Market news

-

22:28

Stocks. Daily history for Apr 20’2017:

(index / closing price / change items /% change)

Nikkei -1.71 18430.49 -0.01%

TOPIX +1.39 1472.81 +0.09%

Hang Seng +231.10 24056.98 +0.97%

CSI 300 +16.01 3462.09 +0.46%

Euro Stoxx 50 +19.04 3440.03 +0.56%

FTSE 100 +4.18 7118.54 +0.06%

DAX +10.87 12027.32 +0.09%

CAC 40 +74.18 5077.91 +1.48%

DJIA +174.22 20578.71 +0.85%

S&P 500 +17.67 2355.84 +0.76%

NASDAQ +53.74 5916.78 +0.92%

S&P/TSX +72.68 15625.56 +0.47%

-

20:08

The main US stock indices increased significantly as a result of today's trading

Major US stock indices added about a percentage on Thursday, mainly due to the growth of shares in the conglomerate sector and financial segment.

In addition, as it became known today, new applications for unemployment benefits in the US rose slightly more than expected last week, but the number of Americans who continue to receive unemployment benefits fell to a 17-year low, indicating a tightening of the labor market. Initial claims for unemployment benefits increased by 10,000 and, taking into account seasonal fluctuations, reached 244,000 for the week ending April 15. This increase followed a three-week decline. Economists predicted that primary treatment will grow to 242,000 people. The average four-week moving average of calls, which is considered to be the best indicator of labor market trends, fell by 4,250 to 243,000 last week. The report also showed that the number of repeated applications for unemployment benefits decreased by 49,000 to 1.98 million in the week to April 8. This was the lowest rate since April 2000.

At the same time, the report submitted by the Federal Reserve Bank of Philadelphia showed that the index of business activity in the production sector fell in April to 22 points from 32.8 points in March. Economists had expected a decline to 25 points. The employment index rose to 19.9 from 17.5 in March, while the index of new orders fell to 27.4 from 38.6 in March.

Oil futures fell a little on Thursday, Negative impact on prices was provided by evidence of an increase in oil production in the US, but further drop in quotes held back comments from the leading oil producers in the Gulf of Mexico regarding the extension of the current agreement to reduce oil production.

Most components of the DOW index finished trading in positive territory (26 out of 30). More fell shares Verizon Communications Inc. (VZ, -1.35%). The leader of growth was shares of American Express Company (AXP, + 6.12%).

Almost all sectors of the S & P index showed a positive trend. The leader of growth was the conglomerate sector (+ 1.7%). Only the utilities sector fell (-0.3%).

At closing:

DJIA + 0.86% 20.579.26 +174.77

Nasdaq + 0.92% 5,916.78 +53.75

S & P + 0.76% 2,355.92 +17.75

-

19:00

DJIA +0.97% 20,602.46 +197.97 Nasdaq +1.04% 5,923.91 +60.88 S&P +0.87% 2,358.61 +20.44

-

16:00

European stocks closed: FTSE 100 +4.18 7118.54 +0.06% DAX +10.87 12027.32 +0.09% CAC 40 +74.18 5077.91 +1.48%

-

13:33

U.S. Stocks open: Dow +0.30%, Nasdaq +0.48%, S&P +0.31%

-

13:28

Before the bell: S&P futures +0.26%, NASDAQ futures +0.37%

U.S. stock-index rose amid increased optimism around the first-quarter earnings season, while oil prices kept above $50 level.

Stocks:

Nikkei 18,430.49 -1.71 -0.01%

Hang Seng 24,056.98 +231.10 +0.97%

Shanghai 3,172.59 +1.90 +0.06%

FTSE 7,110.50 -3.86 -0.05%

CAC 5,046.67 +42.94 +0.86%

DAX 12,018.06 +1.61 +0.01%

Crude $50.74 (-0.22%)

Gold $1,282.10 (-0.10%)

-

12:58

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALTRIA GROUP INC.

MO

71.6

-0.51(-0.71%)

2745

Amazon.com Inc., NASDAQ

AMZN

898.5

-0.70(-0.08%)

46970

American Express Co

AXP

77.3

1.75(2.32%)

9226

Apple Inc.

AAPL

141.2

0.52(0.37%)

44780

AT&T Inc

T

40.01

-0.24(-0.60%)

109961

Barrick Gold Corporation, NYSE

ABX

19.05

0.14(0.74%)

50830

Caterpillar Inc

CAT

93.1

0.40(0.43%)

2522

Cisco Systems Inc

CSCO

32.74

0.09(0.28%)

1751

Citigroup Inc., NYSE

C

58.03

0.30(0.52%)

5678

Deere & Company, NYSE

DE

107.9

-0.32(-0.30%)

1611

Exxon Mobil Corp

XOM

80.65

0.16(0.20%)

5117

Facebook, Inc.

FB

142.61

0.34(0.24%)

54343

Ford Motor Co.

F

11.23

0.04(0.36%)

13275

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.45

0.10(0.81%)

9518

General Electric Co

GE

30.04

0.04(0.13%)

2079

General Motors Company, NYSE

GM

33.9

0.11(0.33%)

1129

Goldman Sachs

GS

214.9

0.81(0.38%)

11403

Hewlett-Packard Co.

HPQ

18.37

-0.01(-0.05%)

250

Intel Corp

INTC

36.01

0.10(0.28%)

1342

International Business Machines Co...

IBM

161.5

-0.19(-0.12%)

12053

Johnson & Johnson

JNJ

121.05

-0.32(-0.26%)

229

JPMorgan Chase and Co

JPM

84.85

0.39(0.46%)

15320

Microsoft Corp

MSFT

65.28

0.24(0.37%)

2192

Nike

NKE

55.92

0.06(0.11%)

31640

Starbucks Corporation, NASDAQ

SBUX

59.9

0.86(1.46%)

23035

Tesla Motors, Inc., NASDAQ

TSLA

306.58

1.06(0.35%)

19842

The Coca-Cola Co

KO

43.3

0.07(0.16%)

242

Travelers Companies Inc

TRV

117.95

-2.45(-2.03%)

84297

Twitter, Inc., NYSE

TWTR

14.58

0.04(0.28%)

11338

Verizon Communications Inc

VZ

47.84

-1.10(-2.25%)

564791

Visa

V

90.26

0.51(0.57%)

6035

Wal-Mart Stores Inc

WMT

74.15

0.08(0.11%)

514

Walt Disney Co

DIS

114.02

0.29(0.26%)

706

Yahoo! Inc., NASDAQ

YHOO

47.2

0.20(0.43%)

630

Yandex N.V., NASDAQ

YNDX

23.41

0.09(0.39%)

5800

-

12:51

Upgrades and downgrades before the market open

Upgrades:

Goldman Sachs (GS) upgraded to Overweight from Neutral at Atlantic Equities

Starbucks (SBUX) upgraded to Buy from Hold at Stifel

Downgrades:

Other:

Amazon (AMZN) target raised to $1000 from $940 at Maxim Group

-

12:09

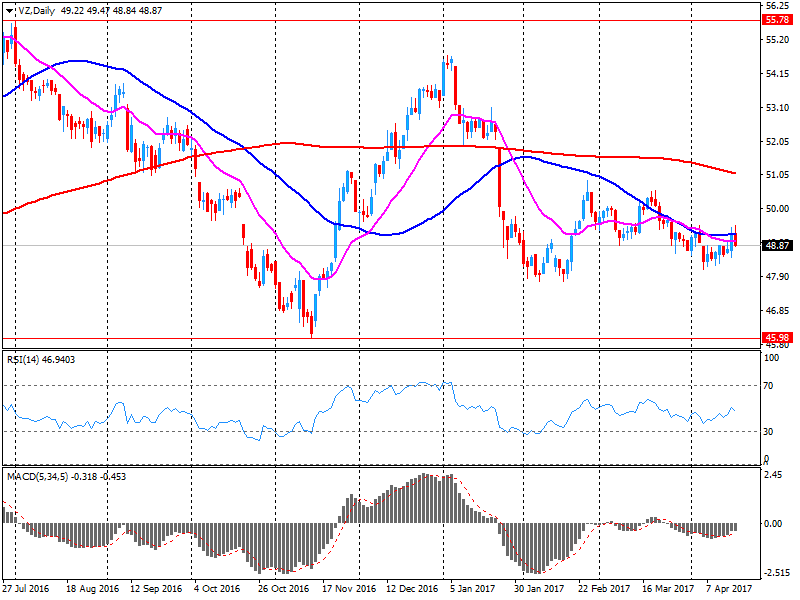

Company News: Verizon (VZ) posts worse-than-expected quarterly results

Verizon (VZ) reported Q1 FY 2017 earnings of $0.95 per share (versus $1.06 in Q1 FY 2016), missing analysts' consensus estimate of $0.96.

The company's quarterly revenues amounted to $29.814 bln (-7.3% y/y), missing analysts' consensus estimate of $30.411 bln.

VZ fell to $48.05 (-1.82%) in pre-market trading.

-

12:04

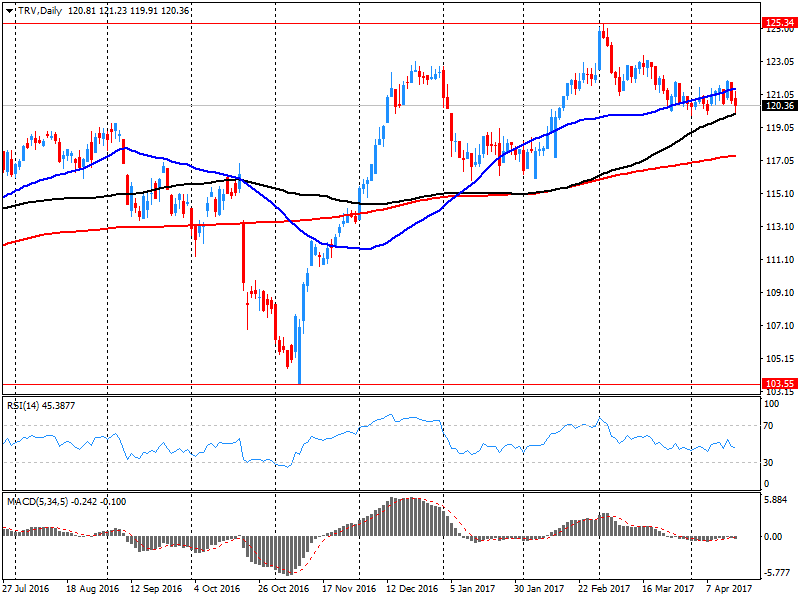

Company News: Travelers (TRV) quarterly results miss analysts’ expectations

Travelers (TRV) reported Q1 FY 2017 earnings of $2.16 per share (versus $2.33 in Q1 FY 2016), missing analysts' consensus estimate of $2.38.

The company's quarterly revenues amounted to $6.183 bln (+3.4% y/y), missing analysts' consensus estimate of $6.252 bln.

TRV fell to $119.00 (-1.16%) in pre-market trading.

-

12:01

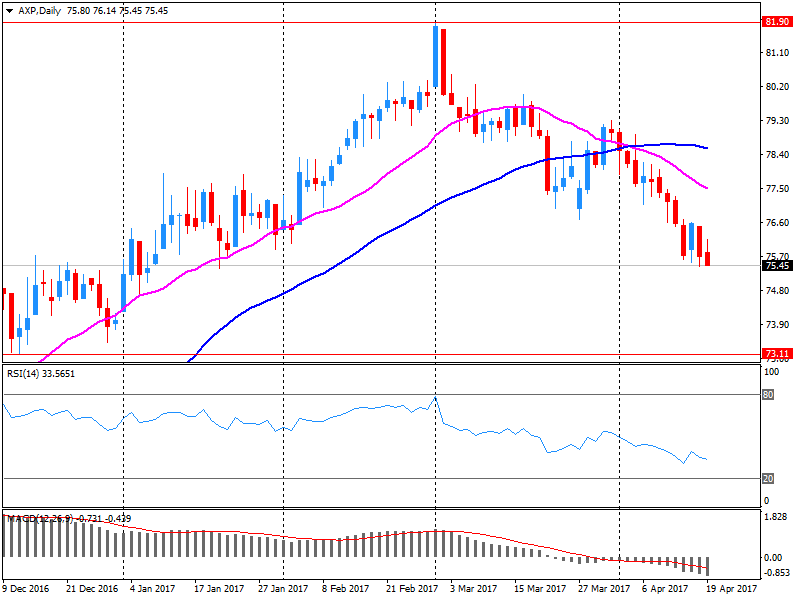

Company News: American Express (AXP) quarterly results beat analysts’ estimates

American Express (AXP) reported Q1 FY 2017 earnings of $1.34 per share (versus $1.45 in Q1 FY 2016), beating analysts' consensus estimate of $1.27.

The company's quarterly revenues amounted to $7.889 bln (-2.5% y/y), beating analysts' consensus estimate of $7.764 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $5.60-5.80 versus analysts' consensus estimate of $5.65.

AXP rose to $77.50 (+2.58%) in pre-market trading.

-

07:47

Major European stock exchanges trading in the green zone: FTSE 7126.45 +12.09 + 0.17%, DAX 12019.81 +3.36 + 0.03%, CAC 5029.16 +25.43 + 0.51%

-

06:50

Mixed start of trading expected on the main European stock exchanges: DAX -0.1%, CAC40 flat, FTSE -0.5%

-

05:32

Global Stocks

European stocks finished with moderate gains Wednesday, as investors assessed a stack of earnings reports a day after the market suffered its worst session in five months.

European stocks finished with moderate gains Wednesday, as investors assessed a stack of earnings reports a day after the market suffered its worst session in five months.

Asian stocks posted broad early gains Thursday after wide weakness Wednesday as investors eased up on worries. Some so-called havens - including sovereign debt, gold and the yen - pulled back overnight. That sentiment carried over into Asia.

-