Market news

-

20:06

Major US stock indexes finished trading slightly below zero

Major US stock indices fell slightly on Friday, as investors held back from taking risky deals on the eve of the first round of the presidential elections in France.

In addition, as it became known today, adjusted for seasonality, the preliminary composite PMI release index from Markit in the US fell to 52.7 in April, compared to 53.0 in March, signaling a further slowdown in production growth in the private sector. The latest reading pointed to the weakest growth since September 2016. The modest growth in the private sector reflected a loss of momentum in the economy of the services sector (preliminary index was 52.5 in April), and manufacturing (preliminary index was 53.4).

At the same time, home sales in the secondary market in the US increased more than expected in March, to the highest level in the last ten years, as more homes appeared on the market and they were quickly bought up by consumers. The National Association of Realtors said on Friday that the volume of home sales in the secondary market grew by 4.4 percent and, subject to seasonal adjustment, reached 5.71 million units last month. Economists forecast sales growth of 2.5% to 5.60 million units in March.

Most components of the DOW index closed in the red (16 of 30). More shares fell shares Verizon Communications Inc. (VZ, -2.33%). The leader of growth was shares of Microsoft Corporation (MSFT, + 1.47%).

Most sectors of the S & P index showed a decline. The conglomerate sector fell most of all (-0.7%). The leader of growth was the utilities sector (+ 0.6%).

At closing:

Dow -0.15% 20.547.76 -30.95

Nasdaq -0.11% 5,910.52 -6.26

S & P -0.30% 2,348.70 -7.14

-

19:00

DJIA +0.03% 20,584.75 +6.04 Nasdaq -0.12% 5,909.60 -7.18 S&P -0.19% 2,351.35 -4.49

-

17:02

U.S.: Baker Hughes Oil Rig Count, April 688

-

16:00

European stocks closed: FTSE 100 -3.99 7114.55 -0.06% DAX +21.25 12048.57 +0.18% CAC 40 -18.71 5059.20 -0.37%

-

14:17

On Sunday voters will elect two candidates to run for the office of the 25th President of France. Keep in mind the open positions on EUR pairs, gaps can occur

-

14:02

US existing-home sales took off in March to their highest pace in over 10 years

Existing-home sales took off in March to their highest pace in over 10 years, and severe supply shortages resulted in the typical home coming off the market significantly faster than in February and a year ago, according to the National Association of Realtors. Only the West saw a decline in sales activity in March.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, ascended 4.4 percent to a seasonally adjusted annual rate of 5.71 million in March from a downwardly revised 5.47 million in February. March's sales pace is 5.9 percent above a year ago and surpasses January as the strongest month of sales since February 2007 (5.79 million).

-

14:00

U.S.: Existing Home Sales , March 5.71 (forecast 5.6)

-

13:45

U.S.: Services PMI, April 52.5 (forecast 53)

-

13:45

U.S.: Manufacturing PMI, April 52.8 (forecast 53.5)

-

13:33

U.S. Stocks open: Dow +0.07%, Nasdaq 0.00%, S&P -0.02%

-

13:32

Option expiries for today's 10:00 ET NY cut

EURUSD: 1.0600 (EUR 1.2bln) 1.0680 (803m) 1.0700-10 (1.7bln) 1.0725 (860m) 1.0750 (531m) 1.0780 (450m) 1.0800 (620m)

USDJPY: 108.00 (USD 1.1bln) 108.30 (388m) 108.50 (544m) 109.00 (651m) 109.15-25 (530M) 110.00 (782m) 110.25 (540m)

GBPUSD 1.2650 (GBP 430m) 1.2675 (350m) 1.2745-50 (211m) 1.2900-10 (365m)

EURGBP: 0.8465 (EUR 401m)

USDCHF 0.9925 (USD 250m)

AUDUSD 0.7500 (192m) 0.7515-25 (528m) 0.7570 (279m)

USDCAD: 1.3340-50 (332m) 1.3380-90 (200m) 1.3400 (320m) 1.3500 (393m) 1.3540 (605m)

NZDUSD: 0.6950-60 (NZD 272m) 0.7025 (357m)

-

13:29

BoE's Saunders: Mpc not obliged to delay rate move until it has certainty over exact implications of Brexit

-

Would not be surprised if cpi inflation reaches 3 pct in late 2017 or early 2018, above BoE feb forecasts

-

Prospective inflation pressure does not imply UK will face persistently high inflation, MPC has not gone soft

-

Current monetary policy stance is "clearly accommodative", would provide "considerable stimulus" even after modest rate rise

-

-

13:11

Before the bell: S&P futures +0.11%, NASDAQ futures +0.12%

U.S. stock-index rose slightly as, despite positive earnings reports from Visa (V), General Electric (GE) and Honeywell (HON), investors preferred not to make big bets ahead of the first round of the French presidential elections over the weekend.

Stocks:

Nikkei 18,620.75 +190.26 +1.03%

Hang Seng 24,042.02 -14.96 -0.06%

Shanghai 3,173.15 +1.05 +0.03%

FTSE 7,123.83 +5.29 +0.07%

CAC 5,068.41 -9.50 -0.19%

DAX 12,080.12 +52.80 +0.44%

Crude $50.71 (0.00%)

Gold $1,284.10 (+0.02%)

-

12:52

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

32.43

0.39(1.22%)

2703

Amazon.com Inc., NASDAQ

AMZN

904.5

2.44(0.27%)

3482

Apple Inc.

AAPL

142.51

0.07(0.05%)

26431

Barrick Gold Corporation, NYSE

ABX

19.27

0.07(0.36%)

21119

Boeing Co

BA

179.6

0.30(0.17%)

1200

Citigroup Inc., NYSE

C

58.5

0.09(0.15%)

7234

Exxon Mobil Corp

XOM

81.1

0.09(0.11%)

2079

Facebook, Inc.

FB

143.93

0.13(0.09%)

15378

Ford Motor Co.

F

11.49

0.02(0.17%)

18370

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

12.78

0.27(2.16%)

112556

General Electric Co

GE

30.57

0.30(0.99%)

1803892

General Motors Company, NYSE

GM

34.15

0.05(0.15%)

1677

Goldman Sachs

GS

218.5

0.44(0.20%)

2065

Google Inc.

GOOG

841.1

-0.55(-0.07%)

1114

HONEYWELL INTERNATIONAL INC.

HON

127.6

3.83(3.09%)

11221

International Business Machines Co...

IBM

162.75

0.45(0.28%)

950

Johnson & Johnson

JNJ

122

0.13(0.11%)

235

JPMorgan Chase and Co

JPM

85.75

0.20(0.23%)

1874

McDonald's Corp

MCD

133.64

0.37(0.28%)

164

Microsoft Corp

MSFT

65.55

0.05(0.08%)

491

Pfizer Inc

PFE

33.7

-0.04(-0.12%)

361

Procter & Gamble Co

PG

89.3

-0.03(-0.03%)

331

Starbucks Corporation, NASDAQ

SBUX

60.28

0.20(0.33%)

4738

Tesla Motors, Inc., NASDAQ

TSLA

302.48

-0.03(-0.01%)

19200

The Coca-Cola Co

KO

43.04

-0.05(-0.12%)

936

Twitter, Inc., NYSE

TWTR

14.67

0.02(0.14%)

8273

UnitedHealth Group Inc

UNH

171.8

0.26(0.15%)

301

Verizon Communications Inc

VZ

48.28

-0.13(-0.27%)

16306

Visa

V

93.21

2.06(2.26%)

93599

Wal-Mart Stores Inc

WMT

74.73

-0.07(-0.09%)

153

Walt Disney Co

DIS

114.81

0.02(0.02%)

2213

Yahoo! Inc., NASDAQ

YHOO

47.68

0.01(0.02%)

1058

Yandex N.V., NASDAQ

YNDX

23.6

0.29(1.24%)

5600

-

12:48

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Hold from Buy at Argus

Other:

McDonald's (MCD) initiated with an Outperform at BMO Capital

McDonald's (MCD) target raised to $140 from $136 at Telsey Advisory Group

-

12:36

Canadian CPI rose less than expected in March

The Consumer Price Index (CPI) rose 1.6% on a year-over-year basis in March, following a 2.0% gain in February.

Excluding food and energy, the CPI was up 1.7% year over year in March, after posting a 2.0% increase in February.

Prices were up in five of the eight major components in the 12 months to March, with the transportation and shelter indexes contributing the most to the year-over-year rise in the CPI. The food index and the clothing and footwear index declined year over year, while the price index for household operations, furnishings and equipment was unchanged.

Transportation costs rose 4.6% over the 12-month period ending in March, after increasing 6.6% in February. The increase in transportation costs, as well as the deceleration in the growth of these prices compared with the previous month, was led by the gasoline index. On a year-over-year basis, gasoline prices rose 15.2% in March, following a 23.1% increase in February. The purchase of passenger vehicles index was up 2.1% in the 12 months to March, following a gain of 3.6% in February

-

12:30

Canada: Bank of Canada Consumer Price Index Core, y/y, March 1.3%

-

12:30

Canada: Consumer price index, y/y, March 1.6% (forecast 1.8%)

-

12:30

Canada: Consumer Price Index m / m, March 0.2% (forecast 0.4%)

-

12:06

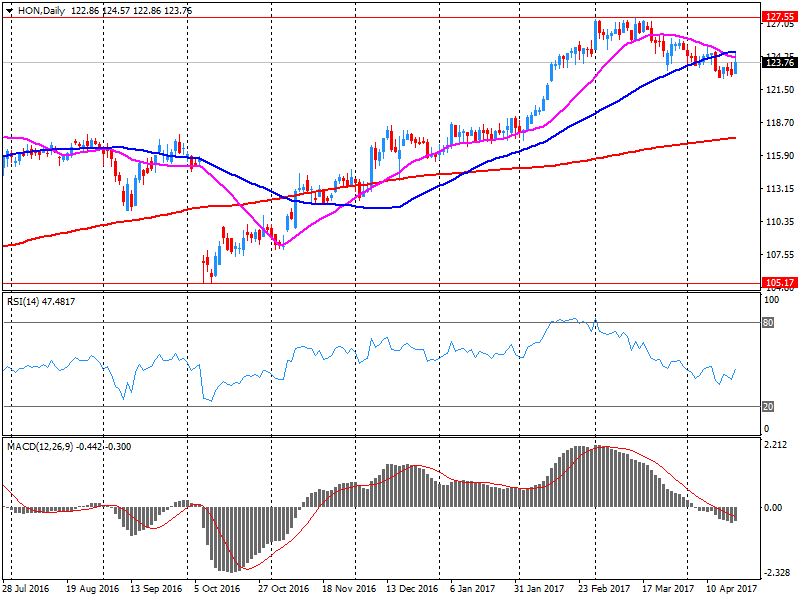

Company News: Honeywell (HON) posts better-than-expected quarterly results

Honeywell (HON) reported Q1 FY 2017 earnings of $1.66 per share (versus $1.53 in Q1 FY 2016), beating analysts' consensus estimate of $1.64.

The company's quarterly revenues amounted to $9.492 bln (-0.3% y/y), beating analysts' consensus estimate of $9.329 bln.

The company also issued in-line guidance for FY 2017, projecting EPS of $6.90-7.10 versus beating analysts' consensus estimate of $7.03.

HON rose to $127.86 (+3.30%) in pre-market trading.

-

12:04

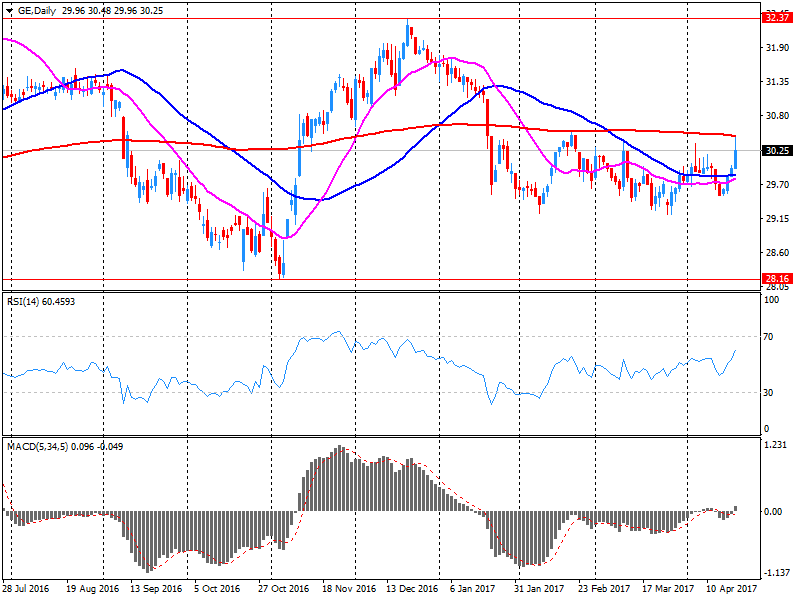

Company News: General Electric (GE) quarterly results beat analysts’ estimates

General Electric (GE) reported Q1 FY 2017 earnings of $0.21 per share (versus $0.21 in Q1 FY 2016), beating analysts' consensus estimate of $0.17.

The company's quarterly revenues amounted to $27.660 bln (-0.7% y/y), beating analysts' consensus estimate of $26.371 bln.

The company also reaffirmed guidance for FY 2017, projecting EPS of $1.60-1.70 versus analysts' consensus estimate of $1.63.

GE

rose to $30.45 (+0.59%) in pre-market trading.

-

12:02

Orders

EUR/USD

Offers: 1.0750-55 1.0770-75 1.0800 1.0830 1.0850

Bids: 1.0720 1.0700 1.0680-85 1.0650 1.0635 1.0620 1.0600

GBP/USD

Offers: 1.2850 1.2880 1.2900 1.2920 1.2950-60 1.2975 1.3000

Bids: 1.2800 1.2770-75 1.2760 1.2750 1.2720 1.2700 1.2680 1.2650

EUR/JPY

Offers: 117.30 117.50 117.80 118.00 118.50

Bids: 117.00 116.80 116.50 116.30 116.00 115.80-85 115.50

EUR/GBP

Offers: 0.8380-85 0.8400 0.8425-30 0.8445-50 0.8480 0.8500-05

Bids: 0.8360 0.8350 0.8335 0.8320 0.8300 0.8280 0.8260 0.8200

USD/JPY

Offers: 109.50 109.80 110.00 110.30 110.50 110.80 111.00

Bids: 109.00 108.70 108.50108.30 108.00 107.80 107.50 107.00

AUD/USD

Offers: 0.7550 0.7580 0.7600 0.7620 0.7650

Bids: 0.7520-25 0.7500 0.7480-85 0.7465 0.7450

-

12:01

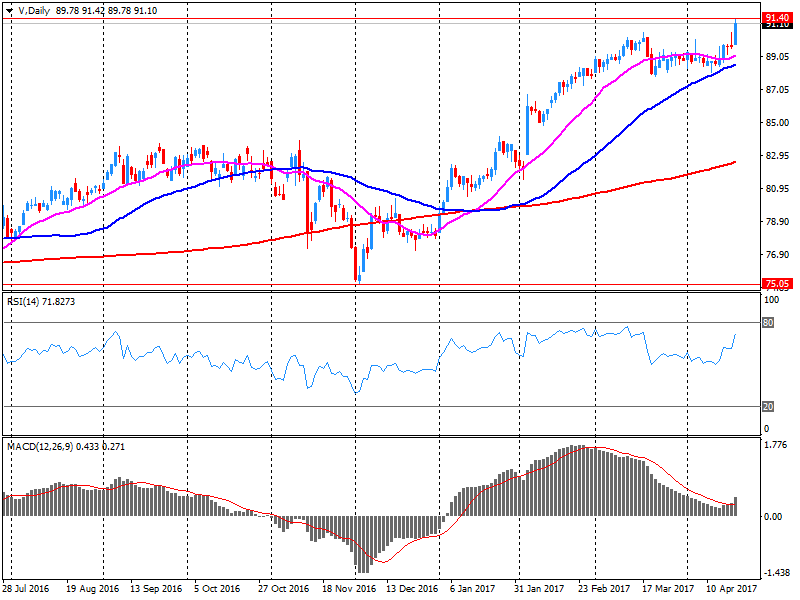

Company News: Visa (V) quarterly results beat analysts’ expectations

Visa (V) reported Q2 FY 2017 earnings of $0.86 per share (versus $0.68 in Q2 FY 2016), beating analysts' consensus estimate of $0.79.

The company's quarterly revenues amounted to $4.477 bln (+23.5% y/y), beating analysts' consensus estimate of $4.291 bln.

The company also reported its Board authorized a new $5.0 billion class A common stock share repurchase program.

V rose to $93.60 (+2.69%) in pre-market trading.

-

11:42

French PM Cazeneuve says Le Pen seeking to use Paris shooting incident to divide the french people

-

10:23

Macron seen getting 24 pct of votes in first round of french presidential election, Le Pen 22 pct - Sopra/Steria poll

-

09:47

French presidential candidate Fillon says fight against "islamist totalitarianism" should be priority of next president

-

will renegotiate Schengen Treaty

-

-

09:12

UK government says if political agreement in N. Ireland not possible before june 8 uk election, govt will provide flexibility to allow a deal to be concluded

-

09:01

Forex option contracts rolling off today at 14.00 GMT:

EURUSD: 1.0600 (EUR 1.2bln) 1.0680 (803m) 1.0700-10 (1.7bln) 1.0725 (860m) 1.0750 (531m) 1.0780 (450m) 1.0800 (620m)

USDJPY: 108.00 (USD 1.1bln) 108.30 (388m) 108.50 (544m) 109.00 (651m) 109.15-25 (530M) 110.00 (782m) 110.25 (540m)

GBPUSD 1.2650 (GBP 430m) 1.2675 (350m) 1.2745-50 (211m) 1.2900-10 (365m)

EURGBP: 0.8465 (EUR 401m)

USDCHF 0.9925 (USD 250m)

AUDUSD 0.7500 (192m) 0.7515-25 (528m) 0.7570 (279m)

USDCAD: 1.3340-50 (332m) 1.3380-90 (200m) 1.3400 (320m) 1.3500 (393m) 1.3540 (605m)

NZDUSD: 0.6950-60 (NZD 272m) 0.7025 (357m)

-

08:39

UK retail sales decreased more than expected in March. GBP/USD down 50 pips

The 3 months to March shows a decrease of 1.4%; the third consecutive decrease for the underlying 3 month on 3 month pattern.

Looking at the quarterly movement, the 3 months to March 2017 (Quarter 1) is the first quarterly decline since 2013 (Quarter 4).

In March 2017, the quantity bought in the retail industry is estimated to have increased by 1.7% compared with March 2016 and decreased by 1.8% compared with February 2017; decreases are seen across the four main store types.

Average store prices (including fuel) increased by 3.3% on the year, the largest growth since March 2012; the largest contribution came from petrol stations, where year-on-year average prices rose by 16.4%.

Online sales (excluding automotive fuel) increased year-on-year by 19.5% and by 0.5% on the month, accounting for approximately 15.5% of all retail spending.

-

08:30

United Kingdom: Retail Sales (MoM), March -1.8% (forecast -0.2%)

-

08:30

United Kingdom: Retail Sales (YoY) , March 1.7% (forecast 3.4%)

-

08:14

The current account of the euro area recorded a surplus of €37.9 billion in February

The current account of the euro area recorded a surplus of €37.9 billion in February 2017. This reflected surpluses for goods (€29.5 billion), services (€9.5 billion) and primary income (€4.2 billion), which were partly offset by a deficit for secondary income (€5.4 billion).

The 12-month cumulated current account for the period ending in February 2017 recorded a surplus of €360.2 billion (3.4% of euro area GDP), compared with one of €341.2 billion (3.2% of euro area GDP) for the 12 months to February 2016 (see Table 1 and Chart 1). This was due to increases in the surpluses for goods (from €344.0 billion to €368.6 billion) and primary income (from €53.7 billion to €79.5 billion). These were partly offset by a decrease in the surplus of services (from €70.7 billion to €49.5 billion) and an increase in the deficit for secondary income (from €127.1 billion to €137.4 billion).

-

08:13

Eurozone economic growth hit a fresh six-year high in April

Eurozone economic growth hit a fresh six-year high in April, according to PMI survey data. Job creation also rose to the highest for almost a decade as firms boosted operating capacity in line with buoyant demand and widespread optimism about future prospects. Price pressures meanwhile remained among the strongest seen over the past six years.

The Markit Eurozone PMI rose to 56.7 in April, according to the preliminary 'flash' estimate (based on approximately 85% of final replies). Up from 56.4 in March, the latest reading was the highest since April 2011.

-

08:00

Eurozone: Current account, unadjusted, bln , February 27.9

-

08:00

Eurozone: Manufacturing PMI, April 56.8 (forecast 56)

-

08:00

Eurozone: Services PMI, April 56.2 (forecast 56)

-

07:44

German economic growth remained strong at the start of the second quarter - Markit

German economic growth remained strong at the start of the second quarter of 2017, despite slower increases in both manufacturing output and services activity compared with the highs seen in March. The April PMI survey data also registered slightly softer rates of new business expansion and job creation, plus a slight moderation in price pressures.

The Markit Flash Germany Composite Output Index registered 56.3 in April, down from March's near six-year high of 57.1. This signalled the first easing in growth of private sector business activity since the start of the year, but still the secondfastest rate of expansion in over three years. The latest data extended the current sequence of continuous growth to four years.

-

07:30

Germany: Manufacturing PMI, April 58.2 (forecast 58)

-

07:30

Germany: Services PMI, April 54.7 (forecast 55.5)

-

07:18

Tenth consecutive month of private sector growth in France

April's flash France PMI data pointed to a tenth consecutive month of private sector growth in France. The Markit Flash France Composite Output Index, based on around 85% of normal monthly survey replies, registered 57.4, compared to March's reading of 56.8.

The latest figure was indicative of the sharpest rate of growth in almost six years. In the service sector, activity increased for the tenth time in as many months. Moreover, the rate of expansion accelerated to a 71-month high and was sharp overall. Manufacturing output also continued to rise markedly, and at the fastest pace in six years.

-

07:00

France: Manufacturing PMI, April 55.1 (forecast 53)

-

07:00

France: Services PMI, April 57.7 (forecast 57.1)

-

06:53

Positive start of trading expected on the main European stock markets: DAX + 0.5%, CAC40 + 0.4%, FTSE + 0.2%

-

06:30

Options levels on friday, April 21, 2017

EUR/USD

Resistance levels (open interest**, contracts)

$1.0846 (1042)

$1.0808 (466)

$1.0785 (177)

Price at time of writing this review: $1.0710

Support levels (open interest**, contracts):

$1.0650 (644)

$1.0603 (862)

$1.0544 (2606)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 61998 contracts, with the maximum number of contracts with strike price $1,1100 (5063);

- Overall open interest on the PUT options with the expiration date June, 9 is 64139 contracts, with the maximum number of contracts with strike price $1,0400 (5181);

- The ratio of PUT/CALL was 1.03 versus 1.03 from the previous trading day according to data from April, 20

GBP/USD

Resistance levels (open interest**, contracts)

$1.3108 (1934)

$1.3011 (1333)

$1.2915 (1069)

Price at time of writing this review: $1.2803

Support levels (open interest**, contracts):

$1.2688 (219)

$1.2591 (1195)

$1.2494 (4602)

Comments:

- Overall open interest on the CALL options with the expiration date June, 9 is 21009 contracts, with the maximum number of contracts with strike price $1,2800 (2241);

- Overall open interest on the PUT options with the expiration date June, 9 is 25897 contracts, with the maximum number of contracts with strike price $1,2500 (4602);

- The ratio of PUT/CALL was 1.23 versus 1.30 from the previous trading day according to data from April, 20

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:59

Flash Japan Manufacturing PMI up to 2-month high

Flash Japan Manufacturing PMI up to 2-month high of 52.8 in April (52.4 in March).

Flash Manufacturing Output Index at 53.6 (53.0 in March). Marked increase in production signalled.

Stronger growth in new export orders recorded.

Commenting on the Japanese Manufacturing PMI survey data, Paul Smith, Senior Economist at IHS Markit, which compiles the survey, said: "April's PMI data signalled continued healthy growth of Japan's manufacturing sector, and the latest results were again consistent with production rising at a quarterly rate of around 2%. "Driven by firmer external demand, the sector was underpinned by a stronger export performance in April, with new export orders rising at a rate amongst the best seen in the past three years. Companies are also adding to their workforces at a rate that matched January's 34- month peak, but price pressures continue to mount with input costs and output charges rising at stronger rates."

-

05:57

Japan Fin Min Aso says told G20 Japan sees as great benefit that G20 reconfirmed at Baden-Baden excess fx volatility, disorderly moves undesirable

-

05:51

One Policeman Killed, Another Wounded In Shooting Incident In Paris - Police Source

-

05:29

Global Stocks

French stocks leapt by the most in seven weeks Thursday, ending higher as gains for Publicis Groupe SA and Pernod Ricard SA helped relieve pressure from concerns over the outcome of Sunday's first-round presidential election vote. The pan-European index was held back by declines in the oil and gas and utility sectors, but the industrial, financial and technology groups printed gains.

The stock market ended with solid gains Thursday, with the Nasdaq closing at a record, as investors welcomed a deluge of stronger-than-expected corporate earnings reports and economic data. Comments by Treasury Secretary Steven Mnuchin, who said that President Donald Trump's tax overhaul plans aren't linked to the outcome of a health care bill, also bolstered sentiment, analysts said.

Stock markets across Asia were higher early Friday, catching an updraft from overnight gains in the U.S. as investors positioned themselves ahead of the start of the French presidential election. Markets were calm following a suspected terrorist attack in Paris overnight that left at least one police officer dead, three days before the election.

-

04:31

Japan: Tertiary Industry Index , February 0.2%

-

00:30

Japan: Manufacturing PMI, April 52.8

-