Market news

-

23:28

Stocks. Daily history for Nov 17’2016:

(index / closing price / change items /% change)

Nikkei 225 17,862.63 +0.42 0.00%

Shanghai Composite 3,208.68 +3.62 +0.11%

S&P/ASX 200 5,338.54 0.00 0.00%

FTSE 100 6,794.71 +44.99 +0.67%

CAC 40 4,527.77 +26.63 +0.59%

Xetra DAX 10,685.54 +21.67 +0.20%

S&P 500 2,187.12 +10.18 +0.47%

Dow Jones Industrial Average 18,903.82 +35.68 +0.19%

S&P/TSX Composite 14,826.09 +92.87 +0.63%

-

20:00

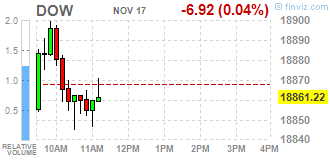

DJIA 18875.16 7.02 0.04%, NASDAQ 5323.04 28.46 0.54%, S&P 500 2184.26 7.32 0.34%

-

17:02

European stocks closed: FTSE 6794.71 44.99 0.67%, DAX 10685.54 21.67 0.20%, CAC 4527.77 26.63 0.59%

-

16:31

WSE: Session Results

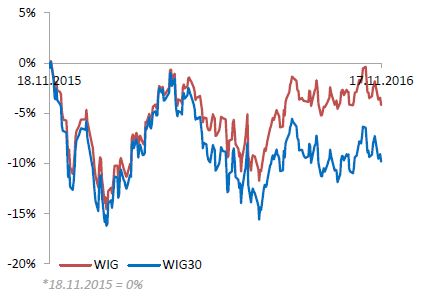

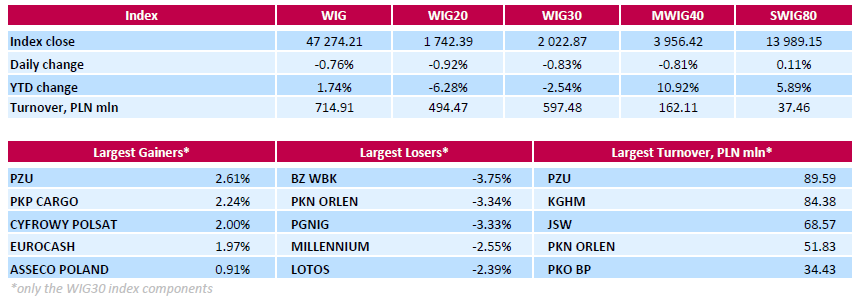

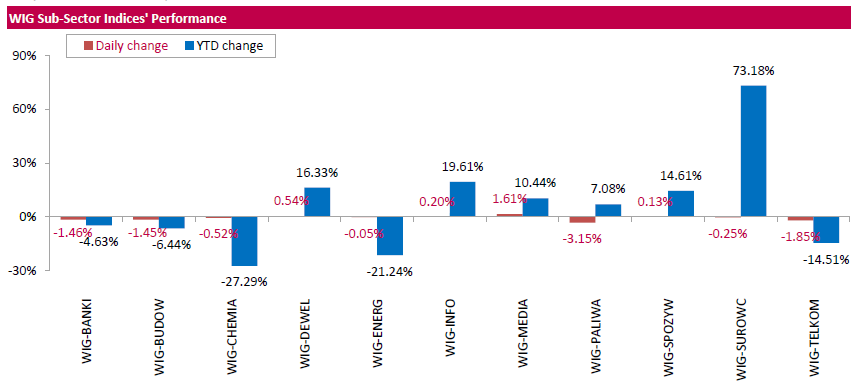

Polish equities closed lower on Friday. The broad market benchmark, the WIG Index, lost 0.76%. Sector performance within the WIG Index was mixed. Oil and gas (-3.15%) fell the most, while media (+1.61%) fared the best.

The large-cap stocks plunged by 0.83%, as measured by the WIG30 Index. Within the index components, three oil and gas industry stocks - PKN ORLEN (WSE: PKN), PGNIG (WSE: PGN) and LOTOS (WSE: LTS), as well as four banking sector names - BZ WBK (WSE: BZW), MILLENNIUM (WSE: MIL), PKO BP (WSE: PKO) and ING BSK (WSE: ING), led the laggards, tumbling between 2.03% and 3.75%. On the other side of the ledger, insurer PZU (WSE: PZU) topped the list of gainers with a 2.61% advance, followed by railway freight transport operator PKP CARGO (WSE: PKP) and FMCG-wholesaler EUROCASH (WSE: EUR), which rose by 2.24% and 2% respectively.

-

16:22

Wall Street. Major U.S. stock-indexes mixed

Major U.S. stock-indexes little changed on Thursday, a day after the Dow broke a seven-day rally, as investors await a testimony by Federal Reserve Chair Janet Yellen.

Most of Dow stocks in negative area (18 of 30). Top gainer - The Home Depot, Inc. (HD, +1.64%). Top loser - Cisco Systems, Inc. (CSCO, -5.19%).

Most of S&P sectors in positive area. Top gainer - Financials (+0.5%). Top loser - Conglomerates (-0.9%).

At the moment:

Dow 18826.00 -7.00 -0.04%

S&P 500 2179.00 +6.25 +0.29%

Nasdaq 100 4800.25 +17.00 +0.36%

Oil 46.50 +0.40 +0.87%

Gold 1228.40 +4.50 +0.37%

U.S. 10yr 2.24 +0.02

-

14:51

WSE: After start on Wall Street

In his speech in front of the Congress Janet Yellen said that the Federal Reserve would raise interest rates "relatively quickly" if the data will point to the improvement in the labor market and the acceleration of inflation. Published in the afternoon data only confirm these words. The weekly number of applications for unemployment benefits fell to the lowest level for 43 years and was amounted to barely 235 thousand. These data were very good for a long time, but this week are simply sensational. Added to this is a positive surprise for housing starts, which after weaker September grew in October up by 26% to the highest level in nine years.

The beginning of trading on Wall Street took place under the sign of indecision and the percentage change is not too far away from zero. Thus, everything indicates that such a mood will accompany us until the end of today's trading on the Warsaw Stock Exchange.

An hour before the end of trading in Warsaw, the WIG20 index reached the level of 1,756 points (-0,10%).

-

14:32

U.S. Stocks open: Dow -0.05%, Nasdaq -0.11%, S&P -0.01%

-

14:24

Before the bell: S&P futures -0.01%, NASDAQ futures -0.01%

U.S. stock-index futures were little changed as investors awaited a testimony from Federal Reserve Chair Janet Yellen for clues on the timing of rate increases.

Global Stocks:

Nikkei 17,862.63 +0.42 +0.00%

Hang Seng 22,222.63 -57.90 -0.26%

Shanghai 3,208.45 +3.40 +0.11%

FTSE 6,758.39 +8.67 +0.13%

CAC 4,498.48 -2.66 -0.06%

DAX 10,633.83 -30.04 -0.28%

Crude $46.11 (+1.18%)

Gold $1,224.80 (+0.07%)

-

13:48

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

ALCOA INC.

AA

31.07

-0.35(-1.1139%)

6944

ALTRIA GROUP INC.

MO

62.74

0.08(0.1277%)

238

Amazon.com Inc., NASDAQ

AMZN

747.1

0.61(0.0817%)

14404

Apple Inc.

AAPL

109.94

-0.05(-0.0455%)

50010

AT&T Inc

T

37.25

0.10(0.2692%)

15563

Barrick Gold Corporation, NYSE

ABX

15.53

-0.07(-0.4487%)

44086

Cisco Systems Inc

CSCO

29.99

-1.58(-5.0048%)

436659

Citigroup Inc., NYSE

C

54.54

-0.09(-0.1647%)

28520

Deere & Company, NYSE

DE

91.28

0.03(0.0329%)

721

Exxon Mobil Corp

XOM

86.21

0.46(0.5364%)

3169

Facebook, Inc.

FB

116.65

0.31(0.2665%)

66824

Ford Motor Co.

F

11.9

-0.10(-0.8333%)

60045

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.79

-0.01(-0.0725%)

134206

General Electric Co

GE

30.7

-0.04(-0.1301%)

1487

Goldman Sachs

GS

205.95

-0.31(-0.1503%)

6748

Google Inc.

GOOG

765.98

1.50(0.1962%)

3771

Home Depot Inc

HD

125.59

0.26(0.2074%)

5190

International Business Machines Co...

IBM

158.7

-0.59(-0.3704%)

397

JPMorgan Chase and Co

JPM

77.5

0.10(0.1292%)

48029

McDonald's Corp

MCD

118.8

-0.41(-0.3439%)

1000

Merck & Co Inc

MRK

62.5

-0.13(-0.2076%)

990

Microsoft Corp

MSFT

60.38

0.73(1.2238%)

116594

Nike

NKE

50.94

0.26(0.513%)

1304

Pfizer Inc

PFE

32.03

0.07(0.219%)

1811

Procter & Gamble Co

PG

83.44

0.25(0.3005%)

540

Tesla Motors, Inc., NASDAQ

TSLA

183.88

-0.05(-0.0272%)

6160

The Coca-Cola Co

KO

41.55

0.29(0.7029%)

694

Twitter, Inc., NYSE

TWTR

18.71

0.08(0.4294%)

36460

UnitedHealth Group Inc

UNH

152

0.50(0.33%)

110

Verizon Communications Inc

VZ

47.95

0.02(0.0417%)

2454

Visa

V

80.4

0.32(0.3996%)

658

Wal-Mart Stores Inc

WMT

69.35

-2.04(-2.8575%)

299883

Yahoo! Inc., NASDAQ

YHOO

41.25

0.27(0.6589%)

264

Yandex N.V., NASDAQ

YNDX

17.95

0.34(1.9307%)

12520

-

13:44

Upgrades and downgrades before the market open

Upgrades:

Microsoft (MSFT) upgraded to Buy from Neutral at Goldman; target raised to $68 from $60

Downgrades:

Freeport-McMoRan (FCX) downgraded to Hold from Buy at Deutsche Bank

Other:

-

13:15

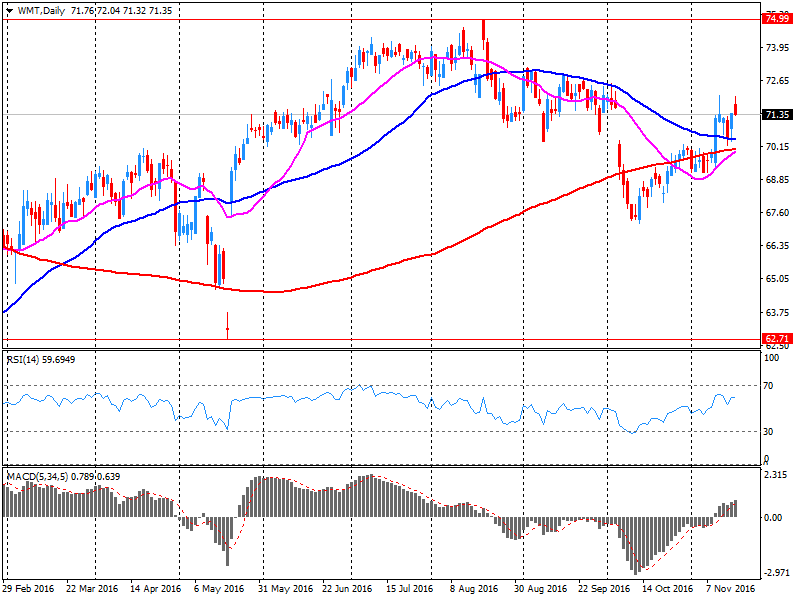

Company News: Wal-Mart (WMT) Q3 EPS beat analysts’ estimate

Wal-Mart reported Q3 FY 2016 earnings of $0.98 per share (versus $0.99 in Q3 FY 2015), beating analysts' consensus estimate of $0.96.

The company's quarterly revenues amounted to $117.176 bln (+0.5% y/y), slightly missing analysts' consensus estimate of $117.862 bln.

The company also issuee in-line guidances for Q4 and FY 2017, projecting Q4 EPS of $1.18-1.33 (versus analysts' consensus estimate of $1.32) and FY2017 EPS of $4.20-4.35 (versus analysts' consensus estimate of $4.33).

WMT fell to $69.43 (-2.73%) in pre-market trading.

-

12:04

WSE: Mid session comment

The first half of today's trading on the Warsaw market brought a slightly less activity than during the session immediately after the US election.

Initially quite strange growth has been committed, but the market picked up to the vicinity of the opening with reflective prices of KGHM and PZU. In a broader context, it does not change anything, because we remain more or less in the middle of the observed range of fluctuation. Slightly weakens the dollar, which reduces the tension in the global financial system, with particular emphasis on emerging markets.

Virtually on all markets we may see boredom. Neither in Euroland, nor in Warsaw none of the parties may not yet move out of consolidation, the consequence of which are small fluctuations in indices around their equilibrium levels. It is clear that investors are waiting for the time when in the front of the combined economic committee of the US Congress will occur Fed chief Janet Yellen. This the first occurrence after the announcement of the election results in the US may shed light on what is the current attitude of the Fed to tighten monetary policy in the US and could ultimately determine whether the increase in December is almost certain.

At the halfway point of today's session, the WIG 20 index was at the level of 1,759 points, with the turnover of PLN 195 million.

-

11:54

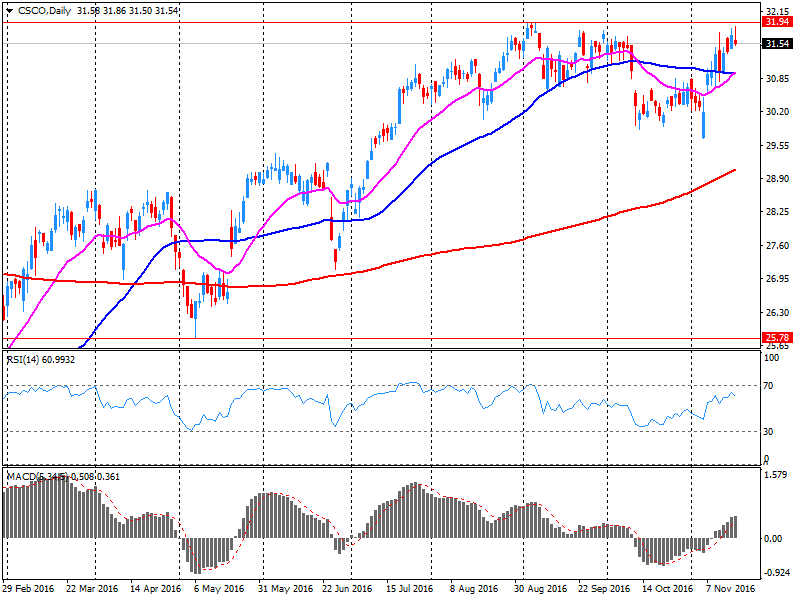

Company News: Cisco Systems (CSCO) quarterly results beat analysts’ expectations

Cisco Systems reported Q1 FY 2017 earnings of $0.61 per share (versus $0.59 in Q1 FY 2017), beating analysts' consensus estimate of $0.59.

The company's quarterly revenues amounted to $12.352 bln (-2.6% y/y), slightly beating analysts' consensus estimate of $12.332 bln.

The company also issued downside guidance for Q2, projecting EPS of ~$0.55-0.57 (versus analysts' consensus estimate of $0.59) and revenues ~$11.27-11.51 bln (down 2-4% y/y and versus analysts' consensus estimate of $12.15 bln).

CSCO fell to $30.44 (-3.58%) in pre-market trading.

-

08:47

Major stock exchanges trading mixed: FTSE + 0.1%, DAX -0.2%, CAC40 -0.1%, FTMIB -0.3%, IBEX -0.1%

-

08:18

WSE: After opening

WIG20 index opened at 1761.95 points (+0.19%)*

WIG 47763.53 0.27%

WIG30 2045.55 0.28%

mWIG40 4003.63 0.37%

*/ - change to previous close

The WIG20 futures contracts took off 4 points in the red, corresponding to a change rate of 0.23 percent. The cash market (WIG20) started the day with a light growth, which was surprising in the context of the prevailing caution on the futures market, or reductions in the environment. The atmosphere in the markets this morning refers to yesterday, accompanied by continued uncertainty about the outcome of the US presidential election and the growing conviction about the increase in interest rates by the Fed at the December meeting. Under these conditions, the contracts for the major Euroland indexes remain this morning at the minimum cons. Therefore it looks as the next session of uncertainty.

The index of the largest companies, like yesterday, starts with a quick raise up, which, however, was not very promising and already after the first few minutes the level of prices descends under line.

After fifteen minutes of trading on the Warsaw market index WIG20 was at the level of 1,752 points (- 0.32%).

-

07:54

Positive start of trading expected on the major stock exchanges in Europe: DAX flat, CAC 40 + 0.1%, FTSE + 0.2%

-

07:21

WSE: Before opening

Two important indices on the stock exchanges of New York: DJI (-0.29%) and the S&P 500 (-0.16%) closed in negative territory on Wednesday, while the Nasdaq gained (+ 0.36%). There is the increased volatility associated with the post-election mood swing in the US and uncertainty to the intentions of the future administration of the White House. Markets are waiting for the specifics economic plans of Donald Trump. Investors are still counting on a fairly aggressive tightening of monetary policy which, taking into account the current proceedings FOMC seems unlikely. Interesting in this context may be today's speech of Janet Yellen that can affect the market, but on the other hand, we must realize that the head of the Fed has not secret knowledge, and probably also does not know yet how it will exactly look the economic policy of the future president.

Quotations in Asia are mixed, but the common point are minor changes. Contracts for US indices are traded on light pros.

European parquet sessions can start with small increases. This globally should maintain a two-day stabilization seen in the spectrum of large domestic companies. It remained even yesterday, when the old continent was dominated by a rather somber moods and declines. The balance is fragile, but it should go back to the markets.

-