Market news

-

23:28

Currencies. Daily history for Dec 19’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0401 -0,37%

GBP/USD $1,2392 -0,69%

USD/CHF Chf1,027 -0,03%

USD/JPY Y117,08 -0,71%

EUR/JPY Y121,78 -1,08%

GBP/JPY Y145,06 -1,42%

AUD/USD $0,7242 -0,73%

NZD/USD $0,6927 -0,40%

USD/CAD C$1,3406 +0,43%

-

23:00

Schedule for today,Tuesday, Dec 20’2016 (GMT0)

00:30 Australia RBA Meeting's Minutes

03:00 Japan BoJ Interest Rate Decision -0.1% -0.1%

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

07:00 Germany Producer Price Index (MoM) November 0.7% 0.1%

07:00 Germany Producer Price Index (YoY) November -0.4% -0.2%

07:00 Switzerland Trade Balance November 2.68

09:00 Eurozone Current account, unadjusted, bln October 29.8

11:00 United Kingdom CBI industrial order books balance December -3 -5

13:30 Canada Wholesale Sales, m/m October -1.2%

21:45 New Zealand Visitor Arrivals November 14%

21:45 New Zealand Trade Balance, mln November -846

-

15:35

Further EUR/DKK Downside Unlikely, Says Danske

-

15:35

Australia: Conference Board Australia Leading Index, October -0.4%

-

15:23

Financial Times Poll: the Fed will raise interest rates only twice in the next year

Economists surveyed by Financial Times suggest that the Federal Reserve will raise interest rates again not earlier than six months.

Fed's leaders want to wait and see the first steps of the future president of the United States, Donald Trump, the respondents said.

According to economists, the Fed will raise interest rates only twice in the next year, while the dot plot for the December meeting suggested three rate hikes. FT survey participants believe that at the end of 2017 the Fed rate will be located in the target range of 1% to 1.25%.

-

15:15

Japan Center for Economic Research raised the inflation forecast

Japanese economists have raised the inflation forecast. This was the last of the positive developments for the Bank of Japan, which is trying to defeat deflation.

According to the survey of 41 economists conducted by the Japan Center for Economic Research, in the next fiscal year, which ends in late March 2018, inflation will reach 0.73%. In November the forecast was 0.61%.

Economists also raised the forecast for next year to 1.01% against 0.94% prior. These changes coincide with a reduction in expectations of further Bank of Japan easing policy.

-

14:50

US services PMI surveys indicate that the economy continued to show solid, steady growth - Markit

Adjusted for seasonal influences, the Markit Flash U.S. Services PMI Business Activity posted 53.4 in December, down slightly from 54.6 in November but above the 50.0 no-change value for the tenth consecutive month. The average reading for the final quarter of 2016 (54.2) pointed to the steepest upturn in service sector output since Q4 2015.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit said: "Although service sector growth cooled in December, the PMI surveys indicate that the economy continued to show solid, steady growth at the end of the year. The surveys are consistent with GDP rising at an annualised rate of 2.0% in the fourth quarter, fuelled mainly by improving domestic demand".

-

14:45

U.S.: Services PMI, December 53.4

-

14:23

IMF chief Lagarde convicted by French court over tycoon payout - AFP

-

14:00

Apple (AAPL) will appeal against the requirement of the European Commission to repay $ 14 billion in taxes

According to Reuters, Apple plans to file an appeal against the decision of the European Commission (EC) for the recovery of $ 14 billion in unpaid taxes. The company argued that the EU regulatory authorities have ignored the views of tax experts and corporate law, and deliberately chose a method to maximize the fine.

Recall, on August 30, the European Commission recognized that the Irish government illegally helped Apple significantly underestimate the amount of tax deductions for the period from 2003 to 2014. The Company is obliged to compensate for the missing amount plus interest. Apple (AAPL) and Ireland denied the charges.

AAPL shares fell in premarket trading to $ 115.85 (-0.10%).

-

13:42

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0300 (EUR 591m) 1.0500 (795m) 1.0600 (719m) 1.0650-55 (1.18bln) 1.0700 (984m) 1.0750 (2.41bln) 1.0800 (1.21bln)

USD/JPY 112.00 (USD 1.83bln) 114.00 (1.22bln) 115.50 (530m) 116.00 (USD 575m) 117.00 (510m) 118.00 (530m)

AUD/USD 0.7500 (AUD 584m)

-

13:09

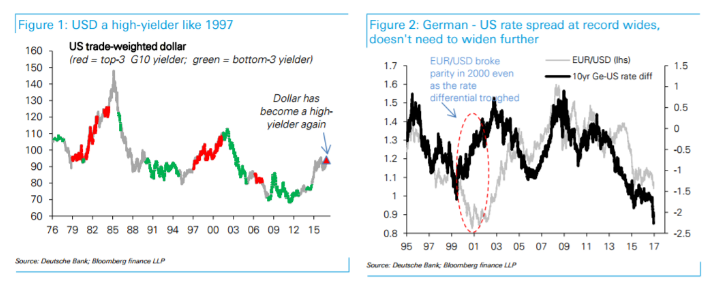

Deutsche Bank staying short EUR/USD, something special happened

"Something special happened last week: Fed funds - the interest rate on overnight dollars - rose to 66bps.

Why is this important? Because historically, it is not only the direction of US yields that matters for the dollar but also the absolute level.

When the USD joins the ranks of the high-yielders - defined as having at least the third highest central bank yield in the G10 - it typically rallies very strongly. The dollar entered such a regime yesterday: only Australia and New Zealand now have higher central bank rates than the US.

The last time this happened for more than a few months was in 1979 and 1997; the dollar rallied by 30% and 20% respectively (chart 1).

What about long-end yields? The US comes out on top here too: among the world's 20 largest bond markets, US 10-year treasury yields are now at least the third highest across the 5, 10 and 30-yr tenors.The dollar is truly a high-yielder.

Summing up, there is a threshold of yields beyond which the dollar rallies even if the rate differential stops widening. Indeed, the break of EUR/USD parity back in the 2000s was accompanied by a narrowing, not widening in the EU-US rate differential as portfolio flows flocked to the US from Europe (chart 2). From this perspective, a stabilization in UST yields attracting fresh buyers may end up being even more negative for EUR/USD.

We remain bearish and expect a break of parity down to at least 95 cents next year".

Copyright © 2016 DB, eFXnews™

-

12:59

Orders

EUR/USD

Offers : 1.0485 1.0500 1.0525 1.0550-55 1.0585 1.0600 1.0625-30 1.0650

Bids: 1.0450 1.0425-30 1.0400 1.0380 1.0350 1.0335 1.0300

GBP/USD

Offers : 1.2500-10 1.2530 1.2550 1.2565 1.2580 1.2600 1.2630-35 1.2650

Bids: 1.2455-60 1.2430 1.2400 1.2380-85 1.2350 1.2330-35 1.2300

EUR/GBP

Offers : 0.8400 0.8420-250.8450 0.8460-65 0.8480 0.8500

Bids: 0.8350-55 0.8330-35 0.8300 0.8285 0.8250

EUR/JPY

Offers : 123.00-05 123.30 123.60 123.85 124.00-10 124.30 124.50

Bids: 122.50 122.20 122.00 121.75 121.50 121.00

USD/JPY

Offers : 117.50-60 117.80 118.00 118.25-30 118.60 118.80 119.00

Bids: 117.00-116.95 116.70 116.50 116.30 116.00 115.85 115.50 115.00

AUD/USD

Offers : 0.7320 0.7350 0.7365 0.7380 0.7400 0.7430 0.7450 0.7485 0.7500

Bids: 0.7280 0.7265 0.7250 0.7225 0.7200 0.7170 0.7150

-

11:27

UK companies plan to hire more employees in 2017

UK companies are going to add more jobs in the next year, despite the uncertainty about future relations with the EU after the adoption of Brexit solutions.

Four out of ten companies across the UK will increase their workforces in the coming year, showed the latest Employment Trends Survey CBI / Pertemps Network Group from the Confederation of British Industry.

The balance of companies planning to add staff and those who expect job cuts amounted to 28 percent. Thus continues the optimistic trend seen every year since 2011.

Nevertheless, the balance of respondents expecting that the UK will be a more attractive place to work for people in the next five years, turned up to -21 percent from + 16 percent in 2015.

"With a record level of employment, more people than ever before now have to work, and a strong labor market look convincing to get positive results for 2017," said Josh Hardy, Deputy Director General of the CBI.

-

10:31

Brown Brothers Harriman about EUR / USD

According to analysts of Brown Brothers Harriman, the current correction of the downtrend in the euro - a temporary phenomenon in the light of the Fed's statements and the ECB decision. Experts believe that in the $ 1.0500- $ 1.0530 there is a large number of sellers. The possible target will be $ 0.95. Also Brown Brothers Harriman advised to pay attention to the resistance area $ 1.0560. Analysts predict that the close above this level will deploy a large-scale correction on EUR / USD.

-

10:05

Hourly labour costs rose by 1.5% in the euro area

Hourly labour costs rose by 1.5% in the euro area (EA19) and by 1.9% in the EU28 in the third quarter of 2016, compared with the same quarter of the previous year. In the second quarter of 2016, hourly labour costs increased by 1.0% in the euro area (EA19) and by 1.4% in the EU28. These figures are published by Eurostat, the statistical office of the European Union.

The two main components of labour costs are wages & salaries and non-wage costs. In the euro area, wages & salaries per hour worked grew by 1.6% and the non-wage component by 1.2% in the third quarter of 2016 compared with the same quarter of 2015.

In the second quarter of 2016, the annual changes were +0.9% and +1.5% respectively. In the EU28, hourly wages & salaries rose by 2.0% and the non-wage component by 1.5% in the third quarter of 2016. In the second quarter of 2016, annual changes were +1.4% and +1.7% respectively.

-

09:48

Option expiries for today's 10:00 ET NY cut

EUR/USD 1.0300 (EUR 591m) 1.0500 (795m) 1.0600 (719m) 1.0650-55 (1.18bln) 1.0700 (984m) 1.0750 (2.41bln) 1.0800 (1.21bln)

USD/JPY 112.00 (USD 1.83bln) 114.00 (1.22bln) 115.50 (530m) 116.00 (USD 575m) 117.00 (510m) 118.00 (530m)

AUD/USD 0.7500 (AUD 584m)

Информационно-аналитический отдел TeleTrade

-

09:30

Ifo German business morale rose in December - Reuters

Dec 19 German business morale rose in December, a survey showed on Monday, hitting its highest level since February 2014 and supporting expectations that Europe's largest economy will rebound in the fourth quarter.

The Munich-based Ifo economic institute said its business climate index, based on a monthly survey of some 7,000 firms, rose to 111.0 after from 110.4 in November.

The December reading compared with a Reuters consensus forecast for a value of 110.7.

-

09:15

Oil is trading higher

This morning, New York futures for Brent rose 0.69% to $ 55.59 and WTI increased in value by 0.83% to $ 53.39 per barrel. Thus, the black gold is continuing gains on news of production cuts by OPEC countries and countries outside the cartel after nearly a year of negotiations.

-

09:08

Any transitional deal with EU should not diminish Brexit vote - minister

-

09:01

Germany: IFO - Expectations , December 105.6 (forecast 105.6)

-

09:00

Germany: IFO - Business Climate, December 111 (forecast 110.7)

-

09:00

Germany: IFO - Current Assessment , December 116.6 (forecast 115.9)

-

08:01

Today’s events

-

At 11:00 GMT the Bundesbank Monthly Report

-

At 18:30 GMT the Federal Reserve Board of Governors Chairman Janet Yellen will deliver a speech

-

-

07:51

Danske targeting 1.35 In 1-Month on USD/CAD

"Canada benefits from the improved growth outlook in the US, even if uncertainties as to the implications of the Trump victory for US-Canadian trade relations have risen markedly. The Bank of Canada left rates unchanged at the December meeting and our base case remains unchanged rates over the next 12M, even if the probability of a H2 17 hike has increased.

With the outlook of near-term USD strength and the risk of a setback in oil prices, we still see risks skewed towards a higher USD/CAD over the coming months.

We forecast the cross at 1.35 in 1M (previously1.36), 1.34 in 3M (unchanged), 1.30 in 6M (unchanged) and 1.28 in 12M (unchanged)".

Copyright © 2016 Danske, eFXnews™

-

07:45

Expected slowdown in China's economy

According to the report published today by the Chinese Academy of Social Sciences economic growth rate will amount to 6.5% in 2017. This year, China's GDP will grow by 6.7%.

The report noted that against the background of decline in world trade, igures in 2016 were the weakest since 2008, is expected a slowdown in the Chinese economy. "Low growth in global demand, reducing private investment and foreign capital companies in the Chinese economy, as well as the slowdown in domestic consumption and the excessive growth of mortgage lending were the main reasons for the slowdown of the Chinese economy", - the report says.

-

07:38

ANZ Business Outlook

Businesses are wrapped in optimism. A net 22% of businesses are optimistic about the year ahead, up 1 point on the month prior. The construction sector is the most optimistic and manufacturing the least, but all sectors sit on the positive side of the ledger.

Businesses are jolly when they consider the outlook for their own firms. A net 40% of businesses expect better times for their own business with positivity across all the five major sectors. That's 12 points above the long-run average and flags very strong growth. Construction sector activity expectations are poles ahead of the others, sitting at a celebratory net 63%

-

07:35

Japan exports fell at a slower pace in November

According to data released by Japan's Ministry of Finance, the total trade balance amounted to ¥ 152.5 billion in November, below the forecast of ¥ 227.4 billion and ¥ 496.2 the previous value Bln.

Exports decreased at an annual rate of -0.4% in November, while analysts had expected a decline of -2.3% y / y. Exports from Japan to China increased by 4.4% y / y, and in Asia in general +3.4% y / y. Exports from Japan to Europe fell by -2.2%.

Imports fell less than experts expected in November, -8.8% y / y after declining by 16.5% y / y in October

-

07:25

Australia Economic and Fiscal Outlook 2016-17

The Government is delivering on its plan for economic growth and jobs, with the budget maintaining an improving trajectory consistent with the Government's fiscal strategy. The budget is projected to return to surplus in 2020-21, the same year as at the 2016 Pre-election Economic and Fiscal Outlook (PEFO).

The net impact of decisions taken since the 2016 PEFO is an improvement to the underlying cash balance of $2.5 billion over the forward estimates. The Government has also made significant headway in legislating measures to repair the budget, with over $22 billion of budget repair measures implemented since the election. The Australian economy continues to transition from the investment phase to the production phase of the mining boom.

Economic growth is expected to increase over the forecast period, as the drag from the decline in mining investment dissipates and the economy transitions to broader-based growth, supported by historically low interest rates and a lower Australian dollar.

-

07:20

Fitch says Australia's budget outlook still consistent with AAA ratings despite slight deterioration

-

06:07

Options levels on monday, December 19, 2016:

EUR/USD

Resistance levels (open interest**, contracts)

$1.0722 (434)

$1.0674 (403)

$1.0616 (225)

Price at time of writing this review: $1.0463

Support levels (open interest**, contracts):

$1.0368 (1079)

$1.0329 (1871)

$1.0282 (2838)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 42399 contracts, with the maximum number of contracts with strike price $1,1500 (3207);

- Overall open interest on the PUT options with the expiration date March, 13 is 52240 contracts, with the maximum number of contracts with strike price $1,0000 (5571);

- The ratio of PUT/CALL was 1.23 versus 1.22 from the previous trading day according to data from December, 16

GBP/USD

Resistance levels (open interest**, contracts)

$1.2714 (484)

$1.2618 (994)

$1.2523 (333)

Price at time of writing this review: $1.2481

Support levels (open interest**, contracts):

$1.2381 (273)

$1.2285 (342)

$1.2188 (533)

Comments:

- Overall open interest on the CALL options with the expiration date March, 13 is 9983 contracts, with the maximum number of contracts with strike price $1,2600 (994);

- Overall open interest on the PUT options with the expiration date March, 13 is 12819 contracts, with the maximum number of contracts with strike price $1,1500 (2954);

- The ratio of PUT/CALL was 1.28 versus 1.30 from the previous trading day according to data from December, 16

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

00:00

New Zealand: ANZ Business Confidence, December 21.7

-