre-market trading.

-

12:01

Orders

EUR/USD

Offers: 1.0750 1.0780 1.0800 1.0830 1.0850

Bids: 1.0700 1.0680-85 1.0650 1.0635 1.0620 1.0600

GBP/USD

Offers: 1.2850 1.2880 1.2900 1.2920 1.2950-60 1.2975 1.3000

Bids: 1.2800 1.2775-80 1.2760 1.2750 1.2720 1.2700 1.2680 1.2650

EUR/JPY

Offers: 116.85 117.00 117.30 117.50 117.80 118.00

Bids: 116.50 116.30 116.00 115.80-85 115.50 115.20 115.00

EUR/GBP

Offers: 0.8380 0.8400 0.8425-30 0.8445-50 0.8480 0.8500-05

Bids: 0.8335 0.8320 0.8300 0.8280 0.8260 0.8200

USD/JPY

Offers: 109.00 109.20-25 109.50 109.80110.00 110.30 110.50

Bids: 108.50 108.30 108.00 107.80 107.50 107.00

AUD/USD

Offers: 0.7530 0.7550 0.7580 0.7600 0.7620 0.7650

Bids: 0.7500 0.7480-85 0.7465 0.7450 0.7400

-

11:05

Poland expects gdp growth at 3.6 pct in 2017, 3.8 pct in 2018, 3.9 pct in 2019 in EU convergence plan update

-

Expects its fiscal deficit at 2.9 pct/gdp in 2017, 2.5 pct in 2018, 2.0 pct in 2019 in eu convergence plan update

-

Expects annual average cpi at 1.8 pct in 2017, 2.3 pct in 2018, 2.3 pct in 2019 in eu convergence plan update

-

Public debt at 55.3 pct/gdp in 2017, 54.8 pct in 2018, 54.0 pct in 2019, 52.1 pct in 2020 - Finance Ministry

-

-

10:13

Ecb's Hansson says need more incoming data before considering concrete policy action

-

09:45

Euro area trade balance surplus continued to rise

The first estimate for euro area (EA19) exports of goods to the rest of the world in February 2017 was €170.3 billion, an increase of 4% compared with February 2016 (€163.2 bn). Imports from the rest of the world stood at €152.6 bn, a rise of 5% compared with February 2016 (€144.9 bn). As a result, the euro area recorded a €17.8 bn surplus in trade in goods with the rest of the world in February 2017, compared with +€18.2 bn in February 2016. Intra-euro area trade rose to €149.1 bn in February 2017, up by 5% compared with February 2016. These data are released by Eurostat, the statistical office of the European Union.

-

09:04

Euro area annual inflation was 1.5% in March 2017

Euro area annual inflation was 1.5% in March 2017, down from 2.0% in February. In March 2016 the rate was 0.0%. European Union annual inflation was 1.6% in March 2017, down from 2.0% in February. A year earlier the rate was 0.0%. These figures come from Eurostat, the statistical office of the European Union. The lowest annual rates were registered in Romania (0.4%), Ireland and the Netherlands (both 0.6%). The highest annual rates were recorded in Latvia (3.3%), Lithuania (3.2%) and Estonia (3.0%). Compared with February 2017, annual inflation fell in seventeen Member States, remained stable in six and rose in five. The largest upward impacts to euro area annual inflation came from fuels for transport (+0.48 percentage points), heating oil (+0.11 pp) and vegetables (+0.08 pp), while telecommunication and package holidays (-0.09 pp each), and garments (-0.05 pp) had the biggest downward impacts.

-

09:01

Eurozone: Harmonized CPI ex EFAT, Y/Y, March 0.7% (forecast 0.7%)

-

09:01

Eurozone: Trade balance unadjusted, February 17.8 (forecast 16.2)

-

09:00

Eurozone: Harmonized CPI, Y/Y, March 1.5% (forecast 1.5%)

-

09:00

Eurozone: Harmonized CPI, March 0.8% (forecast 0.8%)

-

08:38

Turkish prime minister Yildirim says appeals against referendum results are a right, but calling people to the streets in protest is not

-

08:36

Italian trade balance surplus lower than expected in Feb

In February 2017 seasonally-adjusted data, compared to January 2017, decreased by 2.0% for outgoing flows while increased by 1.3% for incoming flows. The decrease of exports is the result of an increase for EU countries (+0.3%) and a decrease for non EU countries (-4.7%). The increase of imports is the result of an increase for EU countries (+2.5%) and a drop for non EU countries (-0.4%). Over the last three months, seasonally-adjusted data, in comparison with the previous three months, showed a growth of 3.7% for exports and of 5.6% for imports.

In February 2017, compared with the same month of the previous year, exports and imports increased (+2.3% and +9.1% respectively). Outgoing flows increased by 1.3% for EU countries and by 3.6% for non EU countries. Incoming flows increased by 7.3% for EU area and by 11.9% for non EU area. The trade balance in February amounted to +1.9 billion Euros (+0.2 billion Euros for EU area and +1,7 billion Euros for non EU countries).

-

08:00

British PM May says there will be no second referendum on EU membership

-

We won't be doing television debates in election campaign

-

-

07:59

The main stock markets in Europe trading mixed: FTSE 7138.91 -8.59 -0.12%, DAX 12011.11 +10.67 + 0.09%, CAC 4988.26 -1.99 -0.04%

-

07:21

British PM Theresa May says this election will allow us to strengthen our position in EU talks - BBC interview

-

Says holding election now will provide stability for longer period

-

Planned 2020 election would have clashed with crunch time in EU talks

-

-

06:51

Mixed start of trading expected on the main European stock exchanges: DAX -0.1%, CAC40 flat, FTSE -0.5%

-

06:40

Options levels on wednesday, April 19, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0857 (1052)

$1.0819 (455)

$1.0795 (166)

Price at time of writing this review: $1.0719

Support levels (open interest**, contracts):

$1.0657 (531)

$1.0608 (757)

$1.0548 (1947)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 60413 contracts, with the maximum number of contracts with strike price $1,1100 (5074);

- Overall open interest on the PUT options with the expiration date June, 9 is 60770 contracts, with the maximum number of contracts with strike price $1,0400 (5229);

- The ratio of PUT/CALL was 1.01 versus 1.09 from the previous trading day according to data from April, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.3109 (720)

$1.3012 (1249)

$1.2917 (970)

Price at time of writing this review: $1.2820

Support levels (open interest**, contracts):

$1.2785 (305)

$1.2689 (221)

$1.2592 (437)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 18056 contracts, with the maximum number of contracts with strike price $1,2800 (2216);

- Overall open interest on the PUT options with the expiration date June, 9 is 20503 contracts, with the maximum number of contracts with strike price $1,1500 (3064);

- The ratio of PUT/CALL was 1.14 versus 1.16 from the previous trading day according to data from April, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

06:29

U.S vice president Pence: U.S policy on North Korea will be to work with allies and China on economic and diplomatic pressure

-

U.S will protect freedom of navigation and overflight in South China sea, will ensure unimpeded flow of lawful commerce

-

Those who would challenge our resolve should know we will defeat any attack with overwhelming response

-

-

06:27

Fitch - forecast two more US rate hikes in 2017, and another four in 2018

-

US tightening, trade risks weigh on APAC growth outlook

-

-

06:23

Australian new motor vehicle sales up 1.9% in March

The March 2017 trend estimate (96,023) decreased by 0.3% when compared with February 2017.

When comparing national trend estimates for March 2017 with February 2017, sales for Sports utility vehicles and Other vehicles increased by 0.2%and 0.5% respectively. By contrast, sales for Passenger vehicles decreased by 1.3%.

The largest downward movement across all states and territories, on a trend basis, was in Tasmania (-1.9%), continuing a downward trend that began in November 2016.

The Northern Territory was the only jurisdiction not to record a decrease in sales.

-

06:21

Trump says will stand up for Wisconsin dairy farmers against Canadian trade practices - Reuters

-

05:38

Global Stocks

European stocks moved sharply lower on Tuesday, with U.K. stocks leading the charge south after U.K. Prime Minister Theresa May unexpectedly called an early general election. A slump in commodity shares and nerves ahead of the first round of voting in France's presidential election on Sunday also added selling pressure on European equity benchmarks.

U.S. stocks on Tuesday finished squarely in negative territory, but off session lows, as a spate of tepid corporate earnings weighed on the broader market. A decline in shares of Goldman Sachs Group Inc. GS, -4.72% shaved more than 70 points off the Dow industrials after the investment bank's first-quarter results missed Wall Street expectations.

Equities investors in Asia tempered their risk appetite on Wednesday, tracking declines in the U.S., as geopolitical concerns continued to weigh on markets. British Prime Minister Theresa May's announcement of a general election in June, aimed at shoring up her mandate to take Britain out of the EU, added to already simmering market worries around North Korea, Syria and Russia.

-

01:31

Australia: New Motor Vehicle Sales (MoM) , March 1.9%

-

01:31

Australia: New Motor Vehicle Sales (YoY) , March -3.0%

-