Market news

-

23:29

Stocks. Daily history for Dec 19’2016:

(index / closing price / change items /% change)

Shanghai Composite 3,122.57 -0.4069 -0.01%

Nikkei 225 19,391.60 -9.55 -0.05%

S&P/ASX 200 5,562.08 0.00 0.00%

FTSE 100 7,017.16 +5.52 +0.08%

CAC 40 4,822.77 -10.50 -0.22%

Xetra DAX 11,426.70 +22.69 +0.20%

S&P 500 2,262.53 +4.46 +0.20%

Dow Jones Industrial Average 19,883.06 +39.65 +0.20%

S&P/TSX Composite 15,269.85 +17.65 +0.12%

-

21:06

Major US stock indexes finished trading in the "green zone"

Major US stock indices are moderately higher on Monday, hovering close to record levels, driven by the growth of the technology sector stocks. Trading activity in the market is low and likely to remain so, as many market participants go on vacation.

As shown by the latest survey, the acceleration of growth in jobs for the third month in a row and a greater degree of optimism about the prospects for business development in the year ahead. At the same time, cost pressures intensified in December, while the last increase in purchase prices was one of the fastest since mid-2015. On a seasonally adjusted, preliminary index of business activity in the US services sector from Markit reached 53.4 in December, slightly down from 54.6 in November, but above the neutral value of 50.0 tenth month in a row. The average reading for the last quarter of 2016 (54.2) indicated the steepest rise in output in the services sector in the fourth quarter of 2015.

Oil prices fell in response to concern about the increase in supply in the United States. However, some support oil quotes provided the delay in the supply of oil from Libya. On Sunday, the Libyan state-owned National Oil Co. suspended the planned production recovery in the western oil fields as rebels threatened to block the supply of oil. Experts warn, production recovery in Libya could affect the overall effectiveness of the OPEC agreement. If Libya is to increase oil production, it can cause other countries to the cartel on the larger production cuts.

Some analysts expect that oil prices will continue in early 2017 because of the deal between the Organization of Petroleum Exporting Countries and some other manufacturers, which implies a reduction of oil production by almost 1.8 mln. Barrels per day since January.

DOW index components closed mostly in positive territory (20 of 30). Most remaining shares rose United Technologies Corporation (UTX, + 2.08%). Outsider were shares of Merck & Co., Inc. (MRK, -2.23%).

Most of the S & P sectors recorded increase. The leader turned out to be the technology sector (+ 0.5%). conglomerates (-1.7%) sectors fell most.

At the close:

DOW + 0.20% 19,883.88 +40.47

Nasdaq + 0.37% 5,457.44 +20.28

S & P + 0.20% 2,262.57 +4.50

-

20:00

DJIA +0.23% 19,888.63 +45.22 Nasdaq +0.44% 5,461.34 +24.18 S&P +0.20% 2,262.66 +4.59

-

18:02

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Monday in light trading, with the three major indexes hovering near record levels, driven by a rise in technology shares. Apple (AAPL), Amazon (AMZN) and Microsoft (MSFT) were up 1%-2,1%, providing the biggest boost to the Nasdaq and the S&P 500.

Most of Dow stocks in positive area (17 of 30). Top gainer - Microsoft Corporation (MSFT, +2.09%). Top loser - Merck & Co., Inc. (MRK, -1.55%).

Most of S&P sectors in positive area. Top gainer - Technology (+0.7%). Top loser - Conglomerates (-1.3%).

At the moment:

Dow 19823.00 +29.00 +0.15%

S&P 500 2259.25 +4.00 +0.18%

Nasdaq 100 4952.50 +36.75 +0.75%

Oil 53.23 +0.28 +0.53%

Gold 1141.90 +4.50 +0.40%

U.S. 10yr 2.54 -0.06

-

17:00

European stocks closed: FTSE 100 +5.52 7017.16 +0.08% DAX +22.69 11426.70 +0.20% CAC 40 -10.50 4822.77 -0.22%

-

16:31

WSE: Session Results

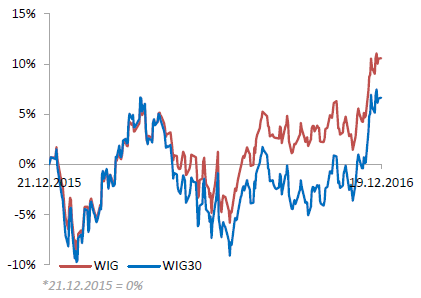

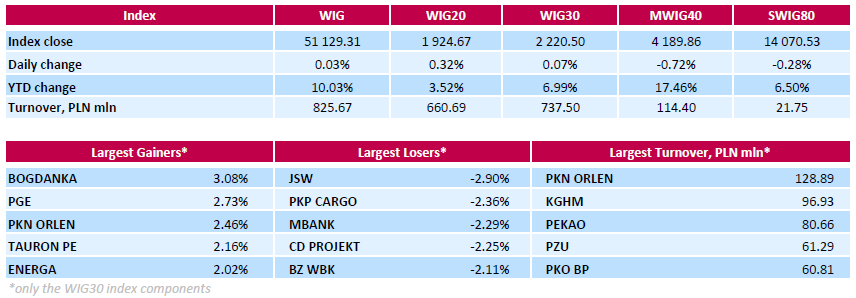

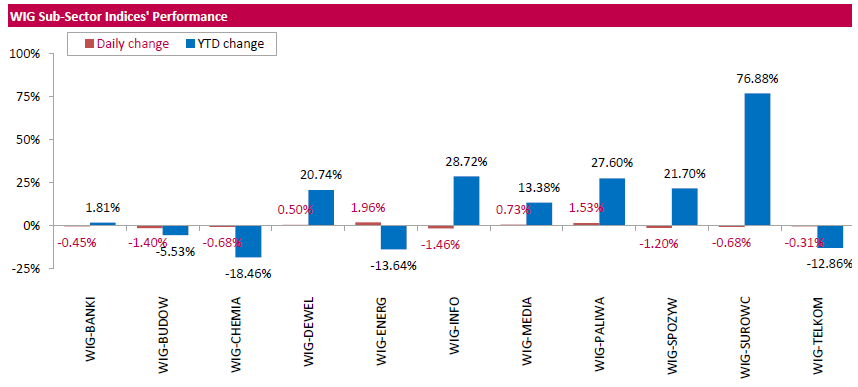

Polish equity market closed flat on Monday. The broad market measure, the WIG index, edged up 0.03%. Sector performance within the WIG Index was mixed. Utilities (+1.96%) outperformed, while informational technology (-1.46%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, inched up 0.07%. In the index basket, thermal coal miner BOGDANKA (WSE: LWB) generated the biggest advance, soaring by 3.08%. Other major gainers were oil refiner PKN ORLEN (WSE: PKN) and all four gencos PGE (WSE: PGE), TAURON PE (WSE: TPE), ENERGA (WSE: ENG) and ENEA (WSE: ENA), adding between 1.24% and 2.73%. On the other side of the ledger, coking coal miner JSW (WSE: JSW) led the decliners with a 2.9% drop, followed by railway freight transport operator PKP CARGO (WSE: PKP), bank MBANK (WSE: MBK) and videogame developer CD PROJEKT (WSE: CDR), sliding by 2.36%, 2.29% and 2.25% respectively.

-

14:52

WSE: After start on Wall Street

Data from the national economy proved to be very good. Positively surprised both industrial production and retail sales. The latter rising by as much as 6.6%, which is the strongest since April 2014. For the production data is good both in the processing (+ 4.3%) and the seasonally adjusted data (+ 3%). Even construction output falls the least since March this year (-12.8%). Big surprise is also a clear acceleration in producer prices, which are rising as much as 1.7%. To a large extent this is due to a jump of prices in mining (+ 17.2%), but in manufacturing prices also grow faster, which means increasing inflationary pressures. Despite considerable surprises data passed completely without reaction of the market.

The market on Wall Street opened with cosmetic increases that are virtually negligible and we may speak about a flat early trading. It seems that the market after a strong rally begins to consolidate, which is the natural course of things.

An hour before the close of trading the WIG20 index was at the level of 1,921 points (+0,16%).

-

14:33

U.S. Stocks open: Dow +0.06%, Nasdaq +0.07%, S&P +0.08%

-

14:27

Before the bell: S&P futures +0.04%, NASDAQ futures +0.13%

U.S. stock-index futures were flat amid slowing trading activity, as many market participants started taking off for the holidays.

Global Stocks:

Nikkei 19,391.60 -9.55 -0.05%

Hang Seng 21,832.68 -188.07 -0.85%

Shanghai 3,118.43 -4.56 -0.15%

FTSE 7,016.79 +5.15 +0.07%

CAC 4,820.67 -12.60 -0.26%

DAX 11,400.43 -3.58 -0.03%

Crude $51.70 (-0.39%)

Gold $1,141.60 (+0.37%)

-

14:01

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

177.55

0.10(0.0564%)

110

ALCOA INC.

AA

29

-0.40(-1.3605%)

4656

ALTRIA GROUP INC.

MO

67.14

0.10(0.1492%)

686

AMERICAN INTERNATIONAL GROUP

AIG

66.5

0.20(0.3017%)

290

Apple Inc.

AAPL

115.89

-0.08(-0.069%)

54406

AT&T Inc

T

41.82

0.15(0.36%)

6585

Barrick Gold Corporation, NYSE

ABX

14.38

0.10(0.7003%)

42102

Caterpillar Inc

CAT

92.1

-0.48(-0.5185%)

4551

Chevron Corp

CVX

117.9

-0.18(-0.1524%)

1107

Citigroup Inc., NYSE

C

59.65

-0.10(-0.1674%)

24657

Exxon Mobil Corp

XOM

91.22

0.04(0.0439%)

7087

Facebook, Inc.

FB

119.9

0.03(0.025%)

45371

FedEx Corporation, NYSE

FDX

196.55

0.07(0.0356%)

705

Ford Motor Co.

F

12.67

0.04(0.3167%)

10639

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

13.59

-0.24(-1.7354%)

97028

General Electric Co

GE

31.77

0.02(0.063%)

6343

Goldman Sachs

GS

238.17

-0.73(-0.3056%)

5911

International Business Machines Co...

IBM

166.77

0.04(0.024%)

387

Johnson & Johnson

JNJ

116.1

0.22(0.1899%)

1635

JPMorgan Chase and Co

JPM

84.75

-0.19(-0.2237%)

10730

Merck & Co Inc

MRK

61.69

-0.75(-1.2012%)

1211

Nike

NKE

50.96

0.04(0.0786%)

5942

Procter & Gamble Co

PG

84.7

0.02(0.0236%)

333

Tesla Motors, Inc., NASDAQ

TSLA

202.36

-0.13(-0.0642%)

12213

The Coca-Cola Co

KO

78.5

0.15(0.1914%)

2881

Twitter, Inc., NYSE

TWTR

18.68

0.05(0.2684%)

29237

United Technologies Corp

UTX

109.4

0.88(0.8109%)

1462

Verizon Communications Inc

VZ

52.39

0.12(0.2296%)

1304

Visa

V

78.5

0.15(0.1914%)

2881

Walt Disney Co

DIS

105.05

1.14(1.0971%)

20916

Yandex N.V., NASDAQ

YNDX

20.38

0.13(0.642%)

5595

-

13:59

Upgrades and downgrades before the market open

Upgrades:

United Tech (UTX) upgraded to Outperform from Neutral at Credit Suisse

Downgrades:

Merck (MRK) downgraded to Underperform from Hold at Jefferies

Deutsche Bank (DB) downgraded to Sell from Neutral at Citigroup

Other:

Walt Disney (DIS) added to US 1 List at BofA/Merrill

-

12:01

WSE: Mid session comment

During the forenoon phase of today's session, the segment of blue chips managed to make up most of the morning losses and as we may see in the currency market, we return to the area of the Friday's closing. In the case of medium size companies, the morning downward impulse is sustained and mWIG40 once again coming to the tested on Friday support.

At the halfway point of today's session the WIG20 index was at the level of 1,915 points (-0,16%).

-

11:42

Major stock indices in Europe trading mixed in ultra low volumes

European stocks opened the last full trading week of the year mixed after two weeks of gains. Indexes traded mixed, as the region's financial sector was under pressure from events in Italy, while business confidence in Germany rose sharply.

The composite index of the largest companies in the region Stoxx Europe 600 down 0.2%, trading volumes have already started to decline with the approach of the European Christmas holidays.

Italian banks are the focus. Monte dei Paschi fell about 7% trying to attract 5 billion euros ($ 5.2 billion), to avoid applying for financial assistance from the state. On Sunday, the bank announced that the offer to institutional investors will be open until Thursday, while the offer to retail investors will be closed on Wednesday.

Deutsche Bank also contributed to the deterioration in sentiment in the European banking sector, resulting, after the lender has agreed to pay more than $ 40 million to settle an investigation.

Outside the region, the mood in the sector also worsened after Ukraine announced its largest bank insolvent.

As shown by the economic data, business confidence in Germany rose in December, reaching its highest level since April 2014. The business confidence index for the German economy, which is calculated Institute IFO, in December rose to 111 points from 110.4 the previous month. Analysts on average had expected an increase to 110.7 points.

At the same time, oil prices mark the rise as investors believe in commitments to reduce production starting in January.

Shares of Danone SA fell 2.8%, as the French company worsened the revenue forecast for the current fiscal year due to the weakness of the Spanish market.

The capitalization of the German manufacturer of roofing materials Braas Monier Building Group jumped 7.6%. The company agreed to the proposal of the American Standard Industries offer, which estimates it at 1.1 billion euros.

Volkswagen shares fell by 0.3%. The automaker's costs in connection with the diesel scandal could rise by another $ 1 billion due to payments on the larger and more expensive vehicles.

At the moment:

FTSE 6996.47 -15.17 -0.22%

DAX 11408.51 4.50 0.04%

CAC 4822.14 -11.13 -0.23%

-

09:05

Major stock markets in Europe trading little changed: FTSE flat, DAX -0.2%, CAC40 -0.2%, FTMIB -0.3%, IBEX -0.4%

-

08:16

WSE: After opening

WIG20 index opened at 1915.46 points (-0.16%)*

WIG 50943.74 -0.34%

WIG30 2209.31 -0.44%

mWIG40 4202.72 -0.41%

*/ - change to previous close

The cash market started the new week with a small discount at a rather modest turnover concentrated on the shares of KGHM and JSW. The German DAX also go down, but in a very modest scale of 0.06%. The first transactions on the Warsaw market confirm a negative response to the weekend events. In addition, we need to take an amendment to the nature of Friday's session, when the market was clearly drawn in the fight for the settlement price of the December futures contract series.

After fifteen minutes of trading the WIG20 was at the level of 1,897 pts. (-1,09%).

-

07:46

Negative start of trading expected on the major stock exchanges in Europe: DAX -0.2%, CAC40 -0.2%, FTSE -0.1%

-

07:24

WSE: Before opening

Friday's session on the New York stock market has brought a slight declines in the major indexes. The uncertainty in the market caused by the interception of a Chinese ship US unmanned submarine. At the close the Dow Jones Industrial fell by 0.04 percent, Nasdaq Composite by 0.36 percent and the S&P500 lost 0.18 percent.

Asian markets are dominated by the red color, although besides the discount of 0.8% in Hong Kong drops are cosmetic. Contracts in the US are slightly on the gain and thus work out a modest loss from the last day of the previous week.

New week on the Warsaw market begin with a political event, which slightly spoils the mood around the Polish asset and this is a new series of opposition protests. Fortunately, in the last hours the temperature of the dispute seems to fall and began the search for a compromise. The zloty remains relatively stable this morning, which means that we are rather not in danger of discount as a result of a new political dispute.

In today's macro calendar this morning readings of the German Ifo index will be published, in the afternoon we will know a series of data from our national economy, industrial production, retail sales and producer prices.

-

06:19

Global Stocks

European stocks gained Friday, with drugmaker shares showing strength, as the Stoxx Europe 600 notched its highest close of the year.

U.S. stocks closed lower Friday, with the Dow industrials swinging to a loss, following reports that a Chinese warship seized an underwater U.S. Navy drone in international waters off the coast of the Philippines. Even as the Dow was curtailed from its advance to the psychologically important 20,000 level, the blue-chip average still nabbed its longest weekly winning streak in more than a year, rising six weeks in a row.

Markets were broadly lower Monday as Japanese stocks were hit by a strengthening yen, and Chinese markets continued to be rattled by the bond selloff. Chinese stocks edged down amid fears that money is exiting China's capital markets, as suggested by a sharp selloff in government bonds that began last week.

-