Market news

-

20:06

Major US stock indexes finished trading slightly below zero

Major US stock indices fell slightly on Friday, as investors held back from taking risky deals on the eve of the first round of the presidential elections in France.

In addition, as it became known today, adjusted for seasonality, the preliminary composite PMI release index from Markit in the US fell to 52.7 in April, compared to 53.0 in March, signaling a further slowdown in production growth in the private sector. The latest reading pointed to the weakest growth since September 2016. The modest growth in the private sector reflected a loss of momentum in the economy of the services sector (preliminary index was 52.5 in April), and manufacturing (preliminary index was 53.4).

At the same time, home sales in the secondary market in the US increased more than expected in March, to the highest level in the last ten years, as more homes appeared on the market and they were quickly bought up by consumers. The National Association of Realtors said on Friday that the volume of home sales in the secondary market grew by 4.4 percent and, subject to seasonal adjustment, reached 5.71 million units last month. Economists forecast sales growth of 2.5% to 5.60 million units in March.

Most components of the DOW index closed in the red (16 of 30). More shares fell shares Verizon Communications Inc. (VZ, -2.33%). The leader of growth was shares of Microsoft Corporation (MSFT, + 1.47%).

Most sectors of the S & P index showed a decline. The conglomerate sector fell most of all (-0.7%). The leader of growth was the utilities sector (+ 0.6%).

At closing:

Dow -0.15% 20.547.76 -30.95

Nasdaq -0.11% 5,910.52 -6.26

S & P -0.30% 2,348.70 -7.14

-

19:00

DJIA +0.03% 20,584.75 +6.04 Nasdaq -0.12% 5,909.60 -7.18 S&P -0.19% 2,351.35 -4.49

-

16:00

European stocks closed: FTSE 100 -3.99 7114.55 -0.06% DAX +21.25 12048.57 +0.18% CAC 40 -18.71 5059.20 -0.37%

-

13:33

U.S. Stocks open: Dow +0.07%, Nasdaq 0.00%, S&P -0.02%

-

13:11

Before the bell: S&P futures +0.11%, NASDAQ futures +0.12%

U.S. stock-index rose slightly as, despite positive earnings reports from Visa (V), General Electric (GE) and Honeywell (HON), investors preferred not to make big bets ahead of the first round of the French presidential elections over the weekend.

Stocks:

Nikkei 18,620.75 +190.26 +1.03%

Hang Seng 24,042.02 -14.96 -0.06%

Shanghai 3,173.15 +1.05 +0.03%

FTSE 7,123.83 +5.29 +0.07%

CAC 5,068.41 -9.50 -0.19%

DAX 12,080.12 +52.80 +0.44%

Crude $50.71 (0.00%)

Gold $1,284.10 (+0.02%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32.43

0.39(1.22%)

2703

Amazon.com Inc., NASDAQ

AMZN

904.5

2.44(0.27%)

3482

Apple Inc.

AAPL

142.51

0.07(0.05%)

26431

Barrick Gold Corporation, NYSE

ABX

19.27

0.07(0.36%)

21119

Boeing Co

BA

179.6

0.30(0.17%)

1200

Citigroup Inc., NYSE

C

58.5

0.09(0.15%)

7234

Exxon Mobil Corp

XOM

81.1

0.09(0.11%)

2079

Facebook, Inc.

FB

143.93

0.13(0.09%)

15378

Ford Motor Co.

F

11.49

0.02(0.17%)

18370

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.78

0.27(2.16%)

112556

General Electric Co

GE

30.57

0.30(0.99%)

1803892

General Motors Company, NYSE

GM

34.15

0.05(0.15%)

1677

Goldman Sachs

GS

218.5

0.44(0.20%)

2065

Google Inc.

GOOG

841.1

-0.55(-0.07%)

1114

HONEYWELL INTERNATIONAL INC.

HON

127.6

3.83(3.09%)

11221

International Business Machines Co...

IBM

162.75

0.45(0.28%)

950

Johnson & Johnson

JNJ

122

0.13(0.11%)

235

JPMorgan Chase and Co

JPM

85.75

0.20(0.23%)

1874

McDonald's Corp

MCD

133.64

0.37(0.28%)

164

Microsoft Corp

MSFT

65.55

0.05(0.08%)

491

Pfizer Inc

PFE

33.7

-0.04(-0.12%)

361

Procter & Gamble Co

PG

89.3

-0.03(-0.03%)

331

Starbucks Corporation, NASDAQ

SBUX

60.28

0.20(0.33%)

4738

Tesla Motors, Inc., NASDAQ

TSLA

302.48

-0.03(-0.01%)

19200

The Coca-Cola Co

KO

43.04

-0.05(-0.12%)

936

Twitter, Inc., NYSE

TWTR

14.67

0.02(0.14%)

8273

UnitedHealth Group Inc

UNH

171.8

0.26(0.15%)

301

Verizon Communications Inc

VZ

48.28

-0.13(-0.27%)

16306

Visa

V

93.21

2.06(2.26%)

93599

Wal-Mart Stores Inc

WMT

74.73

-0.07(-0.09%)

153

Walt Disney Co

DIS

114.81

0.02(0.02%)

2213

Yahoo! Inc., NASDAQ

YHOO

47.68

0.01(0.02%)

1058

Yandex N.V., NASDAQ

YNDX

23.6

0.29(1.24%)

5600

-

12:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Hold from Buy at Argus

Other:

McDonald's (MCD) initiated with an Outperform at BMO Capital

McDonald's (MCD) target raised to $140 from $136 at Telsey Advisory Group

-

12:06

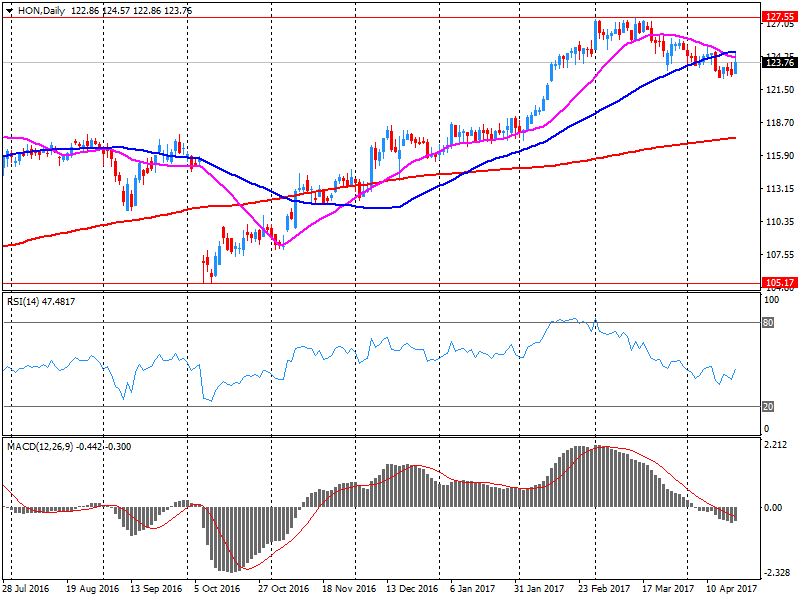

Company News: Honeywell (HON) posts better-than-expected quarterly results

Honeywell (HON) reported Q1 FY 2017 earnings of $1.66 per share (versus $1.53 in Q1 FY 2016), beating analysts' consensus estimate of $1.64.

The company's quarterly revenues amounted to $9.492 bln (-0.3% y/y), beating analysts' consensus estimate of $9.329 bln.

The company also issued in-line guidance for FY 2017, projecting EPS of $6.90-7.10 versus beating analysts' consensus estimate of $7.03.

HON rose to $127.86 (+3.30%) in pre-market trading.

-

12:04

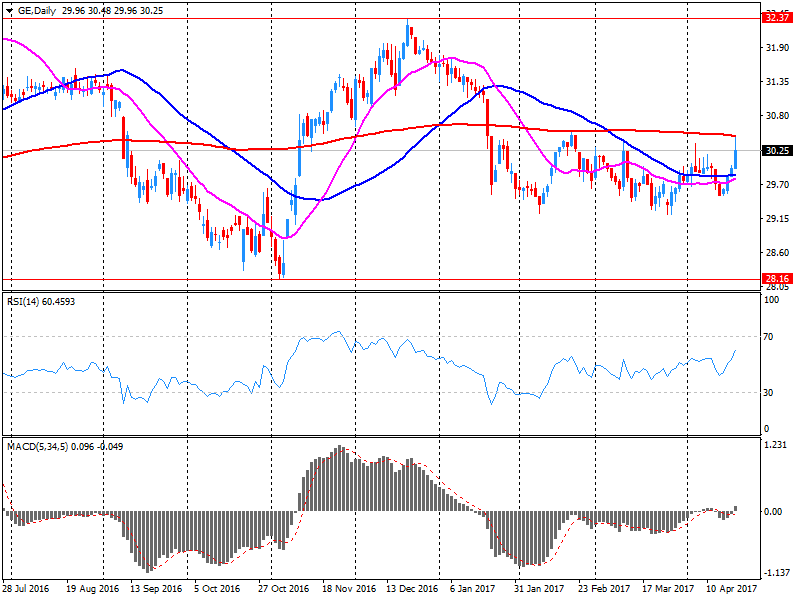

Company News: General Electric (GE) quarterly results beat analysts’ estimates

General Electric (GE) reported Q1 FY 2017 earnings of $0.21 per share (versus $0.21 in Q1 FY 2016), beating analysts' consensus estimate of $0.17.

The company's quarterly revenues amounted to $27.660 bln (-0.7% y/y), beating analysts' consensus estimate of $26.371 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $1.60-1.70 versus analysts' consensus estimate of $1.63.

GE

rose to $30.45 (+0.59%) in pre-market trading.

-

12:01

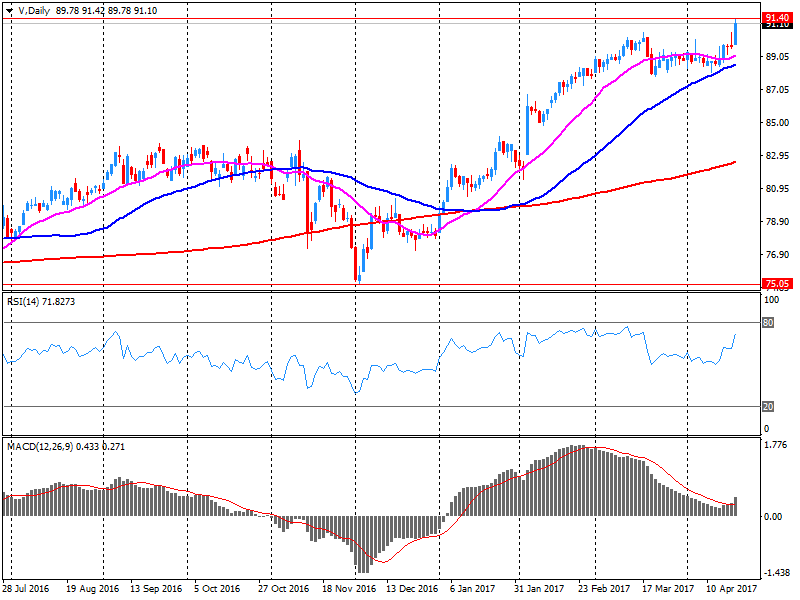

Company News: Visa (V) quarterly results beat analysts’ expectations

Visa (V) reported Q2 FY 2017 earnings of $0.86 per share (versus $0.68 in Q2 FY 2016), beating analysts' consensus estimate of $0.79.

The company's quarterly revenues amounted to $4.477 bln (+23.5% y/y), beating analysts' consensus estimate of $4.291 bln.

The company also reported its Board authorized a new $5.0 billion class A common stock share repurchase program.

V rose to $93.60 (+2.69%) in pre-market trading.

-

05:29

Global Stocks

French stocks leapt by the most in seven weeks Thursday, ending higher as gains for Publicis Groupe SA and Pernod Ricard SA helped relieve pressure from concerns over the outcome of Sunday's first-round presidential election vote. The pan-European index was held back by declines in the oil and gas and utility sectors, but the industrial, financial and technology groups printed gains.

The stock market ended with solid gains Thursday, with the Nasdaq closing at a record, as investors welcomed a deluge of stronger-than-expected corporate earnings reports and economic data. Comments by Treasury Secretary Steven Mnuchin, who said that President Donald Trump's tax overhaul plans aren't linked to the outcome of a health care bill, also bolstered sentiment, analysts said.

Stock markets across Asia were higher early Friday, catching an updraft from overnight gains in the U.S. as investors positioned themselves ahead of the start of the French presidential election. Markets were calm following a suspected terrorist attack in Paris overnight that left at least one police officer dead, three days before the election.

-