Market news

-

20:00

DJIA 18875.88 -27.94 -0.15%, NASDAQ 5323.05 -10.92 -0.20%, S&P 500 2182.24 -4.88 -0.22%

-

18:00

WSE: Session Results

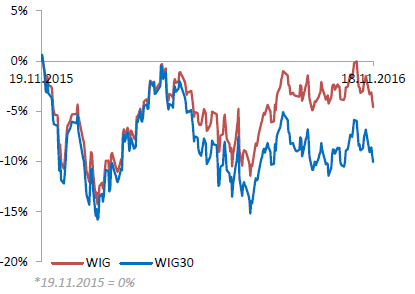

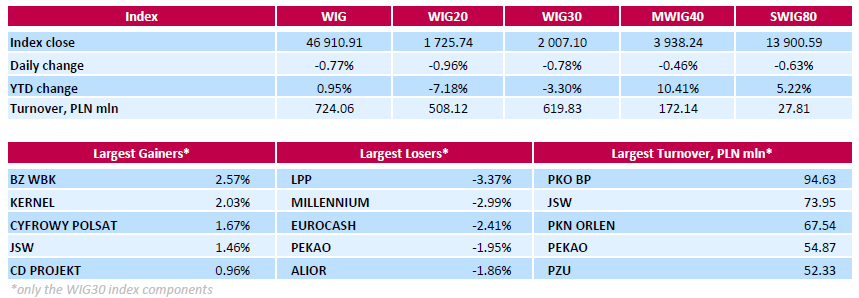

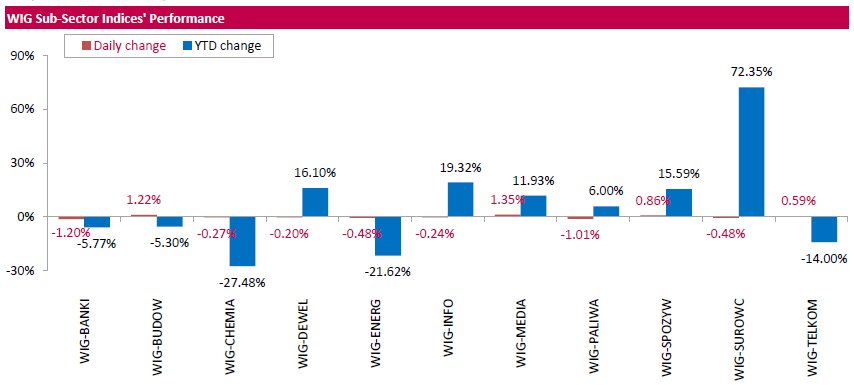

Polish equity market closed lower on Friday. The broad market measure, the WIG index, fell by 0.77%. The WIG sub-sector indices were mixed. Media (+1.35%) outperformed, while banking sector (-1.20%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.78%. In the WIG30, clothing retailer LPP (WSE: LPP), led the underperformers with a 3.37% decline, followed by FMCG-wholesaler EUROCASH (WSE: EUR) and four banking names MILLENNIUM (WSE: MIL), PEKAO (WSE: PEO), ALIOR (WSE: ALR) and PKO BP (WSE: PKO), tumbling by 1.78%-2.99%. On the plus side, bank BZ WBK (WSE: BZW) and agricultural producer KERNEL (WSE: KER) were the biggest advancers, climbing by 2.57% and 2.03% respectively.

-

17:00

European stocks closed: FTSE 6775.77 -18.94 -0.28%, DAX 10664.56 -20.98 -0.20%, CAC 4504.35 -23.42 -0.52%

-

16:59

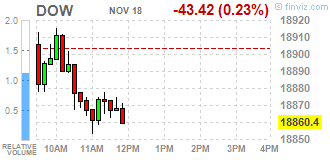

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday as investors cashed in after the post-election rally, but the three major indexes continued to hover near record levels. The Nasdaq hit a record high earlier in the session, helped by a rise in Microsoft and other big tech stocks. U.S. stocks had been on a tear since Donald Trump's surprise victory in the presidential election last week as his proposals to increase infrastructure spending and reduce taxes are seen benefiting the economy.

Most of Dow stocks in negative area (18 of 30). Top gainer - The Goldman Sachs Group, Inc. (GS, +0.89%). Top loser - Johnson & Johnson (JNJ, -1.45%).

Most of S&P sectors in negative area. Top gainer - Conglomerates (+1.1%). Top loser - Healthcare (-1.1%).

At the moment:

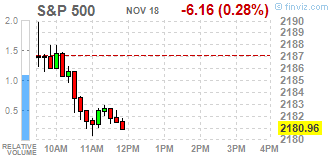

Dow 18849.00 -20.00 -0.11%

S&P 500 2180.00 -4.25 -0.19%

Nasdaq 100 4811.75 -16.75 -0.35%

Oil 45.82 -0.16 -0.35%

Gold 1207.00 -9.90 -0.81%

U.S. 10yr 2.34 +0.06

-

14:52

WSE: After start on Wall Street

As it was indicated by trading of futures on the US indices, the session on Wall Street began with a modest change in the broad index. It's not too attractive, but the US market reached the level of their August records, which may mean more interesting movements in the near future.

On our parquet failed attempt to stall the WIG20 on the green side of quotations and instead we return to a decline of 0.7 percent. The problem is the size of the turnover, which clearly disappeared in the second half of trading.

An hour before the close of trading the WIG20 index was at the level of 1,729 points (-0.75%). The turnover among blue chips was amounted to PLN 385 million.

-

14:35

U.S. Stocks open: Dow +0.03%, Nasdaq +0.23%, S&P +0.12%

-

14:27

Before the bell: S&P futures -0.03%, NASDAQ futures -0.01%

U.S. stock-index futures were little changed after after the stocks gained the previous day, helped by positive U.S. macroeconomic data and optimistic comments from Federal Reserve chair Janet Yellen.

Global Stocks:

Nikkei 17,967.41 +104.78 +0.59%

Hang Seng 22,344.21 +81.33 +0.37%

Shanghai 3,193.27 -15.18 -0.47%

FTSE 6,794.35 -0.36 -0.01%

CAC 4,519.80 -7.97 -0.18%

DAX 10,722.76 +37.22 +0.35%

Crude $45.50 (+0.18%)

Gold $1,214.50 (-0.77%)

-

14:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

Amazon.com Inc., NASDAQ

AMZN

761

4.60(0.6081%)

32215

American Express Co

AXP

71.8

0.02(0.0279%)

5917

AMERICAN INTERNATIONAL GROUP

AIG

64.25

0.02(0.0311%)

500

Apple Inc.

AAPL

110

0.05(0.0455%)

54441

AT&T Inc

T

37.52

0.11(0.294%)

1704

Barrick Gold Corporation, NYSE

ABX

15.18

-0.18(-1.1719%)

73527

Caterpillar Inc

CAT

92.91

0.13(0.1401%)

1030

Chevron Corp

CVX

108.22

0.10(0.0925%)

5655

Cisco Systems Inc

CSCO

29.95

-0.10(-0.3328%)

13775

Citigroup Inc., NYSE

C

55.59

0.14(0.2525%)

38212

Deere & Company, NYSE

DE

90.99

-0.78(-0.85%)

200

Exxon Mobil Corp

XOM

85.4

0.17(0.1995%)

1738

Facebook, Inc.

FB

118.5

0.71(0.6028%)

113955

Ford Motor Co.

F

11.88

0.01(0.0842%)

29331

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.69

-0.11(-0.7971%)

117007

General Electric Co

GE

30.86

0.07(0.2273%)

12201

Goldman Sachs

GS

210.02

0.39(0.186%)

15014

Google Inc.

GOOG

772.3

1.07(0.1387%)

1162

Intel Corp

INTC

35.05

0.03(0.0857%)

8764

International Business Machines Co...

IBM

159.75

-0.05(-0.0313%)

253

Johnson & Johnson

JNJ

115.84

0.07(0.0605%)

2634

JPMorgan Chase and Co

JPM

78.1

0.08(0.1025%)

51593

McDonald's Corp

MCD

119.8

0.35(0.293%)

1523

Microsoft Corp

MSFT

60.9

0.26(0.4288%)

17192

Nike

NKE

51.45

-0.14(-0.2714%)

2341

Pfizer Inc

PFE

31.93

0.20(0.6303%)

7739

Starbucks Corporation, NASDAQ

SBUX

55.83

-0.02(-0.0358%)

1326

Tesla Motors, Inc., NASDAQ

TSLA

191.2

2.54(1.3463%)

32868

The Coca-Cola Co

KO

41.15

0.03(0.073%)

2052

Twitter, Inc., NYSE

TWTR

18.7

0.15(0.8086%)

20721

Verizon Communications Inc

VZ

47.97

0.13(0.2717%)

1409

Visa

V

81

-0.07(-0.0863%)

666

Wal-Mart Stores Inc

WMT

69.27

0.08(0.1156%)

22926

Walt Disney Co

DIS

99.3

-0.07(-0.0704%)

4695

Yahoo! Inc., NASDAQ

YHOO

41.65

0.20(0.4825%)

671

Yandex N.V., NASDAQ

YNDX

18.2

0.24(1.3363%)

14191

-

13:58

Upgrades and downgrades before the market open

Upgrades:

Goldman Sachs (GS) upgraded to Outperform from Neutral at Macquarie

Hewlett Packard Enterprise (HPE) upgraded to Outperform from Mkt Perform at Raymond James

Downgrades:

Citigroup (C) downgraded to Neutral from Outperform at Macquarie

Other:

FedEx (FDX) initiated with a Market Perform at BMO Capital

Wal-Mart (WMT) target lowered to $73 from $76 at Telsey Advisory Group

-

12:03

Major stock indices in Europe show a negative trend

European stocks traded in the red zone, as the increase of US bonds yield has pushed the dollar index to new highs, which has a negative impact on the valuations of mining companies and energy producers.

At the strengthening of the US currency contributed yesterday's statements by Fed Chairman Yellen, who noted that the rise in interest rates in the US may be 'appropriate in a relatively short time. " Thus, it is hinted that the rate could rise as early as next month. According to the futures market, the likelihood of tighter monetary policy in December is 90.6%. Rising interest rates will also signal that the US economic recovery is gaining momentum. In addition, investors see Trump expansionary fiscal policy as a factor of strengthening inflationary pressures in the United States.

Investors' attention is also drawn by statements from ECB President Draghi and Bundesbank head Weidmann. During his speech, Draghi said that the recovery of the eurozone economy is still highly dependent on the stimulus measures of the Central Bank. Such statements suggest that at its December meeting, the ECB will extend the program of quantitative easing (QE). "Now we can not weaken the vigilance of the European Central Bank and will continue to operate using all available instruments, while inflation steadily grows." - Said Draghi. Recall, according to official data, in October consumer price inflation in the euro area was only 0.5%, well below the ECB's target of 2%".

Meanwhile, Bundesbank President Weidmann stated that innovative tools should be used with extreme caution, and monetary policy should not respond automatically to low inflation. "Most of the factors holding inflation low are temporary and inflation in the euro area may rise to 1.5% by February". He also warned that the purchase of government bonds blurs the line between fiscal and monetary policy.

Certain influence also provided data for the euro area. A report from the ECB showed that the current account surplus widened in September to 29.8 billion from euro 22.9 billion at the end of August (figure was revised from 23.6 billion). In addition, it was reported that the seasonally adjusted balance of payments surplus declined to EUR 25.3 billion from29.1 billion. In August.

The composite index of the largest companies in the region Stoxx Europe 600 trading lower by 0.2 percent. Since the beginning of this week the index gained about 0.3 percent.

Fresnillo and Randgold Resources shares have fallen by 6.3 percent and 6.1 percent, as the price of gold fell.

Volkswagen shares rose by 0.3 percent after the automaker said it plans to cut 30,000 jobs by 2021, to help increase profitability and focus on new areas such as electric vehicles and unmanned.

Airbus Group quotes climbed 0.2 project amid reports that the Japanese company Peach Aviation ordered 10 A320 aircrafts worth $ 1.1 billion.

LafargeHolcim securities - the world's largest cement producer - dropped by 3.4 percent. The company announced a plan for buybacks in the amount of 1 millio swiss francs after the worsened outlook for earnings and cash flow for 2018.

At the moment:

FTSE 100 6756.39 -38.32 -0.56%

DAX -16.73 10668.81 -0.16%

CAC 40 4509.77 -18.00 -0.40%

-

12:02

WSE: Mid session comment

The first half of today's session brought a lot of confusion in quotations of the WIG20 index and future contracts. At the beginning of trading we had to deal with the weakening of the market, during growth in Europe. Then, after a confrontation with support in the area of 1,710 points the market has returned to the levels from the session opening, when Euroland was in the red and near the daily lows of the session. It is also difficult to see any justification for such sudden changes, in no way correlated with the situation outside. A positive sign is the appreciating of the Polish currency today.

At the halfway point of today's trading, the WIG20 index reached the level of 1,735 points (-0,40%), the turnover was amounted to PLN 280 million.

-

08:18

Major stock exchanges trading in the green zone: FTSE + 0.1%, DAX + 0.5%, CAC40 + 0.4%, FTMIB + 0.1%, IBEX + 0.3%

-

08:18

WSE: After opening

WIG20 index opened at 1736.82 points (-0.32%)*

WIG 46966.77 -0.65%

WIG30 2007.70 -0.75%

mWIG40 3945.23 -0.28%

*/ - change to previous close

The clear weakness of the Polish stock market against the background of European markets and the USA once again made itself felt at the start of trading. Behind us tough beginning of the session.

At the very opening of the cash market the WIG20 index fell only 0.3 percent, but after a while the index of blue chips adapted to the changes offered by the contracts in trading before the opening. Already in the morning it is difficult for optimism comparing the behavior of our parquet with leading European markets, which glow green. Tellingly also is drop of the BZW after recommendation "buy" from Citigroup and increasing the overall merit of the target price to PLN 341.

After fifteen minutes of trade, the WIG20 index was at the level 1,727 points (-0.84%).

-

07:28

WSE: Before opening

Thursday's trading on Wall Street ended on the green side. The Dow Jones Industrial index at the end of the day increased by 0.19 percent, the S&P500 gained 0.47 percent and the Nasdaq Composite rose by 0.74 percent.

The results of the presidential elections and the Campaign announced fiscal stimulus strengthened inflation expectations in the US economy, what for the Fed could mean a faster pace of monetary tightening. The market is almost certain the December interest rate hike in the US. Measured by the rate contracts, the Fed likelihood to increase the cost of money in the US next month, rose to 96 percent from 68 at the beginning of November.

Night brought no major changes. Although the contracts for S&P500 lost 0.1 percent now, but remain at a level similar to that when Europe ended yesterday their quotes.

On the Warsaw market situation is slightly different. The WSE, especially the WIG20 index, is in the middle of a serious confusion. Pressures associated with the strengthening of the dollar and rising debt yields in developed markets cast a shadow on the condition of the zloty.

For the supply side helps downward pressure from other emerging markets, weak macro data and signals from the Polish political scene, where there is a new wave of activities related to foreign currency loans, where the problem is now connected with the weakening of the zloty against the franc.

In short, the WIG20 index is under pressure of stream of factors favoring discounts.

The technical situation on the chart of the WIG20 allows us to expect further price reductions, where the target level is the area of ,1700 points. Fundamental factors, global and technical are playing in the supply-side camp.

-

06:04

Global Stocks

U.K. stocks rose Thursday, posting their highest close in a week, as retail shares strengthened on sales data that blew past expectations. Retail shares were pushed up as October retail sales leapt above expectations, with the annual rate of 7.4% from the year-ago period the highest rate since April 2002, the Office for National Statistics said.

U.S. stocks closed slightly higher on Thursday as an improving economic picture and greater clarity on Federal Reserve policy allowed the market's postelection uptrend to continue, putting the S&P 500 and Dow within reach of attaining new record closing highs.

A weaker yen sent Japan's Nikkei to a 10-month high on Friday, helping drive gains across key Asian markets as robust U.S. economic data buoyed expectations of an interest-rate hike next month.

-